Boston Scientific Corp.

Latest Boston Scientific Corp. News and Updates

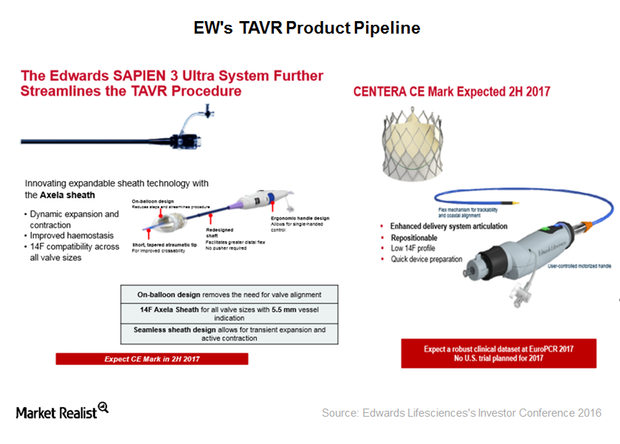

Can Edwards Intuity Elite Boost Edwards Lifesciences’ Revenues?

With the Edwards Intuity Elite valve system, Edwards Lifesciences aims to offer a minimally invasive therapy to complex aortic stenosis patients.

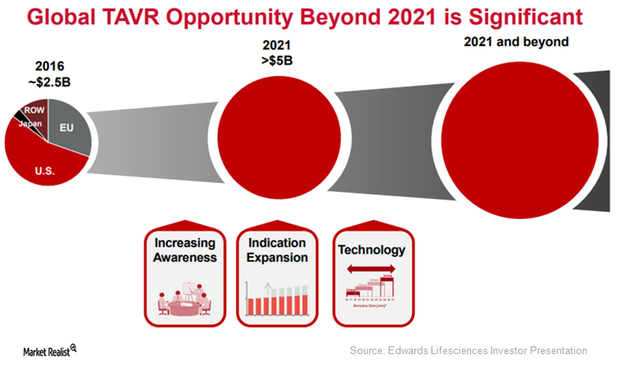

Transcatheter Heart Valve Therapy: Growth Driver for Edwards Lifesciences

In 2Q17, Edwards Lifesciences’ (EW) Transcatheter Heart Valve Therapy segment reported revenues close to $316 million, which represents year-over-year growth of ~28%.

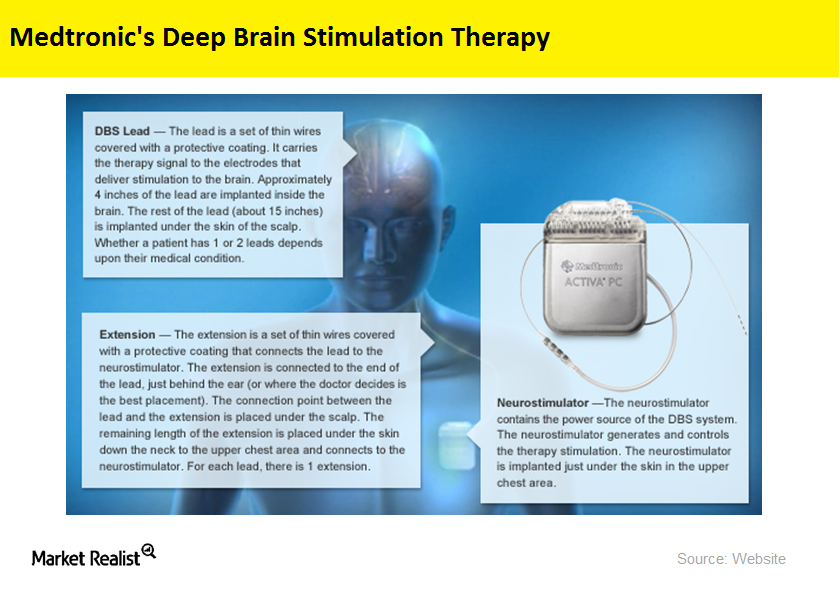

Medtronic Received Health Canada License for SureTune3

On June 6, 2017, Medtronic (MDT) received the Health Canada license for its SureTune3 software for DBS (deep brain stimulation) therapy.

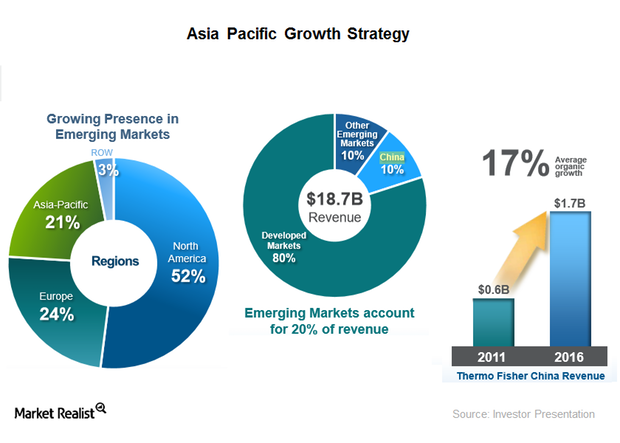

How Long Can Thermo Fisher Scientific’s Asia-Pacific Growth Momentum Last?

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets.

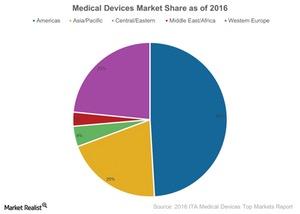

Is Medical Technology Driving the US Healthcare Industry?

The US medical device industry is a global leader. Its market was valued at ~$140 billion for 2016. It represents ~45% of the global market.

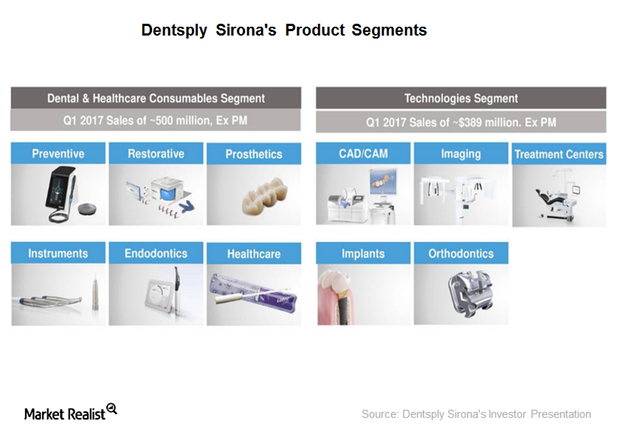

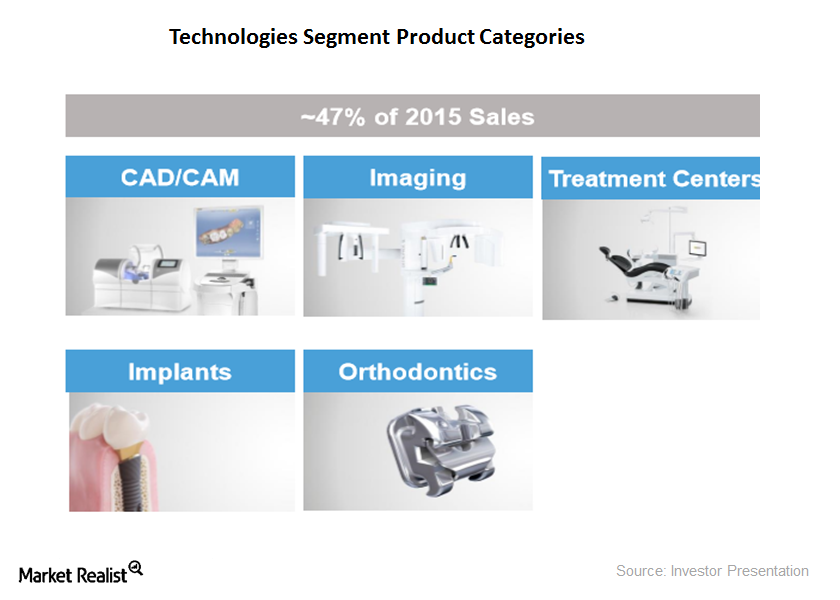

What Dragged Down Technology Business Sales in 1Q17?

Dentsply Sirona’s Technology segment sales Dentsply Sirona (XRAY) reported ~$900 million of revenues worldwide in 1Q17. Of that, ~$389 million was generated through Dentsply Sirona’s Technology segment, which contributed ~43.2% to Dentsply Sirona’s total revenues. On a constant currency basis, the Technology segment’s sales declined by approximately 8.1%. The segment’s sales were flat in Europe. The […]

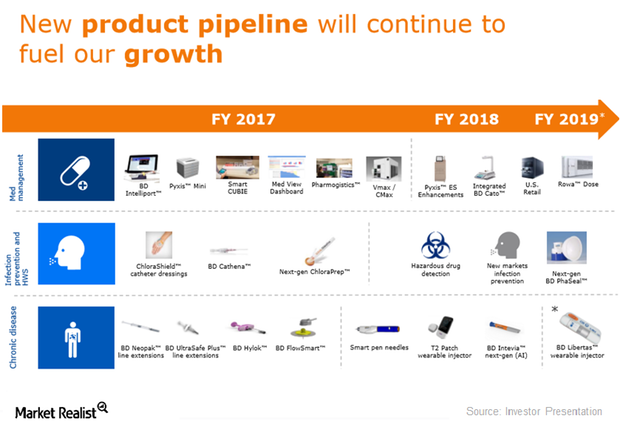

Analyzing the BD Medical Segment’s Product Pipeline

Becton, Dickinson and Company (BDX) generates ~$1 billion from its Infection Prevention business.

Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

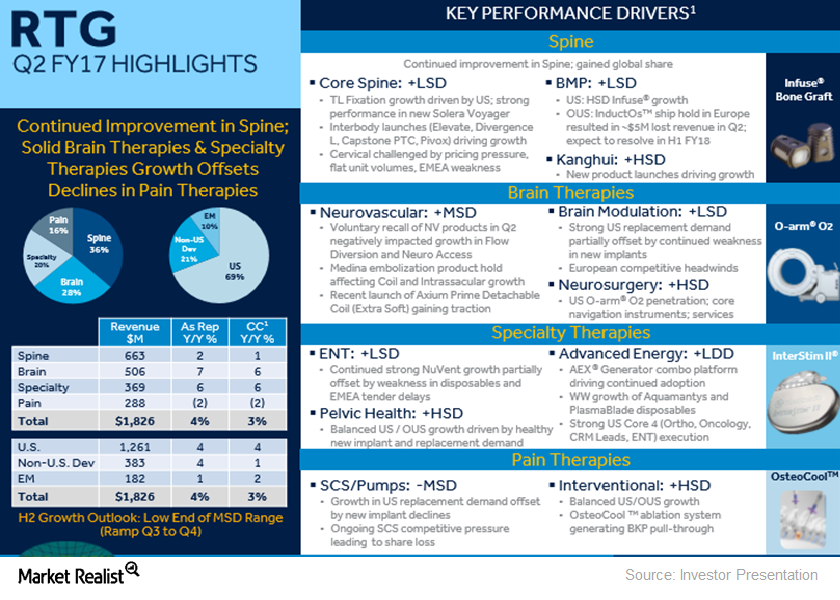

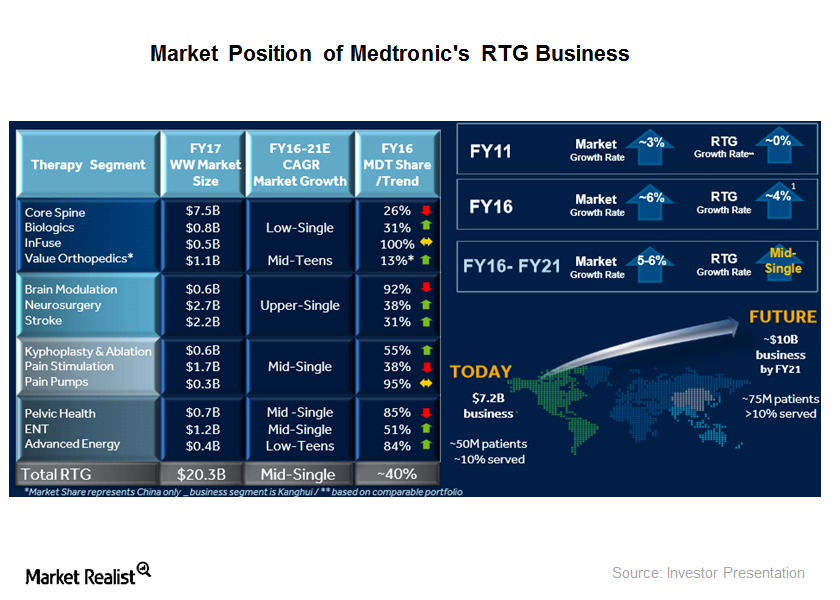

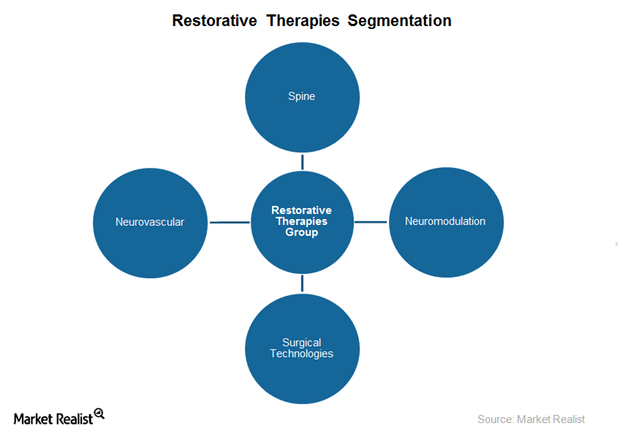

Medtronic’s RTG Sales in Fiscal 2Q17: The Brain and Restorative Therapies Story

Of Medtronic’s ~$7.3 billion in worldwide revenue in fiscal 2Q17, ~$1.8 billion came from its RTG segment, representing ~25% of the company total.

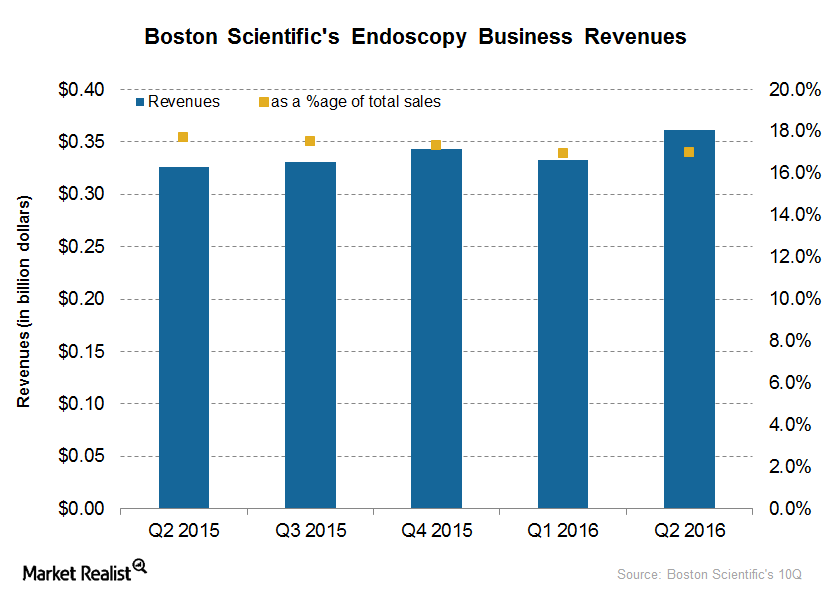

Boston Scientific’s Acquisition of EndoChoice: Must-Know Details

On September 27, 2016, Boston Scientific (BSX) announced the acquisition of EndoChoice Holdings for $210 million.

A Brief Look at the Technologies Segment Sales in 2Q16

In 2Q16, Dentsply Sirona’s leading position in the Digital Sensor category and rebound in the Lab business drove its Technologies segment sales.

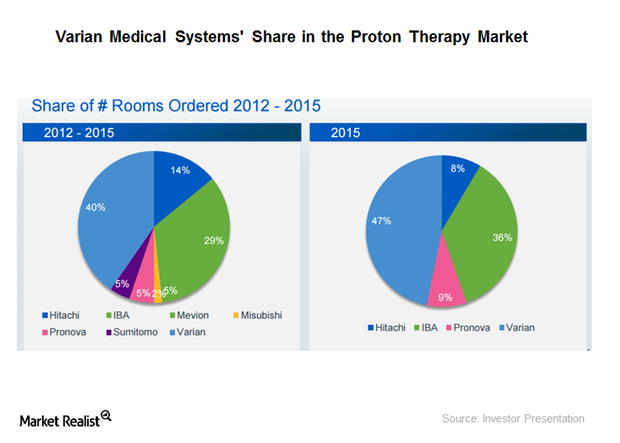

How Is Varian Positioned in the Particle Therapy Business?

Varian Medical Systems (VAR) had gross orders value of $310 million in 2015.

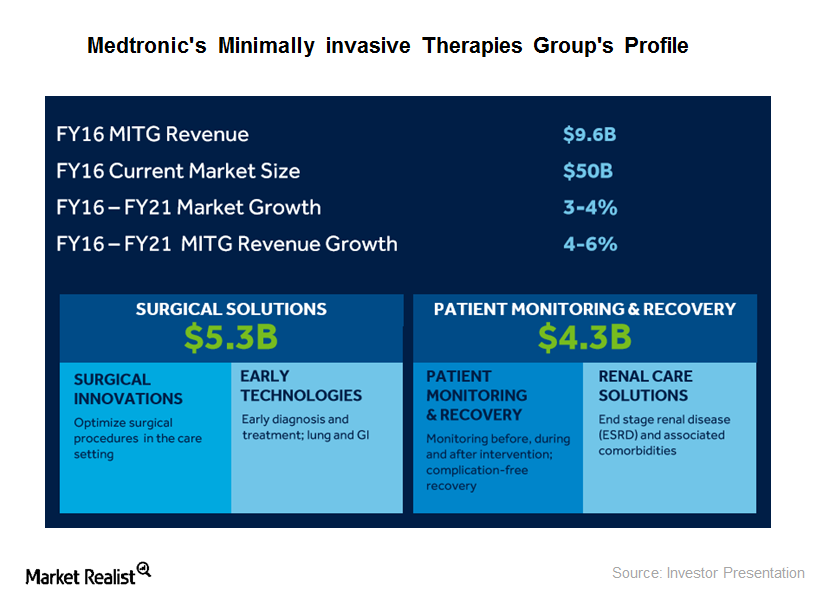

Medtronic’s Minimally Invasive Therapies Group: Major Drivers

Medtronic plans to launch more than 80 products over the next three years.

What Drives Medtronic’s Restorative Therapies Group’s Growth?

Medtronic’s (MDT) Restorative Therapies Group (or RTG) segment, formed around seven years ago, has a strong market position today.

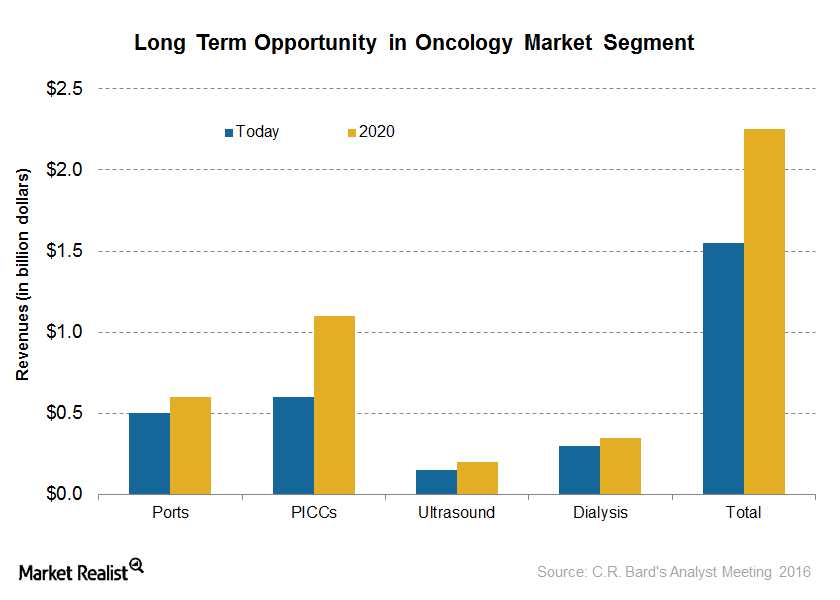

A Look at C. R. Bard’s Oncology Business Segment

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company.

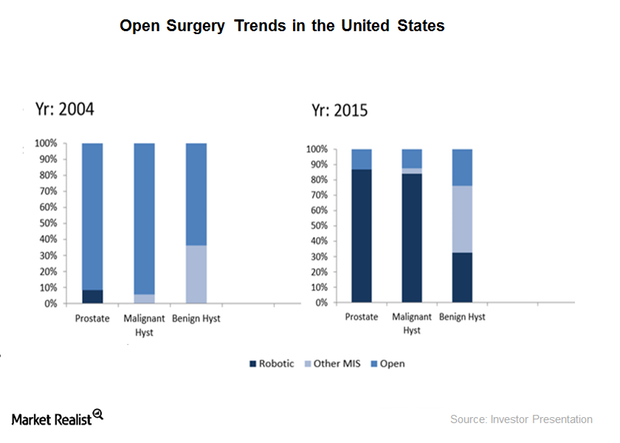

A Closer Look at Intuitive Surgical’s Business Strategy

Intuitive Surgical aims to include a larger patient population under its MIS treatments and to provide better surgery outcomes and lower recovery times.

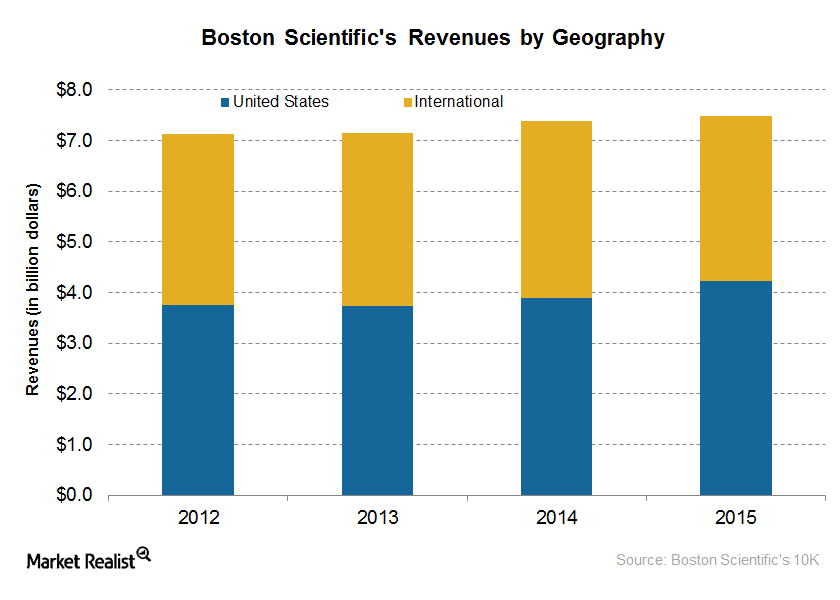

How Is Boston Scientific’s Geographic Strategy Driving Growth?

Boston Scientific has strategically expanded in these geographies through organic as well as inorganic strategies.

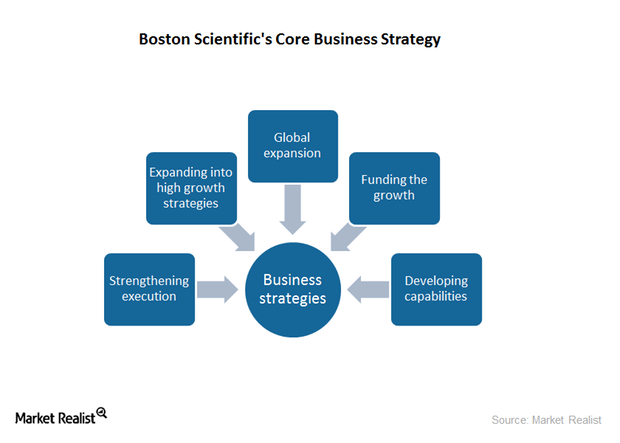

The Business Strategies Driving Boston Scientific’s Growth

Boston Scientific registered emerging market sales growth of approximately 13% in 2015, representing a steady growth in international markets.

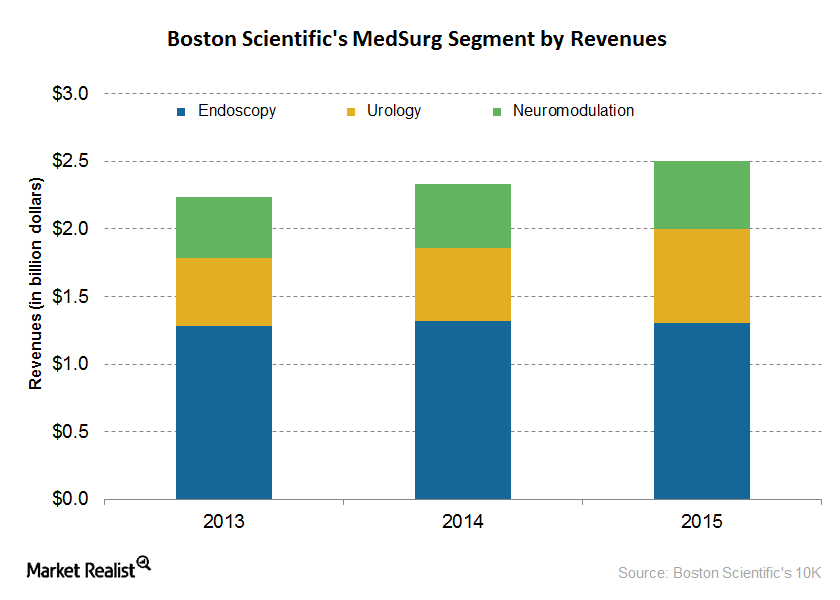

Understanding Boston Scientific’s MedSurg Segment

Boston Scientific’s (BSX) MedSurg segment contributes around 33% to the company’s total revenues and is the company’s second-largest segment.

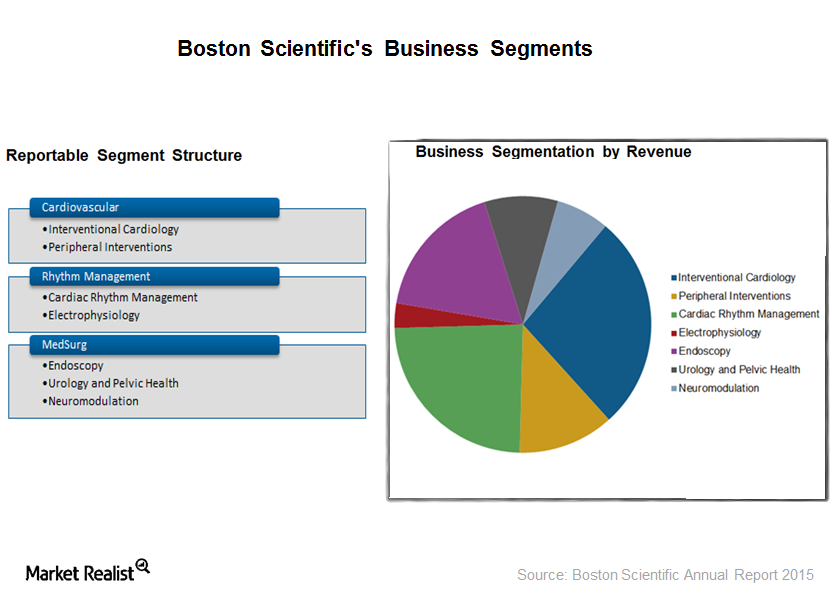

A Brief Look at Boston Scientific’s Business Model

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is BSX’s largest business segment and generated ~39% of the company’s total revenues in 2015.

Overview of Boston Scientific, a Leading Medical Device Company

Starting in 2011, Boston Scientific (BSX) has undertaken cost-cutting programs and reorganization efforts to turn the company’s battered financials around. In 2014, BSX started registering positive growth and profitability.

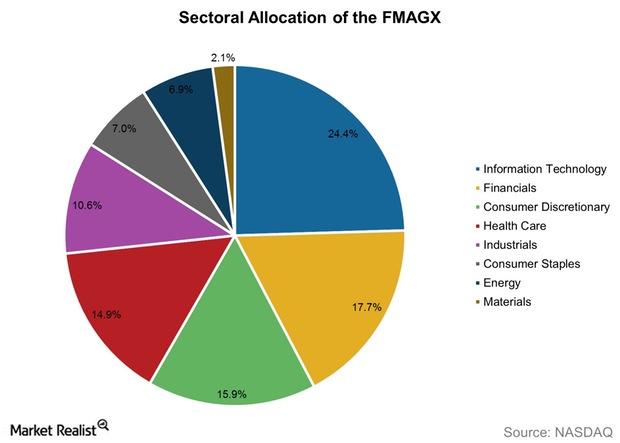

Need-to-Know Facts about the Fidelity Magellan Fund

The Fidelity Magellan Fund (FMAGX) invests primarily in common stocks of US and foreign issuers. It invests in either growth stocks, value stocks, or both.

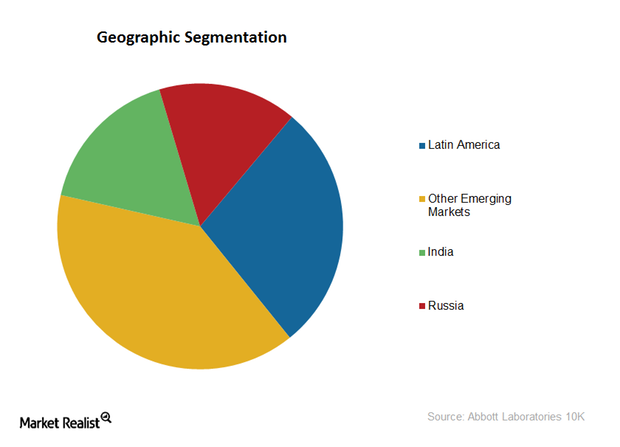

Established Pharmaceuticals Segment of Abbott Laboratories

Abbott’s Established Pharmaceuticals segment is a consumer-oriented segment with a consumer mix of around 75% self-pay consumers and 25% third-party payers.

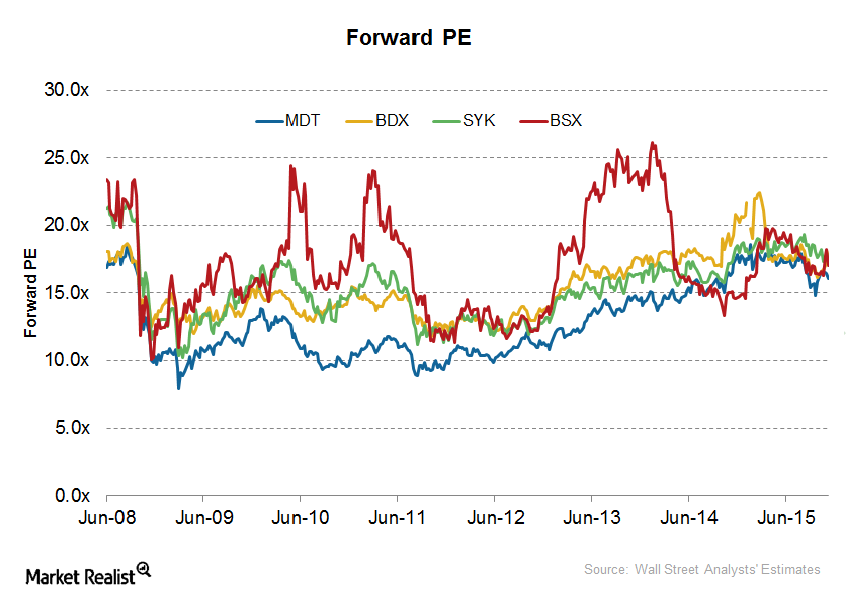

A Look at Becton, Dickinson and Company’s Valuation

Becton, Dickinson and Company is one of the five biggest medical device companies in the United States.

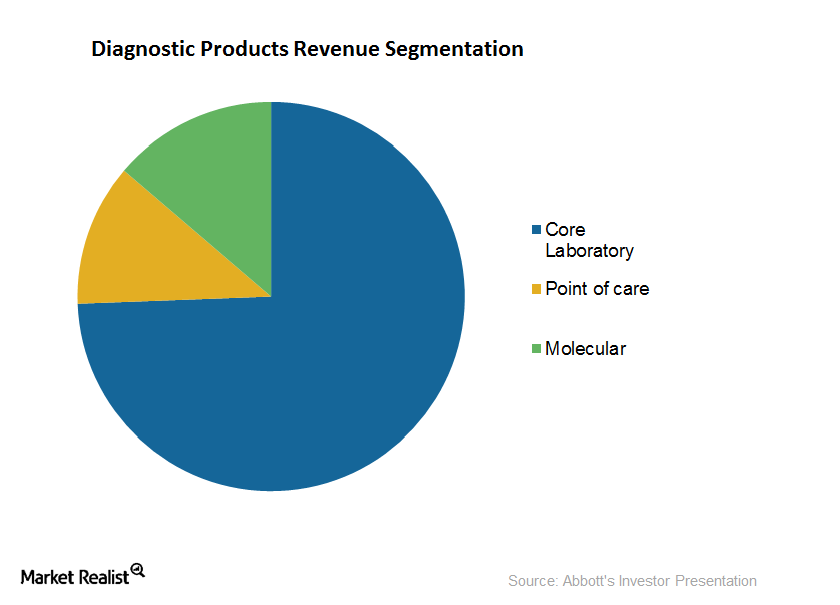

A Rundown of Abbott Laboratories’ Diagnostic Products Segment

Abbott Laboratories is one of the leading companies in the diagnostic products space in the United States, with sales of around $4.7 billion in 2014.

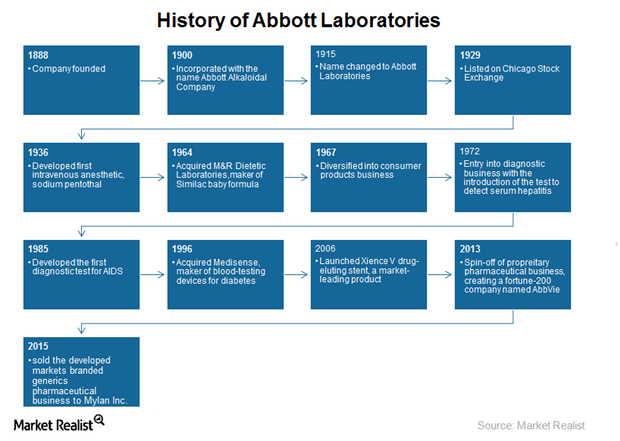

Introducing Abbott Laboratories, a Leading Global Healthcare Company

Abbott Laboratories operates across more than 150 countries, employs over 73,000 people, and is the global leader in the nutrition subsector.

Why Technology Is a Key Driver in the US Medical Device Industry

Traditionally, the United States has been home to the most advanced technological inventions in the medical device industry.

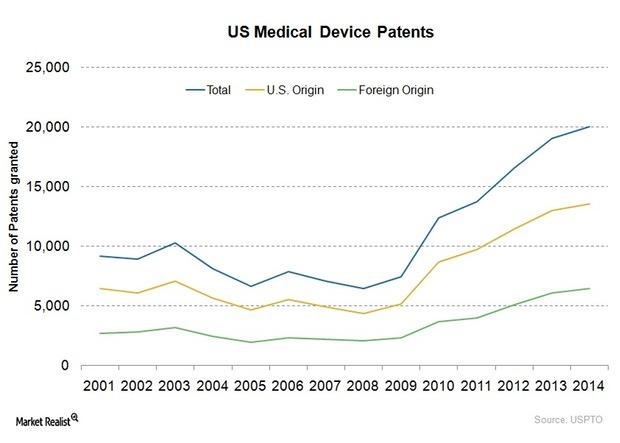

Why Are Patents Necessary for Medical Device Companies?

Medical device companies are driven by innovation and inventions that involve high research and development (or R&D) costs.

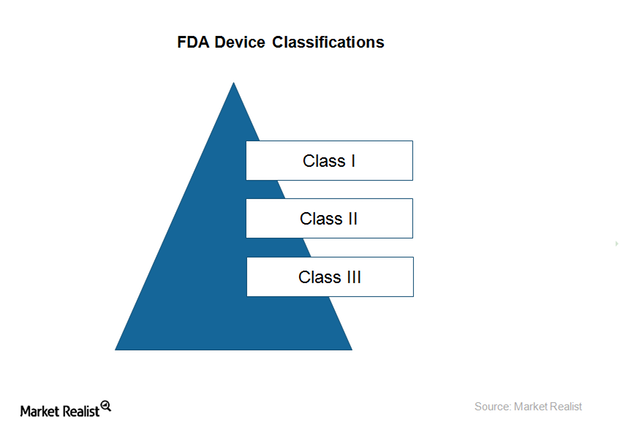

How Does the FDA Classify Medical Devices?

Medical devices are classified as per the level of control required by the Food, Drug, and Cosmetic Act (or FD&C Act).

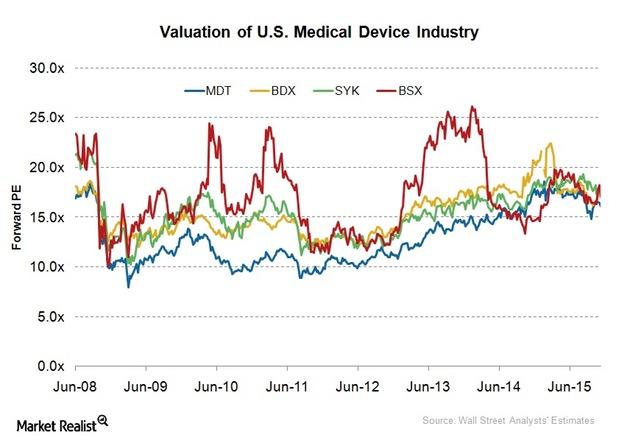

How Is the US Medical Device Industry Valued?

The US medical device industry has rebounded sharply since its 2008 decline, and it is trading at a high PE of 21.9x.

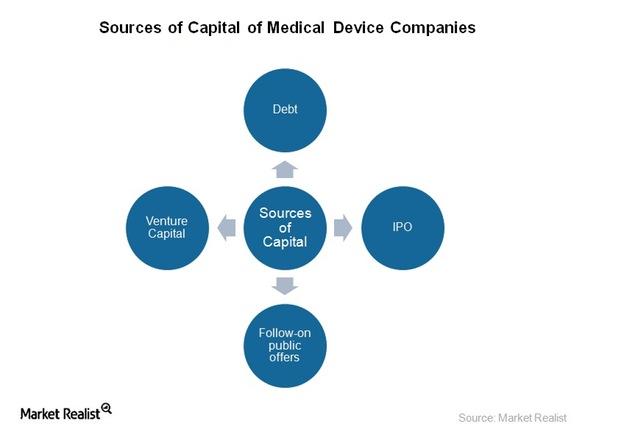

What Are the Major Sources of Capital for Medical Device Companies?

Venture capital is one of the major sources of capital for the US medical device industry.

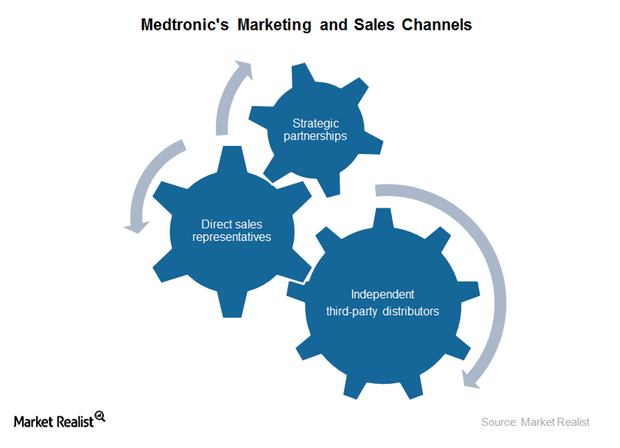

Assessing Medtronic’s Marketing and Sales Strategy in 2015

To extend cost-effective, high-quality medical devices and therapies, Medtronic aims to organize its marketing and sales teams around physician preferences.

Analyzing Medtronic’s Restorative Therapies Group Segment

Medtronic’s Restorative Therapies Group’s net sales in fiscal 2015 reached ~$6.8 billion, which represents an increase of 4% over the prior fiscal year.

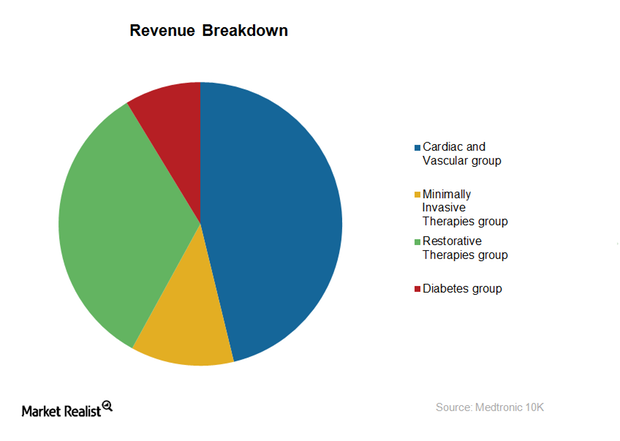

A Key Breakdown of Medtronic’s Business Model

Medtronic generates revenue through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies, Restorative Therapies, and the Diabetes Group.

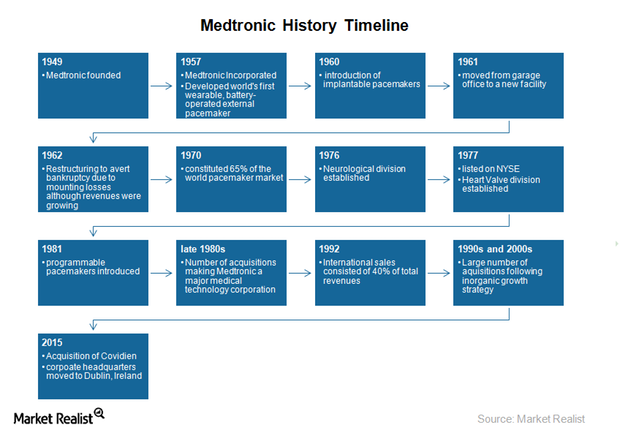

Introducing Medtronic, a Leading Medical Device Company

Headquartered in Minnesota, Medtronic is the world’s largest pure-play medical device company, with operations in 160 countries and over 85,000 employees.

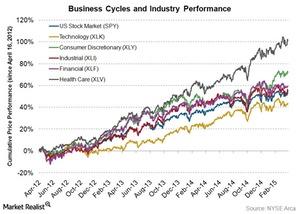

What Stage of the Business Cycle Are We In Now?

Looking at the US economy for the last three years might help us understand which phase of the business cycle the US economy is in right now.

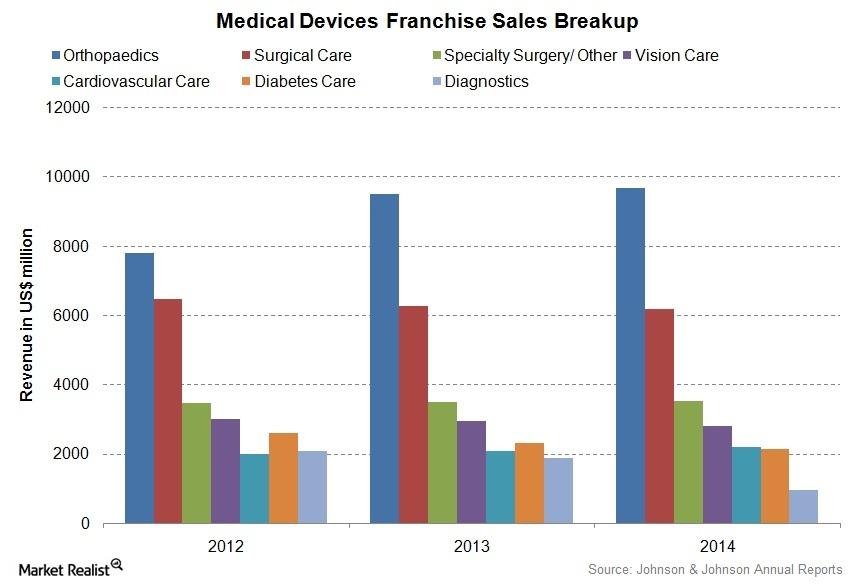

Johnson & Johnson’s Medical Devices and Diagnostics Segment

The Medical Devices and Diagnostics segment contributes over 37% of Johnson & Johnson’s revenue. In 2014, the segment generated about $27.5 billion in revenue.