Prospect Capital Corporation

Latest Prospect Capital Corporation News and Updates

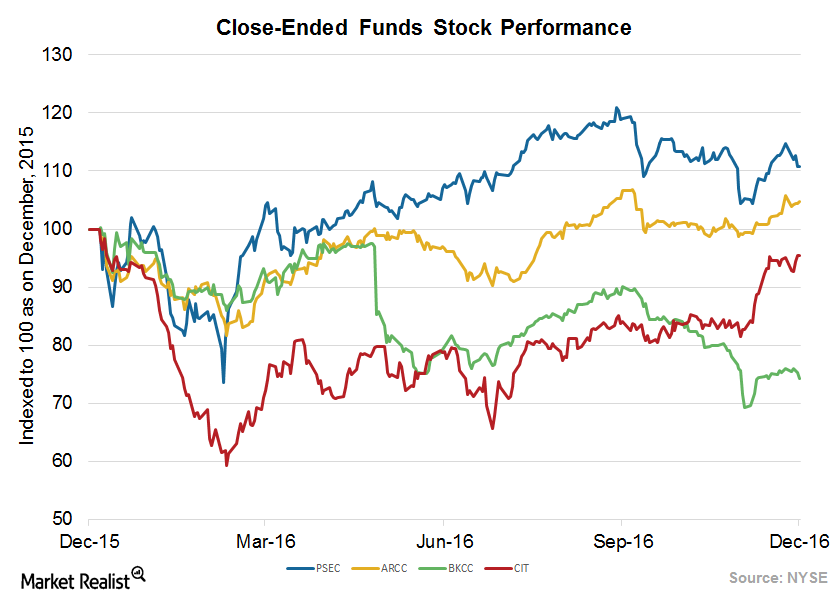

Why Closed-End Funds Are Not That Enthusiastic about Rate Changes

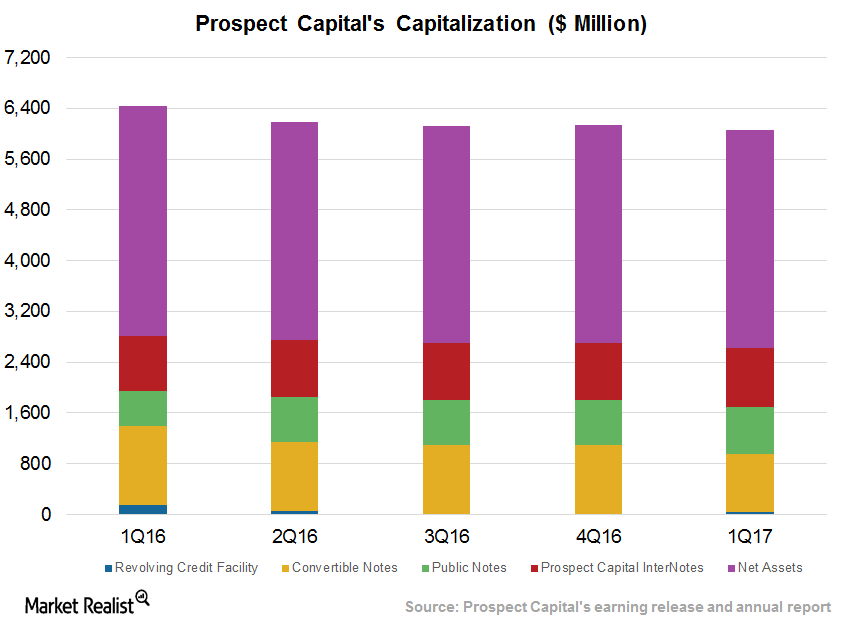

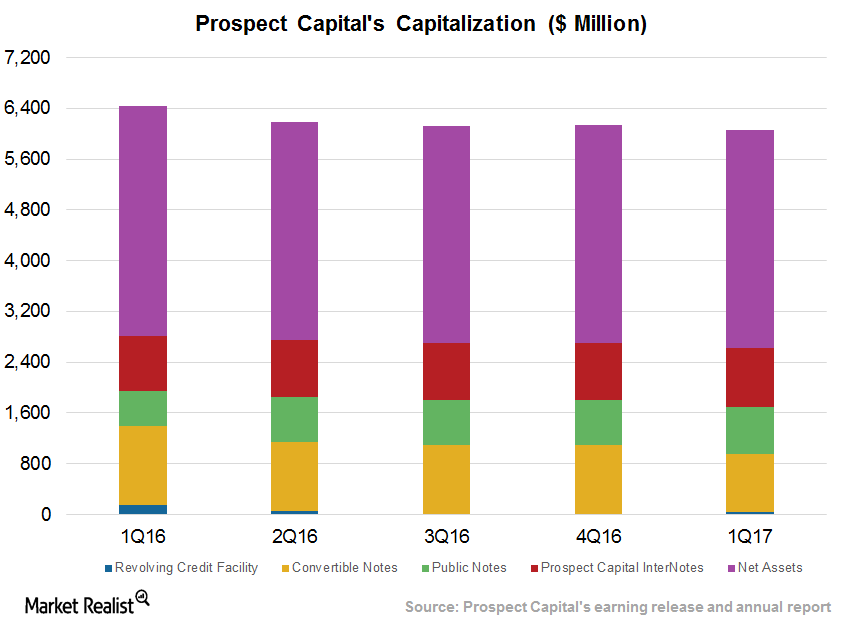

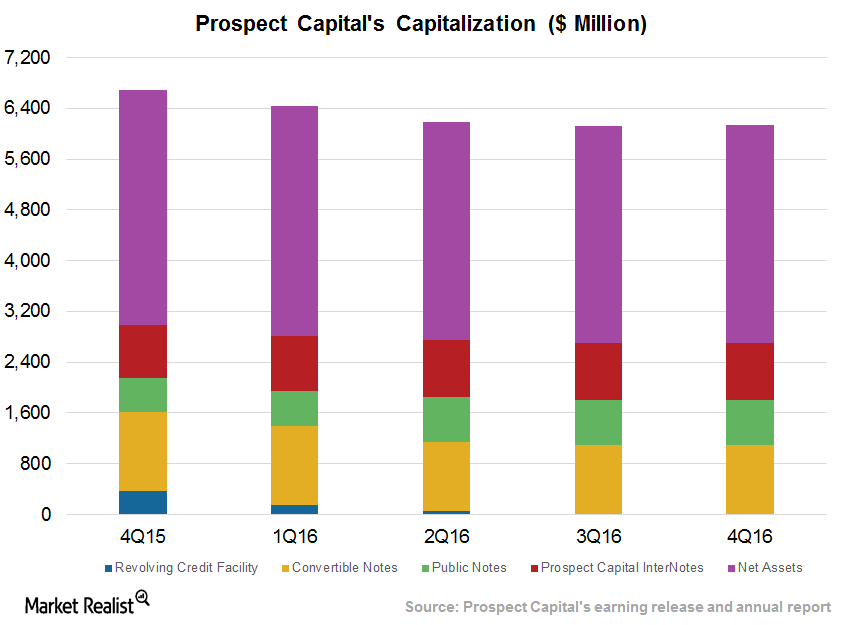

Prospect Capital (PSEC) is strengthening its capital position in order to take advantage of mispricing during volatile times.

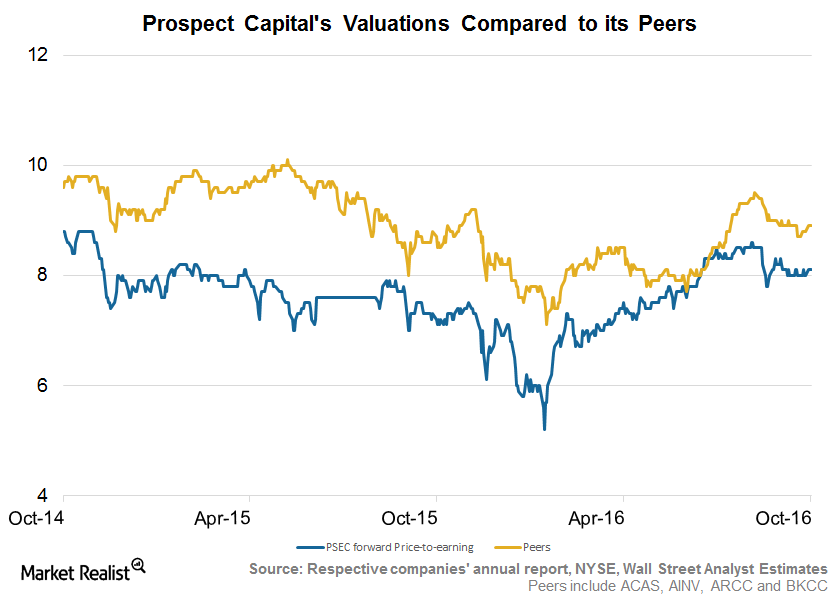

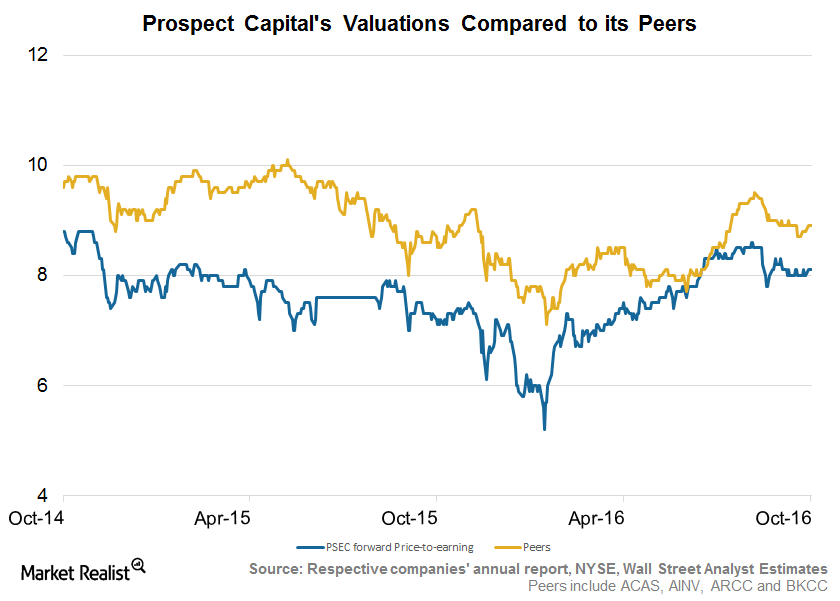

Prospect’s Valuation Discount Consistent on Lower Originations

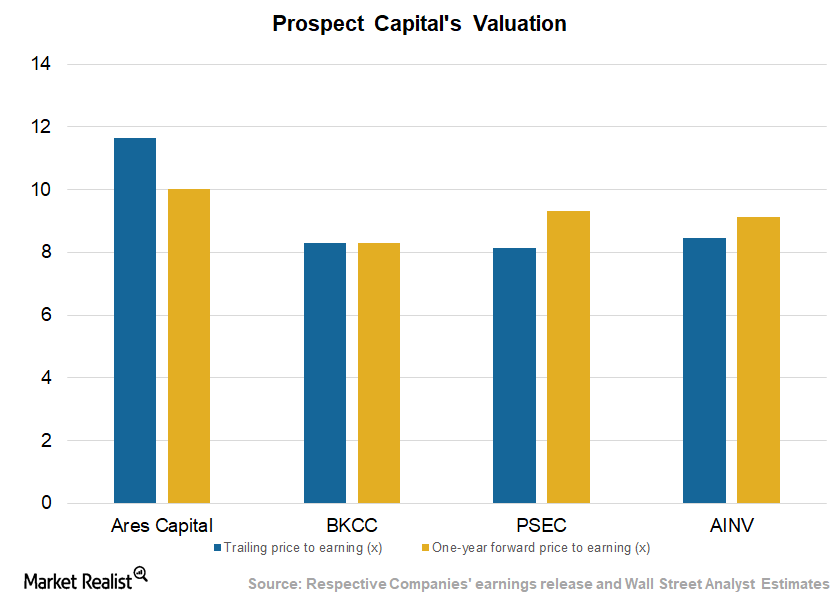

Prospect Capital’s (PSEC) stock has fallen ~3% in the past quarter, and it has risen ~11% in the past year. The company is currently trading 7% lower than its 52-week high.

Prospect Capital’s Valuations: Fair amid Originations, Leverage

Prospect Capital (PSEC) stock rose 3.0% over the past three months and 20.0% over the past year. The company is currently trading 5.0% below its 52-week high.

Prospect Valuations Fair amid Rising Originations, Strong Yields

Prospect Capital’s (PSEC) stock fell ~7% in fiscal 1Q17 (September quarter) but has risen ~6% in the past 12 months.

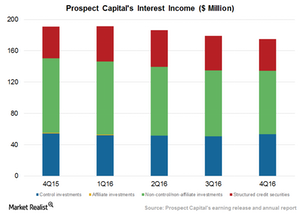

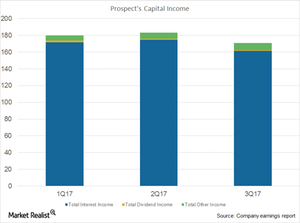

Why Prospect’s Investment Income Fell

In fiscal 2Q18, Prospect Capital’s (PSEC) total investment income was $162.4 million compared to $183.4 million a year earlier.

Prospect Capital’s Valuation: Fair or Discounted in Long Term?

Prospect Capital (PSEC) stock has fallen 14.5% over the past six months and 16.9% over the past year.

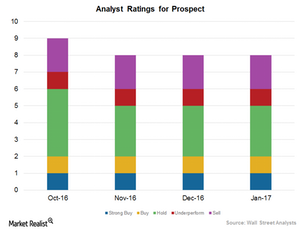

Prospect Capital’s Ratings: What Wall Street Analysts Have to Say

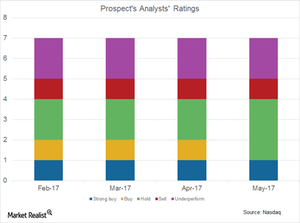

Although Prospect Capital (PSEC) has been delivering decent returns to investors, there has not been much change in the analysts’ ratings.

Prospect Capital’s Increasing Valuations in 2017

Analysts have given PSEC a one-year price target of $8.50 from the current price level, reflecting 0.7% growth.

Prospect Capital’s Total Investments Increase in 2017

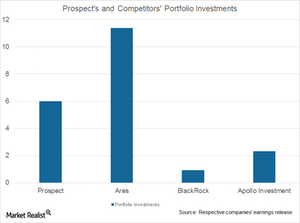

In fiscal 3Q17, Prospect Capital’s total value of investments stood at $6.0 billion in 125 companies, compared to $5.9 billion in fiscal 2Q17 in 123 companies.

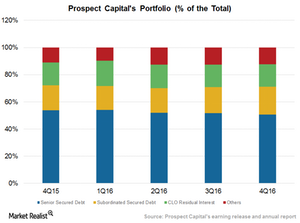

Prospect Capital Prioritizes Secured Lending

About 70% of Prospect Capital’s portfolio is composed of first and second lien secured loans

Prospect Capital Adopts a Conservative Approach in Fiscal 3Q17

Prospect Capital’s (PSEC) originations decreased in fiscal 3Q17 to $449.6 million compared to $469.5 million in fiscal 2Q17.

Prospect Capital’s Disappointing Performance in Fiscal 3Q17

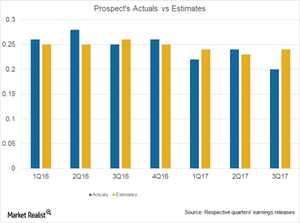

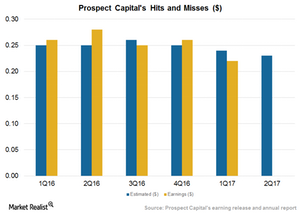

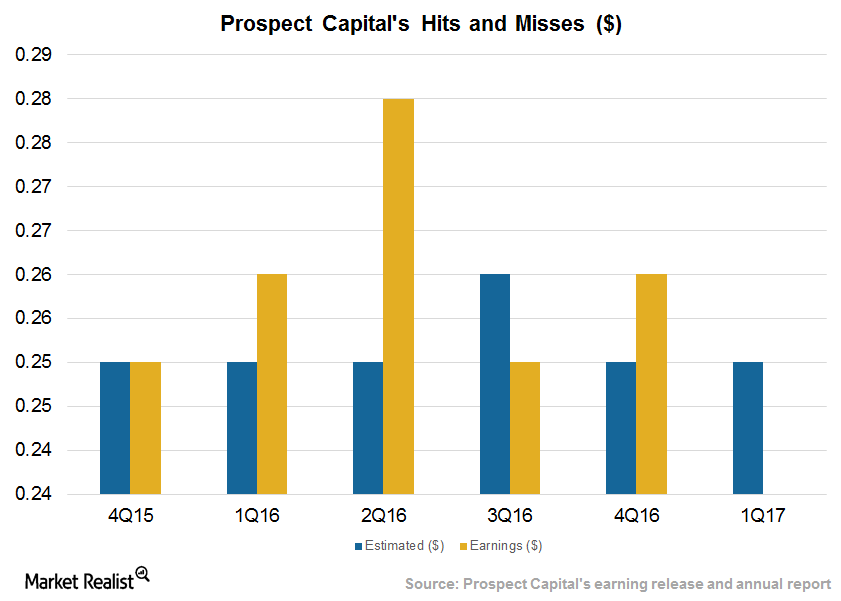

Prospect Capital (PSEC) reported a decline in its net investment income in its fiscal 3Q17 earnings. Analysts expect PSEC’s fiscal 4Q17 EPS to reach $0.20, representing no change from fiscal 3Q17.

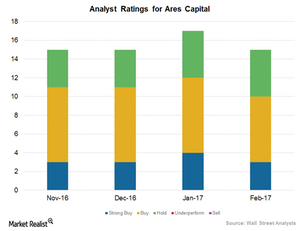

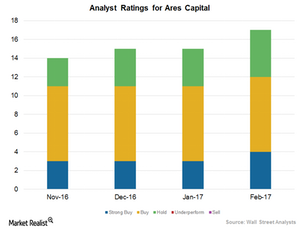

Ares Capital’s Analyst Ratings Suggest Stable Earnings in 2017

In February 2017, 12 of the 17 analysts covering Ares Capital, or ~71%, have rated it as a “buy” or a “strong buy.”

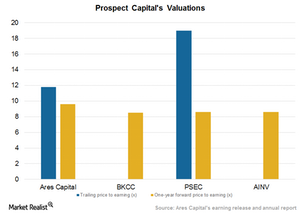

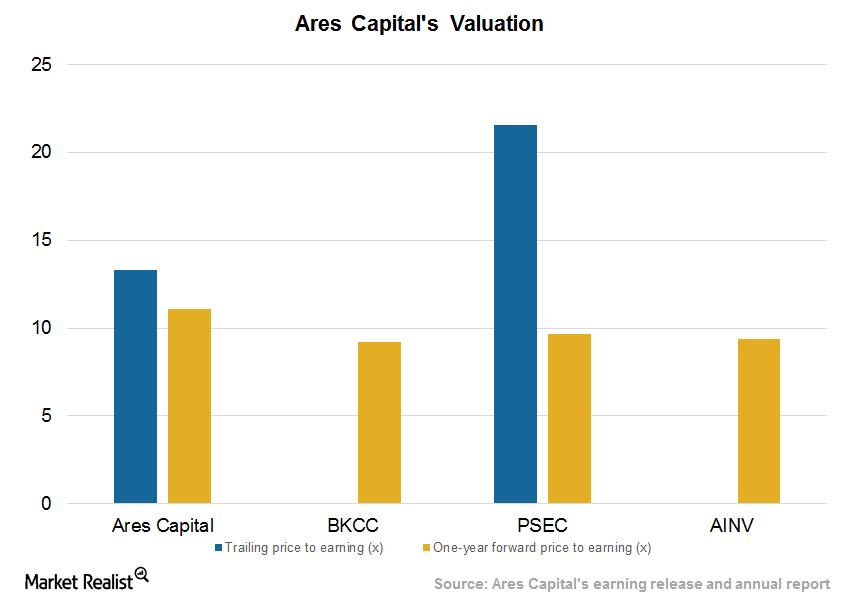

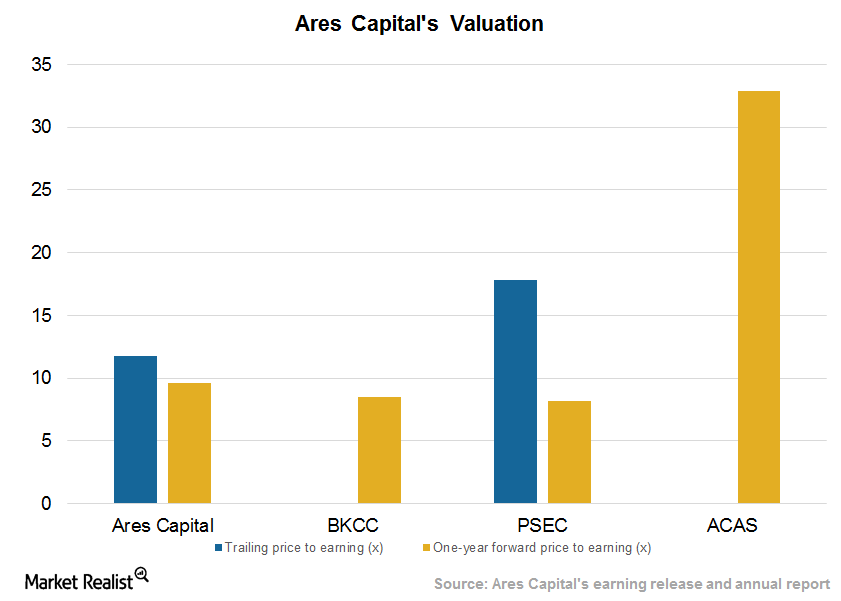

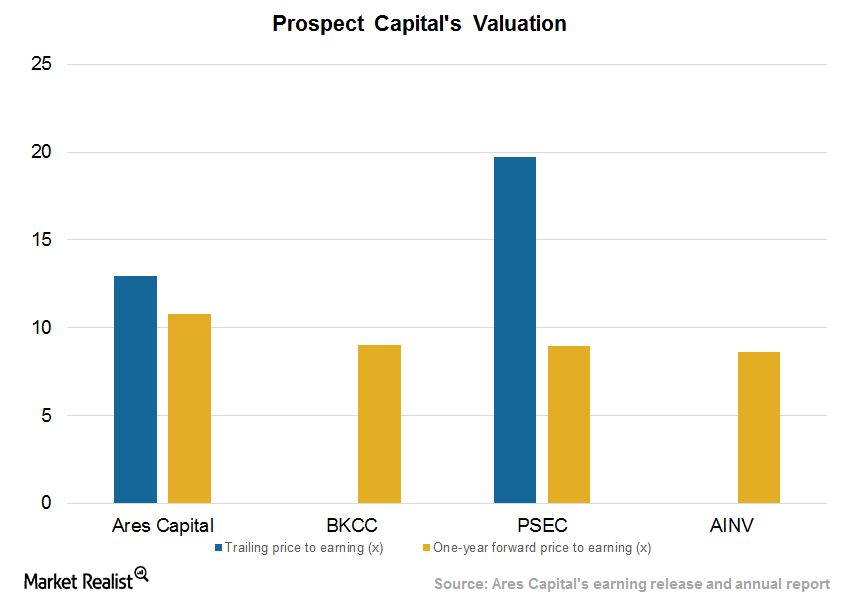

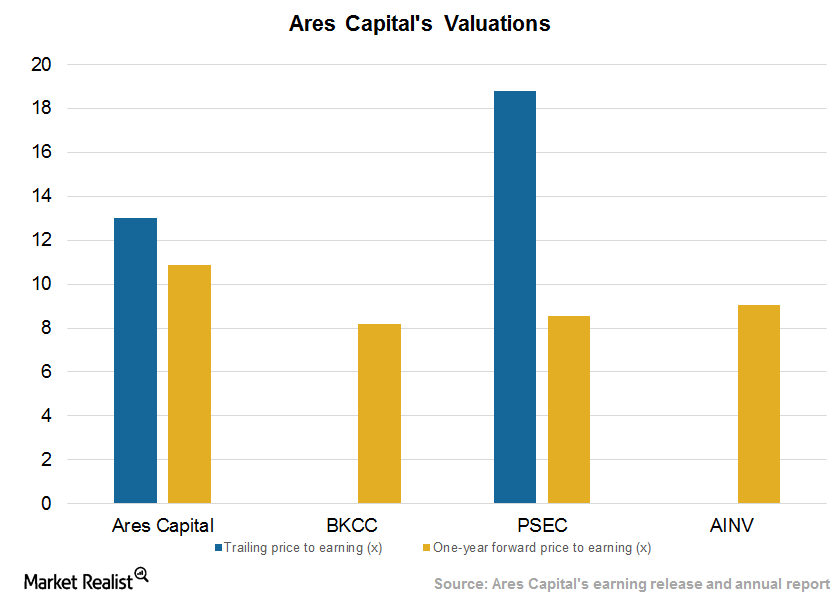

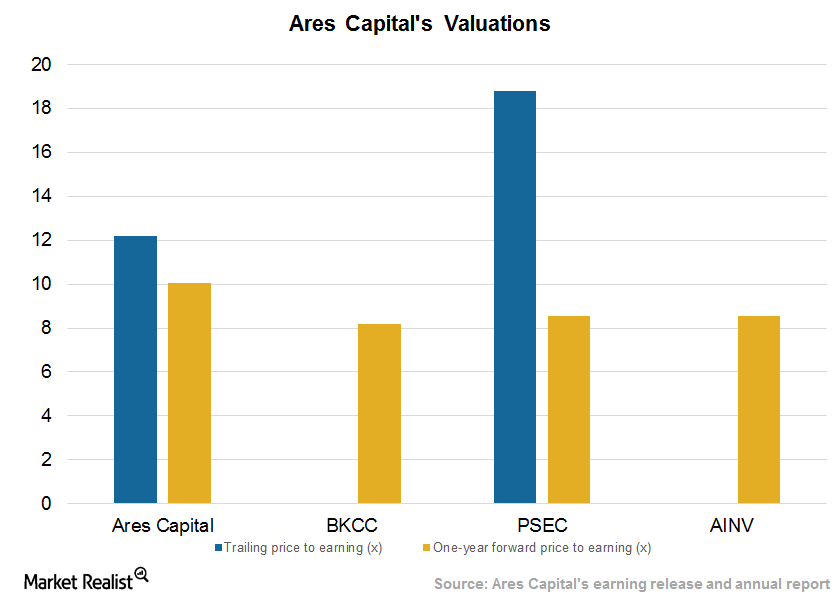

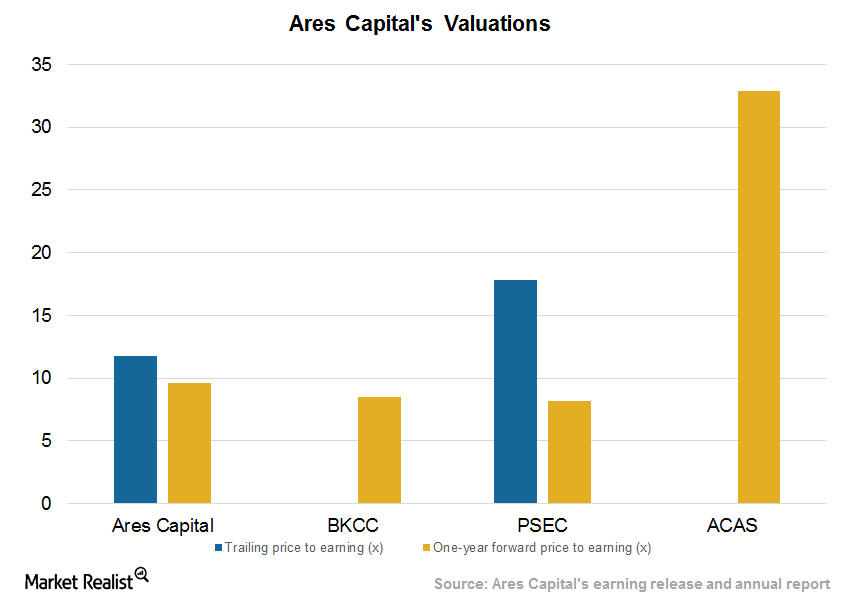

Ares Capital Valuations at a Premium on Relative Outperformance

Ares Capital stock has risen ~11.7% over the past six months. The company saw a strong performance in 4Q16 on higher deployment, stable yields, and expense management.

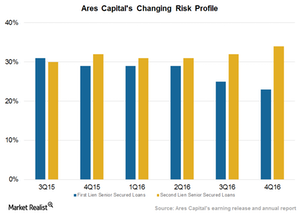

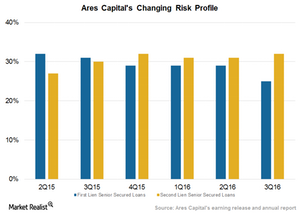

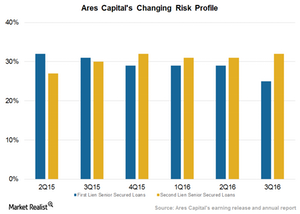

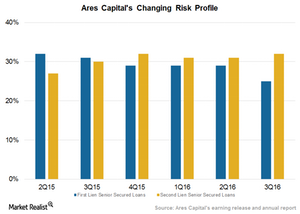

Ares Capital’s Preference for Second Lien Continued in 4Q16

Ares Capital has consistently enhanced its exposure to second lien debt in a bid to generate higher yields. In 4Q16, its second lien debt made up 33% of its new commitments.

Ares Capital’s Credit Statistics Deteriorated Marginally in 4Q16

Ares Capital’s (ARCC) portfolio totaled $8.8 billion at fair value on December 31, 2016. Its total assets stood at $9.2 billion.

Ares Capital Beat Estimates for Deployments, Yields in 4Q16

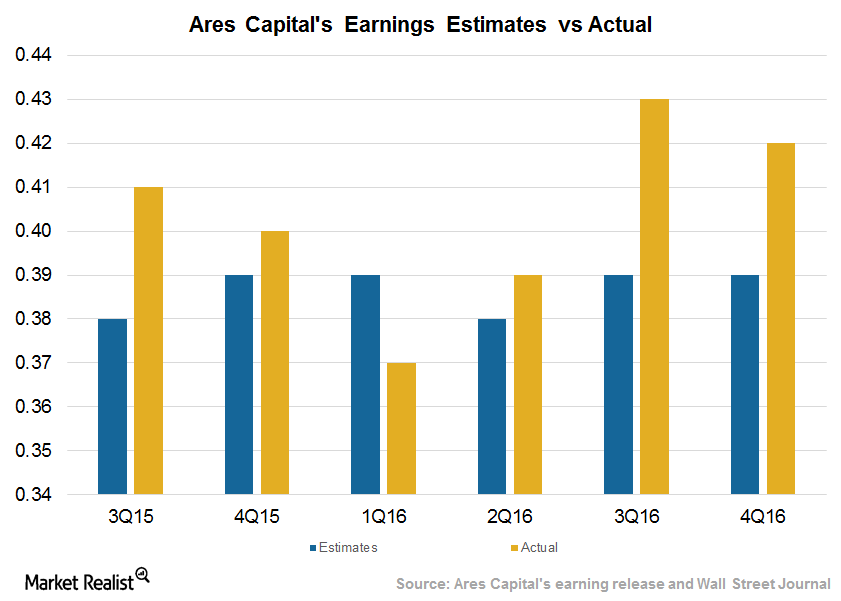

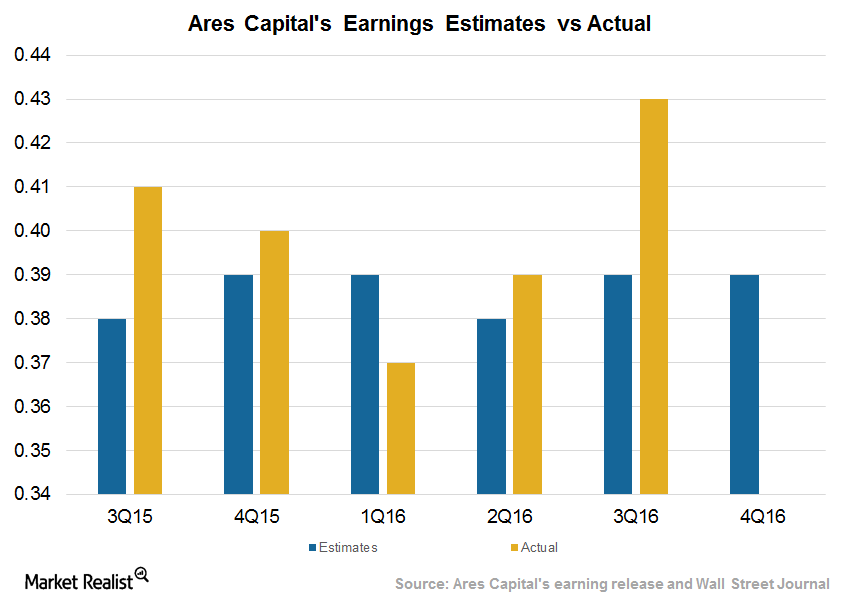

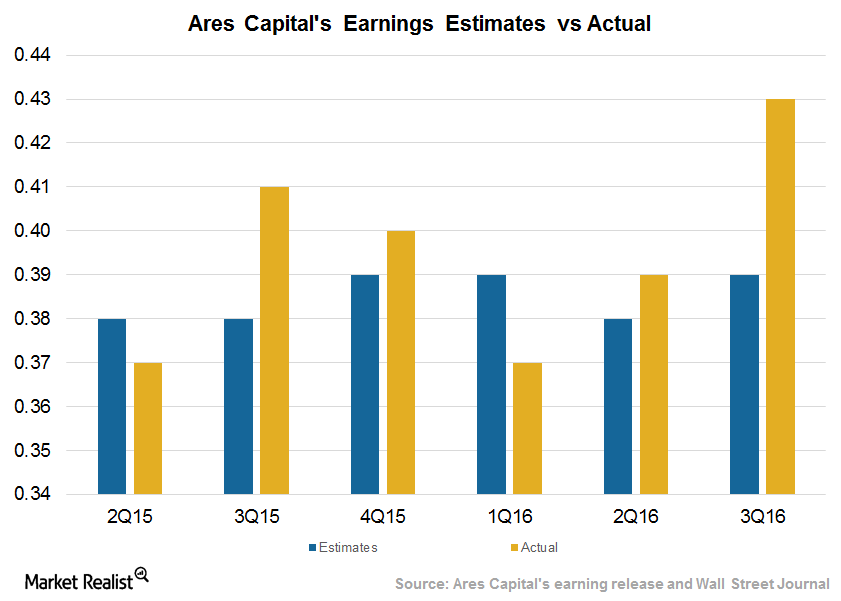

Ares Capital (ARCC) posted EPS (earnings per share) of $0.42, beating Wall Street analysts’ consensus estimate of $0.39 in 4Q16.

What Analyst Ratings Say about Ares Capital’s Performance

Analysts’ ratings for Ares Capital Ares Capital’s (ARCC) analyst ratings have improved over the past few months due to rising earnings and originations. So far in February 2017, twelve of the 17 analysts covering the company have rated it as a “buy” or a “strong buy.” Five analysts rated it as a “hold.” Since January 2017, Ares […]

What Boosted Ares Capital’s Valuation?

Stock performance Ares Capital (ARCC) stock has risen ~14% over the past six months and 37% over the past year due to improved operating performance. In 3Q16, the company saw higher deployments and yields, and lower expenses. The company declared a dividend of $0.38 per share in 3Q16, in line with that of 3Q15. With a dividend […]

Could Ares Capital’s Second-Lien Preference Continue in 4Q?

Second-lien preference Ares Capital (ARCC) has consistently increased its exposure to investments in second-lien debt to garner higher yields. In 3Q16, second-lien debt made up 23% of its new commitments and exits made up 18%. Second-lien loans formed 32% of the company’s total portfolio, and first-lien senior secured loans fell to 25% from 29% in […]

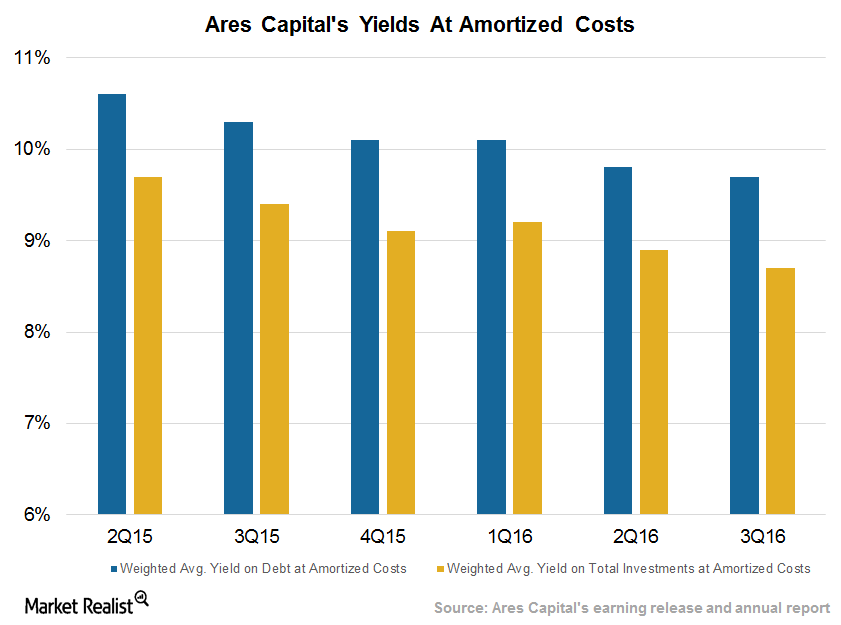

Ares Capital’s Credit Statistics Expected to Improve in 4Q16

Broad markets driving statistics Ares Capital’s (ARCC) portfolio valuation and total assets stood at $8.8 billion and $9.1 billion, respectively, on September 30, 2016. The company’s corporate borrowers posted last-12-month EBITDA (earnings before interest, tax, depreciation, and amortization) growth of ~7% due to adequate growth and repayment capability. In 3Q16, Ares Capital’s credit statistics fell, with non-accrual […]

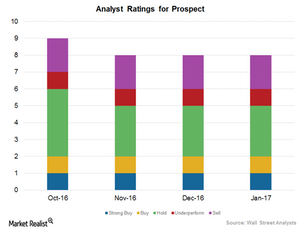

What Analyst Ratings Suggest about Prospect’s Performance

Analysts’ ratings for Prospect Of the eight analysts covering Prospect Capital (PSEC), two rated it a “buy” or “strong buy” in January 2017. Three analysts, or ~37.5%, rated it a “hold.” One analyst rated Prospect an “underperform” and two analysts rated the company a “sell.” Prospect’s mean target price is $8.05 per share, implying a fall of 7.9% […]

Ares Capital’s 4Q16 Quarterly Earnings: What to Expect

Ares Capital (ARCC) is expected to post EPS (earnings per share) of $0.39 in 4Q16, compared with $0.40 in 4Q15 and $0.43 in the previous quarter.

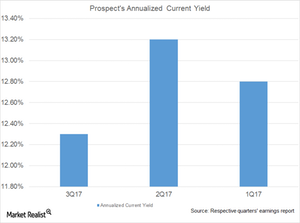

With Net Exits and Improved Yields, Prospect’s Valuation Is Fair

Fiscal 2Q17 net exits Prospect Capital (PSEC) stock has risen 16% over the past three months and 16% over the past year. The company is currently trading near its 52-week high. The company saw net exits of $175.5 million in fiscal 2Q17, with higher exits from first-lien holdings. It saw lower leverage mainly due to higher exits, […]

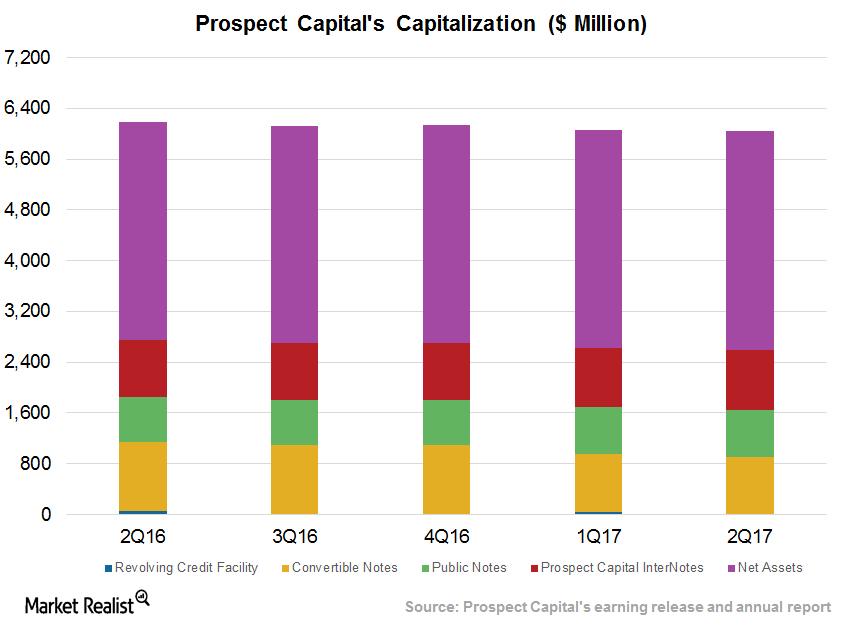

Prospect’s Leverage Falls Due to Net Exits in Fiscal 2Q17

Leverage declines Prospect Capital (PSEC) has been operating at higher leverage to take advantage of low rates. The company saw higher net exits in fiscal 2Q17, which led to lower leverage. Notably, Prospect’s fiscal 2Q17 net debt-to-equity ratio declined to 76.2% from its fiscal 2Q16 debt-to-equity ratio of 80.2% and 77.4% in the two previous quarters. As […]

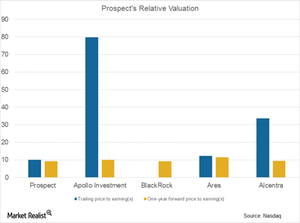

Apollo Investment Valuations Fair amid Marginal Improvements

In fiscal 3Q17, Apollo Investment (AINV) repurchased 2.3 million shares at a weighted average price per share of $5.90 for a total cost of $13.6 million.

How Analysts View Apollo Investment in 2017

Four of the 15 analysts covering Apollo Investment (AINV) rated it a “buy” or “strong buy” in January 2017.

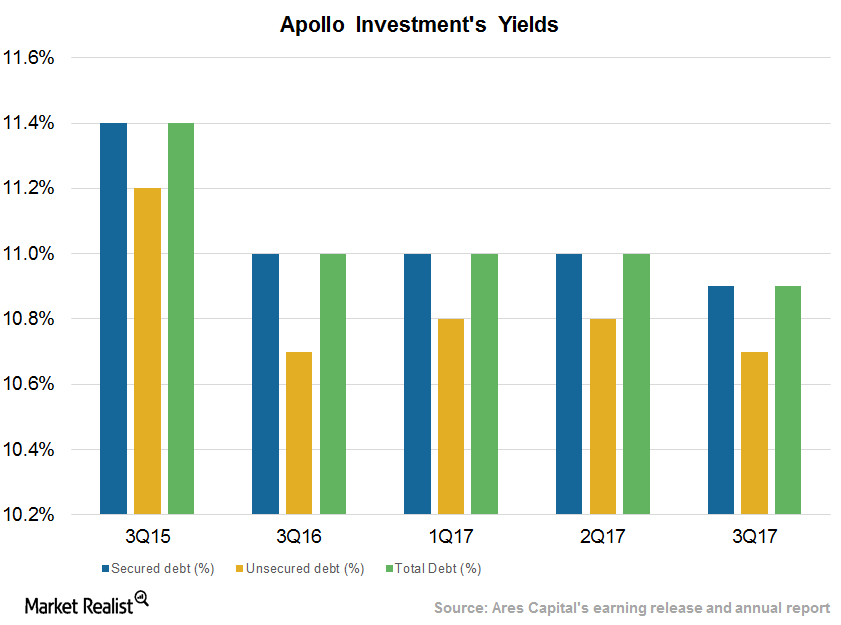

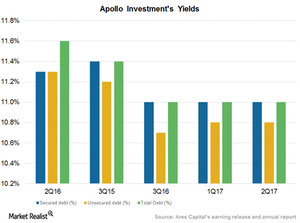

Apollo Investment’s Yields Stabilize on First and Second Liens

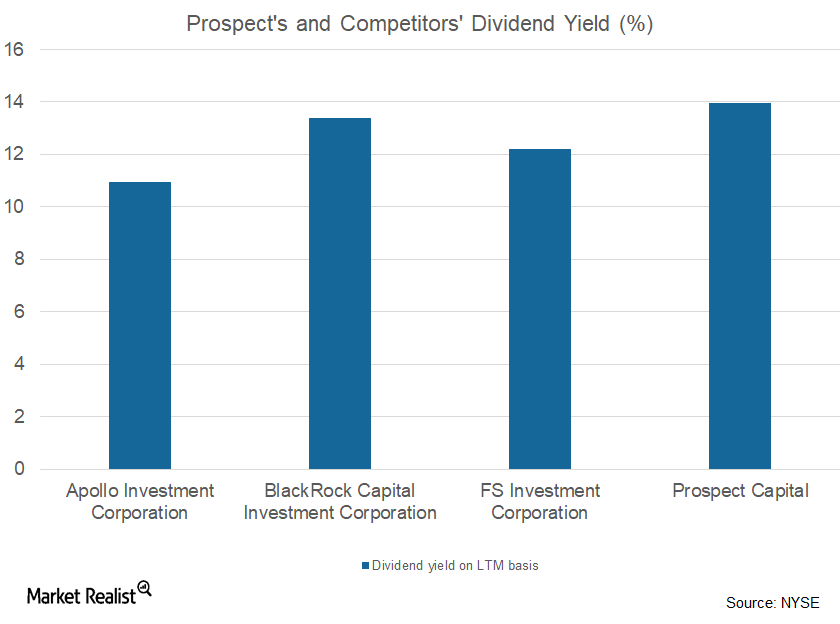

Apollo Investment’s (AINV) yields have declined and stabilized at ~10.9%, on par with average returns garnered by other closed-end funds.

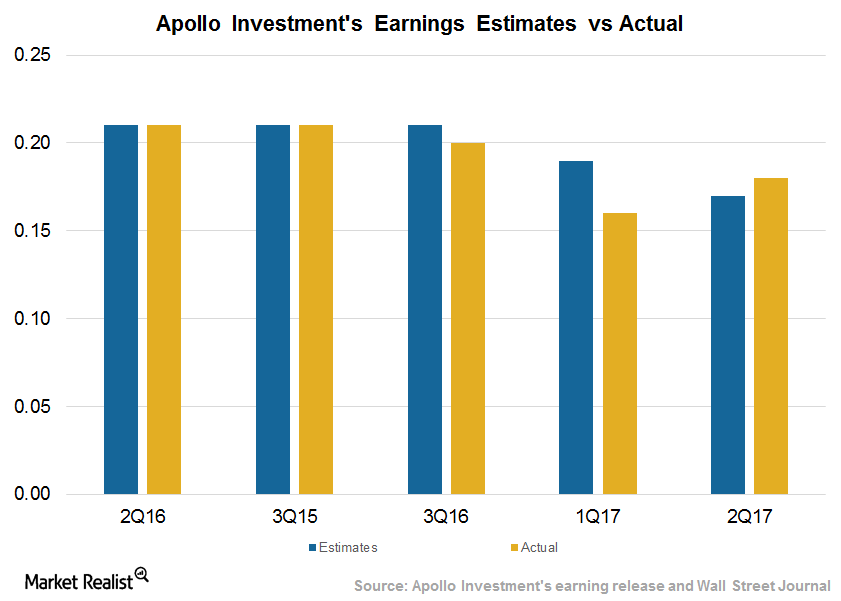

Apollo Investment Earnings Show Signs of Stabilization in Fiscal 4Q17

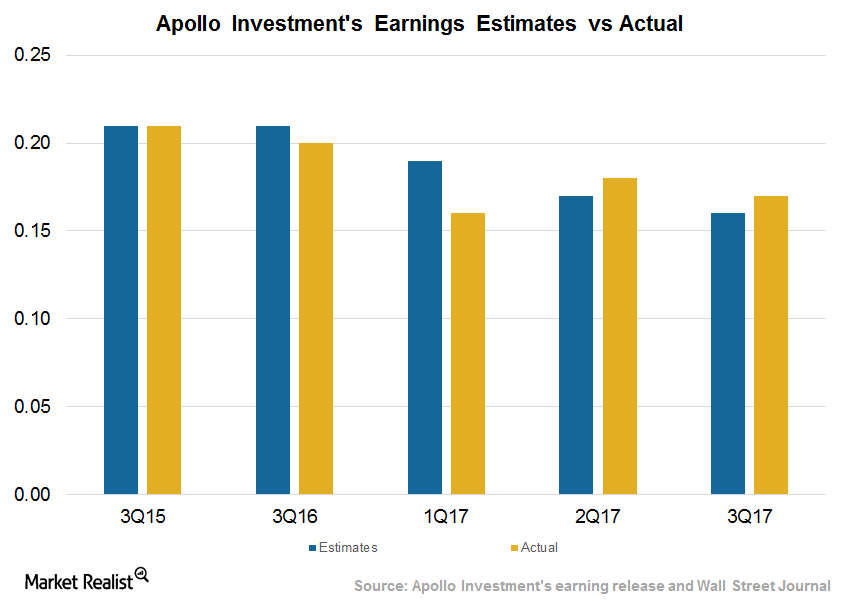

On February 6, 2017, Apollo Investment (AINV) posted earnings per share of $0.17 in fiscal 3Q17, beating analyst estimates of $0.16.

Prospect Capital’s Higher Leverage Could Impact Returns in 2017

Since the Fed increased interest rates in December 2016, Prospect Capital (PSEC) could see some pressure on its cost of capital in 2017.

Prospect Capital’s Performance to Rise Marginally in 2017

In this series, we’ll look at Prospect Capital’s expected performance, deployments, portfolio strategy, yields, balance sheet strength, dividends, and valuations.

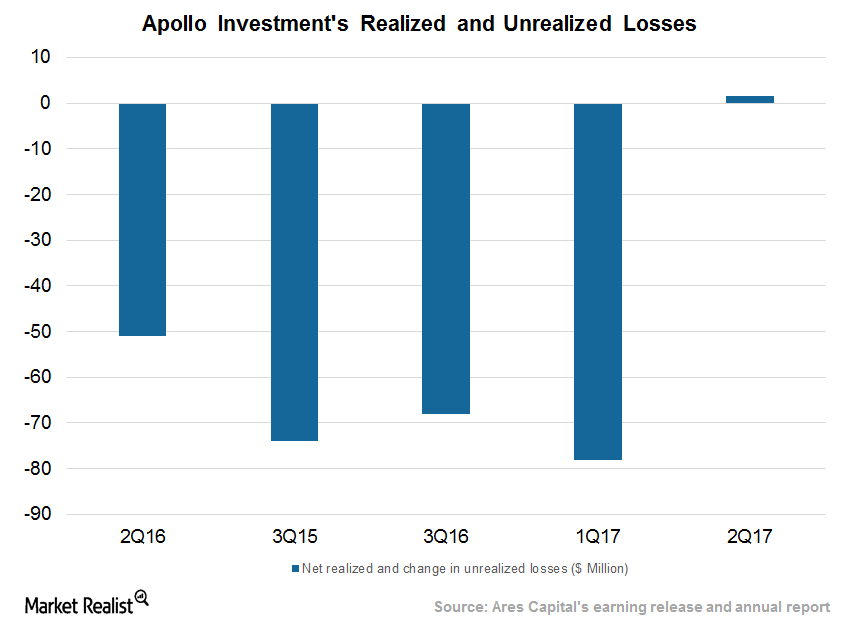

Apollo Investments Sees Gains and Reversal on Portfolio

Apollo Investment’s (AINV) realized and unrealized gains stood at $1.6 million in fiscal 2Q17 compared to realized losses of $42.6 million in fiscal 1Q16.

Apollo Investment’s Yields Stabilize, Reduced Exposure in Energy

At the end of fiscal 2Q17, Apollo Investment’s (AINV) oil and gas investments represented 9.7% of its total portfolio, or $246 million.

AINV’s Valuation Fair, Stock Can Rise on Earnings Surprise

Currently, Apollo Investment (AINV) is trading at 8.5x on a one-year forward earnings basis. Its peers are trading at 8.8x.

Apollo Investment Improved Bottom Line on Select Investments

Apollo Investment (AINV) posted earnings per share of $0.18 in fiscal 2Q17, compared to analyst estimates of $0.17. In this series, we’ll study AINV’s performance, yields, capital deployment, portfolio, dividends, and valuations.

Apollo, BlackRock Target Less Risk, Unlike Ares, Prospect

Over the past few years, closed-end funds (PSP) have deployed funds in middle market companies with better credit ratings.

Closed-End Funds Are Affected by Originations, Rates

Closed-end managers deploy money in middle market companies engaged in businesses across sectors by raising capital through share issuances.

Ares Capital Stock and Valuations Rise on Strong Performance

Ares Capital (ARCC) stock has risen ~1.6% over the past six months. The company saw a strong performance in 3Q16 on higher deployment, yields, and lower expenses.

Ares Capital Second Lien Preference Evident in Portfolio Changes

Ares Capital (ARCC) has consistently enhanced its exposure to second lien debt in a bid to generate higher yields.

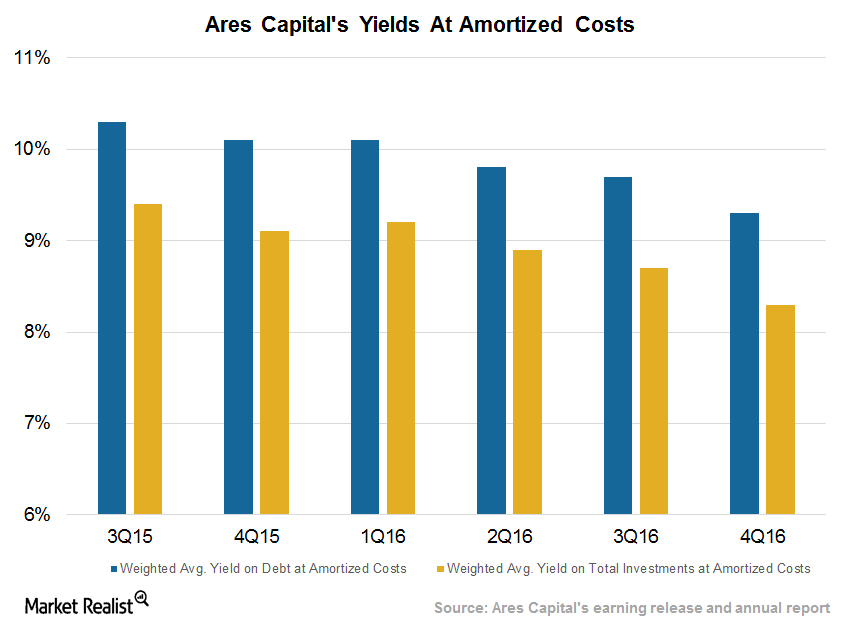

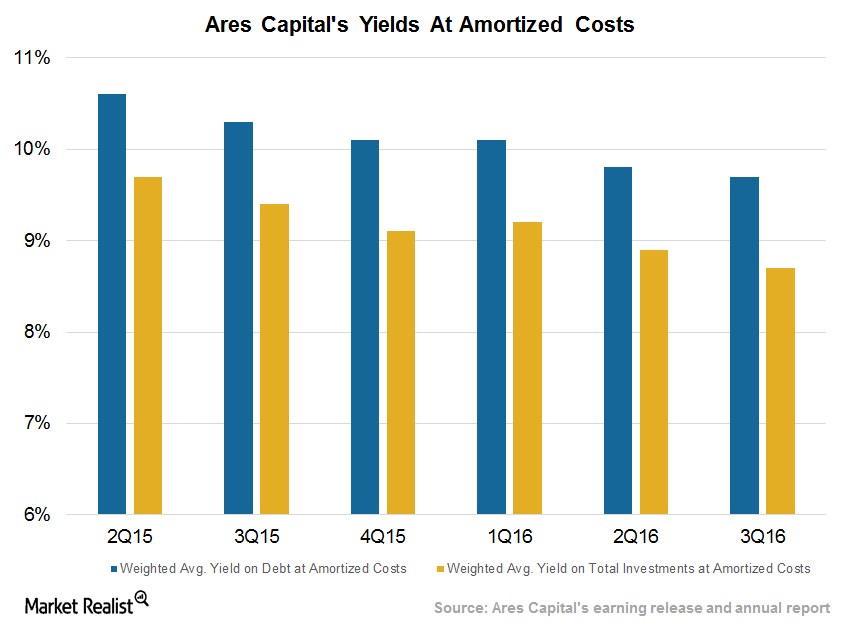

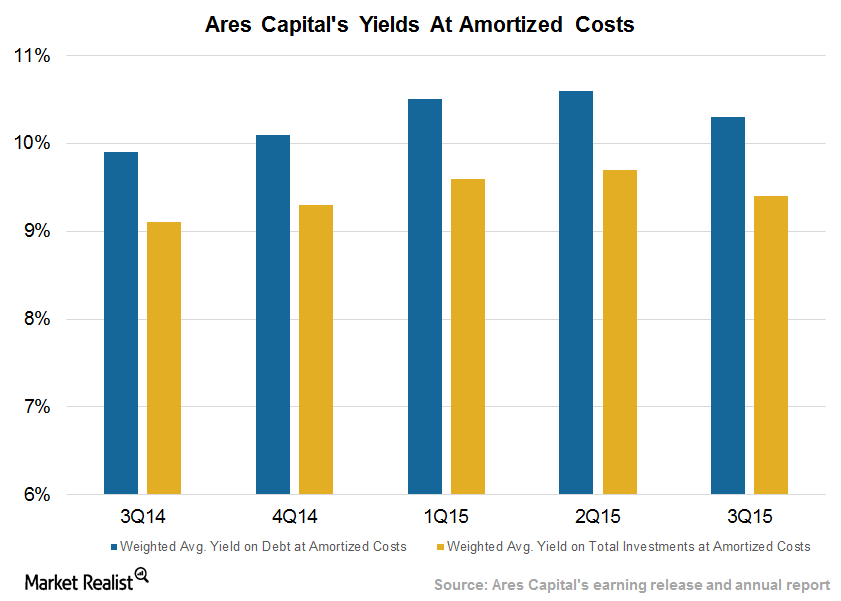

Ares Capital’s Yields and Credit Statistics Fell in 3Q16

Ares Capital’s (ARCC) portfolio totaled $8.8 billion at fair value as of September 30, 2016.

Ares Capital’s Performance Improves amid ACAS Acquisition News

Ares Capital (ARCC) posted EPS (earnings per share) of $0.43, beating Wall Street analysts’ estimate of $0.39 in 3Q16.

Prospect’s Leverage Rises on Higher Origination in Fiscal 1Q17

Prospect Capital has been operating at higher leverage to take advantage of low rates. But the Fed is expected to raise interest rates in calendar 4Q16.

PSEC Reduces Leverage amid Low Originations, Potential Rate Hike

Prospect Capital (PSEC) has used the low interest rate environment to its advantage by deploying higher leverage over the past couple of years.

Prospect Could See Higher Originations in Fiscal 1Q17

In fiscal 4Q16, Prospect Capital (PSEC) made $294 million in investments, a substantial rise compared to its investments of $23 million in fiscal 3Q16.

What to Expect of Prospect Capital’s Earnings in Fiscal 1Q17

Prospect Capital (PSEC) is expected to post earnings per share (or EPS) of $0.24 in fiscal 1Q17, a fall of $0.01 compared to estimates.

Ares Capital’s 3Q15 Investment Performance, Senior Secured Loans

Ares Capital’s (ARCC) portfolio totaled $8.7 billion at fair value as of September 30, 2015. Its total assets stood at $9.2 billion.