Analog Devices Inc

Latest Analog Devices Inc News and Updates

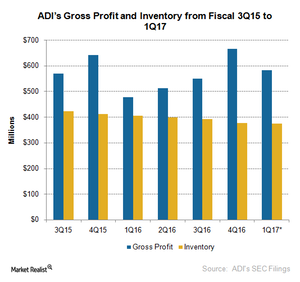

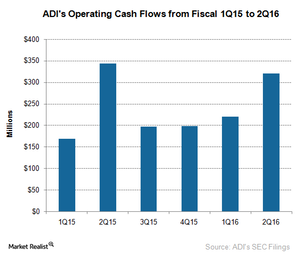

ADI’s Plan for a High Gross Margin in Slow Quarters

Analog Devices’ fiscal 1Q17 revenues will likely see seasonal declines, and this seasonality is something that it can’t escape.

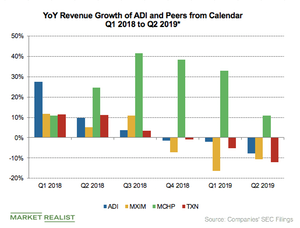

US-China Trade War Impacts Analog Chipmakers’ Guidance

Analog chipmakers have exposure to almost all end markets including industrial, automotive, communications, and consumer markets.

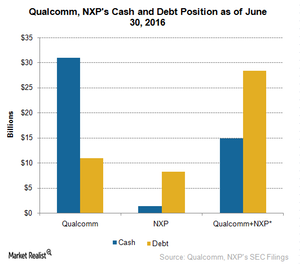

How Would Qualcomm Fund a Possible Acquisition of NXP?

If Qualcomm (QCOM) looks to buy NXP Semiconductors (NXPI), the deal could be valued at just above $30 billion or as high as $46 billion.

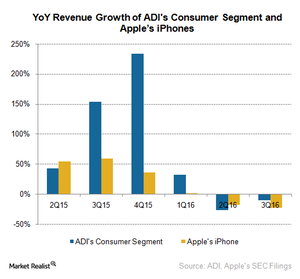

How Related Are ADI’s Consumer Revenues and Apple’s iPhone Sales?

ADI’s Consumer segment is made up of its computing and mobile businesses, and Apple (AAPL) is its biggest customer.

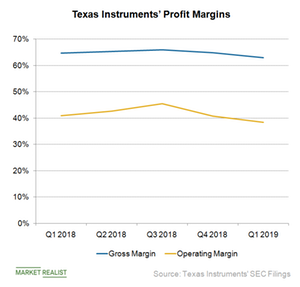

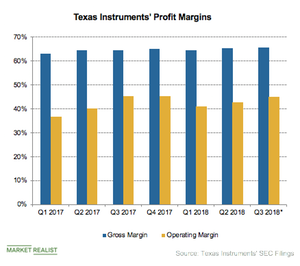

Texas Instruments’ Profit Margins Continue to Beat Peers

Texas Instruments (TXN) manufactures analog chips that are built on old technology nodes that have already been paid off.

A Look at Texas Instruments’ Strategy to Improve Profitability

Texas Instruments (TXN) has improved its revenue by diversifying into various end markets.

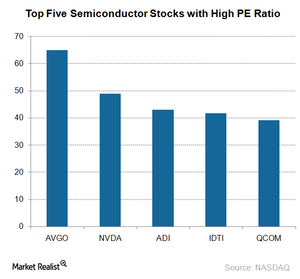

Why Semiconductor Stocks with High PE Ratios Are So Important to Investors

As of December 22, 2017, Broadcom (AVGO) had the highest PE ratio of 65x, followed by NVIDIA (NVDA) at 48.85x.

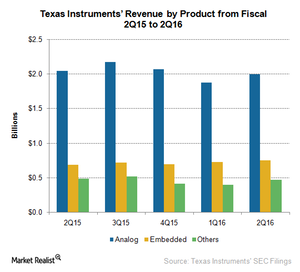

Which Segment Is Most Profitable for Texas Instruments?

Texas Instruments’ Analog segment contributes 62% to the company’s total revenue and is made up of high volume analog and other products.

What Is Analog Devices’ Acquisition Strategy?

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.

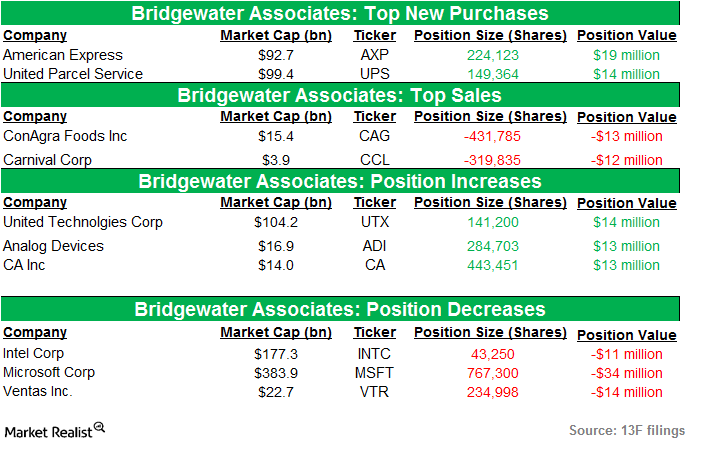

Analyzing Bridgewater Associates’ positions in 3Q14

Bridgewater Associates is an American hedge fund. It was founded in 1975 by Ray Dalio. The firm manages ~$157 billion in global investments.