Dollar Tree Inc

Latest Dollar Tree Inc News and Updates

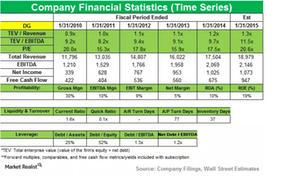

Farallon Capital Increases Its Position in Dollar General

In 2014, Dollar General reported net sales of $18.9 billion, an increase of 8% compared to sales of $17.5 billion in 2013.

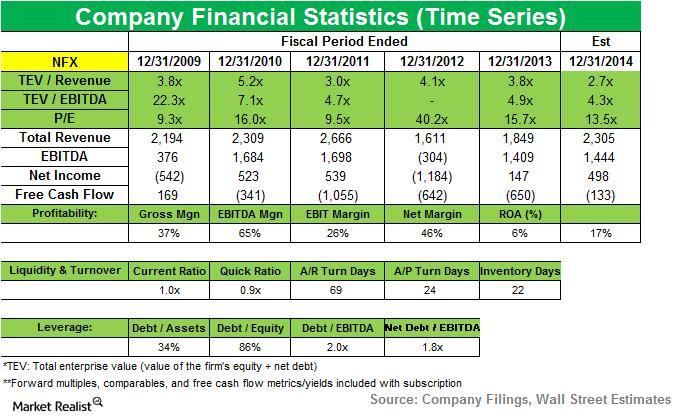

Balyasny exits position in Newfield Exploration Co.

BAM exited its position in Newfield Exploration Co. in 3Q14. It accounted for 1.31% of BAM’s second quarter portfolio. NFX is an energy company.

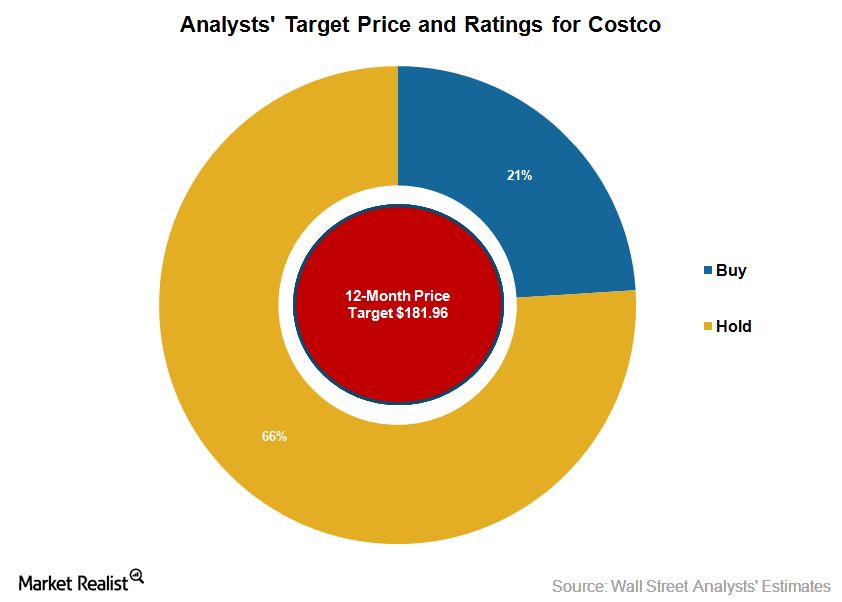

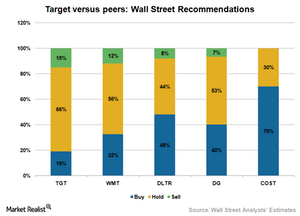

Costco on the Street: Analyst Recommendations

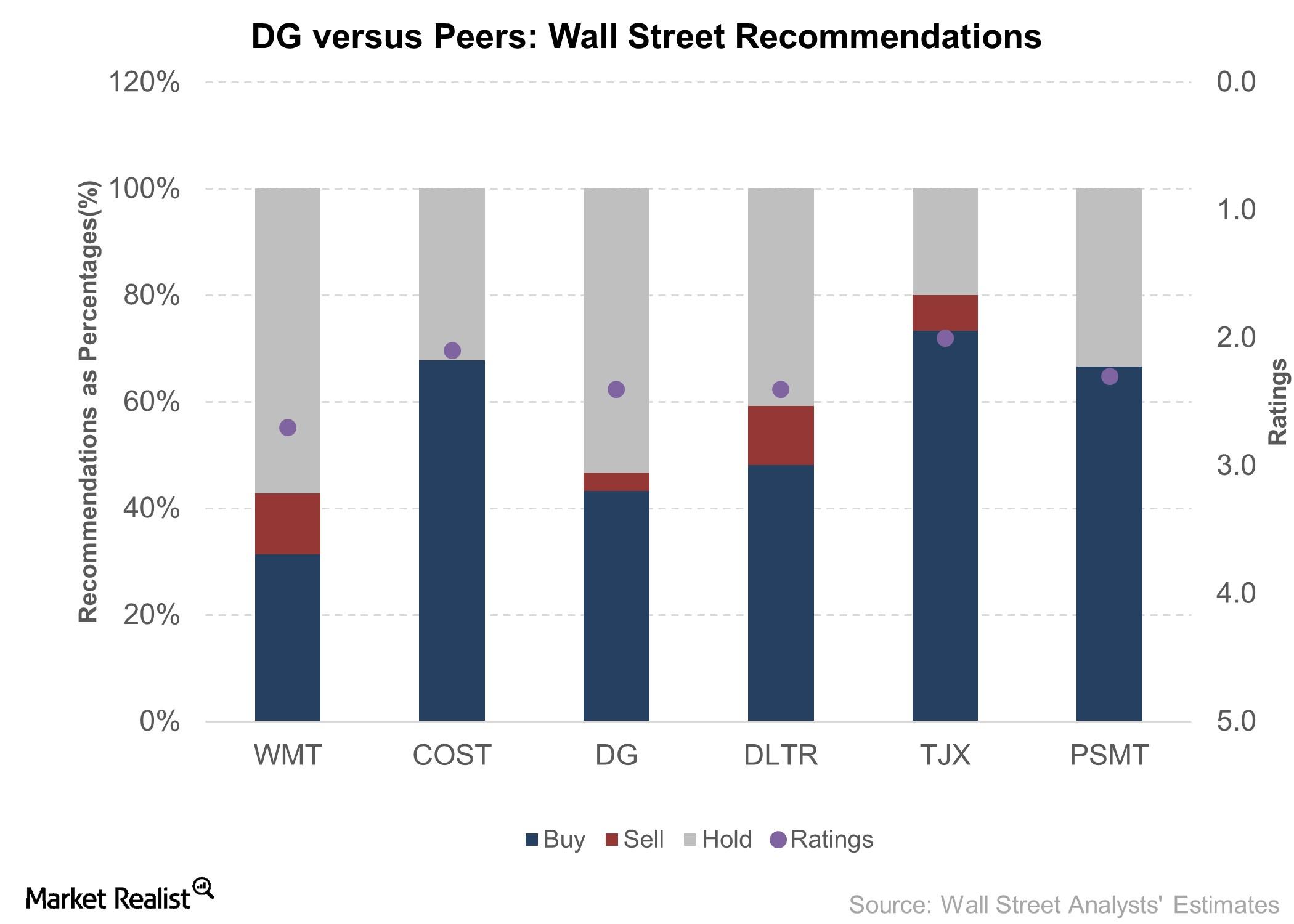

Of the 32 analysts covering Costco (COST), 69.0% have rated the stock as a “buy” as of April 5. The stock has been rated as a “hold” by 31% of these analysts.

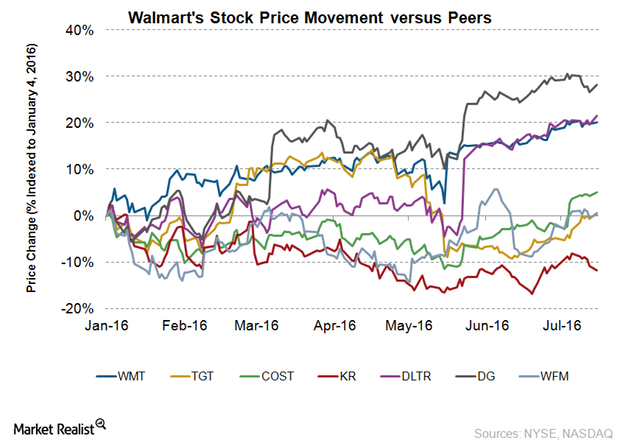

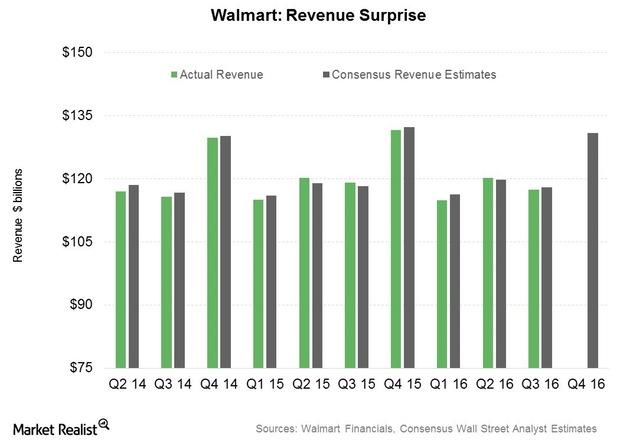

Walmart’s Stock Rises 20% Year-to-Date: Can It Rise More?

The stock price of retail giant Walmart (WMT) has risen by 20.1% on a YTD (year-to-date) basis to $73.84, as of July 18. Walmart’s stock has outperformed the S&P 500 Index, which has risen 7.7% on a YTD basis.

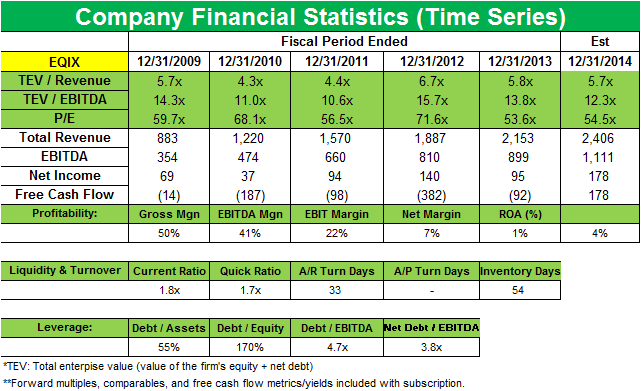

Stephen Mandel’s Lone Pine Capital buys a new position in Equinix

Lone Pine initiated a new position in Equinix (EQIX) last quarter that accounts for 1.81% of the fund’s total 1Q portfolio. Lone Pine had exited the position in 4Q 2013 and restarted it last quarter.

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Walmart’s Key Challenges In Its Business Environment

The NLRB filed a complaint last January. It accused Walmart of violating labor laws. The NLRB claims that the retailer acted against workers who joined unions.

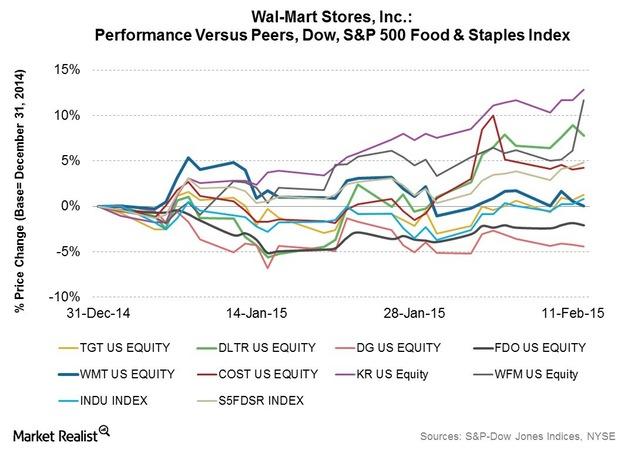

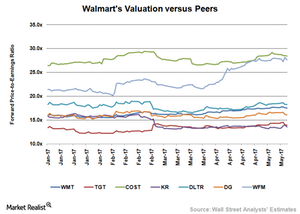

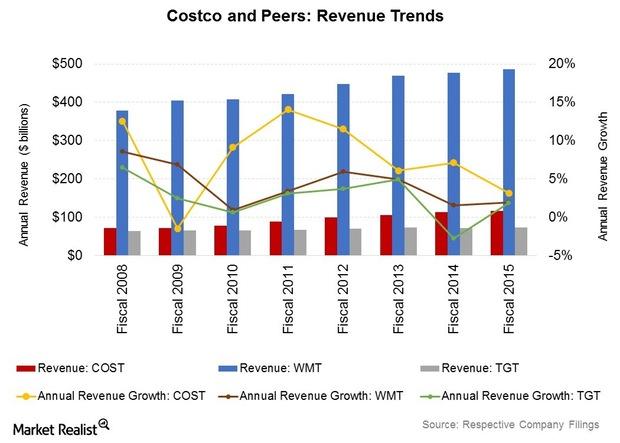

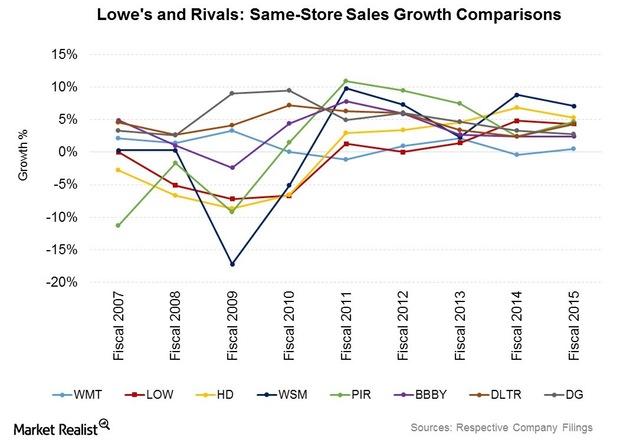

How Walmart Compares to Its Peers

On May 12, 2017, Walmart (WMT) was trading at a 12-month forward PE multiple of 17.5x.

Big Lots Stock Falls despite Telsey Advisory Group’s Upgrade

Telsey Advisory Group upgraded Big Lots from “market perform” to “outperform.” The firm also increased its 12-month target price from $20 to $31.

Dollar General Announces Strong Q3 Earnings

Dollar General (DG) stock was up 1.4% in the pre-market trading session today as the company declared strong third-quarter earnings.

Why Foreign Currency Headwinds Have Hurt Walmart in Fiscal 2016

Adverse foreign currency movements due to an appreciating US dollar have reduced Walmart’s top line by $12.3 billion in the last three quarters.

How Has Walmart’s Profitability Dip Affected Its Outlook?

Walmart’s reported operating income margin declined from 5.6% in fiscal 2015 to 5.0% in fiscal 2016.

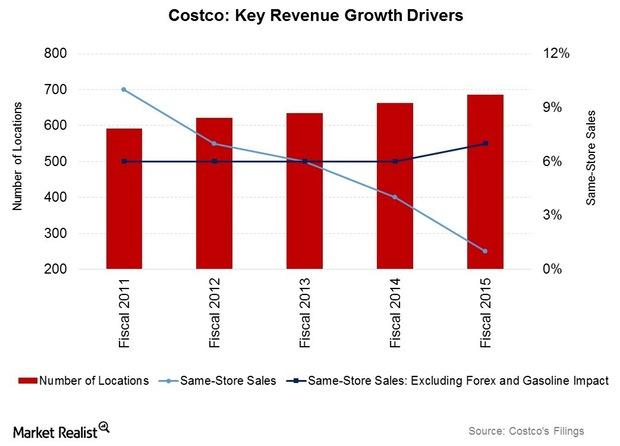

Costco’s Revenue Growth Likely to Moderate in Fiscal 2Q16

Costco posted record results for fiscal 2015. Revenue grew by 3.2% to $116.2 billion, and net income rose by 15.5% to $2.4 billion.

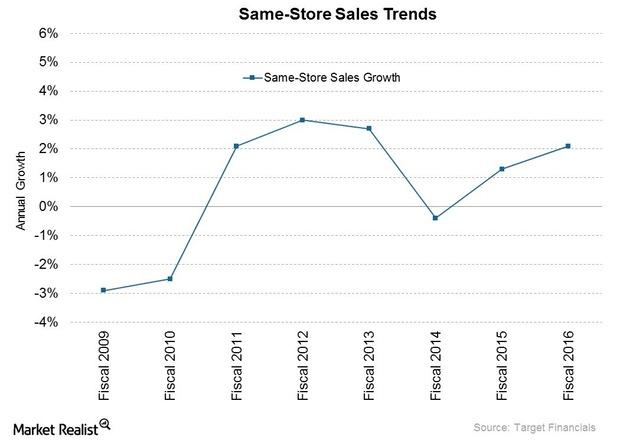

Analyzing Target’s Same-Store Sales Growth in Fiscal 2016

Target had upbeat revenue performance in fiscal 4Q16 and 2016. Store traffic was up by 1.3% YoY in fiscal 2016, trending in positive territory in all four quarters of the year.

Why Dollar General Stock Surged after Its Q2 Results

Dollar General (DG) surged about 8% in premarket trading today after crushing expectations in its second-quarter results. It also raised its guidance for fiscal 2019.

Why Wells Fargo Downgraded Dollar General Stock

Wells Fargo downgraded Dollar General (DG) stock to “market perform” from “outperform” on July 25. It remains positive about the company’s prospects.

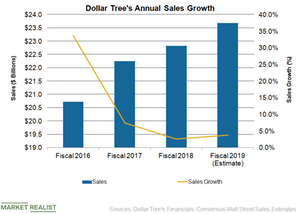

Dollar Tree’s Strategic Plans: Better Results in Fiscal 2019?

Analysts expect Dollar Tree’s sales to rise 3.8% to $23.7 billion in fiscal 2019. The adjusted EPS is expected to fall 2.2% to $5.33.

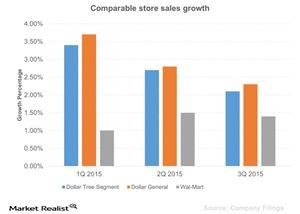

Dollar General versus Dollar Tree: A Quick Look

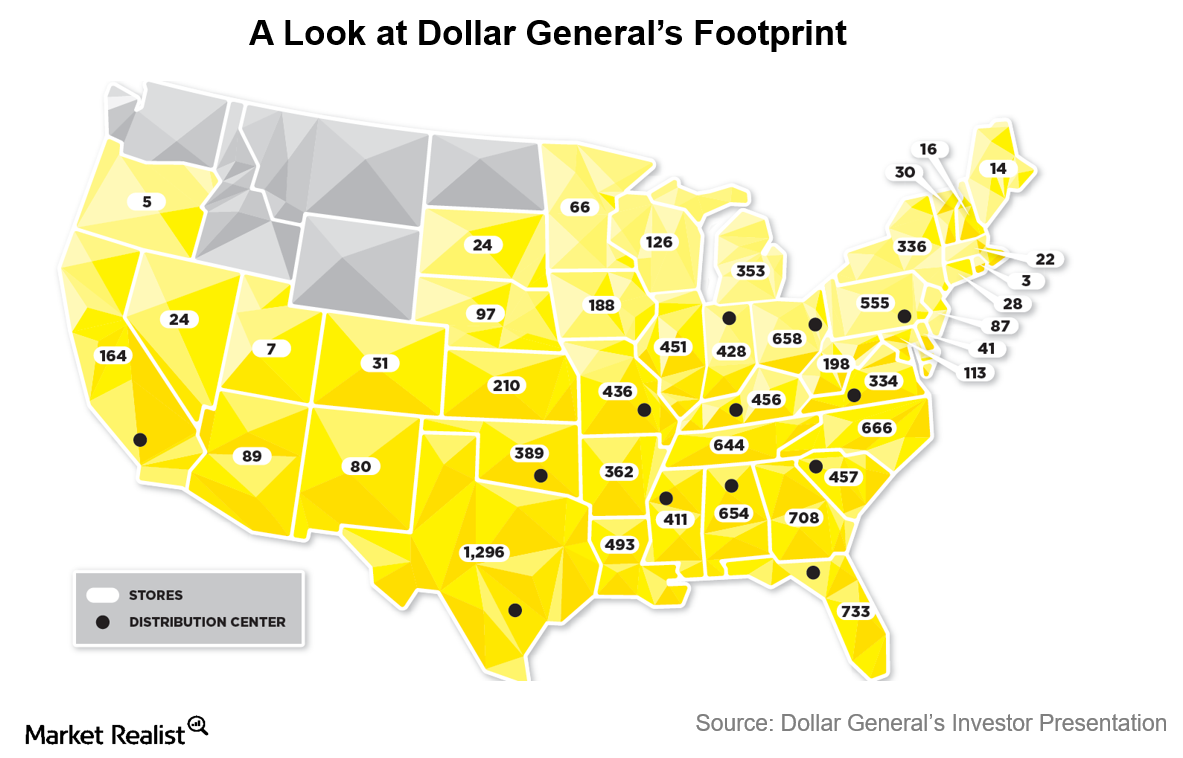

The US dollar industry is highly concentrated and dominated by two major players, Dollar General (DG) and Dollar Tree (DLTR).

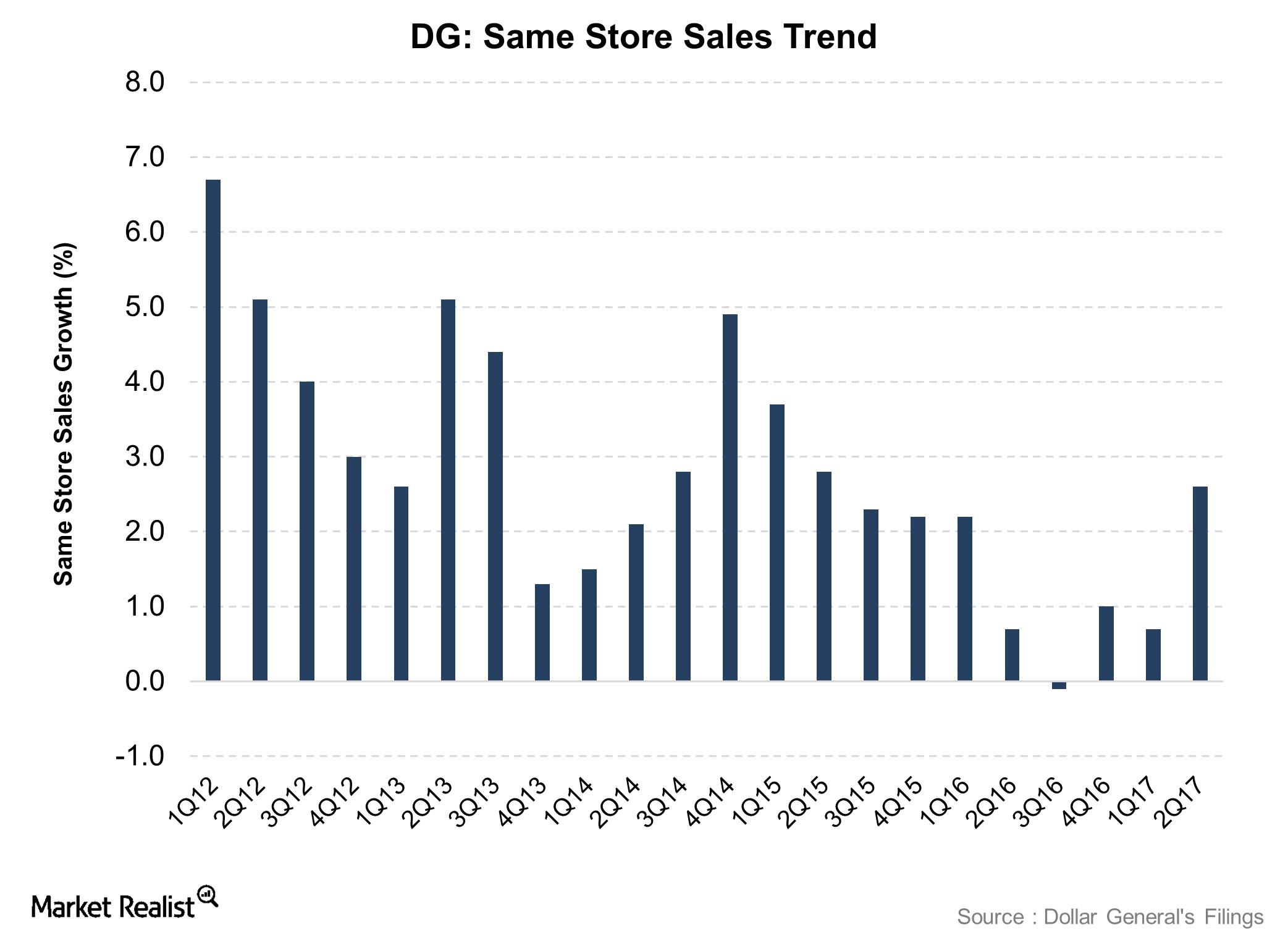

Behind Dollar General’s Fiscal 2Q17 Top Line

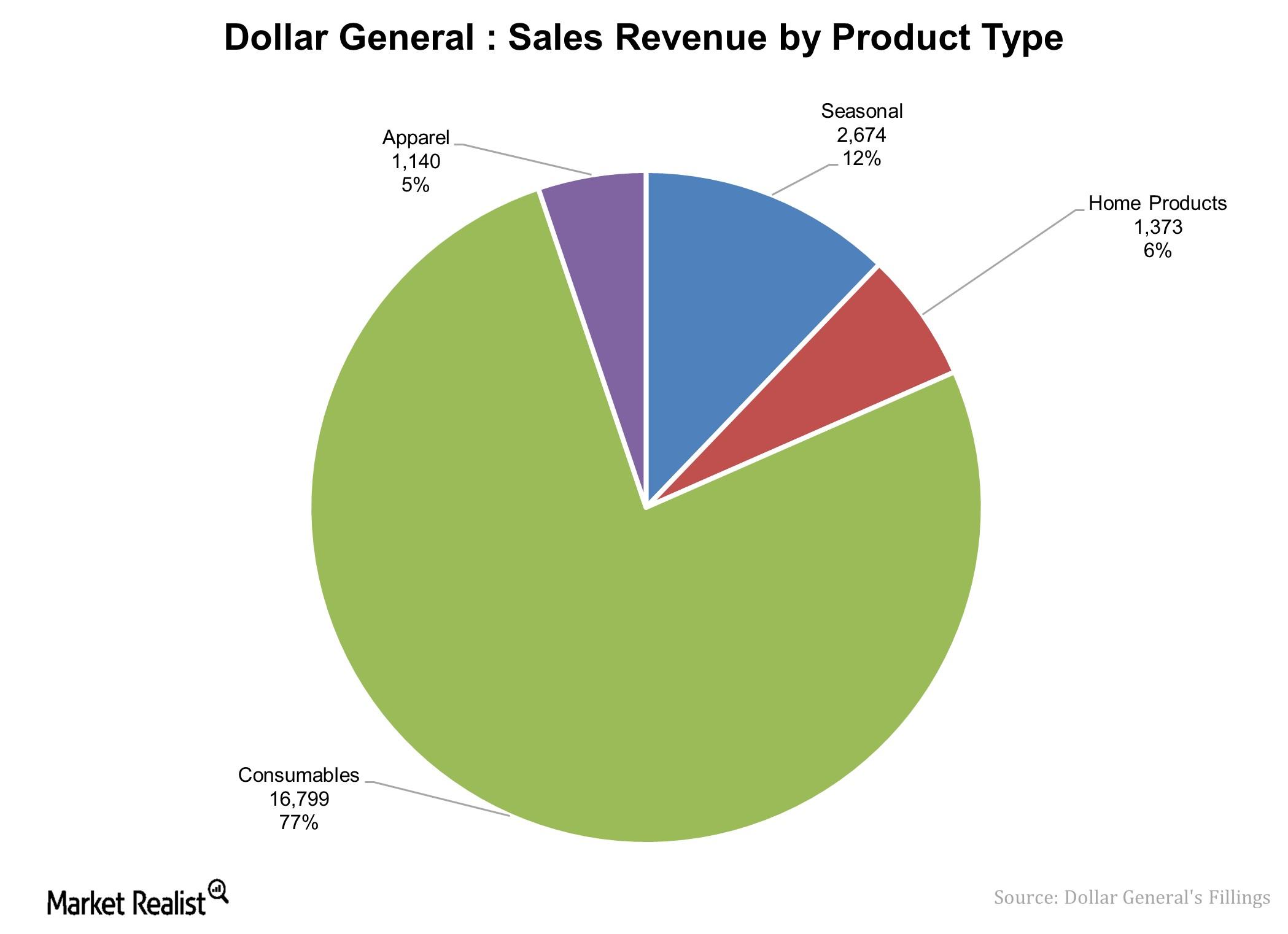

Dollar General (DG) saw its top line rise 8.1% YoY (year-over-year) to $5.6 billion, driven by an 8.9% rise in demand for consumables.

What Analysts Think of Target Stock

The majority of analysts covering Target (TGT) are neutral on the stock. Analysts’ consensus rating on TGT was 2.9 on a scale of 1.0 (strong buy) to 5.0 (strong sell).

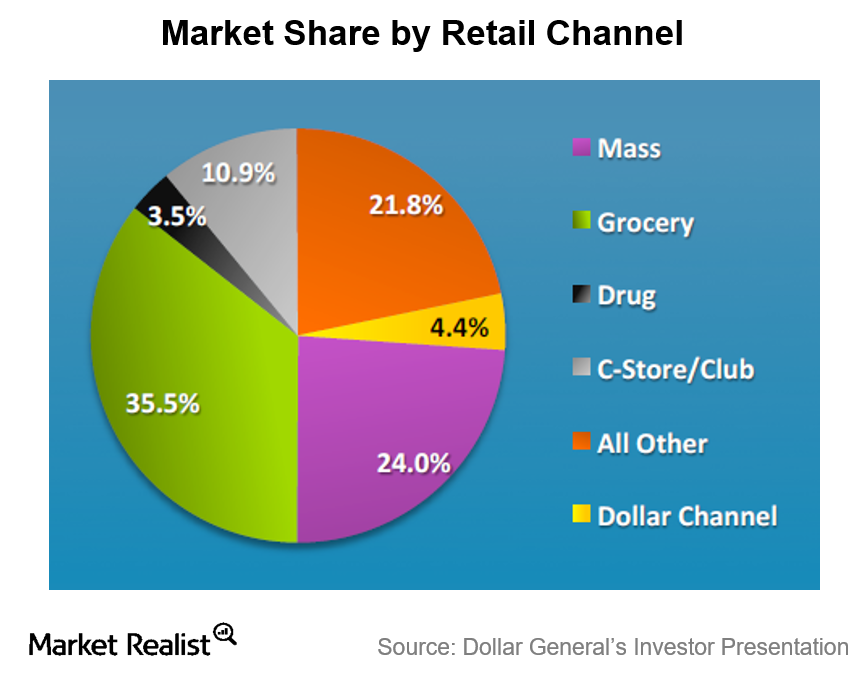

Understanding the US Dollar Store Industry

Dollar stores follow a small-box format to maintain low costs. Target customers are typically lower- and middle-income families.

A Snapshot of Dollar General, America’s Largest Dollar Store Chain

Headquartered in Tennessee, Dollar General (DG) is the largest discount store retailer in the United States in terms of total sales.

Understanding Dollar General’s Key Product Offerings

Dollar General (DG) is the largest discount store retailers in the United States in terms of total revenue generated.

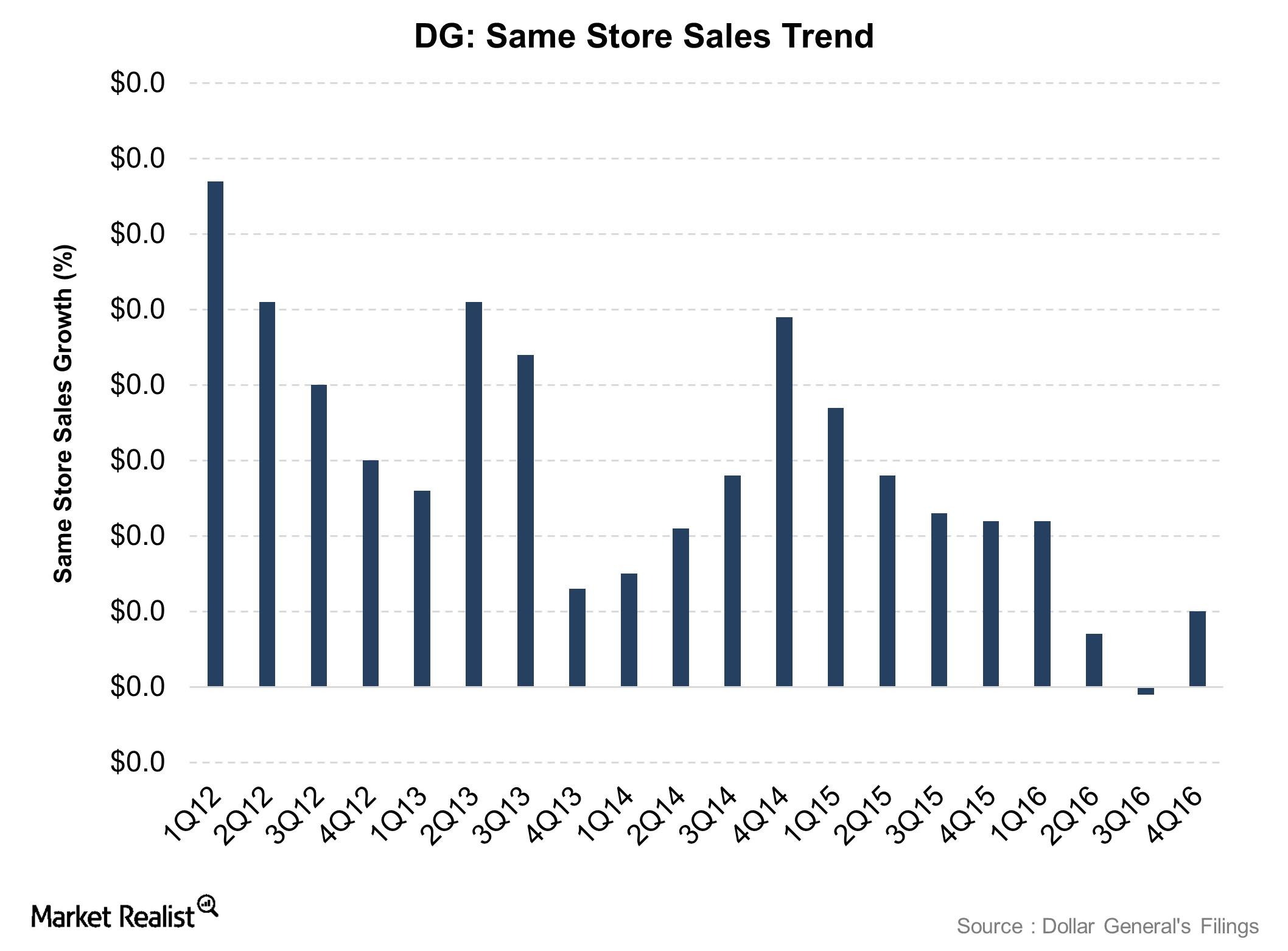

Dollar General’s Sales Comps Turn to Growth in Fiscal 4Q16

In fiscal 4Q16, Dollar General’s (DG) top line increased 13.7% year-over-year to $6 billion.

Why Wall Street Is Mostly Positive on Dollar General

30 Wall Street analysts cover Dollar General (DG). On average, they rate the company a 2.4 on a scale of one (strong buy) to five (strong sell).

Dollar Tree: A Positive Mix of Organic and Inorganic Growth

Dollar Tree (DLTR) (XRT) (XLY) is pretty consistent for extracting organic growth from its business, seeing growth in the mid-single digits over the years.

What Are Lowe’s Strengths and Weaknesses?

Lowe’s (LOW) is one of the largest and oldest big box retailers around. It’s been publicly listed since 1961.

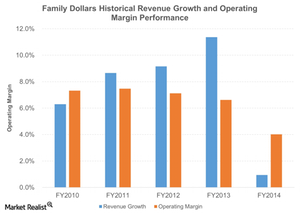

A Glance at Family Dollar’s Historical Performance

Over the last five years, Family Dollar was able to generate a five-year CAGR revenue of 7.2%. That looks decent when you look at it alone. But let’s compare it to its peers.

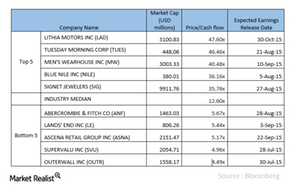

How Are Brick and Mortar Retail Companies Valued?

Brick and mortar retail companies have high inventory levels and are very capital-intensive companies that require a significant amount of working capital and capital expenditure.