Robert Karr

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Robert Karr

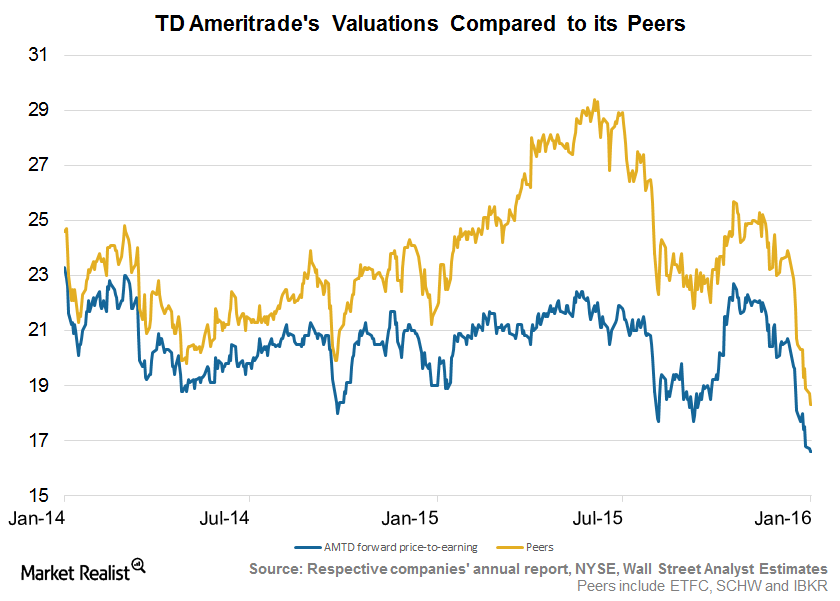

TD Ameritrade’s Valuation Falls alongside the Industry

Historically, TD Ameritrade traded at a discount to its peers because of average operating margins. The sector’s valuations fell in the recent past.

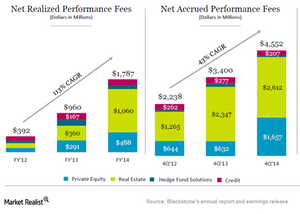

Blackstone Is Attracting New Capital

The launch of innovative ideas at the right time can help Blackstone attract a good amount of new capital through its dedicated network.

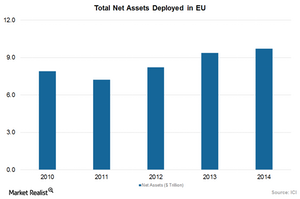

Fund Flows Continue to Rise in the European Union

Fund flows in European equities (EFA) have expanded at a slower pace since 2011. Overall, they’ve grown at an average of 10% over the past three years.

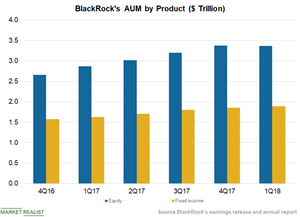

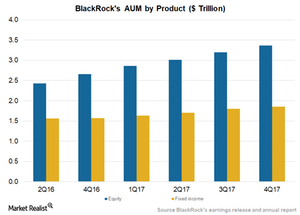

BlackRock’s Diversified Offerings Can Benefit from Rate Hikes

In the first quarter, BlackRock managed ~$1.9 trillion in fixed income offerings, up from ~$1.6 trillion in the first quarter of 2017.

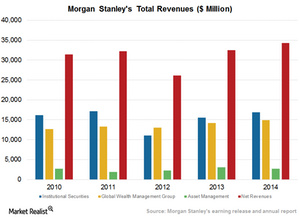

Morgan Stanley’s Strong Revenue Model

Morgan Stanley charges fixed fees and performance fees for asset management services, products and services, and administration of accounts.

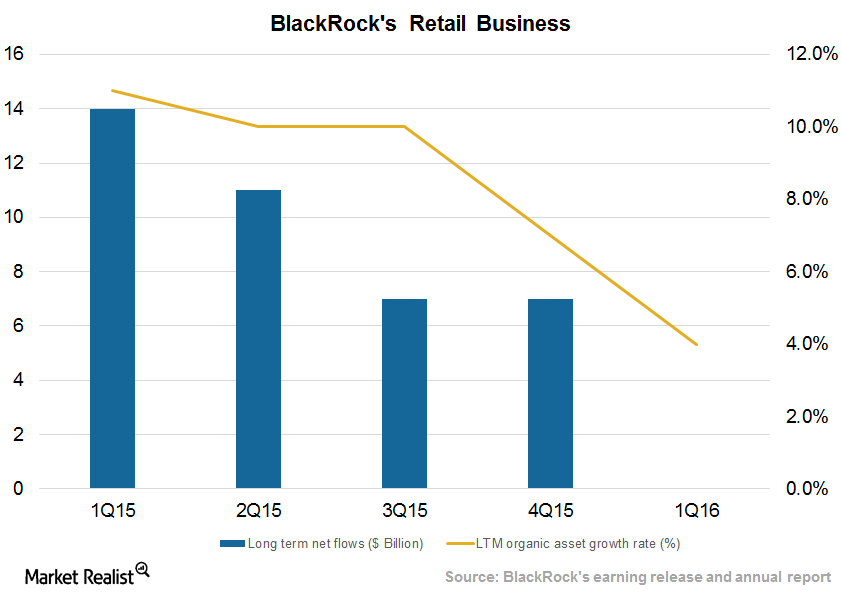

BlackRock’s Retail Continues to Attract New Clients across Classes

BlackRock’s (BLK) retail business had assets under management (or AUM) of $542 billion as of March 31, 2016.

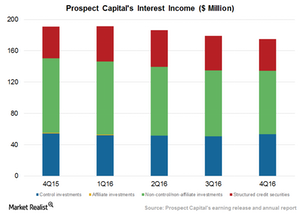

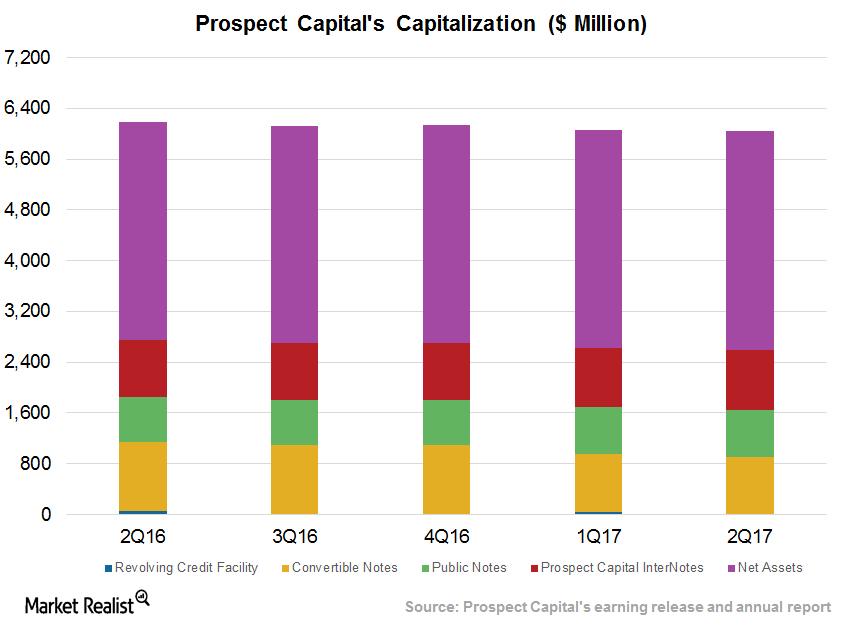

Why Closed-End Funds Are Not That Enthusiastic about Rate Changes

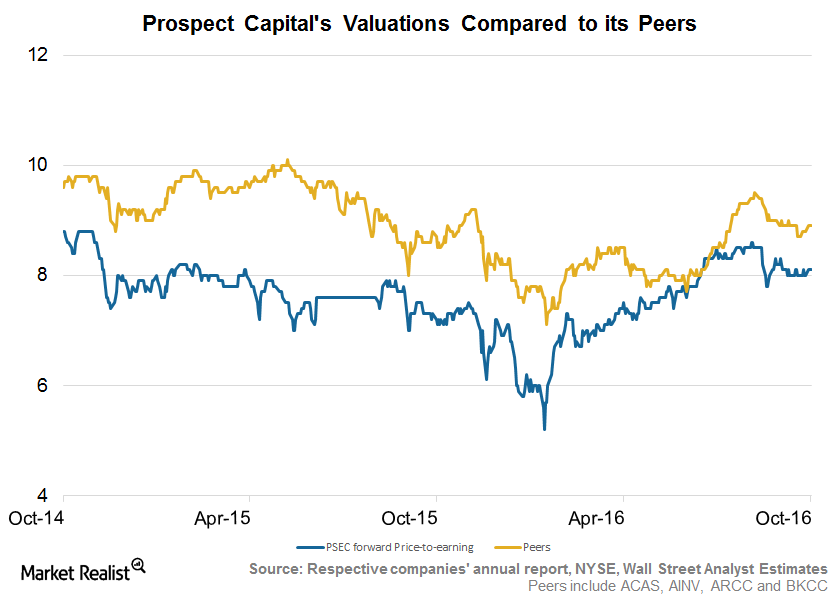

Prospect Capital (PSEC) is strengthening its capital position in order to take advantage of mispricing during volatile times.

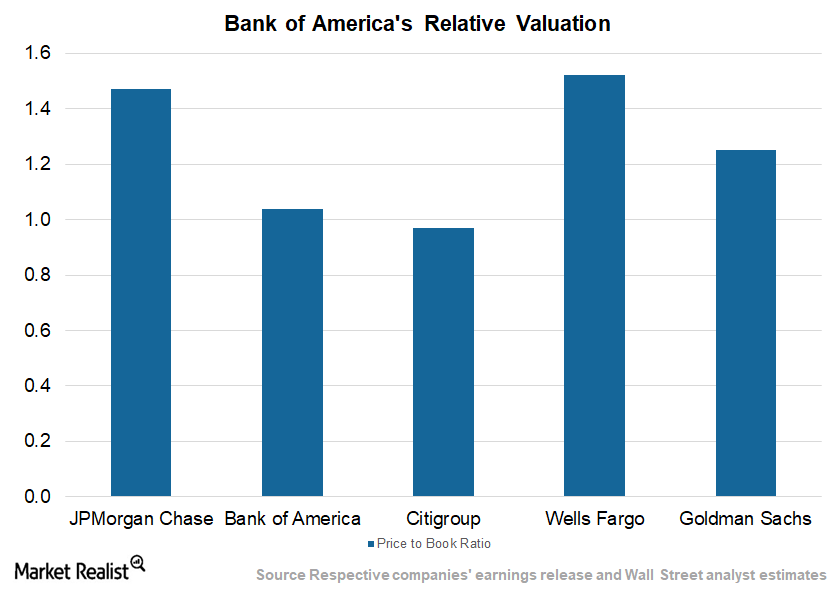

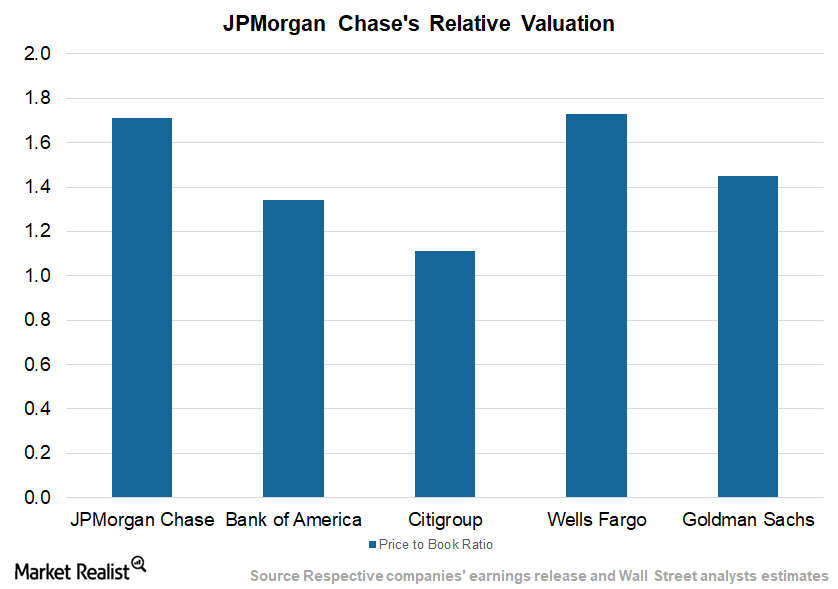

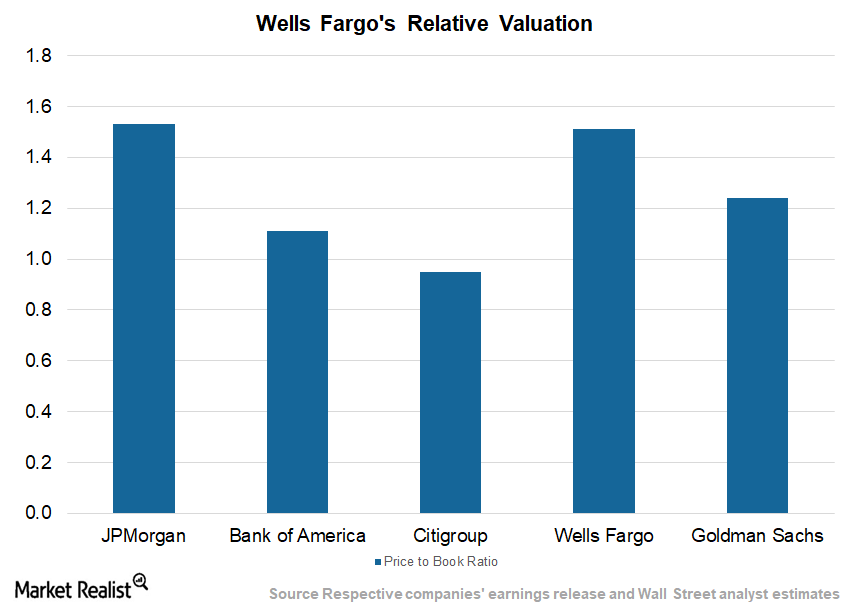

Why JPMorgan and Wells Fargo Are Trading at High Multiples

In spite of a rather weak performance, Wells Fargo (WFC) commands the highest premium due to its strong franchise, mortgage concentration, and high net interest margins.

Interest Rate Expectations Have Jolted Equity and Debt Alike

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings.

BlackRock has a strong position in the competitive landscape

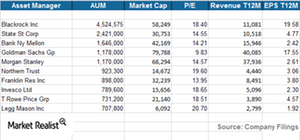

BlackRock (BLK) became the world’s largest asset management company in 2009 with the acquisition of Barclays Global Investors (BGI).

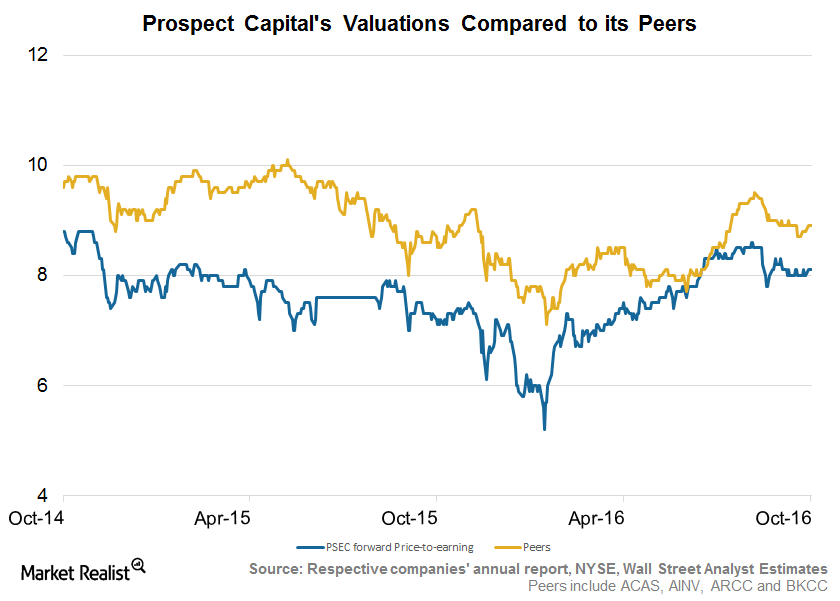

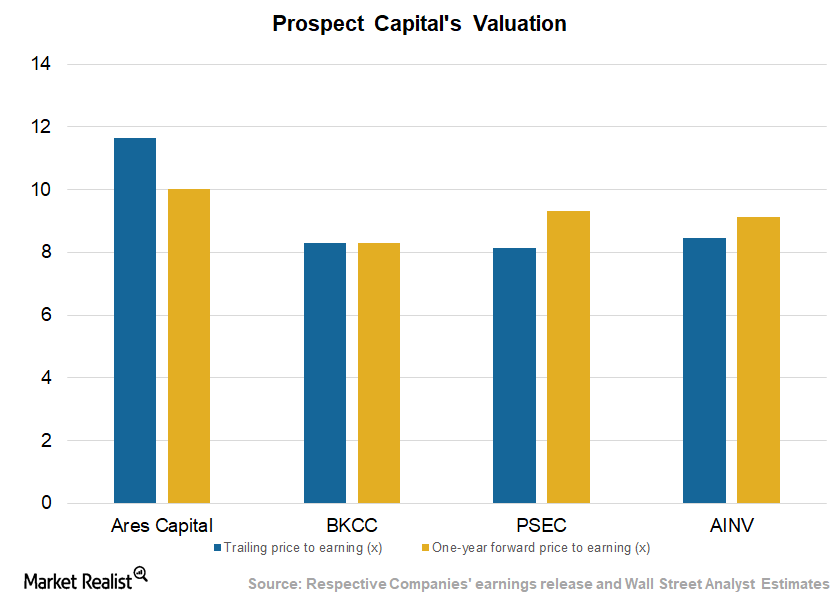

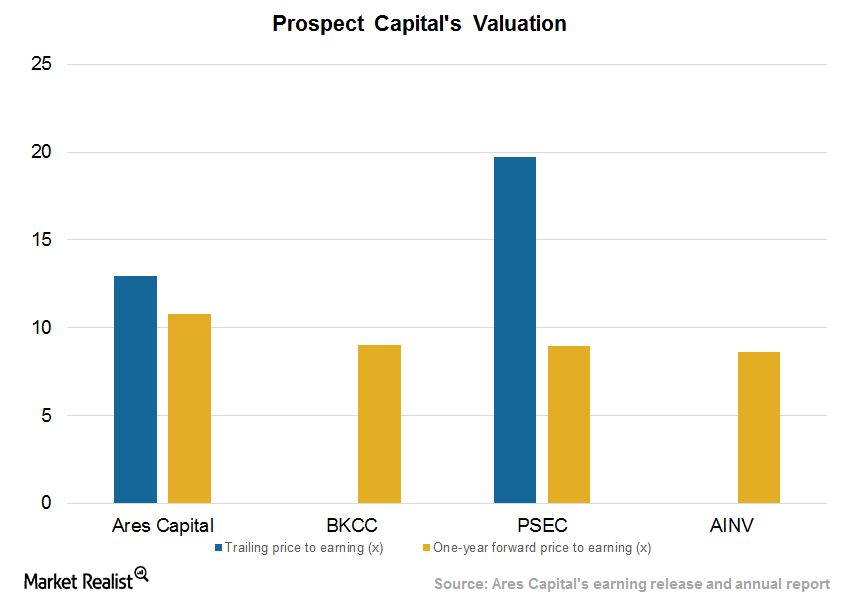

Prospect’s Valuation Discount Consistent on Lower Originations

Prospect Capital’s (PSEC) stock has fallen ~3% in the past quarter, and it has risen ~11% in the past year. The company is currently trading 7% lower than its 52-week high.

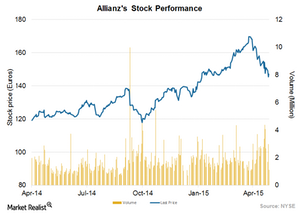

Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

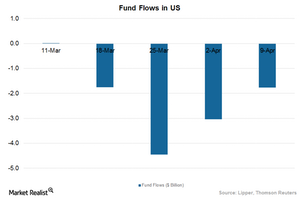

US Equities: 4th Consecutive Week of Outflow

US equities were impacted by weak jobs data and slower construction and manufacturing activity. But the energy sector attracted investors.

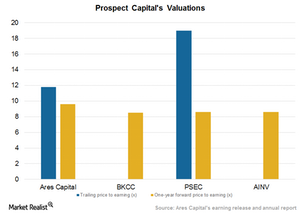

Prospect Capital’s Valuations: Fair amid Originations, Leverage

Prospect Capital (PSEC) stock rose 3.0% over the past three months and 20.0% over the past year. The company is currently trading 5.0% below its 52-week high.

Prospect Valuations Fair amid Rising Originations, Strong Yields

Prospect Capital’s (PSEC) stock fell ~7% in fiscal 1Q17 (September quarter) but has risen ~6% in the past 12 months.

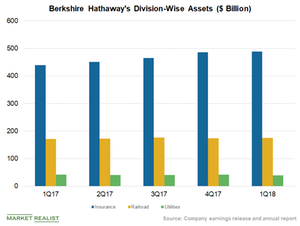

How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

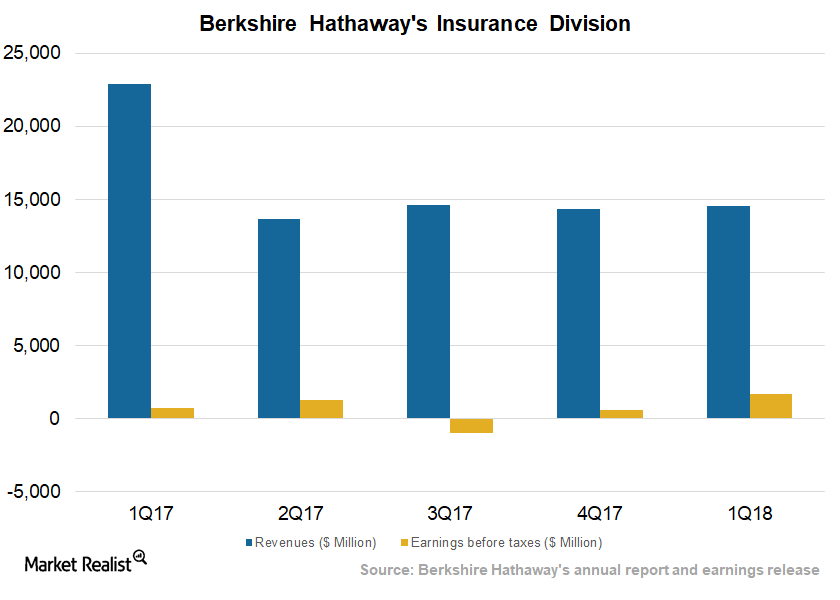

Berkshire’s Insurance Segment Benefits From Fewer Claims

In 1Q18, Berkshire Hathaway’s (BRK.B) insurance revenue fell YoY (year-over-year) to $14.6 billion from $22.9 billion.

What’s JPMorgan Chase’s Valuation?

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year.

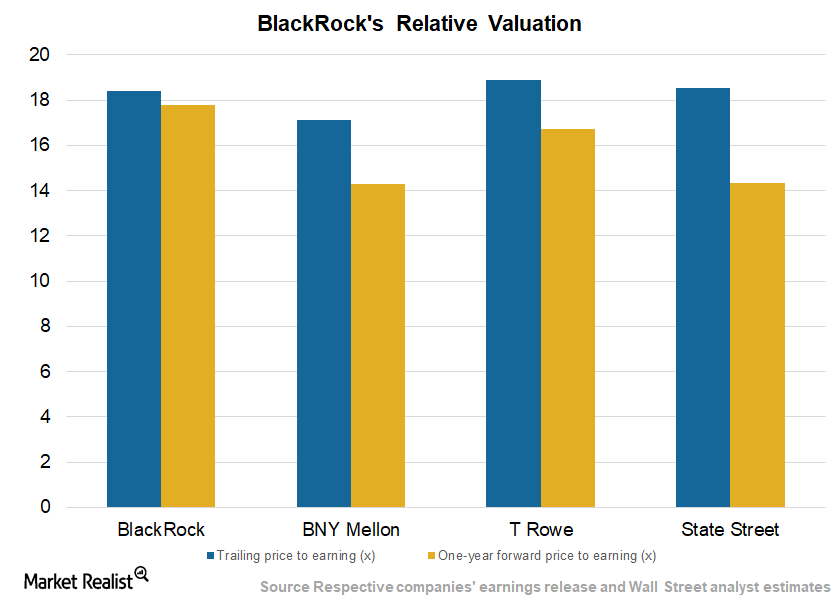

BlackRock’s Valuations Stable amid Strong Operating Performance

BlackRock is currently trading at a forward price-to-earnings ratio of 17.6x, compared with the industry average of 18.6x.

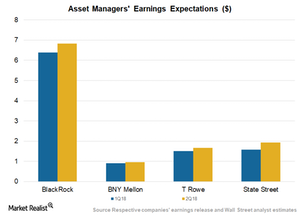

BlackRock and Competitors Look at Strong 1Q18 Numbers

Among the major asset managers, BlackRock (BLK) is expected to post sequential and year-over-year growth in earnings per share to $6.38 in 1Q18 and $6.83 in 2Q18.

Prospect Capital’s Valuation: Fair or Discounted in Long Term?

Prospect Capital (PSEC) stock has fallen 14.5% over the past six months and 16.9% over the past year.

What’s Wells Fargo’s Valuation?

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year.

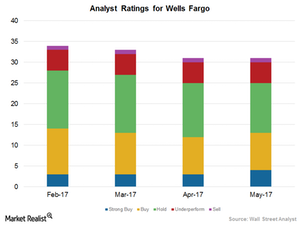

What Do Analysts’ Ratings Suggest for Wells Fargo in 2017?

In May, 13 of the 31 analysts covering Wells Fargo rated the stock as a “buy,” 12 analysts rated it as a “hold,” and six analysts rated it as a “sell.”

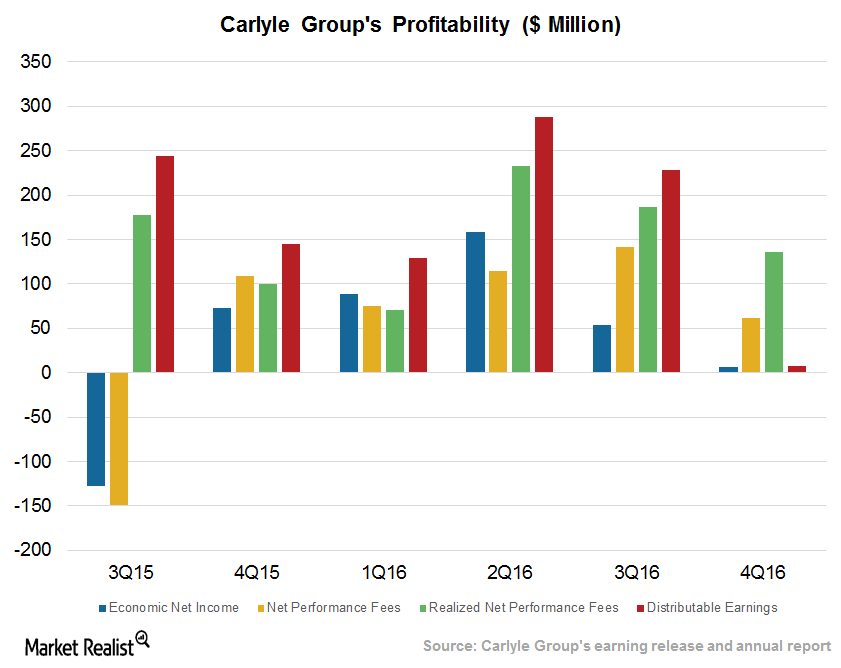

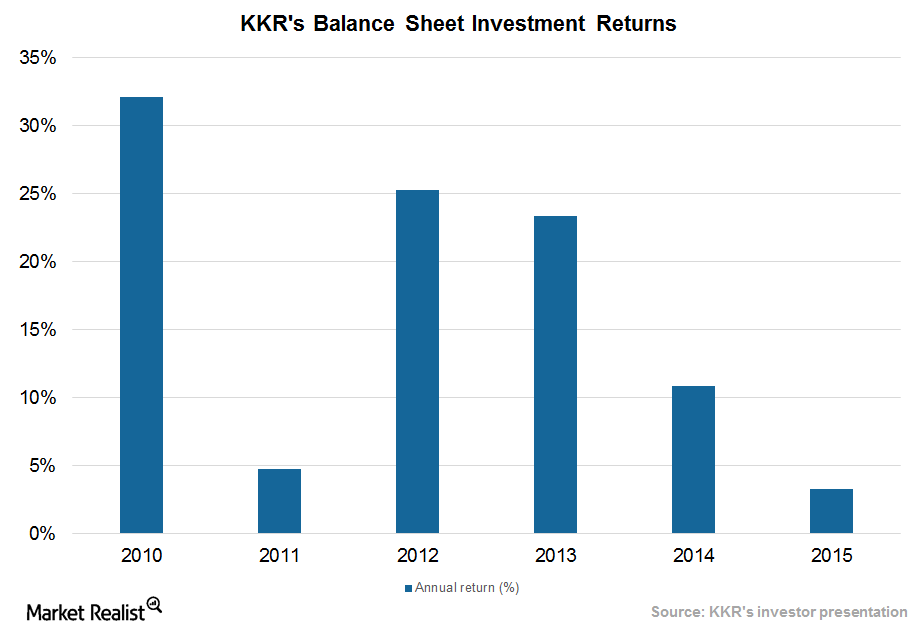

Alternatives’ Deployments May Remain Stable on Fundamentals

In 2016, alternatives saw higher investments as well as exits on the back of improved liquidity, rising markets, higher valuations, and distressed pricing in corporate credit.

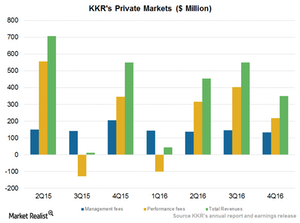

KKR Private Markets Segment Projects Deployment and Growth in 2017

KKR & Company’s (KKR) Private Markets segment contributed almost 71% of the company’s total revenues in 4Q16.

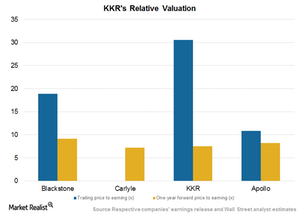

Why KKR’s Valuations Could Rise in 2017

First Data (FDC) is one of KKR’s major holdings. The stock has risen 7.8% in 4Q16 as compared to a substantial decline in 1H16.

KKR Enhances Dividends and Repurchase Program on Growth

KKR & Company (KKR) is creating value for shareholders through share dividends and repurchases.

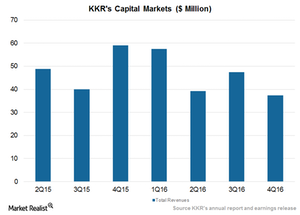

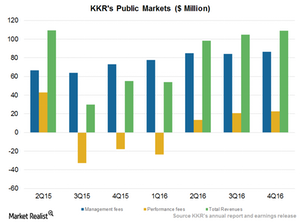

KKR’s Capital Markets Segment Was Subdued amid Lower Activity

KKR’s (KKR) Capital Markets and Principal Activities segment complements its activities in both private and public markets.

KKR Public Markets Could See Slower Growth in 2017 on Rate Hikes

Public markets have performed well over the past couple of quarters mainly due to a rebound in energy prices (USO), which has led to rising prices of distressed credit.

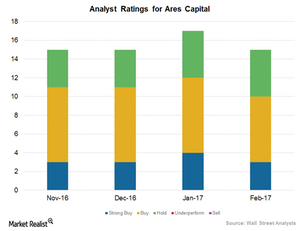

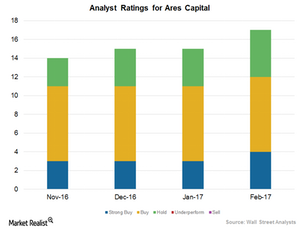

Ares Capital’s Analyst Ratings Suggest Stable Earnings in 2017

In February 2017, 12 of the 17 analysts covering Ares Capital, or ~71%, have rated it as a “buy” or a “strong buy.”

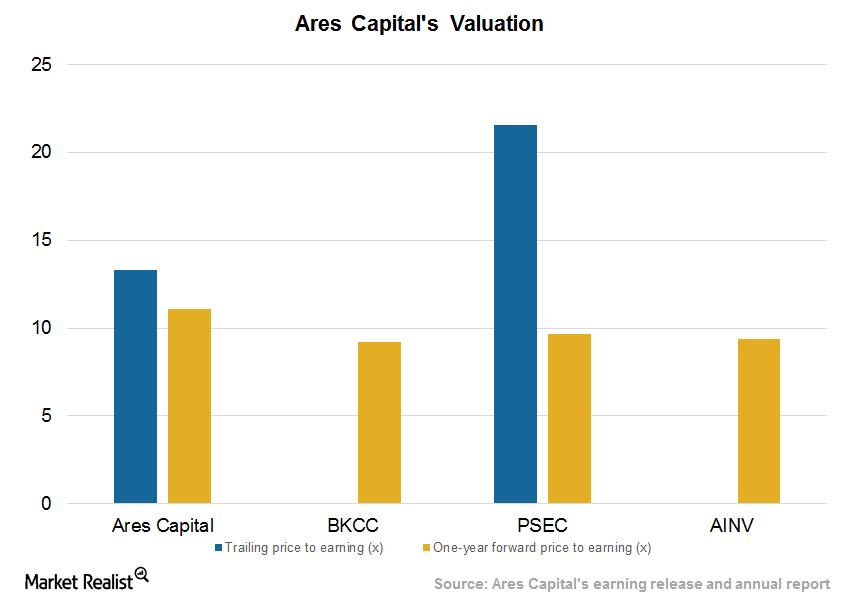

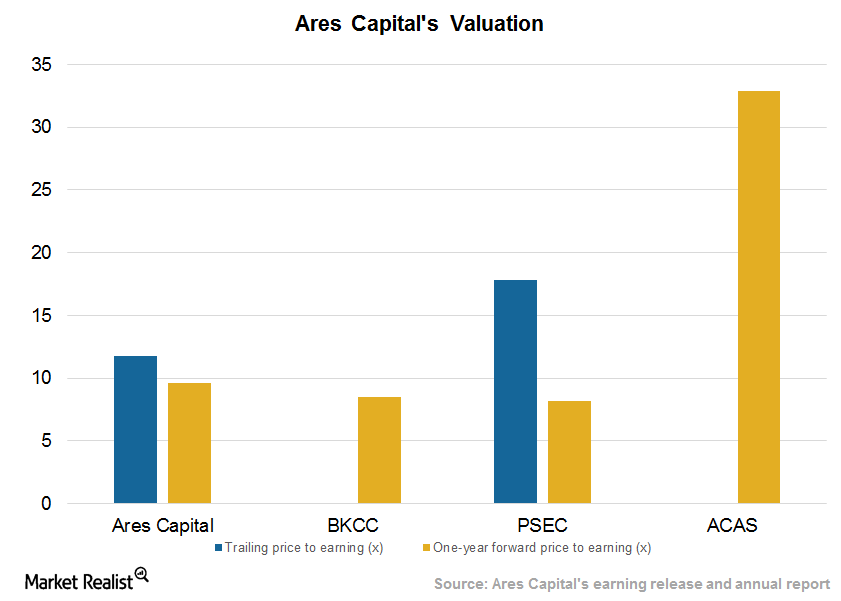

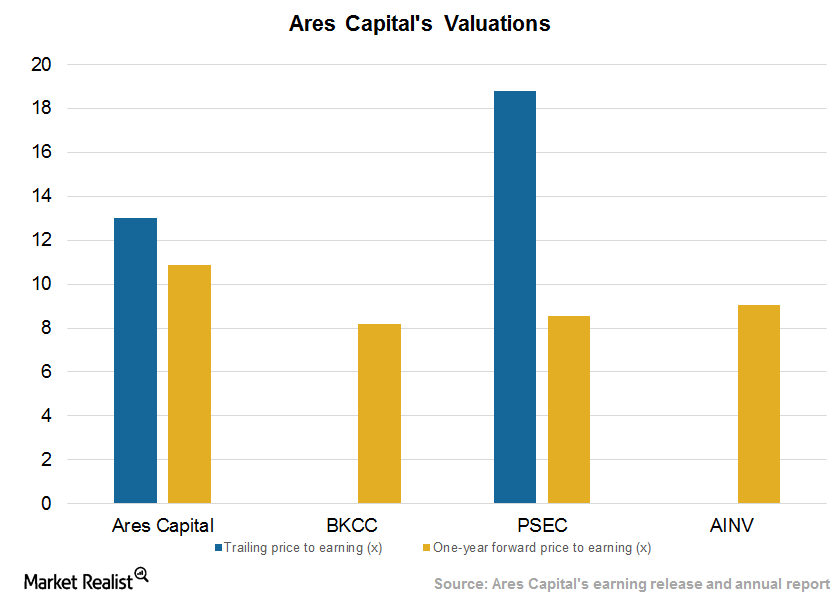

Ares Capital Valuations at a Premium on Relative Outperformance

Ares Capital stock has risen ~11.7% over the past six months. The company saw a strong performance in 4Q16 on higher deployment, stable yields, and expense management.

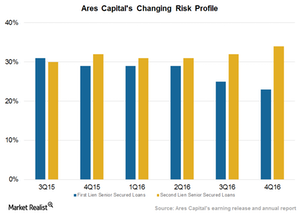

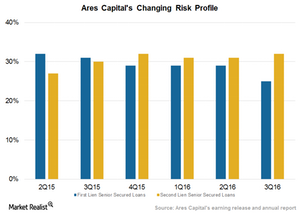

Ares Capital’s Preference for Second Lien Continued in 4Q16

Ares Capital has consistently enhanced its exposure to second lien debt in a bid to generate higher yields. In 4Q16, its second lien debt made up 33% of its new commitments.

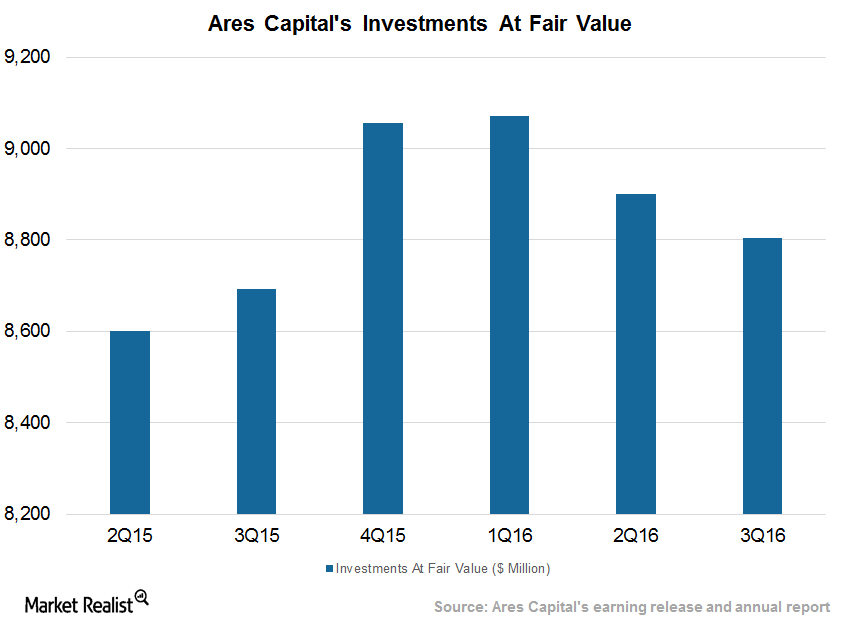

Ares Capital’s Credit Statistics Deteriorated Marginally in 4Q16

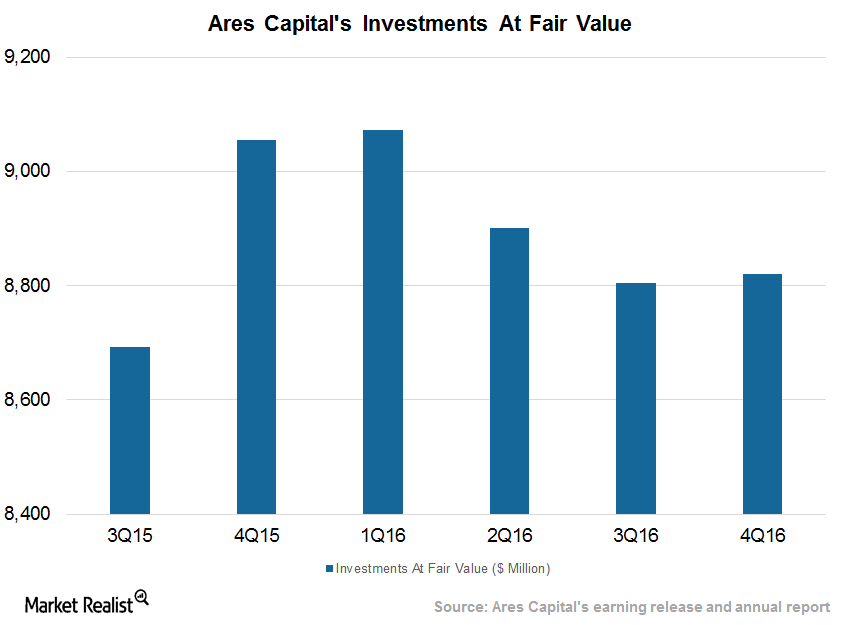

Ares Capital’s (ARCC) portfolio totaled $8.8 billion at fair value on December 31, 2016. Its total assets stood at $9.2 billion.

Ares Capital Beat Estimates for Deployments, Yields in 4Q16

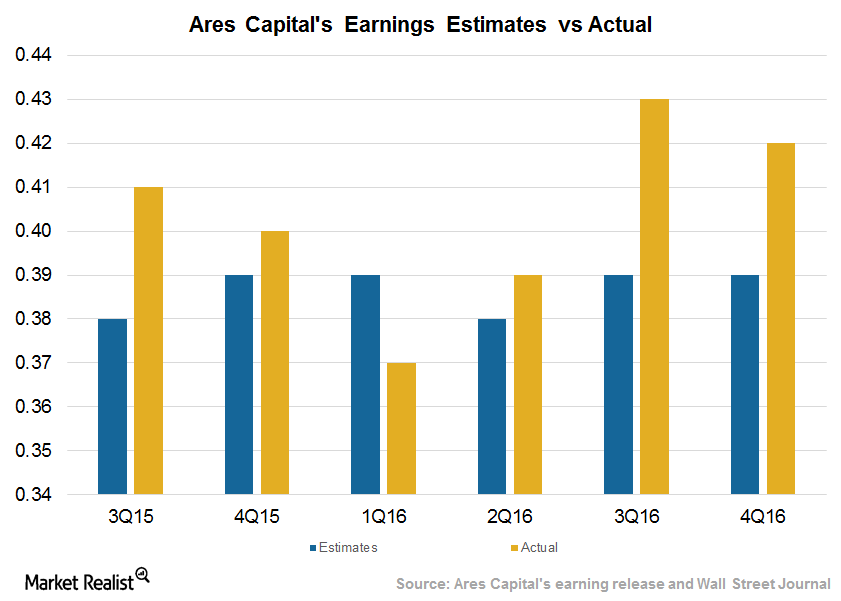

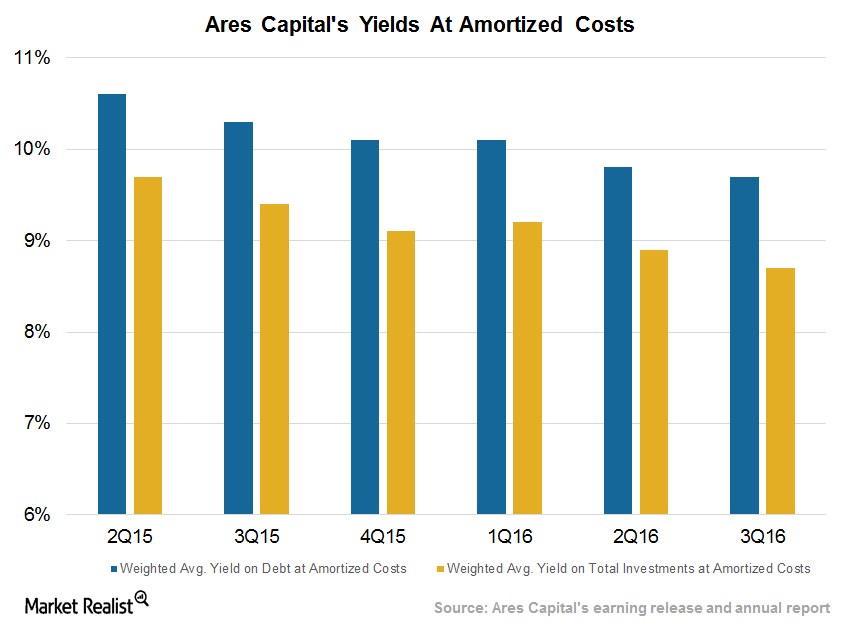

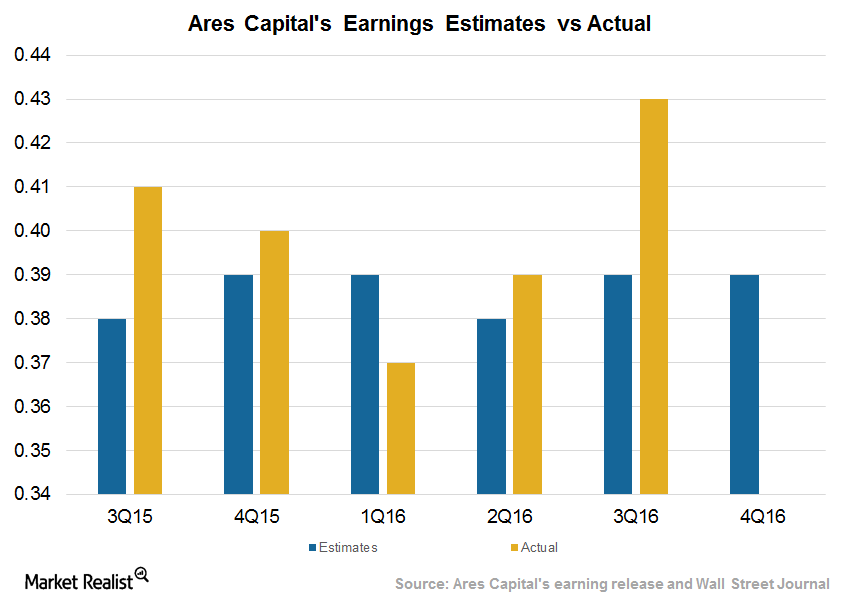

Ares Capital (ARCC) posted EPS (earnings per share) of $0.42, beating Wall Street analysts’ consensus estimate of $0.39 in 4Q16.

ARCC’s Net Investments Rose on Senior Secured Loans in 4Q16

By the end of December 2016, Ares Capital (ARCC) had a diversified portfolio of 218 companies totaling $8.8 billion at fair value.

What Analyst Ratings Say about Ares Capital’s Performance

Analysts’ ratings for Ares Capital Ares Capital’s (ARCC) analyst ratings have improved over the past few months due to rising earnings and originations. So far in February 2017, twelve of the 17 analysts covering the company have rated it as a “buy” or a “strong buy.” Five analysts rated it as a “hold.” Since January 2017, Ares […]

What Boosted Ares Capital’s Valuation?

Stock performance Ares Capital (ARCC) stock has risen ~14% over the past six months and 37% over the past year due to improved operating performance. In 3Q16, the company saw higher deployments and yields, and lower expenses. The company declared a dividend of $0.38 per share in 3Q16, in line with that of 3Q15. With a dividend […]

Could Ares Capital’s Second-Lien Preference Continue in 4Q?

Second-lien preference Ares Capital (ARCC) has consistently increased its exposure to investments in second-lien debt to garner higher yields. In 3Q16, second-lien debt made up 23% of its new commitments and exits made up 18%. Second-lien loans formed 32% of the company’s total portfolio, and first-lien senior secured loans fell to 25% from 29% in […]

Ares Capital’s Credit Statistics Expected to Improve in 4Q16

Broad markets driving statistics Ares Capital’s (ARCC) portfolio valuation and total assets stood at $8.8 billion and $9.1 billion, respectively, on September 30, 2016. The company’s corporate borrowers posted last-12-month EBITDA (earnings before interest, tax, depreciation, and amortization) growth of ~7% due to adequate growth and repayment capability. In 3Q16, Ares Capital’s credit statistics fell, with non-accrual […]

How Ares Capital’s Net Investments Could Rise in 4Q16

Net investments to rise Ares Capital (ARCC) has seen subdued deployment over the past few quarters. The company’s investments have fallen since 1Q16, mainly due to higher exits. In 4Q16, Ares might see marginally higher net investments due to new programs and first- and second-lien lending. As of September 30, 2016, Ares Capital had a diversified […]

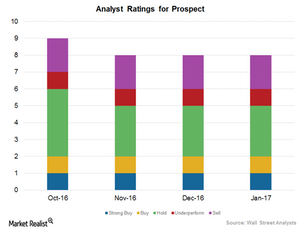

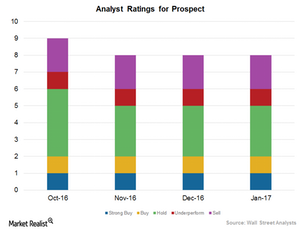

What Analyst Ratings Suggest about Prospect’s Performance

Analysts’ ratings for Prospect Of the eight analysts covering Prospect Capital (PSEC), two rated it a “buy” or “strong buy” in January 2017. Three analysts, or ~37.5%, rated it a “hold.” One analyst rated Prospect an “underperform” and two analysts rated the company a “sell.” Prospect’s mean target price is $8.05 per share, implying a fall of 7.9% […]

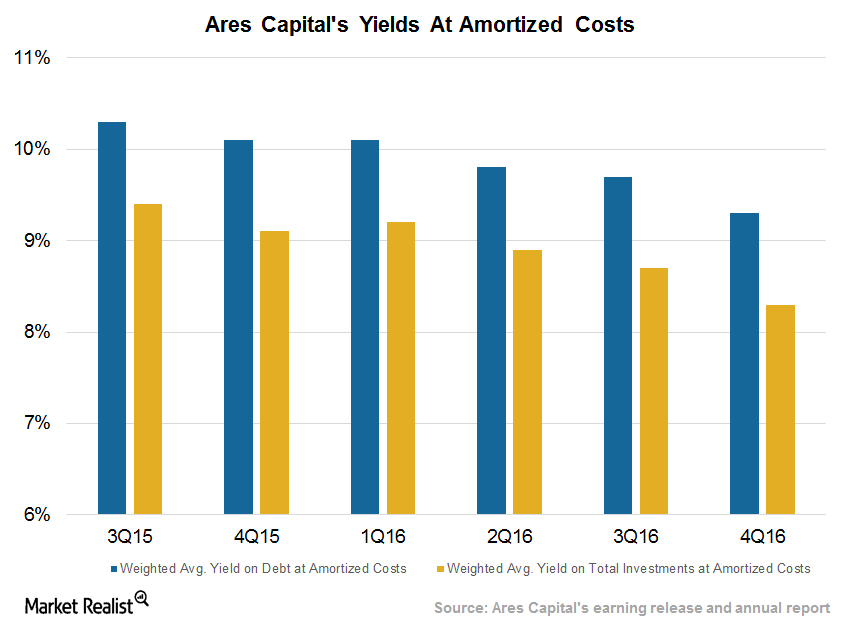

Ares Capital’s 4Q16 Quarterly Earnings: What to Expect

Ares Capital (ARCC) is expected to post EPS (earnings per share) of $0.39 in 4Q16, compared with $0.40 in 4Q15 and $0.43 in the previous quarter.

With Net Exits and Improved Yields, Prospect’s Valuation Is Fair

Fiscal 2Q17 net exits Prospect Capital (PSEC) stock has risen 16% over the past three months and 16% over the past year. The company is currently trading near its 52-week high. The company saw net exits of $175.5 million in fiscal 2Q17, with higher exits from first-lien holdings. It saw lower leverage mainly due to higher exits, […]

Prospect’s Leverage Falls Due to Net Exits in Fiscal 2Q17

Leverage declines Prospect Capital (PSEC) has been operating at higher leverage to take advantage of low rates. The company saw higher net exits in fiscal 2Q17, which led to lower leverage. Notably, Prospect’s fiscal 2Q17 net debt-to-equity ratio declined to 76.2% from its fiscal 2Q16 debt-to-equity ratio of 80.2% and 77.4% in the two previous quarters. As […]

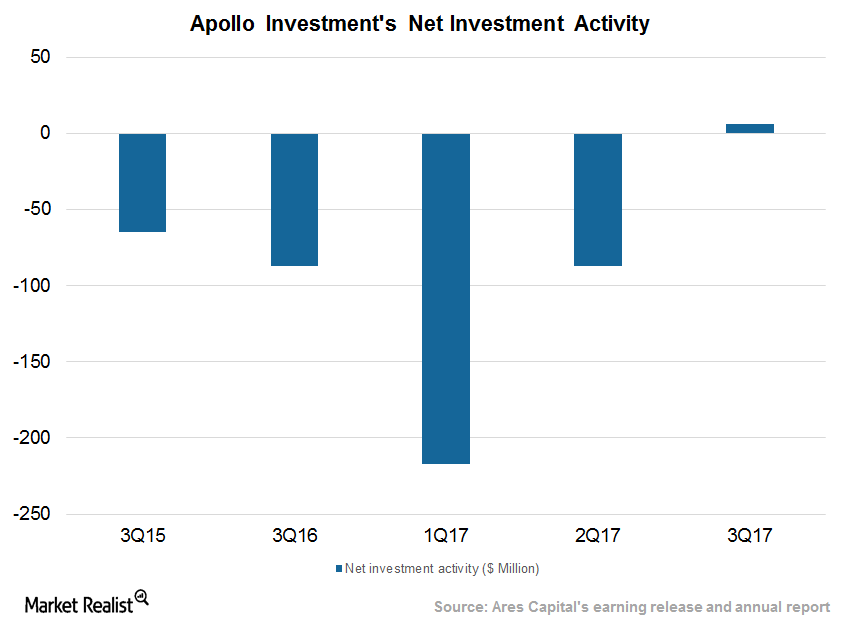

Apollo Investment Sees Net Investments Turn Positive in Fiscal 3Q17

In fiscal 3Q17, Apollo Investments (AINV) sold $17.1 million in investments and repaid $178.2 million.

Apollo Investment Valuations Fair amid Marginal Improvements

In fiscal 3Q17, Apollo Investment (AINV) repurchased 2.3 million shares at a weighted average price per share of $5.90 for a total cost of $13.6 million.

How Analysts View Apollo Investment in 2017

Four of the 15 analysts covering Apollo Investment (AINV) rated it a “buy” or “strong buy” in January 2017.

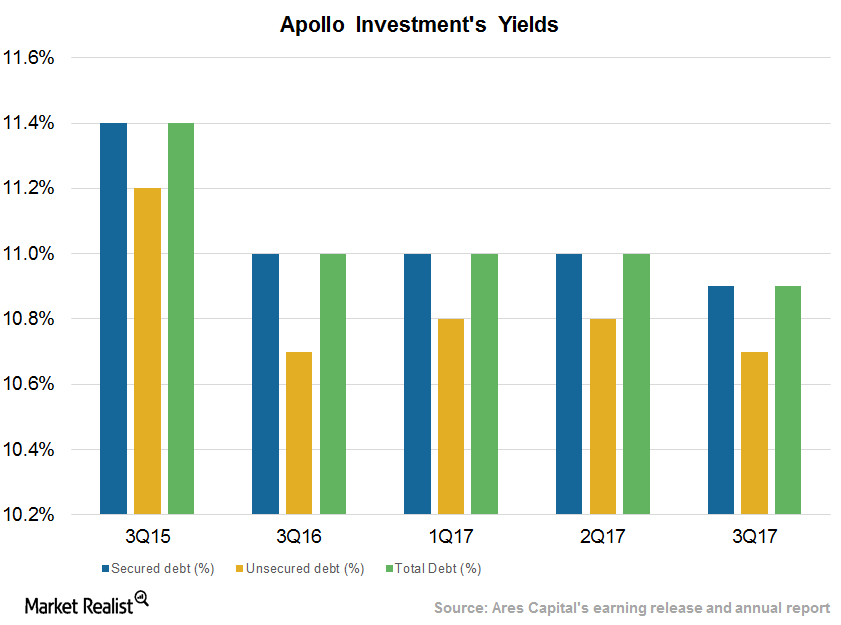

Apollo Investment’s Yields Stabilize on First and Second Liens

Apollo Investment’s (AINV) yields have declined and stabilized at ~10.9%, on par with average returns garnered by other closed-end funds.

Apollo Investment Earnings Show Signs of Stabilization in Fiscal 4Q17

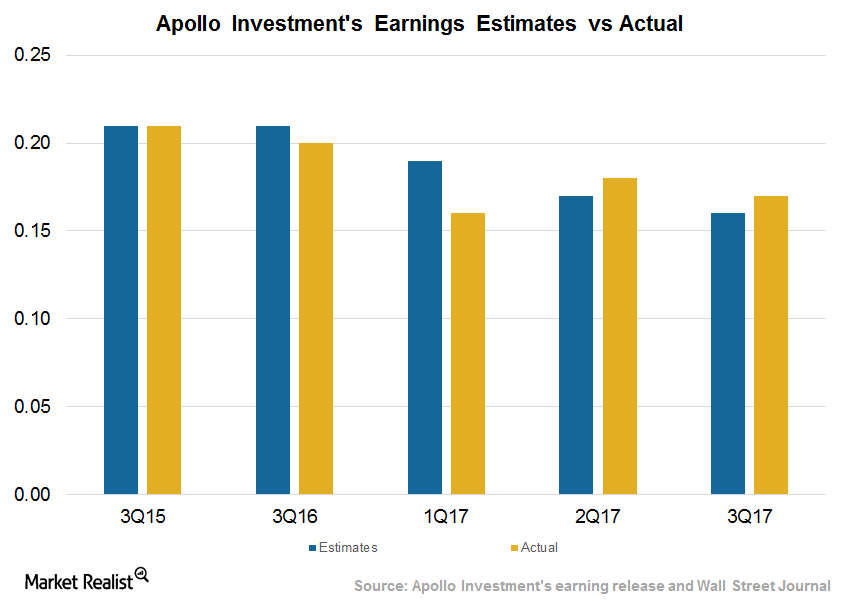

On February 6, 2017, Apollo Investment (AINV) posted earnings per share of $0.17 in fiscal 3Q17, beating analyst estimates of $0.16.

Alternatives to See Improved Realizations and Deployments in 2017

In 2016, alternative asset managers saw higher exits and investments on the back of improved liquidity. The trend is expected to continue in 2017.