Expeditors International of Washington Inc

Latest Expeditors International of Washington Inc News and Updates

What Is FedEx Management’s Outlook for the Future?

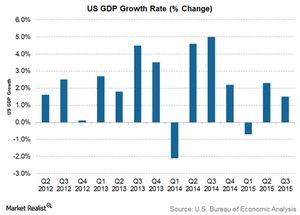

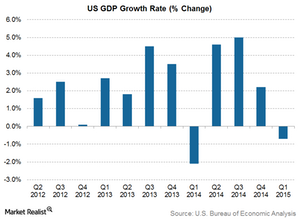

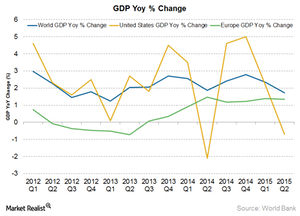

FedEx continues to see growth in the global economy. It expects the US GDP to grow by 2.4% in 2015 and by 2.6% in 2016, driven by increased consumer spending.

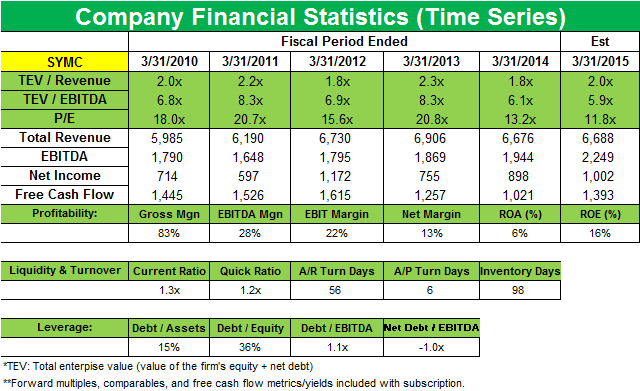

Jeffrey Ubben’s ValueAct Capital buys a new stake in Symantec

ValueAct Capital initiated a new position in Symantec Corp. (SYMC) that accounts for 1.14% of the fund’s first quarter portfolio.

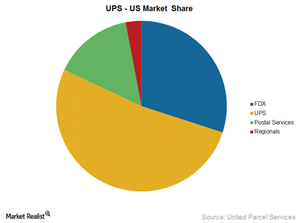

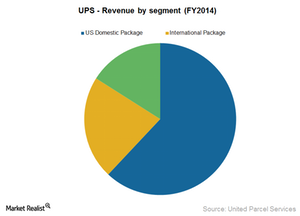

A Look into UPS’s Domestic Package Segment

UPS’s Domestic Package segment provides an array of guaranteed ground and air package transportation services, depending on the customer’s need.

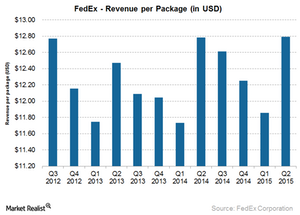

FedEx’s New Pricing Policy Improves Its Efficiency

Effective January 2015, FedEx changed its pricing policy for all of its FedEx Ground packages less than 3 cubic feet to a “dimensional weight pricing” mechanism.

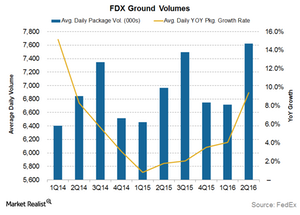

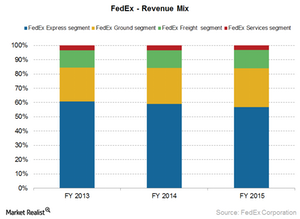

FedEx Ground: Delivering on E-Commerce Growth

FedEx Ground is being driven by the booming growth in e-commerce, and it contributed to 35% of the company’s revenues but 44% of its profits.

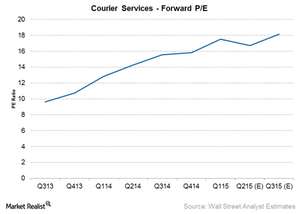

Analyzing the Valuation Trend of Courier Services

The economic upturn since 2009 has improved growth prospects for the courier companies. This coupled with improving industry margins has led to improving industry valuations.

How Is UPS Valued Compared to Its Peers?

UPS’s forward PE ratio stands at 17.1x compared to its current PE ratio of 22.3. Analysts are expecting UPS’s earnings to grow in the next four quarters.

What are UPS’s Revenue Drivers?

Revenue drivers There are three main drivers of revenue growth for United Parcel Service (UPS): package volumes, product mix and pricing, and fuel surcharges. Package volumes and product mix and pricing are in turn driven by economic growth. Economic growth Increasing economic growth increases e-commerce demand, which in turn increases demand for courier services. […]

Inside C.H. Robinson’s Competition and Growth Strategy

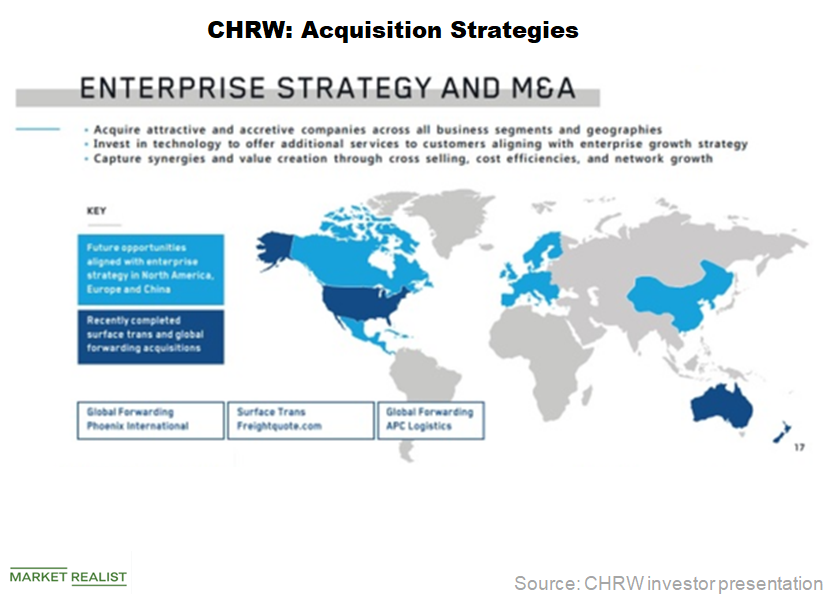

C.H. Robinson Worldwide (CHRW) is the largest third-party logistics provider in the world.

C.H. Robinson: Solid Business Growth through Acquisitions

C.H. Robinson Worldwide (CHRW) went public in 1997. Soon after, the company went on an acquisition spree to further its business interests in new geographies.

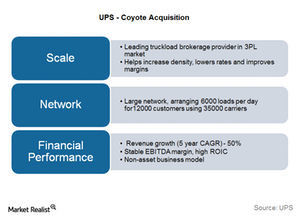

How Does UPS Benefit from Its Acquisition of Coyote Logistics?

United Parcel Services (UPS) announced its agreement to acquire Coyote Logistics. It’s a Chicago-based logistics firm with contract carrier companies.

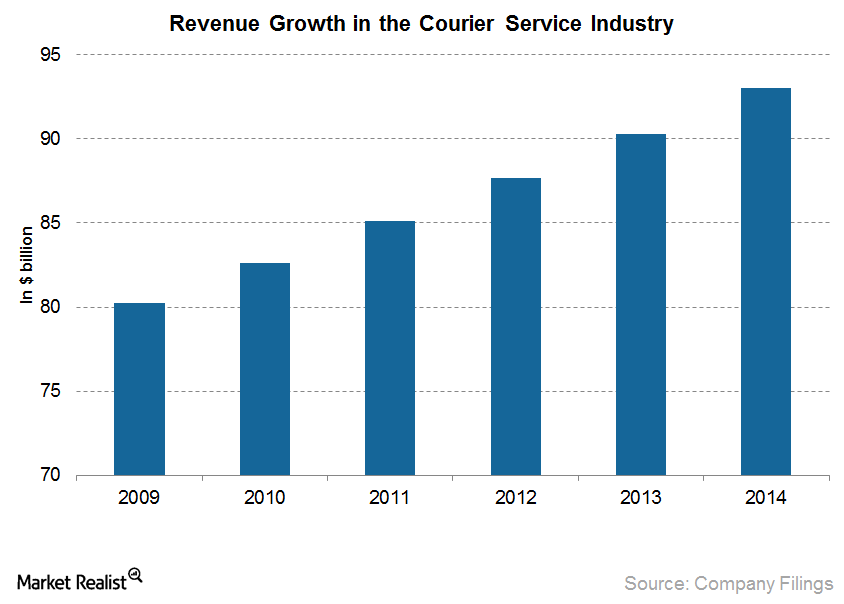

Why Is Economic Growth Important for the Courier Service Industry?

Over the past few years, the global courier services industry has managed to recover from the global economic slowdown.

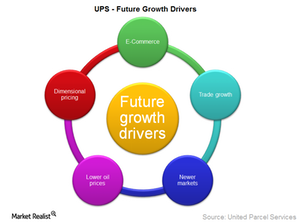

Possible Key Growth Drivers for UPS in the Near Future

The e-commerce industry is poised to grow rapidly in the future. With this growth will come the need for package delivery.

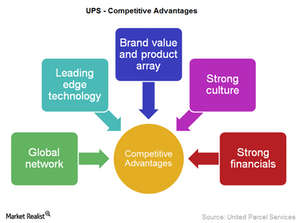

Key Strengths that Keep UPS ahead of Its Peers

Some of UPS’s key strengths that keep it ahead of its competitors include an integrated global network, leading-edge technology, a strong brand name, a strong culture, and impressive financials.

A Look at the Courier Service Industry in the United States

The growth in e-commerce among various economies across the globe has helped shape the highly competitive courier service industry that we know today.

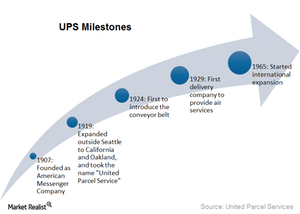

United Parcel Service: How It Delivers Packages to the World

United Parcel Service is the world’s largest package delivery company and a leading global provider of specialized transportation and logistics services. It forms the largest holding of 7.6% in IYT.

UPS: How the World’s Largest Package Delivery Service Began

United Parcel Service (UPS), originally called American Messenger Company, was founded in 1907 by 19-year-old James E. Casey with $100 borrowed from a friend.

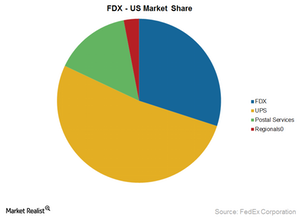

FedEx’s Delivery Market Share Is Threatened by New Competitors

FedEx was formed with a vision to change the way delivery services worked prior to 1971. It established a new industry and it has been leading its peers since then.

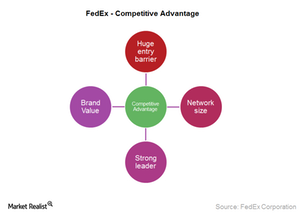

What Are FedEx’s Key Strategic Business Advantages?

FedEx has been in the marketplace for over 40 years. It has established a huge network spread across more than 220 countries and territories worldwide.

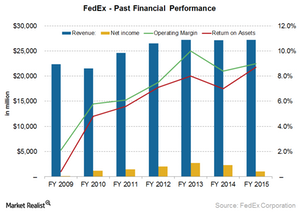

FedEx’s Financial Performance and Long-Term Goals

FedEx’s (FDX) financial performance during the last few years has been extraordinary. It successfully bounced back from the recessionary downturn.

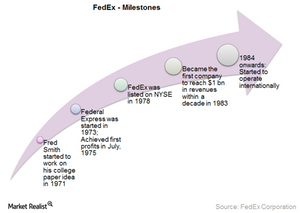

FedEx’s Growth Is Led by Acquisitions and Technology

By 1983, FedEx (FDX) had become the strongest delivery business in the nation. It started a string of acquisitions in order to grow more.

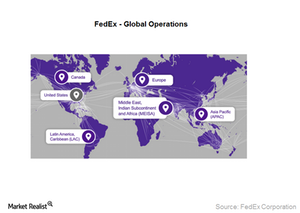

Why FedEx Is Expanding Its Global Reach

FedEx has assembled a portfolio of solutions, from express and freight forwarding to critical inventory logistics, that can solve any global commerce challenge.

FedEx: How a College Paper Idea Turned into a Delivery Giant

The idea behind FedEx (FDX) started off as a term paper by undergraduate Frederick W. Smith in 1965 at Yale University. The company started operations in 1973.

A Key Analysis of FedEx’s Business Model

Currently, FedEx is the global leader in the express delivery market. It offers delivery to and from individuals and businesses. It has various business units.