First Trust NASDAQ Global Auto Index Fund

Latest First Trust NASDAQ Global Auto Index Fund News and Updates

Consumer Why geography matters so much in the automotive industry

The U.S. market is dominated by truck sales, with trucks outselling cars at 51% of market share versus cars accounting for 49% of the market.

Can Malaysia’s Improved Retail Sales Support Economic Growth in 2017?

Retail sales in Malaysia rose 13.9% YoY (year-over-year) in June 2017, compared with its 13.6% gain in May 2017.

Must-know: Top auto industry ETFs for investors

The First Trust NASDAQ Global Auto ETF (CARZ) is the most traded auto-focused ETF. The three-year return for the ETF is 48.32%. YTD, CARZ provided a return of 2.23%.

Should Investors Buy Ford Stock Right Now?

Ford Motor is one of the few US publicly traded auto stocks with attractive returns this year. With a 17% year-to-date gain, the stock has outperformed most of its peers.

Ford Enhances Shareholders’ Wealth with Dividend Payout

Continuing with the strategy of enhancing shareholders’ wealth, Ford Motor Company (NYSE:F) declared a dividend for the first quarter of 2020.

Ford Boosts Investment in Autonomous, Electric Vehicles

Ford is planning to invest over $1.45 billion in its two North American facilities in Michigan, with a focus on autonomous, electric, and big vehicles.

What makes the auto industry highly concentrated?

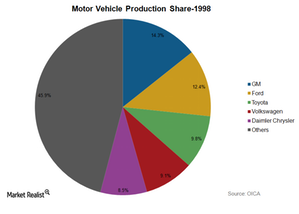

The automobile industry is one of the most highly concentrated industries in the world. The market continues to be dominated by a few major companies.

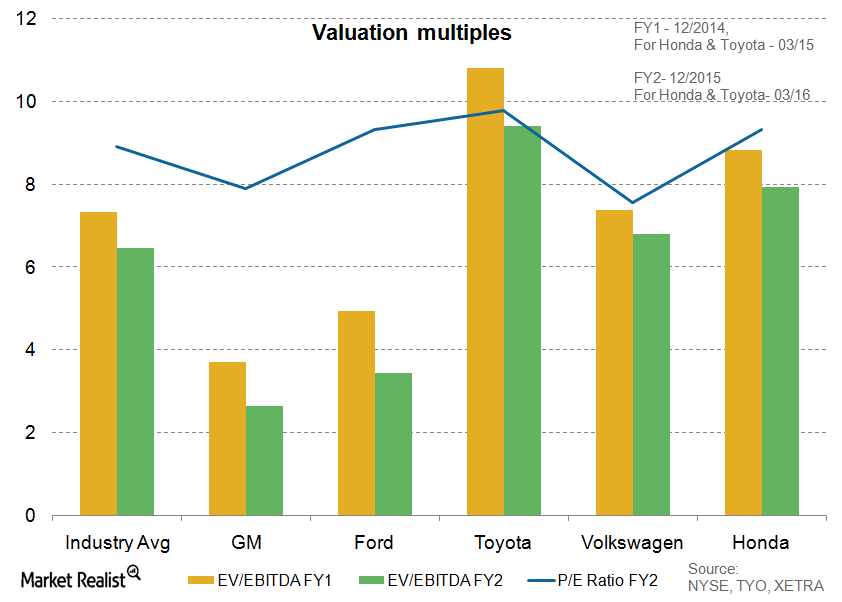

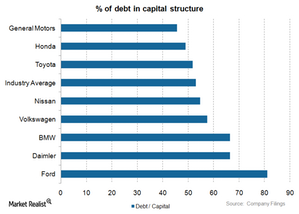

Ford, Daimler, and BMW employ high financial leverage

Ford (F) uses a high amount of financial leverage. Its debt-to-capital ratio is 81.1%. This is significantly above the industry average of 53.1%.

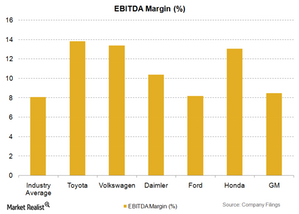

Intense competition leads to low profit margins for automakers

The auto industry has lower margins primarily because of intense competition. It makes it difficult for companies to pass on increases in raw material prices to the customer.Consumer A must-know investor’s guide to Honda Motor Company

In this series, first, we’ll look at Honda’s strategy. Then, we’ll dig into the company’s revenue and earnings to see how Honda compares to other industry players.Consumer Why Tesla’s distribution model differs from competitors

Tesla states in the annual filing that it wants to maintain ownership of distributions and repairs to differentiate itself from the market, keeping greater control over local sales and services.Consumer Tesla’s financial statements show the company’s rapid growth

The bottom line on the income statement is that Tesla remains a start-up or newer business that’s not generating earnings from its sales.

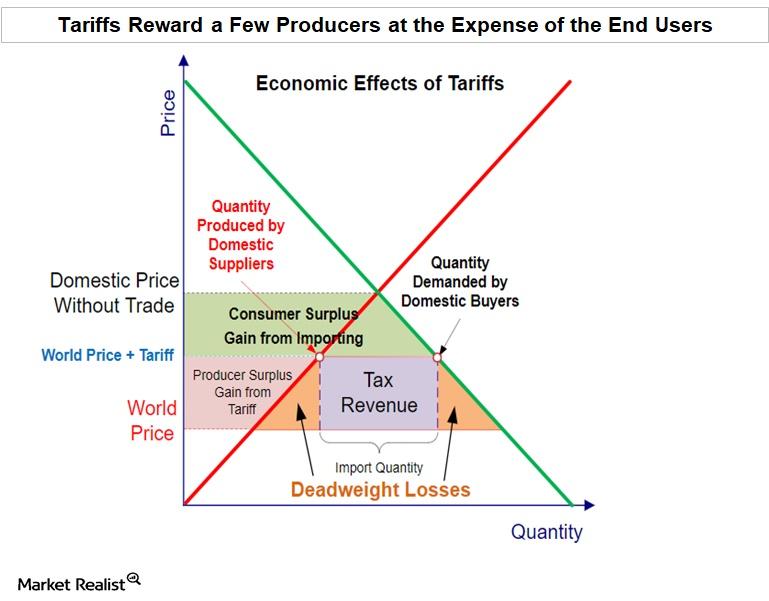

Why Economist Argue That Tariffs Are Bad for the Economy

The recently proposed import tariffs on steel and aluminum imports by US President Donald Trump are an effort to protect the interests of US manufacturers.

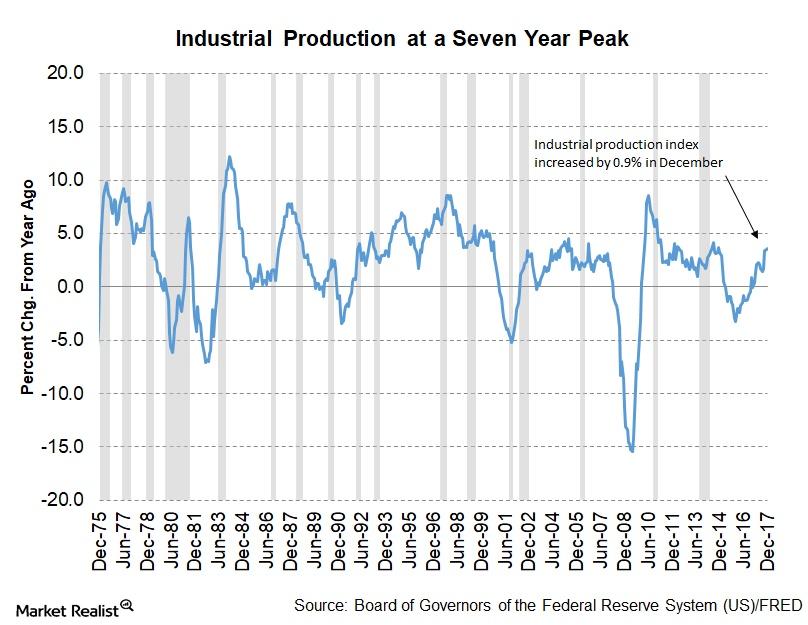

What Drove Industrial Production Higher in December 2017

The Fed’s December industrial production report was released on January 17. The report indicated that industrial production continued to improve throughout 2017.

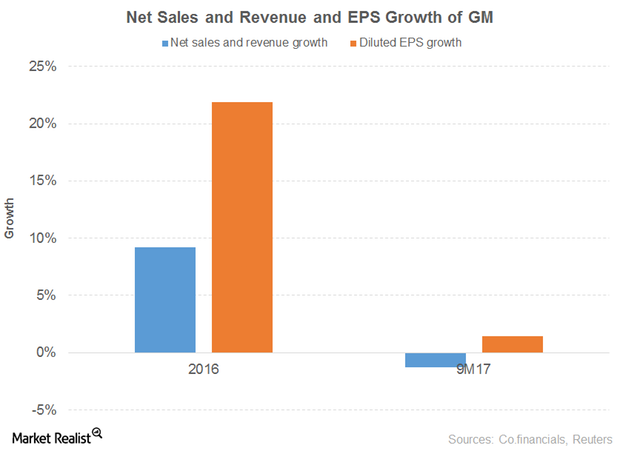

A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

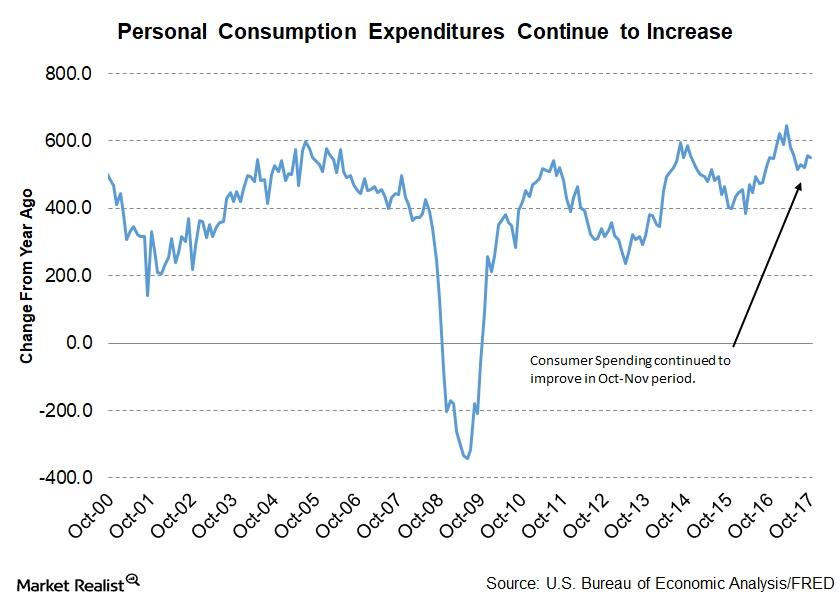

The Economic Indicators Covered by the Fed’s Beige Book

Comparing the economic performance with economic expectations and the previous cycles gives investors an idea of whether the economy is expanding or contracting.

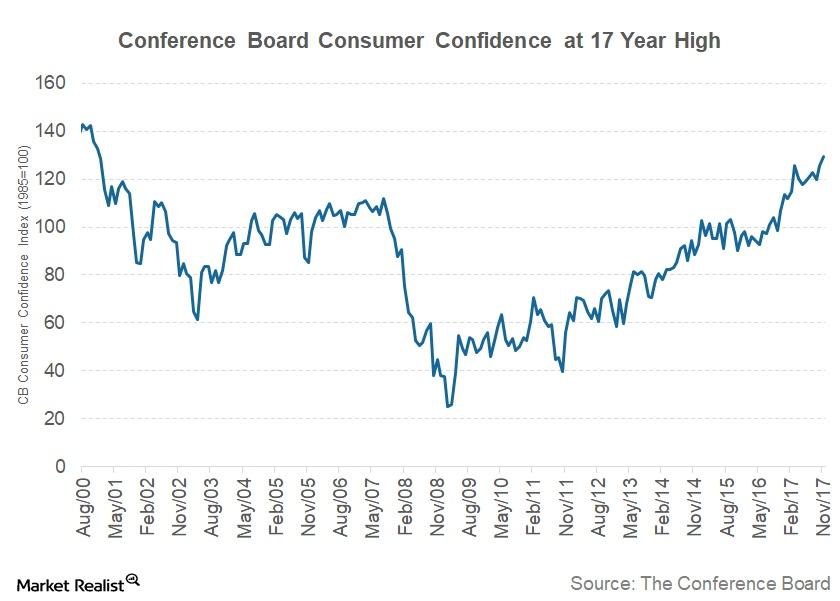

Conference Board Consumer Confidence Rose in November

The Conference Board Consumer Confidence Index for November came in at 129.5, up from 126.2 in October.

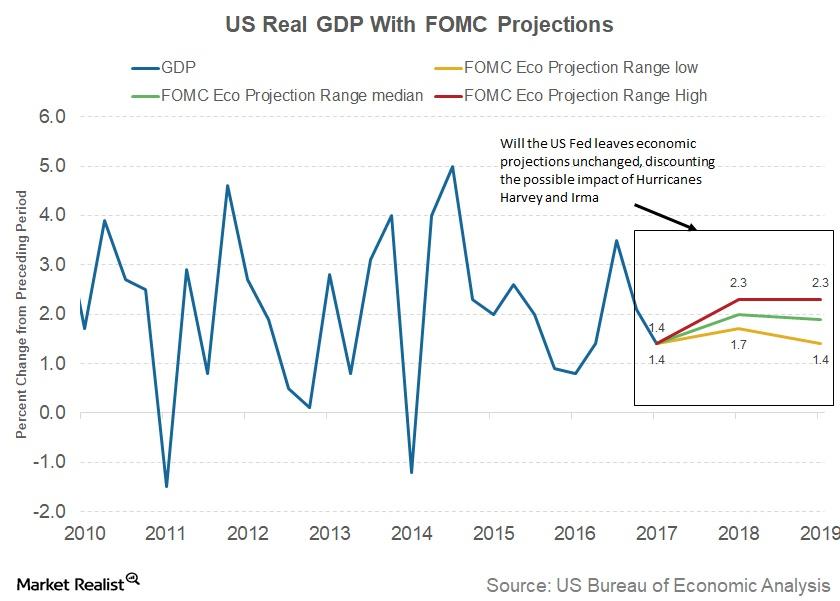

The FOMC’s View on the US Economy

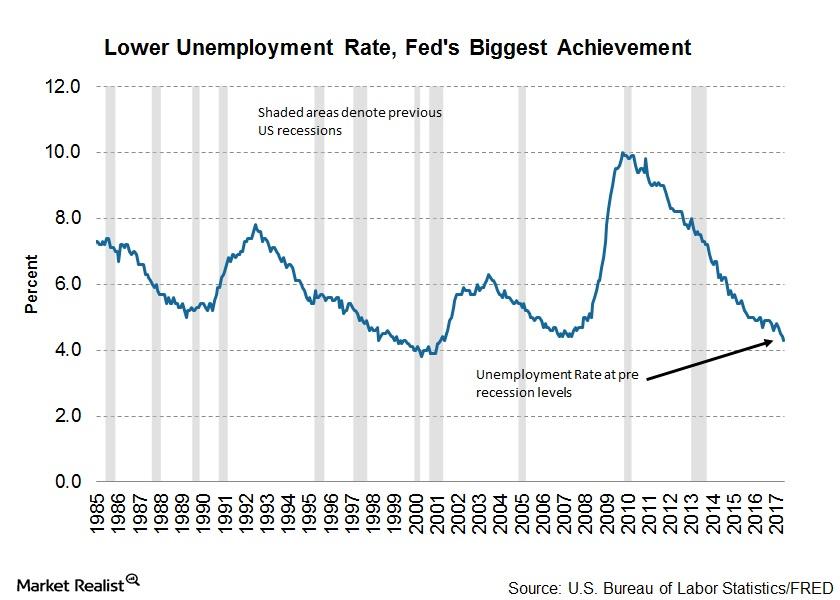

At the November meeting, the FOMC staff review indicated that US labor market conditions continued to strengthen and that the US economy continued to expand at a solid pace.

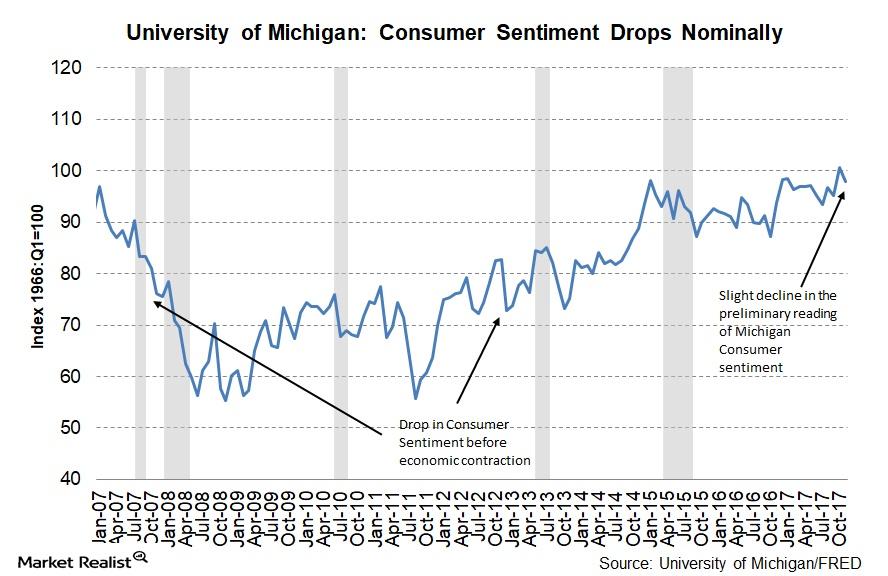

Here’s What Drove Consumer Expectations Lower in November

The University of Michigan Preliminary Consumer Sentiment for November was reported at 97.8, which was 2.9 lower than the final October reading of 100.7.

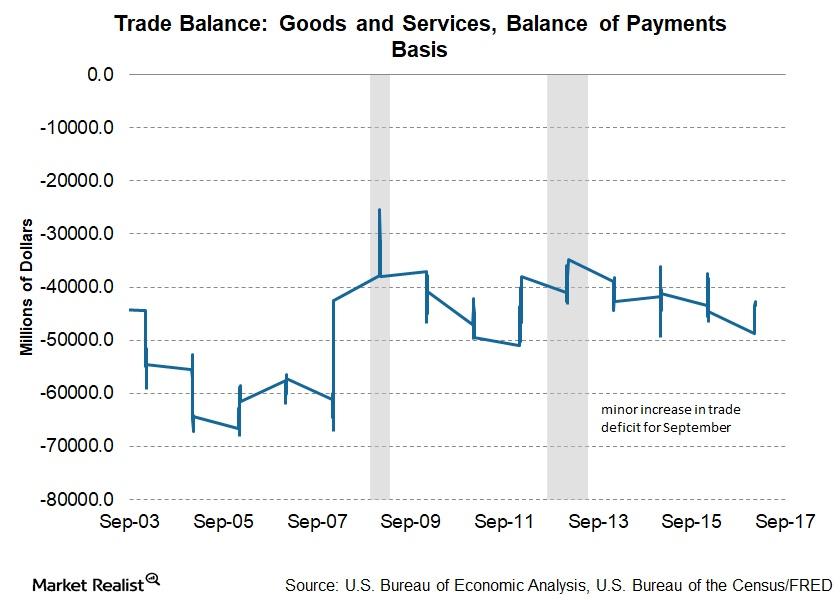

What Led to the Rise in the US Trade Deficit in September?

The latest report was released on November 3 and indicated that the goods and services deficit was $43.5 billion in September, or $0.7 billion higher than in August.

Why the Fed Isn’t Satisfied with Labor Market Conditions

Despite the strong growth in employment numbers, the Fed’s latest monetary policy report had some comments about slow wage growth.

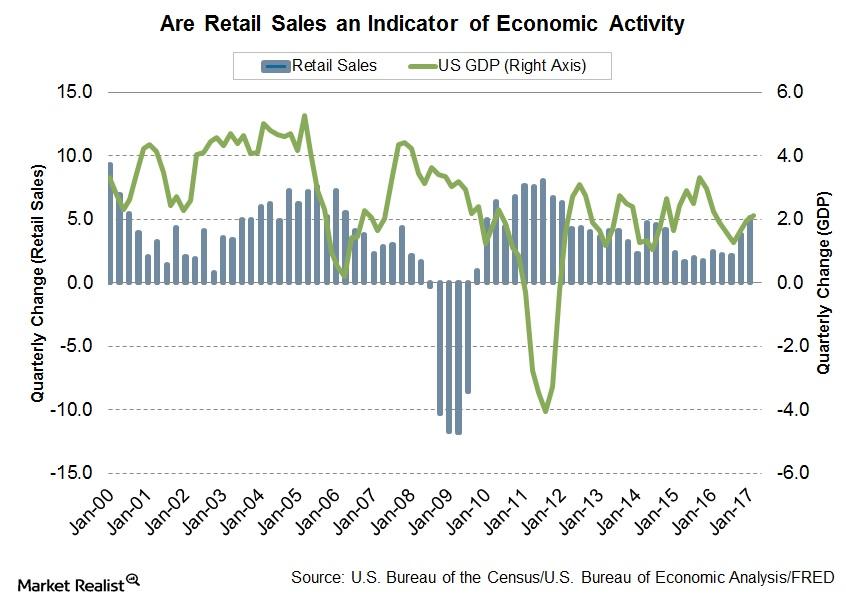

Why Retail Sales Are an Important Indicator of Economic Growth

In this series, we’ll explore the trends in consumer spending in recent months and try to shed some light on the retail sales data that will be released on July 14.

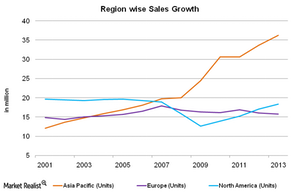

Why growth shifted in the global automotive industry

The automotive industry is geographically concentrated. The top 15 countries produce 88% of the world’s vehicles. Almost all of the G20 nations have a manufacturing unit.

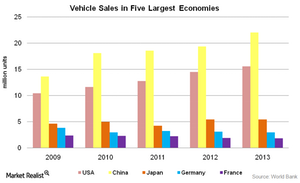

Why GDP and automotive industry growth are related

There’s a direct correlation between the size of a country’s GDP and its automotive industry. The auto industry has been expanding at a fast pace over the past several years.

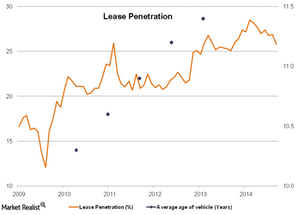

Vehicle leasing is driven by life cycles and innovation

There are higher maintenance and repair costs as a car gets older. This supports the option of leasing a vehicle.

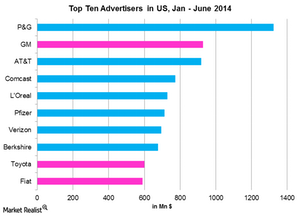

Advertising is key for automotive companies

The automotive industry is one of the biggest spenders when it comes to advertising. General Motors (GM) paid out $928 million during the first half of 2014.

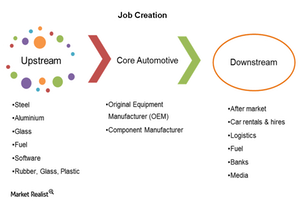

Why the automotive industry generates employment

The automotive sector plays a crucial role in job creation. Car manufacturing activity has an employment multiplier value of five.

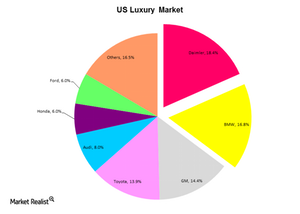

Daimler and BMW dominate the luxury car segment

German automakers lead the luxury space in the US. Daimler AG had an 18.4% share. It was followed by BMW. It had a 16.8% share.Consumer An investor’s guide to Toyota: Revenue and key drivers

We’ll take a brief look at industry sales to assess Toyota Motor Company’s (TM) position in the global industry. First, we’ll look at industry sales, and second, we’ll assess Toyota’s ability to capture its share of the market.Consumer Why companies like Toyota lead in global automobile market share

Global market share is dominated by the top ten original equipment manufacturers (or OEM), which account for 81% of the global automotive industry’s annual sales.Consumer Must-know growth drivers for the global automobile industry

The global automobile market is impacted by global GDP, consumer confidence, employment, the availability of credit, the price of fuel, and consumer confidence.