Apollo Investment Valuations Fair amid Marginal Improvements

In fiscal 3Q17, Apollo Investment (AINV) repurchased 2.3 million shares at a weighted average price per share of $5.90 for a total cost of $13.6 million.

Feb. 10 2017, Updated 9:07 a.m. ET

Rewarding shareholders

Apollo Investment’s (AINV) operating performance has stabilized in the past couple of quarters due to a continual reduction of exposure in energy and a structured credit space. The company is working on a portfolio alteration toward less risky offerings, strengthening its balance sheet through equity and debt, and improving returns.

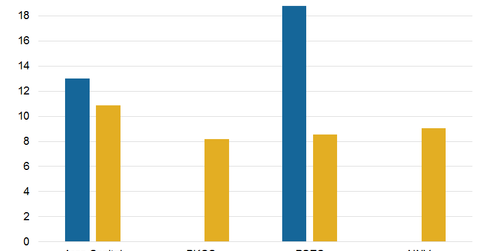

Apollo Investment (AINV) is paying dividends in line with its operating performance. It decided to reduce its dividend to $0.15 in fiscal 3Q17 compared to $0.20 in fiscal 3Q16. This implies a dividend yield of 10.1%, in line with other major closed-end funds. AINV’s competitors had the following yields:

Together, these companies form 2.1% of the PowerShares Global Listed Private Equity ETF (PSP).

Repurchases

In fiscal 3Q17, Apollo Investment (AINV) repurchased 2.3 million shares at a weighted average price per share of $5.90 for a total cost of $13.6 million. In fiscal 2Q17, the company expanded its repurchase program by $50 million, resulting in total available cash of $150 million for repurchases.

Since the inception of the repurchase program, Apollo Investment has repurchased 17 million shares at a weighted average price per share of $5.89 for a total cost of $100 million. The repurchases and allocation reflect the company’s confidence in its long-term performance.

Valuations

Currently, Apollo Investment is trading at 9.0x on a one-year forward earnings basis. Its peers are trading at 9.2x. Historically, the company has traded at a discount due to its quality portfolio and unrealized losses. The valuation gap has declined due to improvement in the company’s operating performance.

Apollo Investment is taking a cautious approach on fresh fund deployments with a clear preference toward first and second lien investments, as well as marginal deployments toward structured investments. The company can see improved performance and valuation when it has realized its existing losses.

In the final part of this series, we’ll study Apollo Investment’s analyst ratings in 2017.