HollyFrontier Corp

Latest HollyFrontier Corp News and Updates

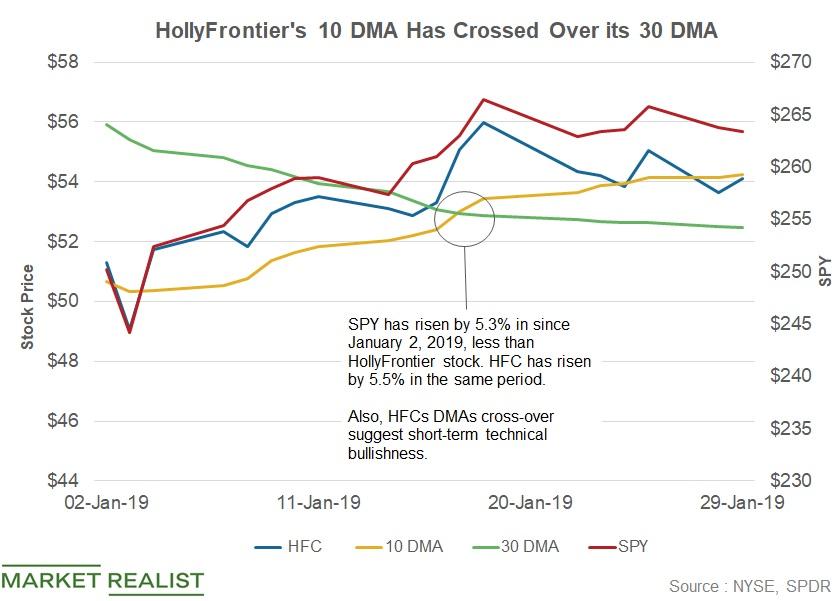

HollyFrontier Stock Has Recovered 5.5% in 2019

HollyFrontier (HFC) stock has risen 5.5% since January 2. The stock has risen less than its peers Marathon Petroleum (MPC) and Valero (VLO).

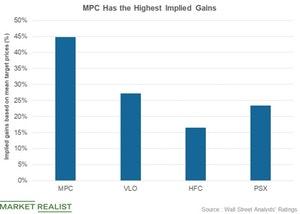

HFC and PSX: Which Company Could Post the Most Gains?

After HollyFrontier’s earnings, RBC lowered its target price on the stock from $68 to $66.

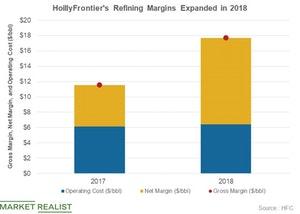

Analyzing HollyFrontier’s Refining Margin in 2018

HollyFrontier’s refining segment is critical for its overall earnings. The refining segment’s adjusted EBITDA rose 127% to $1.7 billion in 2018.

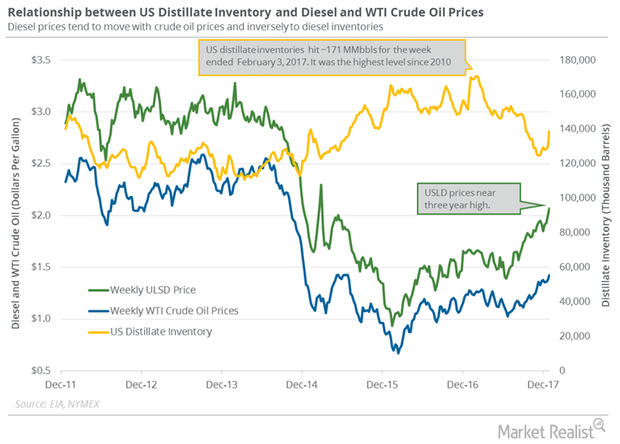

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

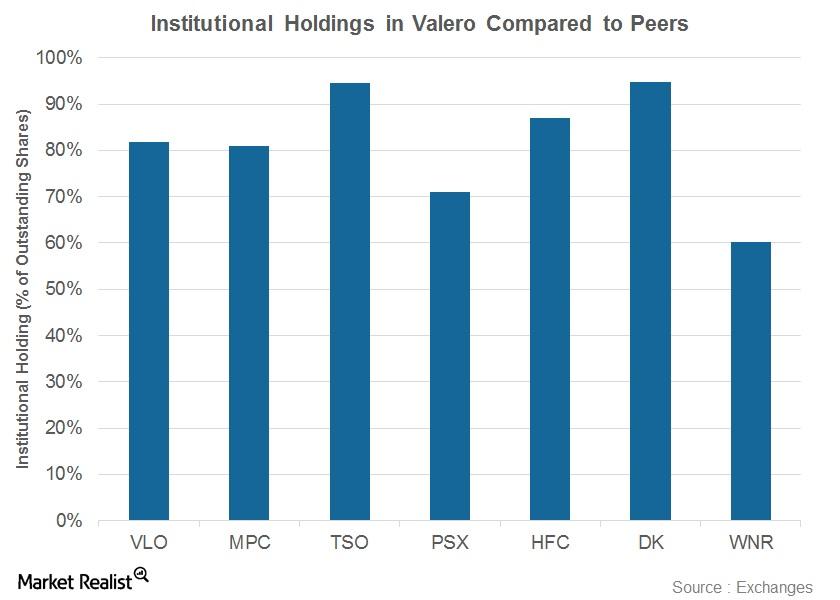

Valero’s Institutional Holdings before the 1Q17 Results

The institutional holdings in Valero Energy (VLO) are higher than the institutional holdings in Marathon Petroleum (MPC), Phillips 66 (PSX), and Western Refining (WNR).

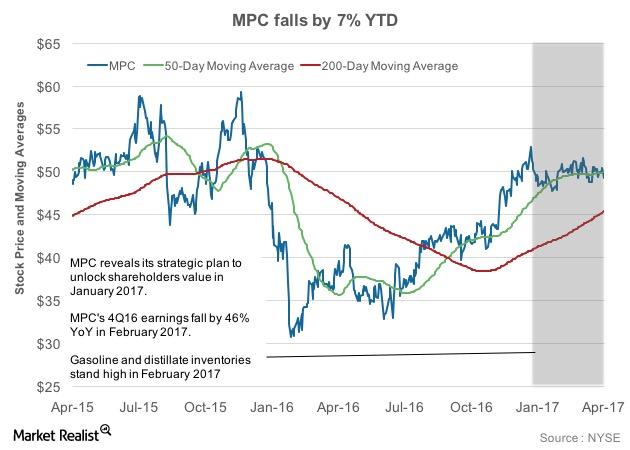

Marathon Petroleum Stock: Performance ahead of the 1Q17 Earnings

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average.

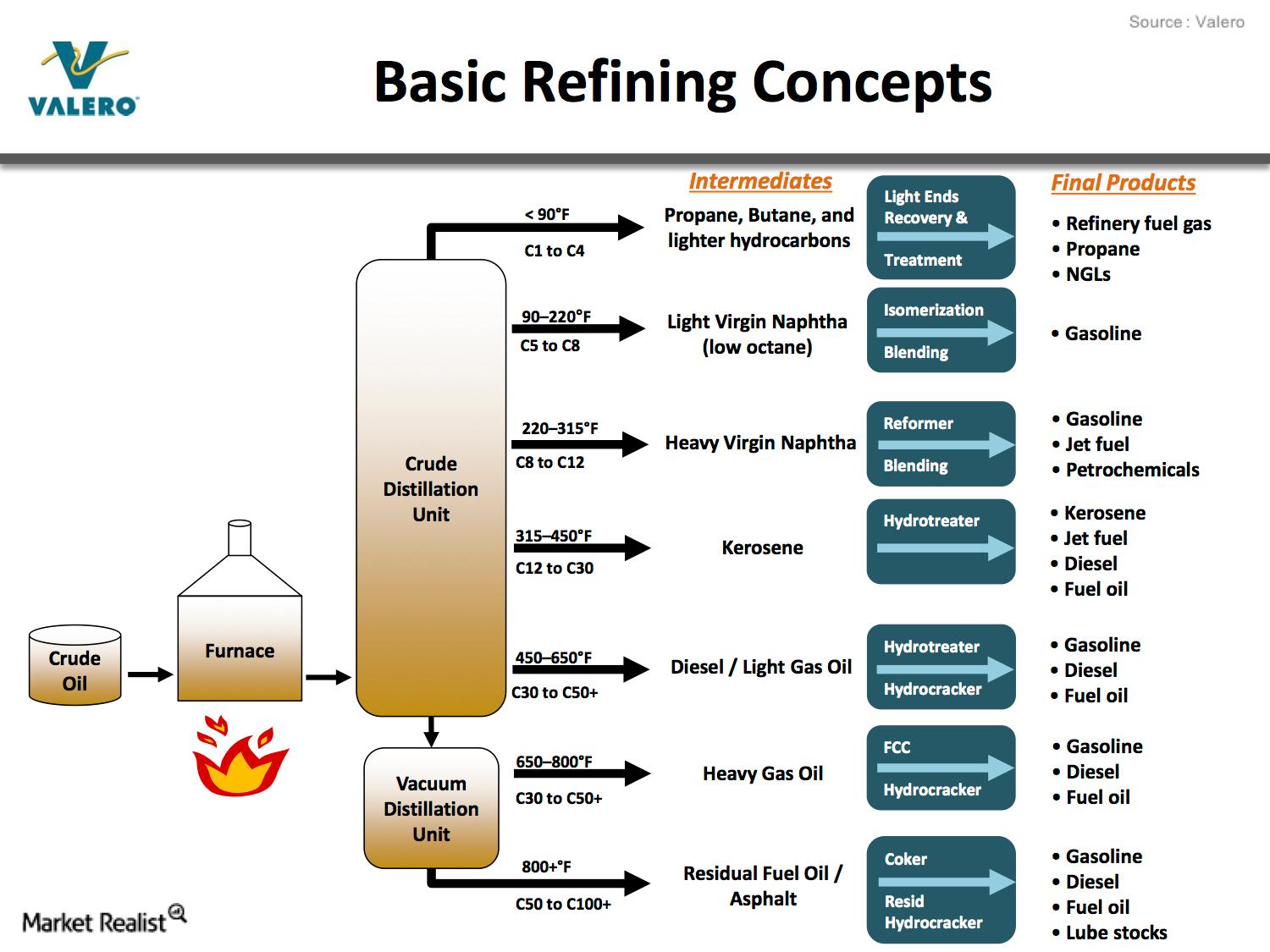

What Is Crude Oil Refining and How Does It Work?

This series will provide you a complete overview of the refining industry as well as a quick snapshot of downstream sector stocks in the US.

Best Refining Stocks: Comparing MPC, VLO, PSX, HFC

Refining stocks’ performance was mixed in the fourth quarter. While Marathon Petroleum and HollyFrontier fell, Valero Energy and Phillips 66 rose.

Valero Stock Rises 12% before IMO 2020

Valero Energy (VLO) stock has risen 11.6% sequentially. The stock has risen due to stronger refining conditions in the current quarter.

Refining Crack Spread Overview: All You Ever Wanted to Know

The crack spread is a major component that drives refiners’ valuation. In this article, we’ll look at the metric’s different aspects.

Best Oil Refining Stocks: MPC, VLO, PSX, HFC, PBF, and DK

Oil refining and marketing stocks have been on investors’ radar. Valero Energy (VLO) and Phillips 66 (PSX) have risen 29.0% and 29.7%, respectively, YTD.

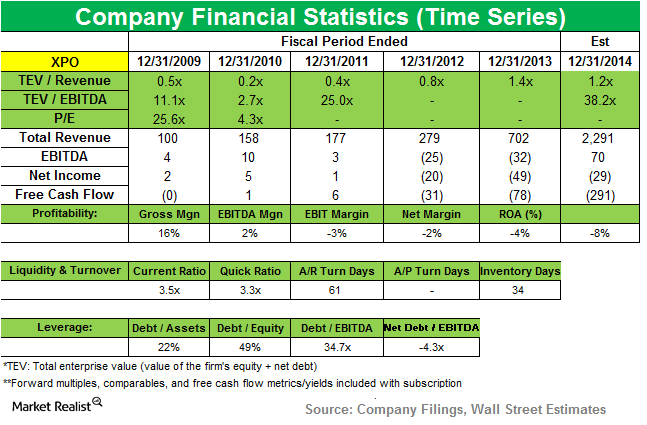

OTPP opens new position in XPO Logistics

OTPP added a new position in XPO Logistics Inc. (XPO) during the third quarter that ended in September. The position accounted for 0.46% of the fund’s total portfolio.

MPC: Elliott Ups Stake by 86% in Marathon Petroleum

In the third quarter, Elliott Management raised its stake in Marathon Petroleum by about 86%. Elliott has criticized MPC’s management on several occasions.

Valero or Marathon Petroleum: Which Is a Better Buy?

Valero (VLO) and Marathon Petroleum’s (MPC) stocks have fallen 2.9% and 0.7%, respectively, so far in Q3. Here, we review which refiner is a better buy.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

Why Is Delek Stock Falling?

Analysts expect Delek’s EPS to fall by 38% YoY and 45% quarter-over-quarter to $0.84 in the second quarter of 2019.

How Has Phillips 66’s Dividend Yield Trended?

Phillips 66’s dividend payments have risen in the past few years. In the first quarter, the company will pay a dividend of $0.8 per share on March 1.

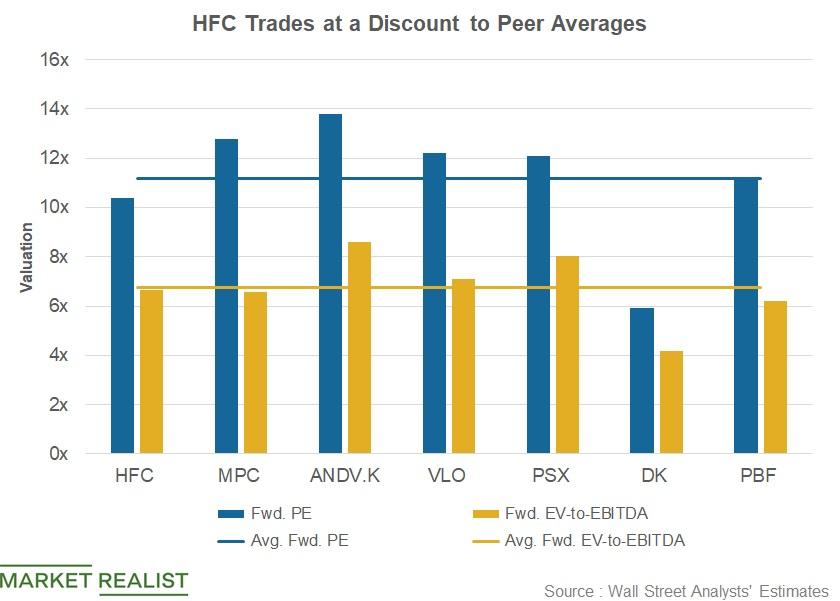

Comparing HollyFrontier’s Valuation with Peers’

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

How Andeavor Stock Has Performed ahead of Q2 2018 Earnings

In the earlier two parts of this series, we looked at Andeavor’s (ANDV) earnings estimates and expected refining margin for Q2 2018.

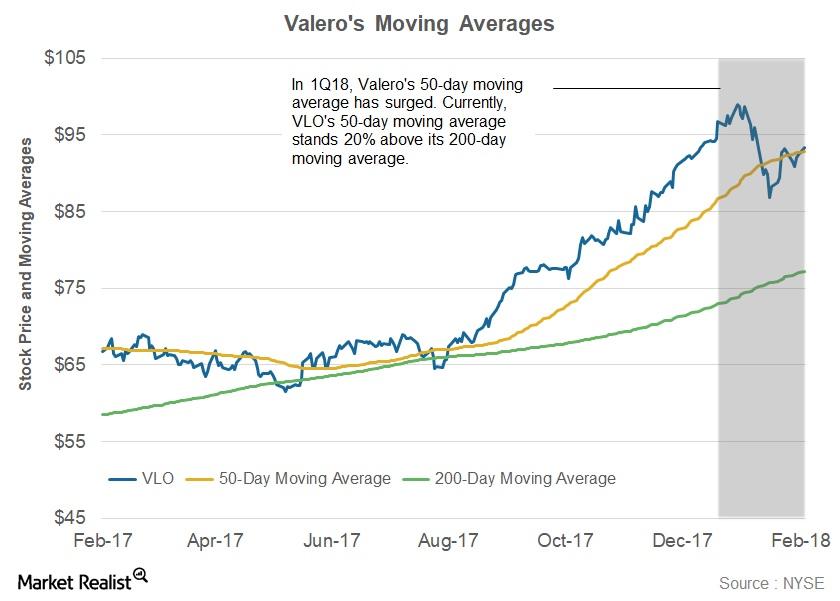

What Does Valero’s Moving Average Suggest?

In 1Q18, VLO’s 50-day moving average remained above its 200-day moving average.

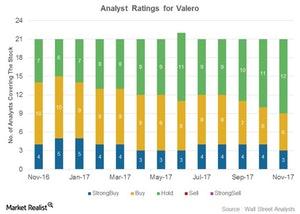

Analysts’ Views on Valero

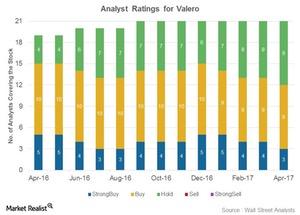

Analysts’ ratings for Valero Previously, we looked at analysts’ expectations for Valero Energy’s (VLO) dividend payment next quarter. In this part, we’ll look at analysts’ ratings for Valero. As shown in the chart above, nine (or 43%) of the 21 analysts covering VLO have rated it a “buy.” The remaining 12 analysts have rated Valero a “hold,” and […]

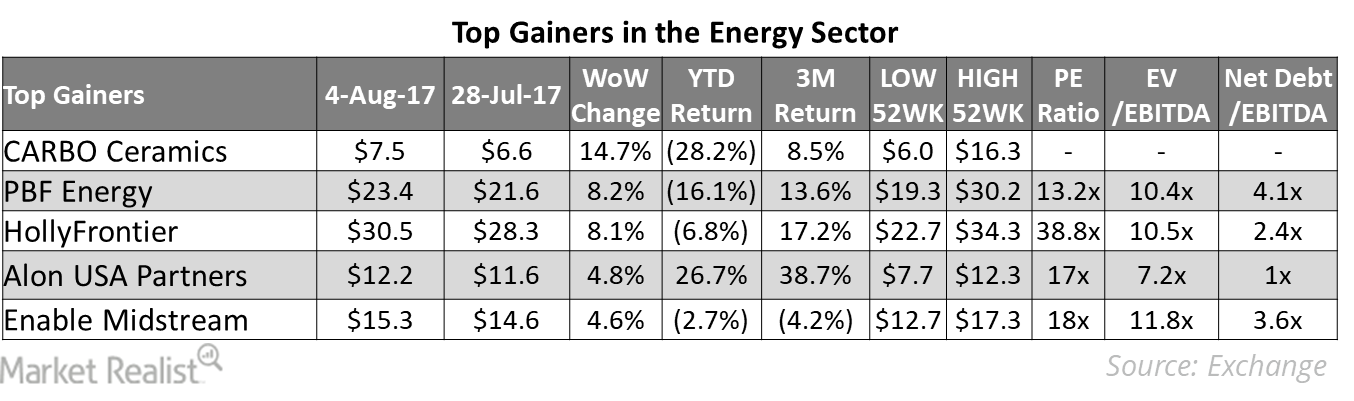

These Energy Stocks Rose the Most Last Week

Oil field services stock CARBO Ceramics (CRR) was the biggest gainer among the energy sector stocks last week.

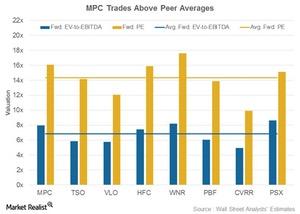

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

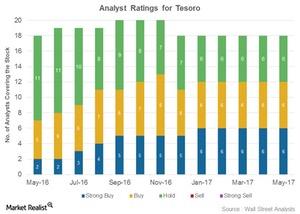

How Analysts Rated Tesoro on Its 1Q17 Earnings Day

Tesoro (TSO) has been rated by 18 analysts. Of those, 12 have assigned the stock a “buy” or “strong buy” rating.

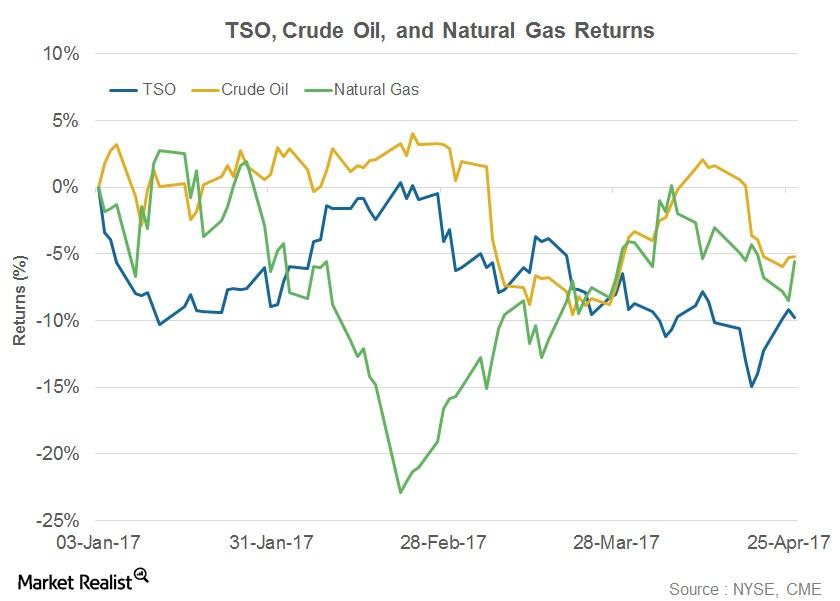

How Did Tesoro’s Stock Perform Pre-1Q17 Earnings?

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date.

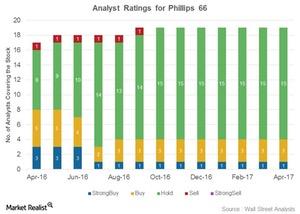

How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

Are Valero’s Analyst Ratings Weaker or Stronger before the 1Q Results?

Of the 21 analysts covering Valero Energy (VLO), 12 (57%) analysts have assigned “buy” or “strong buy” ratings, while nine (43%) have assigned “hold” ratings.

Why Short Interest in Valero Soared in 2017

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017.

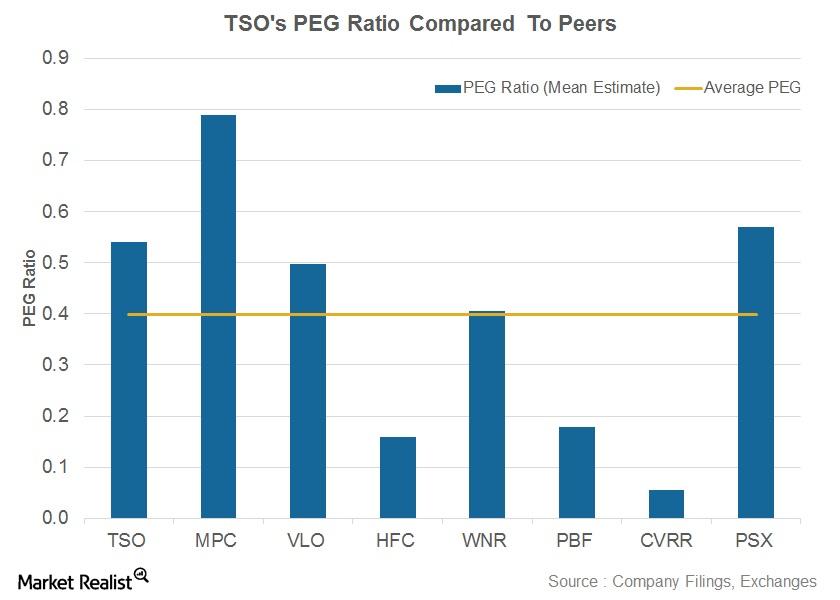

How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

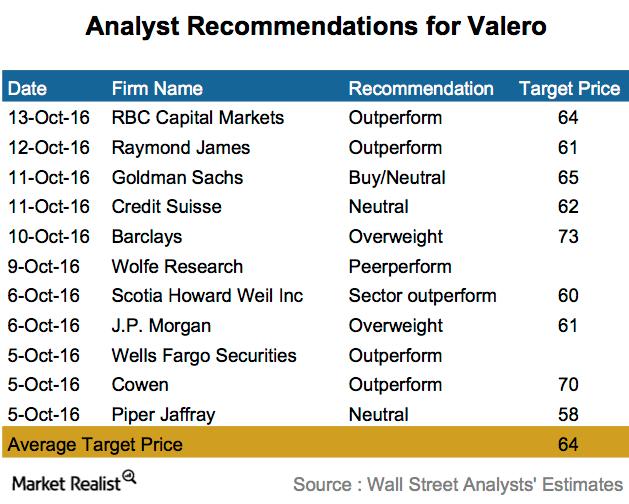

How Analysts Are Rating Valero ahead of Its 3Q16 Earnings

Eight of the 11 firms rated Valero as a “buy,” “overweight,” or “outperform,” with a high 12-month price target of $73, indicating a potential 35% gain.

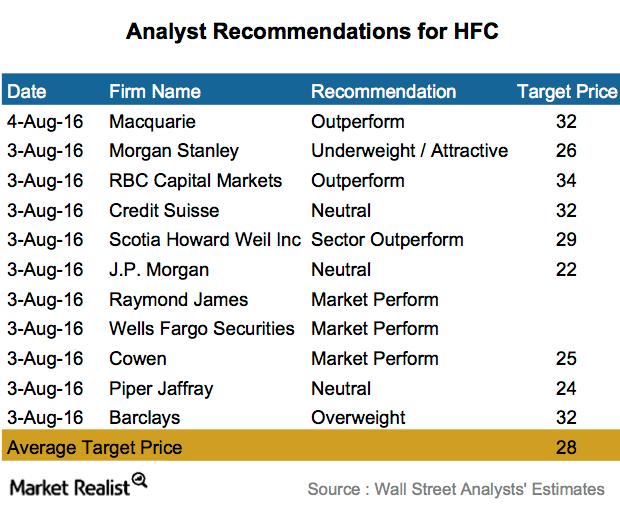

What Are Analysts’ Recommendations for HollyFrontier?

The analysts’ survey shows that six out of the 11 companies surveyed rated HollyFrontier (HFC) as “neutral” or “market perform.”

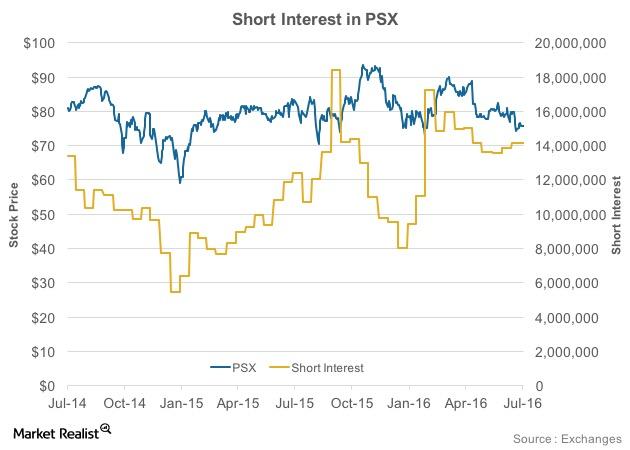

What Does an Analysis of PSX’s Short Interest Reveal?

Since mid-February 2016, Phillips 66 (PSX) has witnessed an 18% fall in its short interest.

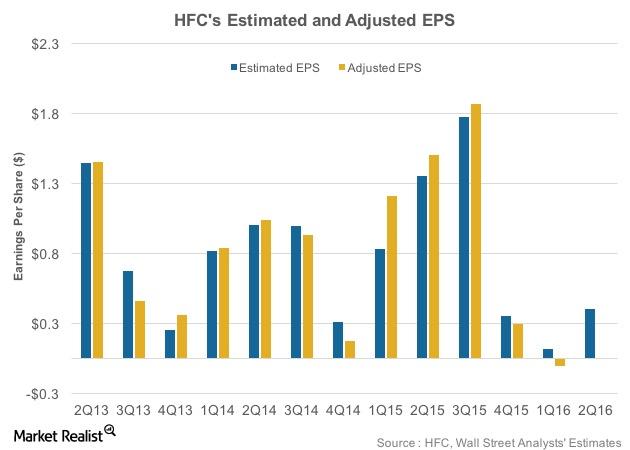

HollyFrontier’s 2Q16 Earnings Expected to Outshine Those of 1Q16

Wall Street analysts expect HollyFrontier to post EPS of $0.35, which is 76% lower than its 2Q15 adjusted EPS.

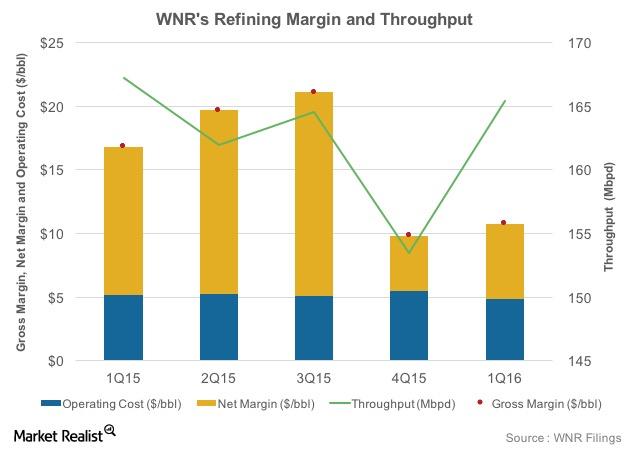

Will WNR’s Refining Margin Trend Higher This Quarter?

Western Refining (WNR) recorded a fall in gross refining margins, from $16.80 per barrel in 1Q15 to $10.80 per barrel in 1Q16.

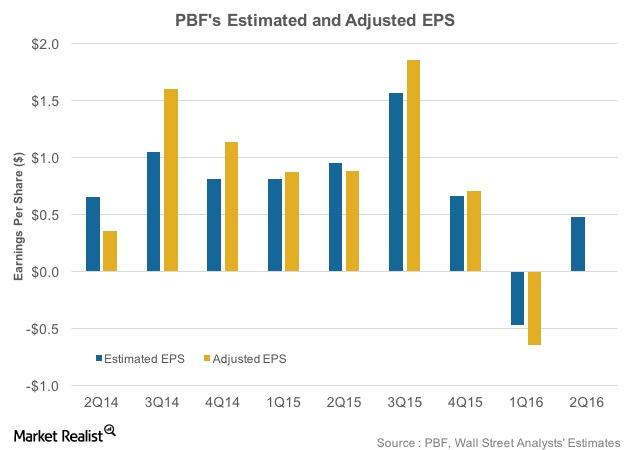

What Do Analysts Expect from PBF Energy’s 2Q16 Earnings?

In 1Q16, PBF Energy’s revenues surpassed Wall Street analyst estimates by 12%. PBF’s 1Q16 adjusted EPS was -$0.65, as compared to the estimated -$0.47.

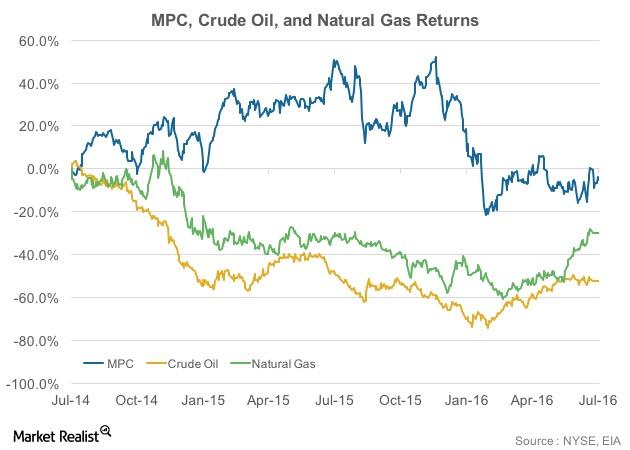

How Has Marathon Petroleum Stock Performed Pre-Earnings?

Between July 2014 and November 2015, Marathon Petroleum (MPC) stock rose 51%. But after that, the stock fell until early 2016.

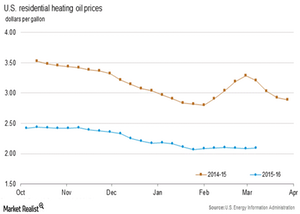

Why Did Heating Oil and Diesel Fuel Prices Rise?

US on-highway diesel fuel prices rose by 2% and were at $2.02 per on March 7, 2016. The current diesel prices are 46% lower than they were a year ago.

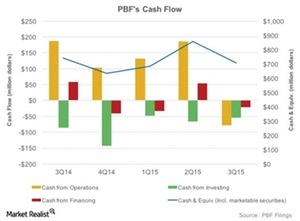

PBF’s Cash Flow Is Volatile amid Changes in Working Capital

PBF Energy has seen a fall in cash balances from 3Q14 to 3Q15. PBF’s cash balance in 3Q15 stood at $707 million, showing a 5% fall over 3Q14.