Compania de Minas Buenaventura S.A.

Latest Compania de Minas Buenaventura S.A. News and Updates

How Investor Appetite for Risk Impacts Precious Metals

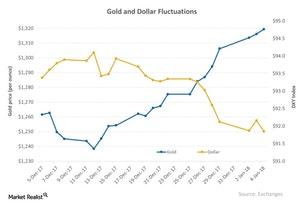

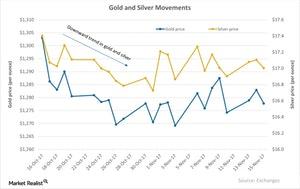

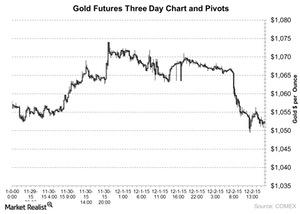

Gold and silver have seen trailing-five-day losses of 0.9% and 2.7%, respectively. The reason behind the fall in the precious metals is the buoyancy of the equity markets and the gains in the US dollar.

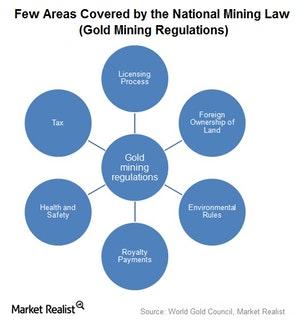

How Strict Is the Gold-Regulated Market?

Bitcoin (ARKW) has seen its price plunge since the start of 2018 due to news that world leaders are planning to implement regulations on digital currencies.

What’s the Impact of Interest Rates on Precious Metals?

Monetary policies have been crucial in determining the movement in precious metals.

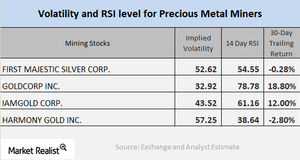

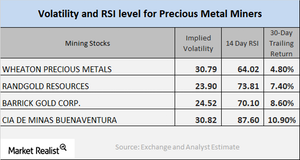

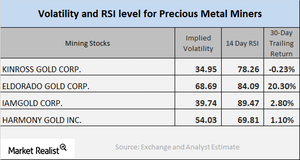

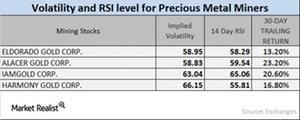

Reading the Technicals and Price Movements of Mining Stocks

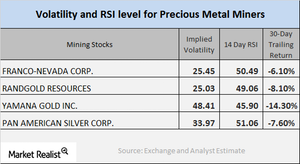

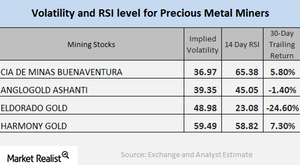

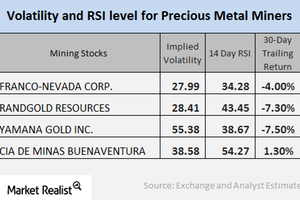

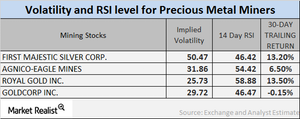

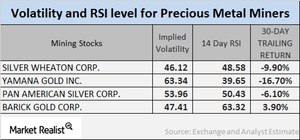

In this article, we’ll do a technical analysis of a few select mining stocks. When investing in mining stocks, it’s crucial to read their indicators.

How Mining Stocks Have Performed in January So Far

SLW, GOLD, ABX, and BVN have call implied volatilities of 30.8%, 23.9%, 24.5%, and 30.8%, respectively.

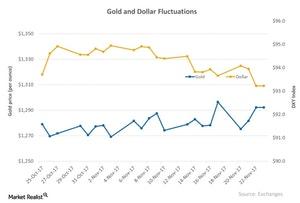

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

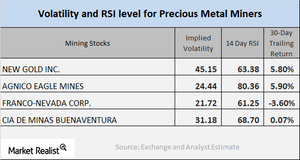

Mining Stocks Follow Precious Metals: Technical Insights

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively.

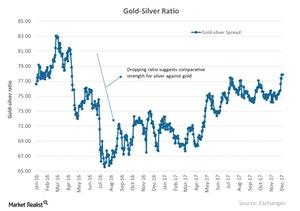

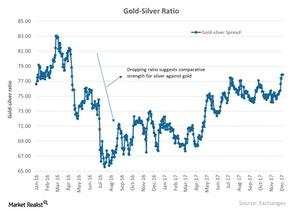

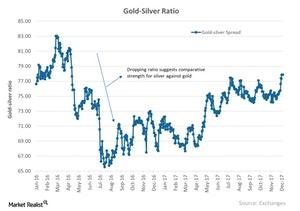

A Look at the Gold Spreads at the End of 2017

A gold-silver spread of 77.3 suggests that it requires almost 78 ounces of silver to buy a single ounce of gold.

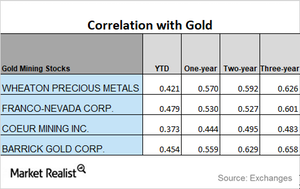

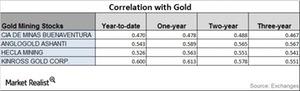

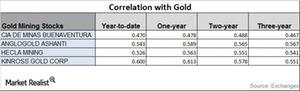

What Direction Is the Correlation of Miners Headed?

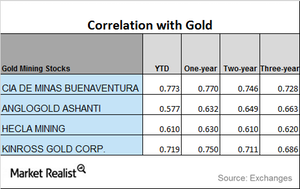

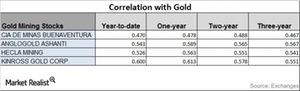

On a year-to-date basis, AngloGold has seen the highest correlation to gold, while Cia De Minas has the lowest year-to-date correlation.

A Brief Look at December 2017’s Precious Metal Spread Measures

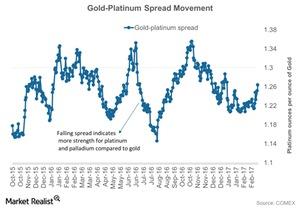

In this article, we’ll discuss the gold-silver, gold-platinum, and gold-palladium spreads. These three spreads stand at 77.9, 1.38, and 1.23, respectively.

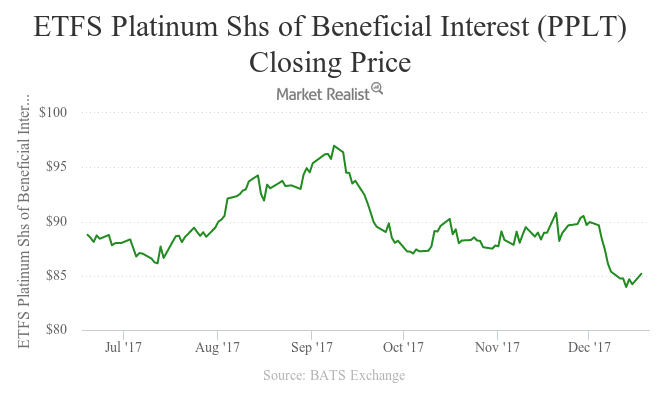

Why Platinum Led the Precious Metals Pack on December 18

All four precious metals except palladium witnessed an up day on December 18, 2017. Platinum touched the day’s high of $915.3 and ended up at $913.2 per ounce.

Where Are Precious Metal Spreads Moving?

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

Is the Dollar-Gold Relationship Getting Stronger?

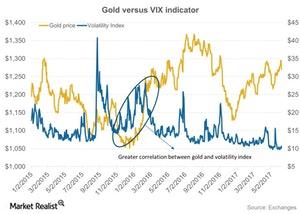

Precious metals have been closely associated with the movement of the US dollar over the last few months.

Who’s Pro Gold and Who’s Not?

Geopolitical events like the tensions with North Korea helped drive the price of gold higher in September 2017.

Analyzing the Correlation of Mining Stocks to Gold

Kinross Gold’s correlation has risen from a three-year correlation of 0.69 to a one-year correlation of 0.77, which suggests that Kinross has moved in the same direction as gold 77% of the time.

Are Global Fears Controlling Precious Metals?

Ongoing worries in North Korea and political chaos in Washington have been crucial in boosting the prices of precious metals.

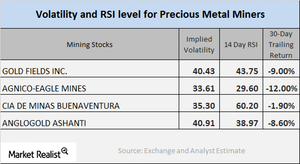

Inside Mining Stock Technicals on October 12

Most precious metals had a down day on Tuesday, October 10, despite the recent overall upward movement in precious metals.

Mining Stocks Today: Your Technical Updates

On October 5, Gold Fields, Agnico-Eagle, Cia De Minas Buenaventura, and AngloGold had implied volatility readings of 40.4%, 33.6%, 35.3%, and 40.9%, respectively.

Reading Miners’ Gold Correlation Trends

Correlation trends On September 26, precious metals and mining stocks fell. Analyzing mining stocks’ correlation with gold is important since it can give some idea of future stock movement. In our analysis, we’ll focus on Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC). Mining funds track precious metals and their price movements. Whereas the Global […]

What Miners’ Technical Indicators Suggest

Most of the miners have seen an upswing in their prices over the past week.

Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

What’s the Volatility of Mining Stocks?

Though the precious metals survived the Fed’s interest rate hike, the miners took a hit. Most mining stocks saw a considerable down day on Wednesday.

Where’s the Platinum Spread Headed in 2017?

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a year-to-date rise of only 5.8%.

Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

Analyzing Mining Stocks’ Correlation in 2016

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

Which Mining Stocks Have Highest Correlation to Gold?

Mining companies that have high correlations with gold include Cia de Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

What Do Mining Stocks’ Technicals Indicate?

Many of the fluctuations in precious metals have been a result of speculation about the Federal Reserve’s interest rate stance.

Gold Touched Its Lowest Levels in the Last Six Years on Wednesday

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on December 2, 2015. Also, platinum fell 0.36%.