Nucor Corp

Latest Nucor Corp News and Updates

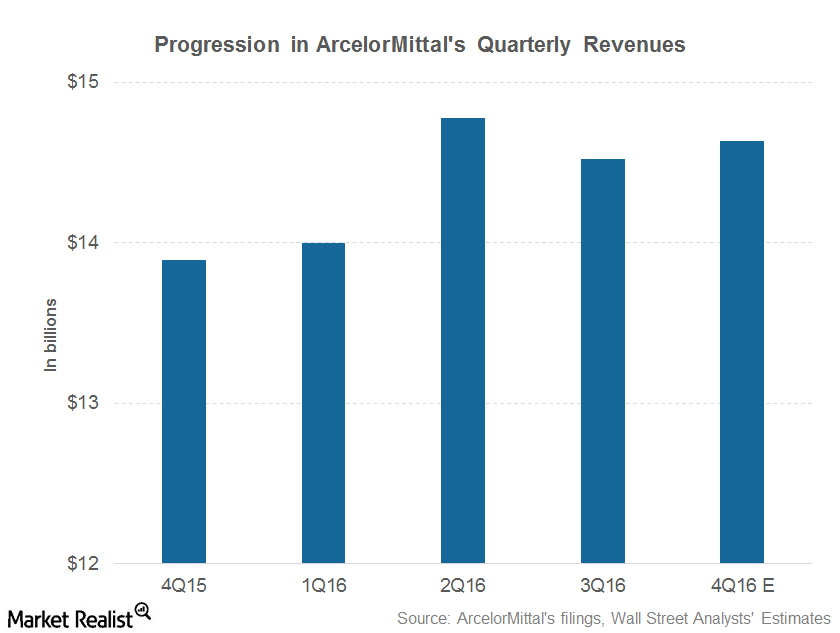

ArcelorMittal’s Expected 4Q16 Revenues: The Word on Wall Street

Analysts expect ArcelorMittal (MT) to post revenues of $14.6 billion in 4Q16. The company posted revenues of $14.5 billion in 3Q16 and $13.9 billion in 4Q15.

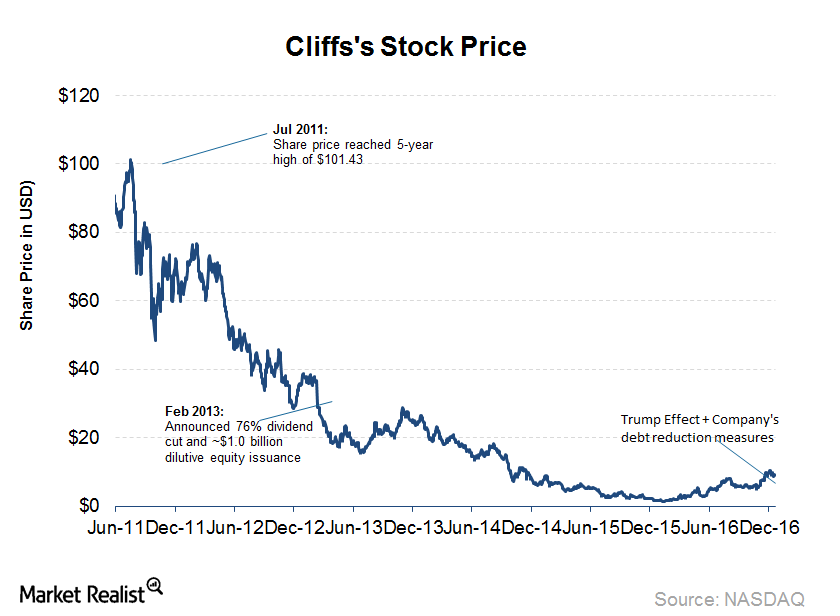

Can Cliffs Natural Resources Scale Greater Heights in 2017?

Cliffs Natural Resources (CLF) was trading at $8.85 on December 23, 2016, which represents a 46% rise since Donald Trump’s win in the US presidential election. That brings the year-to-date rise to a whopping 430.0%.

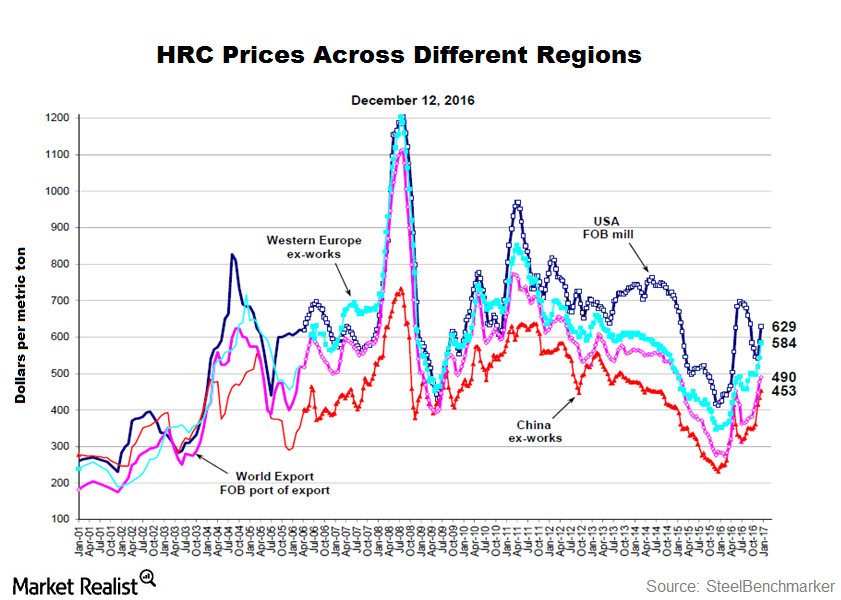

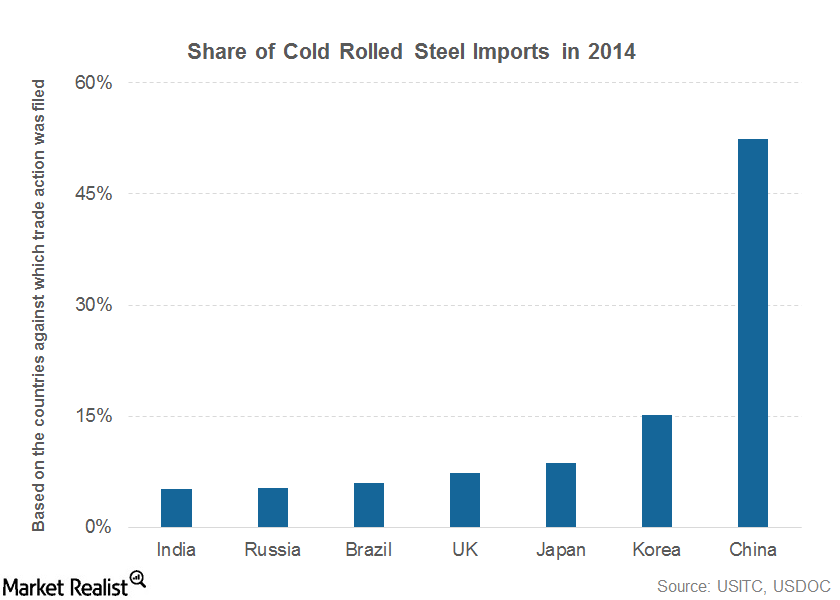

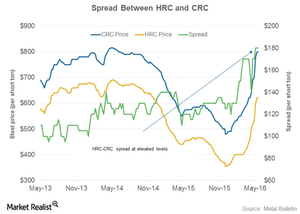

Why U.S. Steel Investors Should Look at Steel Price Spreads

The United States is the largest steel importer globally. Steel companies such as U.S. Steel Corporation frequently blame steel imports for the US steel industry’s woes.

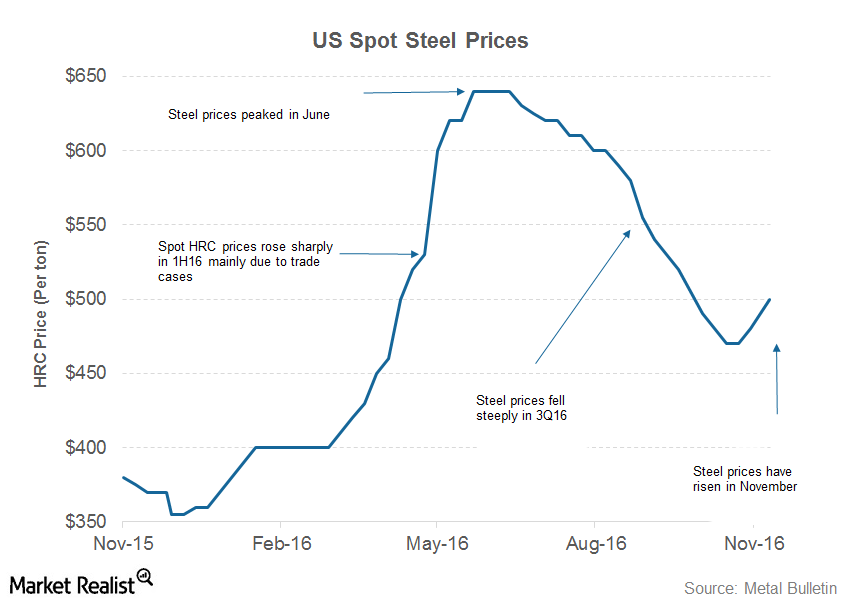

What Factors Are Supporting Steel Prices?

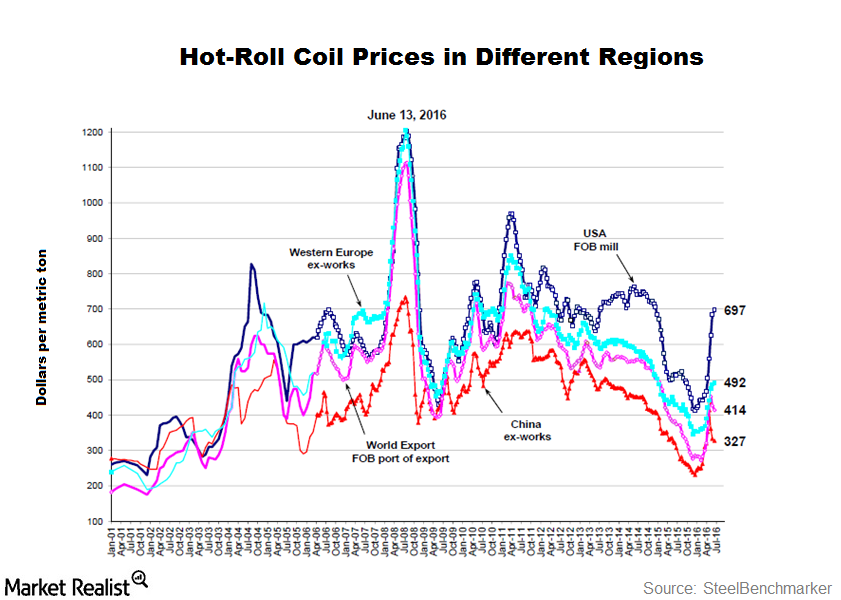

According to data compiled by Metal Bulletin, spot HRC (hot rolled coil) prices rose from $380 per short ton to $640 per short ton between January 2016 and June 2016.

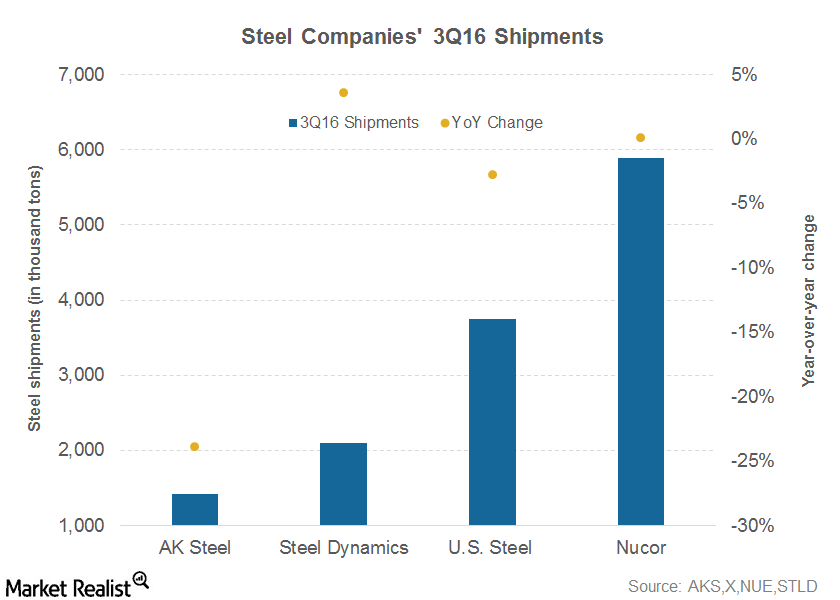

Revenue Miss Was a Hallmark of Steel Companies’ 3Q16 Earnings

One of the key features of steel companies’ 3Q16 financial performance was lower-than-expected revenues.

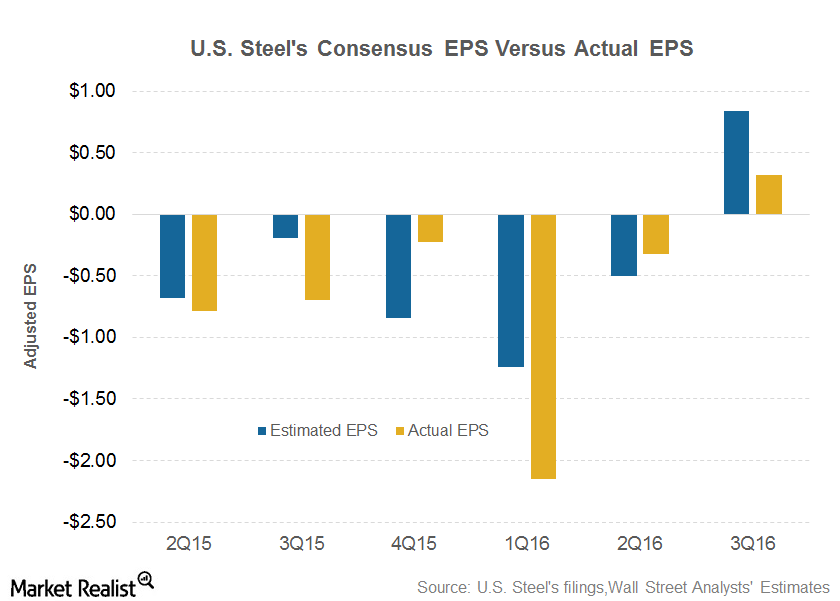

U.S. Steel Bulls Left Heartbroken After 3Q16 Earnings Miss

U.S. Steel Corporation (X) released its 3Q16 financial results on November 1 after the market closed, and it held its earnings conference call on November 2.

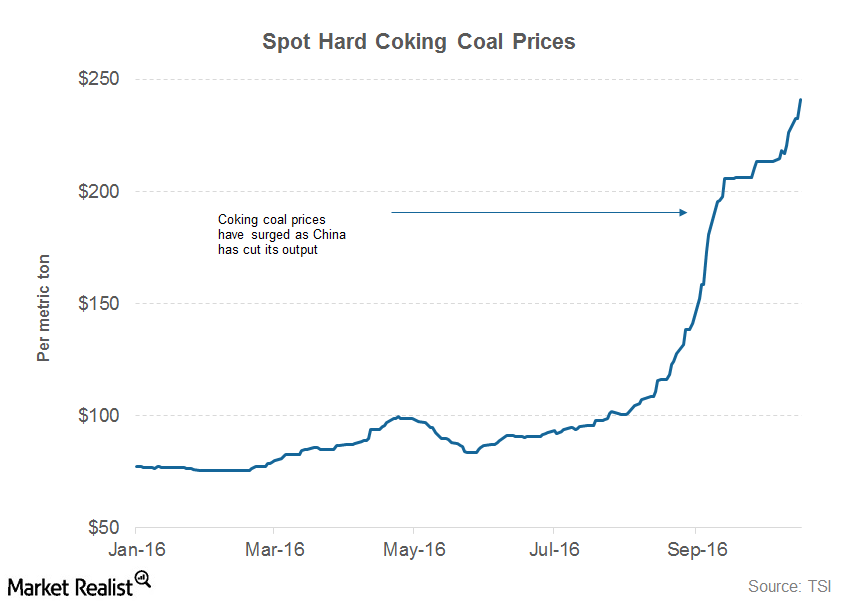

Analyzing the Bullish Argument for U.S. Steel

The bulls and bears have their own sets of arguments about U.S. Steel. U.S. Steel (X) and AK Steel (AKS) mainly use iron ore as a raw material.

What’s Driving the Record Spread Between HRC and CRC Prices?

US Spot hot rolled coil prices have risen in the ballpark of $200 per short ton in 2016. Spot cold rolled coil prices have risen by ~$300 per short ton.

Why Janus Thinks Ignoring Inflation Is a Mistake

In this series, we’ll look at the Janus Asset Allocation team’s views on inflation, policy measures, and asset allocation (ITOT) (NEAR), given its assertion that inflation pressures are building.

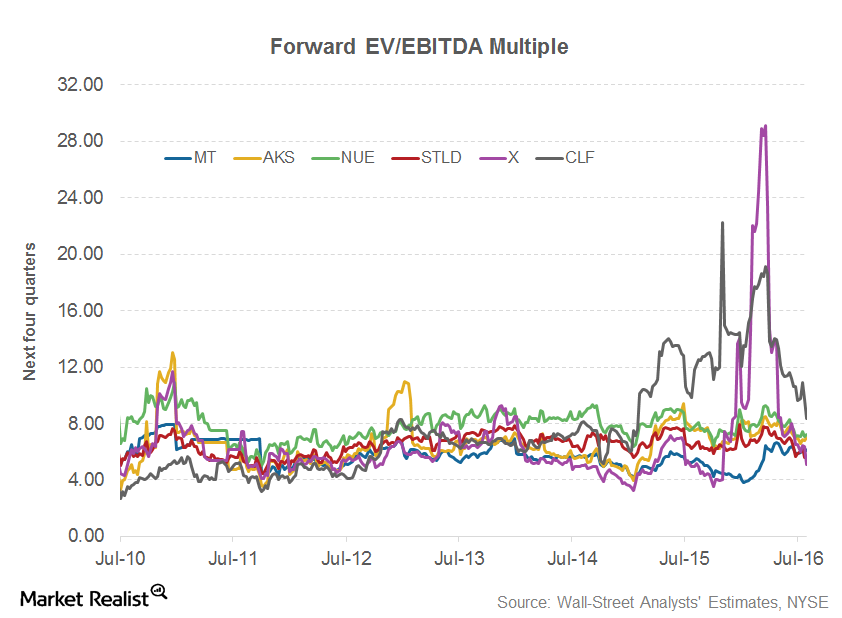

What’s Been Driving Cliffs Natural Resources’ Valuation

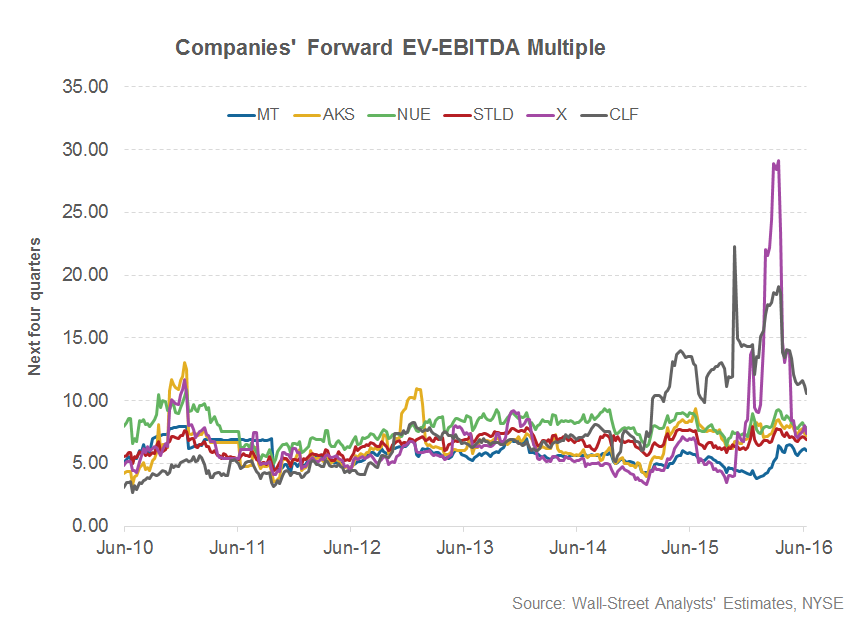

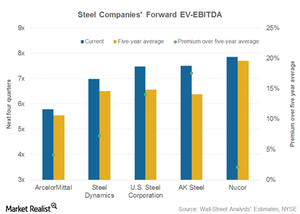

Valuations Valuation multiples are key metrics that investors consider carefully. With the help of relative valuations, we can compare a company’s valuation with its closest peers’ valuations. There are several valuation metrics that we can use. For companies in cyclical industries such as steel and mining, the EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) […]

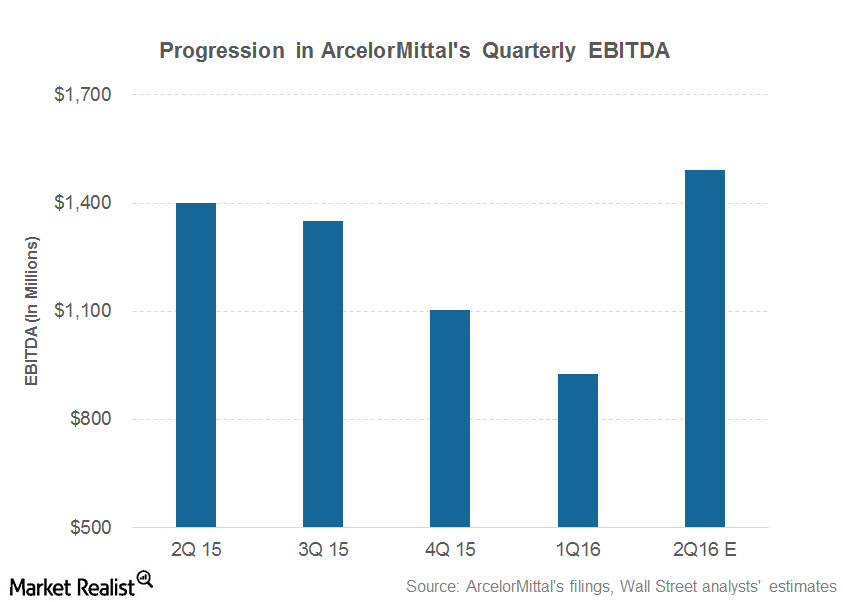

Are ArcelorMittal’s 2Q16 Earnings Estimates a Little Aggressive?

ArcelorMittal (MT) posted adjusted EBITDA of $927 million in 1Q16 and ~$1.4 million in 2Q15.

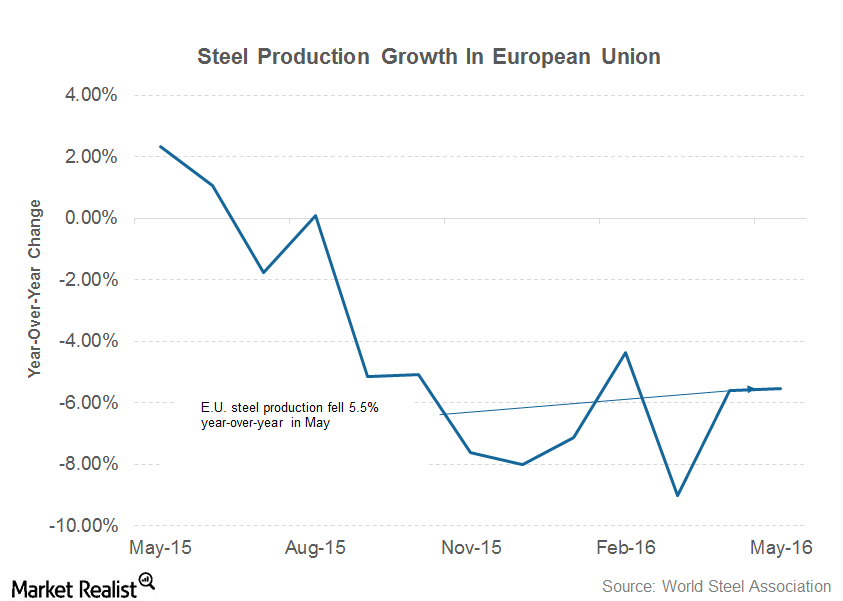

Could Brexit Shake the European Steel Industry?

The EU hasn’t been able to act decisively against higher Chinese steel imports. European steel production has fallen much steeper this year.

Is Cliffs’s Valuation Justified?

Cliffs Natural Resources (CLF) is trading at a forward EV/EBITDA multiple of 11.0x compared with its last five-year average of 8.0x.

Brexit or No Brexit, the European Steel Industry Is in Shambles

In May, ~14.5 million metric tons of steel were produced in the European Union. That was a YoY decline of 5.5%.

A Comparative Analysis of Steel Companies’ Relative Valuations

In this article, we’ll look at steel companies’ forward EV-to-EBITDA multiples to see if there are some underpriced or overpriced bets in the sector.

What Slowdown? US Steel Prices Rose 50% This Year

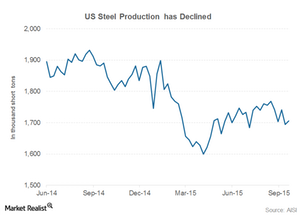

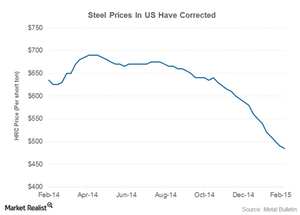

Steel companies’ earnings are sensitive to changes in steel prices. In recent quarters, their earnings have been negatively impacted by falling steel prices.

Scrap or Iron Ore: What Drives US Steel Prices?

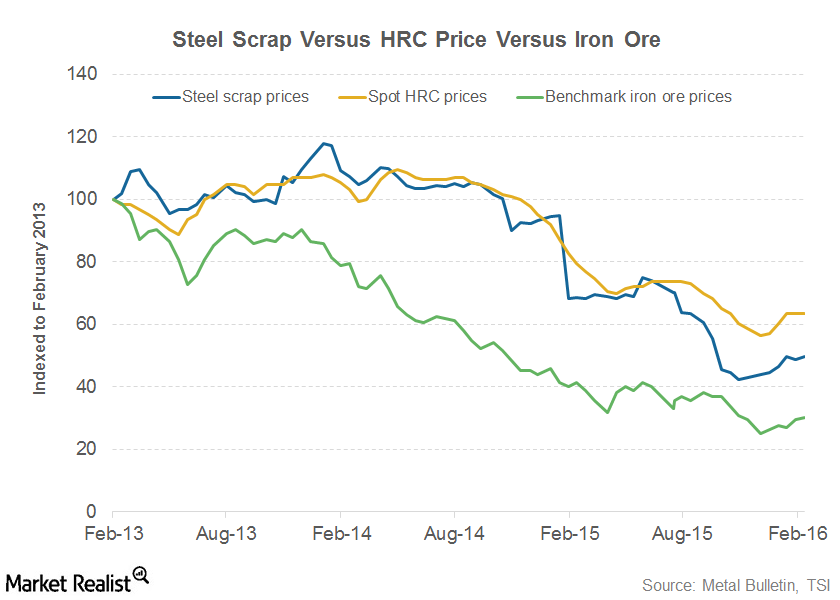

Even the recent uptick in US steel prices has been accompanied by strength in steel scrap prices.

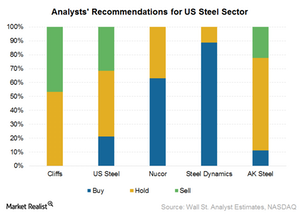

Cliffs Natural Resources: 4Q15 Market Expectations

Of 15 analysts covering Cliffs Natural Resources, eight have given it a “hold” recommendation, and seven have given it a “sell” recommendation.

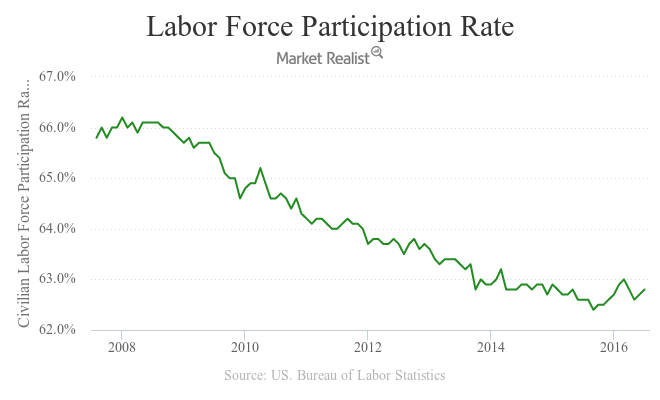

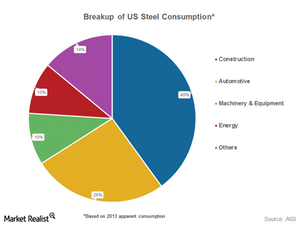

It’s Beginning to Look a Lot like a US Steel Consumption Cool Down

If the Fed continues to raise rates in 2016, we could see the impact on the housing and automotive sectors, which would only add to steel’s woes.

Is there More Downside to Cliffs’s USIO Division Volume Guidance?

In its 2Q15 results, Cliffs Natural Resources (CLF) downgraded its volume guidance for the USIO division for 2015, from 20.5 million tons to 19 million tons.

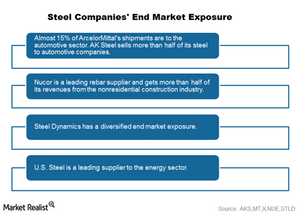

The Importance of Diversified End Market Exposure

Steel companies’ product portfolios and end market exposures can have significant impacts on company performance.

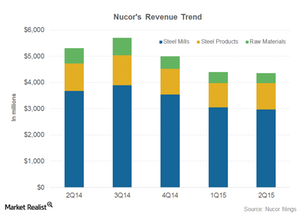

The Hows and Whys of Nucor’s Recent Falling Revenues

Nucor’s net revenues fell ~18% in 2Q15, compared to the corresponding quarter last year. Most steel companies have reported lesser revenues in 2Q15 as well.

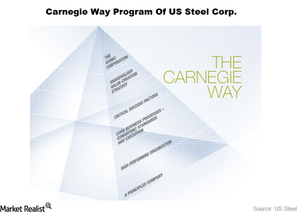

U.S. Steel’s Carnegie Way: Key Points Investors Should Understand

U.S Steel has embarked on an ambitious transformation plan, which it named “Carnegie Way.”

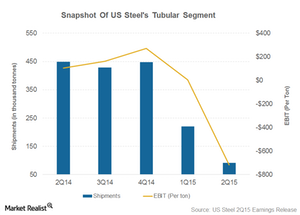

Losses Widen in U.S. Steel’s Tubular Segment as Fixed Costs Rise

Demand for OCTG products is expected to be subdued in the coming months. This would continue to put pressure on U.S. Steel’s Tubular segment.

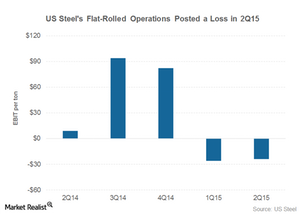

U.S. Steel’s Flat Rolled Segment Posts a Loss in 2Q15

U.S. Steel’s Flat-Rolled segment posted negative EBIT of $24 per ton in 2Q15. This represents a slight improvement over 1Q15 results.

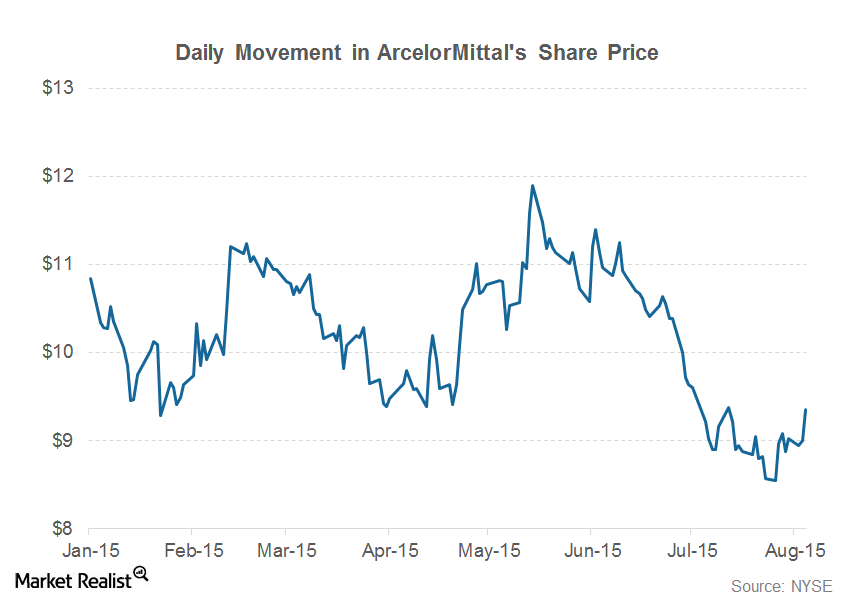

ArcelorMittal’s 2Q15 Earnings: Key Investor Takeaways

ArcelorMittal (MT) released its 2Q15 earnings on July 31. It reported net earnings of $0.2 billion in 2Q15 compared to a loss of $0.7 billion in 1Q15.

U.S. Steel Recovers from 52-Week Low: But Is It out of the Woods?

U.S. Steel has bounced back from its 52-week low. In fact, most steel company earnings have been better than analyst expectations.

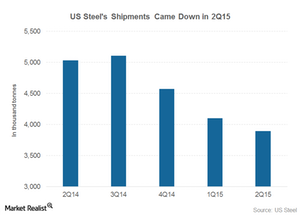

U.S. Steel Sees 2Q15 Steel Shipments, Capacity Use Falter

Fewer 2Q15 shipments from U.S. Steel are attributable to its high exposure to the energy sector. The company’s steel product shipments fell steeply in 2Q15.Materials Must-know: Why Nucor is different from its competitors?

According to Nucor “Empowerment isn’t a corporate buzzword—it’s a way of life.”

Key Investor Takeaways from US Steel’s 1Q Earnings Release

US Steel’s 1Q earnings results came in lower than analyst estimates, and the company’s share price tanked more than 10%.

Steel prices hit rock bottom, the lowest level since 2009

Steel prices crashed by almost two-thirds at the peak of the global financial crisis in 2009. Last year, they dropped by 10%.

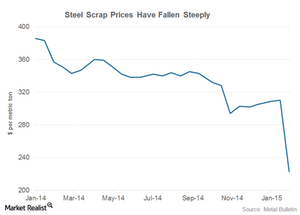

Steel Scrap Prices Have Fallen Sharply in 2015

Steel scrap prices fell by ~20% in 2014. Lower steel scrap prices should bring down unit production costs for steel plays.

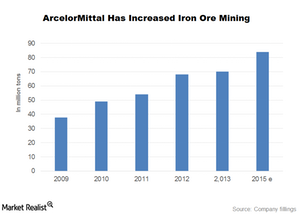

Vertically Integrated Steel Mills Are At A Disadvantage

While iron ore prices crashed, production costs for iron ore haven’t come down. Steel plays’ mining operations have been hit by the fall in iron ore prices.Materials Why steel investors are mindful of capacity utilization rates

Steel prices tend to move in tandem with capacity utilization rates. Steel prices are a key factor affecting performance, directly impacting the revenues of companies.

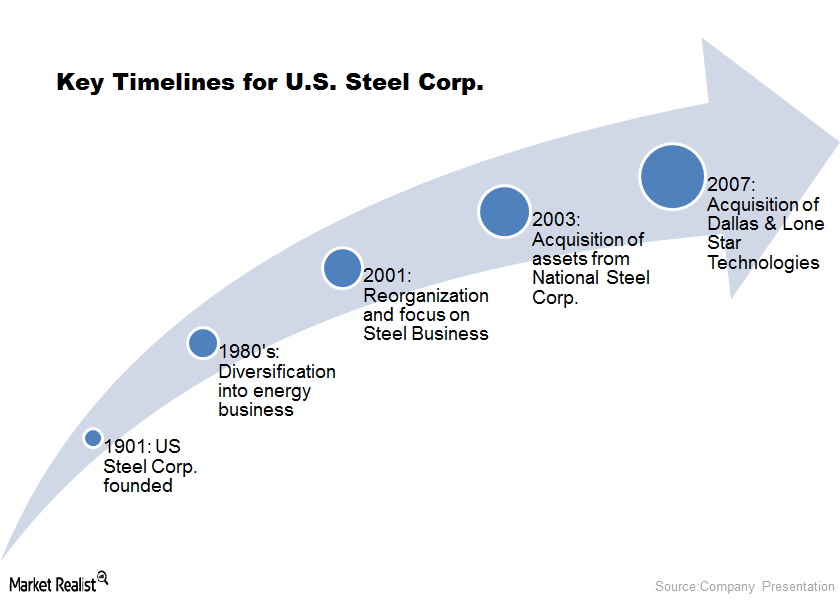

Everything you need to know about US Steel Corporation

U.S. Steel Corporation’s stock has surged in the past few months, delivering more than 150% growth in the last year.

Why direct reduced iron facilities could be a key driver at Nucor

Nucor recently started production at its DRI plant in Louisiana.

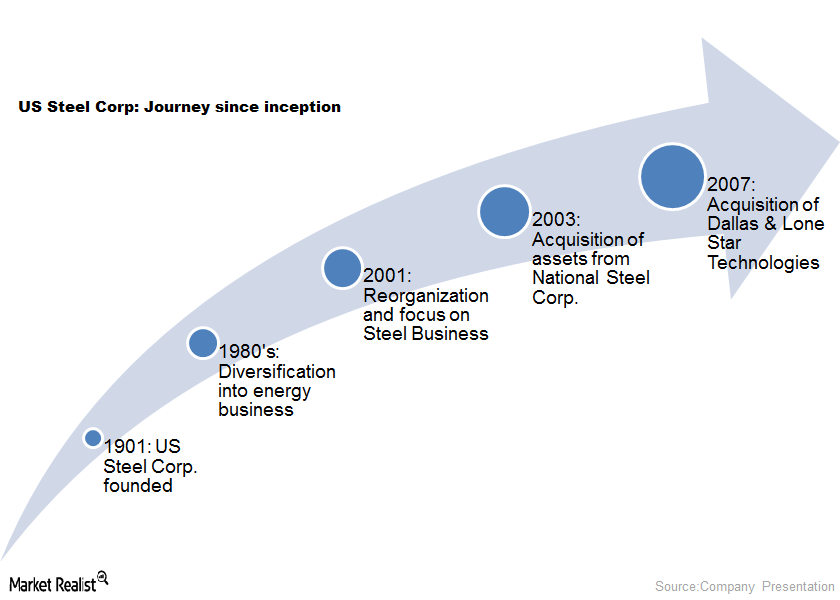

Must-know: The history of US Steel Corporation

After trying its hands at various businesses, the company finally consolidated the operations in 2001.

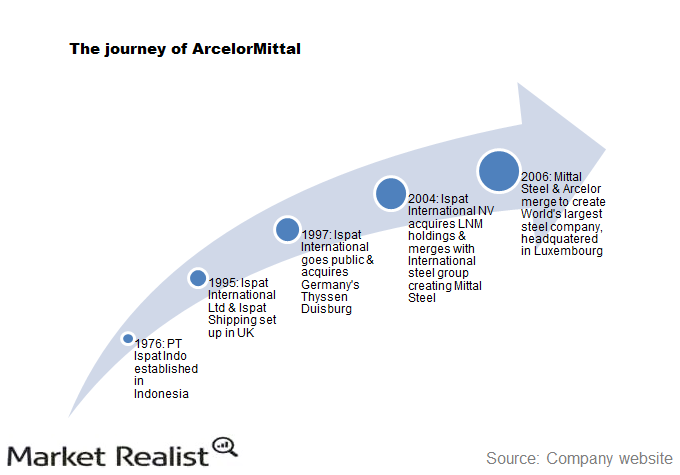

Must-know: ArcelorMittal’s competitive landscape

Since the products are similar, the switching costs aren’t very high for buyers.

Overview: ArcelorMittal—leader in steel manufacturing

In 2007, the newly merged ArcelorMittal continued its expansion strategy by announcing 35 transactions worldwide.