LyondellBasell Industries NV

Latest LyondellBasell Industries NV News and Updates

How Wall Street Analysts Rate LyondellBasell ahead of 1Q18 Earnings

The analyst consensus target price for LyondellBasell is $116.82, implying a return potential of 8.5% over the closing price of $107.68 as of April 20, 2018.

LyondellBasell Announces New Share Repurchase Program

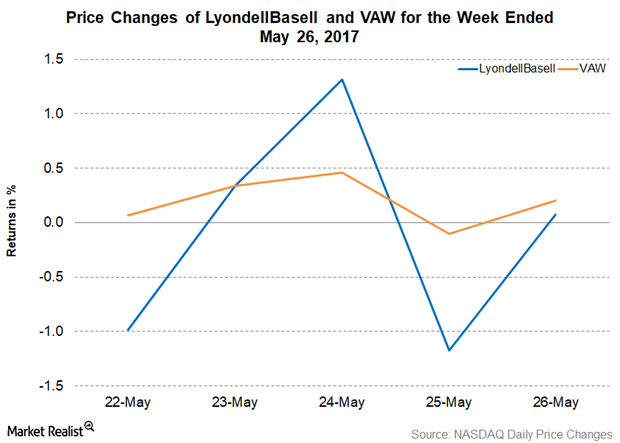

On May 24, 2017, LyondellBasell’s (LYB) board authorized a new share repurchase program. It can repurchase up to 10% of its outstanding shares over the next 18 months.

What Are LyondellBasell’s Global Rankings?

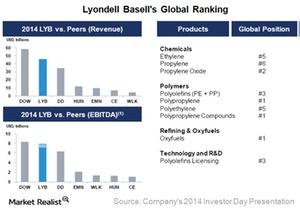

LyondellBasell (LYB) is the leading global producer of olefins and polyolefins.

How Praxair’s European Revenue Is Trending

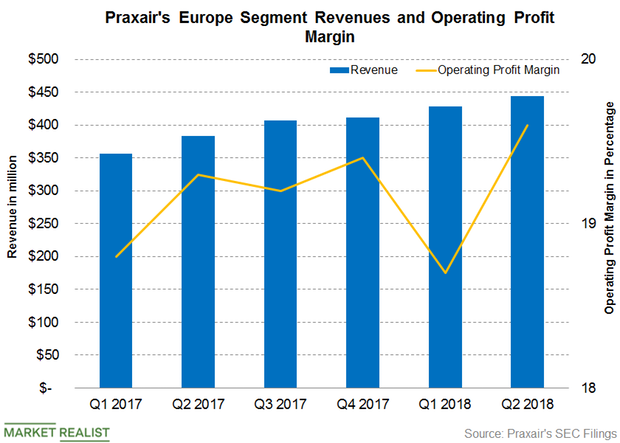

Praxair’s (PX) European segment contributed 14.5% of its total revenue in Q2 2018, compared with 13.5% in Q2 2017.

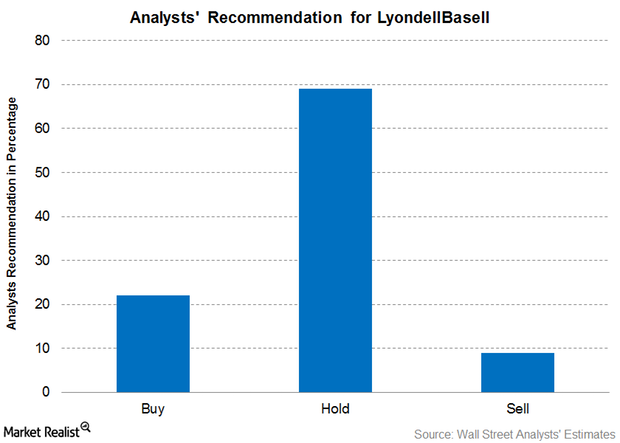

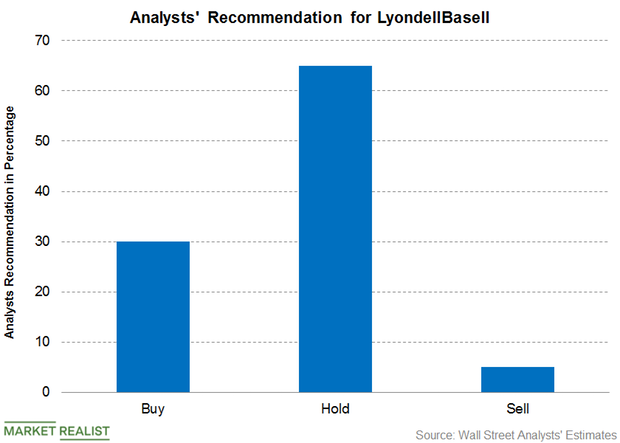

LyondellBasell: Analysts’ Views and Recommendations

For LyondellBasell, 30% of the analysts recommended a “buy,” 65% recommended a “hold,” and 5% recommended a “sell.”

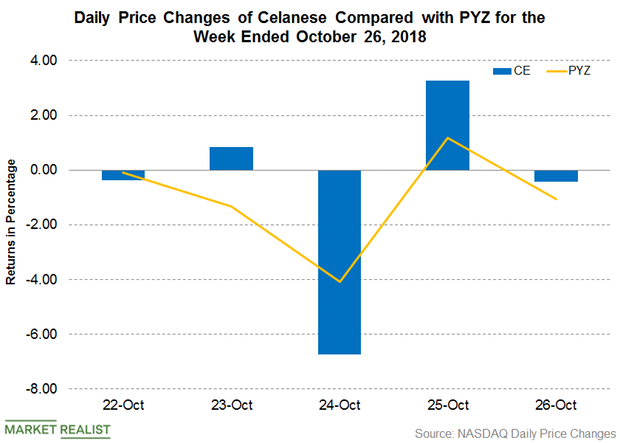

Celanese Increases Prices of Ethyl Acetate in the Americas

On October 22, Celanese (CE) announced that it would be increasing the prices of ethyl acetate in the Americas region.

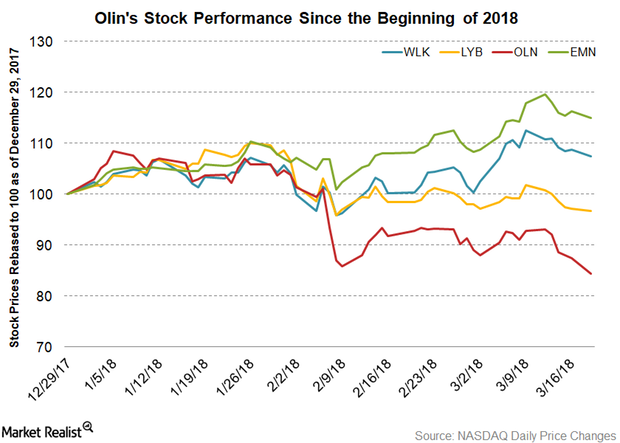

How Olin Stock Has Fared in 2018 Year-to-Date

On a year-to-date basis, until March 19, 2018, OLN stock has fallen 15.5%.

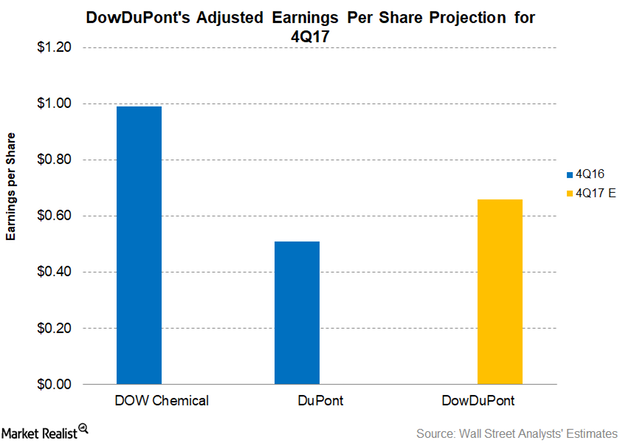

What Could Drive DowDuPont’s Adjusted Earnings in 4Q17?

DowDuPont (DWDP) is expected to post an adjusted EPS (earnings per share) of $0.66 in 4Q17. DowDuPont posted an adjusted EPS of $0.55 in 3Q17.

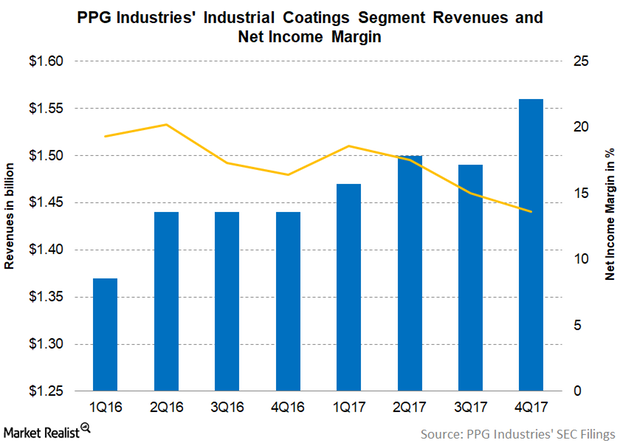

PPG’s Industrial Coatings Segment’s Margins Continue to Contract

PPG Industries’ (PPG) Industrial Coatings segment is its second reporting segment. The segment represented 42.3% of the company’s total revenue in 4Q17 compared to 42.0% in 4Q16.

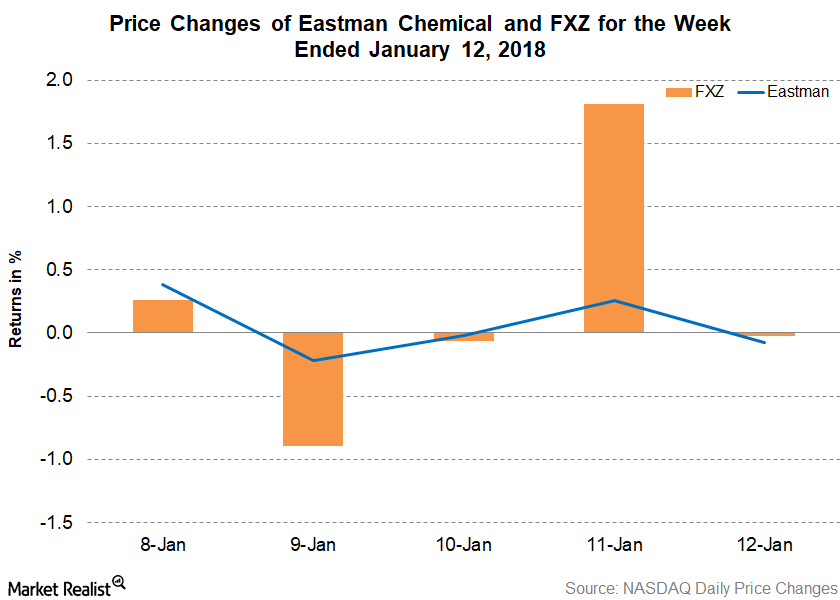

Eastman Chemical’s Demand for Tritan Continues to Grow in Asia

The demand for Eastman Chemical’s Tritan continues to grow.

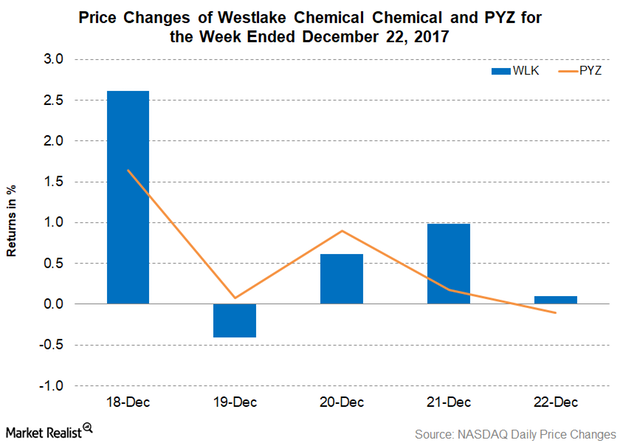

Westlake Announces Optional Redemption of Senior Notes

On December 18, 2017, Westlake Chemical (WLK) announced that it had sent notices about the optional redemption of $688 million in senior notes.

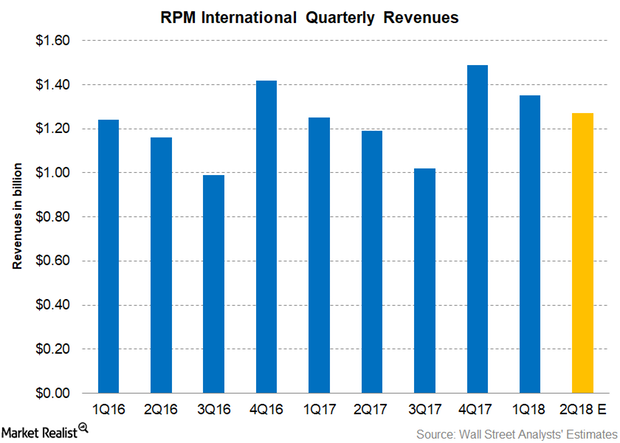

What Could Boost RPM International’s Fiscal 2Q18 Revenue

Analysts’ revenue expectations As of December 20, 2017, analysts expected RPM International (RPM) to report revenue of $1.3 billion in fiscal 2Q18. The expected revenue represents growth of 6.7% year-over-year. In fiscal 2Q17, RPM reported revenue of $1.2 billion. Between 2012 and 2017, RPM’s second-quarter revenue grew at a CAGR (compound annual growth rate) of […]

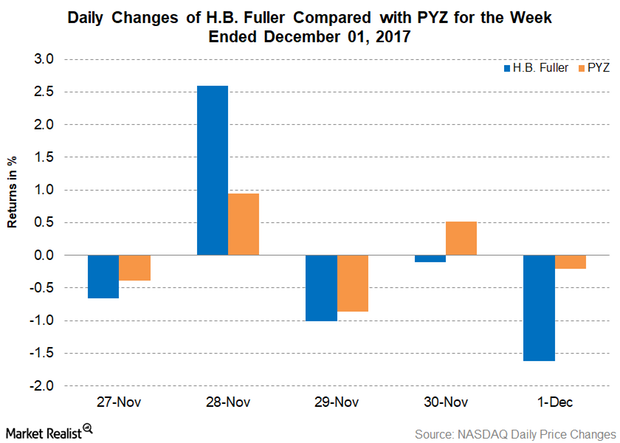

H.B. Fuller Opens a New Facility in Germany

On November 28, 2017, H.B. Fuller (FUL) announced that it has started a new Automotive Competency Center in Mannheim, Germany.

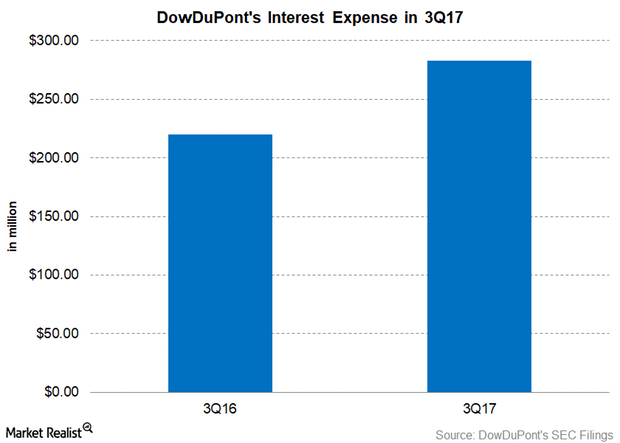

How Strong Is DowDuPont’s Interest Coverage?

In 3Q17, DWDP’s interest expense was reported at $283 million as compared to the $220 million in 3Q16 on a proforma basis.

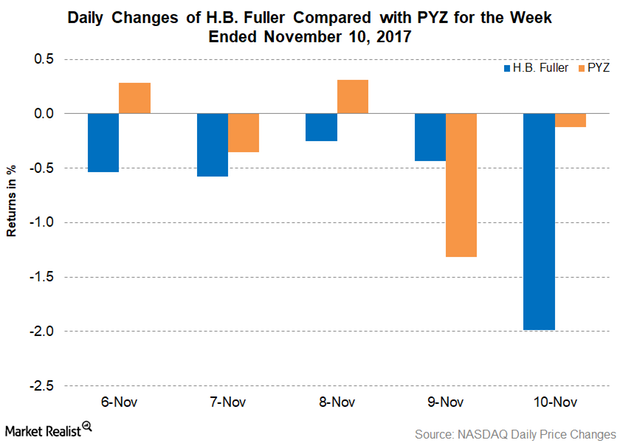

H.B. Fuller Finalizes Its Adecol Deal

On November 6, 2017, H.B. Fuller (FUL) provided its acquisition plans for Adecol Indústria Química, a Brazilian company.

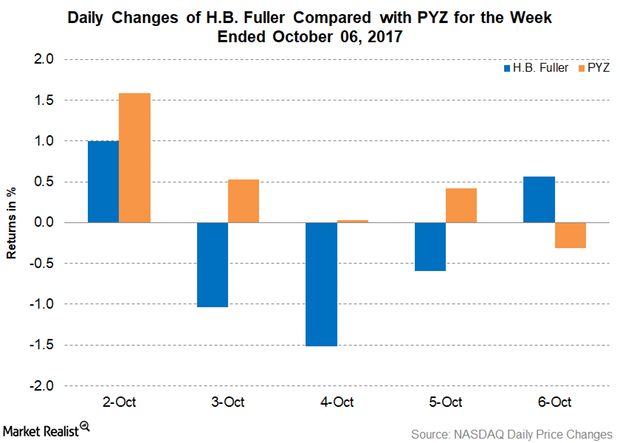

H.B. Fuller Inducts Ruth Kimmelshue to Its Board of Directors

On October 4, 2017, H.B. Fuller (FUL) announced that Ruth Kimmelshue had been appointed to the company’s board of directors, effective immediately.

LyondellBasell Starts Polypropylene Production at Dalian, China

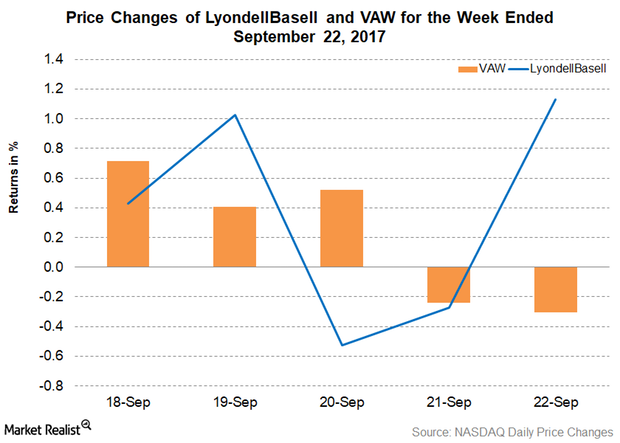

On September 21, 2017, LyondellBasell (LYB) announced that it has started manufacturing polypropylene (or PP) from its production facility in Dalian, China.

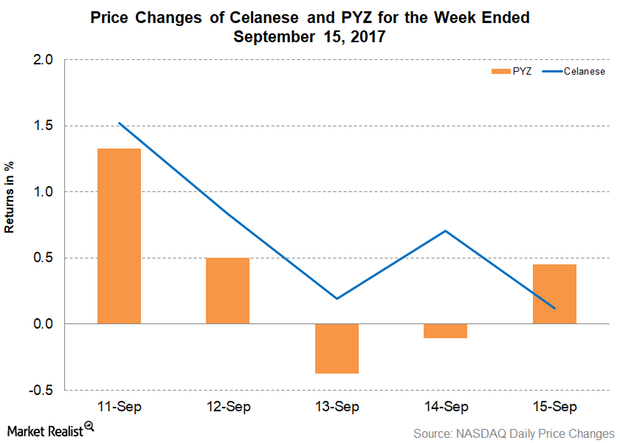

Celanese Continues to Hike Its Product Prices

On September 14, 2017, Celanese (CE) announced that it’s increasing the prices for several of its products across different regions.

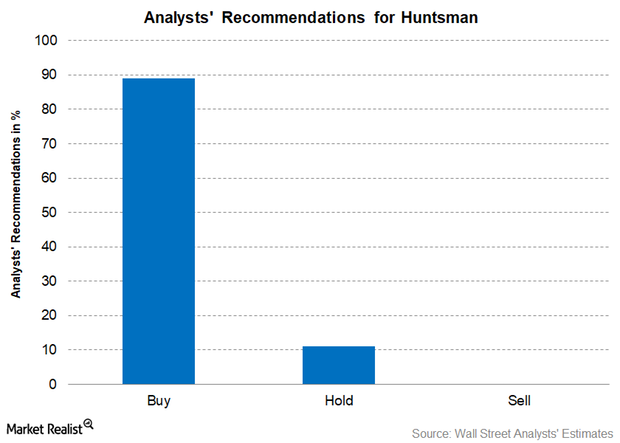

Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

Is LyondellBasell Stock Undervalued Compared to Its Peer?

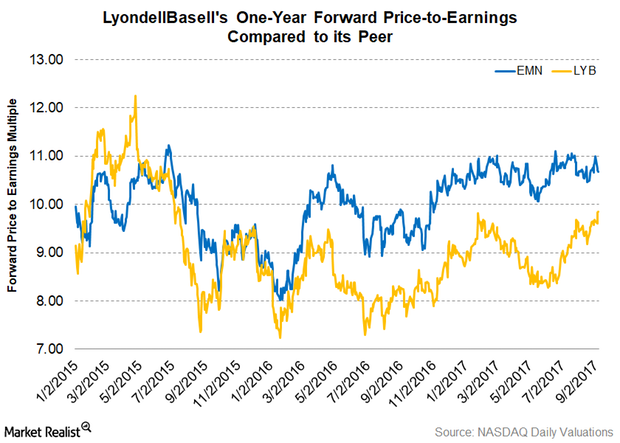

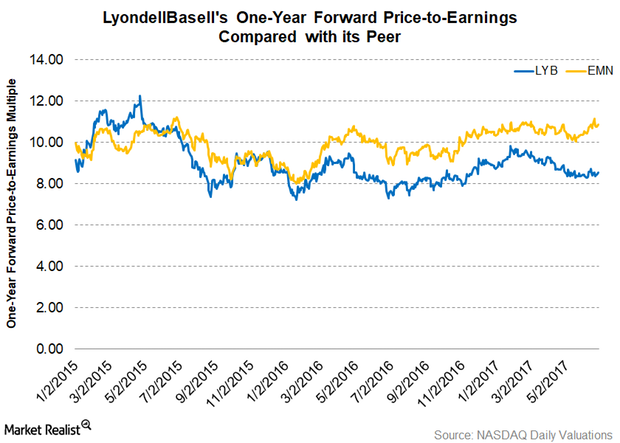

As of September 7, 2017, LyondellBasell’s one-year forward PE multiple stands at 9.80x, while Eastman Chemical has one-year forward PE multiple of 10.70x.

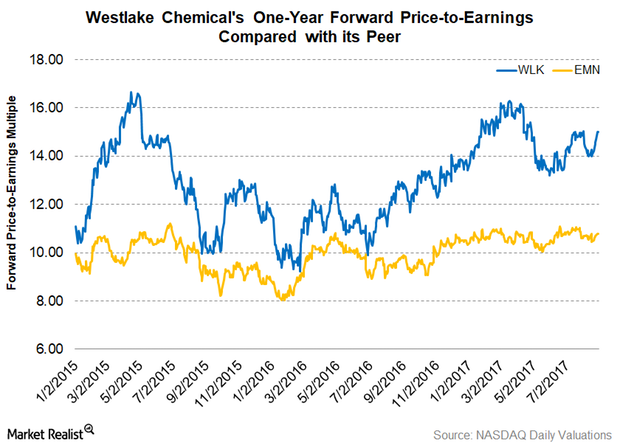

What Do Westlake Chemical’s Valuations Suggest?

Westlake Chemical is trading at a premium to its peer Eastman Chemical. After good earnings in 1H17, analysts expect Westlake Chemical to post EPS of $4.66.

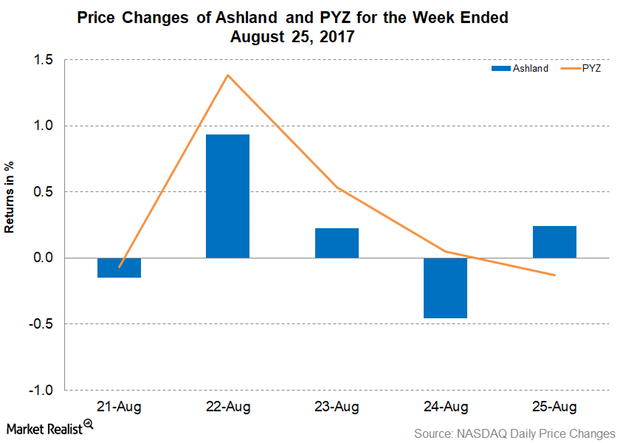

Ashland Hikes Prices of Gelcoat in EMEA

On August 25, 2017, Ashland (ASH) announced that it would hike the prices of its Gelcoat portfolio. The price hike will be 75 euros per metric ton.

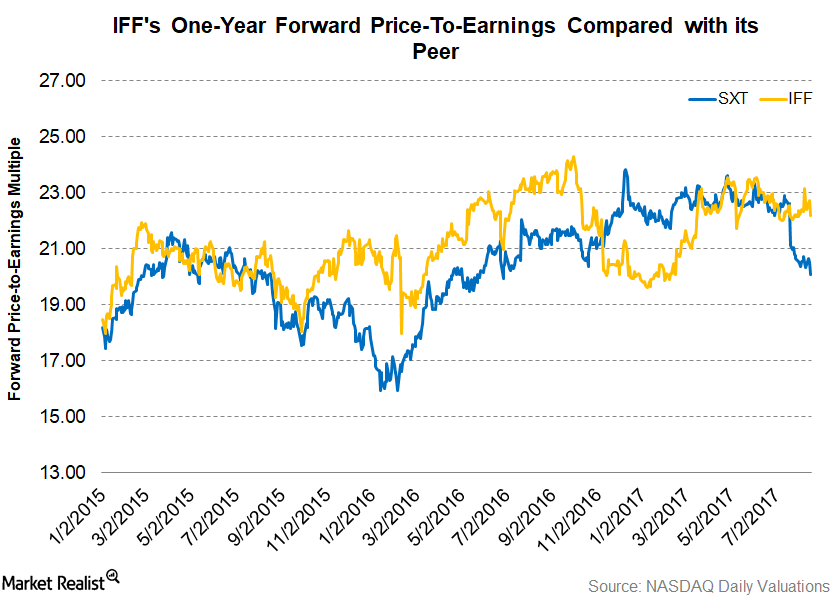

What IFF’s Valuations Suggest about the Stock

As of August 17, 2017, International Flavors and Fragrances traded at a one-year forward PE (price-to-earnings) multiple of 22.20x.

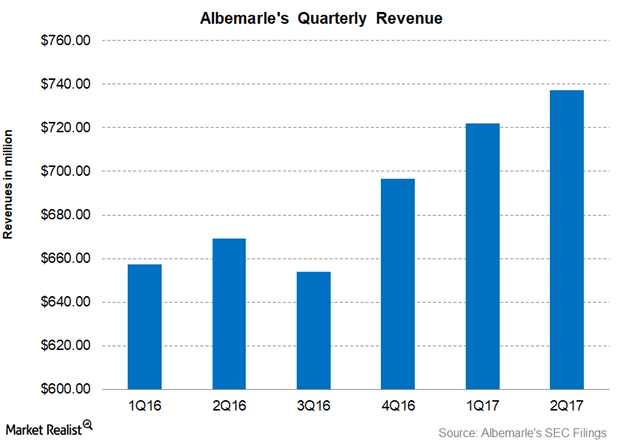

Albemarle’s 2Q17 Revenues Rose on Higher Volumes

ALB has guided its fiscal 2017 revenues to be in the range of ~$2.9 billion–$3.1 billion.

Who’s LyondellBasell Cooking up a License Deal with Now?

On July 12, 2017, LyondellBasell (LYB) granted its Spherizone and Lupotech T Licenses to Shaanxi Coal Yulin Energy and Chemical.

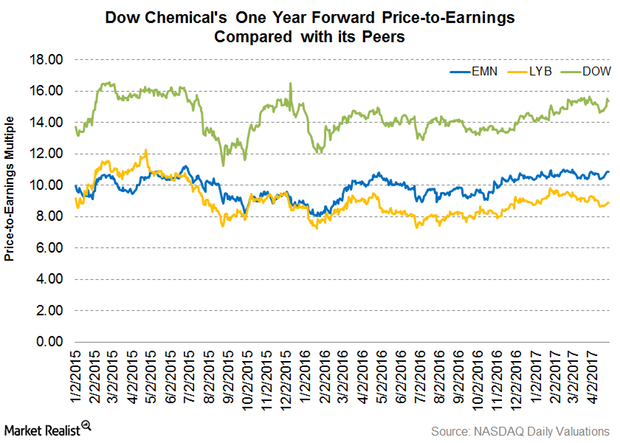

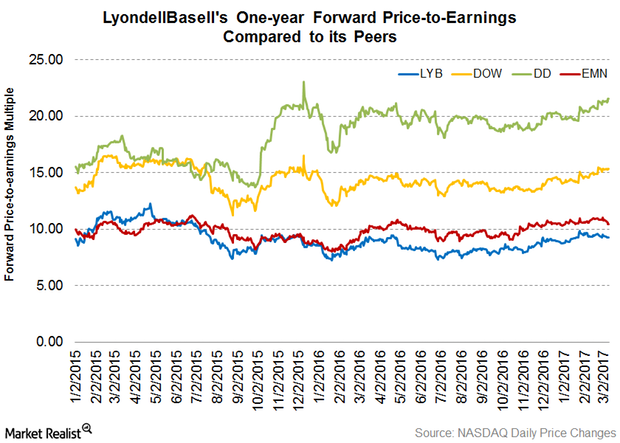

Why LyondellBasell Is Trading at a Discount to Peers

As of June 26, 2017, LyondellBasell’s one-year forward PE (price-to-earnings) multiple stood at 8.50x.

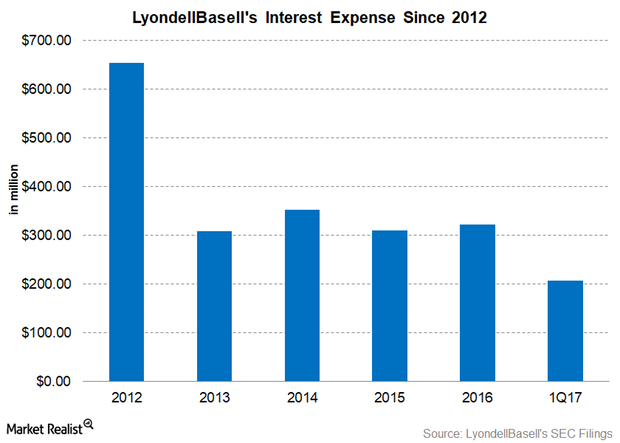

Is LyondellBasell Managing Its Interest Expenses Efficiently?

LyondellBasell’s (LYB) interest expense has been steady in the range of $309 million–$352 million since 2013, although debt has risen during the same period.

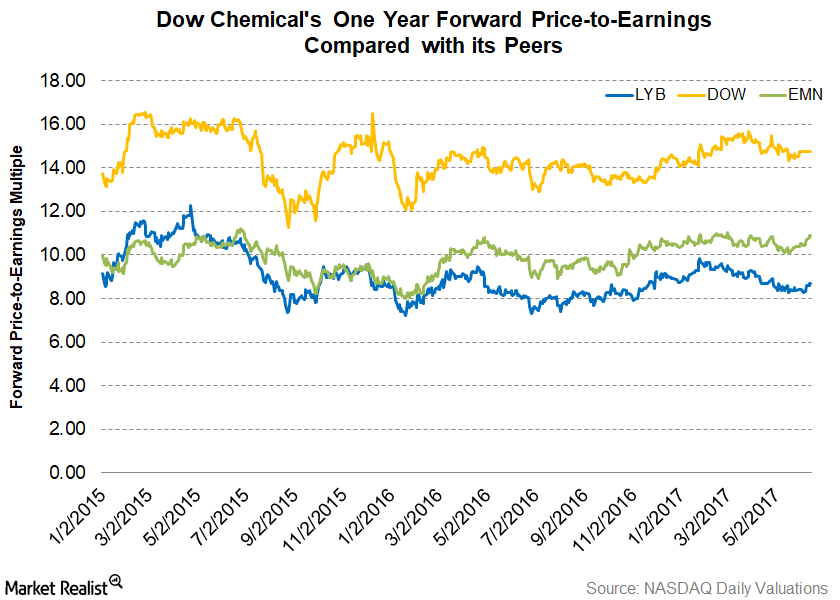

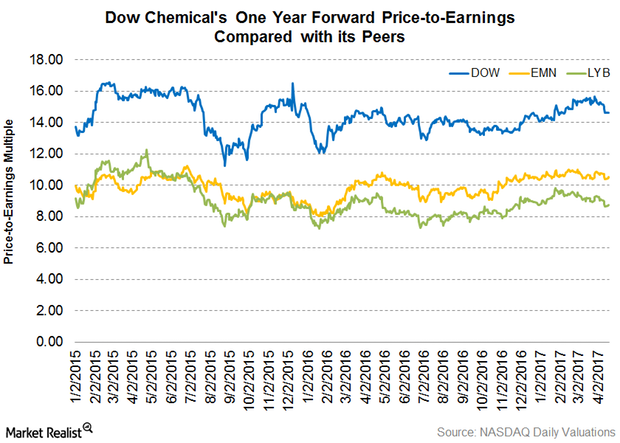

Dow Chemical’s Latest Valuations

As of June 13, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 14.70x, compared to 10.9x for Eastman Chemical (EMN).

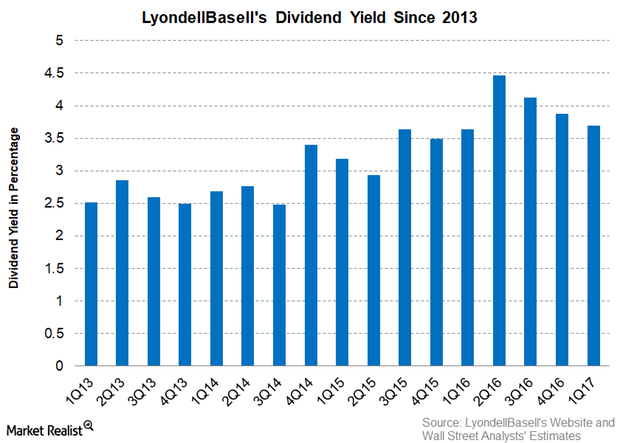

How LyondellBasell’s Dividend Yield Has Changed

On May 25, 2017, LyondellBasell (LYB) stock closed at $80.67. With LYB’s 2Q17 quarterly dividend of $0.90 per share, its current dividend yield is 4.4%.

LyondellBasell to Build Hyperzone Polyethylene Plant

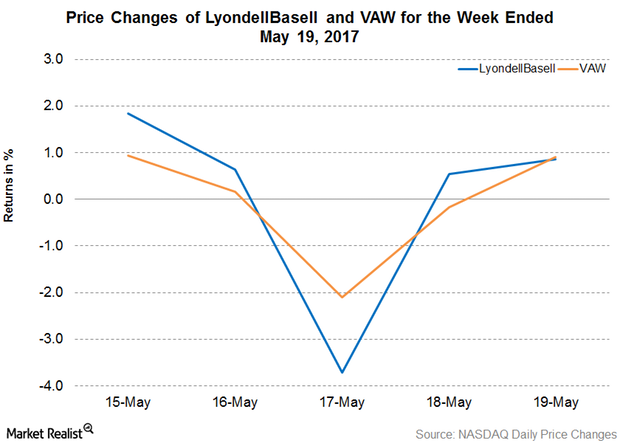

On May 15, 2017, LyondellBasell Industries (LYB) said it’s set to build a polyethylene plant at its La Porte, Texas, facility.

Dow Chemical’s Latest Valuations Post 1Q17 Earnings

As of April 27, 2017, Dow Chemical (DOW) was trading at a one-year forward PE ratio of 15.4x, compared to Eastman Chemical (EMN) and LyondellBasell (LYB) at 10.9x and 8.9x, respectively.

What Are Dow Chemical’s Valuations ahead of 1Q17 Earnings?

As of April 19, 2017, Dow Chemical (DOW) traded at a one-year forward PE ratio of 14.60x.

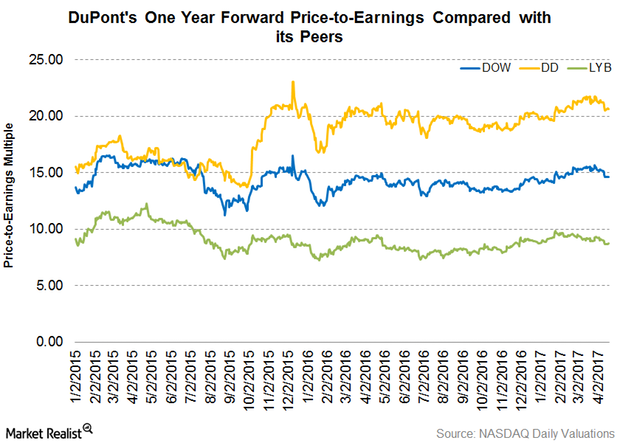

Why DuPont Trades at a Premium to Its Peers

As of April 18, 2017, DD traded at a one-year forward PE multiple of 20.60x.

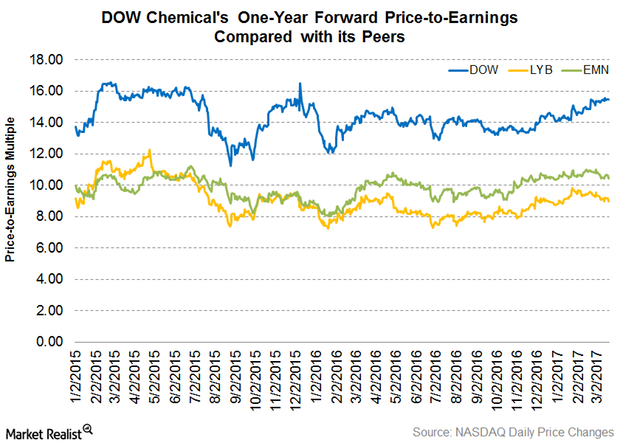

Dow Chemical Trades at a Premium to Its Peers

As of March 21, Dow Chemical (DOW) traded at a one-year forward PE multiple of 15.50x—compared to its peers Eastman Chemical and LyondellBasell.

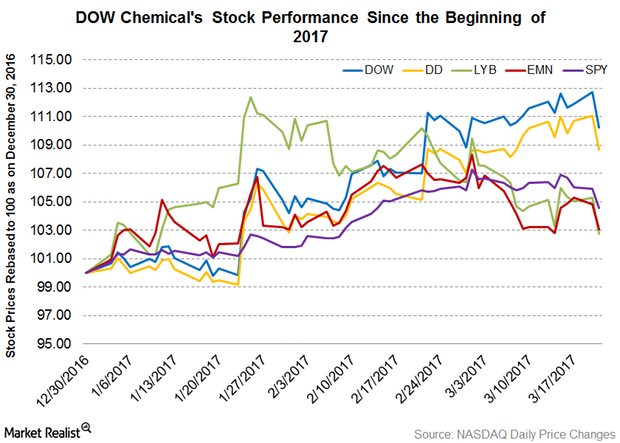

Analyzing How Dow Chemical Stock Has Performed in 2017

From the beginning of 2017 to March 21, 2017, Dow Chemical (DOW) has been an outstanding performer. It rose 10.20% and outperformed SPY.

Shandong Yuhuang Shengshi Chemical Finalizes Deal with LYB

LyondellBasell is a leading licensor of polyethylene technologies with more than 250 polyolefin process licenses.

Can LyondellBasell’s Valuation Come Out of Its Peers’ Shadow?

As of March 9, 2017, LyondellBasell (LYB) was trading at a one-year forward PE (price-to-earnings) multiple of 9.3x.

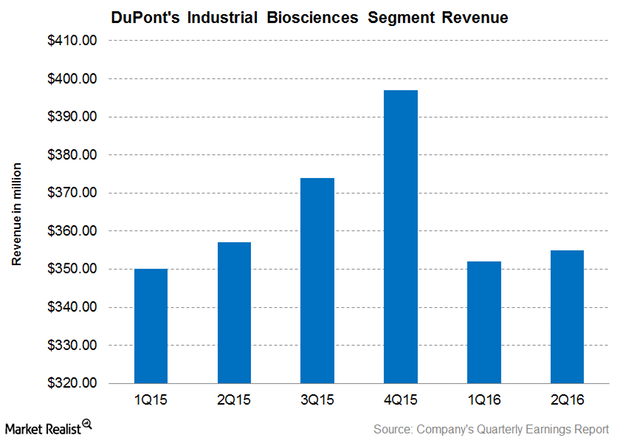

Why Did DuPont’s Industrial Biosciences Segment Revenue Fall in 2Q16?

For 2Q16, DuPont’s Industrial Biosciences segment reported revenues of $355 million, representing 5% of the company’s total revenue.

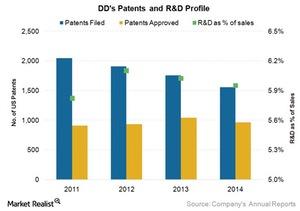

DuPont’s Research and Development Spending Compared to Its Peers’

DuPont is a technology and research and development driven company. It spent an average of 6% of its revenues on R&D activities during the 2011–2014 period.

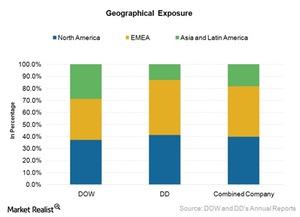

Will the Merger Have Geographical Synergy for the New Company?

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence.

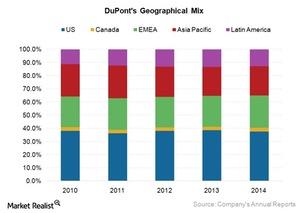

How Is DuPont’s Geographical Sales Exposure and Global Presence?

DuPont is a global company with operations in more than 90 countries. In 2014, the company’s North America region contributed 41% to its total revenue.

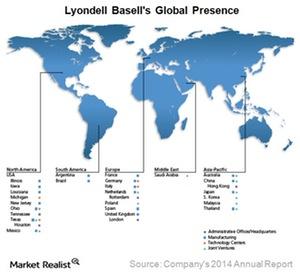

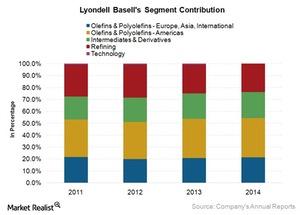

How Does LyondellBasell’s Geographical Exposure Compare to Peers?

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States.

LyondellBasell: A Leading Manufacturer of Olefins and Polyolefins

LyondellBasell is one of the world’s leading producers of olefins and polyolefins. After Dow Chemical, LYB is the second largest company by revenue and EBITDA in the US.

What Will Drive Dow Chemical’s Future Growth?

The Dow Chemical Company has significantly changed its business model to improve its earnings profile and returns to shareholders.

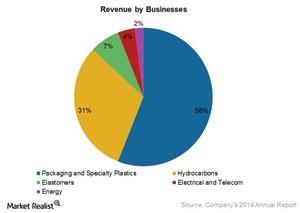

Understanding Dow’s Largest Segment, Performance Plastics

Dow’s Performance Plastics segment contributed 39% and 46% to Dow’s total revenue and EBITDA, respectively, in 2014.