iShares US Basic Materials

Latest iShares US Basic Materials News and Updates

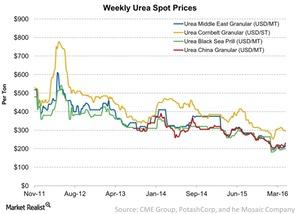

Tracking Urea Price Movement during the Week Ending April 22

In 2013, about 54% of global ammonia was upgraded to urea, according to FERTECON. But urea prices have rebounded from their lows at the beginning of 2016.

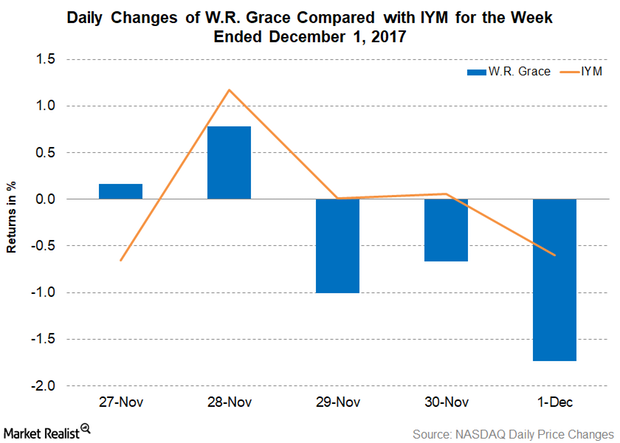

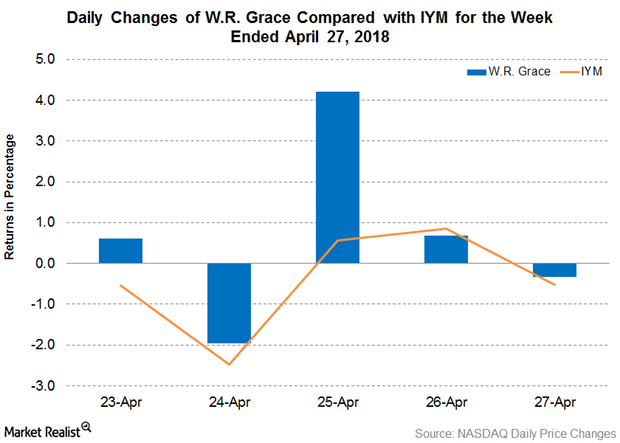

W.R. Grace Signs a Spree of New Contracts

On November 27 and 28, 2017, W.R. Grace (GRA) signed a spree of new contracts for its Unipol license.

Apple’s Premium Pricing Strategy, Product Differentiation

Here is how Steve Jobs strategy to price and differentiate the products that Apple offers has taken shape over time

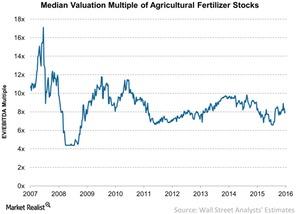

Valuation Multiples for Agricultural Chemicals after Brexit

In this part of the series, we’ll look at agricultural fertilizer producers’ valuations from their historical standpoints. Over the long run, valuation multiples impact a company’s share price.

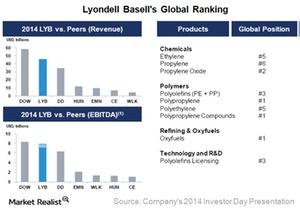

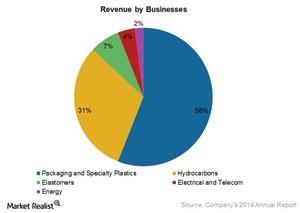

What Are LyondellBasell’s Global Rankings?

LyondellBasell (LYB) is the leading global producer of olefins and polyolefins.

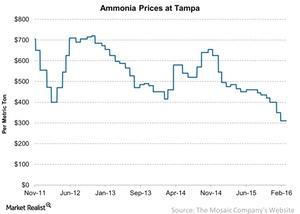

Why Ammonia Prices Are Falling

The average price of ammonia for the week ending March 4, 2016, stood at $310 per metric ton compared to $311 per metric ton a week ago.

APD’s Q4 2018 Earnings Beat Estimates, Revenues Missed

On November 6, Air Products and Chemicals reported revenues of $2.30 billion for the fourth quarter.

W. R. Grace Bags New UNIPOL Technology Client

On April 24, W. R. Grace (GRA) announced that it would be licensing its UNIPOL PP Process Technology to Inter Pipeline to be used in its Heartland Petrochemical complex in Alberta, Canada

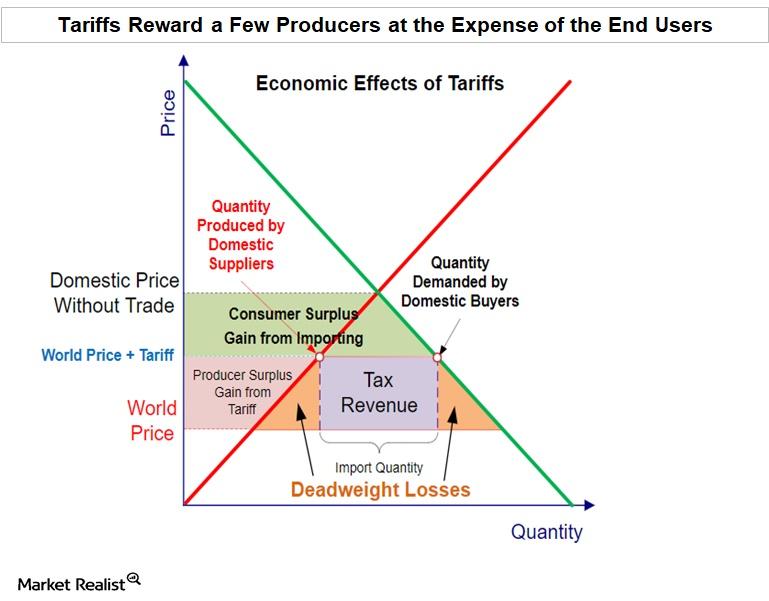

Why Economist Argue That Tariffs Are Bad for the Economy

The recently proposed import tariffs on steel and aluminum imports by US President Donald Trump are an effort to protect the interests of US manufacturers.

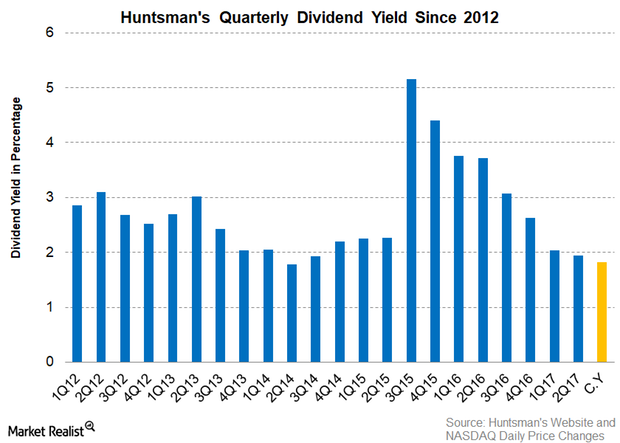

Huntsman’s Dividend Yield Falls as Its Stock Price Rises

Huntsman’s dividend yield Dividend yields are very important for long-term investors, as they fetch a steady income. Investors prefer companies with a strong dividend yield and growth. As Huntsman (HUN) has maintained its dividend rate, we can expect it to pay a fiscal 2017 dividend of $0.50 per share At this dividend rate, Huntsman’s dividend yield […]

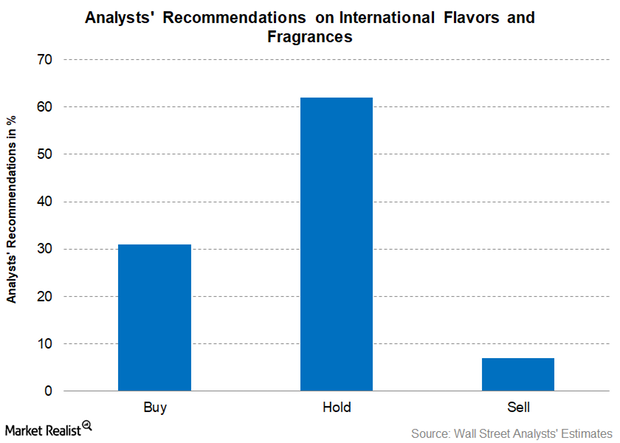

Why Most Wall Street Analysts Recommend a ‘Hold’ for IFF

International Flavors and Fragrances continues to work towards its 2020 vision of increasing its revenue by $500 million by way of acquisitions.

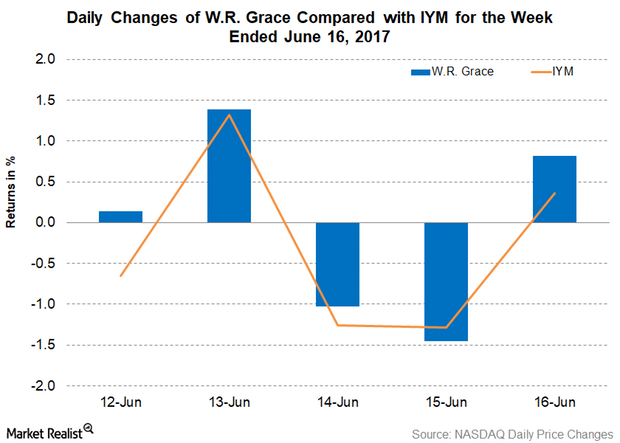

Grace Signs New License Contract with Hengli Refinery

GRA closed at $70.53 with a fall of 0.2% for the week ended June 16, 2017.

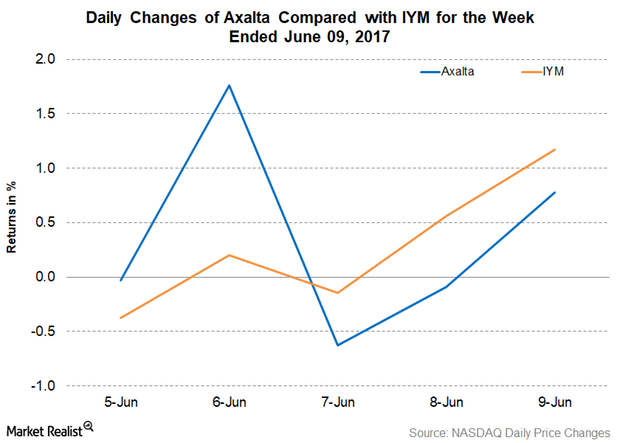

Axalta Completed the Acquisition of Spencer Coatings

Axalta (AXTA) announced its move to acquire United Kingdom–based Spencer Coatings in May. Axalta completed the acquisition.

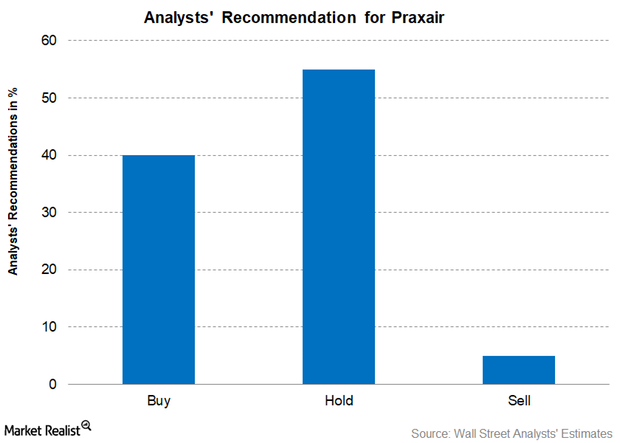

Praxair in the Crosshairs: Analyst Recommendations and Target Prices

On May 26, of the 20 firms tracking Praxair (PX) stock, about 40.0% recommended “buys,” while 55.0% recommended “holds.”

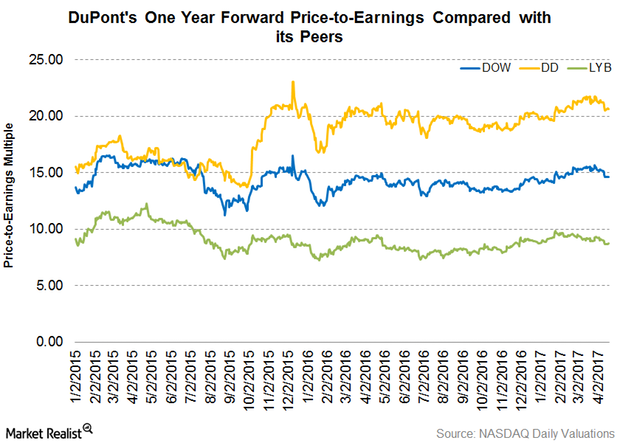

Why DuPont Trades at a Premium to Its Peers

As of April 18, 2017, DD traded at a one-year forward PE multiple of 20.60x.

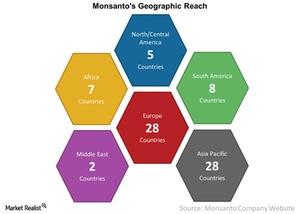

Monsanto Has a Huge Presence in Over 150 Countries

For over 100 years, Monsanto (MON) has been spread across several countries, with some of its brands being sold and used in over 150 countries.

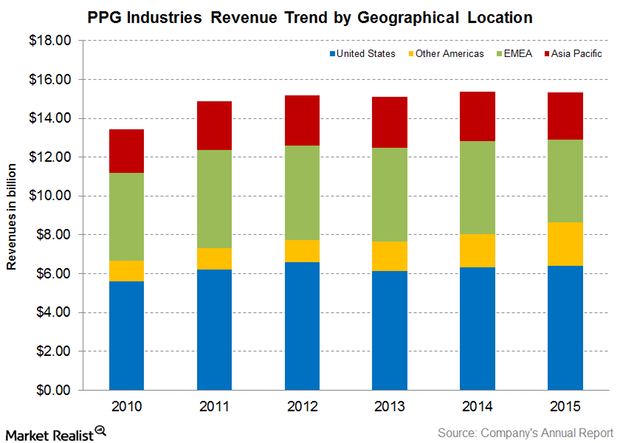

PPG Industries’ Geographical Revenue Mix

PPG Industries (PPG) is a leading global player in the paint and coatings segment, operating in 70 global locations. Let’s look at their revenue contributions to PPG.

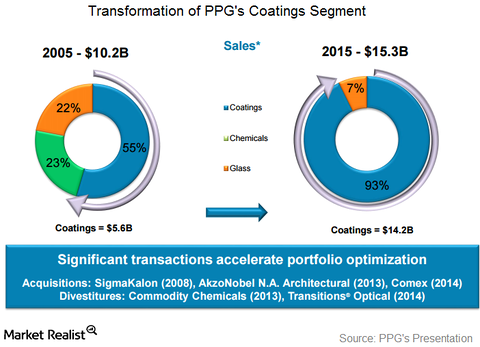

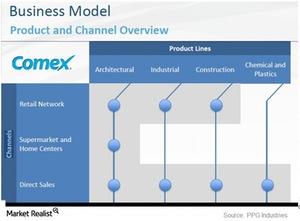

PPG Industries’ Business Model Aids Its Coatings Segment

PPG Industries’ (PPG) coatings segment has been growing at a CAGR of 7.1% since 2010. PPG has been able to increase its revenues basically through acquisitions.

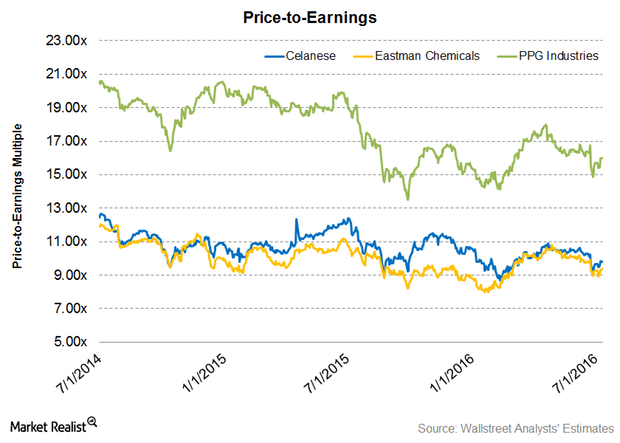

Where Do Celanese Valuations Stand before Its 2Q16 Earnings Report?

On July 11, Celanese’s forward EV-to-EBITDA ratio stood at 7.5x.

Urea Prices: Still a Concern for Nitrogen Fertilizer Stocks

As most global ammonia production is upgrading to urea, ammonia prices may affect urea prices.

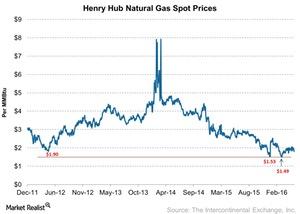

How Do Natural Gas Price Forecasts Impact Fertilizer Companies?

Natural gas is the key raw material for the production of nitrogen fertilizers such as ammonia and urea.

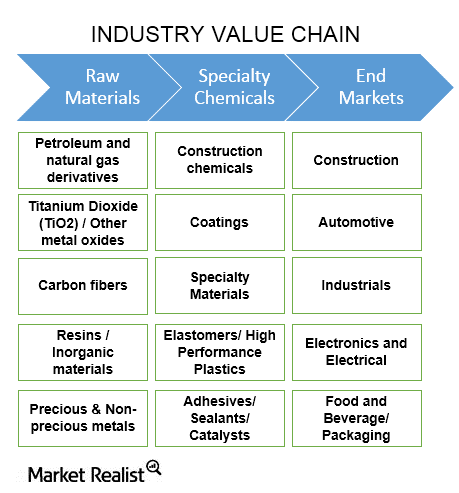

Understanding the Business Models of Specialty Chemical Companies

Companies in the specialty chemical industry have fewer intermediaries in their distribution range as they move from coatings to more specialized chemicals.

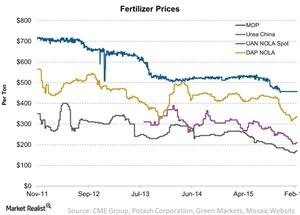

An Update on NPK Fertilizer Price Trends

Fertilizer prices have fallen significantly over the years. But more recently, prices are showing a trend reversal for urea, UAN, and phosphate fertilizer.

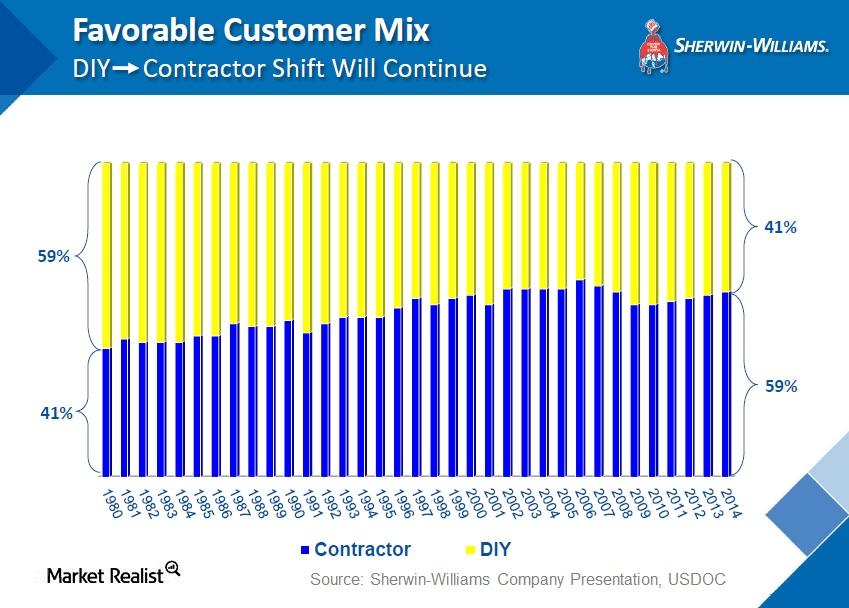

Why Paint Companies Are Posting Their Best Gross Margins

Paint companies benefit significantly when titanium dioxide prices enter recessionary cycles.

Introducing the Specialty Chemicals Industry: What You May Not Yet Know

The specialty chemicals industry caters to diverse sectors through innovative products that are tailored to the specific requirements of end markets.

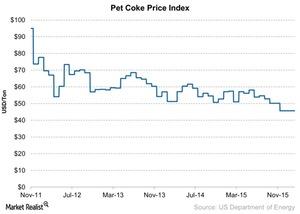

What’s Happening to Pet Coke Prices?

Coal, or petroleum coke, is widely used by nitrogen fertilizers producers in China. Declining coal prices negatively impact natural gas-based producers.

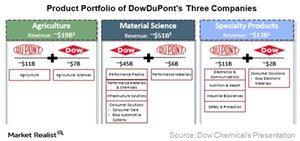

DowDuPont Will Spin Off into 3 Independent Public Companies

After the merger, DowDuPont will spin off into three independent and public companies—agriculture, material science, and specialty products.

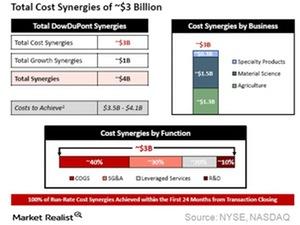

Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.

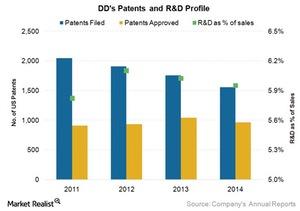

DuPont’s Research and Development Spending Compared to Its Peers’

DuPont is a technology and research and development driven company. It spent an average of 6% of its revenues on R&D activities during the 2011–2014 period.

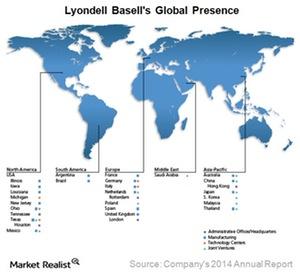

How Does LyondellBasell’s Geographical Exposure Compare to Peers?

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States.

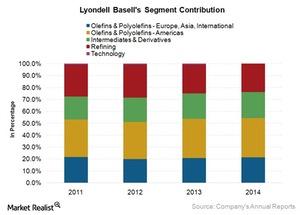

LyondellBasell: A Leading Manufacturer of Olefins and Polyolefins

LyondellBasell is one of the world’s leading producers of olefins and polyolefins. After Dow Chemical, LYB is the second largest company by revenue and EBITDA in the US.

What Will Drive Dow Chemical’s Future Growth?

The Dow Chemical Company has significantly changed its business model to improve its earnings profile and returns to shareholders.

Understanding Dow’s Largest Segment, Performance Plastics

Dow’s Performance Plastics segment contributed 39% and 46% to Dow’s total revenue and EBITDA, respectively, in 2014.

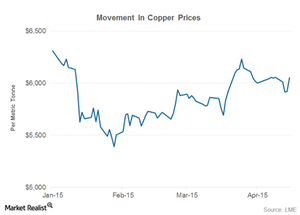

Supply Disruptions in 2015 Support Copper Prices

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.

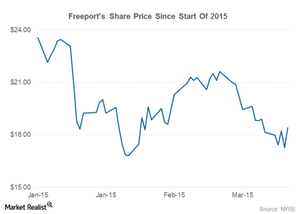

Key Indicators Freeport Investors Should Track

Freeport has lost almost 20% of its market capitalization so far this year, making 2015 a turbulent period for the company.

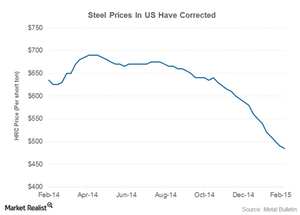

Steel prices hit rock bottom, the lowest level since 2009

Steel prices crashed by almost two-thirds at the peak of the global financial crisis in 2009. Last year, they dropped by 10%.

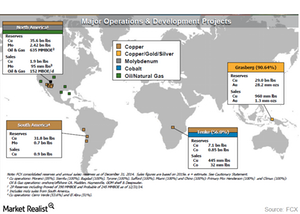

Freeport-McMoRan’s global mining portfolio

Freeport’s global mining portfolio shows that Freeport has major operations in North America, South America, Africa, and Indonesia.

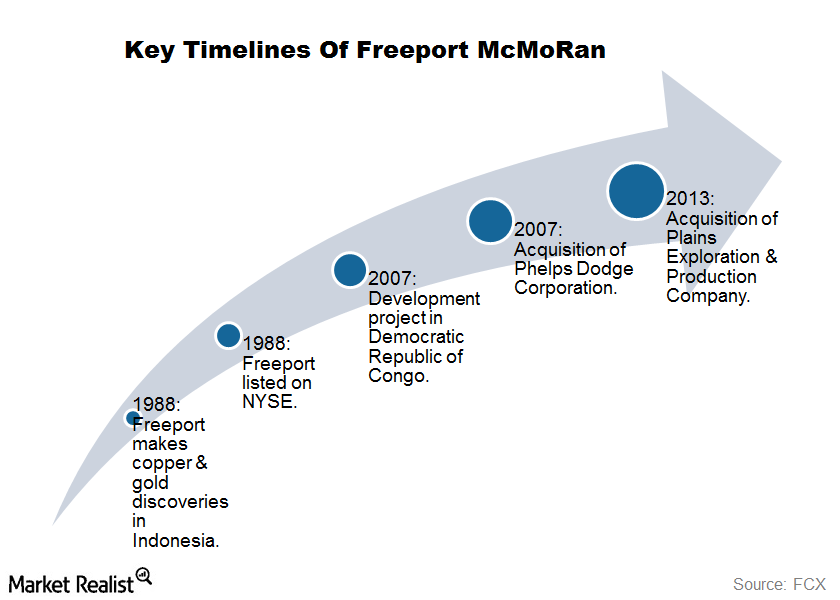

Why is Freeport’s key historical timeline important?

Freeport’s key historical timeline starts more than a century ago when Freeport Sulphur established the city of Freeport, Texas, near its sulphur mine.