Marathon Oil Corp

Latest Marathon Oil Corp News and Updates

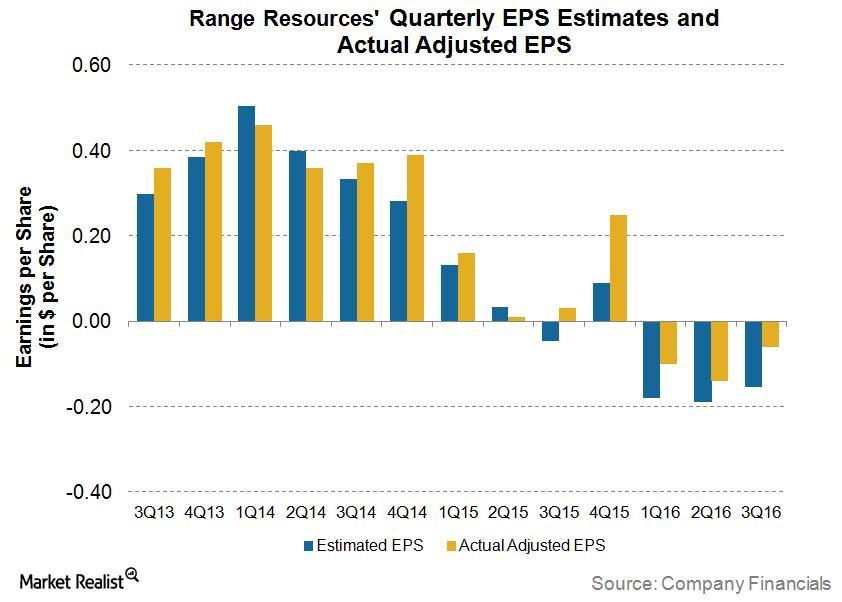

Inside Range Resources’ 3Q16 Earnings

For 3Q16, Range Resources reported an adjusted loss per share of $0.06—$0.09 better than the Wall Street analyst consensus estimate of $0.15 loss per share.

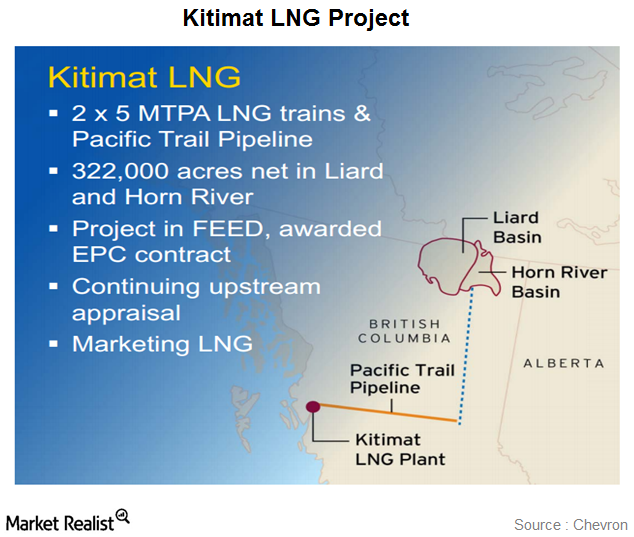

Why Chevron is cutting spending on some projects

Chevron has cut spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

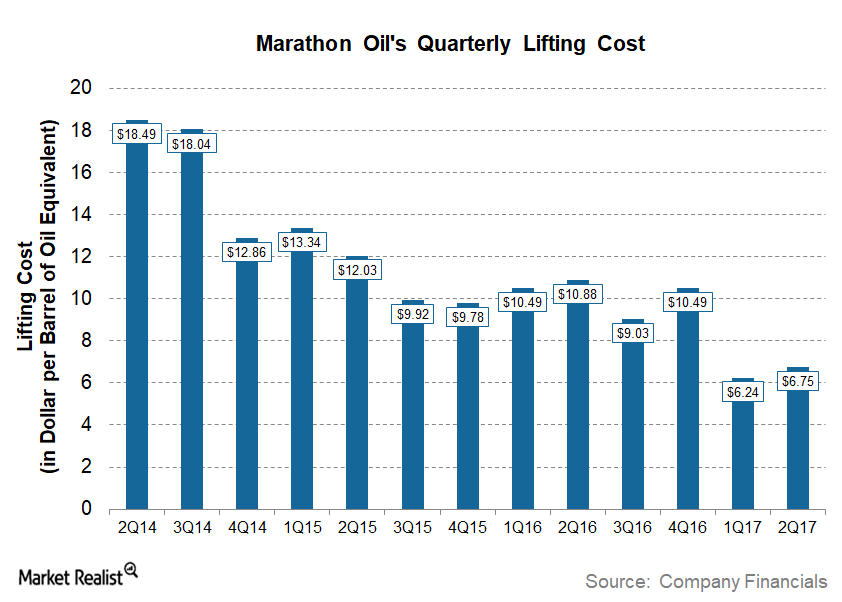

Marathon Oil’s Lifting Costs

In 2Q17, Marathon Oil’s (MRO) reported a lifting cost of ~$6.75 per boe (barrel of oil equivalent), which is ~28.0% lower than its 2Q16 lifting cost of ~$10.88.

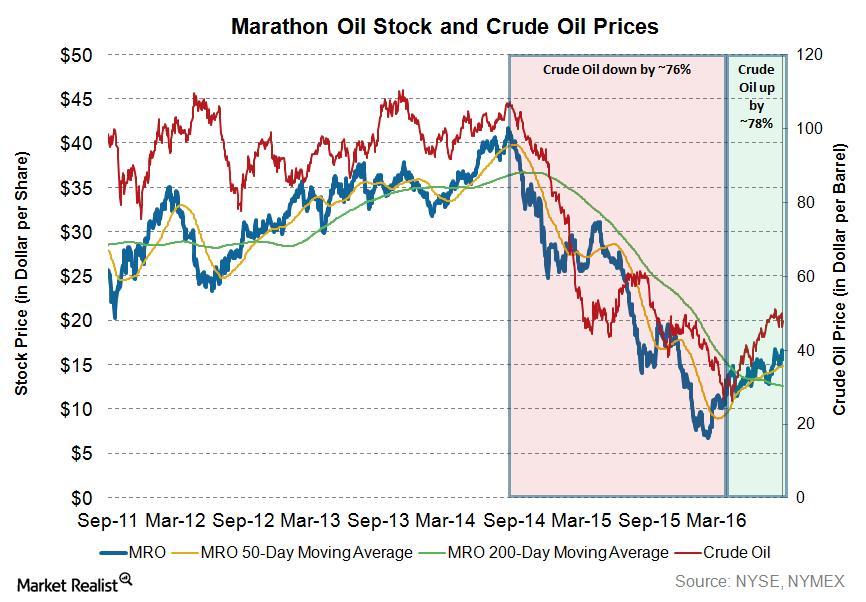

How the Decline in Crude Oil Prices Affected Marathon Oil

Although crude oil prices have rallied ~78% from their lows in February 2016, crude is still trading ~57% lower than its high two years ago.

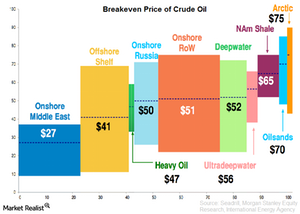

Why is the breakeven price of crude oil so important?

Knowing the breakeven price of crude oil is important when trying to figure out what OPEC needs in order to regain market share.

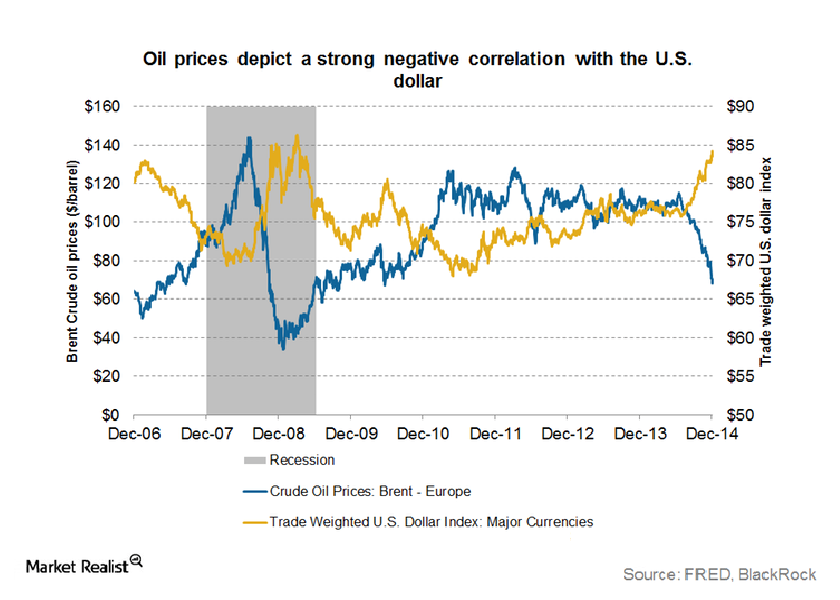

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

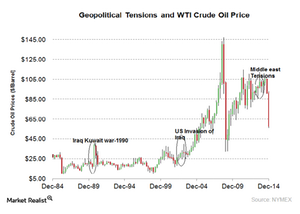

Must know: Geopolitical tensions impact oil prices

A glut in crude oil supply could mean that political tensions in the near term may not impact oil prices.

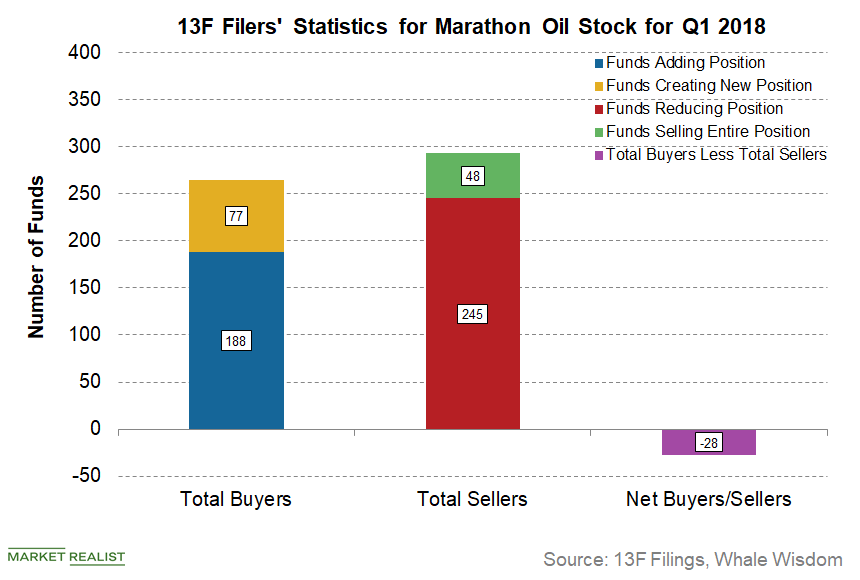

Are Institutional Investors Selling Marathon Oil Stock?

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

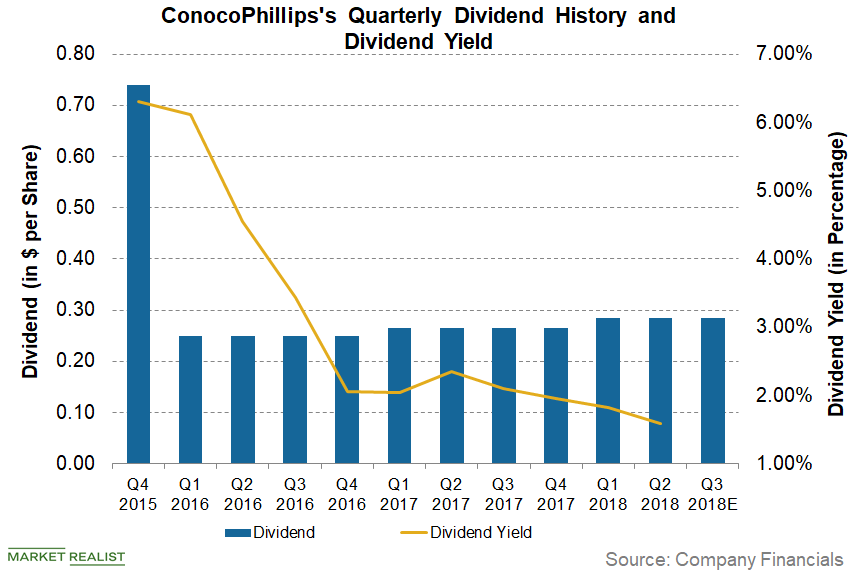

Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

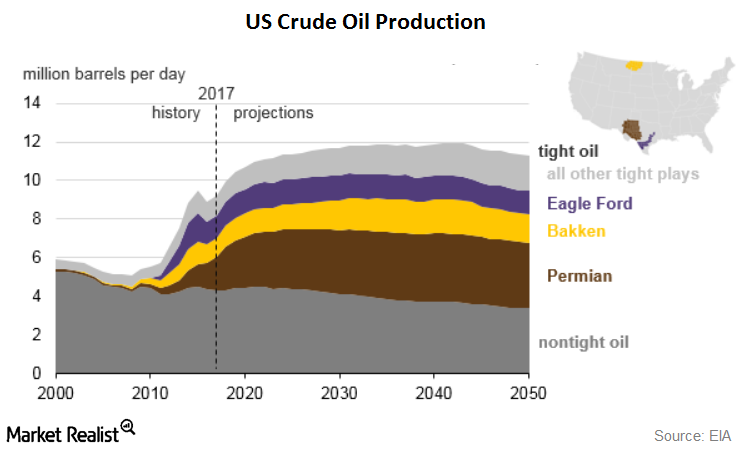

Tight Oil Contribution to Rise to 70%: Key Permian Basin Driver

In its “Annual Energy Outlook 2018,” the US Energy Information Administration (EIA) has forecast that US tight oil production will mostly increase through early 2040.

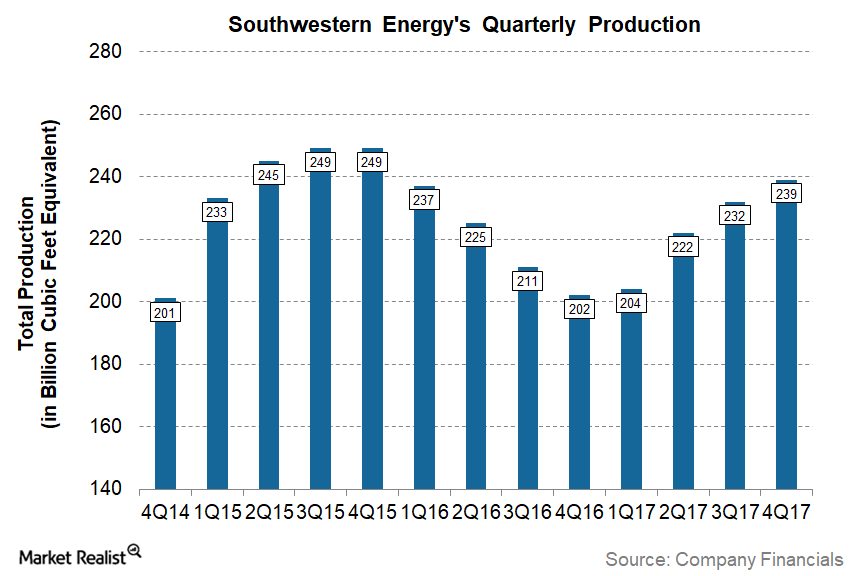

Southwestern Energy Reported Higher Production in 4Q17

Sequentially, Southwestern Energy’s 4Q17 production is ~3% higher compared to its production of 232 Bcfe in 3Q17.

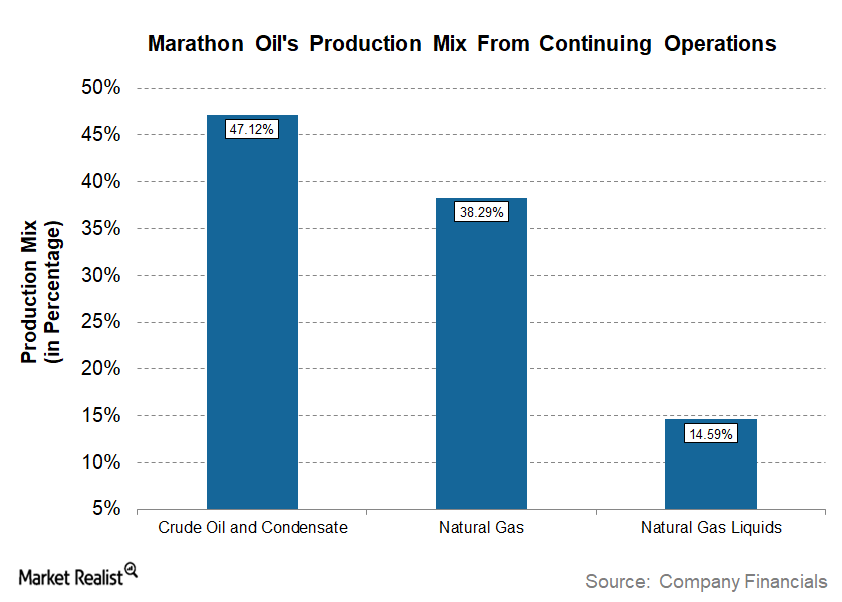

How Marathon Oil’s Divestiture Affected Its Production Mix

In 2Q17, Marathon Oil’s (MRO) production mix from continuing operations was ~47.0% crude oil and condensate, ~15.0% natural gas liquids, and ~38.0% natural gas.

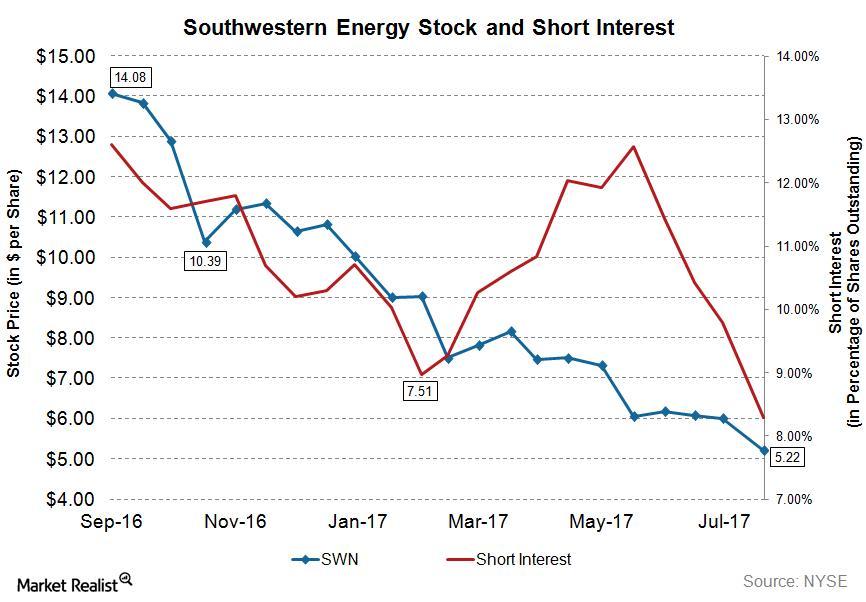

Analyzing the Short Interest in Southwestern Energy Stock

As of August 14, Southwestern Energy’s total shares shorted (or short interest) stood at ~45.89 million, while its average daily volume is ~17.44 million.

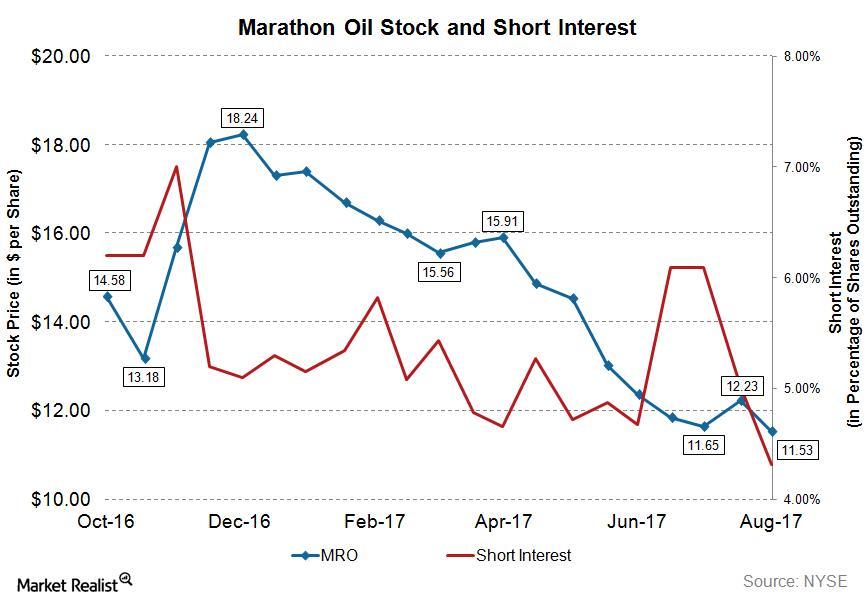

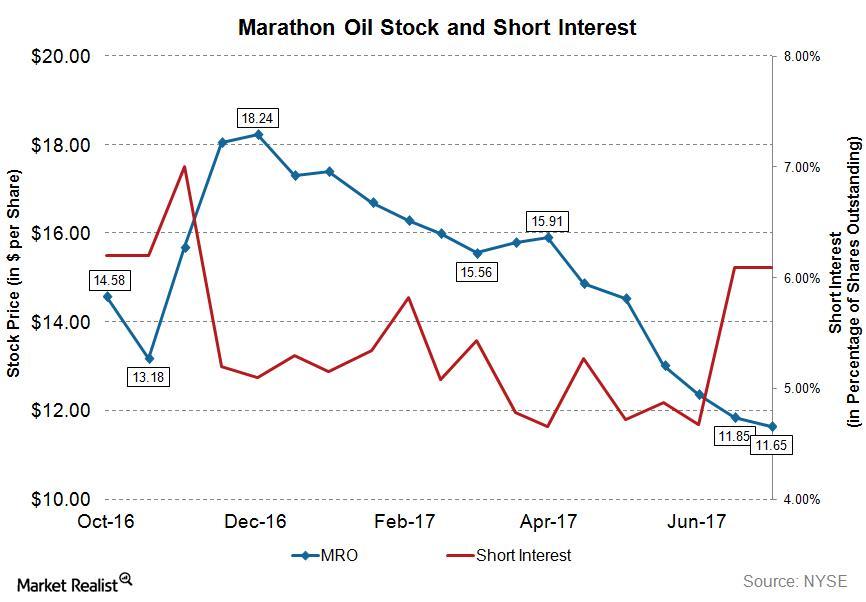

Short Interest in Marathon Oil Stock Remains at Lower Levels

As of August 14, 2017, Marathon Oil’s total shares shorted (or short interest) stood at ~36.65 million, while its average daily volume is ~15.94 million.

Analyzing Short Interest in Occidental Petroleum Stock

On July 14, 2017, Occidental Petroleum’s (OXY) total shares shorted (or short interest) stood at ~10.9 million, and its average daily volume was ~4.8 million.

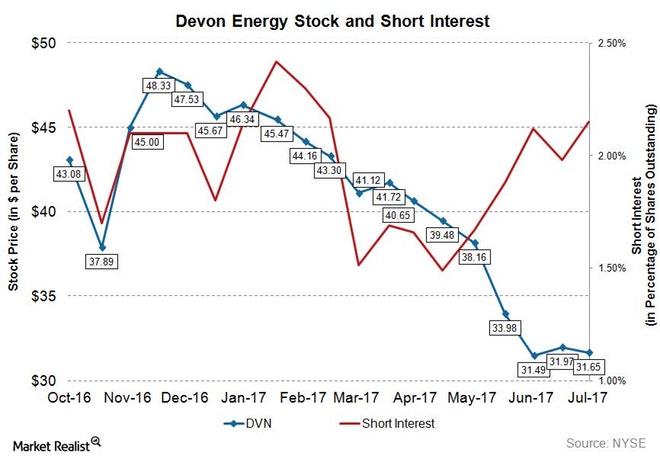

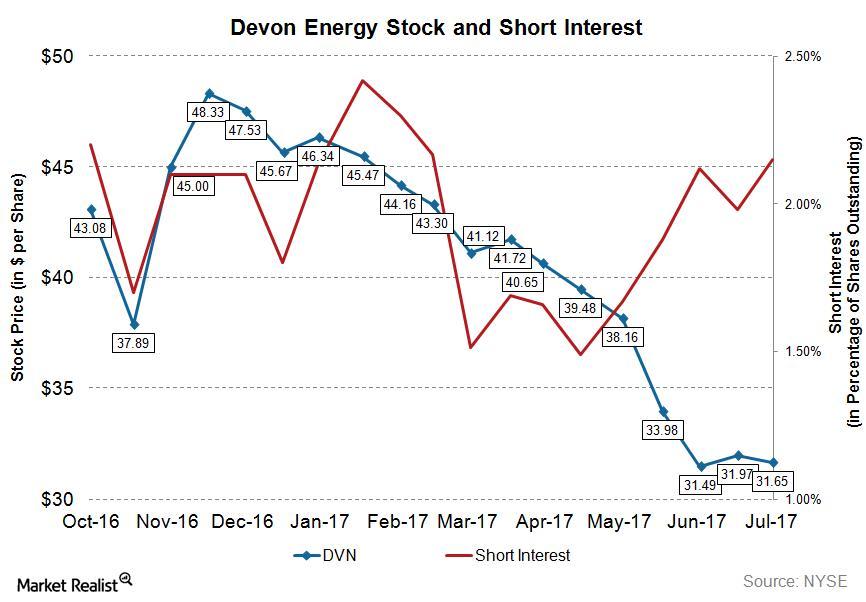

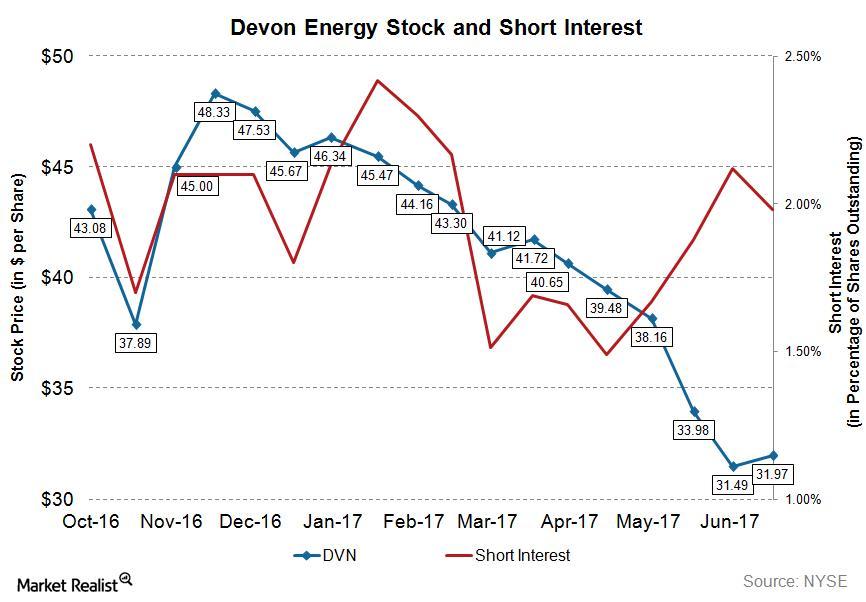

Chart of the Week: What’s the Short Interest in Devon Energy?

As of July 14, 2017, short interest in Devon Energy (DVN) is ~11.3 million shares, while its average daily volume is ~6.2 million shares.

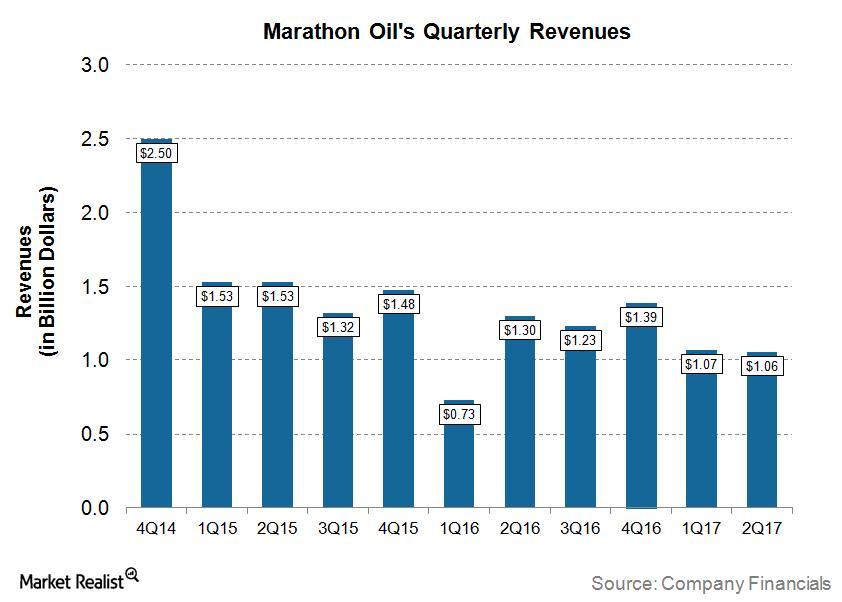

Analyzing Marathon Oil’s 2Q17 Revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

Short Interest in Devon Energy Stock

As of July 14, 2017, Devon Energy’s (DVN) short interest stood at ~11.31 million, while its average daily volume is ~6.21 million.

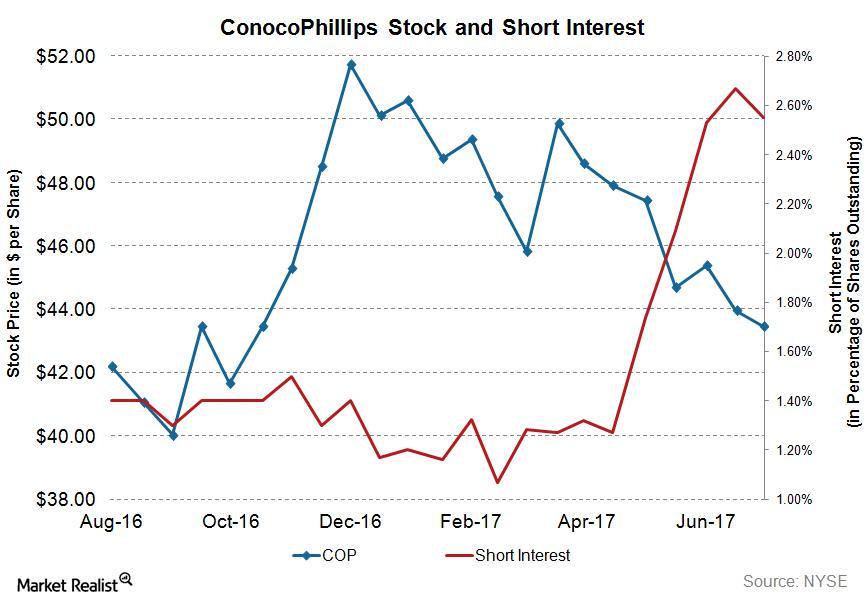

Analyzing Short Interest Trends in ConocoPhillips’s Stock

As of July 14, 2017, ConocoPhillips’s (COP) total shares shorted (or short interest) stood at ~31.48 million, whereas its average daily volume is ~5.91 million.

What’s the Short Interest in Marathon Oil Stock?

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million.

Analyzing Short Interest in Devon Energy Stock

As of June 30, 2017, Devon Energy’s (DVN) total shares shorted (or short interest) stood at ~10.4 million, whereas its average daily volume was ~5.9 million.

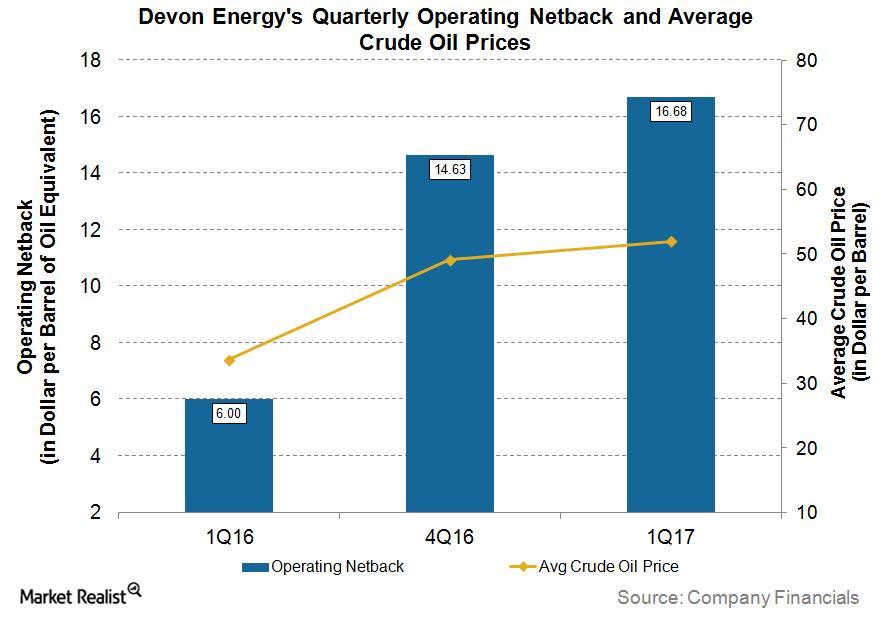

Devon Energy’s Operating Netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16.

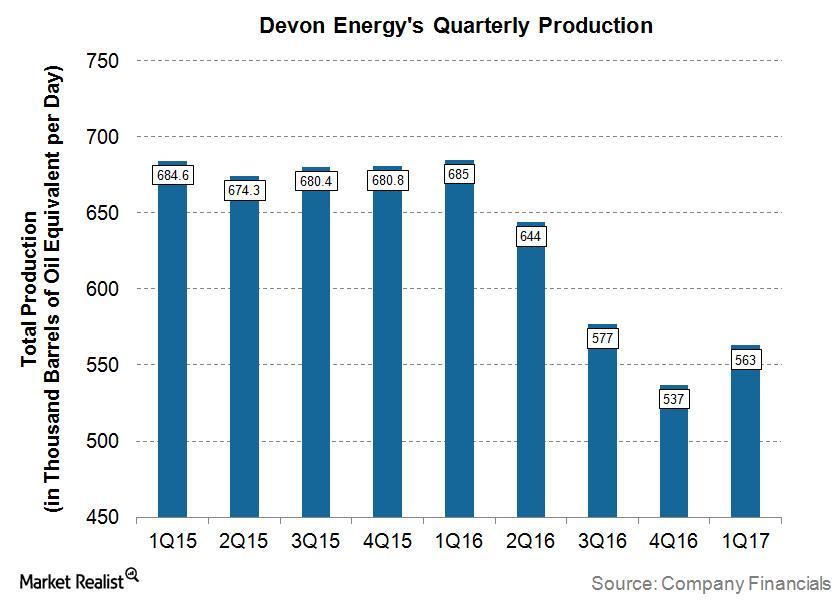

Understanding Devon Energy’s Production Volumes

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

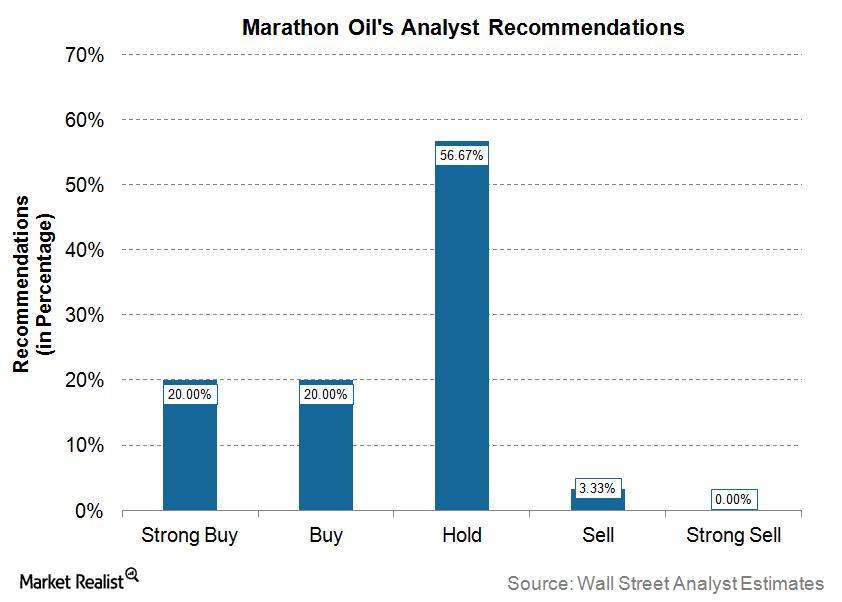

What Are Analysts Saying about Marathon Oil?

Recommendations Currently, 30 analysts cover Marathon Oil (MRO). They’ve given six “strong buy,” six “buy,” 17 “hold,” and one “sell” recommendation on the stock. There were no “strong sell” recommendations. Target price Analysts’ median target price for MRO is $20, which is ~25% higher than the closing price of $16.05 on February 9, 2017. The mean […]

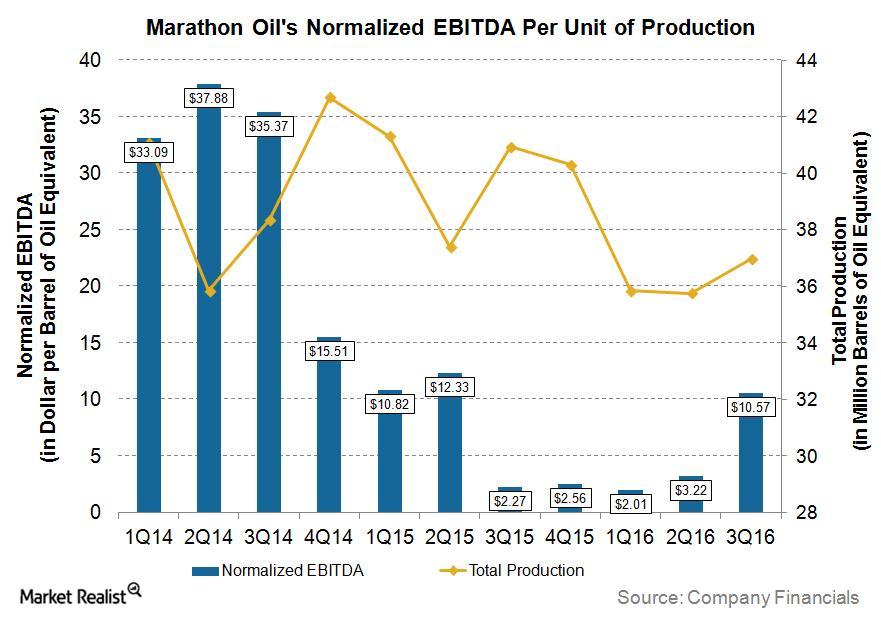

Understanding Marathon Oil’s EBITDA Normalized to Production

In 3Q16, Marathon Oil (MRO) reported normalized EBITDA per unit of production of ~$10.57 per boe, which was ~366% higher than in 3Q15.

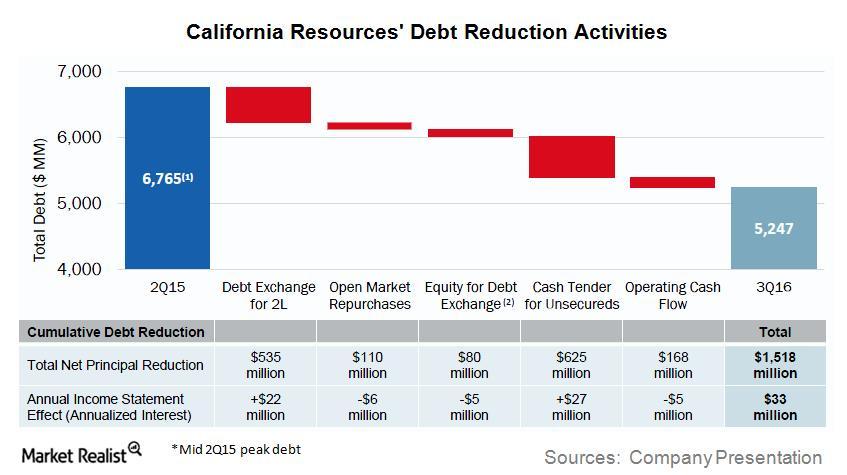

California Resources Has Taken These Steps to Reduce Its Debt

On September 30, 2016, California Resources’ (CRC) total debt stood at ~$5.3 billion. California Resources has been intently focusing on reducing its debt load.

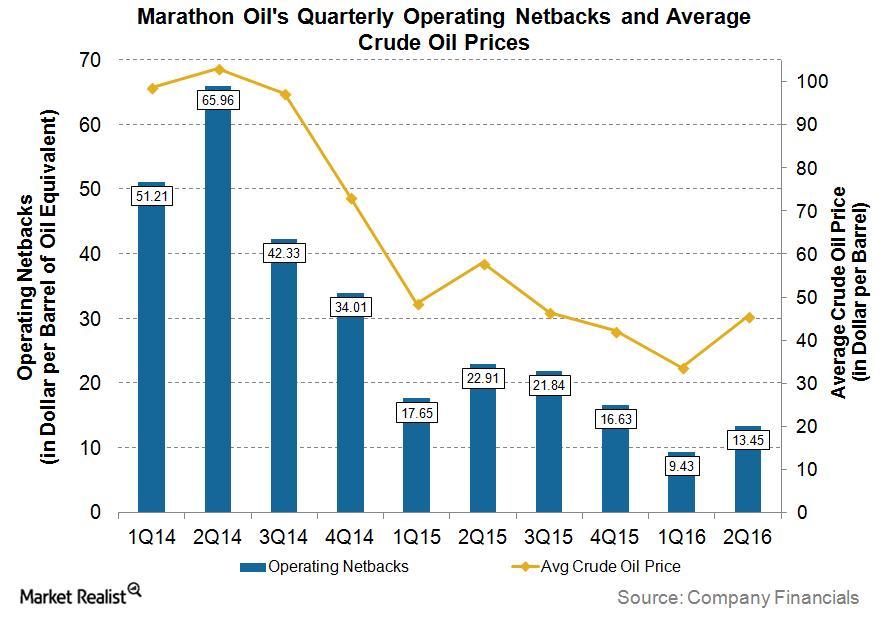

Marathon Oil’s 2Q16 Operating Netbacks Unveiled

In 2Q16, Marathon Oil (MRO) reported an operating netback of ~$13.45 per boe (barrel of oil equivalent), which is ~41% lower than in 2Q15.

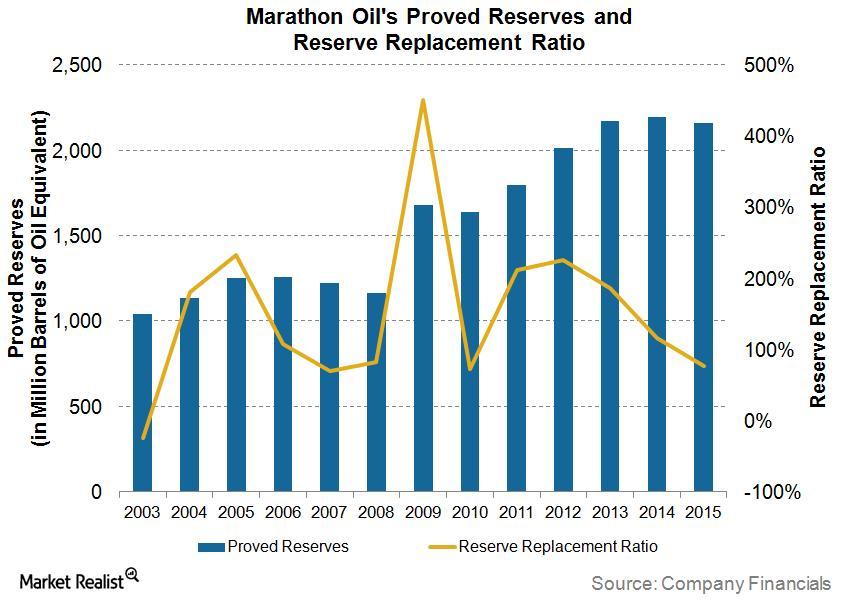

How Are Marathon Oil’s Proved Reserves Evolving?

As of December 31, 2015, the Marathon Oil’s (MRO) proved reserves totaled ~2163 MMboe, which is ~35 MMboe less than in December 31, 2014.

How Marathon Oil’s Stock Has Reacted to Past Earnings Reports

After losing ~84% of its market capitalization between September 2014 and February 2016, Marathon Oil’s stock price has begun to show signs of new uptrends.

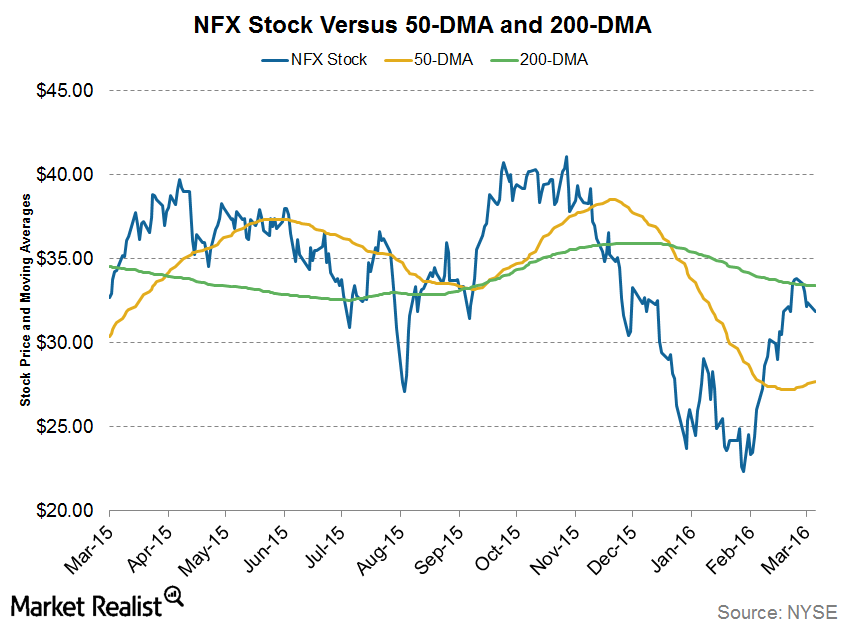

Newfield Exploration Stock Is Up, but for How Long?

With the recent rally in crude oil prices, Newfield Exploration (NFX) stock has been on an uptrend. On March 1, 2016, it crossed its 50-day moving average for the first time in 2016.

Why Is There a Crude Oil Supply and Demand Gap in 2016 and 2017?

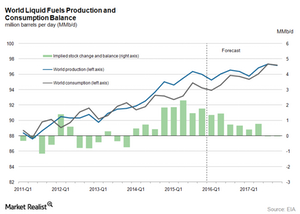

The EIA estimates the global crude oil supply and demand gap to average 1 MMbpd in 2016 and 0.2 MMbpd in 2017. It reported that global consumption should grow 1.2 MMbpd in 2016 and 1.5 MMbpd in 2017.

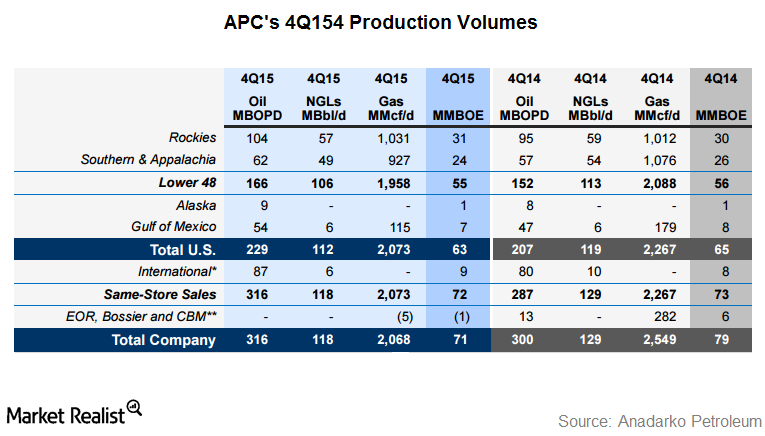

Anadarko Petroleum Slashes Its 2016 Capital Expenditure Budget

Anadarko Petroleum’s preliminary capex (capital expenditure) budget for 2016 is $2.8 billion—nearly 50% less than 2015 levels.

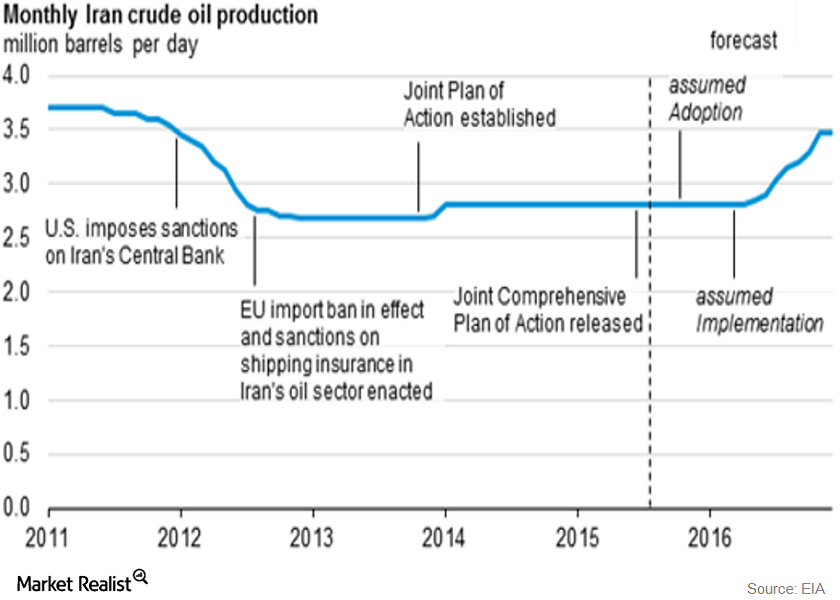

Iran’s Oil Sanctions Lifted: Brent Oil Prices Feel the Heat

Thus, Iran’s Western oil sanctions were lifted on Saturday, January 16, 2016. On Sunday, January 17, Iran stated that it would increase its crude oil production by 500,000 bpd (barrels per day) as soon as possible.

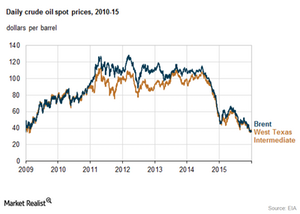

WTI and Brent Crude Oil Prices in 2015, Lowest since 2009

US benchmark WTI crude oil prices averaged at $49 per barrel in 2015. WTI and Brent crude oil prices closed below $40 per barrel in 2015.

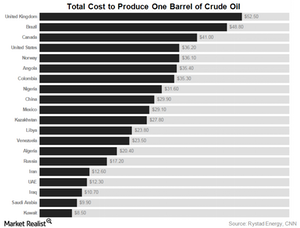

Crude Oil’s Total Cost of Production Impacts Major Oil Producers

OPEC members Nigeria, Libya, and Venezuela have the highest total cost of producing crude oil at $31.6 per barrel, $23.80 per barrel, and $23.50 per barrel.

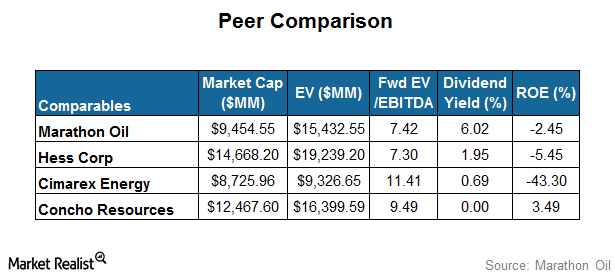

Marathon Oil’s Relative Valuation: A Comparison with Its Peers

In this part of the series, we’ll look at Marathon Oil’s (MRO) relative valuation against its peers’ multiples.

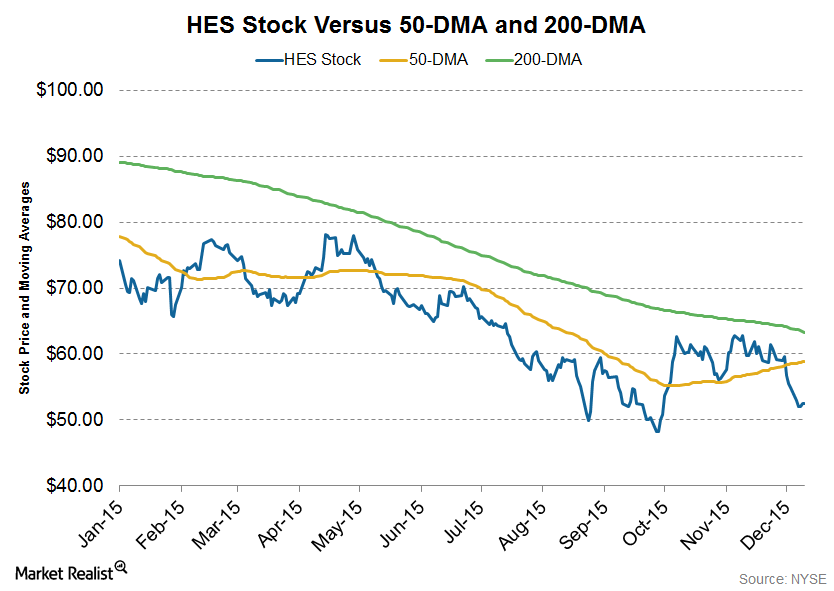

Hess Moves below its 200-Day Moving Average

On December 11, 2015, Hess was trading 17% below its 200-day moving average, a strong upside resistance for the stock. It has narrowed the gap considerably since October.

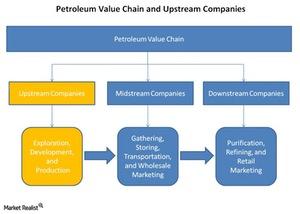

Where Do Upstream Energy Companies Sit along the Petroleum Value Chain?

Upstream energy companies are the starting point of the petroleum value chain and are involved in exploration, appraisal, development, and production.

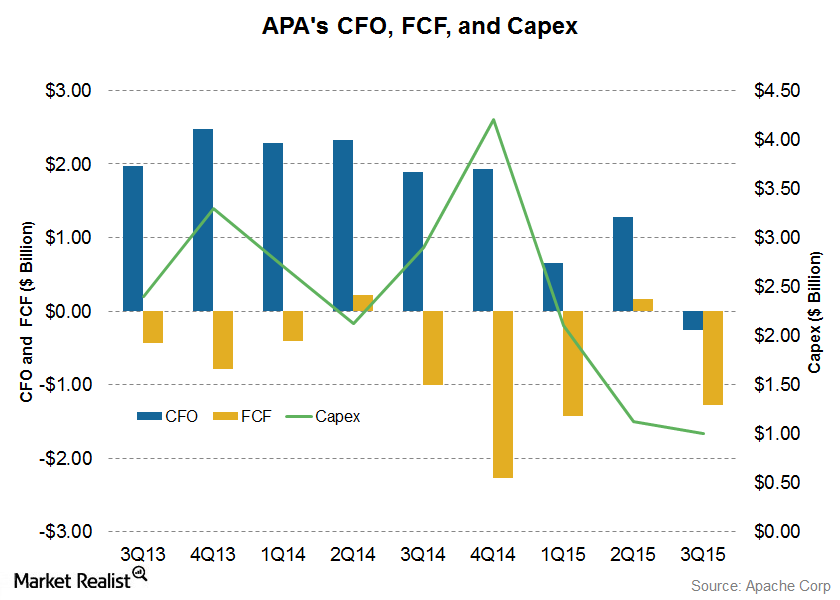

An Analysis of Apache’s Free Cash Flow Trends

Apache’s free cash flow has been mostly negative in the past nine quarters. In 2Q15, it reported FCF of $157 million despite weakness in commodity prices.

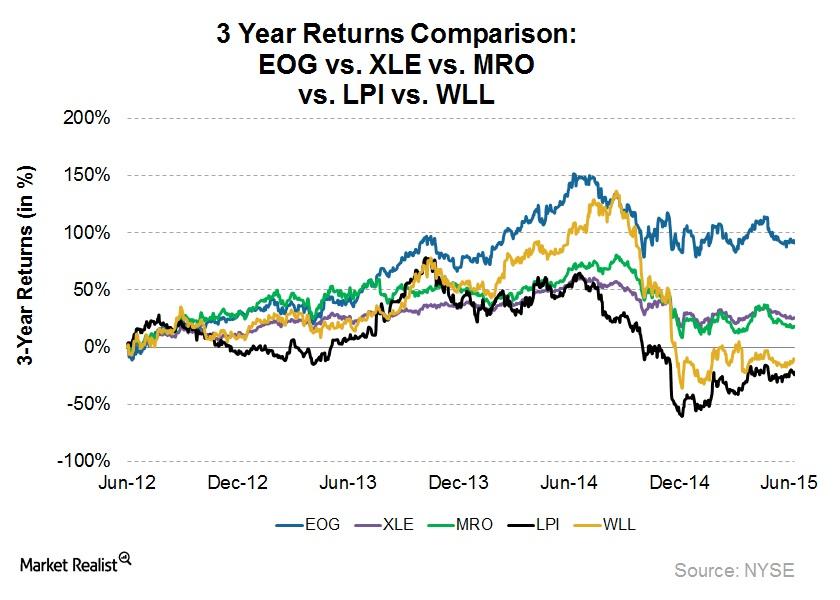

Why EOG Resources Is among the Best Upstream Stocks

EOG Resources (EOG) has generated above-par returns over a three-year period. EOG returned 91.8% in the last three years, mainly due to its strong performance.

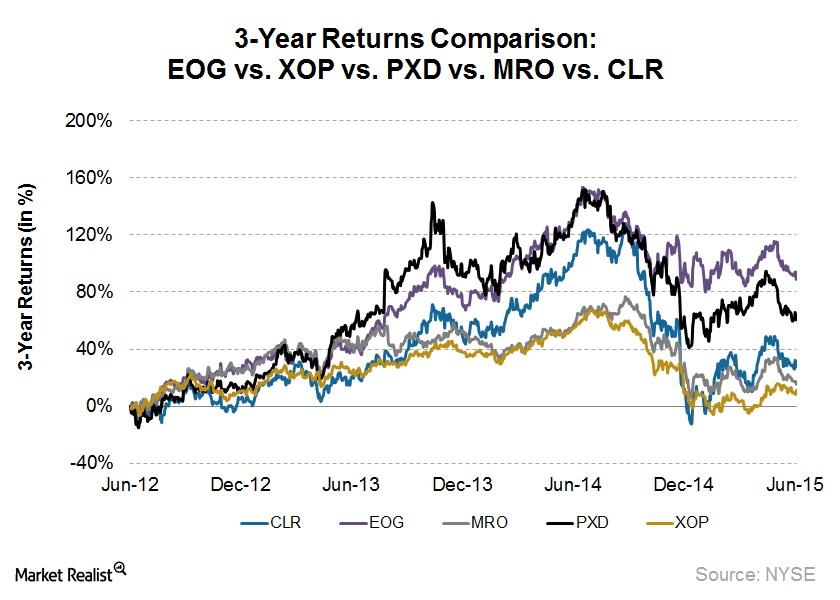

EOG and Pioneer: The Best Upstream Stocks in the Past 3 Years

Of the top American upstream stocks, EOG Resources has been the outperformer since June 2012, returning 93%. During the same period, Pioneer Natural Resources (PXD) returned 61%.

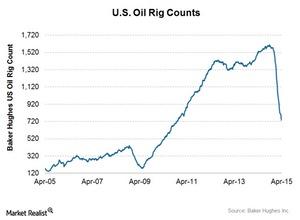

US Crude Oil Rig Count Down for 19 Straight Weeks

US crude oil rig count decreased by 26 for the week ended April 17 down from 760 to 734. The number of oil rigs is now at its lowest level since December 3, 2010.