Amanda Lawrence

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Amanda Lawrence

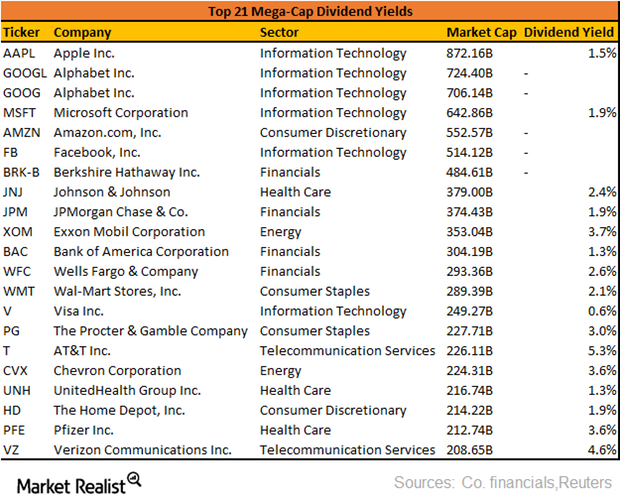

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

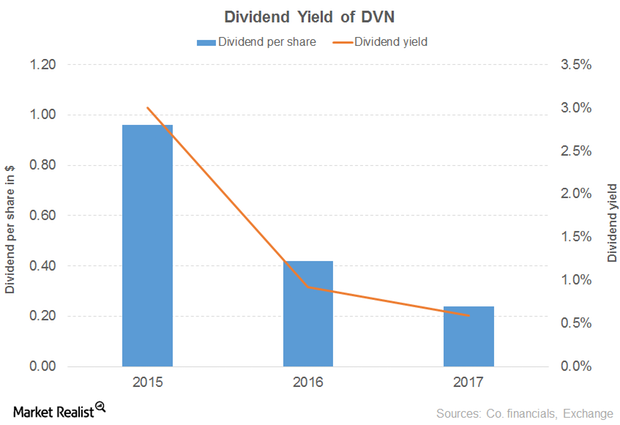

How Did DVN’s Dividend Cut Affect Its Dividend Yield?

Devon Energy Corporation’s 56.0% dividend cut in 2016 was followed by a 43.0% cut in 2017.

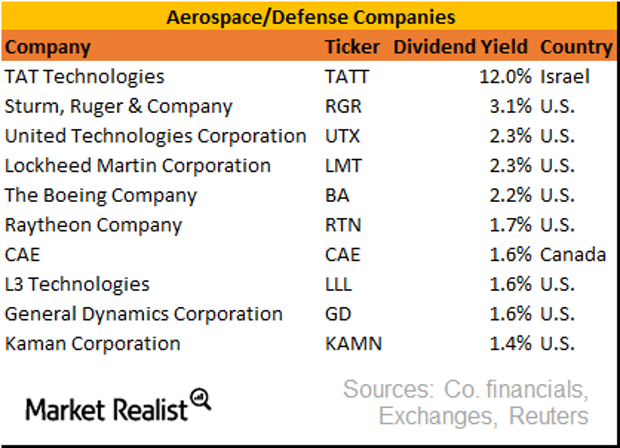

How Do Aerospace and Defense Sector Dividends Look?

This series will discuss the top ten aerospace and defense products and services companies based on their dividend yields.

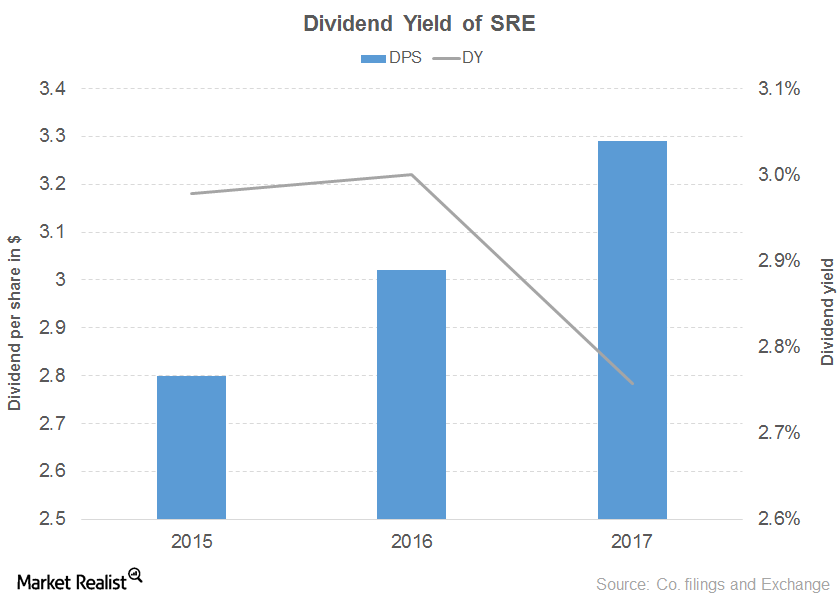

What Led to Sempra Energy’s Sharp Fall in Dividend Yield?

Sempra Energy’s revenue for the first half of 2017 rose 7.0%, driven by every segment.

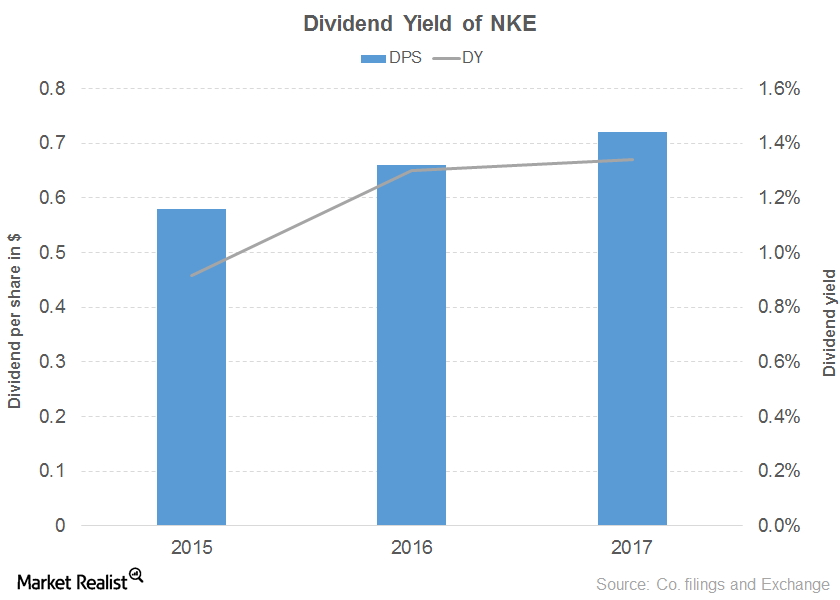

A Look at Nike’s Dividend Yield Curve

Nike’s (NKE) operating income rose 5.0% in 2017 compared to 8.0% in 2016 due to higher expenses and lower gross margins.

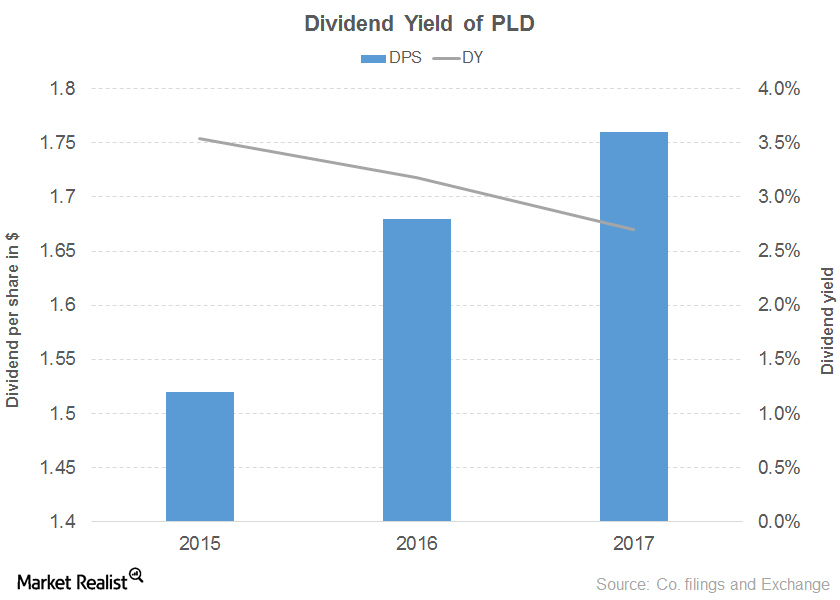

Why Prologis Has a Downward Sloping Dividend Yield Curve

Prologis has noted a 15.0% rise in revenue in the first half of 2017, driven by every segment. Operating income rose 61.0% despite higher expenses.

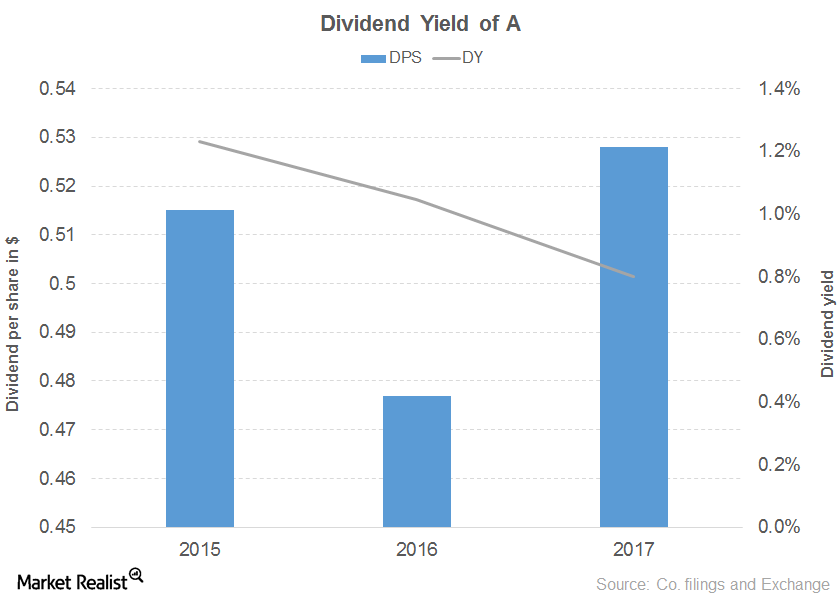

Agilent Technologies’ Downward Sloping Dividend Yield Curve

Agilent Technologies’ net revenue rose 6.0% in the first nine months of 2017, driven by every segment. Income from operations rose 41.0% as total costs didn’t increase much.

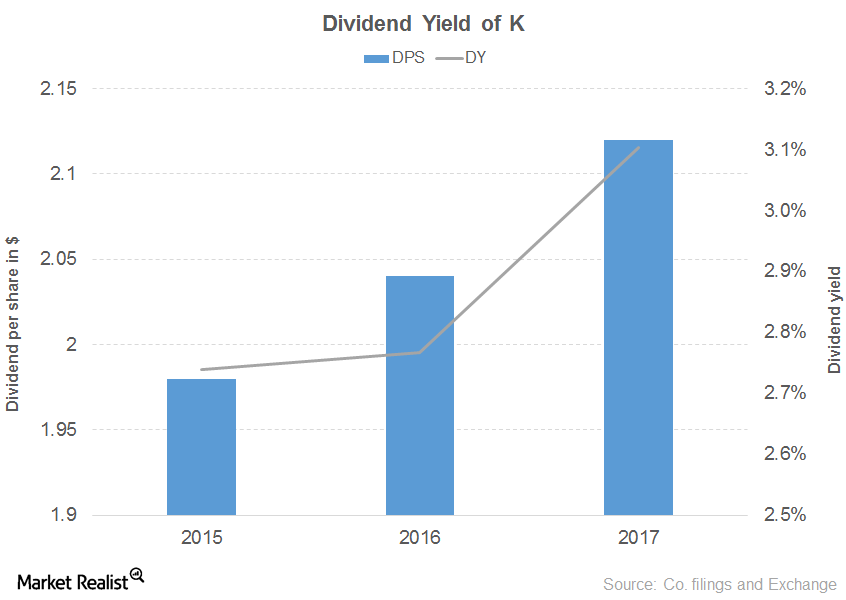

A Look at Kellogg’s Dividend Yield Curve

Kellogg has noted a 3.0% fall in sales for the first half of 2017. The fall is due to a decline in every segment, offset by U.S. Specialty, Latin America, and Asia Pacific.

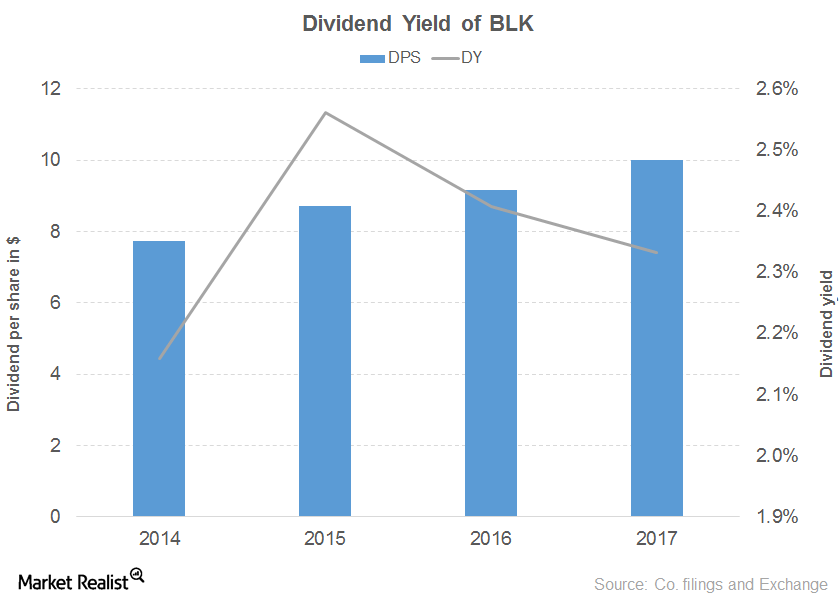

What Led to BlackRock’s Downward Sloping Dividend Yield Curve?

BlackRock posted a 7.0% revenue growth in the first half of 2017, driven by every segment except multi-asset and alternatives, which reported flat growth.

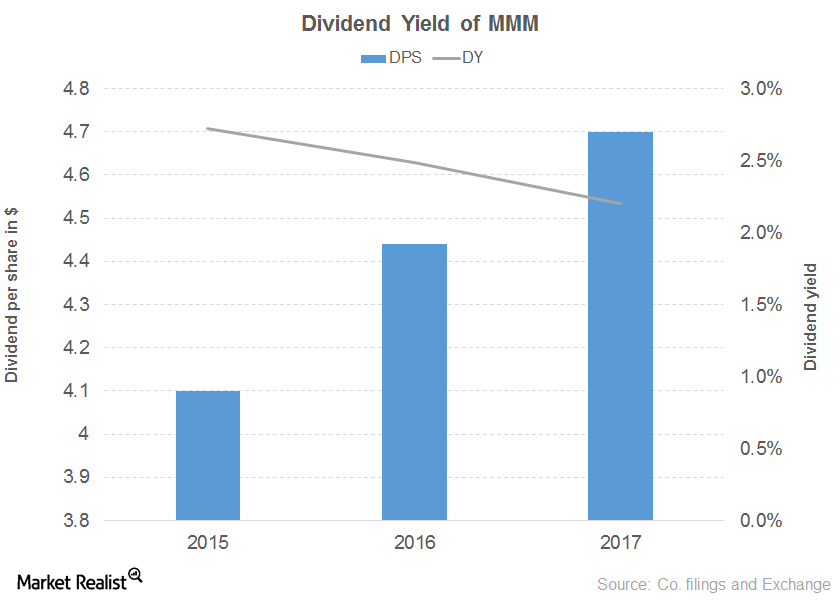

How Does 3M’s Dividend Yield Curve Look?

3M has recorded a 3.0% revenue growth in the first half of 2017, driven by growth in every segment and flat growth in the consumer segment.

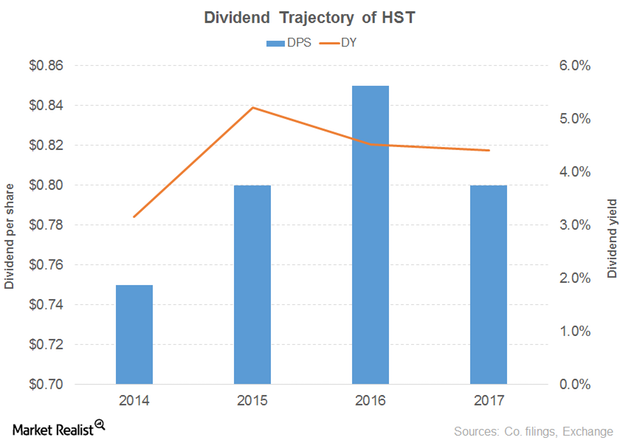

Host Hotels & Resorts’ Dividend Yield over the Years

Revenue and earnings Host Hotels & Resorts (HST), a hotel REIT, is involved in the possession and operation of US hotel properties. The company’s revenue was almost flat in 2015 and 2016, driven by rooms and food and beverages. Its operating costs and expenses rose 1%–2% in 2015 and 2016., while its interest expenses fell 32% […]

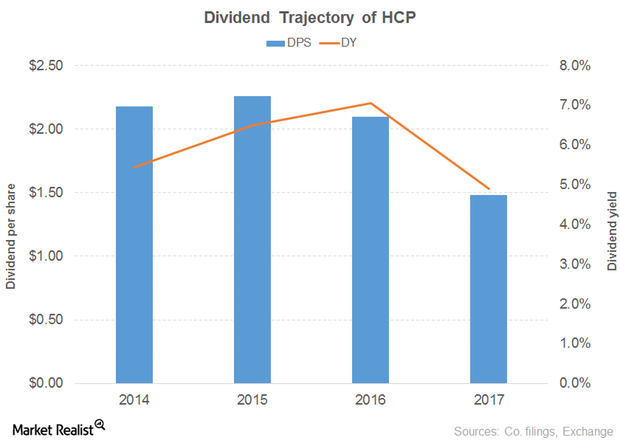

Why HCP’s Dividend Yield Is Moving South

Revenue and earnings HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and […]

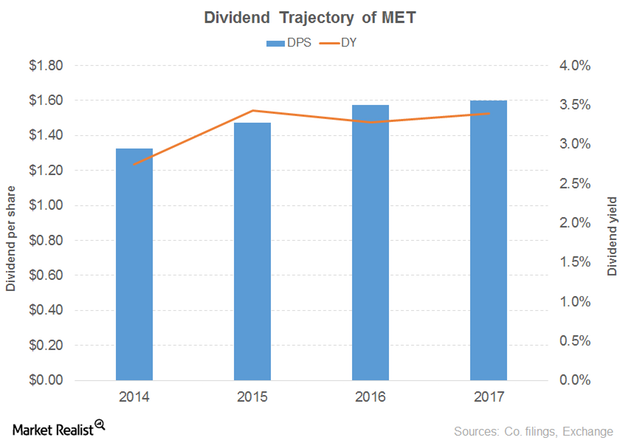

Comparing MetLife’s Dividend Yield

Revenue and earnings MetLife (MET), the holding corporation for the Metropolitan Life Insurance Company, saw its revenue fall 9% in 2016 and 5% in 2015. The fall was driven by universal life and investment-type product policy fees, net investment income, and other revenue. Expenses rose 2% in 2016 after falling 3% in 2015. Income from continuing operations, […]

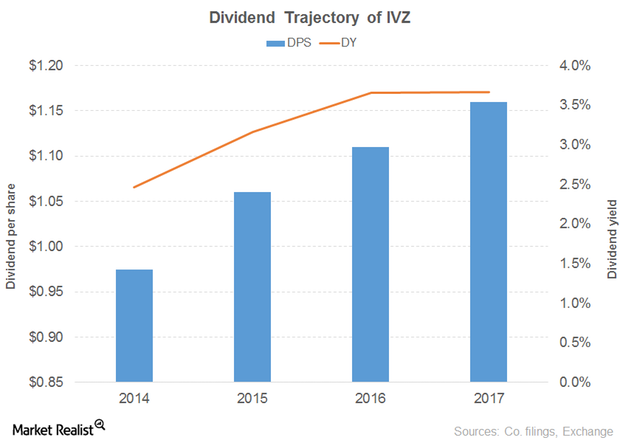

How Invesco’s Dividend Yield Curve Has Evolved

Revenue and earnings Investment management company Invesco (IVZ) saw its revenue fall 8% in 2016, after flat growth in 2015. In 2016, its investment management, service and distribution, and performance fees fell. Its operating expenses fell 3%–5% in 2015 and 2016, and its operating income fell 13% in 2016 after rising 6% in 2015. Meanwhile, its […]

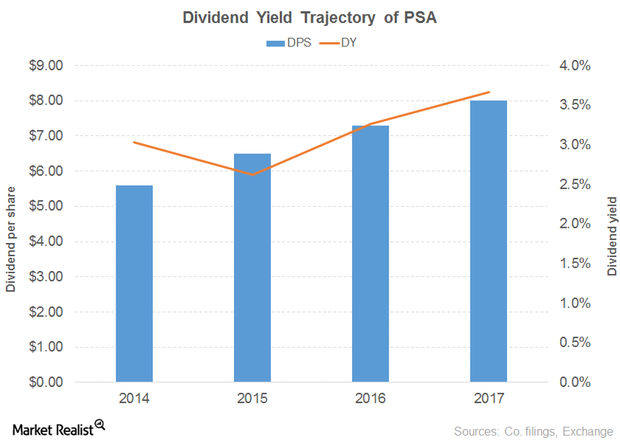

How Public Storage’s Dividend Yield Compares

Revenue and earnings Public Storage (PSA) an industrial REIT, invests in US and European real estate markets. Tthe company’s revenue grew 9% and 8% in 2015 and 2016, respectively. The growth was driven by self-storage facilities and ancillary operations. Its operating costs rose 2%–3% in 2015 and 2016, and its operating income rose 17% in 2015 […]

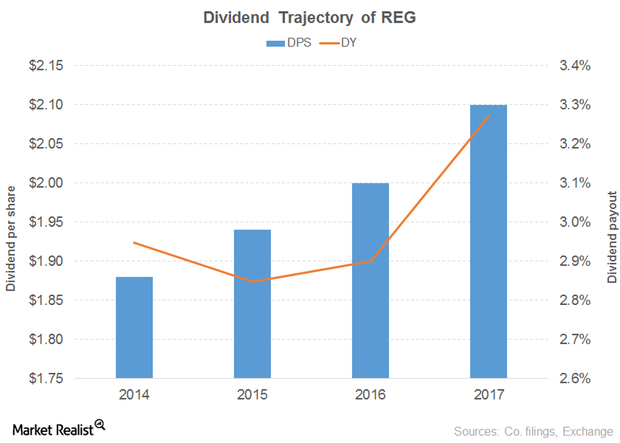

A Look at Regency Centers’ Dividend Yield

Revenue and earnings Retail REIT Regency Centers (REG) saw its revenue grow 8% in 2016, compared with 6% in 2015. The growth was driven by minimum rent, recoveries from tenants, and other income. Its operating expenses rose 10% in 2016, and 3% in 2015. Its interest expenses fell 12% in 2016 and 6% in 2015. Its […]

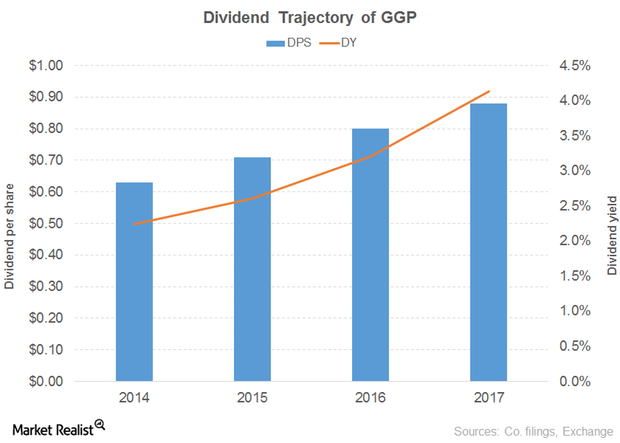

What’s Driving GGP’s Dividend Yield Upward

Revenue and earnings GGP (GGP), a retail REIT engaged in US real estate investment, saw its revenue fall 2% in 2016, compared with 5% in 2015. Growth was driven by management fees and other corporate revenue, and offset by minimum rent, tenant recoveries, and overage rent. Its operating expenses rose 4% in 2016 after a 7% […]

How Realty Income’s Dividend Yield Looks

Revenue and earnings Realty Income (O), a retail REIT engaged in US real estate investment, recorded 8% revenue growth in 2016, compared with 10% growth in 2015. The growth was driven by rentals and tenant reimbursements. Its operating costs and other expenses (including interest expenses) rose 6% in 2016 and 8% in 2015. Its gains on asset […]

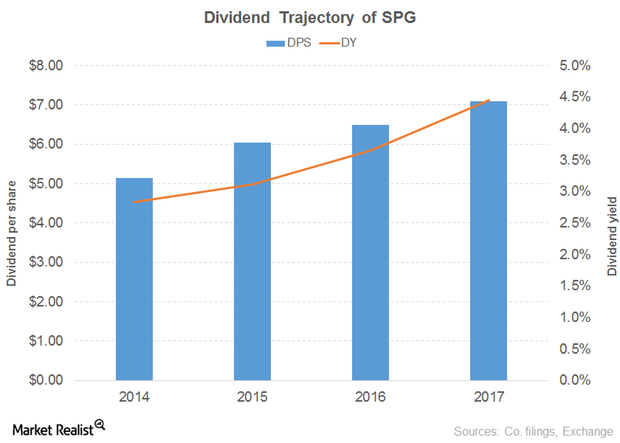

What’s Boosted Simon Property Group’s Dividend Yield

Revenue and earnings In this part, we’ll look at Simon Property Group (SPG). Engaged in real estate investment around the world, this retail REIT saw its revenue growth slow from 8% in 2015 to 3% in 2016. Whereas its minimum rent has risen since 2014, its overage rent, tenant reimbursements, and management fees fell in 2016. Simon […]

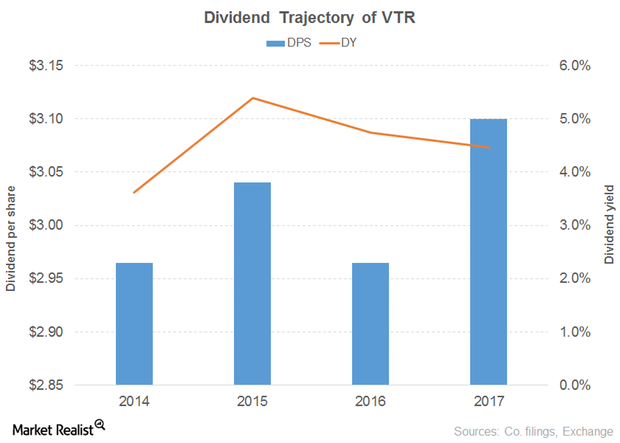

How Ventas’s Dividend Yield Compares

Revenue and earnings Ventas (VTR) is a major REIT in the United States and Canada. The company’s revenue growth slowed from 18% in 2015 to just 5% in 2016. The growth was driven by all of its segments, through resident fees and services, office building and other service revenue, and income from loans and investments, […]

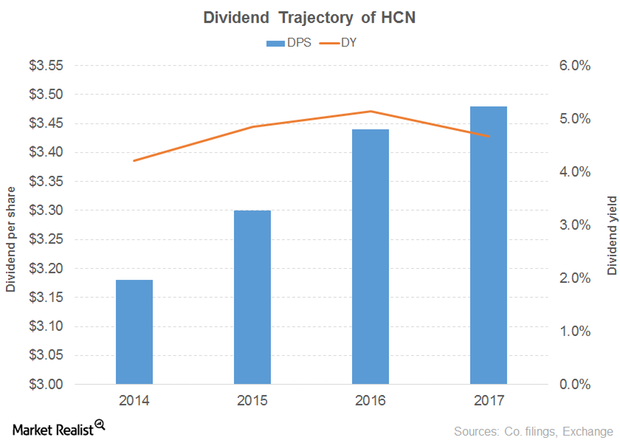

Welltower’s Dividend Yield Falls despite Higher Dividend

Revenue and earnings In this part, we’ll look at Welltower (HCN), a US healthcare REIT. Welltower’s revenue growth slowed from 15% in 2015 to 11% in 2016. The growth was driven by all of its segments, through rental income, resident fees and services, interest income, and other income. Its operating costs and other expenses (including interest expenses) […]

Stocks with High Dividend Yields in the Financial Sector

In this series, we’ll look at 11 S&P 500 companies offering high dividend yields.

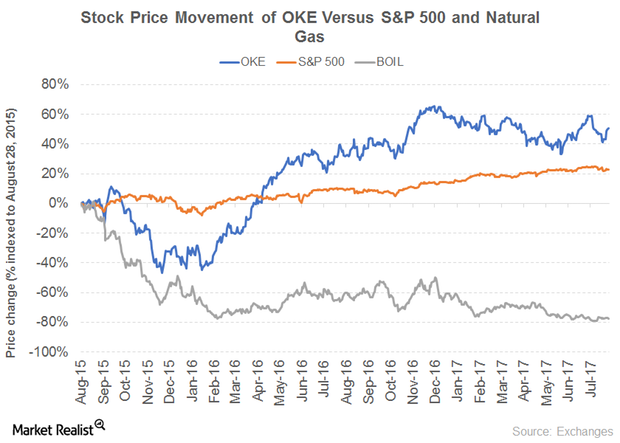

How ONEOK Has Managed Its Impressive Dividend Yield

How ONEOK has maintained a 4% yield ONEOK (OKE), the general partner and 41% owner of ONEOK Partners, owns one of the country’s premier natural gas liquid systems. The company’s revenue grew 15% in 2016 after falling 36% in 2015. The growth was driven by its Natural Gas Gathering and Processing, Natural Gas Liquids, and […]

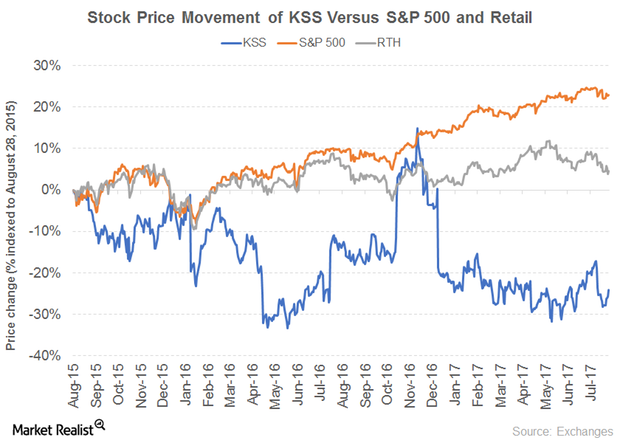

What’s Contributing to Kohl’s Dividend Yield

The story behind Kohl’s rising yield Department store retailer Kohl’s (KSS) saw its sales fall 3% in 2016, driven by lower comparable sales, after recording growth in 2015. Like Macy’s, it was impacted by online competition, store closures, discounts, and advertisements. Its operating income fell 8% in 2015 and 24% in 2016, while its operating […]

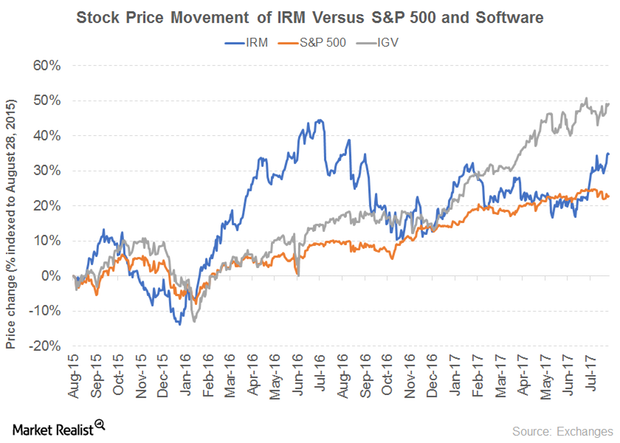

How Iron Mountain Has Maintained Its Dividend Yield

How Iron Mountain has maintained a 5% yield Iron Mountain (IRM) is an enterprise information management services company. The company’s revenue grew in 2016, supported by its North American Records and Information Management Business, North American Data Management Business, Western European Business, and Other International Business segments. Its revenue fell 4% in 2015 before rising 17% in 2016. Its operating income fell 5% in 2015 and 4% in 2016 due to […]

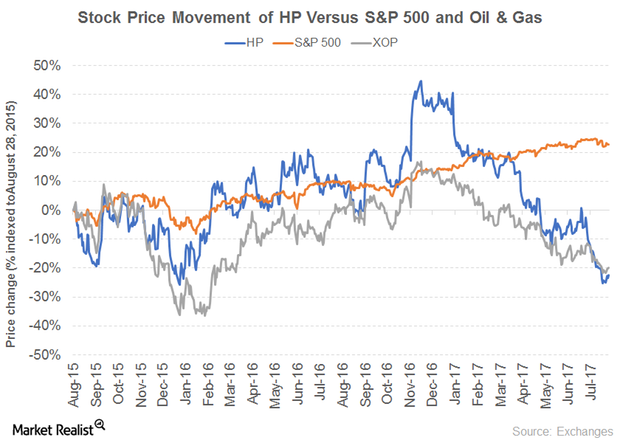

Decoding Helmerich & Payne’s Dividend Yield

What’s driving Helmerich & Payne’s high yield? Contract oil and gas well driller Helmerich & Payne (HP) recorded a sharp drop in its 2016 operating revenue due to declines in its US drilling, offshore, and international segments. Its revenue fell 19% in 2015, compared with 51% in 2016. Its operating income, as a result, ended […]

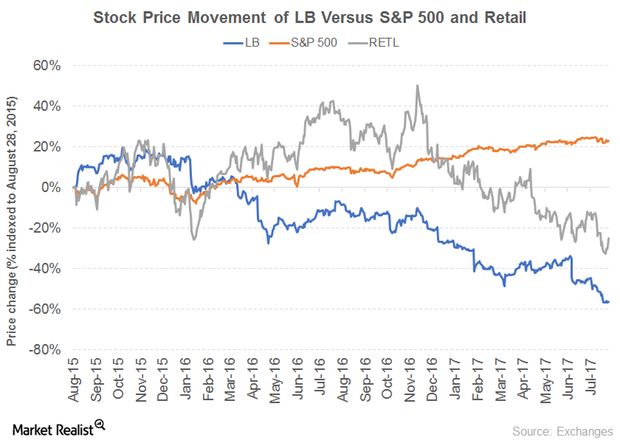

Here’s Why L Brands’ Dividend Yield Is Rising

Reasons behind L Brands’ growing yield Specialty fashion retailer L Brands (LB) saw its sales slow between 2013 and 2016. The company recorded revenue growth of 3.5% in 2016, compared with 6% in 2015. The growth was driven by the Victoria’s Secret and Bath & Body Works segments. Whereas its operating income grew 12% in 2015, it […]

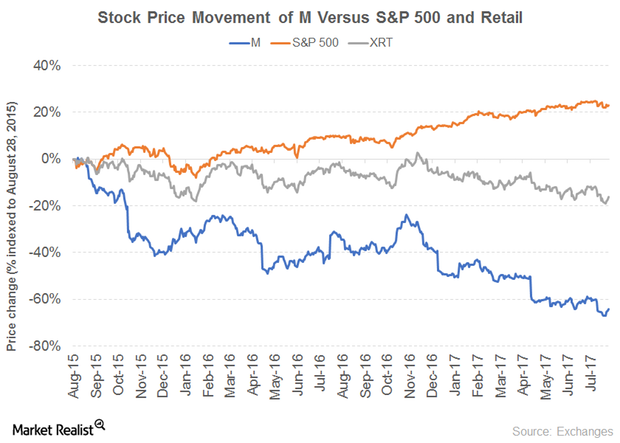

What’s behind Macy’s Rising Dividend Yield

The story behind Macy’s attractive yield Macy’s (M) operates Macy’s and Bloomingdale’s stores. The company’s sales fell between 2013 and 2016. Revenue fell 5% in 2016, compared with 4% in 2015. Online shopping and discount stores have wreaked havoc on brick-and-mortar stores, leading to store closures. Narrowing gross margins and rising impairments, store closing costs, and […]

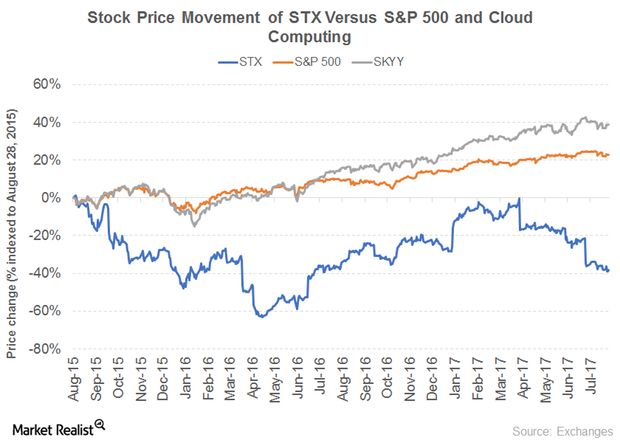

Can Seagate Sustain Its Dividend Yield?

What’s behind Seagate’s dividend yield Seagate Technology (STX) is a data storage technology and solutions provider. The company’s revenue, which has fallen over the years, seems to have recovered in 2017. Its revenue has fallen 3% in 2017, compared with a fall of 19% in 2016 due to intense competition in the data storage market. The company’s […]

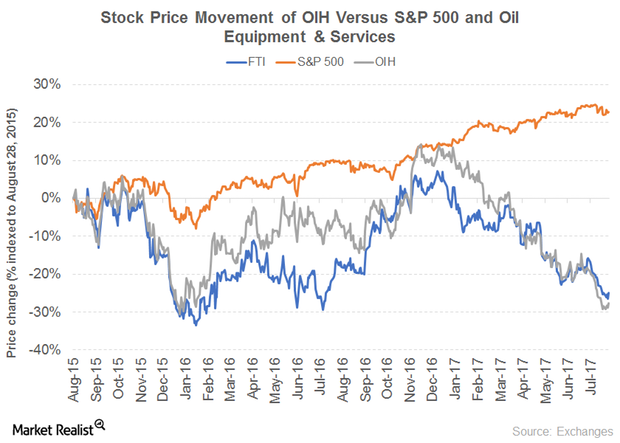

What Could Drive TechnipFMC’s Dividend Yield

How TechnipFMC intends to maintain its yield FMC Technologies and Technip merged to become TechnipFMC (FTI) in 2017, an international provider of subsea, onshore, offshore, and surface projects. The synergy aims to combat the challenges of low oil prices and a challenging outlook through cost cutting and the enhancement of efficiency. The company recorded 51% revenue […]

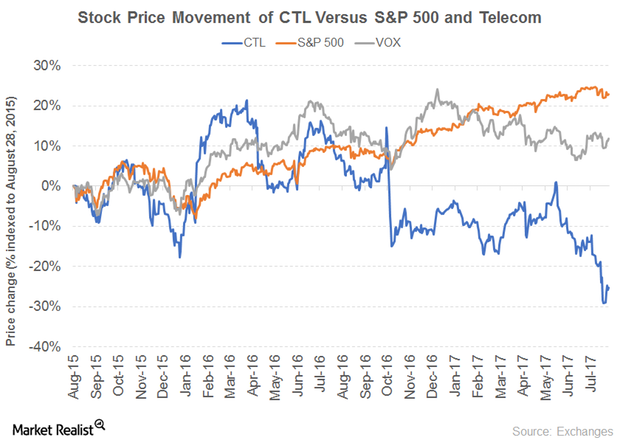

How CenturyLink is Maintaining Its Dividend Yield

The story behind CenturyLink’s 8% yield Another acquisition-driven telecom company is CenturyLink (CTL). The cohesive communications company provides a wide range of services to its residential and business customers. Like Frontier, it has been impacted by the slowing traditional phone business. The company’s operating metrics, excluding those of Prism TV, are trending downwards. This trend has […]

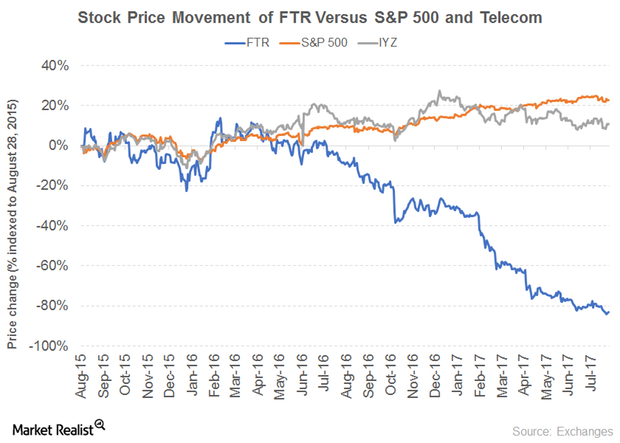

Frontier Communications: High Dividend Yield despite Dividend Cut

In this series, we’ll look some small-cap stocks with high dividend yields.

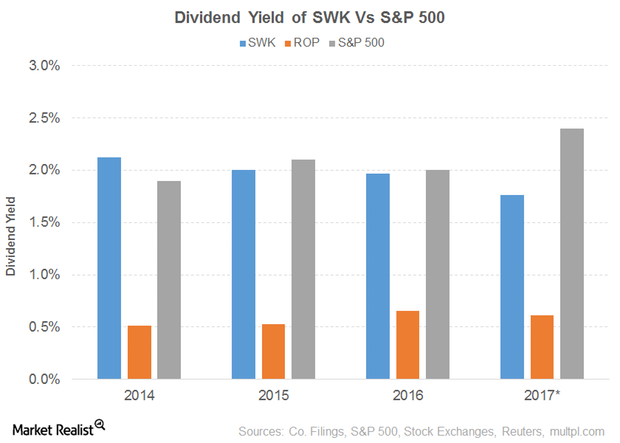

Dividend Yield of Stanley Black & Decker

Stanley Black & Decker’s (SWK) PE ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%.

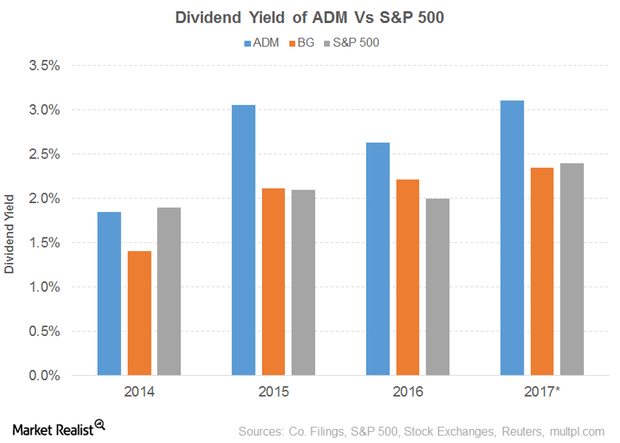

Dividend Yield of Archer-Daniels Midland

Archer-Daniels Midland’s (ADM) PE ratio of 19.1x compares to a sector average of 23.8x. The dividend yield of 3.1% compares to a sector average of 2.4%.

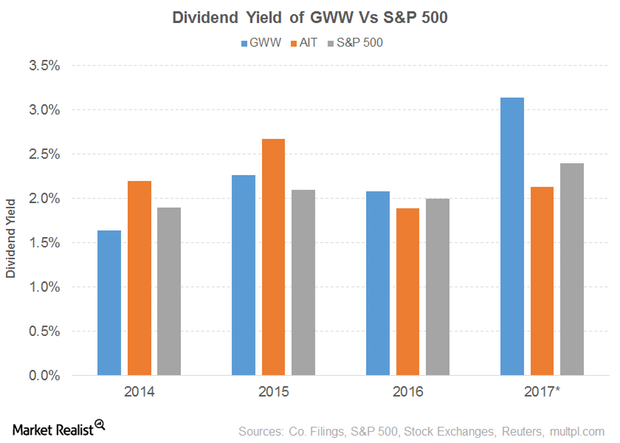

Dividend Yield of W.W. Grainger

W.W. Grainger’s (GWW) PE ratio of 16.3x compares to a sector average of 29.3x. The dividend yield of 3.2% compares to a sector average of 1.6%.

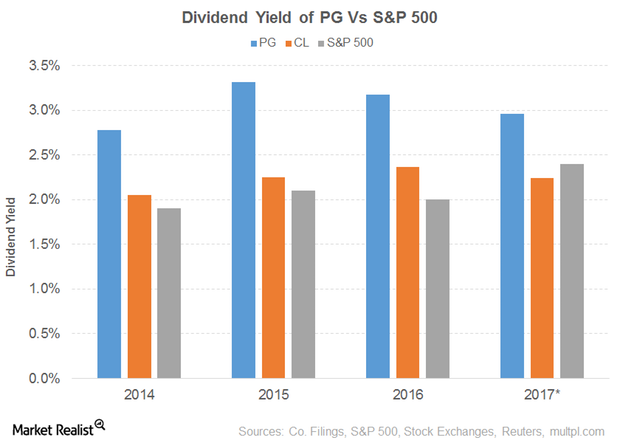

Dividend Yield of Procter & Gamble

Procter & Gamble’s (PG) PE ratio of 25.1x compares to a sector average of 23.3x. The dividend yield of 3.0% compares to a sector average of 3.8%.

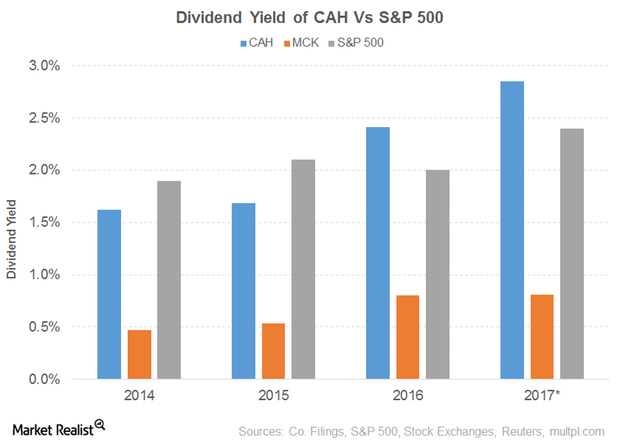

Dividend Yield of Cardinal Health

Cardinal Health’s (CAH) PE ratio of 16.0x compares to a sector average of 20.4x. The dividend yield of 2.9% compares to a sector average of 2.0%.

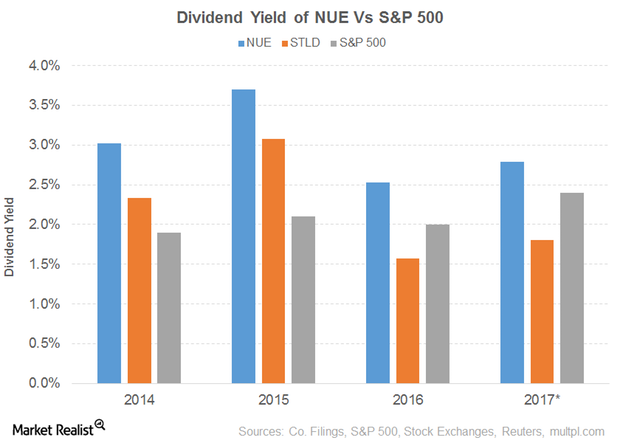

Dividend Yield of Nucor

Nucor’s (NUE) PE ratio of 21.8x is pitted against a sector average of 19.4x. The dividend yield of 1.5% is pitted against a sector average of 1.4%.

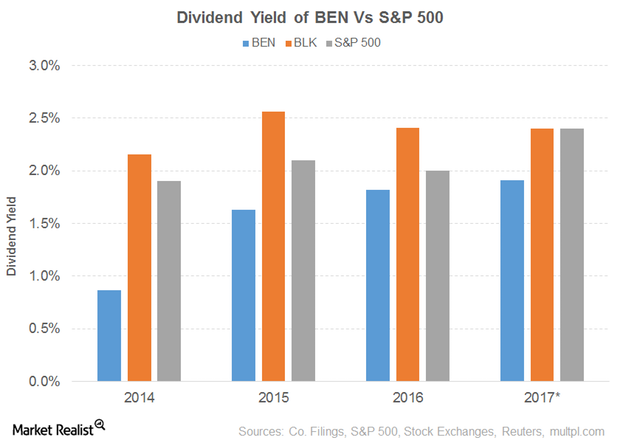

Dividend Yield of Franklin Resources

Franklin Resources (BEN) has recorded consistent growth in dividends since at least March 1982.

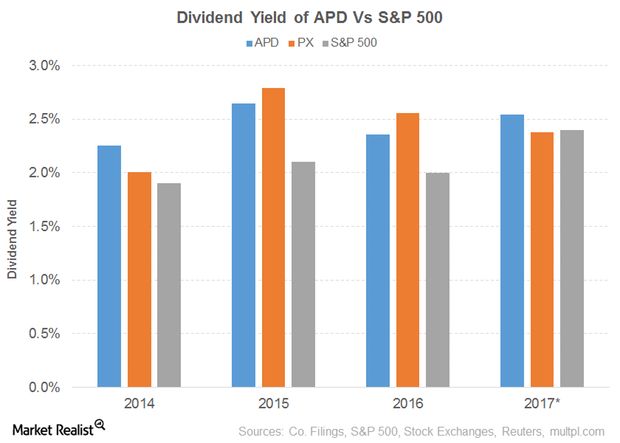

Dividend Yield of Air Products & Chemicals

In this series, we’ll be looking at ten dividend aristocrats with low PE ratios. Dividend aristocrats are S&P 500 stocks that have raised their dividend payouts for at least 25 successive years.

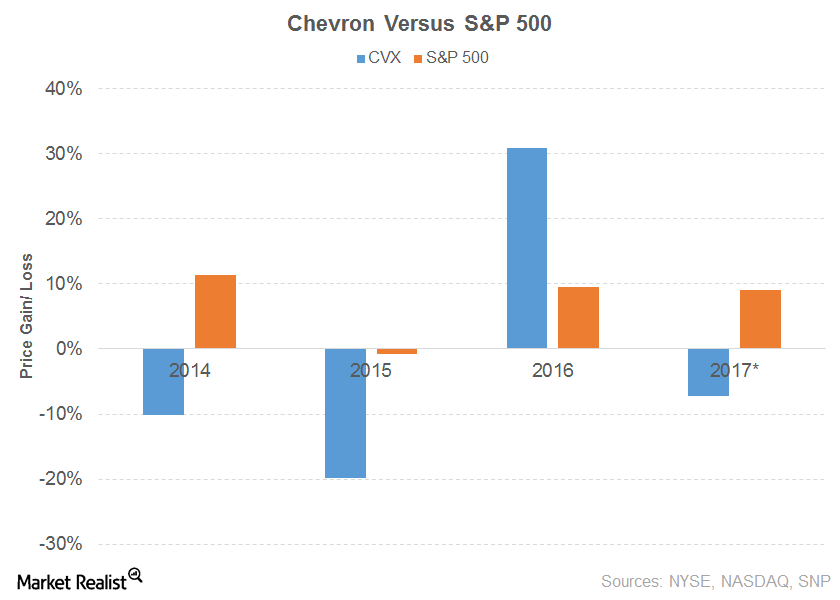

How Good Is Chevron as a Dividend Payer?

Chevron’s (CVX) total sales and other operating revenues for 2016 fell 15.0% due to volatility in commodity prices.

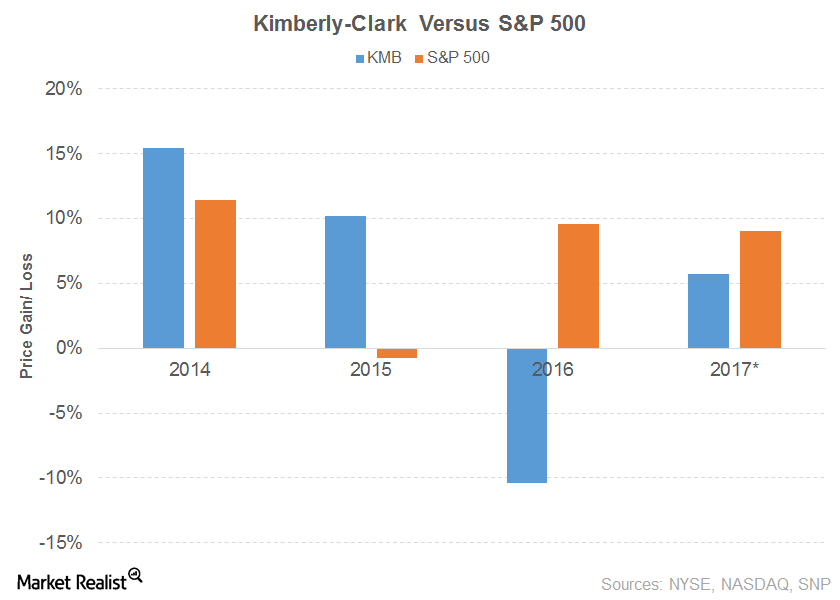

Kimberly-Clark’s Dividend Growth

Kimberly-Clark’s (KMB) 2016 net sales fell 2.0% due to declines in every segment.

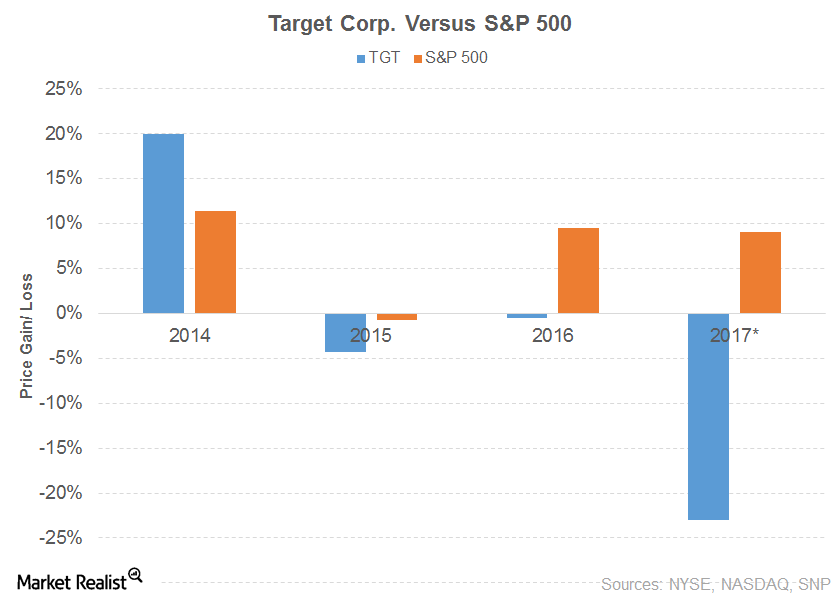

Target’ s Performance as a Dividend Aristocrat

Target’s (TGT) sales for 2016 fell 6.0% due to lower comparable store sales and weak store traffic.

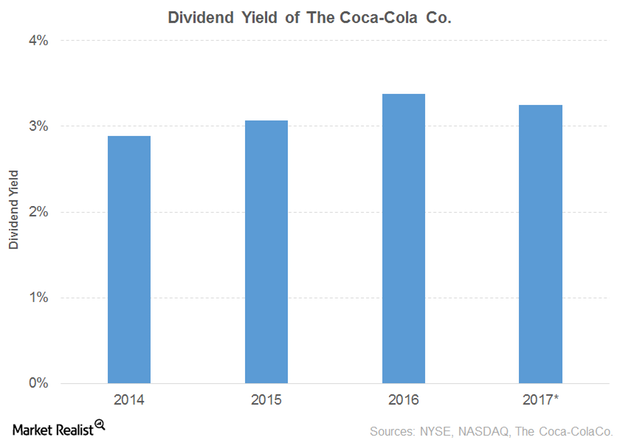

A Look at Coca-Cola’s Dividend Yield

Coca-Cola (KO) recorded a fall of 6.0% in its 2016 net operating revenues due to a decline in its Third Party and Intersegment segments.

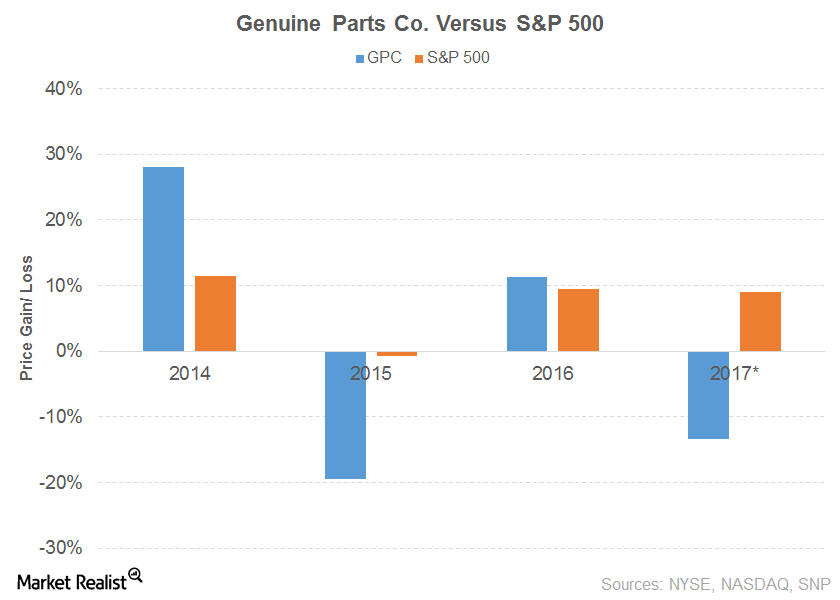

Will Genuine Parts Sustain Its Dividend Yield?

Genuine Parts (GPC) recorded a marginal growth in its 2016 net sales, driven by its Automotive and Office Products segments.

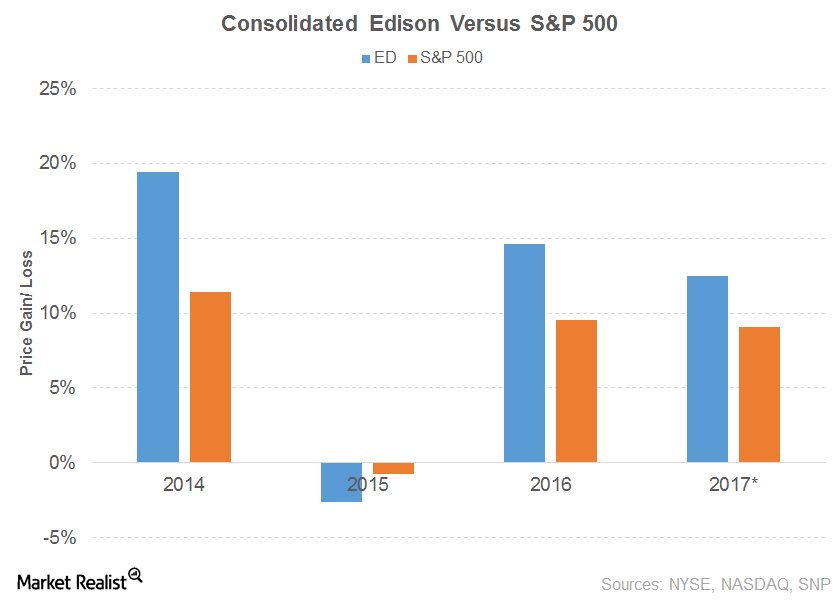

Consolidated Edison’s Dividend Trajectory

Consolidated Edison’s (ED) 2016 operating revenues fell 4.0% due to a decline in every segment; namely, electric, gas, steam, and non-utility.

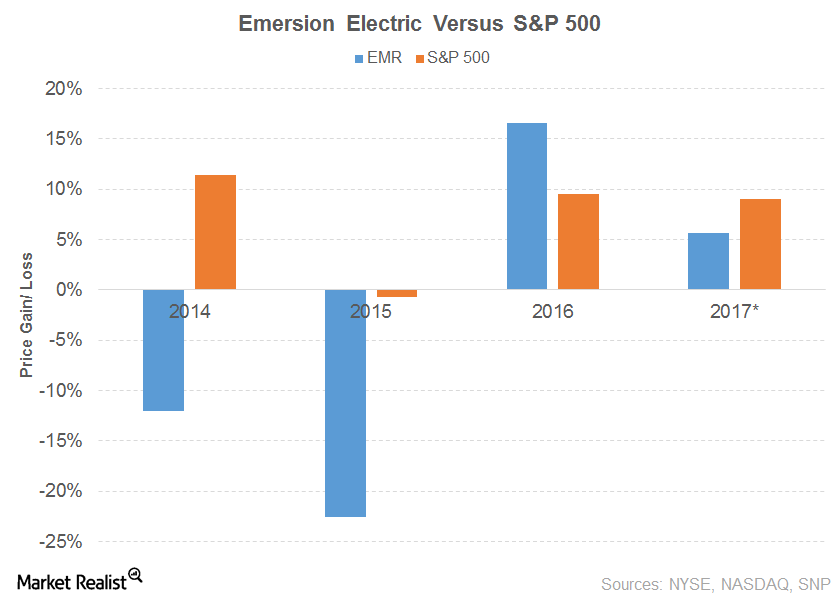

Emersion Electric’s Dividend Woes

Emersion Electric’s (EMR) 2016 net sales fell 11.0% due to a fall in every segment.

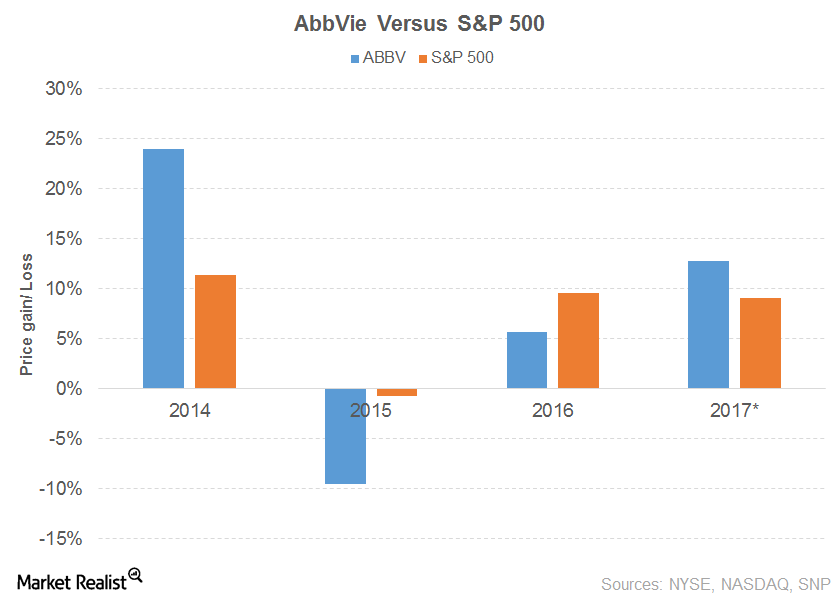

What Does AbbVie’s Dividend Curve Look Like?

AbbVie (ABBV) recorded a 12.0% rise in net revenue for 2016, mainly driven by Humira and Imbruvica.

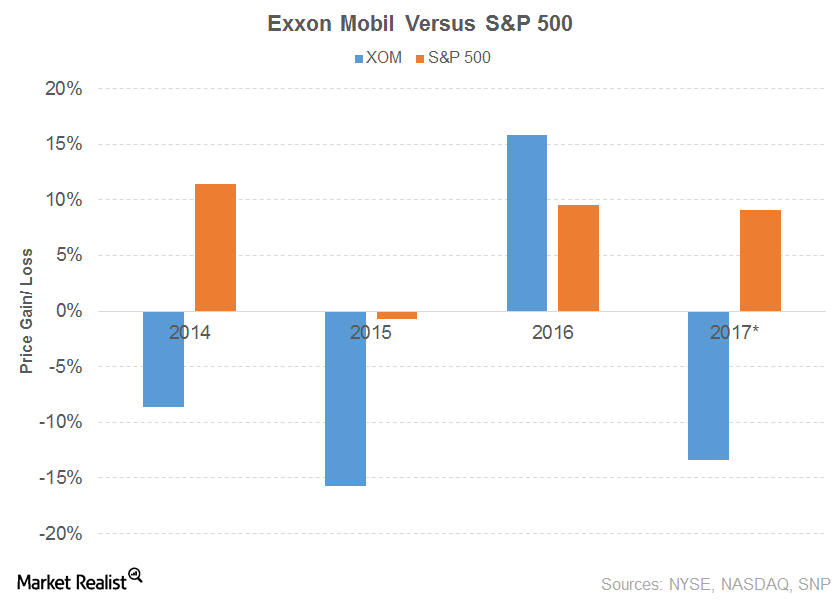

ExxonMobil’s Journey as a Dividend Aristocrat

ExxonMobil’s (XOM) story is similar to Chevron’s. The company’s sales and other operating revenue for 2016 fell 16.0%.

How Are Dividends of Caterpillar and Walmart Trending?

Caterpillar’s (CAT) growth of 7.0% in total sales and revenues for the first half of 2017 were mainly driven by sales of the machinery, energy, and transportation segment.