Prospect’s Leverage Falls Due to Net Exits in Fiscal 2Q17

Leverage declines Prospect Capital (PSEC) has been operating at higher leverage to take advantage of low rates. The company saw higher net exits in fiscal 2Q17, which led to lower leverage. Notably, Prospect’s fiscal 2Q17 net debt-to-equity ratio declined to 76.2% from its fiscal 2Q16 debt-to-equity ratio of 80.2% and 77.4% in the two previous quarters. As […]

Feb. 14 2017, Updated 9:06 a.m. ET

Leverage declines

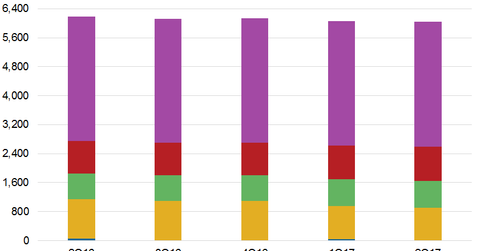

Prospect Capital (PSEC) has been operating at higher leverage to take advantage of low rates. The company saw higher net exits in fiscal 2Q17, which led to lower leverage. Notably, Prospect’s fiscal 2Q17 net debt-to-equity ratio declined to 76.2% from its fiscal 2Q16 debt-to-equity ratio of 80.2% and 77.4% in the two previous quarters. As of December 31, 2016, Prospect had 90.4% of its total assets deployed in floating rate earning assets and almost all of its liabilities carried a fixed rate, reflecting protection from short-term interest rates.

The company had $4.8 billion of unencumbered assets, which represent ~78% of the company’s total assets. Prospect can evaluate monetization of select investments and follow-on public offers for fundraising. However, as the company’s stock prices have remained subdued, it is not looking at equity markets for liquidity. Prospect should soon be able to take advantage of lower interest rates and generate higher returns for its equity holders. In comparison, Prospect’s peers generated the following returns on equity deployment:

Together, these companies make up 1.6% of the PowerShares Global Listed Private Equity ETF (PSP).

Diversified lenders

Prospect Capital’s cost of debt has fallen substantially over the past few quarters due to negotiations with various lenders. The company’s facility continues to carry an “Aa3” investment-grade rating with Moody’s.

Prospect has diversified its counterparty risk. It had brought in 21 institutional lenders for its facility as of December 31, 2016, the highest lender count among industry peers. Its revolving facility is available through March 2019, with an additional one-year amortization period. The company has seven separate unsecured debt issuances with maturities ranging from October 2017 to June 2024. As of December 31, 2016, Prospect had $962 million outstanding program notes with maturities through October 2043.

PSEC’s balance sheet assets had risen marginally to $6.18 billion as of December 31, 2016, compared with $6.24 billion on June 30, 2016. Its net assets stood at $3.5 billion on December 31, 2016. Next, let’s discuss Prospect’s fundraising strategies.