Patricia Garner

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Patricia Garner

Yahoo Coins the Term MaVeNS, Its Key Revenue Growth Driver

In 2015, Yahoo’s management expects that MaVeNS will contribute more than $1.5 billion of revenue to Yahoo’s overall business.

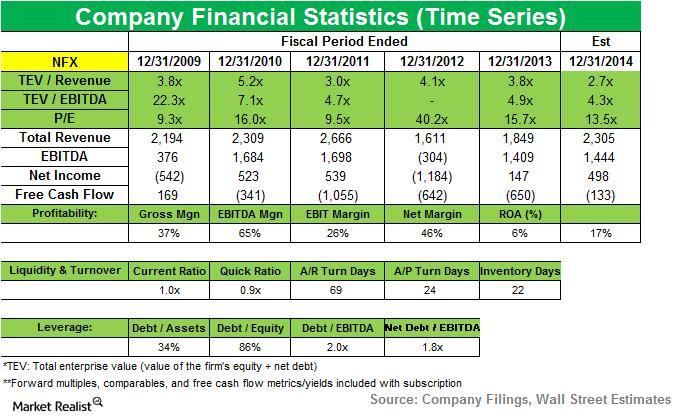

Balyasny exits position in Newfield Exploration Co.

BAM exited its position in Newfield Exploration Co. in 3Q14. It accounted for 1.31% of BAM’s second quarter portfolio. NFX is an energy company.

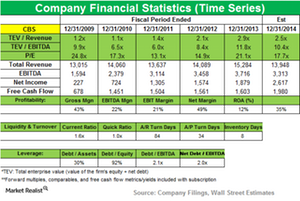

CBS gets position with Davidson Kempner

Davidson Kempner Capital Management initiated a new position in CBS Corporation (CBS) that accounted for 1.55% of the fund’s 3Q14 portfolio.Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.

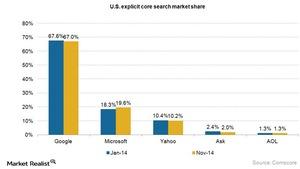

Why Facebook stopped using Bing for its web search results

The company has now stopped including results from Microsoft’s Bing search engine through the Facebook search.

Maverick Capital Sells Its Position in Martin Marietta Materials

MLM’s 4Q14 net sales were up 59% to $779.5 million, compared with net sales of $491.4 million in 4Q13. It beat its 4Q14 revenue estimates by $84 million.Financials Moore Capital lowers its stakes in JPMorgan Chase

JPMorgan’s latest 2Q14 results beat estimates. Meanwhile, net income was down to $6 billion from $6.5 billion in 2Q13. The earnings per share (or EPS) was $1.46, compared to $1.60 in 2Q13.

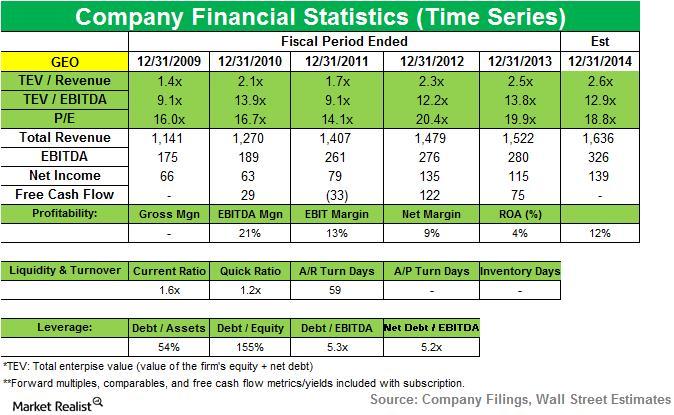

Why AQR Capital exits its position in Geo Group Inc.

AQR Capital sold a position in GEO Group Inc. in 2Q14. The company accounted for a 0.0206% position in the fund’s first quarter U.S. long portfolio.

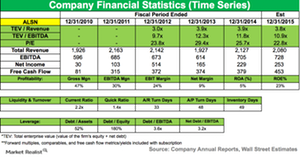

Maverick Capital Decreases Position in Allison Transmission

Allison Transmission and its subsidiaries design and manufacture commercial and defense fully automatic transmissions. In 4Q14, net sales grew 11% to $544 million.

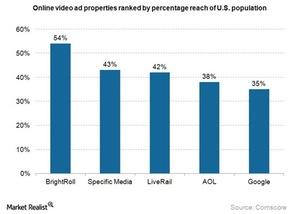

Yahoo completed the acquisition of BrightRoll

On December 15, 2014, Yahoo completed the acquisition of BrightRoll for ~$640 million in cash. It’s the industry’s leading programmatic video advertising platform.

Renaissance Invested in Gold and Silver Mining Stocks in 1Q15

The investment in silver mining stocks appears to be based on the view that the stocks could outperform the market. This is due to a rise in consumer demand for silver.

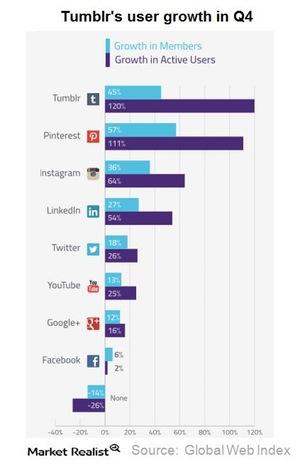

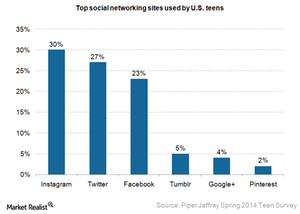

Yahoo’s Tumblr Outshines Instagram in User Growth

Yahoo plans to make Tumblr similar to YouTube and is trying to convince some of Google’s top YouTube stars to make Tumblr their exclusive video distributor.

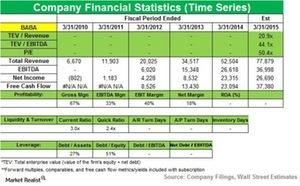

Magnetar Capital’s new position in Alibaba Group

Magnetar started a new position in BABA in 3Q14. The position accounts for 4.05% of the fund’s total portfolio in the third quarter. BABA is the largest e-commerce player in China.

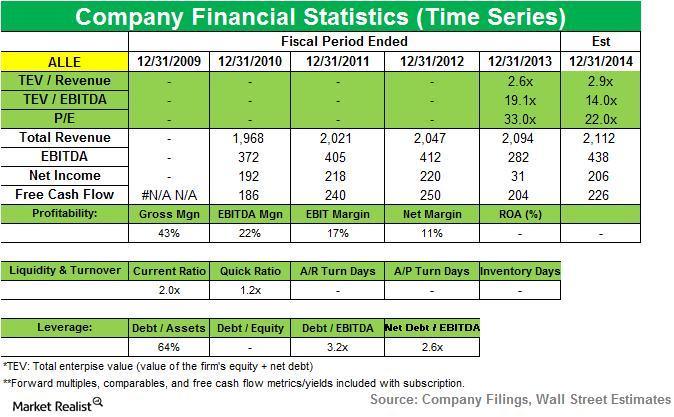

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.

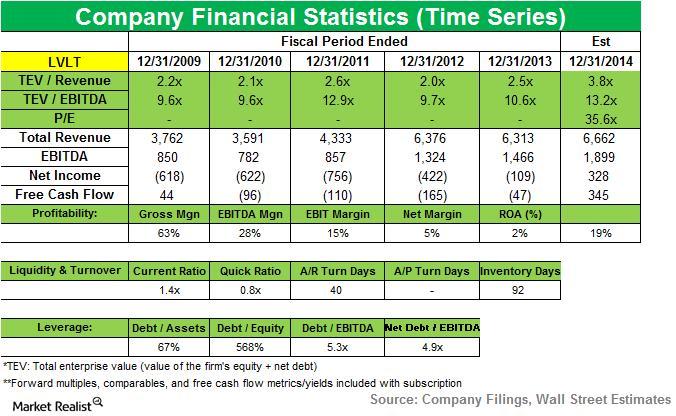

Coatue Management adds new position in Level 3 Communications

Coatue Management added a new position in Level 3 Communications Inc. (LVLT) during the third quarter. The stock accounted for 1.46% of the fund’s 3Q14 portfolio.

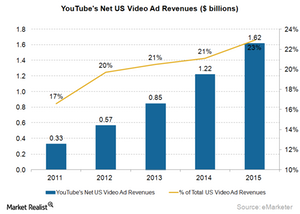

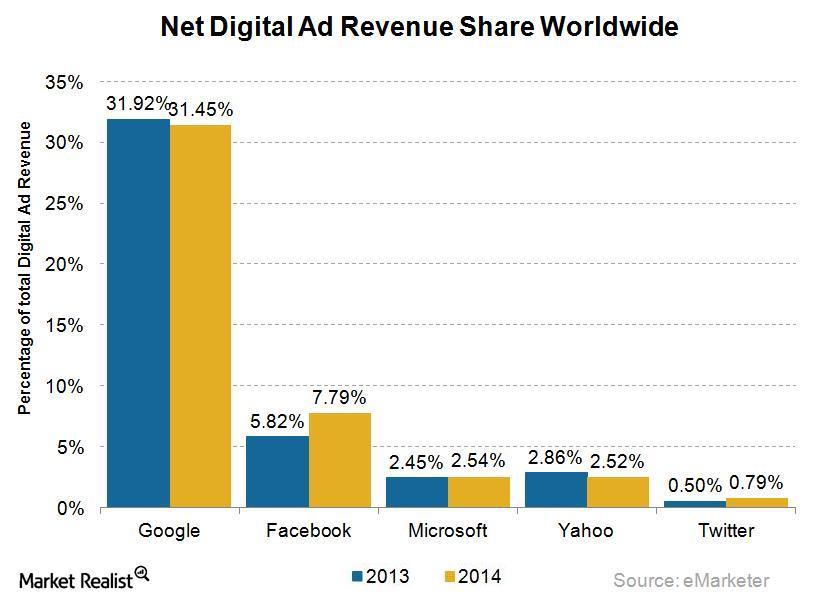

The evolution of online advertising

Since its inception in the early 90’s, online advertising has exponentially increased in growth.

Maverick Capital lowers position in Baidu, Inc.

Maverick Capital lowered its position in Baidu, Inc. in 3Q14. The position accounts for 0.36% of the fund’s total portfolio in the third quarter.

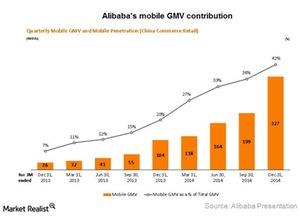

Mobile Commerce: One of Alibaba’s Key Growth Drivers

For the quarter ending in December 2014, Alibaba achieved 265 million monthly active users on its mobile commerce apps. This is a sequential growth of 22%.

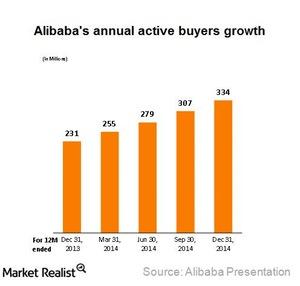

Why Is Alibaba’s Active User Base Growing at a Fast Rate?

Part of the reason for Alibaba’s GMV growth was the growth in its active user base. The growth was driven by an increase in active buyers throughout China.

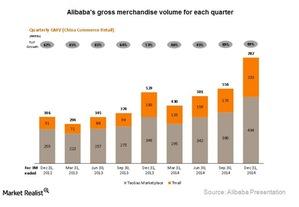

Alibaba’s Gross Merchandise Volume Continued to Grow

Across its China retail marketplaces, Alibaba’s gross merchandise volume grew by 49% YoY. It was driven by strength in Taobao Marketplace and Tmall.com.

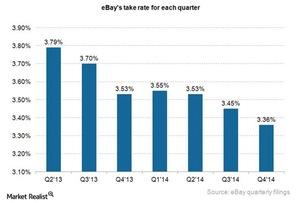

Why eBay isn’t worried about a falling take rate

eBay’s take rate fell from 3.79% in 2Q13 to 3.53% in 2Q14. However, the company isn’t worried about it since take rate is offset by healthy revenue growth.Earnings Report Facebook plans to monetize WhatsApp: Ads or mobile payments?

There’s been a lot of media speculation around the strategy that Facebook (FB) will adopt to monetize WhatsApp.

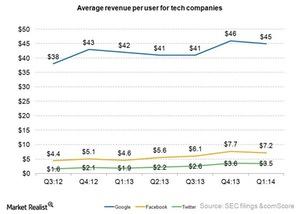

Average revenue per user is an important growth driver

Average revenue per user (or ARPU) is another important metric for Internet companies. It provides an idea of how well a company can monetize its user base.

Why Yahoo’s acquisition of Tumblr generated revenue

In May 2013, Yahoo announced that it planned to acquire Tumblr, a blogging site, for $1.1 billion. Tumblr is one of the fastest-growing media networks in the world.

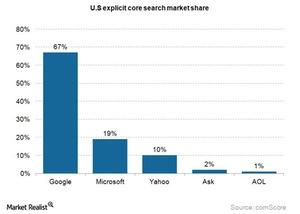

Yahoo’s position in the search market

We’ll look at Yahoo’s search market business. In the third quarter, Yahoo (YHOO) generated 41% of its revenue from the search advertising business.

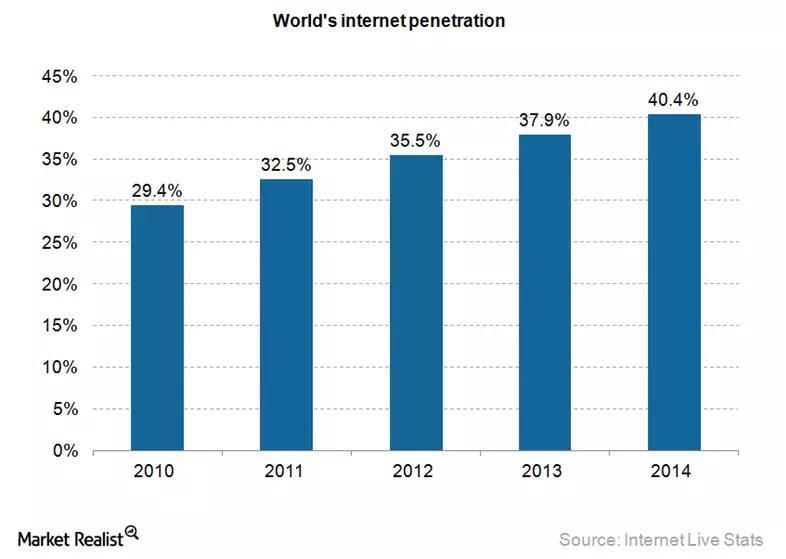

Online advertising growth is aided by increased internet users

In 2013, globally mobile internet user penetration was 73.4%. It will be more than 90% in 2017. Internet users had mobile internet usage on smartphones and tablets.

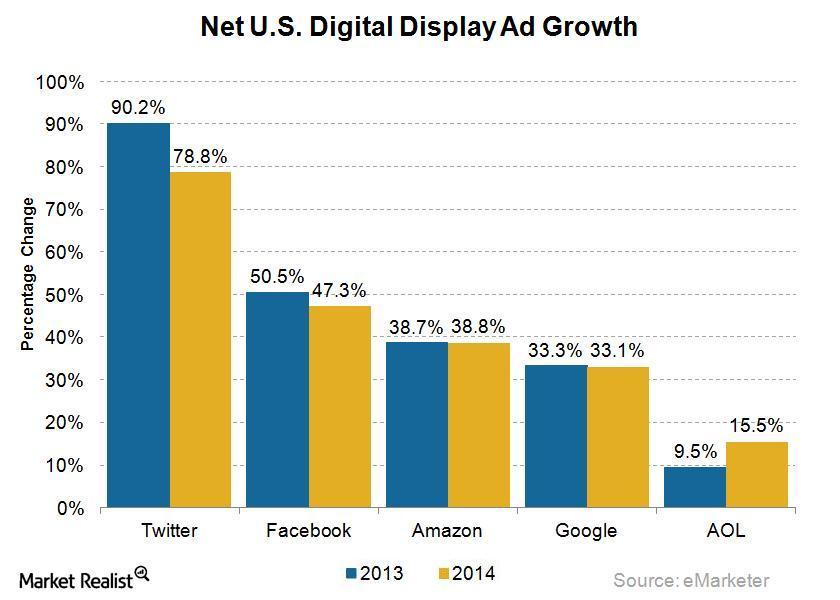

The pros and cons of the growing display advertising market

Display advertising is a type of online advertising that appears next to content on websites, instant messaging (or IM) applications, and email.