iShares S&P 100

Latest iShares S&P 100 News and Updates

Industrials Can manufacturing activity in the northeast increase the pace?

The Philadelphia Fed will release the results of its Business Outlook Survey for June, on Thursday, June 19.

When Can You Expect Walmart’s Profitability Margins to Stabilize?

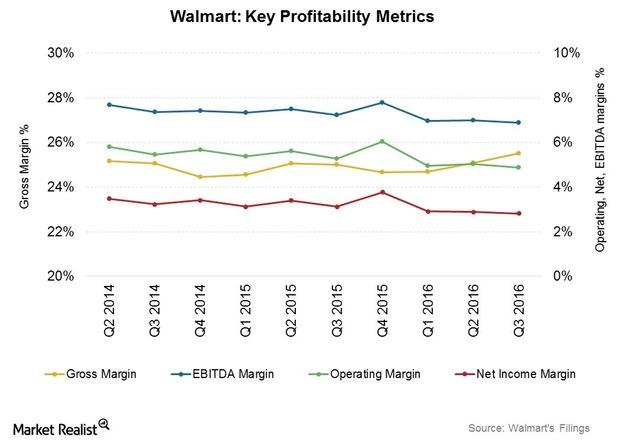

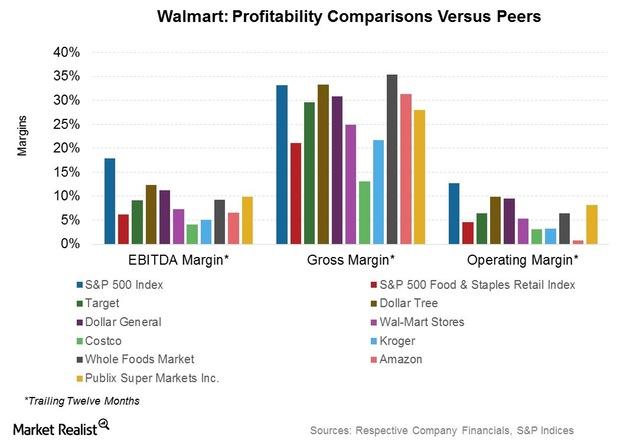

Despite the revenue headwinds we discussed in the previous part of this series, Walmart (WMT) expanded its gross margin by 21 basis points to 24.6% in the first three quarters of fiscal 2016.

Weak Currencies, but Consumer Packaged Goods Margins Improved

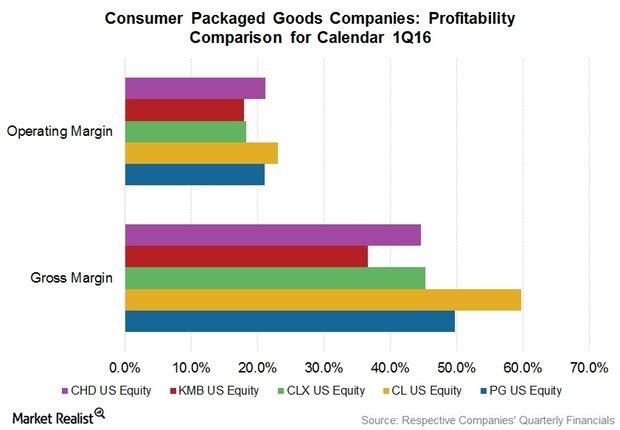

The 1Q16 margins of consumer packaged goods (or CPG) companies sent strong signals. These companies have been investing heavily in innovative products and other growth initiatives.

Walmart’s Strategic Business Priorities and Their Impact

Walmart’s strategic priorities include building omni-channel capabilities, growing its top line faster, focusing on core assets and capital discipline, and generating stronger shareholder returns.

Walmart Lowers Capital Expenditure Projections

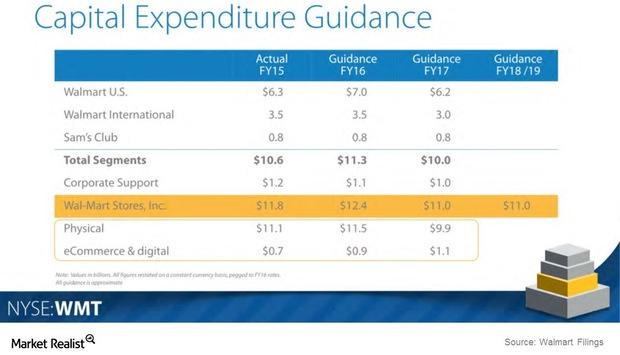

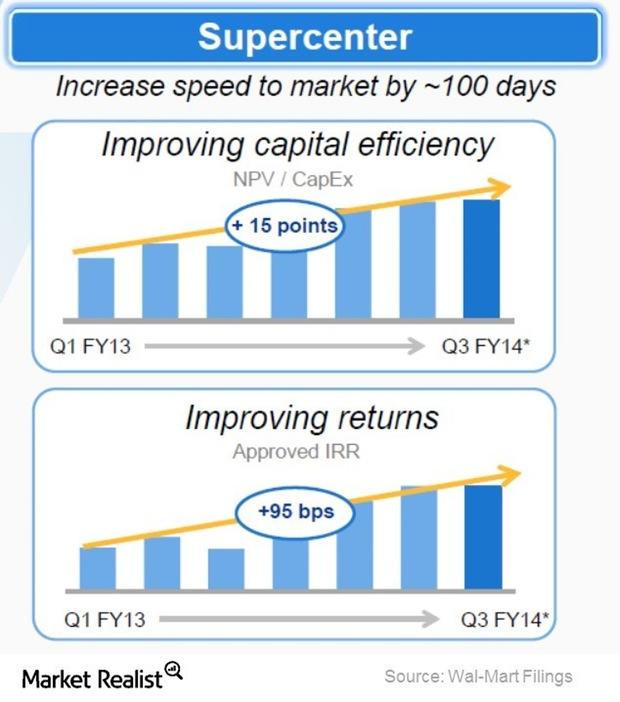

Walmart has updated its capital expenditure projections for fiscal 2016. It expects to spend $12.4 billion in fiscal 2016, in the middle of the $11.6–$12.9 billion guidance range provided earlier.

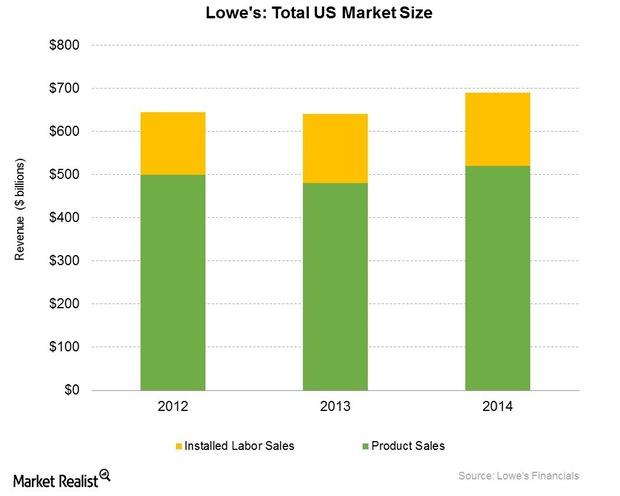

Why Home Depot and Lowe’s Are Leaders in Home Improvement Retail

Lowe’s (LOW) operates in the home improvement retail industry. The company competes with a number of retail and wholesale players.

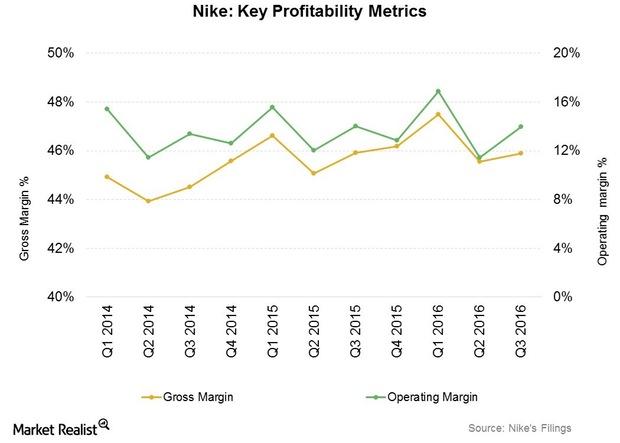

How Nike Has Sustained Profitability despite Headwinds

Nike’s profitability in fiscal 3Q16 was helped by better-than-average performance in North America and Greater China, two of its most profitable segments.Financials Investing in fixed income: What motivates bond investors?

We can understand the investment objectives of fixed income investors in terms of returns, risks, and constraints. There are two categories of investors.

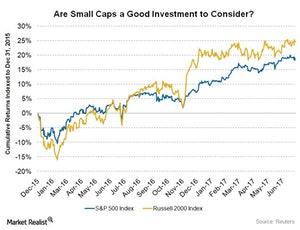

Are Small Caps Worth the Risk Right Now?

The small-cap stock universe started rallying after Trump’s victory in November.

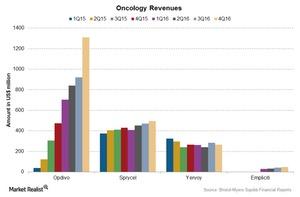

How Bristol-Myers Squibb’s Oncology Segment Performed in 2016

Given the strong performance of Opdivo, Bristol-Myers Squibb’s Oncology segment emerged as its largest revenue contributor in 2016. The segment contributed ~35% of BMY’s total revenue.

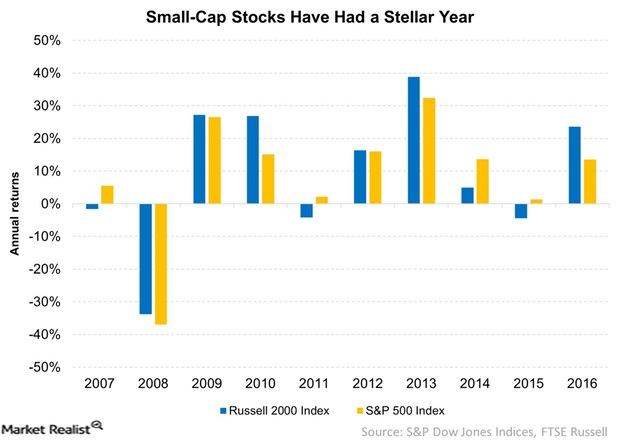

Why Did Small-Cap Stocks Have a Stellar Year in 2016?

Small-cap stocks have outperformed large caps on a regular basis since 1926. Small-cap stocks had a stellar year in 2016.

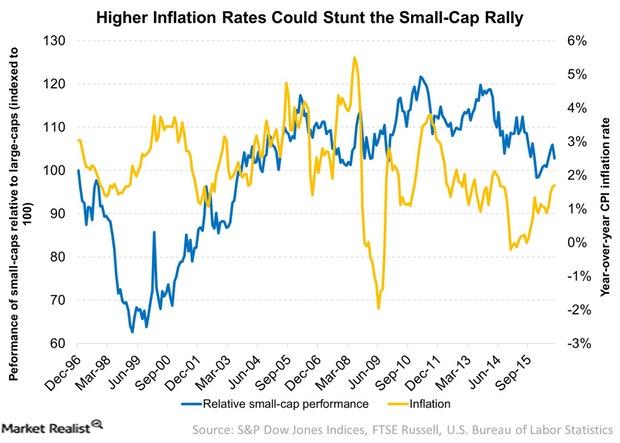

How Would Higher Inflation Impact Small Caps?

Higher inflation rates suggest that the economy might be improving. It’s good for small caps. They tend to outperform large caps during economic upturns.

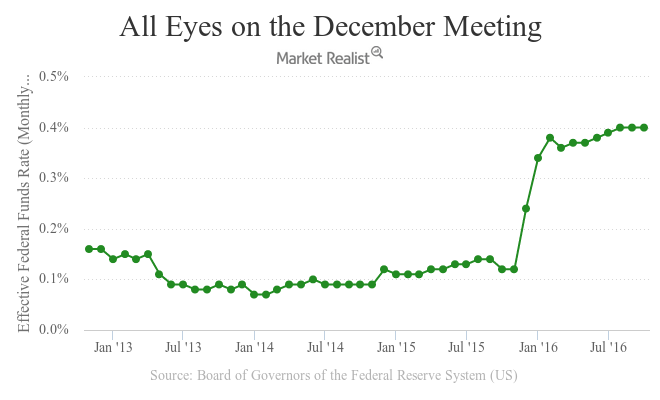

A Pass on a November Hike: It’s Up to December Now

The expected occurred on November 2, 2016, when the FOMC (Federal Open Market Committee) left the federal funds rate unchanged at 0.25%–0.5%.

Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

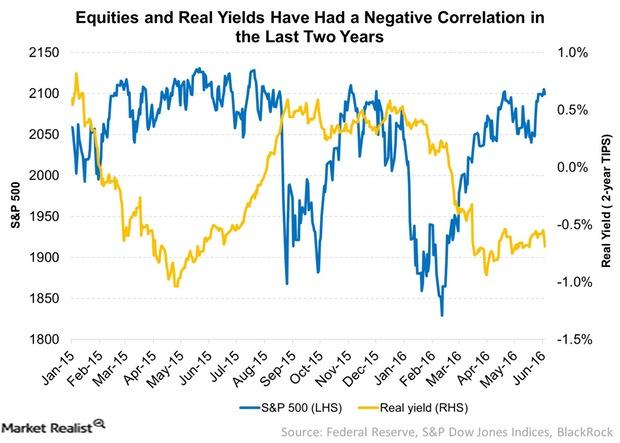

How Rising Real Yields Could Affect Equities

Since the start of 2015, the S&P 500 and real yields have had a high negative correlation. Falling real yields have encouraged investors to take more risk in search of higher returns.

Why Your Portfolio Needs More Carry

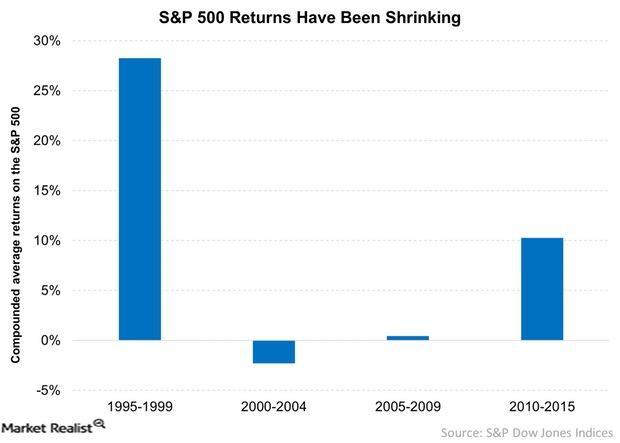

Since 2009, equities have staged a comeback. Between 2010 and 2015, the S&P 500 index has risen 10.3% on a CAGR basis. Most of the comeback is due to multiple expansion.

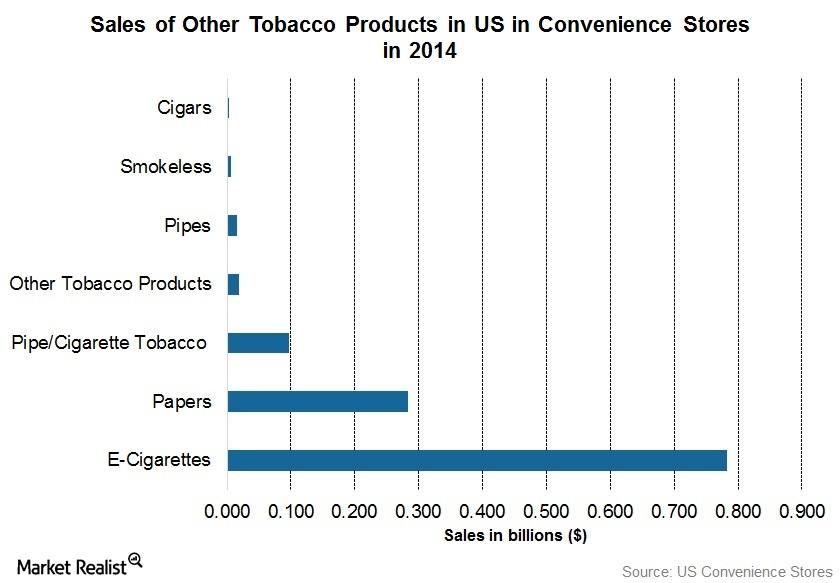

Weighing Altria Group’s Strengths and Opportunities

Altria’s major strength is its diversified portfolio, which includes wine and beer assets. Altria has the most diverse business model among US peers.

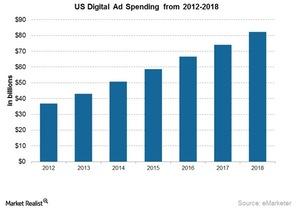

A Look at Disney’s Advertising Revenues

The Walt Disney Company’s (DIS) advertising revenues made up 37% of its Media Networks segment’s total revenues of $5.7 billion in fiscal 3Q15.

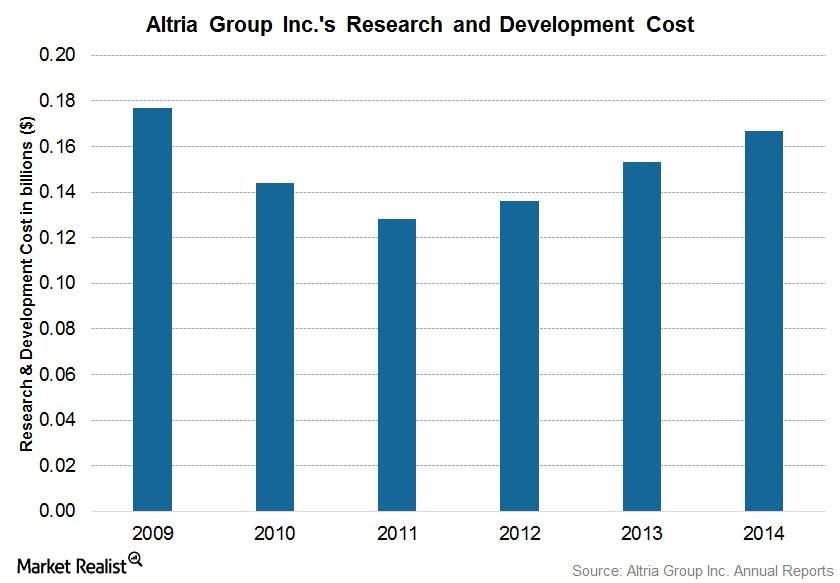

Altria’s Heritage of Innovation and Investments in R&D

Altria’s R&D expenses for fiscal 2014 were $0.2 billion, or 0.9% of net sales. Its R&D expenses upped by 9.2% in 2014, reflecting a trend toward innovation.

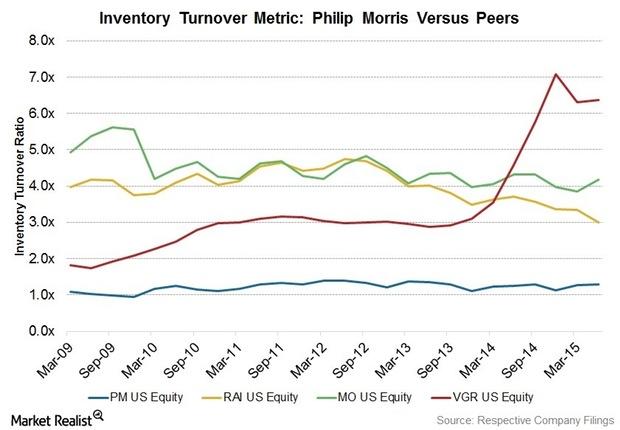

Philip Morris’s Initiatives to Boost Distribution and Manufacturing Channels

Philip Morris oversees the distribution of tobacco products in more than 180 countries and territories and owns 50 manufacturing facilities across 23 markets.

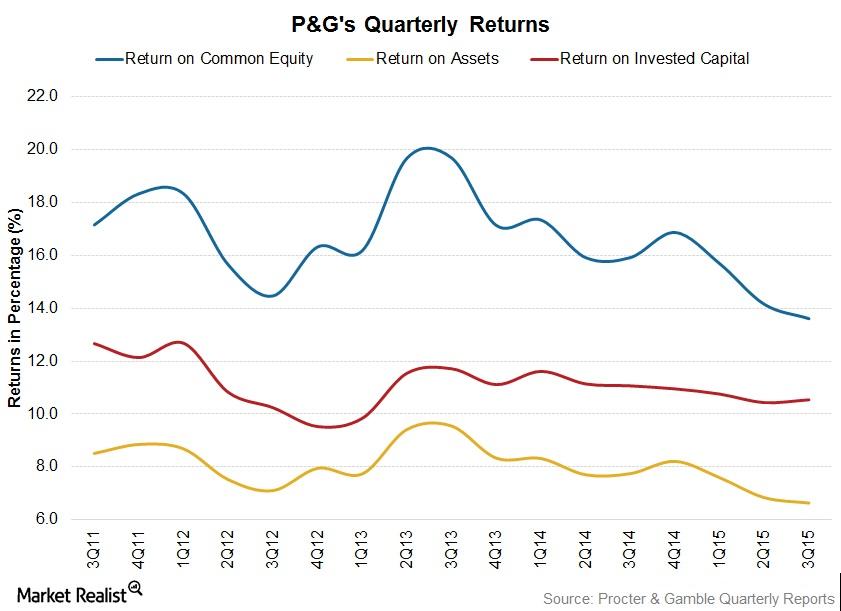

Procter & Gamble: Strategies to Improve Long-Term Profitability

Procter & Gamble continues to look at large developing markets where it thinks it can win enough market share to take a leadership position.

Procter & Gamble Leads the Market in Baby, Feminine, Family Care

The company’s Baby, Feminine and Family Care segment is the second-largest grossing segment at Procter & Gamble.

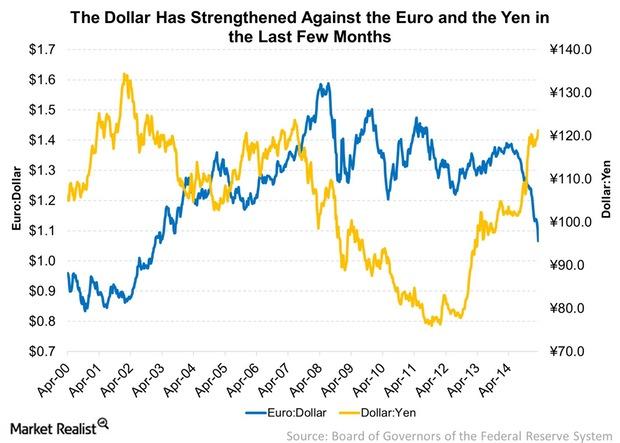

What’s Causing the US Dollar to Strengthen?

The strength in the US dollar is because of divergence in central bank policies. The US dollar is strengthening against most of the major currencies.

Walmart’s Capital Strategy – Smaller Stores And Supercenters

Walmart embarked to aggressively minimize the capital cost per square foot of retail space with the aim of faster payback on investment.Energy & Utilities Why the Bureau of Labor and Statistics jobs report is important

The employment situation is the primary monthly indicator of aggregate economic activity because it encompasses all major sectors of the economy.