Amanda Lawrence

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Amanda Lawrence

Have Intel and Procter & Gamble Been Able to Increase Dividends?

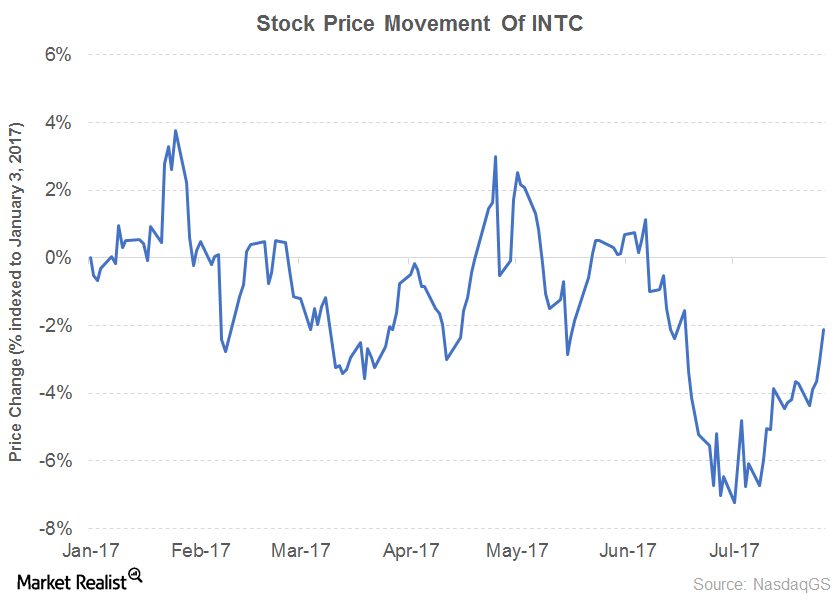

Intel (INTC) released its 2Q17 results on July 27, 2017. The company’s revenue and EPS for the first half of 2017 rose 8.5% and 72.0%, respectively.

Analyzing the Dividend Curves of General Electric and Cisco Systems

General Electric’s (GE) revenue fell 7.0% in the first half of 2017, driven by its energy connections and lighting business.

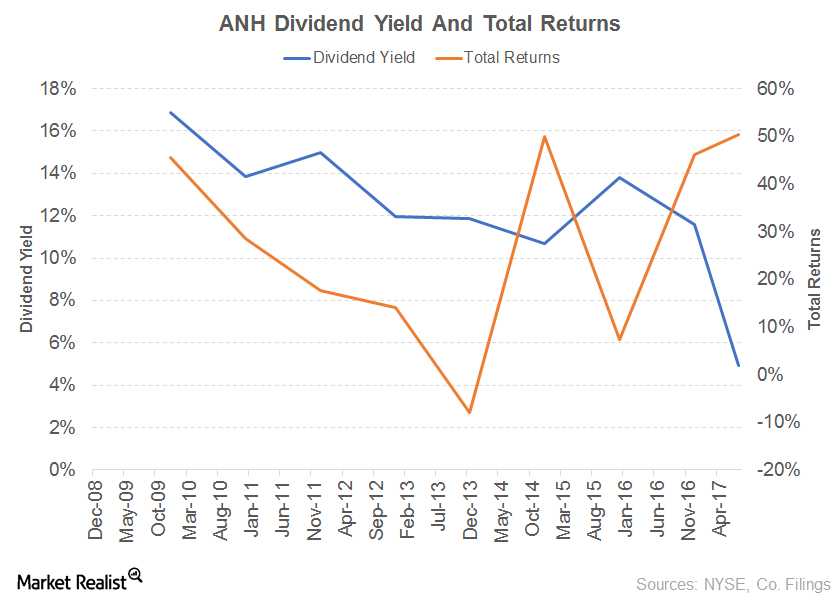

Anworth Mortgage Paid 338.8% of Earnings in Dividends in 2016

Anworth Mortgage (ANH) paid 338.8% of its earnings as dividends in 2016 compared to 102.1% in 1Q17.

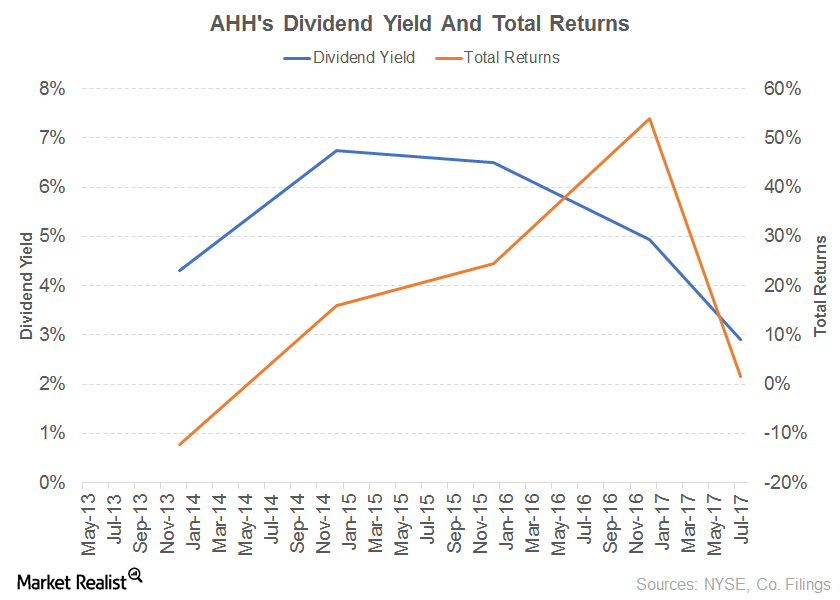

Armada Hoffler Properties’ Dividend Yield

Armada Hoffler Properties has recorded a dividend yield of 2.9% and total returns of 1.5% on a YTD basis.

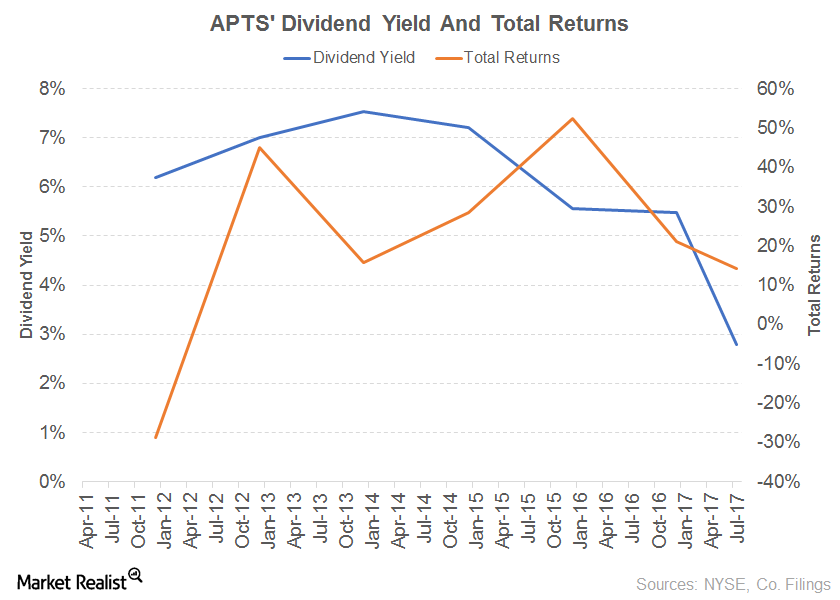

Preferred Apartment Communities’ Dividend Background

Preferred Apartment Communities (APTS) paid 41% of its earnings as dividends in 1Q17. It also declared a dividend in 2016 despite negative EPS.

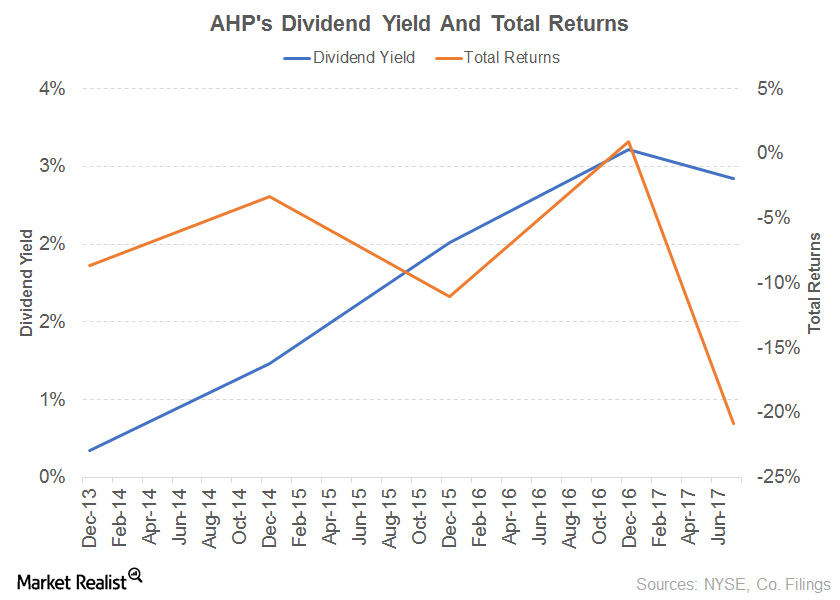

Ashford Hospitality Prime’s Dividend Confidence

Ashford Hospitality Prime (AHP) has paid 98.4% of its earnings as dividends in 2016. It also declared a dividend for 1Q17 despite negative earnings per share.

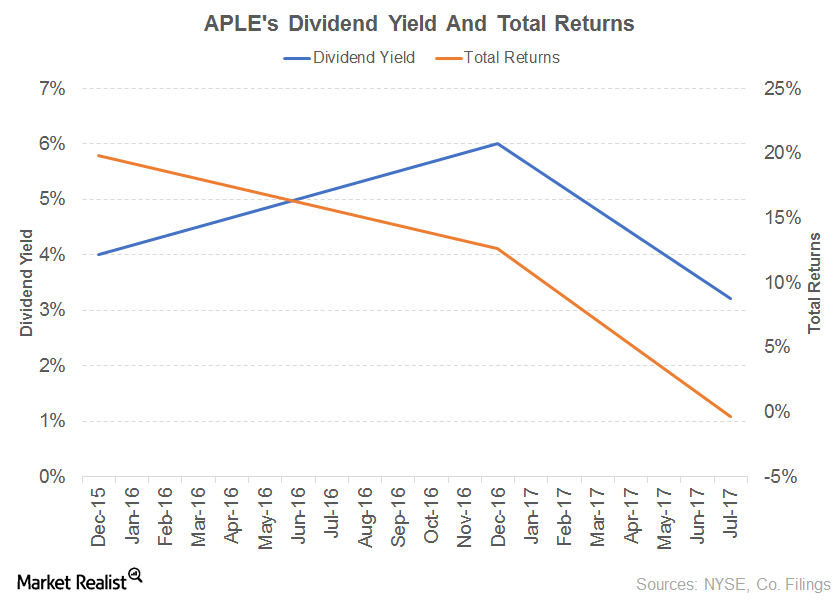

Apple Hospitality REIT’s Dividend Trends

Apple Hospitality (APLE) has paid 157.9% of its earnings as dividends in 2016 compared to 200.0% in 1Q17.

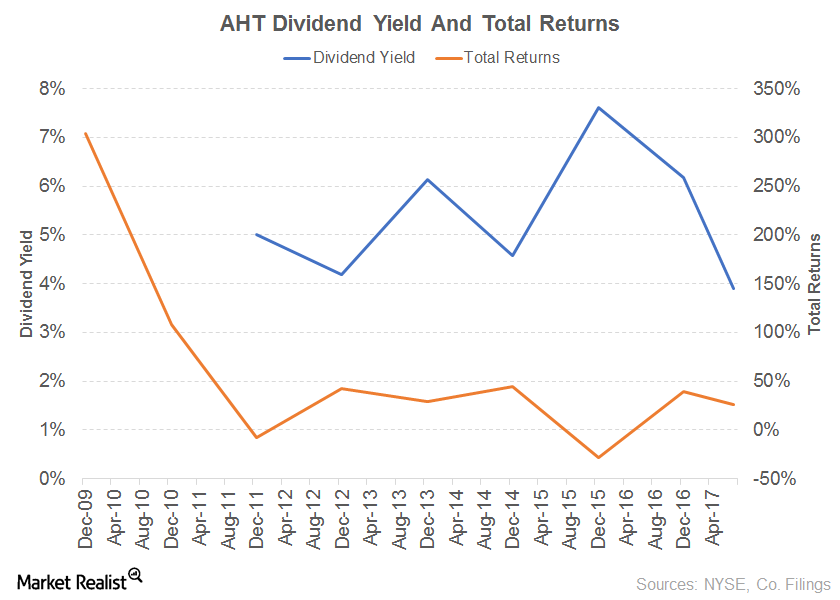

Ashford Hospitality Trust’s Dividend Woes

Ashford Hospitality Trust (AHT) didn’t declare a dividend between September 15, 2008, and February 24, 2011.

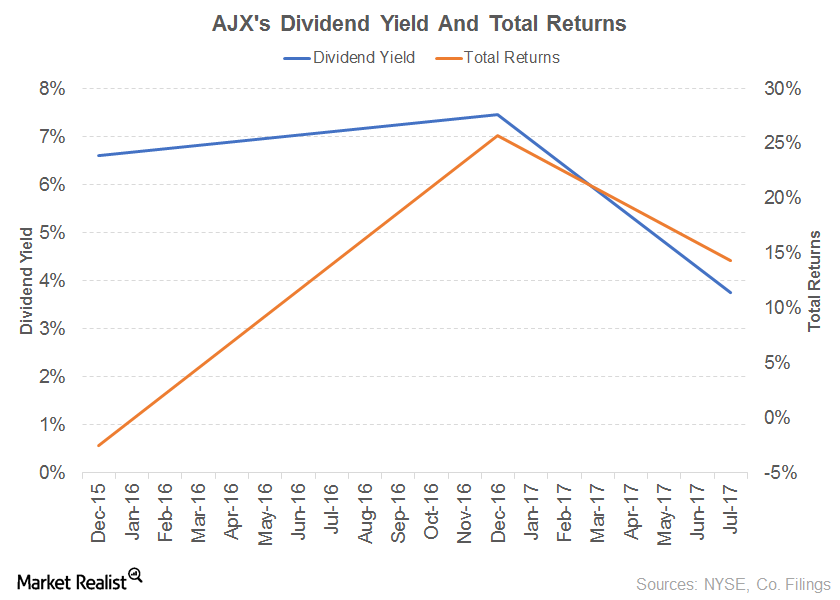

Great Ajax’s Dividend Performance

Great Ajax (AJX) has recorded a dividend yield of 3.8% and total returns of 14.3% on a year-to-date basis.

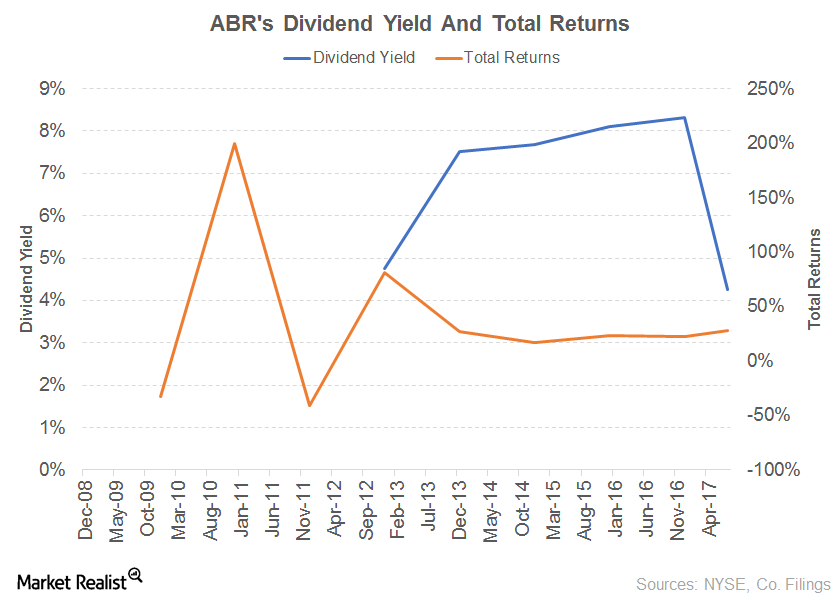

Arbor Realty Trust’s Dividend Growth Prospects

Arbor Realty Trust (ABR) paid 74.1% of its earnings as dividends in 2016 compared to 56.7% in 1Q17.

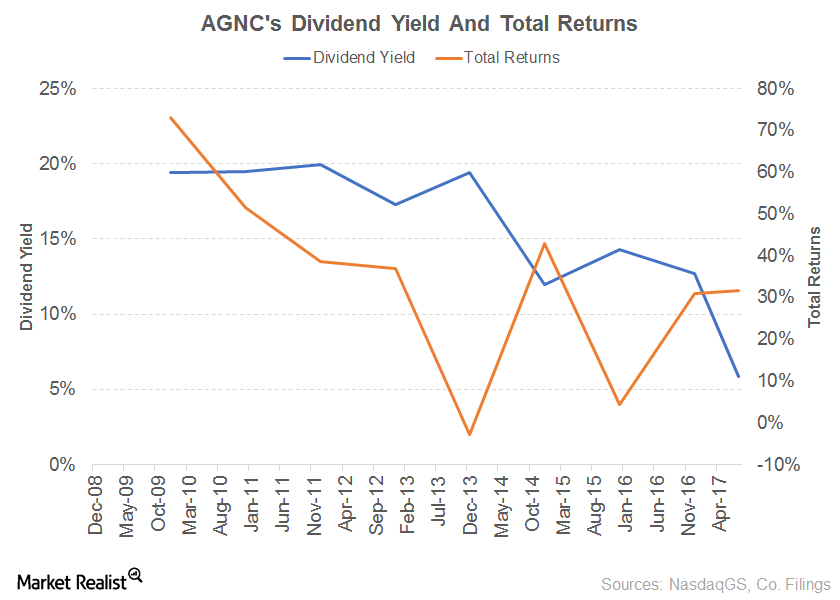

American Capital Agency: A 5-Year Slump in Funds from Operations

American Capital Agency (AGNC) paid 134.5% of its earnings as dividends in 2016 compared to 257.1% in 1Q17.

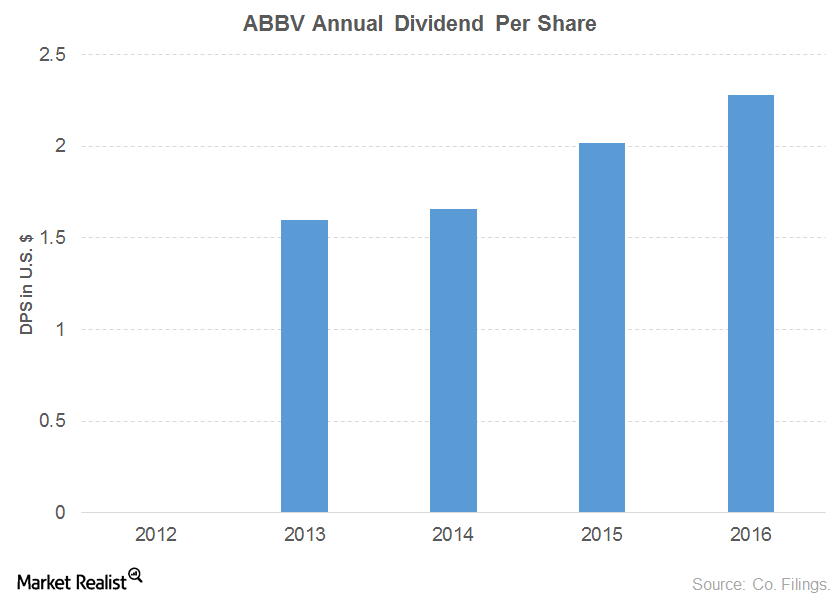

The Top Dividend-Growing Healthcare and Industrials Stocks

The sector has seen the weakest growth in its top and bottom lines due to uncertainty in terms of sector reforms.

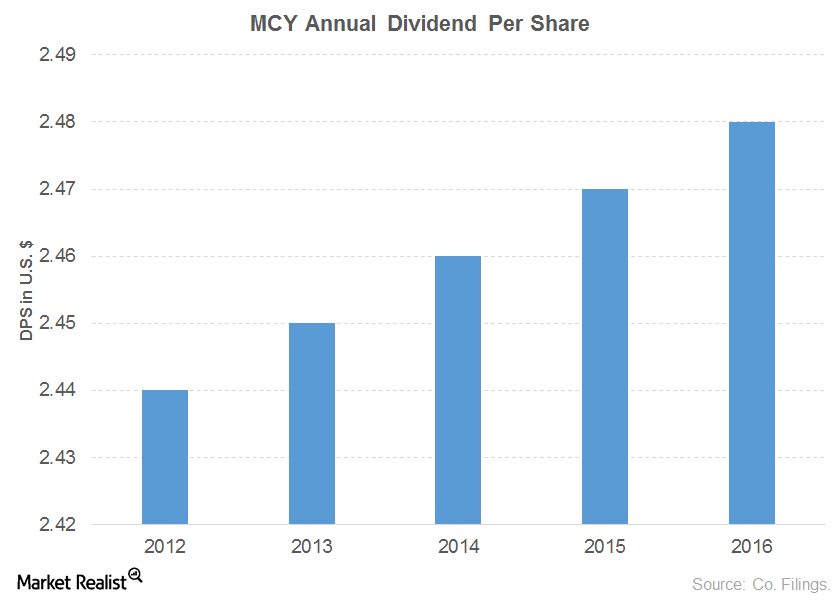

The Top Dividend-Growing Financial Sector Stocks

Mercury General (MCY) has consistently recorded revenue growth since fiscal 2011, except for a minor decline in fiscal 2015

Consumer Discretionary: Which Are the Top Dividend Growers?

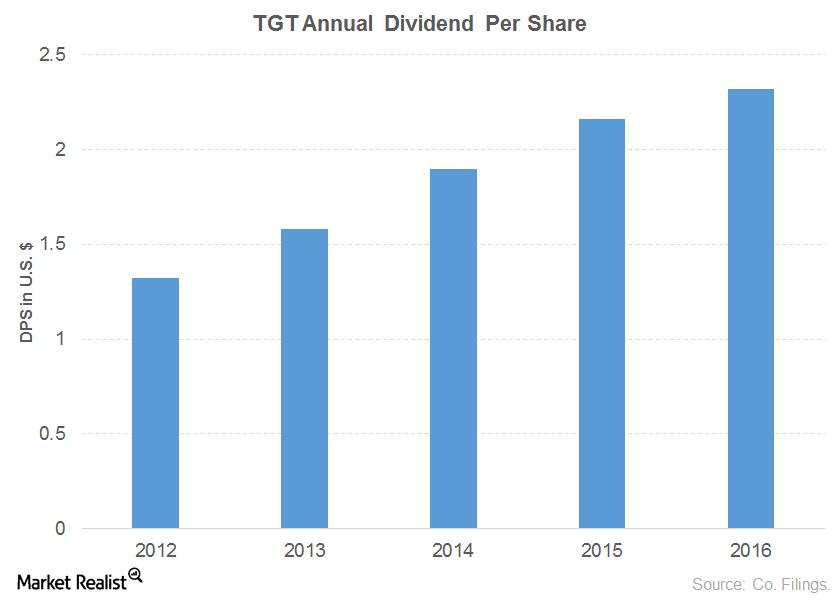

Consumer Discretionary Select Index sales, earnings, and dividends have grown at a CAGR (compound annual growth rate) of 6%, 7.2%, and 10.7%, respectively between 2012 and 2017.

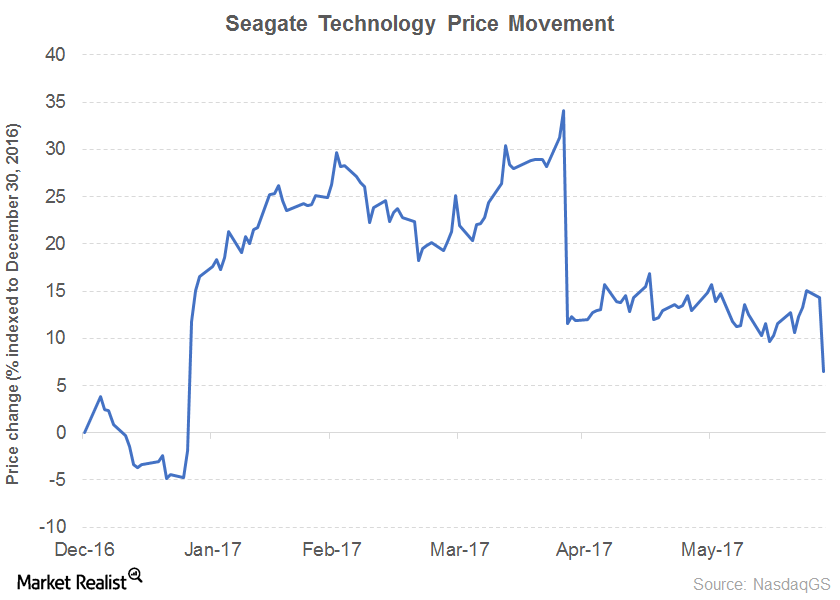

Dividend Growth of Seagate Technology and Garmin

Garmin (GRMN) recorded three-year annualized growth of 5.3%, and its five-year annualized growth fell ~1%. Its growth dipped ~24% in 2016.

IBM’s Dividend Growth Curve

For IBM (IBM), 1Q17 marked the 22nd year of annual dividend growth despite being the 20th successive quarter with no revenue growth.

Dividend Growth for Qualcomm and Crown Castle International

Qualcomm (QCOM) recorded a year-over-year decline in revenues for 2Q17 after growth in the preceding quarter.

Charts in Focus: Dividend Growth of Telus and Nielsen Holdings

Telus Corp. (TU) recorded five-year annualized growth of 11%. However, it recorded three-year annualized growth of ~2%.

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

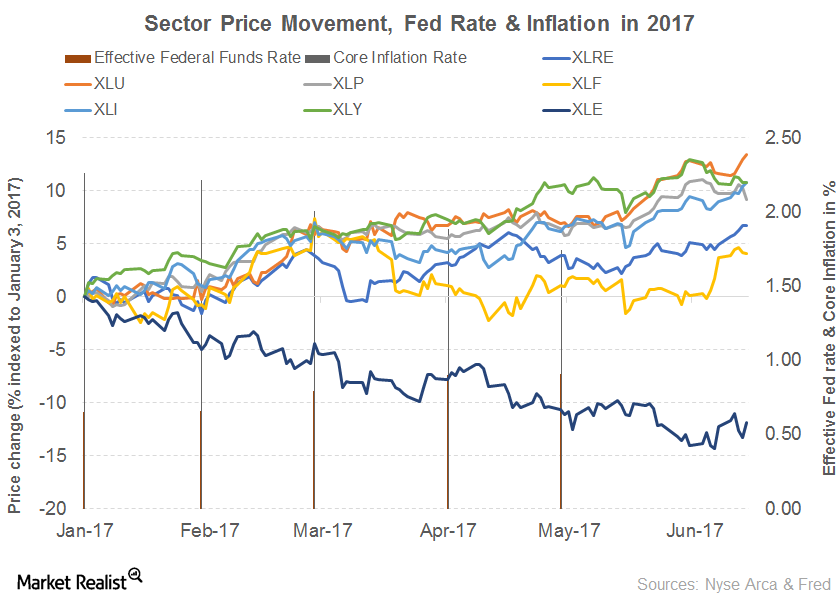

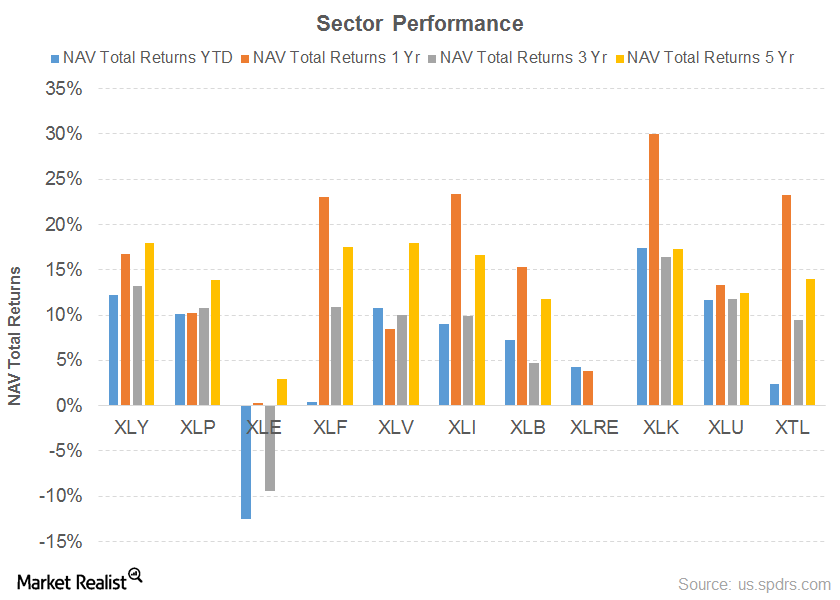

How Are the Defensive and Cyclical Sectors Performing?

If we compare the performances of the defensive sectors, we can see that their YTD performance and one-year performances have been reasonably uniform with the exception of the energy and telecom sectors.

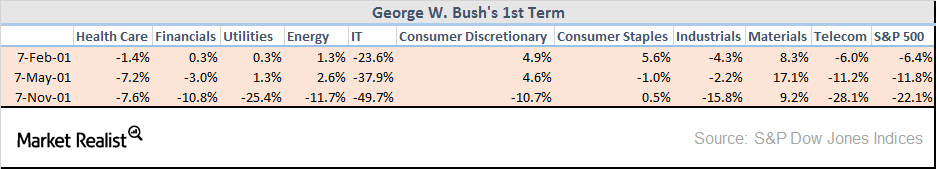

Which Sectors to Invest in If Donald Trump Wins

When Republican George H.W. Bush was elected president, the S&P 500 rose 8.5% three months after the election. It had a return of 11.2% six months after the election.