Ralph Lauren Corp

Latest Ralph Lauren Corp News and Updates

LVMH May Acquire Ralph Lauren in High-Fashion Merger

Luxury mega-brand LVMH is considering merging with Ralph Lauren in a move that could define retail M&As in 2022. Here are the latest details.

These 6 Fashion Brands Are Suited Up for the Metaverse

The metaverse has reached the fashion industry as more brands are aligning with Web 3.0 initiatives. So far, six fashion brands are creating and building within the metaverse.

Ralph Lauren Wants to Target a Younger Audience With the Metaverse

Ralph Lauren has already released its fair share of digital goods and collectibles. Now, it wants to pursue younger audiences with the metaverse.

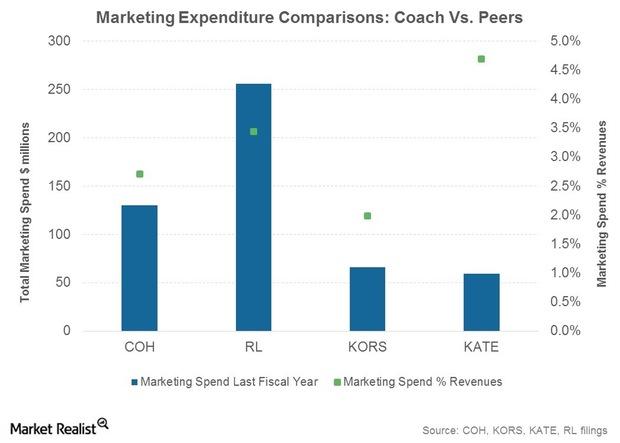

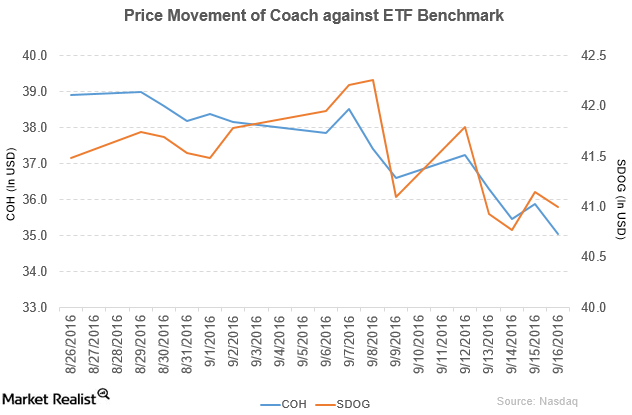

Understanding Coach’s Marketing Strategies

To support its direct marketing initiatives, Coach has a database of 24 million households in North America and 10 million in Asia.

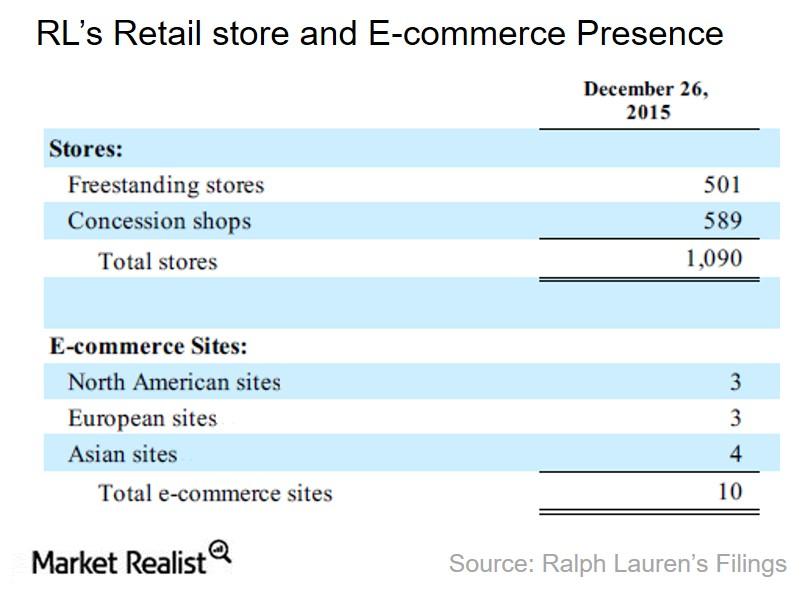

Inside Ralph Lauren’s Key Strengths, Potential Upsides, and Key Risks

Ralph Lauren’s merchandise is available through ~13,000 wholesale distribution channels, 501 retail stores, 589 shops-within-shops, and ten websites.

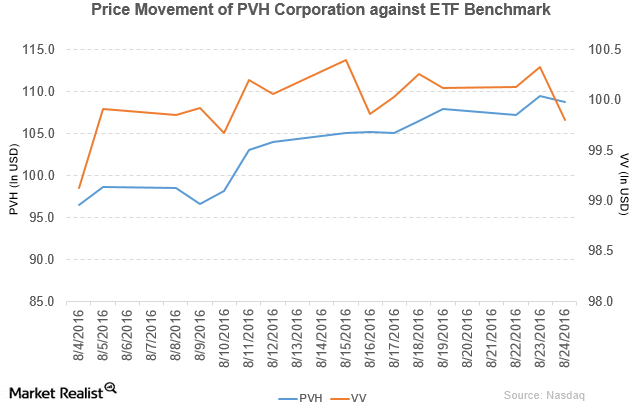

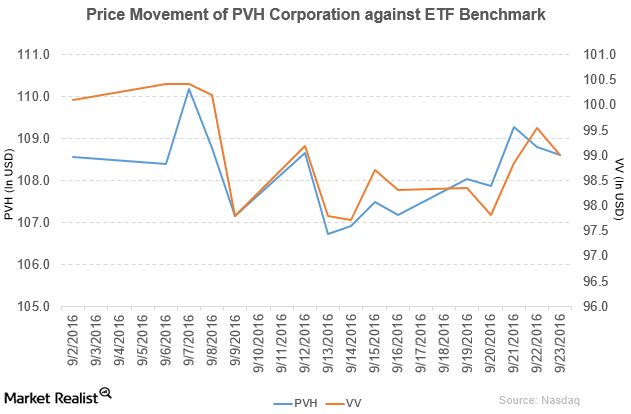

How Did PVH Corporation Perform in 2Q16?

PVH Corporation (PVH) has a market cap of $8.9 billion. It fell by 0.67% to close at $108.82 per share on August 24, 2016.

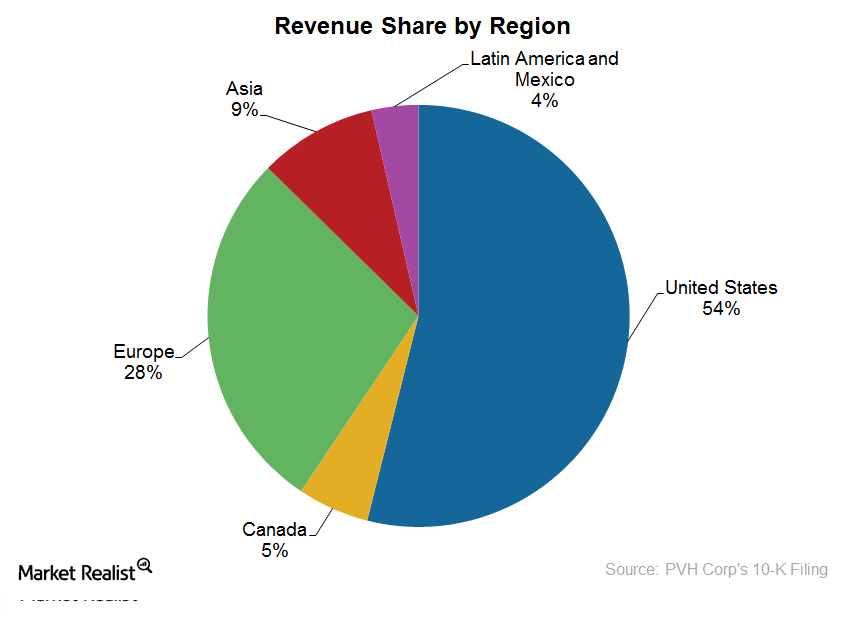

An overview of PVH’s business by geographies

We’ll look at PVH’s operations by geographies. It markets its products in over 100 countries through wholesale partners. It has over 4,700 retail locations.

Maverick Capital lowers position in Baidu, Inc.

Maverick Capital lowered its position in Baidu, Inc. in 3Q14. The position accounts for 0.36% of the fund’s total portfolio in the third quarter.

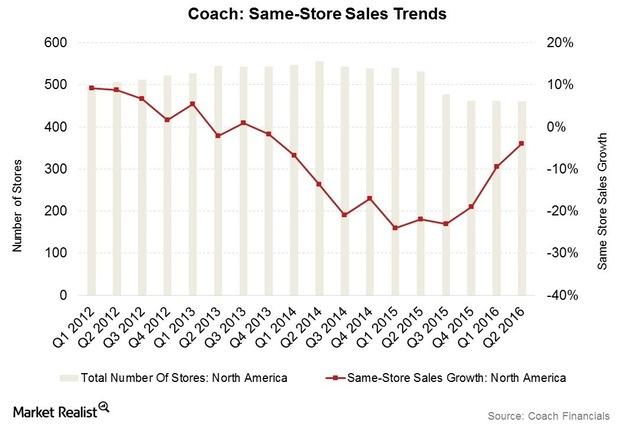

Can Coach Revive North America Same-Store Sales in Fiscal 2016?

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million.

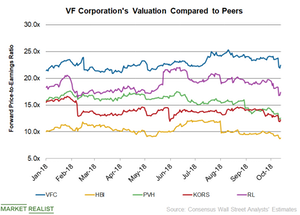

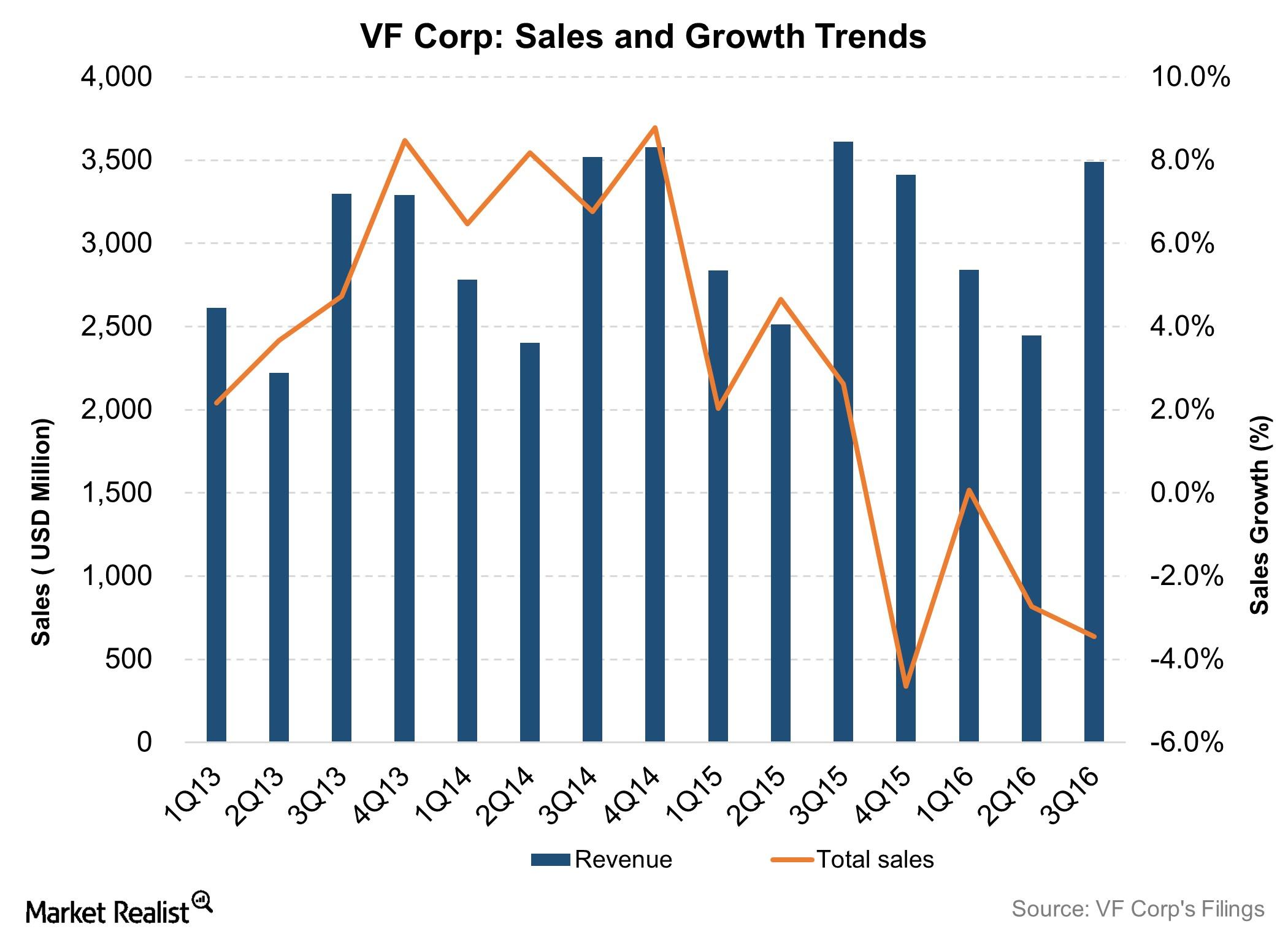

How VFC’s Valuation Compares with Peers

On October 12, VF Corporation’s (VFC) 12-month forward PE (price-to-earnings) ratio was 22.4x.

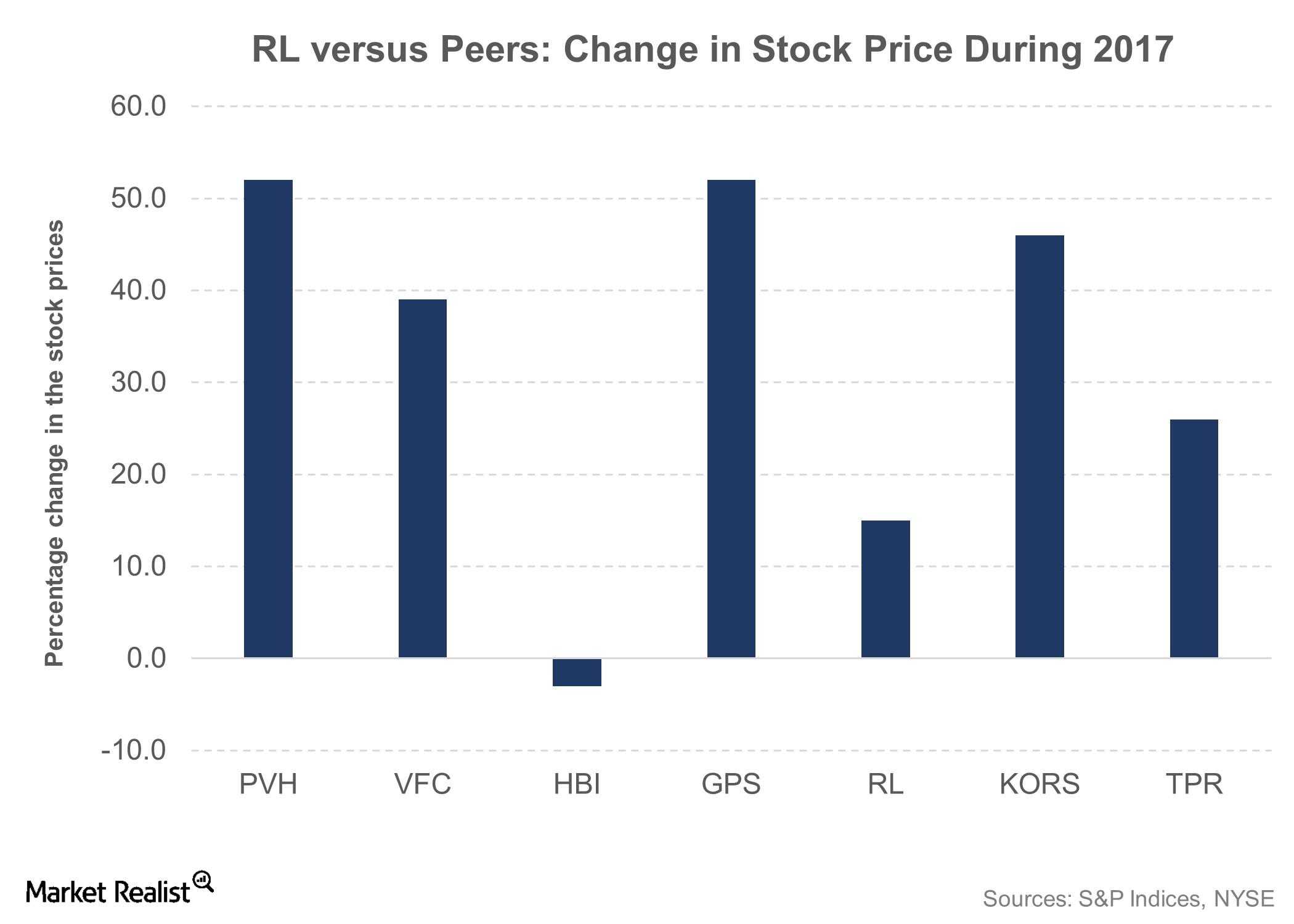

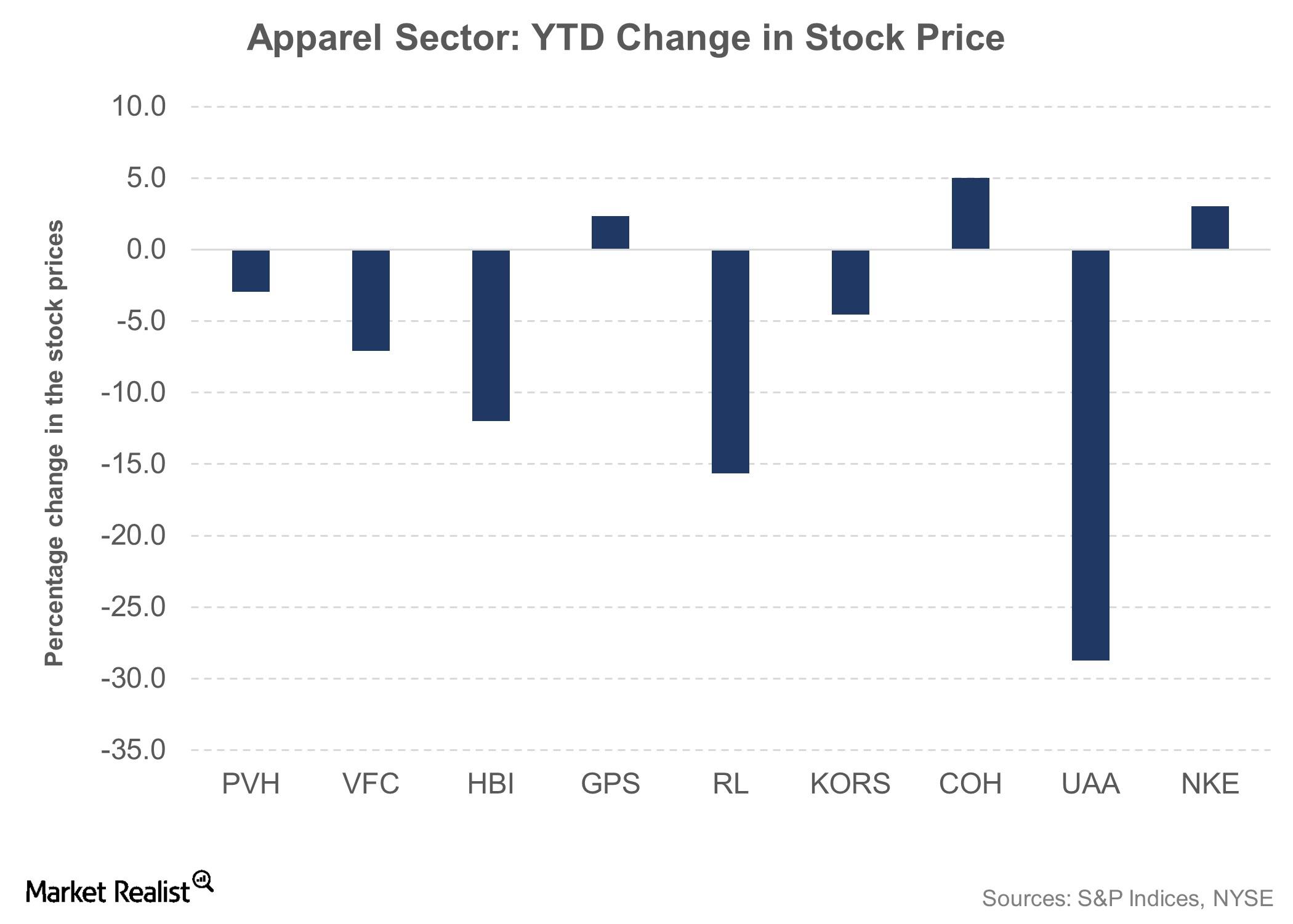

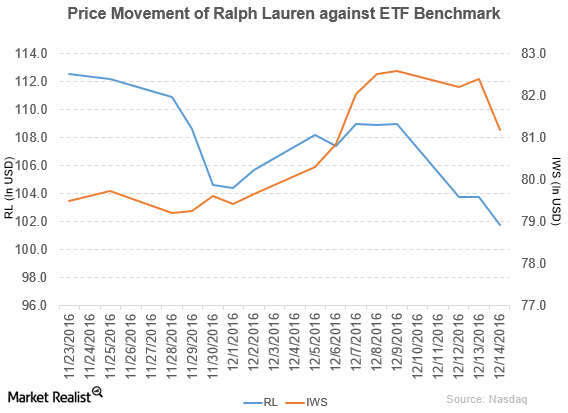

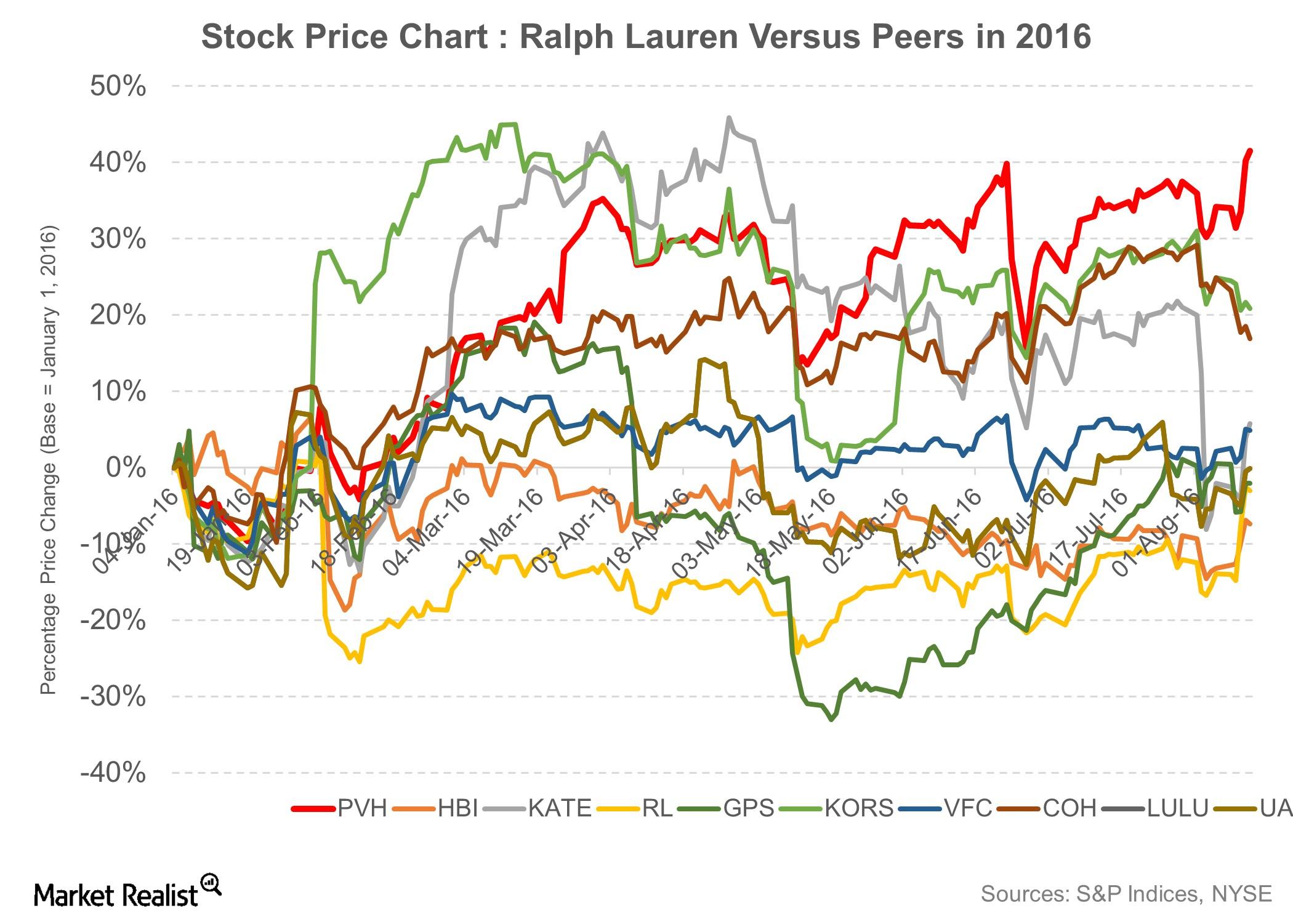

Ralph Lauren: Stock Returns and Valuations

Though Ralph Lauren (RL) has been having a tough time attracting customers, it has been able to impress investors with its stock market gains.

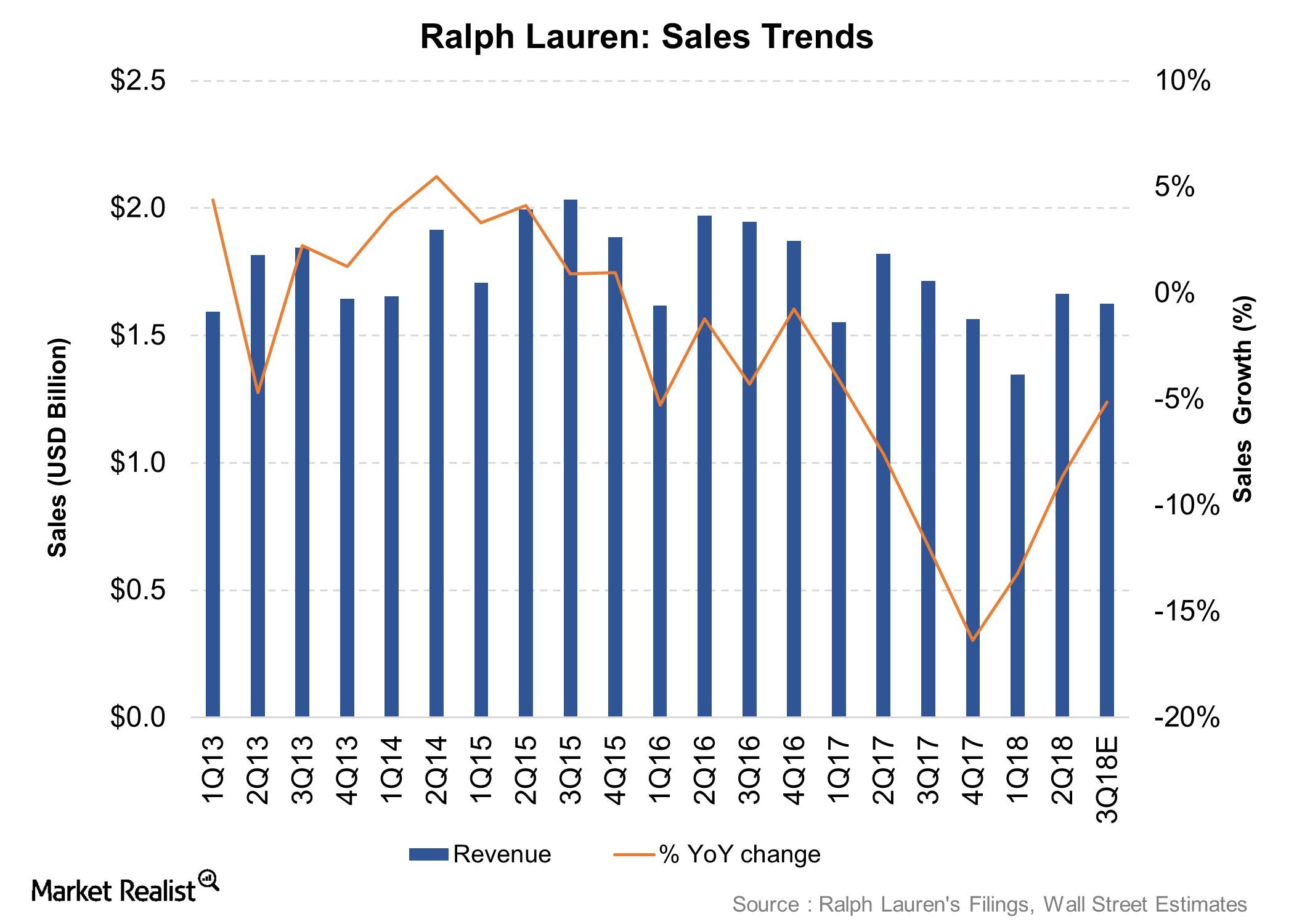

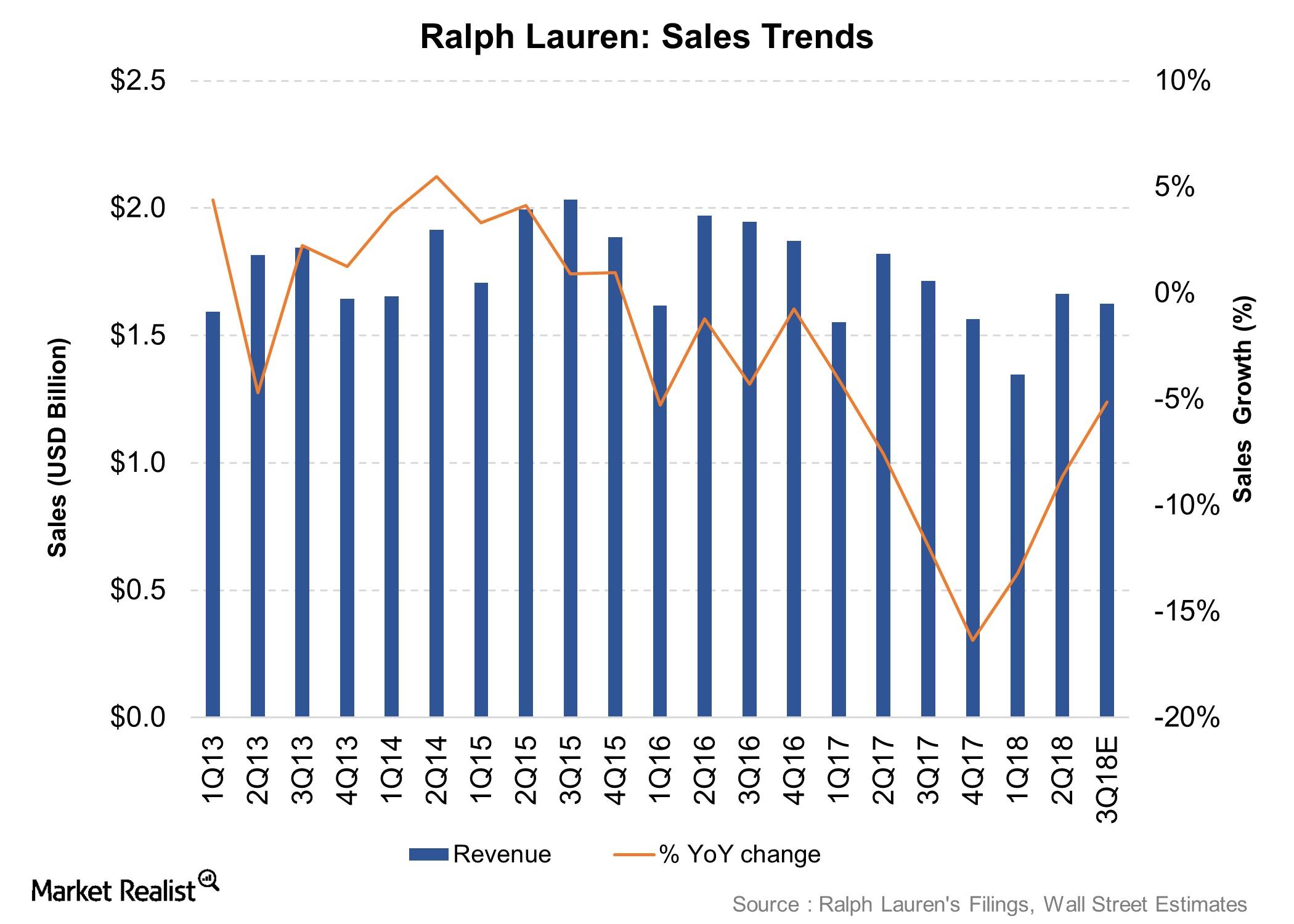

Will Ralph Lauren Struggle with Sales Growth in the Near Term?

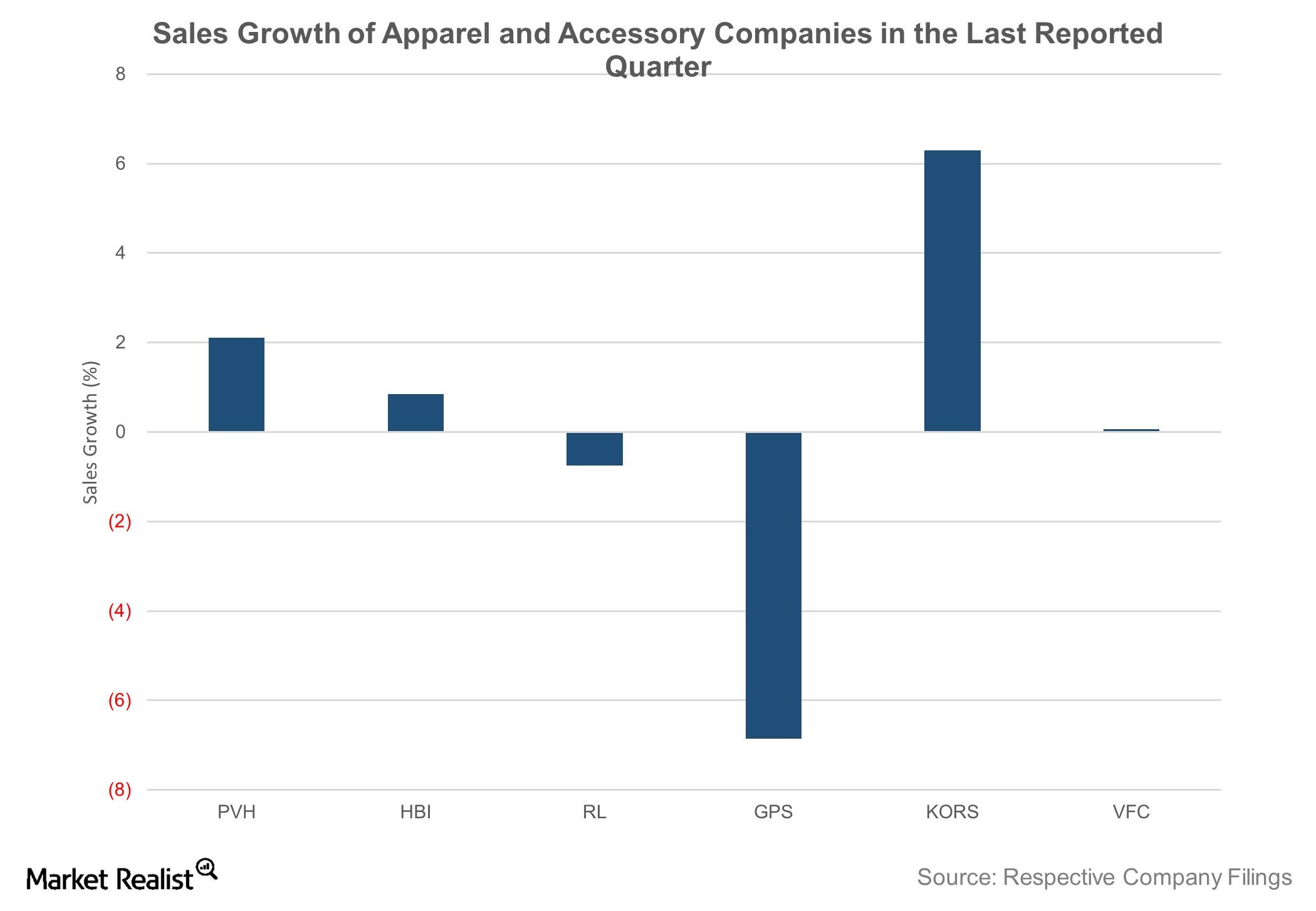

Ralph Lauren (RL) is working hard to improve its brand image and turn around its business.

Why Ralph Lauren Is Having a Tough Time

Ralph Lauren (RL), which is scheduled to report its third-quarter results on February 1, is expected to post another quarter of top-line declines.

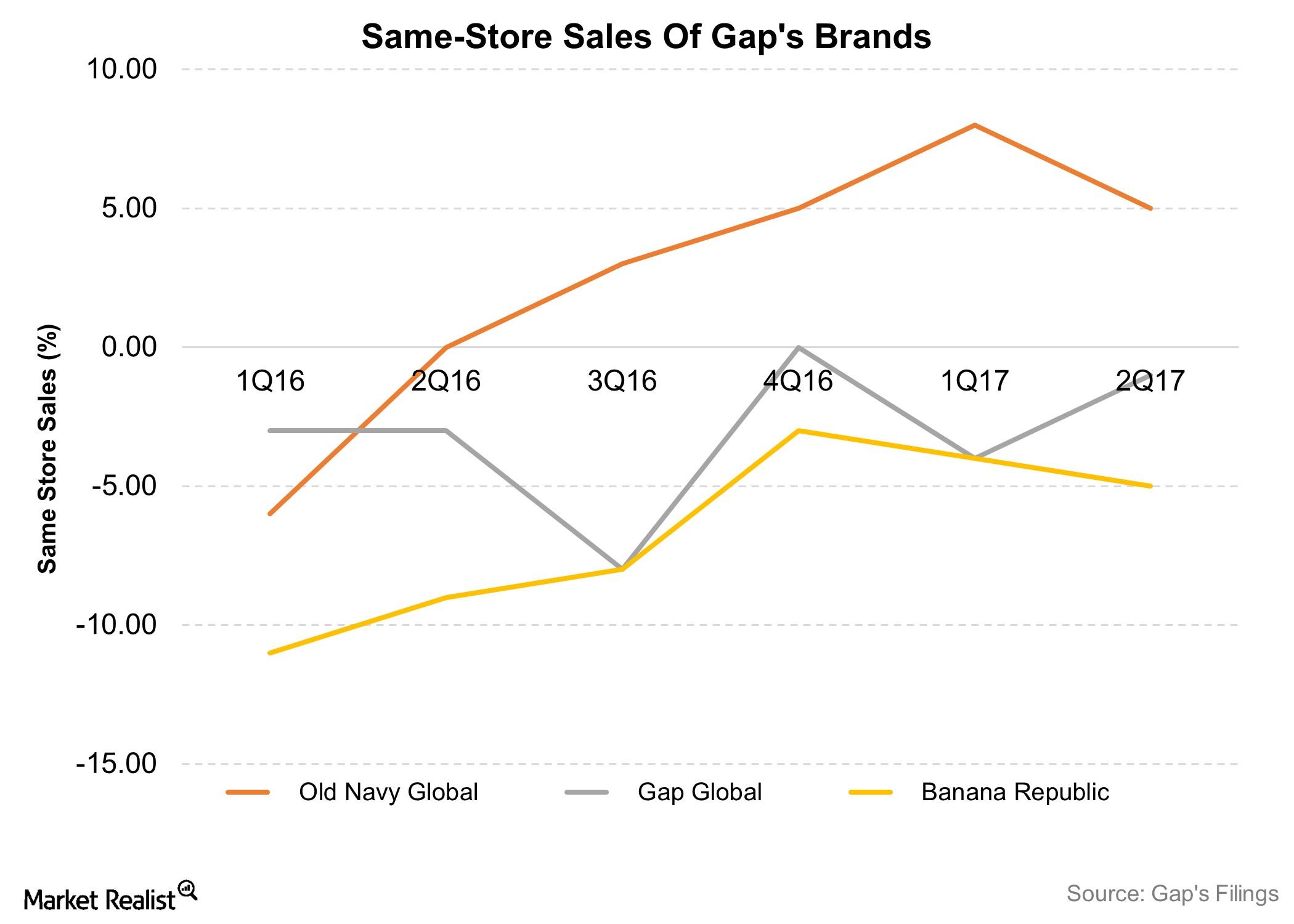

Analyzing Gap’s 2Q17 Top-Line Performance

Gap (GPS) reported total revenues of $3.8 billion in 2Q17 and beat the consensus by $30 million. On a YoY basis, the company’s top line fell 1.4%.

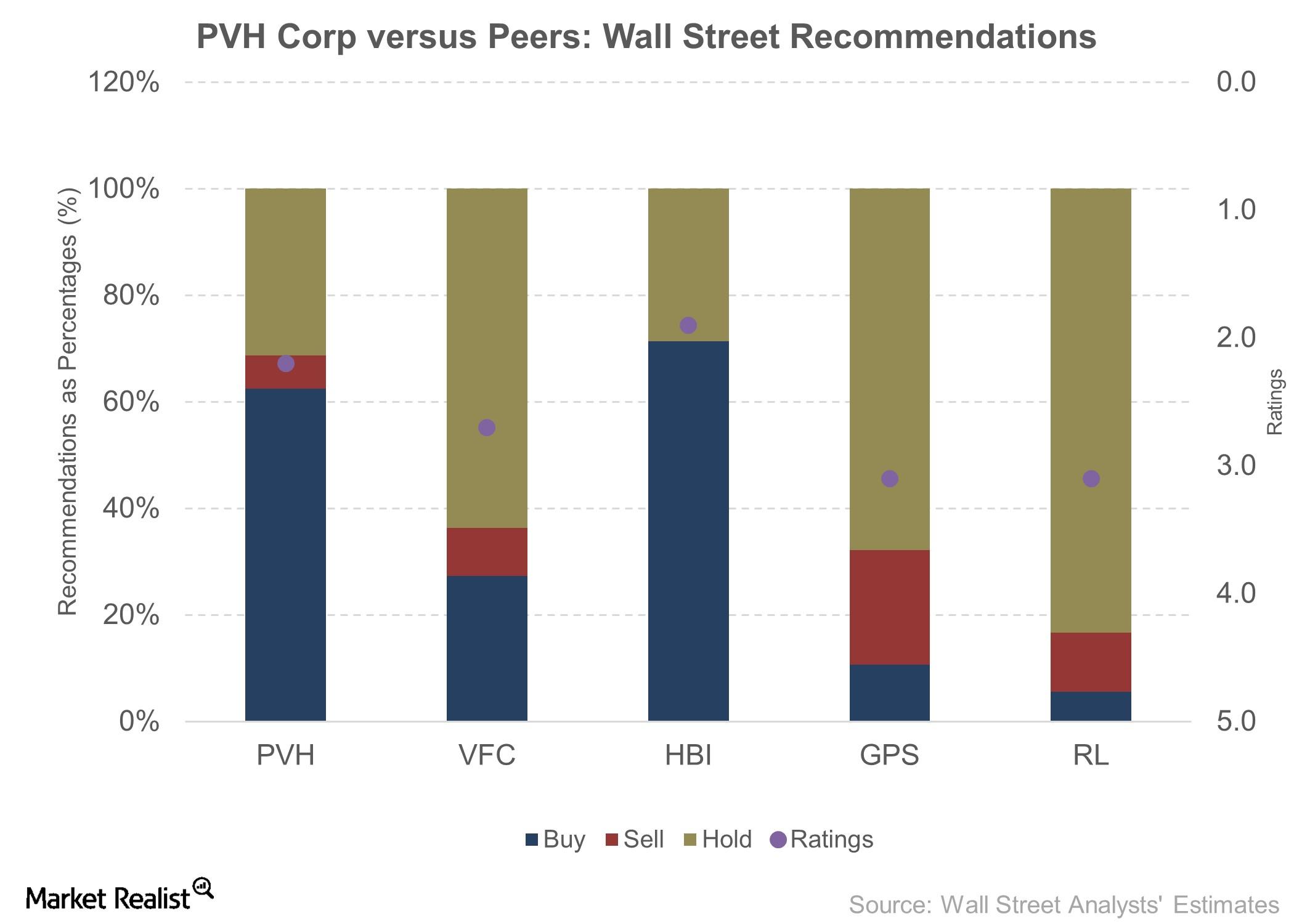

What Wall Street Thinks of PVH Corp Now

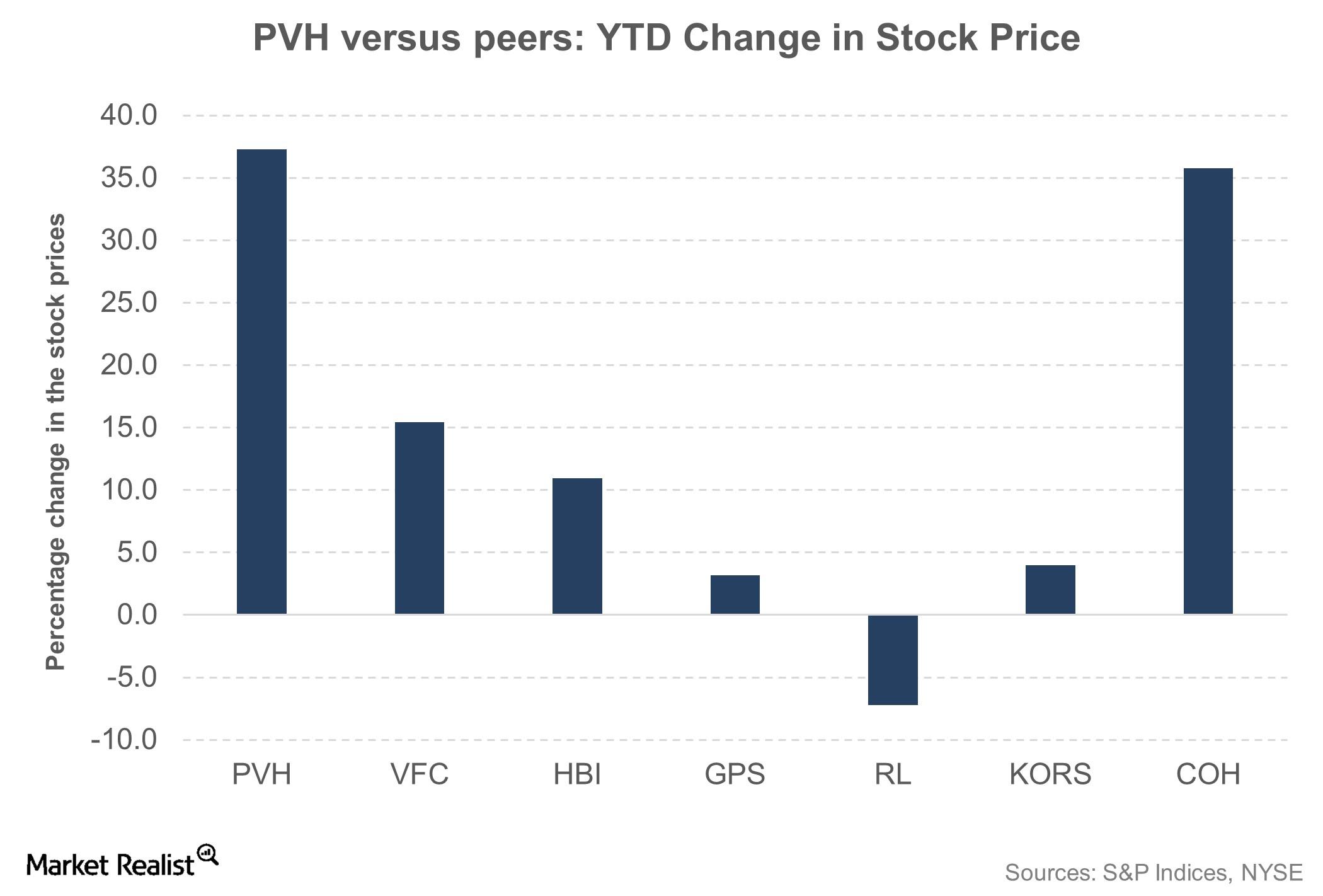

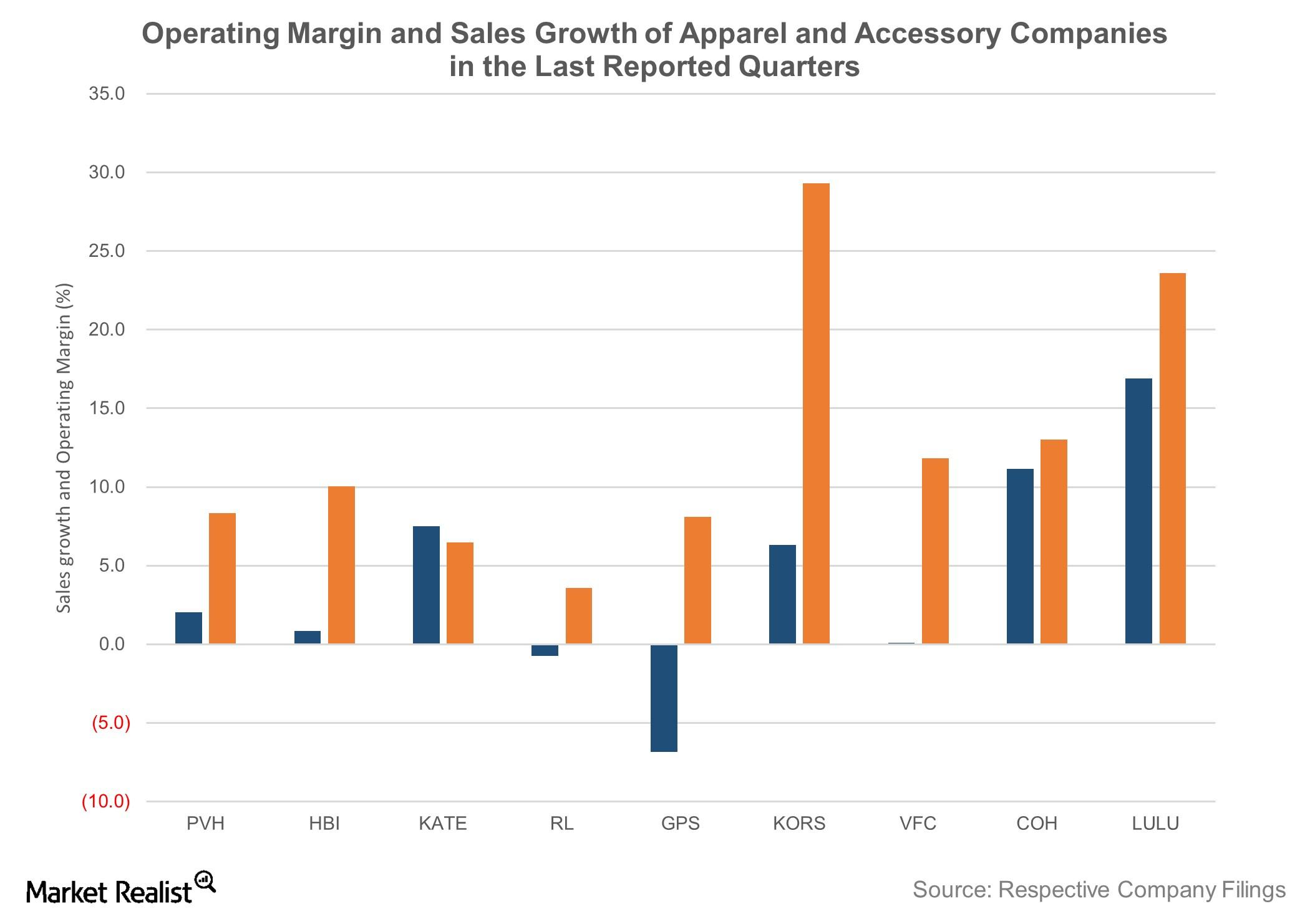

PVH’s YTD gains have outperformed Hanesbrands’ (HBI) 11%, VF Corporation’s (VFC) 15.5%, Michael Kors’s (KORS) 4%, and Ralph Lauren’s (RL) -7.2% gains.

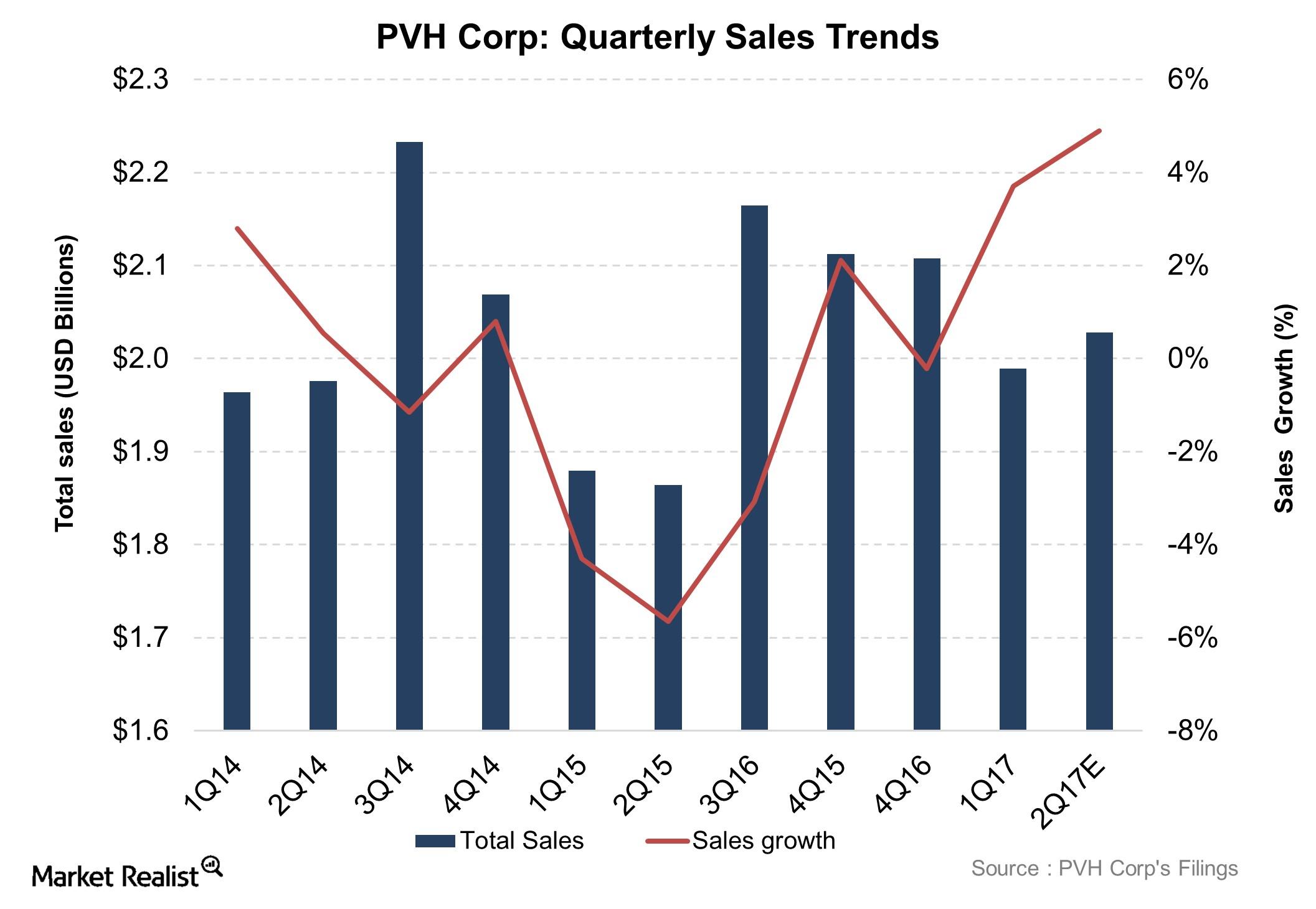

Despite Currency Headwinds, PVH Delivers Better Growth than Peers

PVH Corporation’s (PVH) top line is predicted to grow 4.9% YoY (year-over-year) in 2Q17.

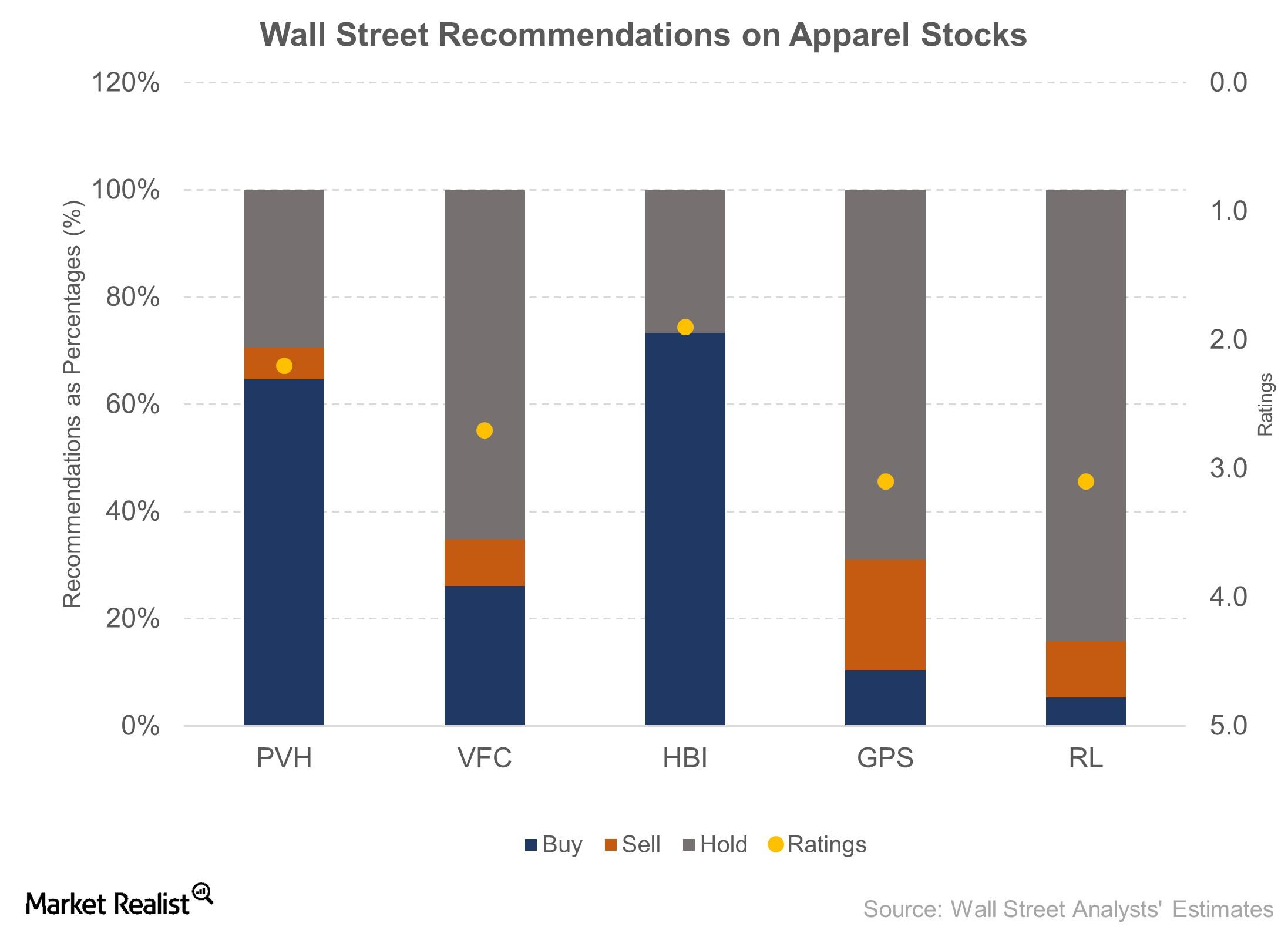

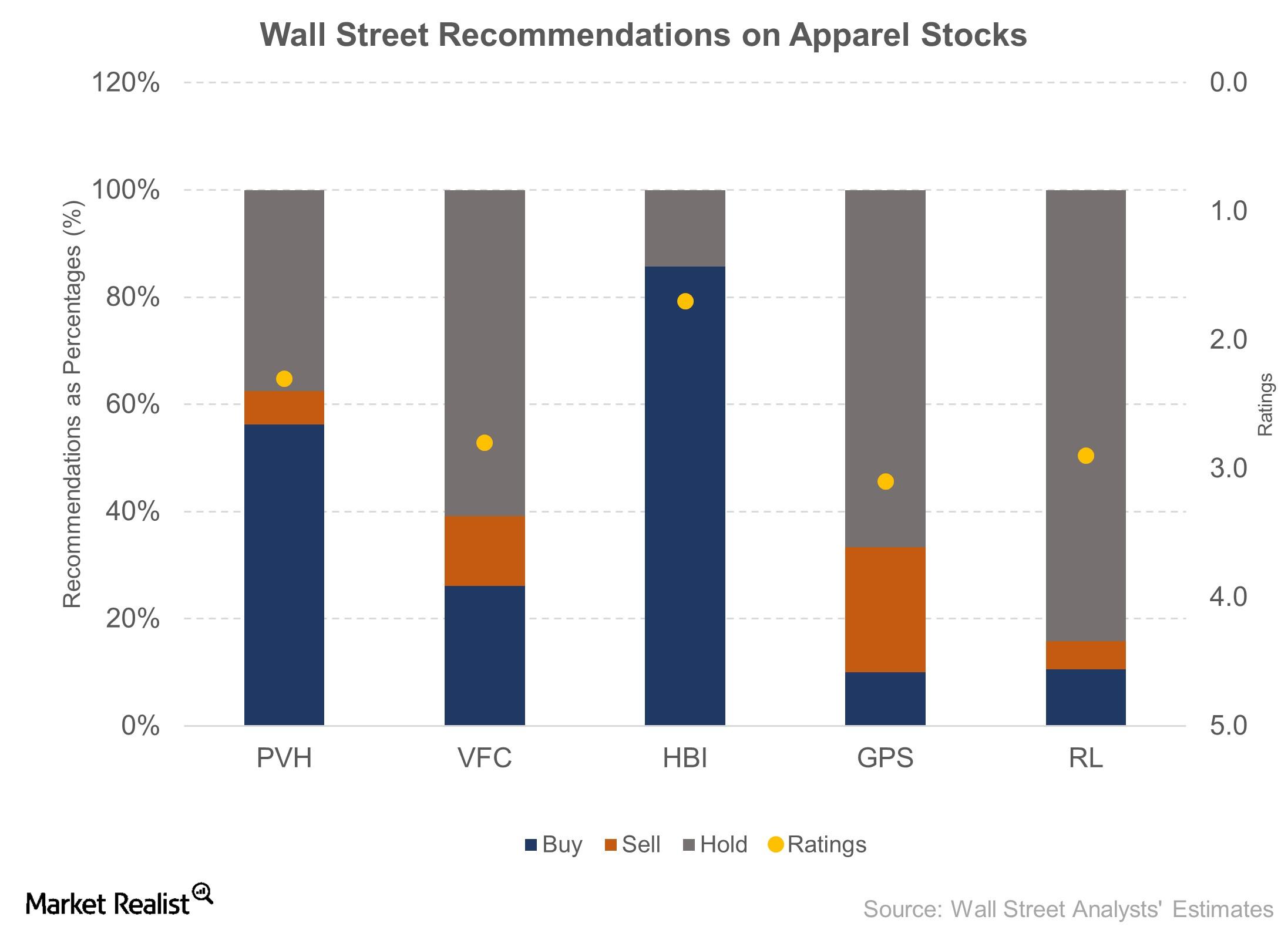

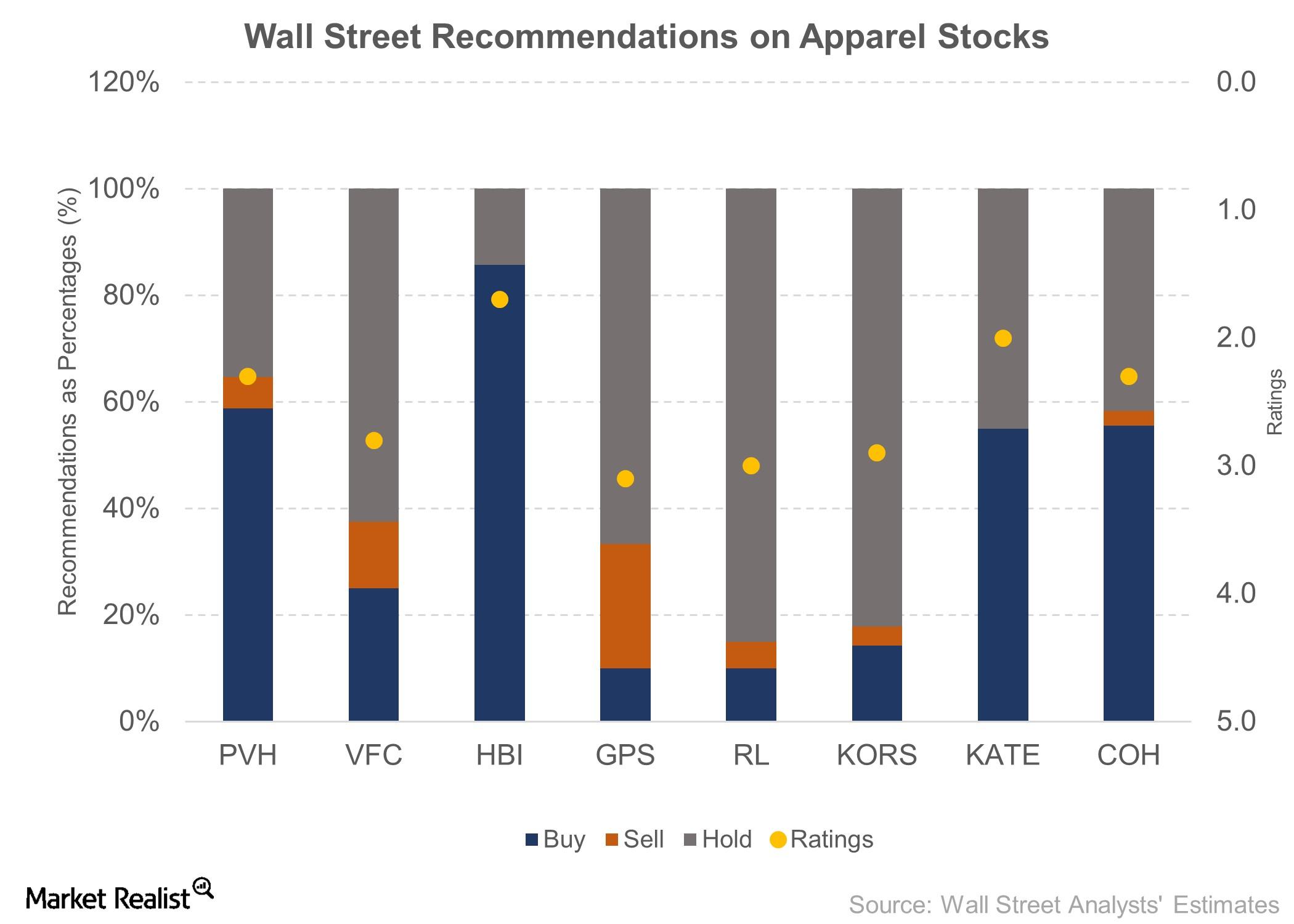

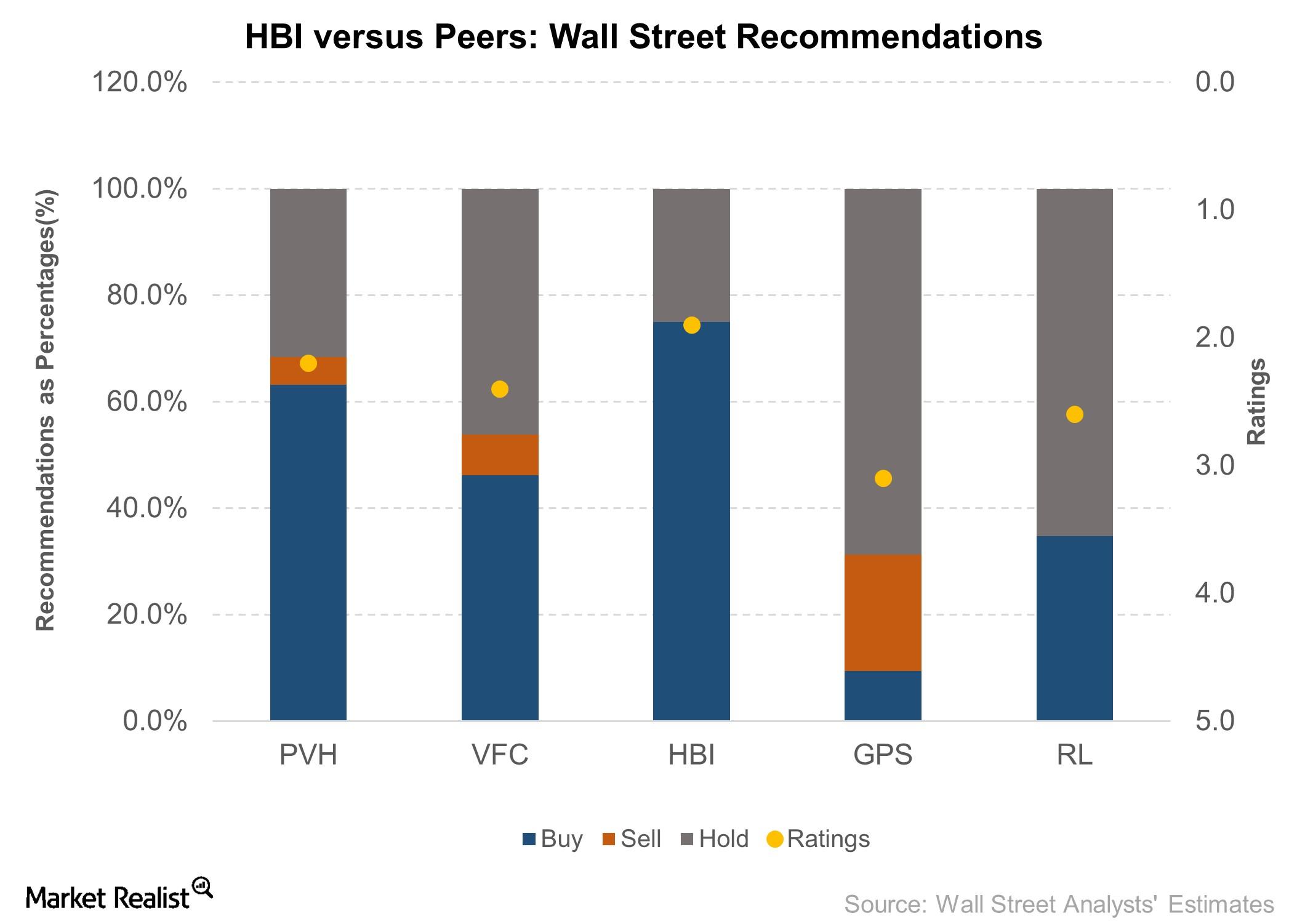

What Wall Street Recommends for VFC ahead of 2Q17 Results

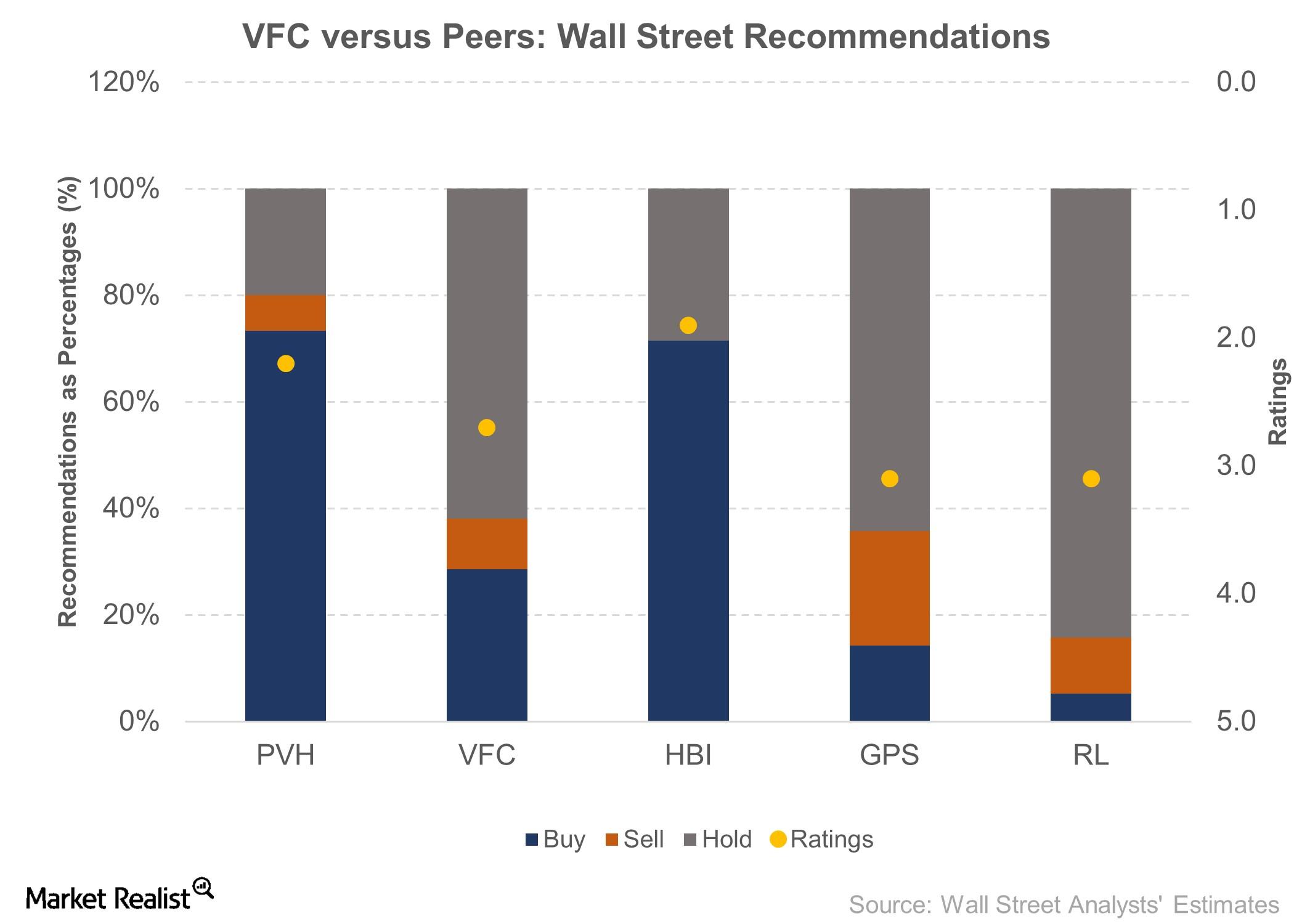

VFC is covered by 21 Wall Street analysts. It has received a 2.7 rating on a scale where one is a “strong buy” and five is a “strong sell.”

PVH Stock Rises 5% following Its 1Q17 Results

PVH Corporation (PVH) reported a strong 1Q17 on May 24, 2017, beating analysts’ consensus estimate on both its top and bottom lines.

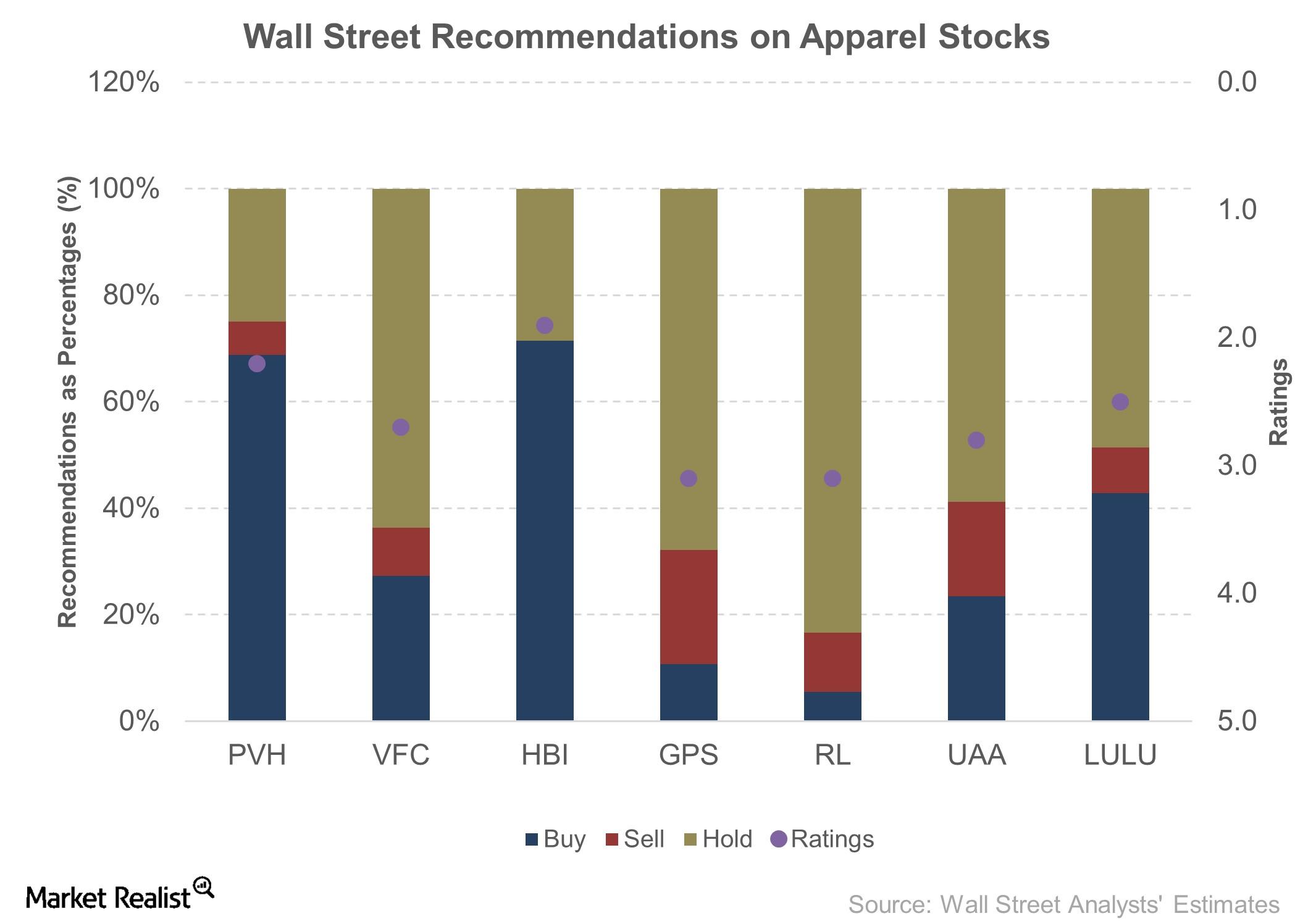

Wall Street Analysts’ View on PVH Corp Is Positive

PVH Corp stock is covered by 16 analysts—63% of the analysts recommended a “buy,” 31% recommended a “hold,” and 6% recommended a “sell.”

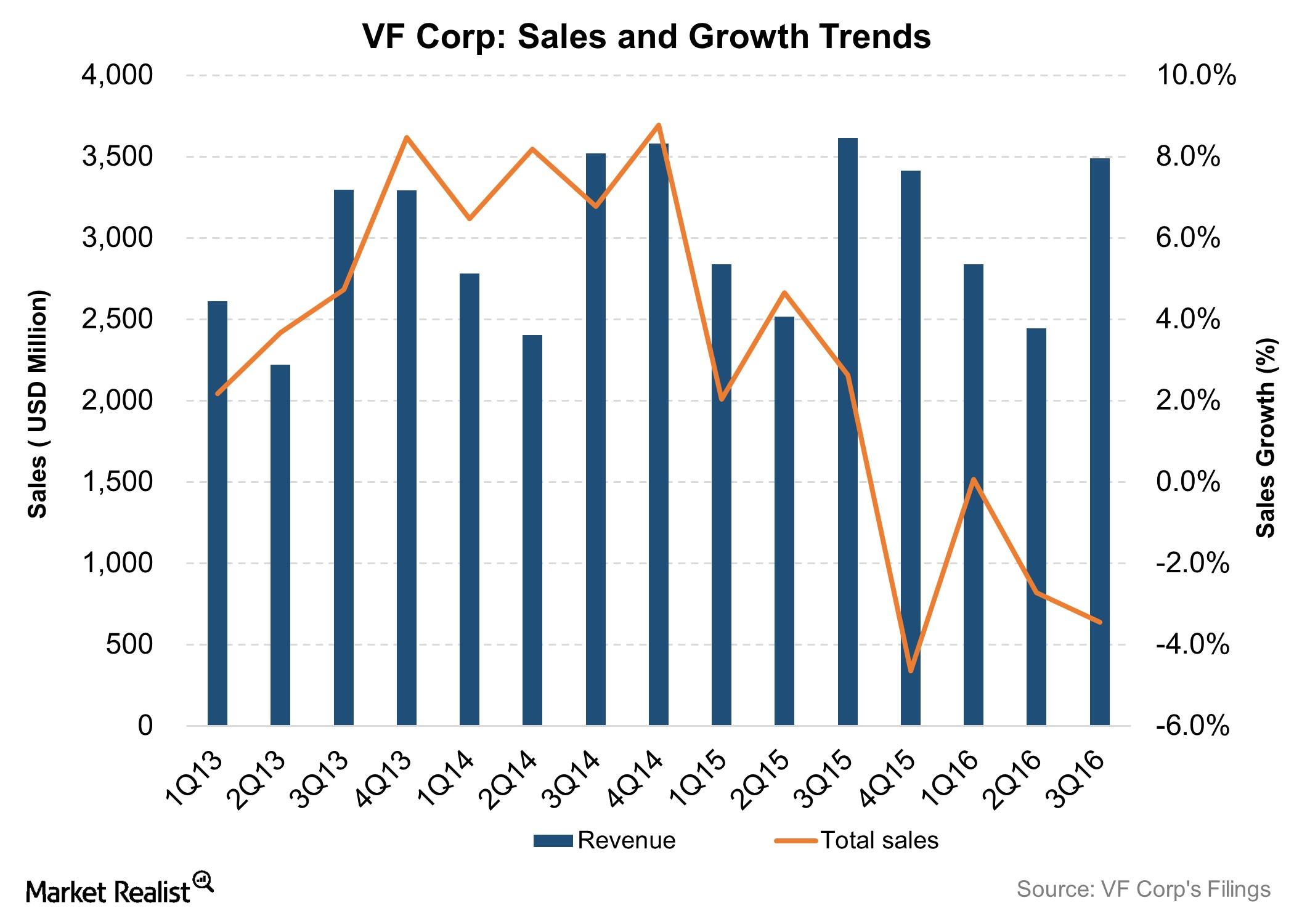

Why VF Corporation Stock Has a Downside of 4%

VFC stock is currently trading at $56.44, which is ~17.0% below its 52-week high price.

Wall Street Sees a 1% Upside on VFC Stock

VFC is covered by 23 Wall Street analysts who have a neutral view on the company. Plus, 26% of these analysts recommended a “buy,” 61% recommended a “hold,” and 13% recommended a “sell” on the stock.

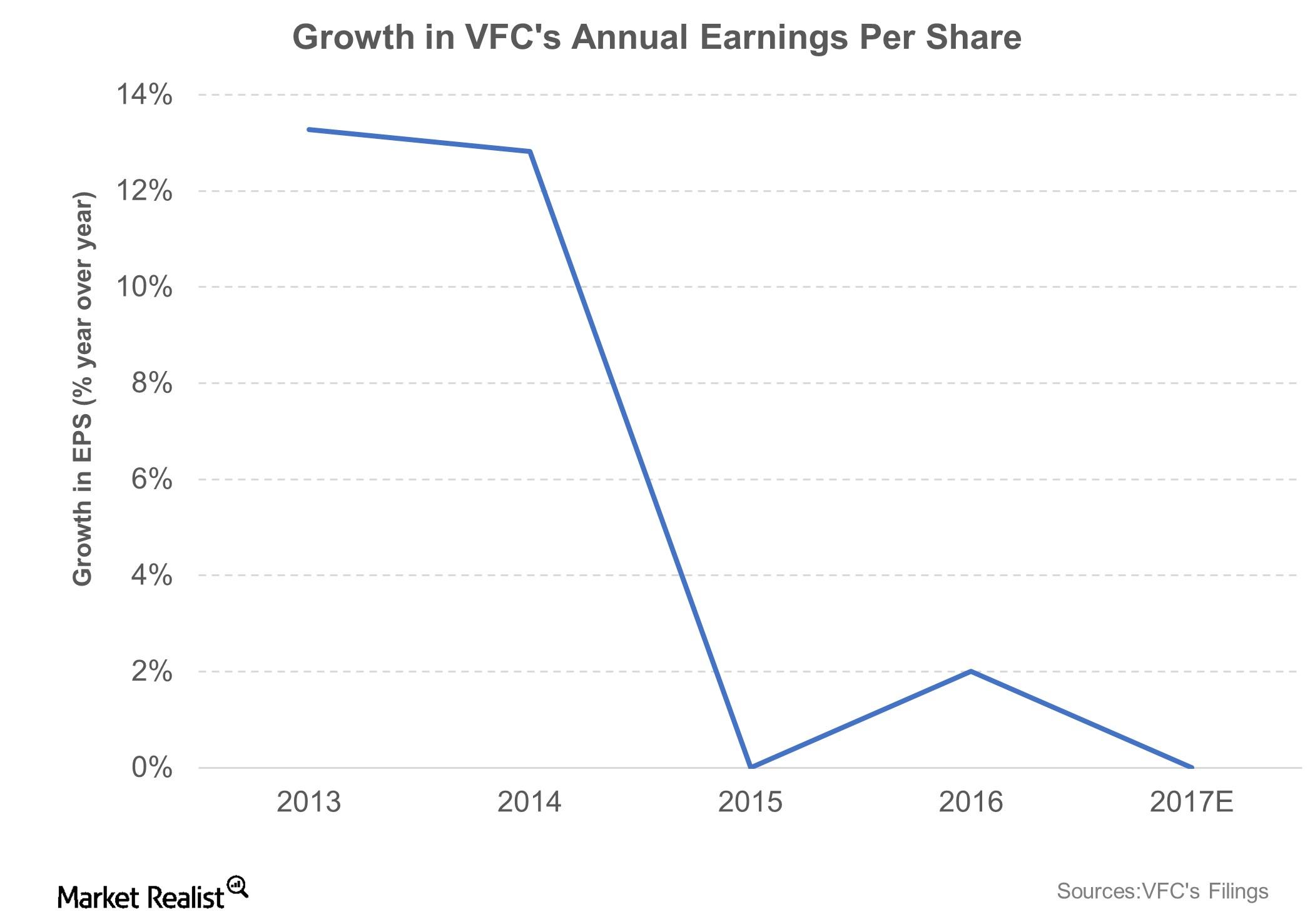

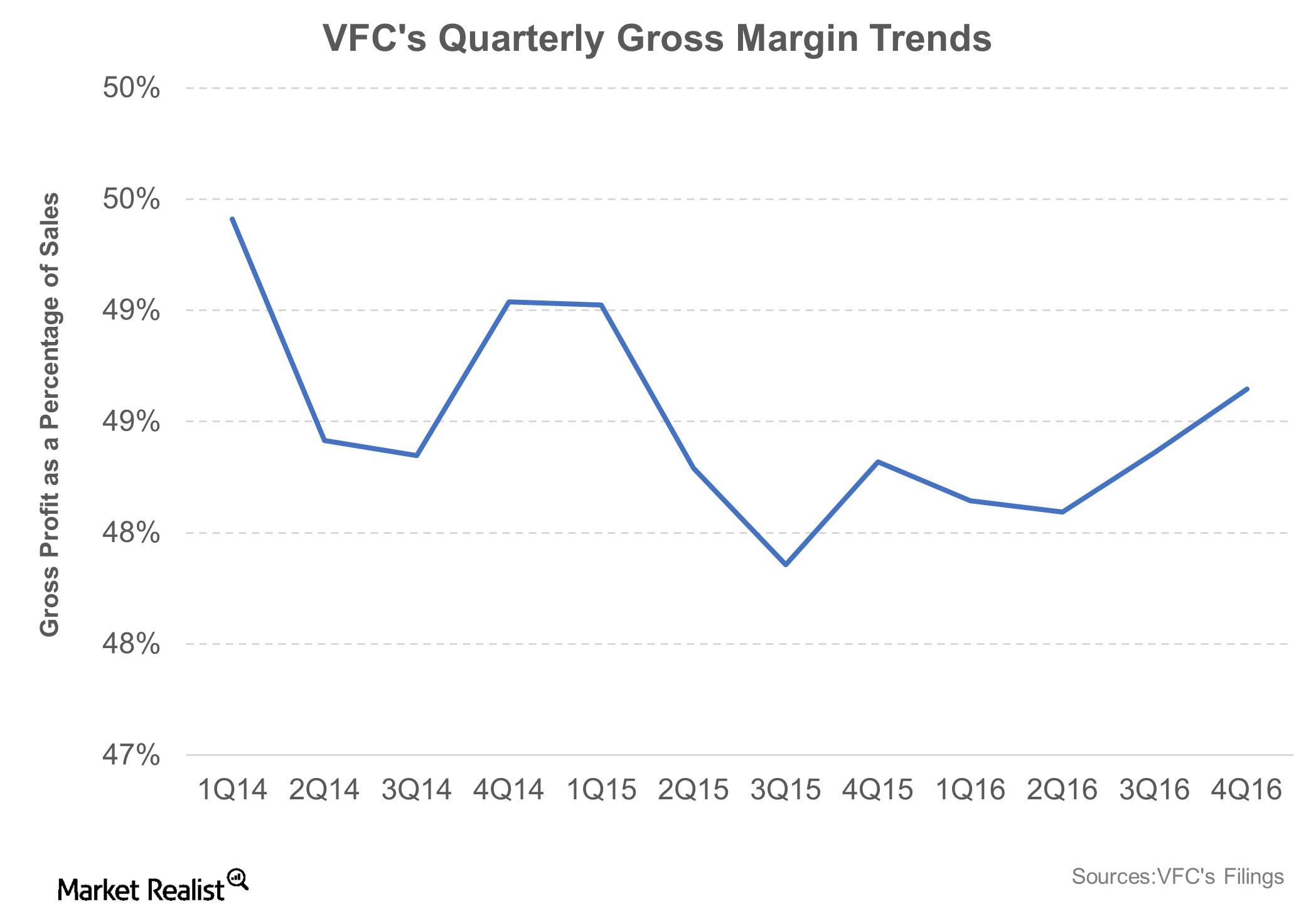

Management Expects VFC’s EPS to Contract in Fiscal 2017

VFC’s gross margin is likely to remain flat at 48.6% and would include 70 basis points of negative impact from currency adjustments.

VFC Posts a 2% Jump in Fiscal 2016 EPS despite Forex Headwinds

For fiscal 2016, VFC’s adjusted earnings per share rose 2% to $3.11. On a constant currency basis, the increase was ~7%.

Another Robust Quarter by Vans Boosts VFC’s Fiscal 4Q16 Top Line

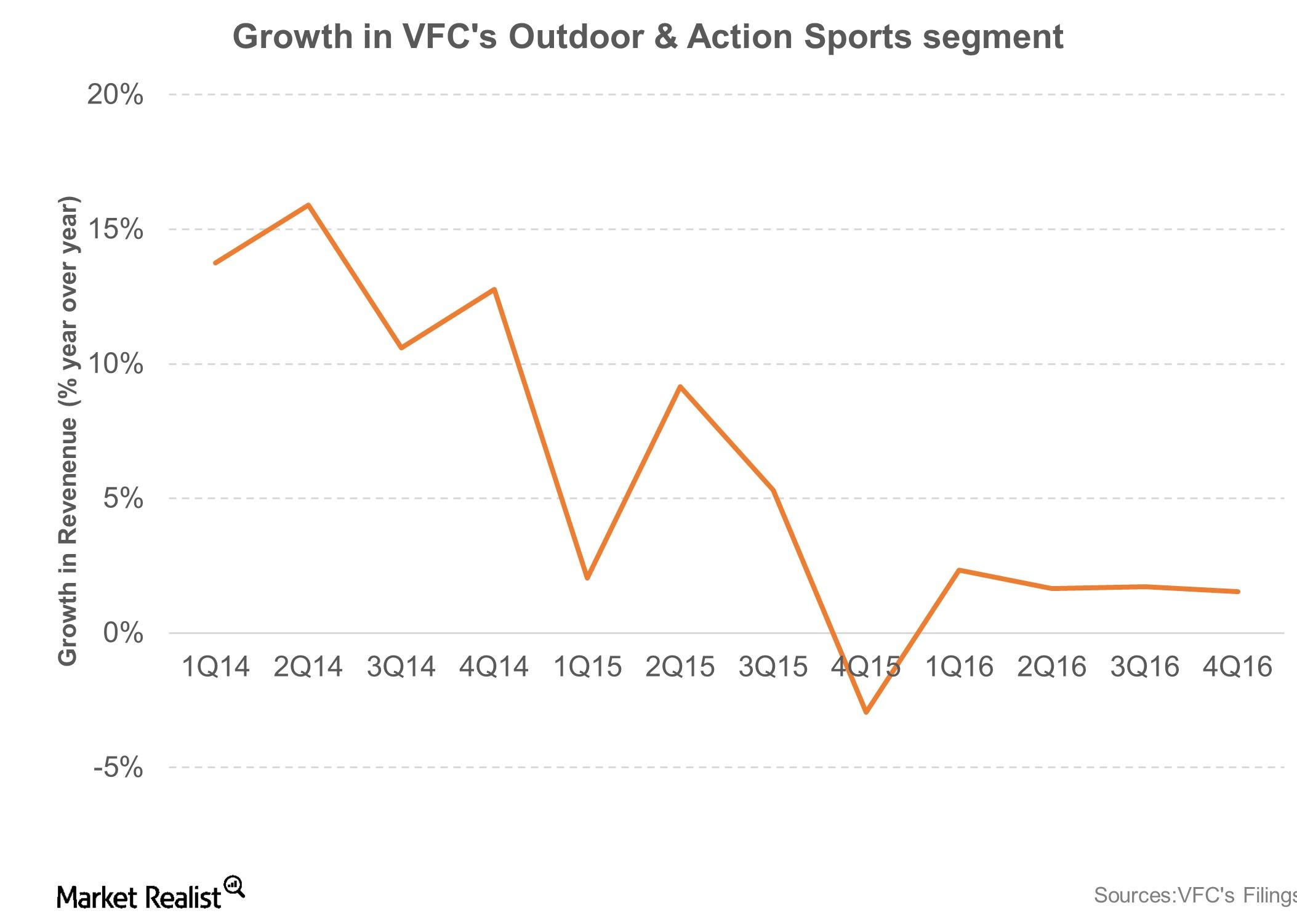

Revenues from VFC’s Outdoor and Action Sports segment rose 2% YoY to $2.1 billion, slightly below the company’s expectations.

VFC: Wholesale versus Direct-to-Customer Channel

VFC’s Direct-to-Customer channel is likely to grow more slowly than the company had expected earlier.

Hanesbrands Stock: Understanding Wall Street’s View

In this part of the series, we’ll look at Wall Street’s recommendation on Hanesbrands (HBI) and discuss Wall Street’s take on the company.

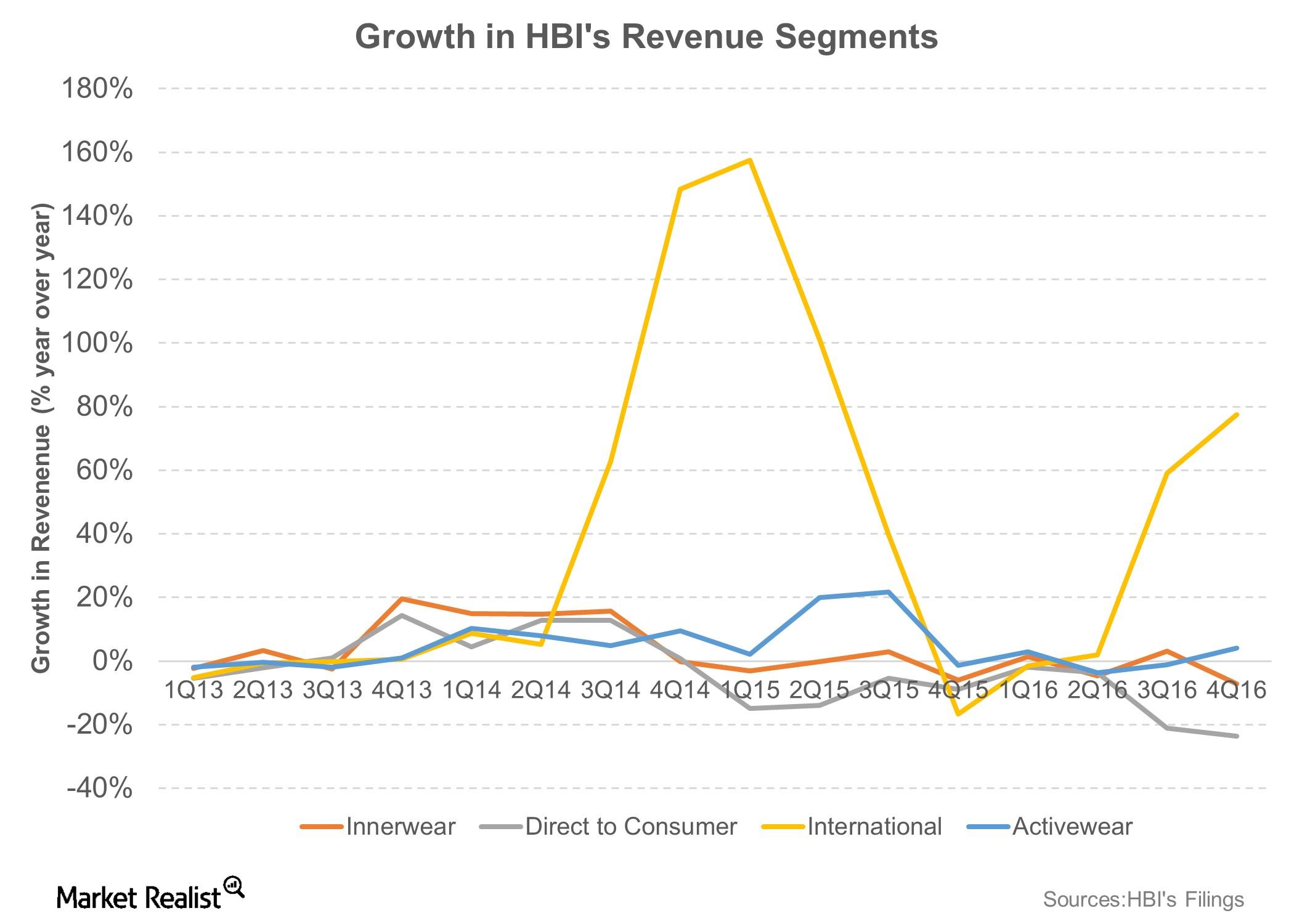

Why Hanesbrands’ Weak Innerwear Sales Drove Its Top Line Miss

With trailing-12-month sales of over $6 billion, Hanesbrands (HBI) is one the largest marketers of basic apparel in the United States.

Hanesbrands Stock Reacts to Weak Results and Gloomy Guidance

Shares of Hanesbrands (HBI) tumbled 16% on Friday, February 3, as the company posted weaker-than-expected fourth quarter results and lackluster guidance.

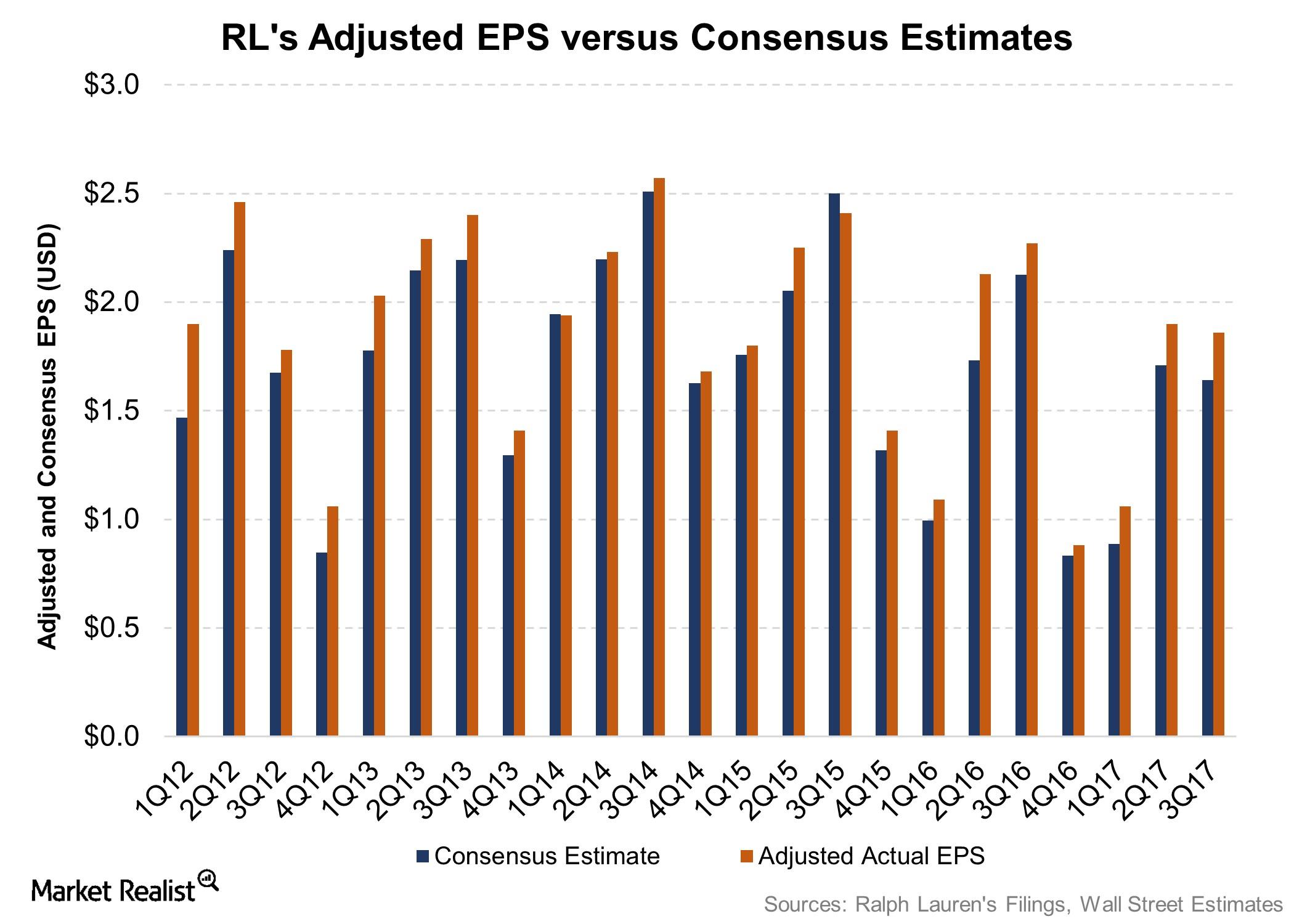

Inside Ralph Lauren’s Fiscal 3Q17 Results

RL delivered better-than-expected earnings and in-line revenues, but its EPS fell 18% YoY to $1.86.

Ralph Lauren Declares a Dividend

Ralph Lauren declared a regular quarterly dividend of $0.50 per share on its common stock. The dividend will be paid on January 13, 2017, to shareholders.

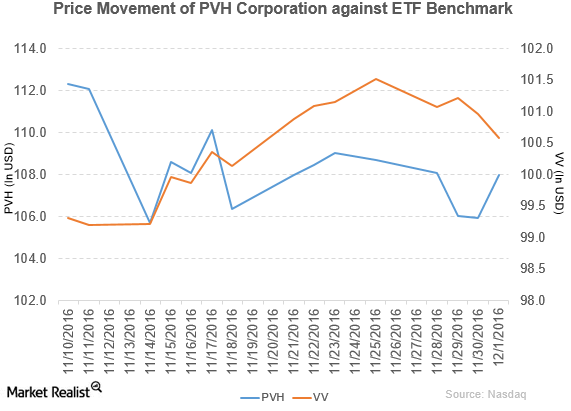

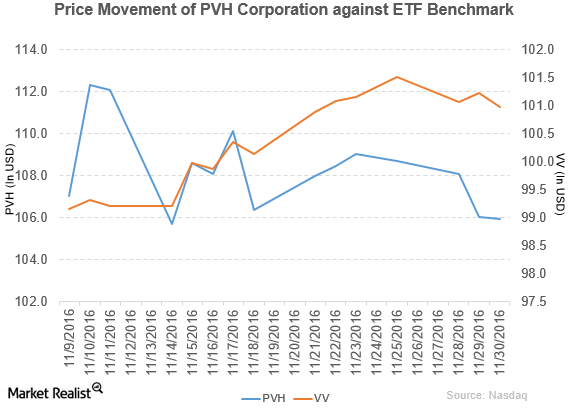

PVH Corporation and Grupo Axo Close Their Joint Venture

PVH Corporation (PVH) has a market cap of $8.7 billion. It rose 1.9% and closed at $107.99 per share on December 1, 2016.

How Did PVH Corporation Perform in 3Q16?

PVH Corporation (PVH) has a market cap of $8.5 billion. It fell 0.08% to close at $105.94 per share on November 30, 2016.

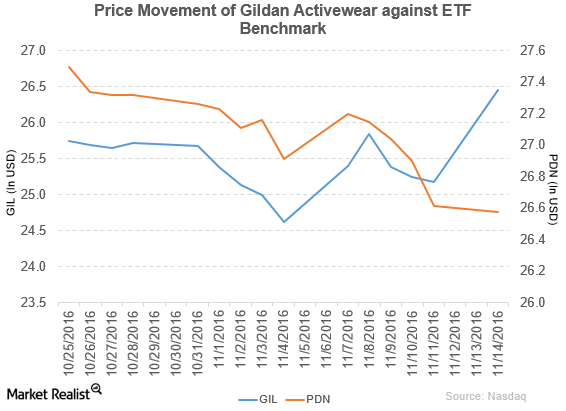

Gildan Activewear Acquires American Apparel for $66 Million

Gildan Activewear (GIL) reported fiscal 3Q16 net sales of $715.0 million, a rise of 6.0% compared to net sales of $674.5 million in fiscal 3Q15.

How Did Ralph Lauren Perform in 2Q17?

Ralph Lauren (RL) reported fiscal 2Q17 net revenues of ~$1.8 billion, a fall of 7.6% compared to net sales of ~$2.0 billion in fiscal 2Q16.

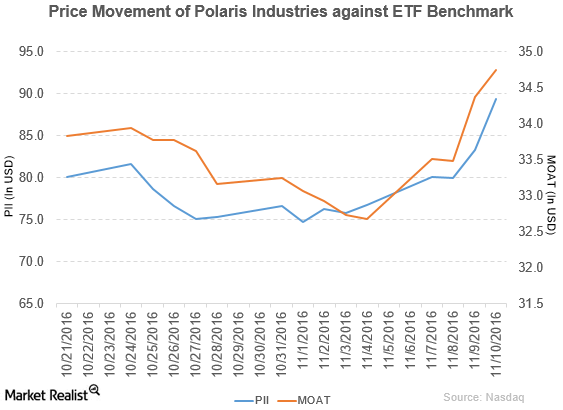

Polaris Industries Acquired Transamerican Auto Parts for $665 Million

Polaris Industries (PII) reported 3Q16 sales of ~$1.2 billion, which represents a fall of 18.5% from its ~$1.5 billion in sales in 3Q15.

What Does Wall Street Expect from HBI for the Rest of 2016?

Hanesbrands updated its 2016 full-year outlook while reporting its third quarter results.

Weakness in North America Offset VFC’s International Gains

As in the last several quarters, VF’s (VFC) international business remained firm during the third quarter.

Judith Amanda Sourry Knox Joins PVH’s Board of Directors

PVH Corporation (PVH) rose 1.3% to close at $108.60 per share during the third week of September 2016.

Morgan Stanley Downgrades Coach to ‘Underweight’

Coach (COH) fell 4.2% to close at $35.04 per share during the second week of September 2016.

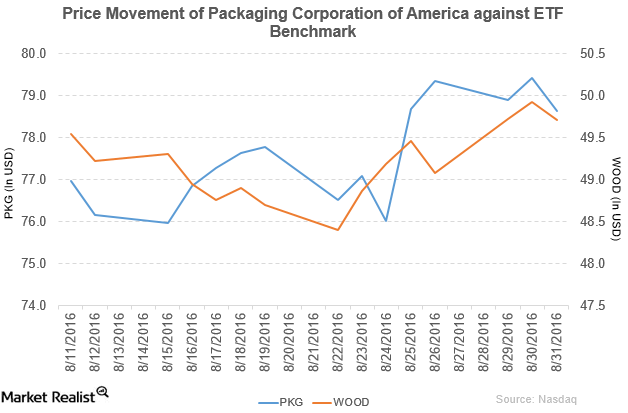

PKG Declares Dividend of $0.63 Per Share

Packaging Corporation of America (PKG) has a market cap of $7.4 billion. It fell by 0.99% to close at $78.63 per share on August 31, 2016.

Better-than-Expected Earnings Support Falling Ralph Lauren Stock

Despite a decline in earnings, Ralph Lauren continues to hold $1.2 billion in cash and short-term investments on its balance sheet.

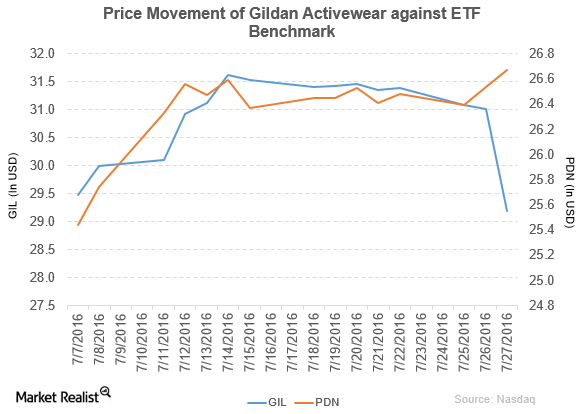

Gildan Activewear Declares Its 2Q16 Results and Dividend

Gildan Activewear (GIL) has a market cap of $6.9 billion. It fell by 5.9% to close at $29.19 per share on July 27, 2016.

Inside Kate Spade’s Key Focus Areas

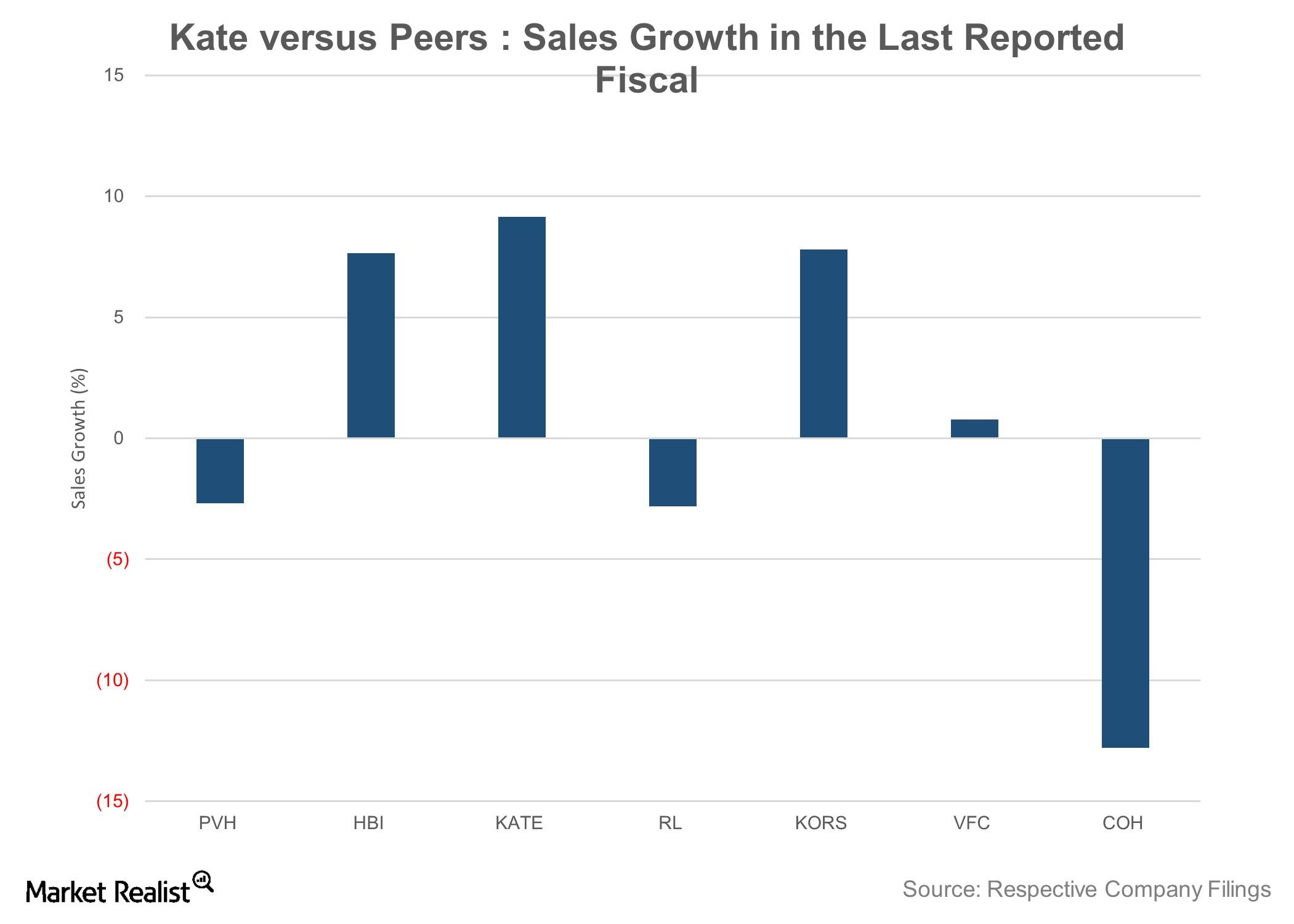

KATE’s top line grew by 9.1% YoY (year-over-year) in fiscal 2015, as compared to a 7.7% YoY increase for Michael Kors and a 12.7% YoY decline for Coach.

Why Did PVH Issue Senior Notes?

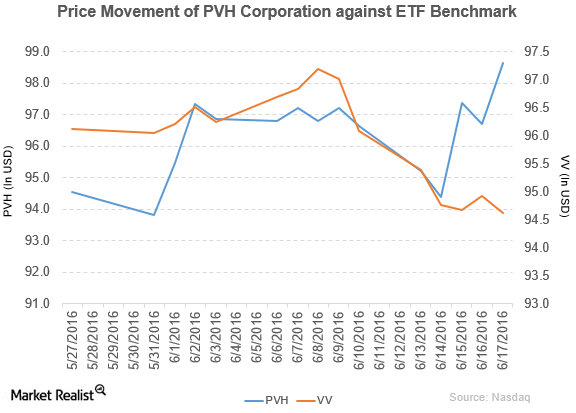

PVH (PVH) rose by 2.1% to close at $98.63 per share at the end of the third week of June 2016.

Why Did PVH Offer Senior Notes?

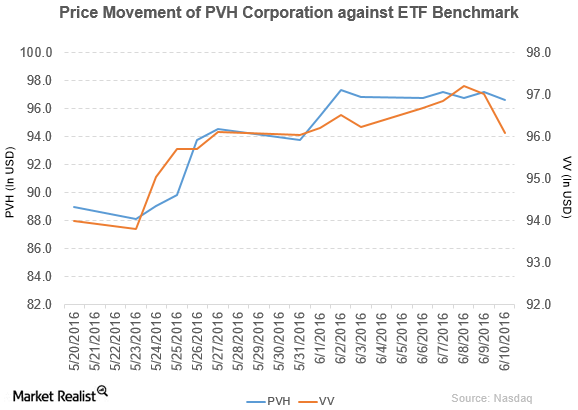

PVH Corporation (PVH) has a market cap of $7.8 billion. It fell by 0.58% to close at $96.65 per share on June 10, 2016.

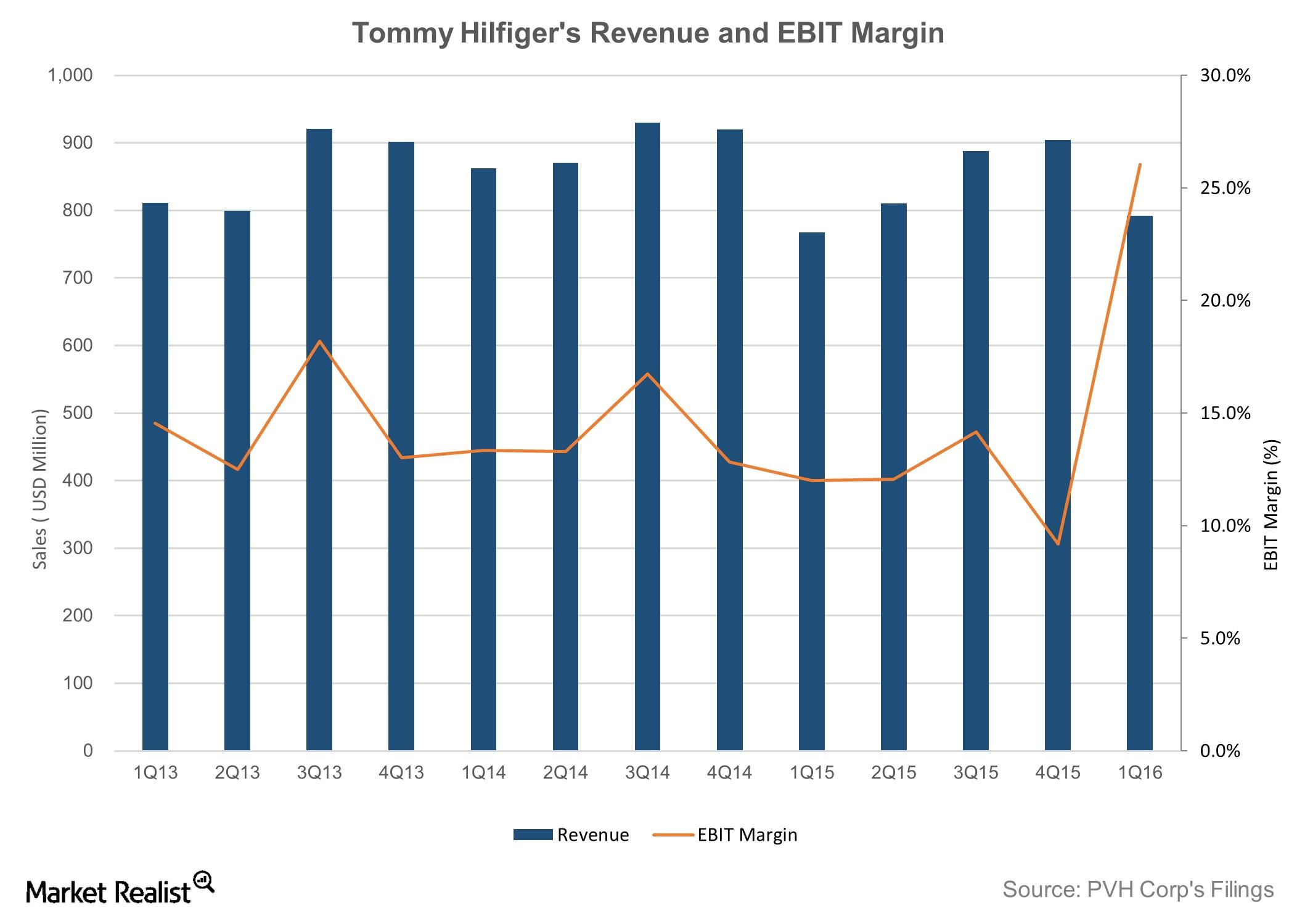

PVH’s Tommy Hilfiger Gets Boost from Strong International Sales

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

How Calvin Klein and Tommy Hilfiger Gave PVH a Strong 1Q16

Phillips-Van Heusen (PVH) posted $1.9 billion in revenue for fiscal 1Q16. That’s a 2.1% YoY increase on a GAAP basis.

PVH Delivered a Solid 4Q15 on Strong Calvin Klein Performance

PVH Corp. (PVH) registered a 2.1% year-over-year increase in its top line in fiscal 4Q15, which ended January 31, 2016, to $2.1 billion.

Inside Ralph Lauren’s Liquidity Position and Financial Health

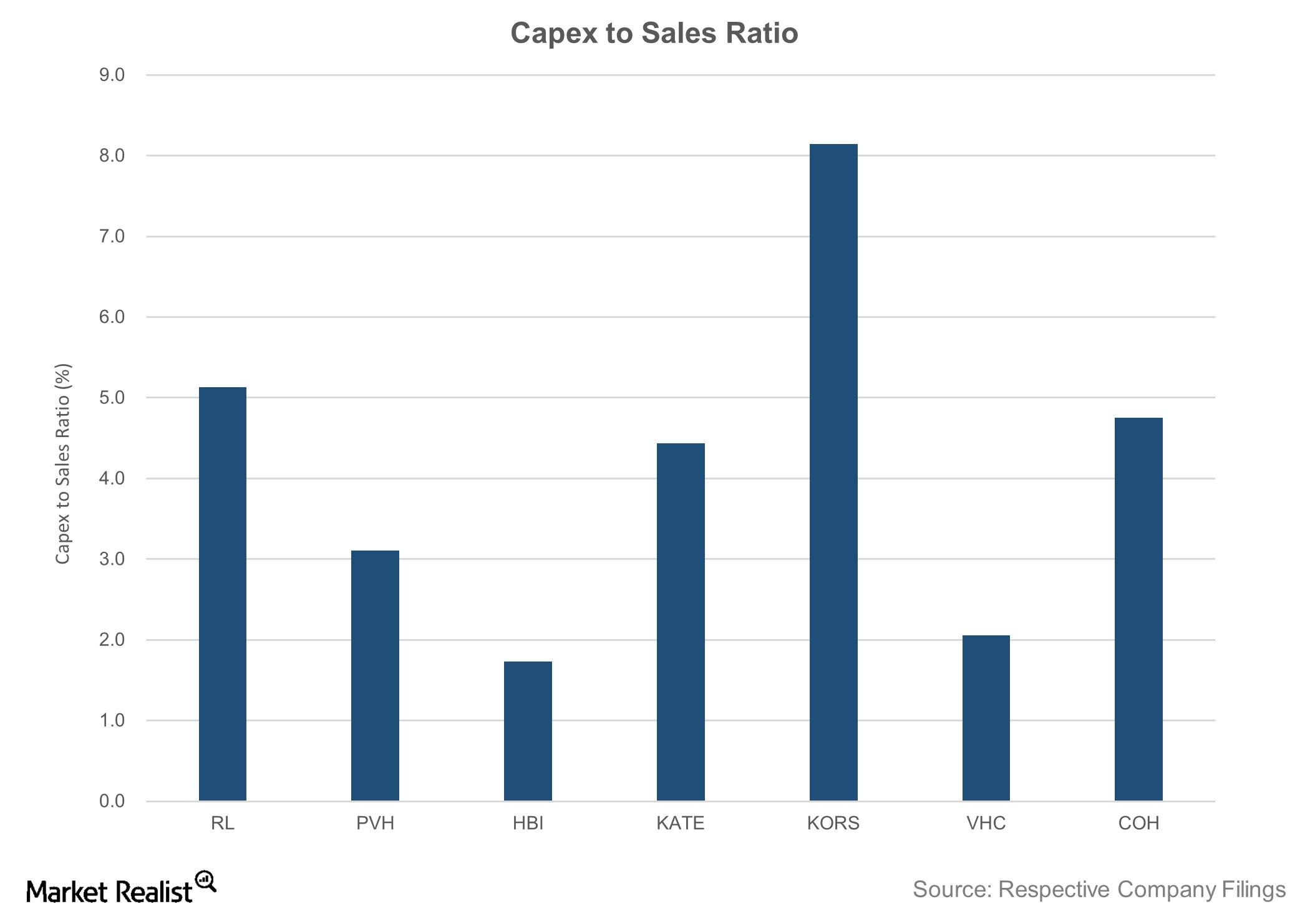

Ralph Lauren has a $1.7 billion capex. Its capex-to-sales ratio of 5.1% (as of March 28, 2015) is among the highest in its fashion and apparel peer group.

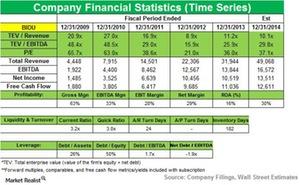

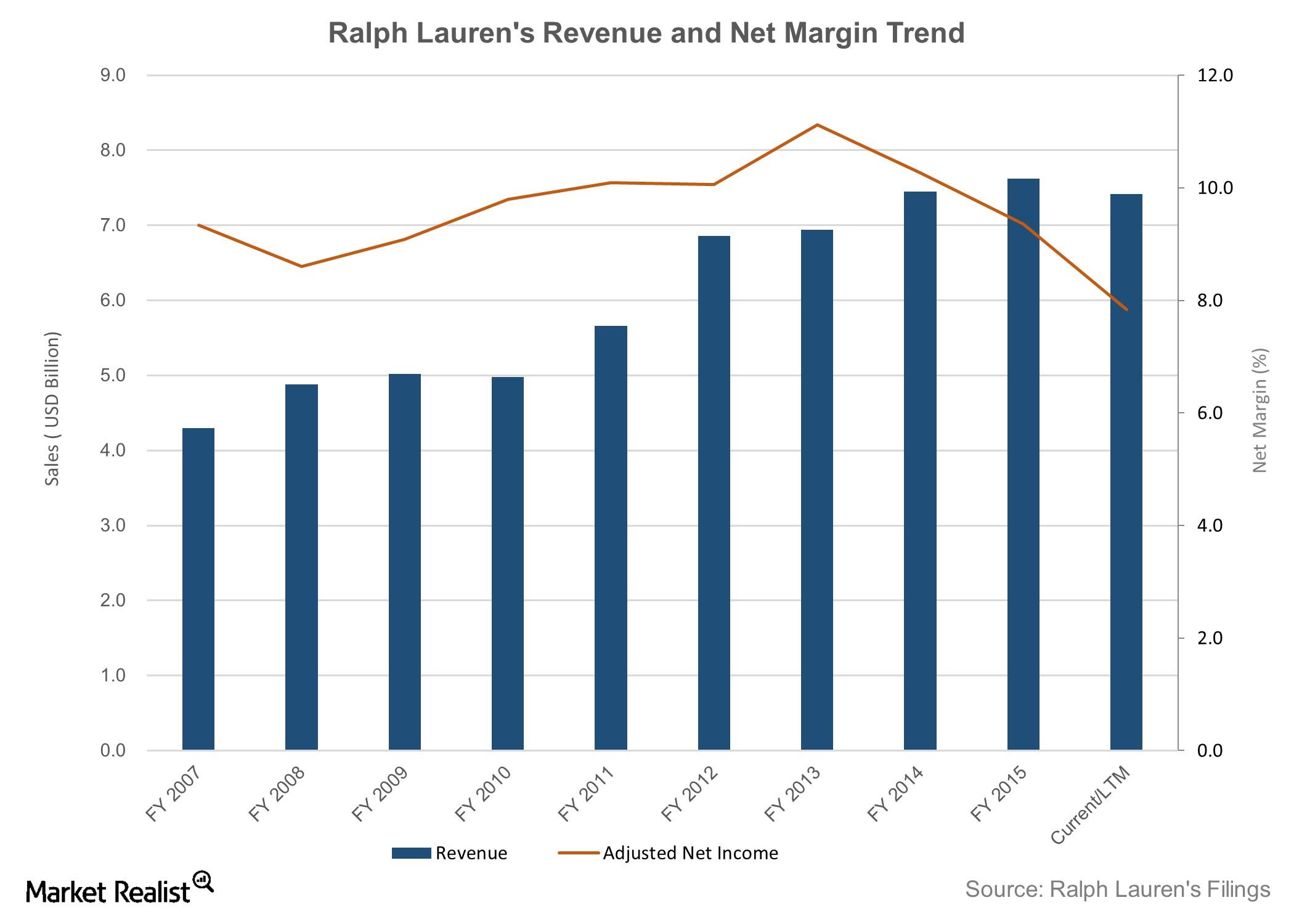

Behind Ralph Lauren’s Historical Financial Performance

Ralph Lauren’s top line has grown by a CAGR of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015.