How Do Aerospace and Defense Sector Dividends Look?

This series will discuss the top ten aerospace and defense products and services companies based on their dividend yields.

Oct. 19 2017, Published 9:46 a.m. ET

Aerospace and defense (or A&D) sector revenues

Worldwide A&D revenues rose 2.4% in 2016, thereby beating the estimated global GDP growth of 2.3%. The European commercial and US defense subsectors drove the 2016 growth. Deloitte has projected 2% growth in the A&D sector for 2017 amid worldwide tensions and security concerns, volatility in the Middle East, and a higher US US Department of Defense budget. The main revenue drivers will be the defense subsector and European A&D sector. The defense subsector is expected to propel revenues given Donald Trump’s emphasis on the consolidation of the US military, which is anticipated to be offset by the commercial aerospace subsector.

The A&D sector’s dividend yield

A&D falls under the industrial sector. The industrial sector has a dividend yield of 1.9%, and prices have risen 14% on a YTD basis, while the A&D sector has a dividend yield of 1.7%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.3% and YTD price gains of 15.7%. The S&P 500 (SPX-INDEX) (SPY) has a dividend yield of 2.3% and YTD price gains of 14%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has YTD price gains of 22.7%.

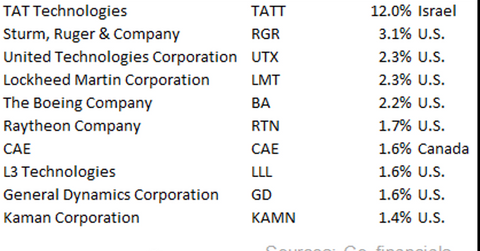

This series will discuss the top ten A&D products and services companies based on their dividend yields. All the companies on the list are domiciled in the US with the exception of TAT Technologies (TATT) in Israel and CAE (CAE) in Canada.

Now let’s look at a few important ETFs. The PowerShares Aerospace & Defense (PPA) has a 1.2% dividend yield and a PE of 21.3x. It has 81% exposure to industrials. The Direxion Daily Aerospace & Defense Bull 3X Shares (DFEN) has a PE of 20.7x. The First Trust Value Line Dividend Index (FVD) is a dividend ETF with 12% exposure to industrials. It has a dividend yield of 2.1% and a PE of 20.4x. The First Trust STOXX European Select Dividend Index Fund (FDD) is a dividend ETF with 14% exposure to industrials. It has a dividend yield of 3.1% and a PE of 14.5x.