Prospect Capital’s Valuation: Fair or Discounted in Long Term?

Prospect Capital (PSEC) stock has fallen 14.5% over the past six months and 16.9% over the past year.

Jan. 9 2018, Updated 10:32 a.m. ET

Originations are key

Prospect Capital (PSEC) stock has fallen 14.5% over the past six months and 16.9% over the past year, reflecting weaker spreads, lower originations, and higher leverage. The company is currently trading at $6.70, which is near its 52-week low of $5.50. It’s better positioned to expand lending amid stable leverage, a new investment pipeline, and an expected expansion of spreads.

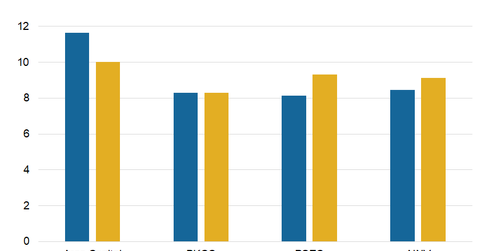

Prospect Capital generated distributable income of $81.6 million, or $0.23 on a per-share basis, in fiscal 1Q18. In fiscal 2017, its EPS (earnings per share) was $0.70. It declared a dividend of $0.23 for the quarter, translating to an annualized yield of 13.2%, which is the highest among competitors in the industry. Here’s how the yields of some of its peers compare:

Together, these companies make up 3.9% of the PowerShares Global Listed Private Equity ETF (PSP).

Fair valuation

Prospect Capital has a one-year forward PE (price-to-earnings) multiple of 9.3x compared to an average of 9.1x for its competitors in the closed end industry. Prospect’s valuation has seen a revision in recent months, mainly due to lower earnings expectations in 2018 compared to 2017. Analysts expect the company to post EPS of $0.72 in fiscal 2018.

Overall, the sector has witnessed subdued valuations in recent months, largely due to a spread compression and implied higher real interest rates due to rate hike expectations. Prospect is hoping to depend on its investment pipeline to expand returns and originations. However, given its leverage, the room for expansion could be slightly less amid no equity offering plans.