Anadarko Petroleum Corp

Latest Anadarko Petroleum Corp News and Updates

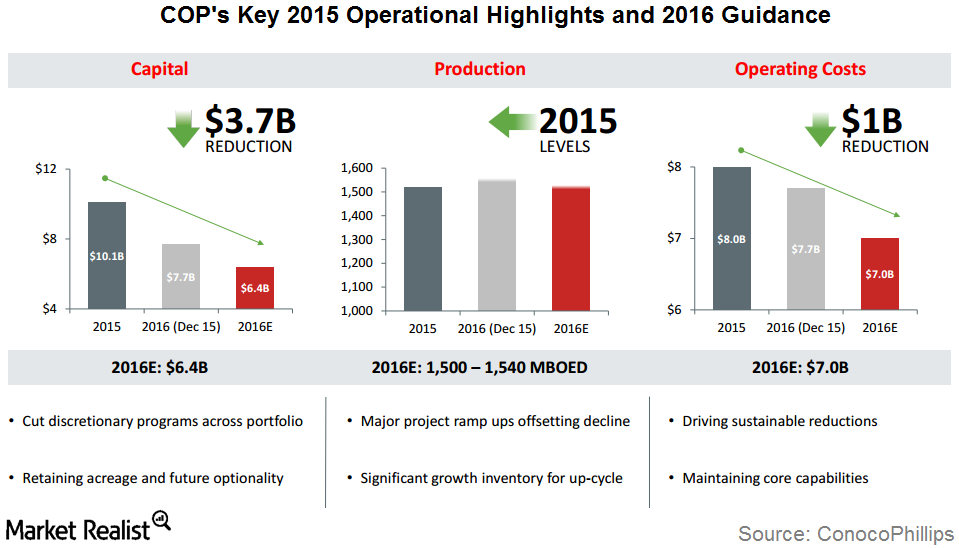

ConocoPhillips: 2015 Operational Highlights, 2016 Guidance

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

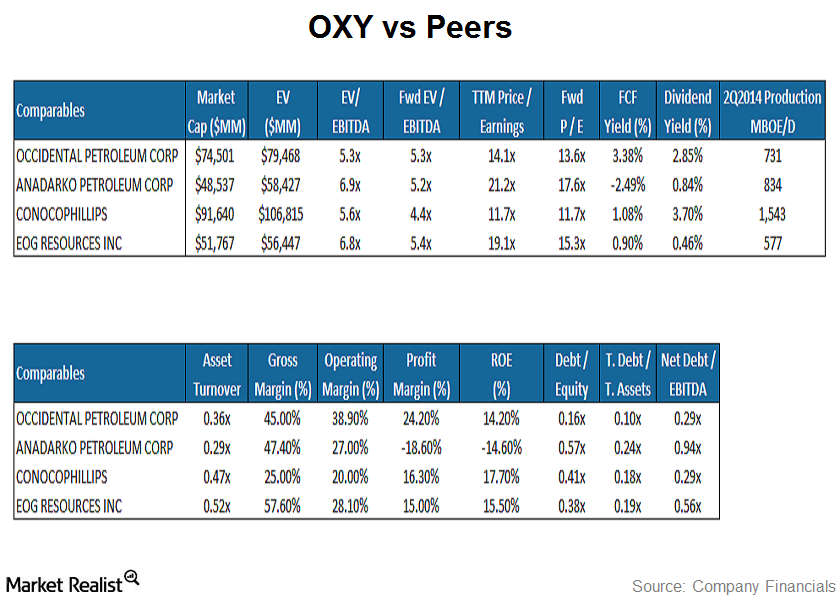

How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

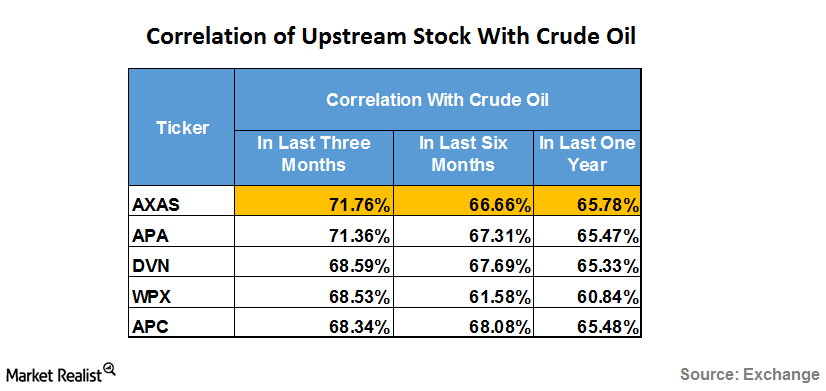

Which Upstream Stocks Are More Sensitive to Crude Oil?

In the last three months, Abraxas Petroleum (AXAS) has had the highest positive correlation with WTI crude oil among upstream companies that are part of XOP.

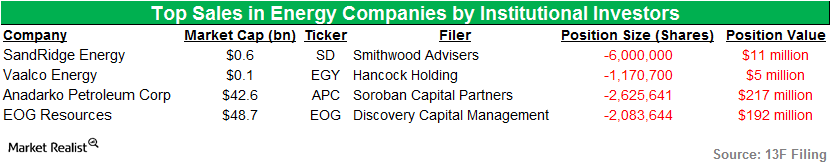

Smithwood Advisers and Hancock Sell Stakes in Energy in 1Q15

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding was one of the firms that sold stakes in Vaalco Energy.

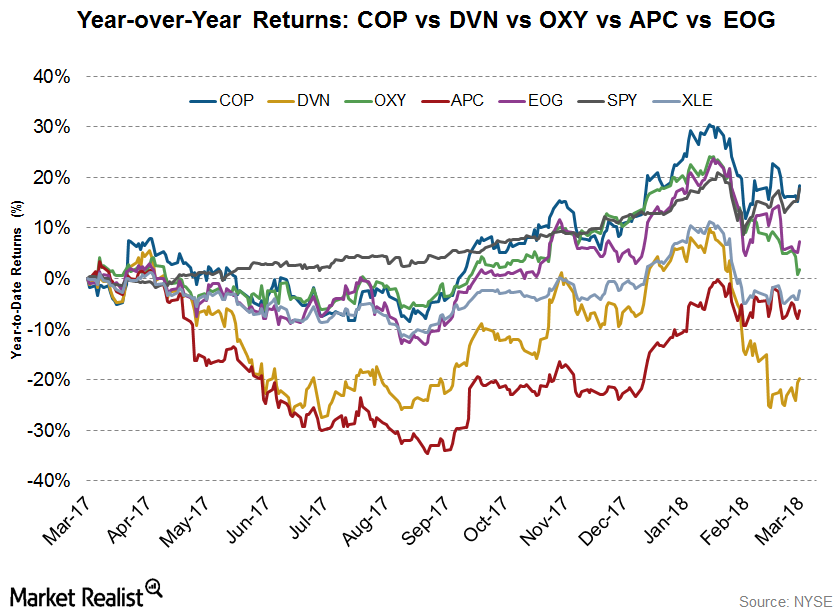

Stock Comparison: How Have COP, DVN, OXY, APC, and EOG Fared?

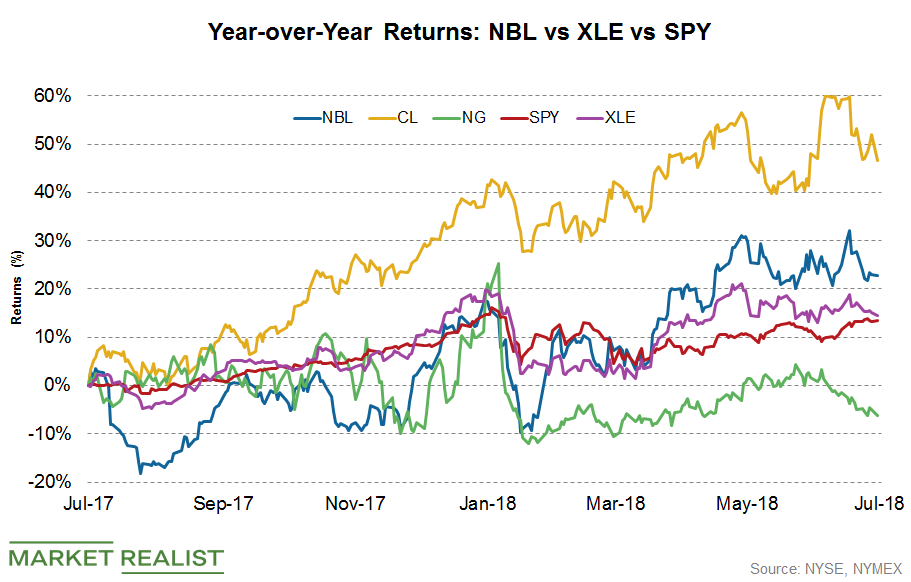

Stock performance In this article, we’ll discuss the year-to-date (YTD) stock performance of ConocoPhillips (COP), Devon Energy (DVN), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and EOG Resources (EOG), which reported the highest revenue among upstream companies in fiscal 2017. Outliers and underperformers The above image shows that ConocoPhillips (COP) is the outlier among peers. YoY […]

Hedge Funds’ Net Long Positions in US Natural Gas

Hedge funds decreased their net bullish positions in US natural gas futures and options 1.9% to 186,799 on June 12–19.

Tesla Institutional Investors: Who All Sold Too Early?

In 2019, Tesla (TSLA) rose 29.3%. The S&P 500 Index gained 29.2%. The top institutional investors were bullish on the electric car manufacturer in Q3 2019.Financials Understanding the simple moving average in technical analysis

The simple moving average (or SMA) is an average of the closing price of a stock over a specified number of periods. The moving average smooths the short-term fluctuations in the stock prices.Consumer Overview: Ambre Energy—a coal and oil shale export company

Ambre Energy was founded in June 2005. It’s an Australian-American coal and oil shale company. The company’s Australian headquarters are located at Brisbane. The head American office is located at Salt Lake City, Utah. The company operates in three business lines—U.S. coal export infrastructure, international coal marketing and trading, and U.S. thermal coal production.

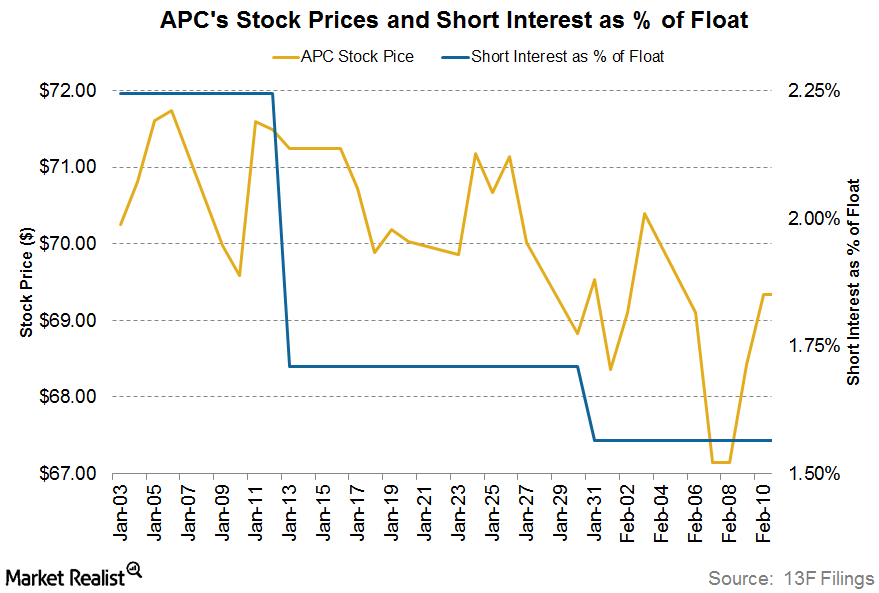

Anadarko Petroleum: Key Short Interest Trends

Anadarko Petroleum’s (APC) short interest ratio on February 10, 2017, was ~1.6%. At the beginning of the year, its short interest ratio was ~2.2%.

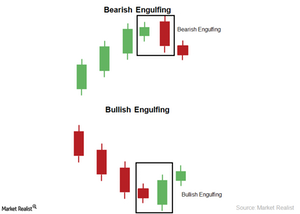

The Bearish Engulfing and Bullish Engulfing Candlestick Pattern

The Bullish Engulfing candlestick pattern is a reversal pattern. The pattern has two candles. The first candle is small and bearish. The second candle is long and bullish.

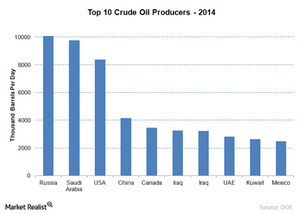

Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

Why the US Imposed Sanctions on Iran and Why They Matter

The United States first imposed restrictions on its activities with Iran in 1979, after the seizure of the US embassy in Tehran.

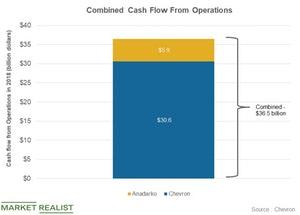

How Will the Anadarko Acquisition Benefit Chevron?

Chevron (CVX) has agreed to acquire Anadarko (APC) in a cash and equity deal.

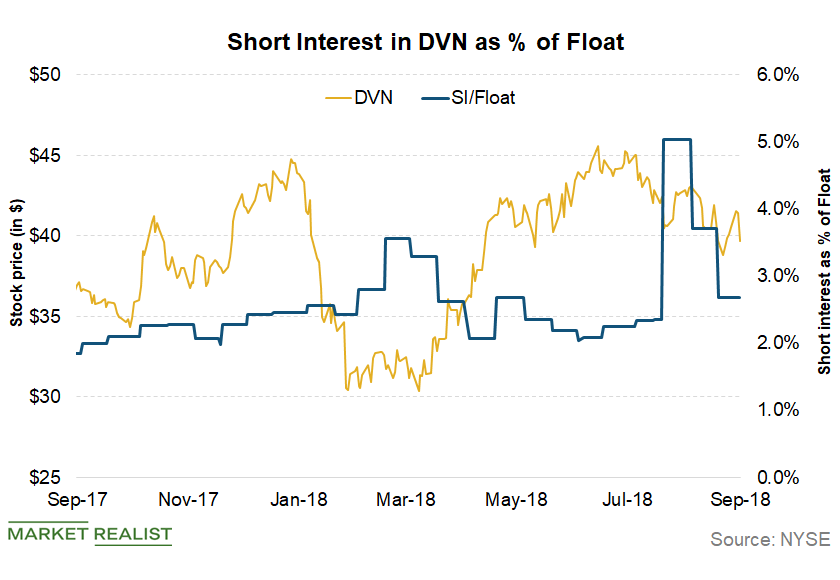

What Devon Energy’s Technical Indicators Tell Us

Devon Energy (DVN) continues to trade below its short-term (50-day) moving average.

Capital World Investors Sold a Major Position in NBL in Q2

So far in this series, we’ve looked at institutional investments in five major oil-weighted E&P (exploration and production) stocks: ConocoPhillips (COP), EOG Resources (EOG), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and Pioneer Natural Resources (PXD).

How Has Noble Energy Stock Been Performing Recently?

Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period.

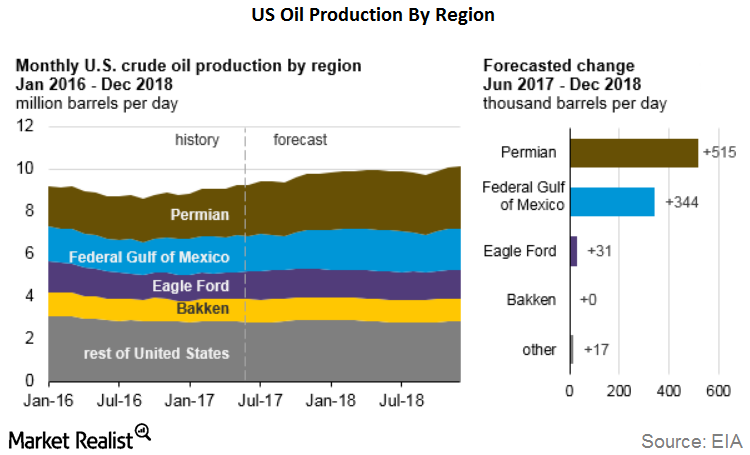

Could Permian Basin Drive Growth in US Crude Oil Production?

In its November Short-Term Energy Outlook (or STEO) report, the EIA forecast that US crude oil production in 2017 would average 9.2 million barrels per day.

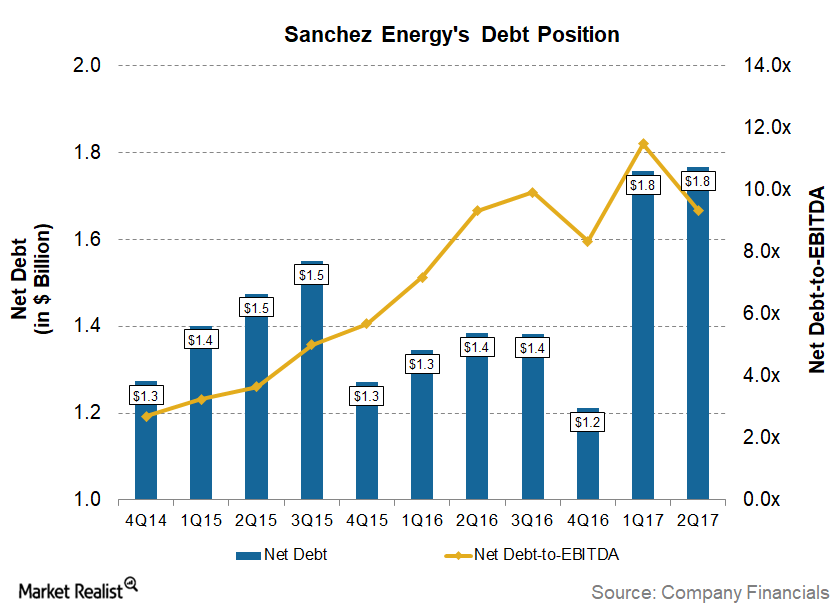

Is Sanchez Energy Repeating an Old Debt Mistake?

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

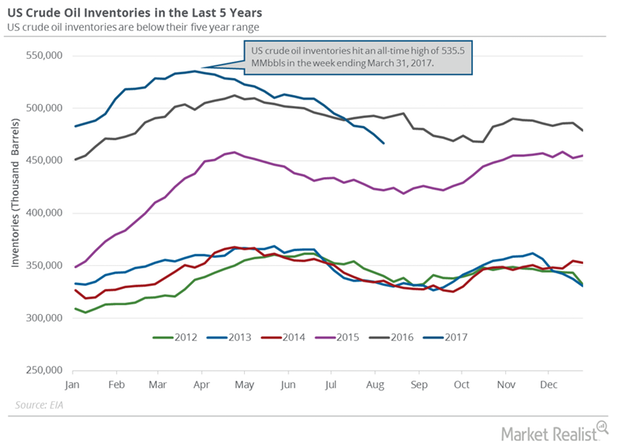

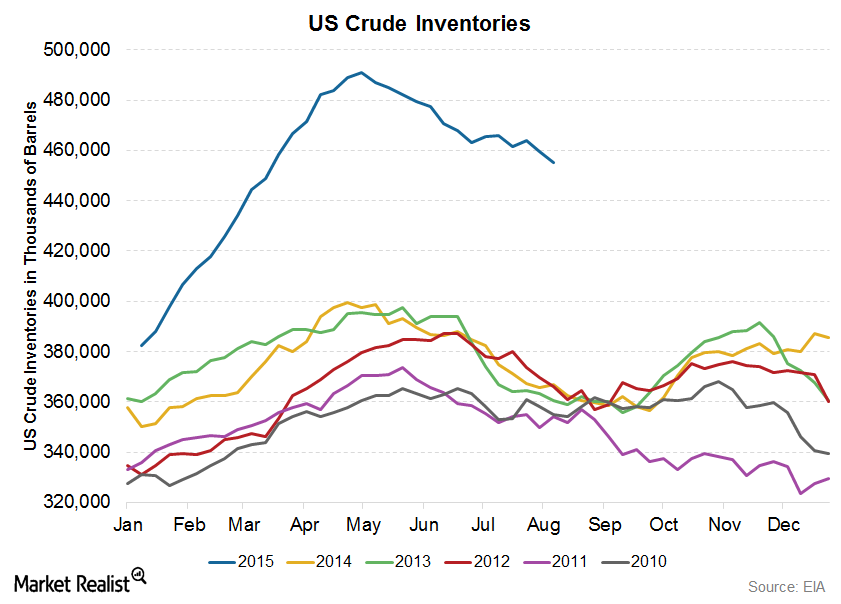

US Crude Oil Inventories: Biggest Draw since September 2016

The EIA reported that US crude oil inventories fell by 8.9 MMbbls or 1.8% to 466.4 MMbbls on August 4–11, 2017—the biggest draw since September 2016.

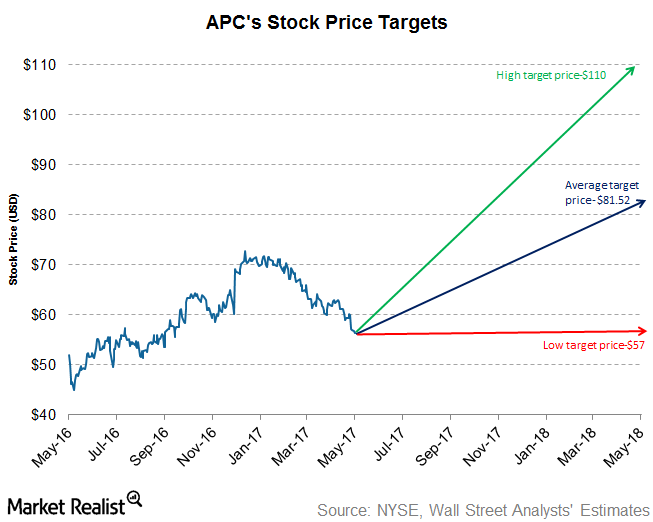

Analyst Recommendations for Anadarko Petroleum after 1Q17

Approximately 83.0% of analysts have rated Anadarko Petroleum (APC) a “buy.” The average broker target price is $81.52.

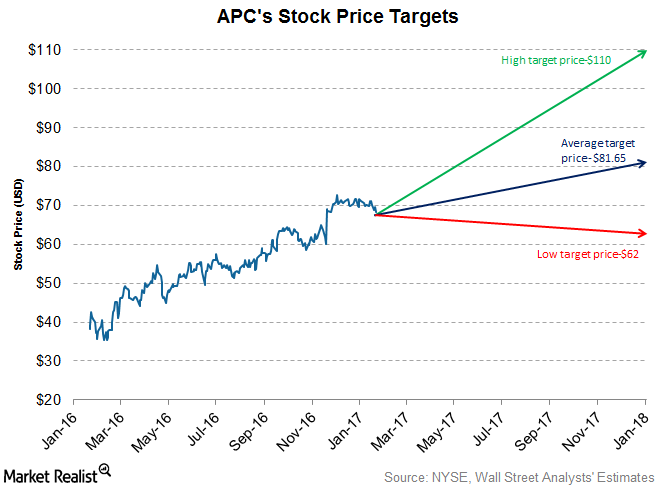

What Analysts Recommend for Anadarko after Its 4Q16 Earnings

The average broker target price of $81.65 for Anadarko Petroleum implies a potential return of ~19.4% for the stock in the next 12 months.

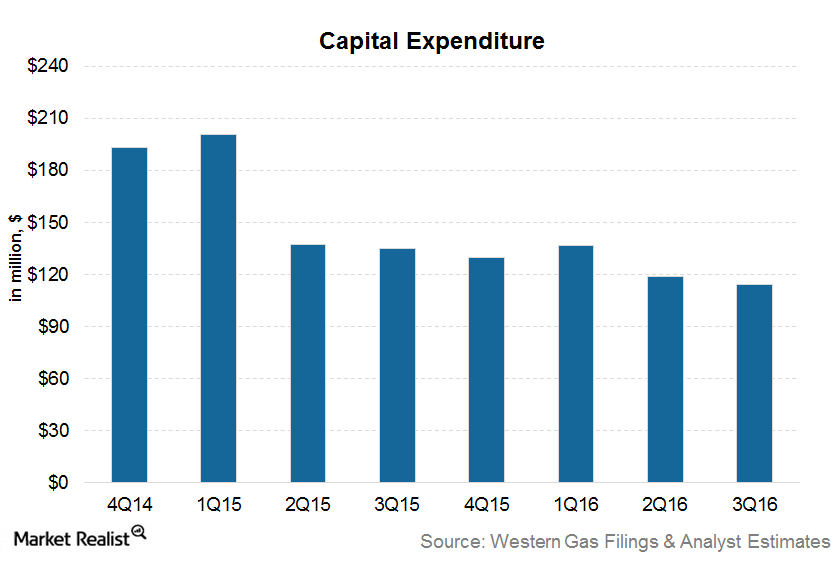

Why Western Gas’s Capital Spending Could Recover in 2017

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

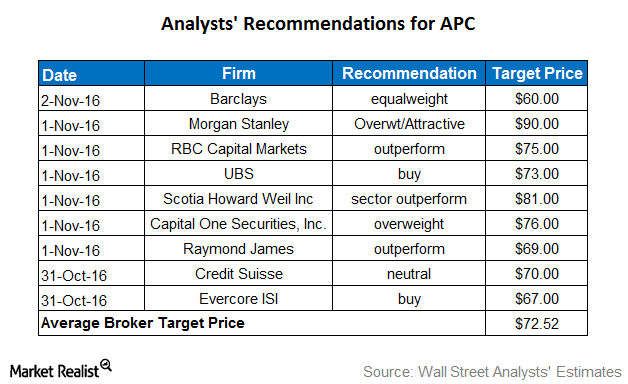

What Do Analysts Recommend for Anadarko Petroleum?

Approximately 73% of the analysts rate Anadarko a “buy,” 22% rate it a “hold,” and 5% rate it a “sell.” The average broker target price is $72.52.

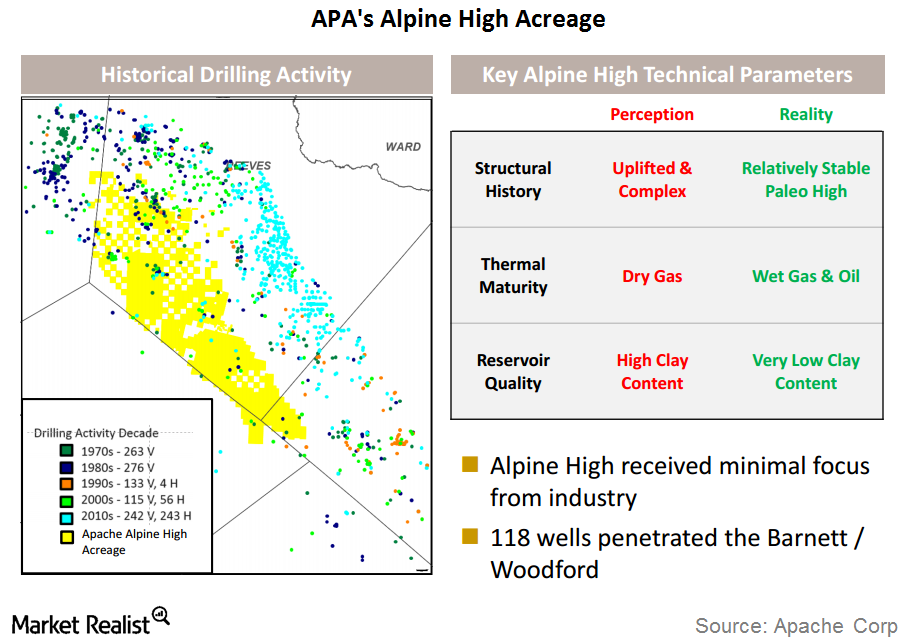

Apache Announces a New Oil and Gas Discovery

On September 7, 2016, Apache (APA) announced a new resource play, Alpine High, in the Delaware Basin of Texas.

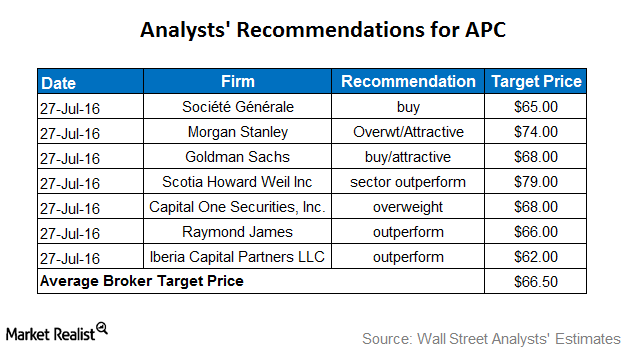

What Do Analysts Recommend for Anadarko after Its 2Q16 Earnings?

Approximately 73% of analysts rate Anadarko a “buy,” whereas 22% rate it a “hold,” and 5% rate it a “sell.” The average broker target price is $66.50.

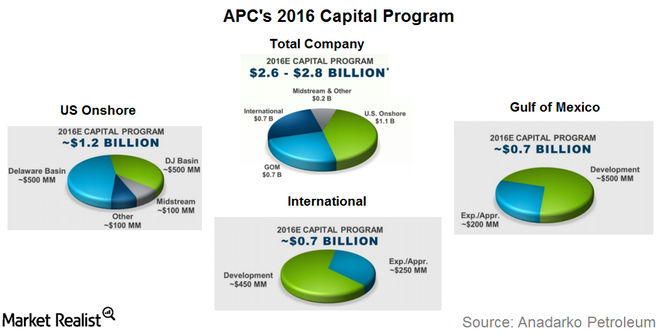

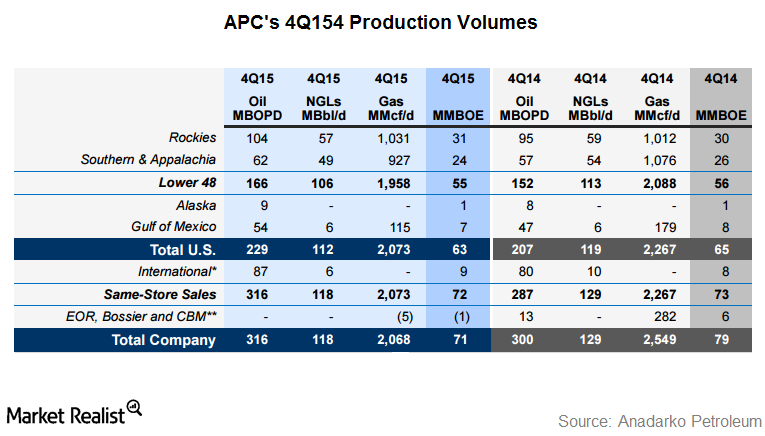

What Are Anadarko’s Capex Plans in 2016?

Anadarko Petroleum’s (APC) 2016 capex (capital expenditures) budget is $2.6 billion–$2.8 billion, a 50% reduction from $5.4 billion in 2015.

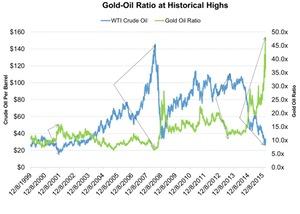

Gold-Oil Ratio Is at a Historic High: Why Isn’t the Bottom Near?

A rise in the ratio can be correlated the corresponding rise in gold prices. An increase in the ratio indicates that gold is more expensive than crude oil.

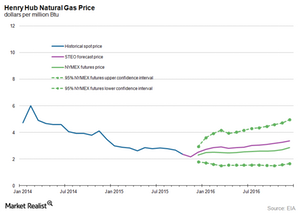

What’s the Long-Term Forecast for Natural Gas Prices?

US natural gas prices have fallen for the third time in the last five trading sessions. Prices are following the long-term bearish trend and trading close to 16-year lows.

Anadarko Petroleum Slashes Its 2016 Capital Expenditure Budget

Anadarko Petroleum’s preliminary capex (capital expenditure) budget for 2016 is $2.8 billion—nearly 50% less than 2015 levels.

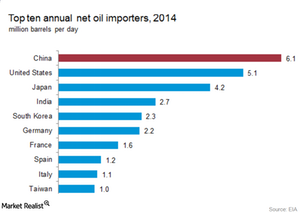

Top Crude Oil Importers’ Role in 2016

China and the United States are the largest crude oil importers in the world. In 2015, they consumed about 30.5 MMbpd (million barrels per day) of crude oil and liquid fuels, per the EIA.

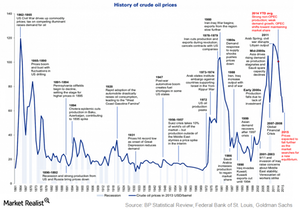

Why Roller Coaster Crude Oil Prices Are Nothing New

Crude oil prices like any other commodity are subject to changes based on the supply and demand dynamics.

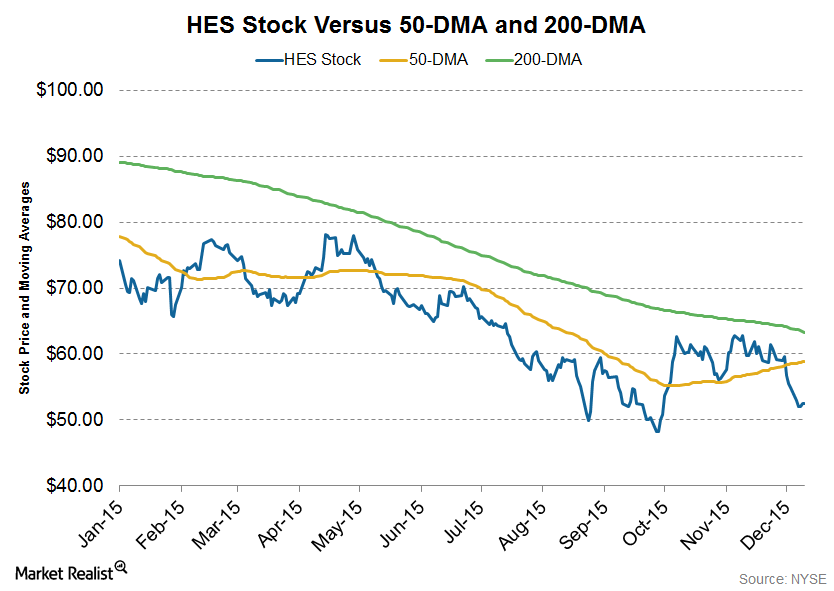

Hess Moves below its 200-Day Moving Average

On December 11, 2015, Hess was trading 17% below its 200-day moving average, a strong upside resistance for the stock. It has narrowed the gap considerably since October.

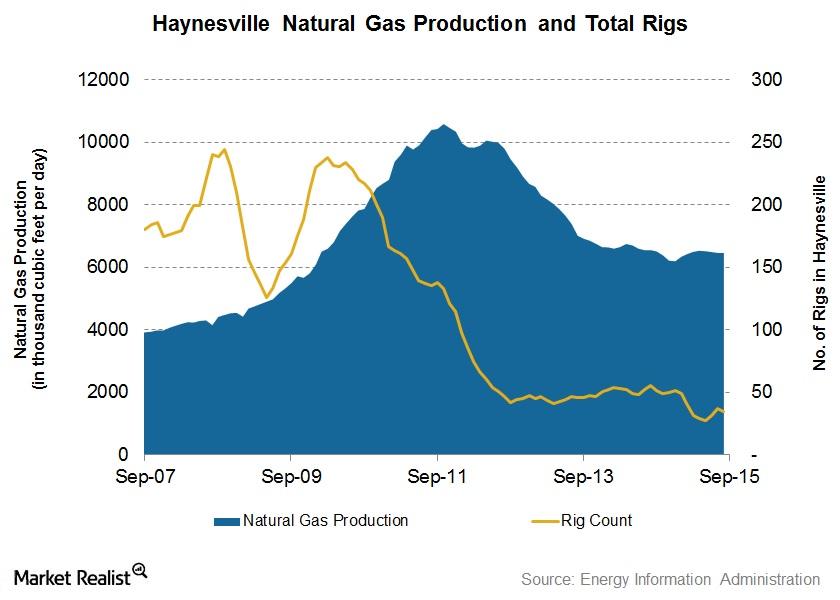

Haynesville Shale Natural Gas Production Fell in September

The Haynesville Shale’s natural gas production in September was 0.1% lower than August. On a YoY basis, it was 1.4% less. The drop marked the fourth straight month-over-month fall in production.

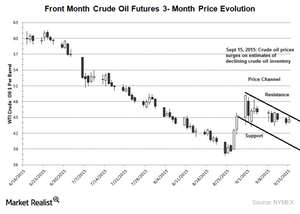

Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.

Crude Oil Inventories Fell, but Why Did WTI Crude Prices Slump?

The U.S. Energy Information Administration reported a decrease of 4.4 million barrels in crude oil inventories for the week ended July 31.

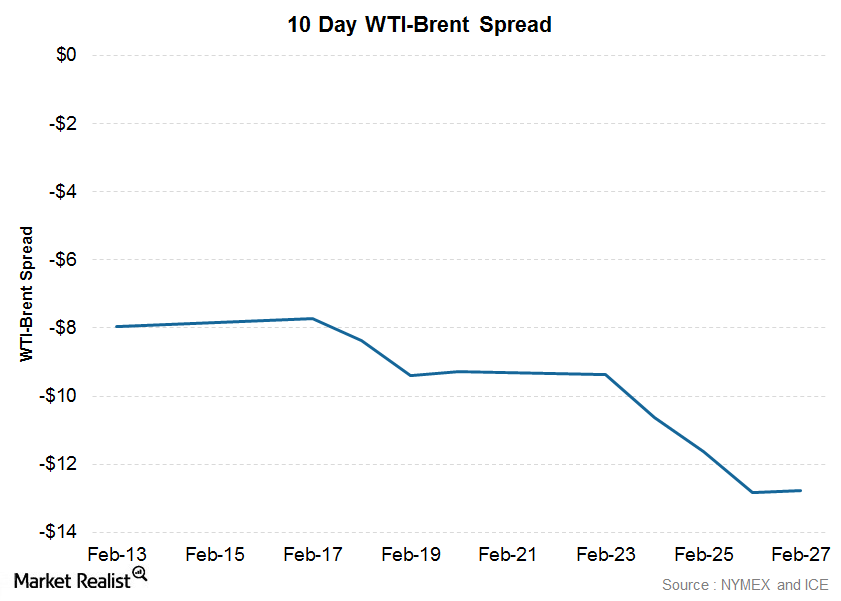

What caused the WTI-Brent spread to widen?

Capping the month with a gain of 3.1% since January 30, WTI’s (West Texas Intermediate) increase has been small compared to Brent’s 18% increase.

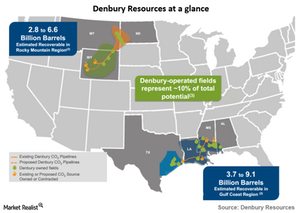

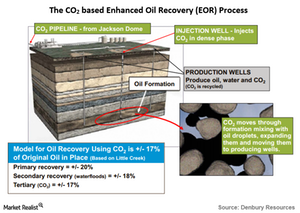

Introducing Denbury Resources

Denbury Resources primarily extracts oil and gas via carbon dioxide–based enhanced oil recovery (or EOR). This is also called tertiary oil recovery.

What’s special about Denbury Resources’s oil recovery method?

ConocoPhillips produces oil and gas via primary or secondary recovery methods. Denbury Resources mainly uses a tertiary, EOR method to produce its oil.

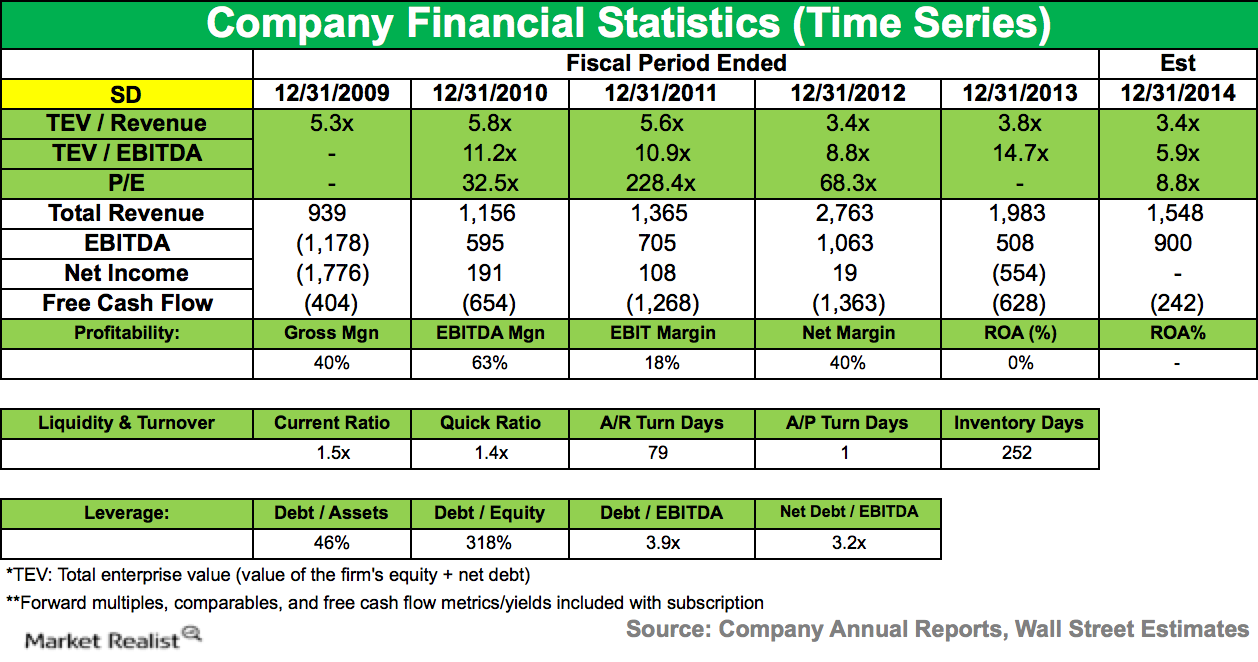

Overview of SandRidge Energy

SandRidge is expanding its low-cost multilateral program and is successfully extending its mid-continent resource base with Chester and Woodford production.Consumer BP lost 55% shareholder value after the Deepwater Horizon incident

Deepwater Horizon was a deepwater, offshore oil drilling rig owned by Transocean (RIG) and operated by BP Plc. (BP). On April 20, 2010, while drilling at the Macondo Prospect, there was an explosion on the rig caused by a blowout that killed 11 crew members.