CIT Group Inc

Latest CIT Group Inc News and Updates

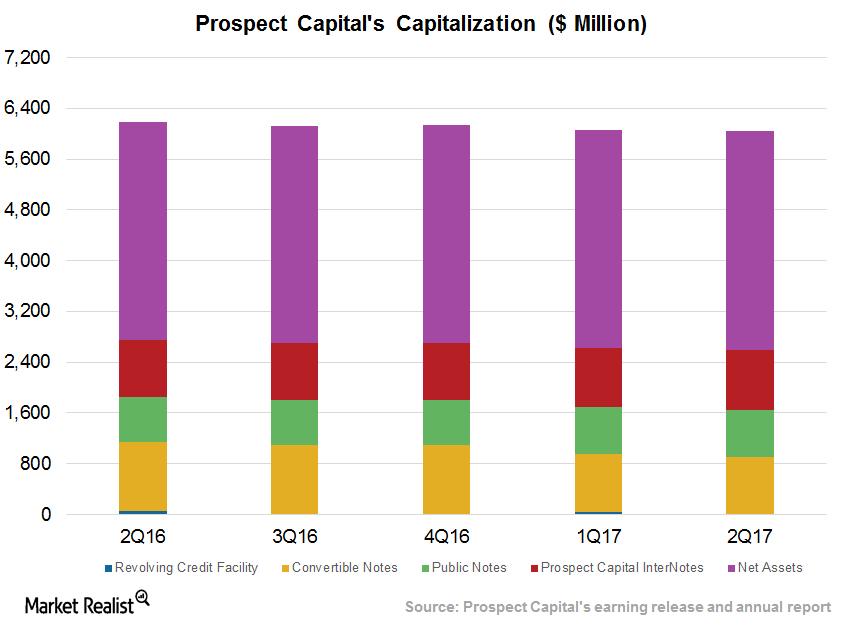

Prospect’s Leverage Falls Due to Net Exits in Fiscal 2Q17

Leverage declines Prospect Capital (PSEC) has been operating at higher leverage to take advantage of low rates. The company saw higher net exits in fiscal 2Q17, which led to lower leverage. Notably, Prospect’s fiscal 2Q17 net debt-to-equity ratio declined to 76.2% from its fiscal 2Q16 debt-to-equity ratio of 80.2% and 77.4% in the two previous quarters. As […]

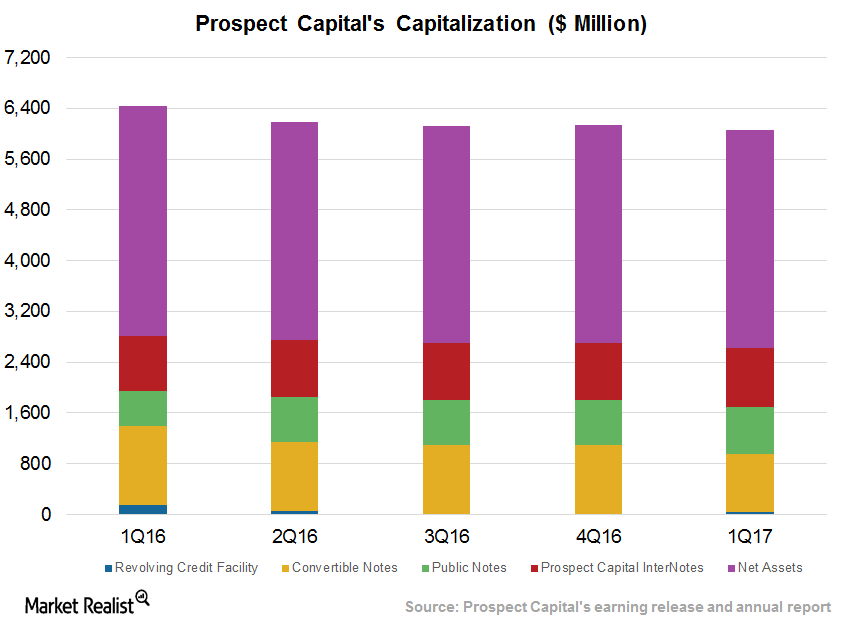

Prospect Capital’s Higher Leverage Could Impact Returns in 2017

Since the Fed increased interest rates in December 2016, Prospect Capital (PSEC) could see some pressure on its cost of capital in 2017.

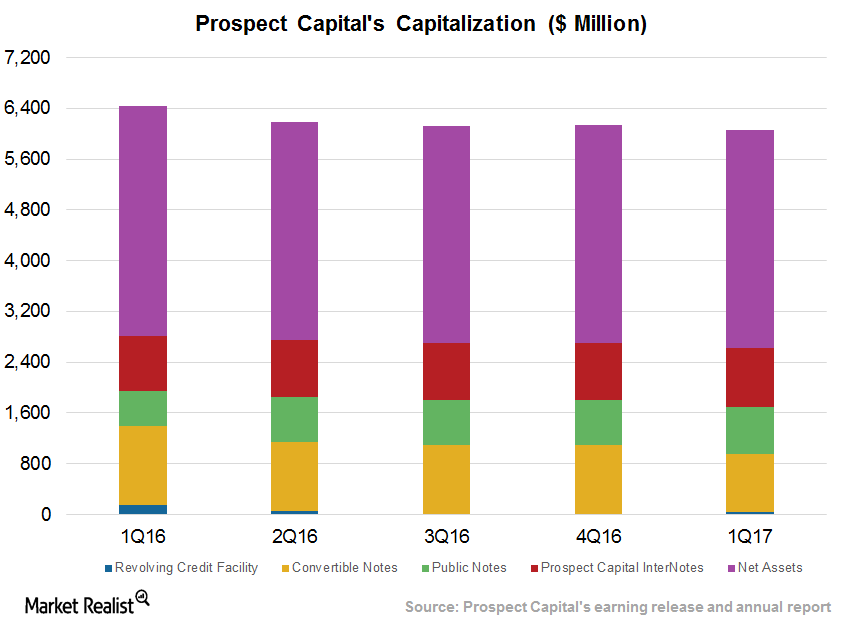

Prospect’s Leverage Rises on Higher Origination in Fiscal 1Q17

Prospect Capital has been operating at higher leverage to take advantage of low rates. But the Fed is expected to raise interest rates in calendar 4Q16.

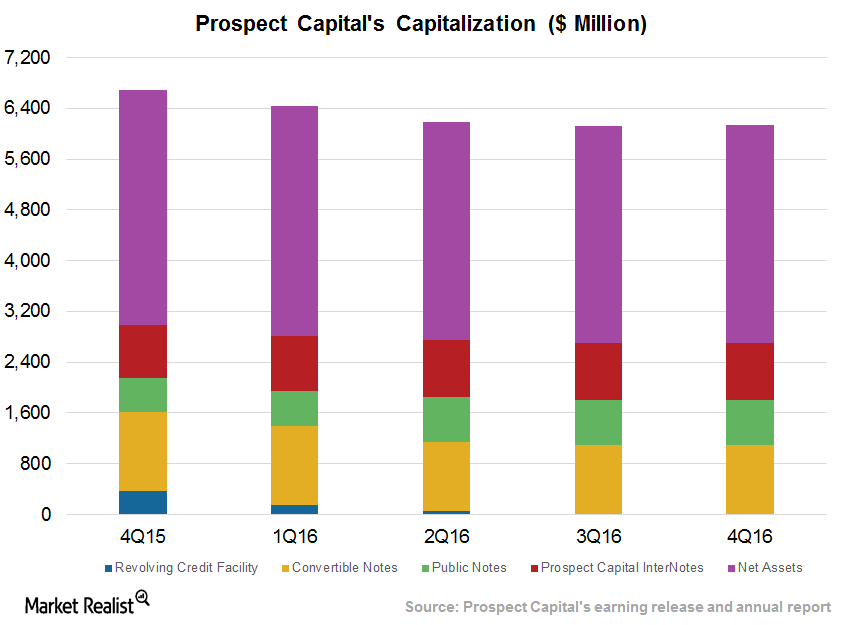

PSEC Reduces Leverage amid Low Originations, Potential Rate Hike

Prospect Capital (PSEC) has used the low interest rate environment to its advantage by deploying higher leverage over the past couple of years.

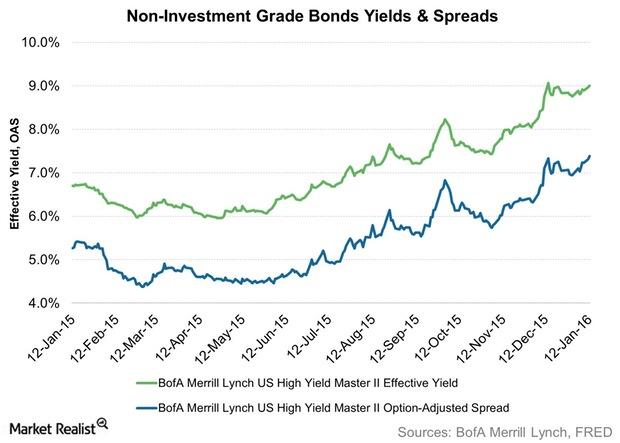

High-Yield Bonds and You in 2016

High-yield bonds, also known as Junk bonds, have an iffy repayment ability, even if they are at the higher end of the junk rating scale.