Merk Gold ETF

Latest Merk Gold ETF News and Updates

How Gold Miners Could Benefit from Deregulation

A record number of junior companies attended the Precious Metals Summit. We are finding companies with attractive development projects in North America and West Africa as well as some exciting discoveries that merit watching.

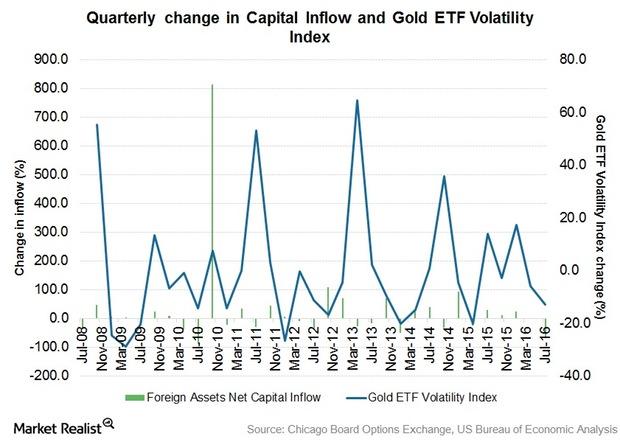

Why Gold ETFs See Robust Net Inflows against Actively Managed Gold Funds

One of the dominant financial trends of the past decade has been a move by investors out of actively managed funds and into passively managed index funds or exchange traded funds (ETFs).

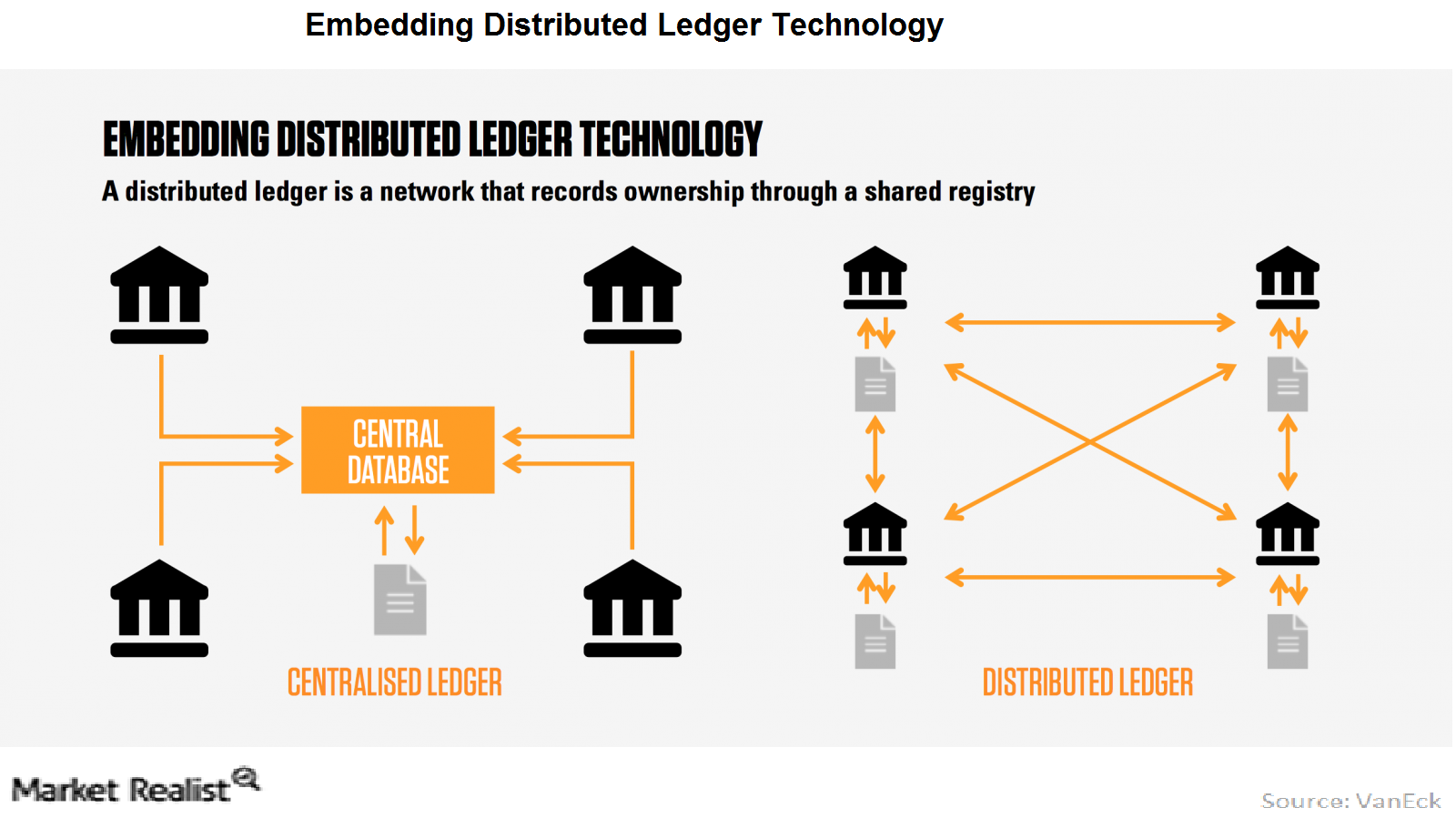

Why Distributed Ledger Technology Is Game Changing

A distributed ledger is a database of transactions held and updated in decentralized form across different locations.

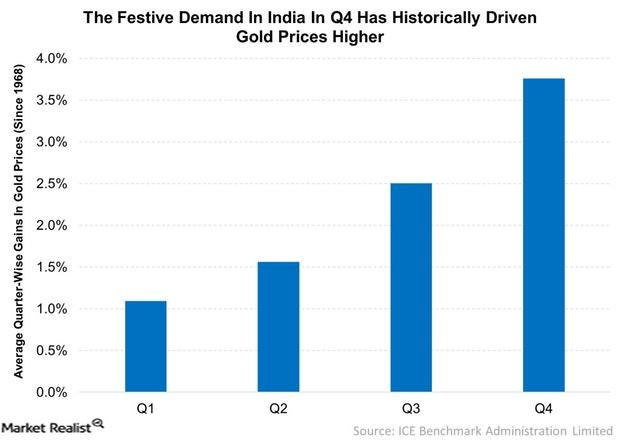

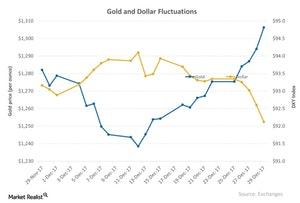

Gold Prices Could Test $1,300

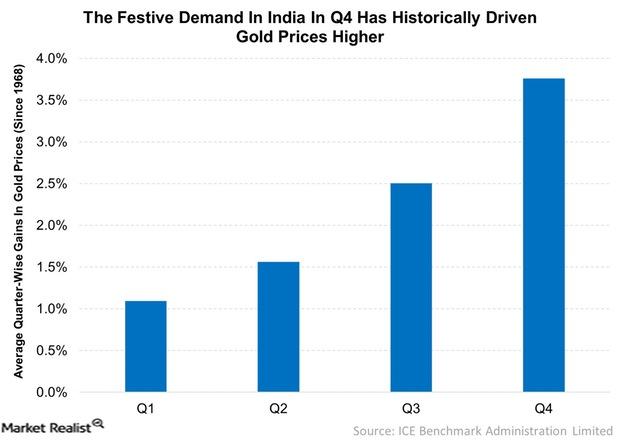

Gold prices tend to rise in the fourth quarter of the calendar year. Gold prices have gained an unannualized ~3.8% in the fourth quarter.

A Quick Look at the Precious Metals Revival, Miners’ Performances

Precious metals prices shot up on January 19, 2018, with concerns looming over the shutdown the of the US government.

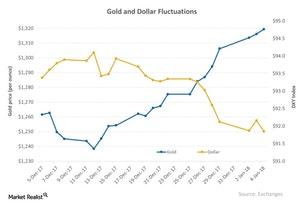

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

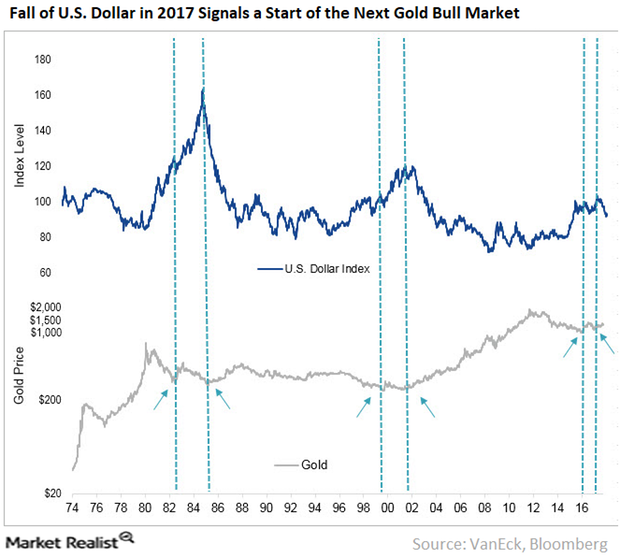

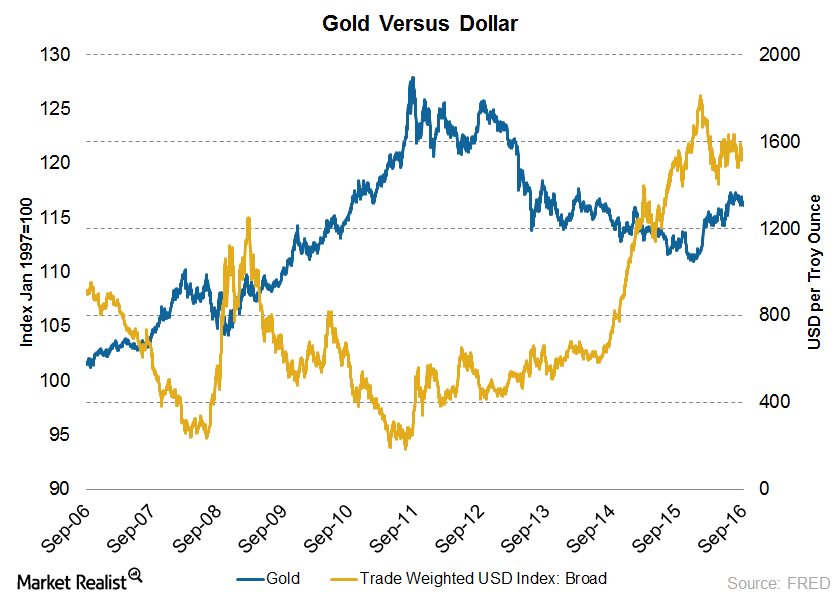

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

Your End-of-2017 Correlation Study of the Major Miners

The PowerShares DB Gold Fund (DGL) and the VanEck Merk Gold Trust (OUNZ) rose 2.2% over the five trading days leading up to December 27, 2017.

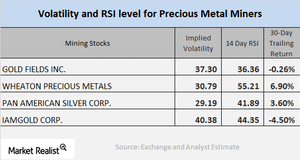

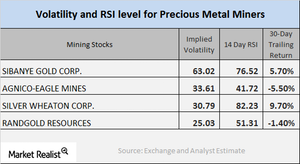

The Revival of Miners and Technical Indicators on December 20

Alamos Gold, Sibanye Gold, Agnico Eagle Mines, and Pan American Silver have call-implied volatilities of 43.2%, 50.5%, 22.1%, and 27.5%, respectively.

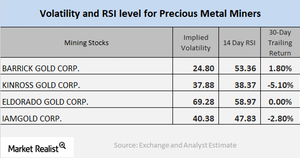

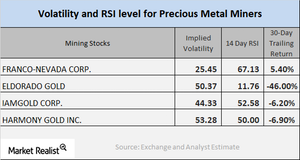

Reading Miner Volatility in December 2017

In this article, we’ll take a look at the call-implied volatilities and RSI scores of Barrick Gold, Kinross Gold, Eldorado Gold, and IAMGOLD.

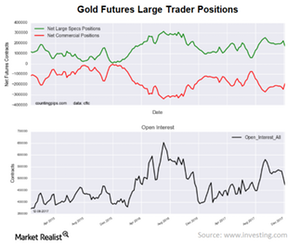

How Is Gold, Commercial and Non-Commercial, Moving?

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016.

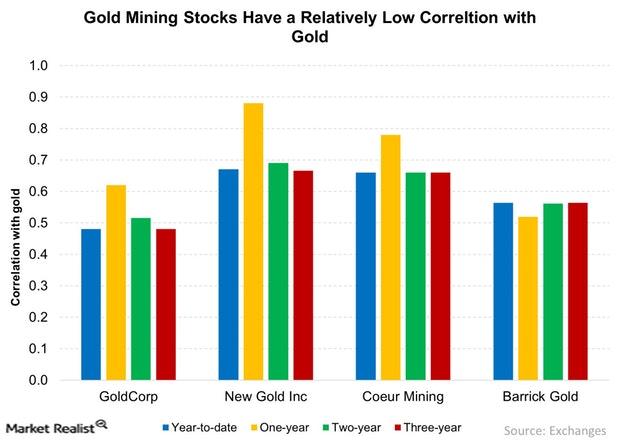

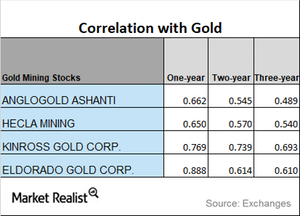

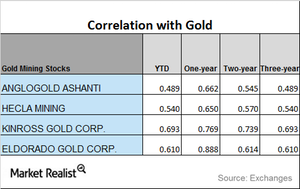

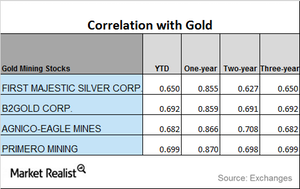

Miners’ Correlation with Gold

Correlation analysis A correlation study of mining stocks to precious metals is important. It gives insights about miners’ potential price movement. Although the mining shares are essentially part of the market’s equity segment, they’re more coordinated with metals’ movement. Gold is the most dominant precious metals. We’ll discuss how Yamana Gold (AUY), Pan American Silver (PAAS), Coeur […]

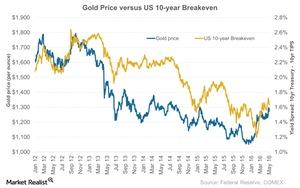

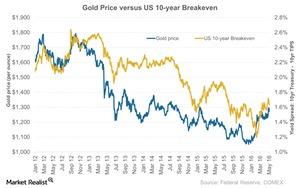

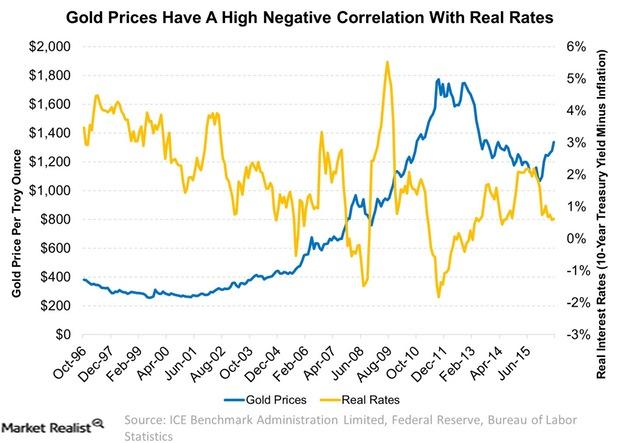

How Inflation Becomes a Core Determinant of the Price of Gold

The possible interest rate hike is taking a lot of market participants’ attention. Many policymakers are also focusing on inflation numbers.

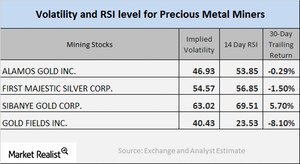

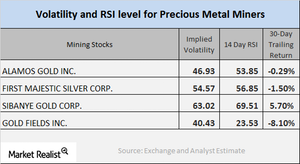

A Quick Look at Miners’ Technical Details

As of November 16, 2017, Alamos Gold, First Majestic Silver, Sibanye Gold, and AngloGold Ashanti had call-implied volatilities of 46.9%, 54.6%, 63%, and 40.9%, respectively.

Directional Changes in the Correlation of Miners to Gold

New Gold and Goldcorp have seen upward trends in their correlations with gold, while Newmont Mining has seen its correlation decline.

Yield Changes for Precious Metals: What Could Be the Impact?

If we look beyond the dollar influence on precious metals, we can analyze how the probability of an interest rate hike could influence precious metals and their miners.

The Importance of Knowing the Technicals of Mining Stocks

On October 30, 2017, ABX, AU, KGC, and IAG had call implied volatilities of 29.1%, 40.9%, 41.6%, and 44.3%, respectively.

A Technical Analysis of Mining Shares as of October 27

On October 26, 2017, Royal Gold, Newmont, Sibanye, and Yamana had call implied volatilities of 24.8%, 25.9%, 63%, and 48.4%, respectively.

1 Technical Trend That Could Affect Gold Prices

Investor complacency doesn’t hide the fact that there are financial risks to QT. Forty percent of the Fed’s balance sheet unwind is in mortgage-backed securities at the same time that the housing market is showing signs of slowing.

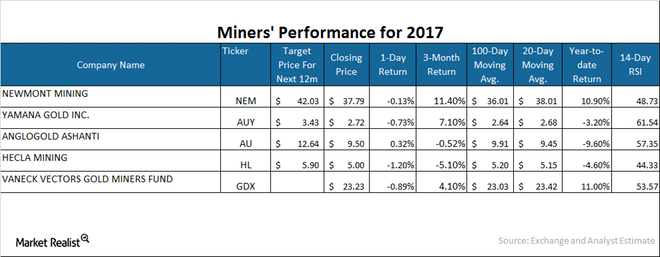

How Gold Companies Have Performed in 2017

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%.

A Technical Analysis of Mining Shares in October

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks.

Analyzing Mining Shares’ Correlation in October

Understanding mining stocks’ correlation with gold is crucial for investors in precious metal mining stocks.

How Key Mining Stocks Are Correlated with Gold in October 2017

The PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ) have risen 12.1% and 12.95, respectively, year-to-date, taking strong cues from gold.

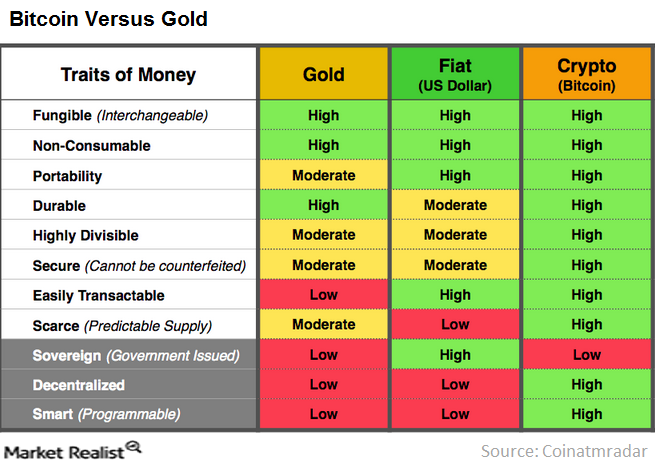

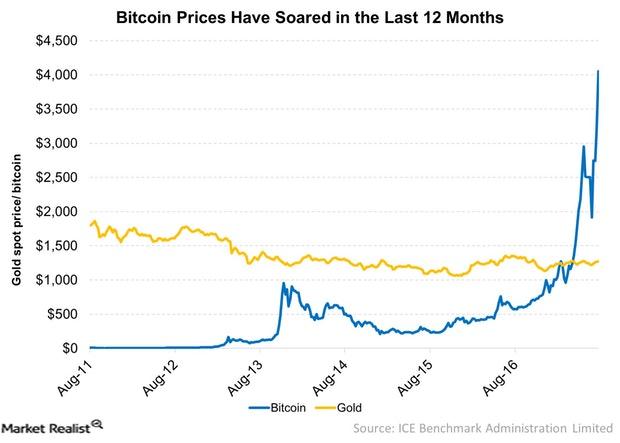

How Are Gold and Bitcoin Different?

Bitcoins can be sent across borders. Bitcoin payment will be the same as paying someone in the same country. People don’t use gold much anymore.

Bitcoin Might Not Replace Gold as a Safe-Haven Asset

Bitcoin is a global digital payment system that offers lower transaction fees than other online payment systems. It’s operated by a decentralized authority.

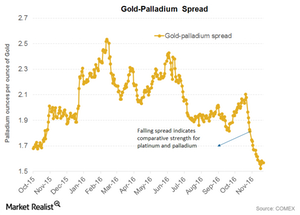

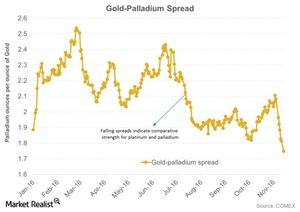

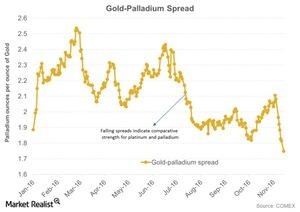

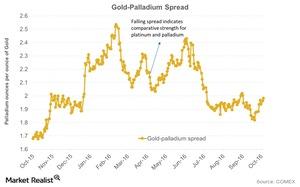

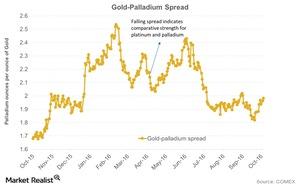

Reading the Movement in the Gold-Palladium Spread

The gold-platinum spread was approximately 1.6 on January 11, 2017. Its RSI (relative strength index) was as low as 40.

Why the Gold-Palladium Spread Is Falling Drastically

Palladium has seen a YTD rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

How Palladium Outperformed Gold: The Gold-Palladium Spread

Palladium has seen a year-to-date rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

What’s Affecting the Gold-Palladium Spread?

Palladium has seen a year-to-date rise of 24.9%, which is higher than the increase in platinum, silver, and gold.

Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.

Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

Are Inflation Concerns Likely to Boost Gold’s Performance?

The difference between yields on ten-year US notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.7% last Tuesday.

How Did the Dollar’s Move Affect the Price of Gold?

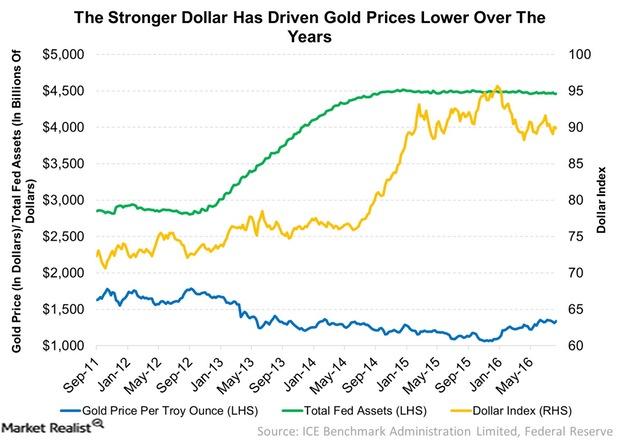

Gold is valued in dollars. As a result, the stronger dollar, driven by the recovery of the US economy, is pushing the gold prices further down.

Demand from India Could Lend Support to the Gold Market

Demand from India Could Lend Support In the near term, India could lend support to the gold market. Indian gold demand has been very weak this year due mainly to the higher gold price. This suggests there is pent-up demand. A good monsoon season in India can lead to a bountiful fall harvest that typically […]

Jackson Hole: An Important Takeaway and What It Means for Gold

Yellen Channels Doobie Brothers’ “What Were Once Vices Are Now Habits” Another aspect of Janet Yellen’s Jackson Hole speech furthered our conviction for strong gold prices in the long term. She described all of the unconventional monetary policies implemented since the financial crisis (e.g., zero rates, QE, etc.) as components of the Fed’s “toolkit”. Perhaps […]

Where Gold Is Likely to Head If the Fed Hikes Rates

The Fed has probably never tightened rates in past cycles with indicators so weak. In fact, at this point in the business cycle, a more normal stance would be to hold steady, looking ahead to a time when it might cut rates. Because of this, we believe any decision to raise rates in 2016 will […]

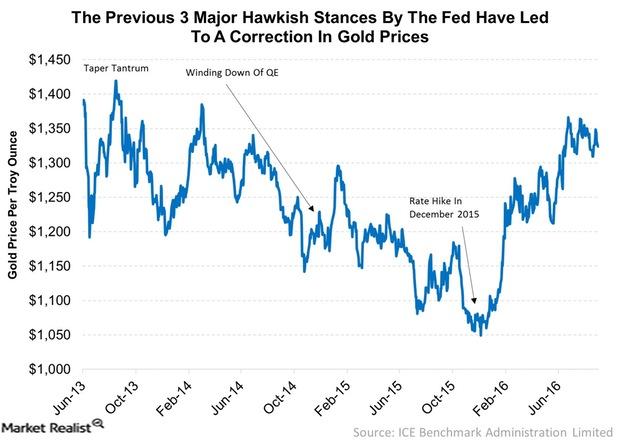

How the Fed’s Shifting Stance on Rates Affects Gold

The Fed’s Shifting Stance on Rates The summer doldrums came late this year for gold and gold stocks. Now that the U.K. Brexit decision is old news, the markets are again obsessed with the Federal Reserve’s (the “Fed”) shifting stance on rate decisions. Although the Fed’s tone had been dovish on rate increases following the […]

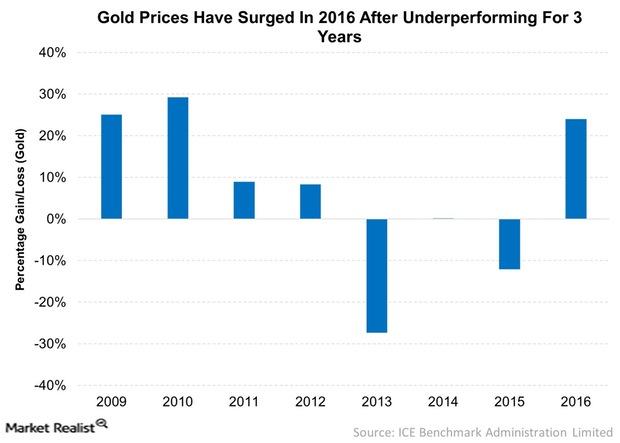

Gold Prices Moving North after 3 Years of Underperformance

This year, gold prices had risen by 24% as of September 19. Gold prices fell in August due to the Fed’s hawkish stance.

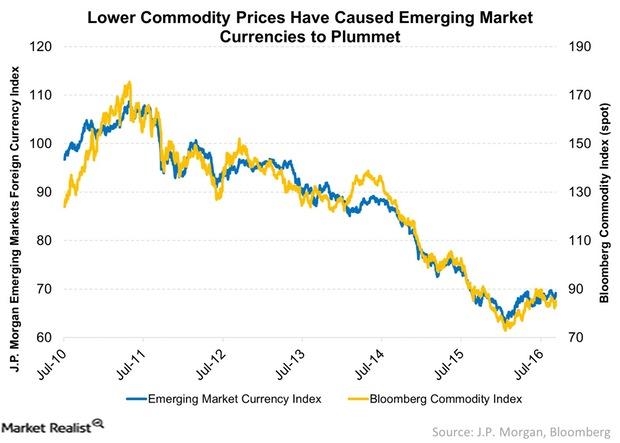

Stable Commodity Prices Have Supported Emerging Market Bonds

Perhaps one of the biggest tailwinds recently, particularly for local currency strategies, has been the stabilization and rebound in commodity prices this year.

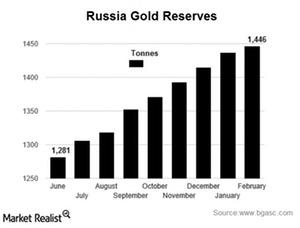

Is Russia Another Gold Stacker?

In January 2016, Russia’s central bank bought almost 22 tons of gold worth ~$800 million—the eleventh month in a row that it bought large gold volumes.