Eldorado Gold Corp

Latest Eldorado Gold Corp News and Updates

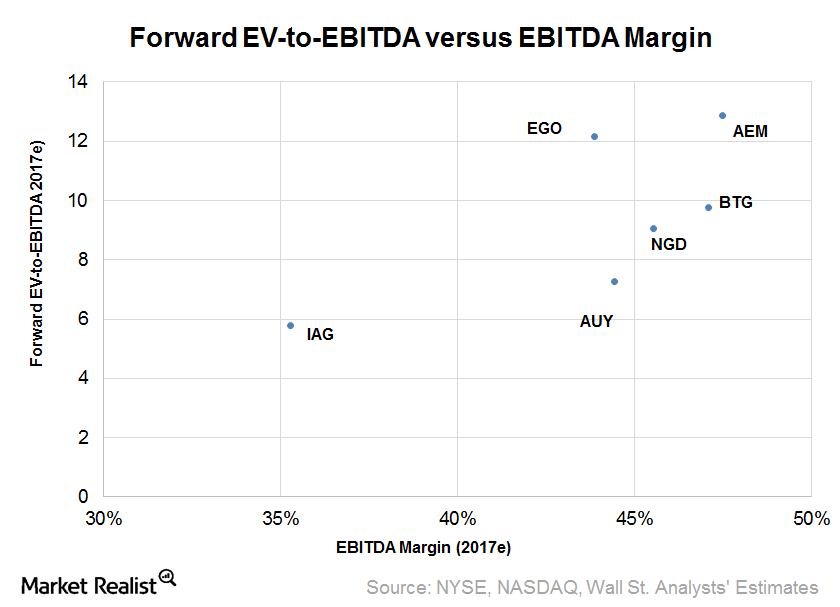

What Could Drive IAMGOLD Corp.’s Valuation Going Forward?

IAG stock could continue to gain traction due to its high operational leverage, at least as long as the upward trend in gold prices continues.

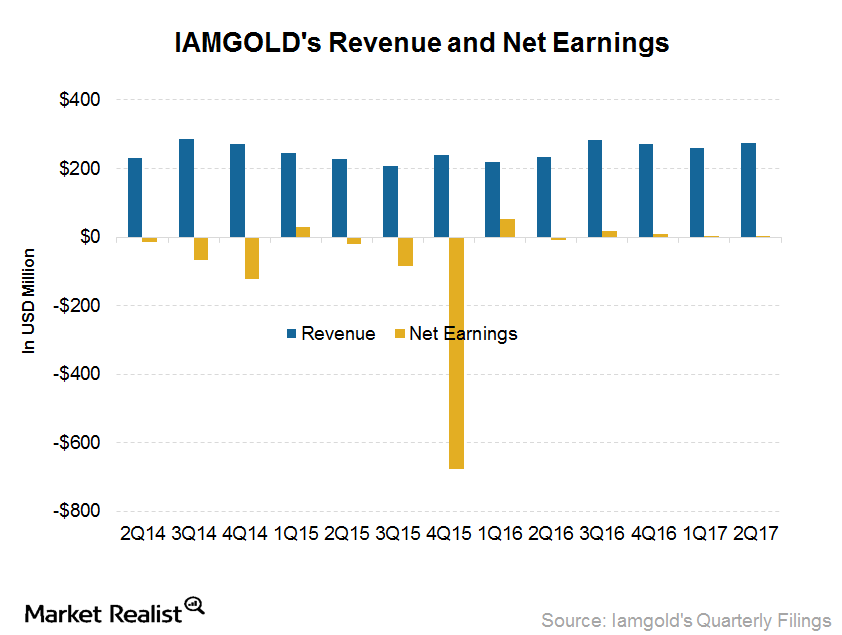

Understanding IAMGOLD’s 2Q17 Earnings Highlights

IAMGOLD’s (IAG) 2Q17 production was 223,000 ounces of gold—growth of 26,000 ounces or 13% year-over-year (or YoY).

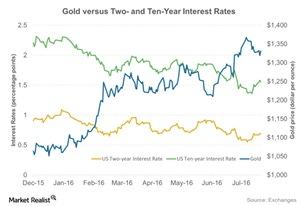

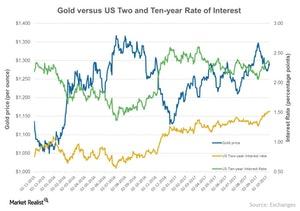

How Do US Economic Numbers Play on Gold?

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent.

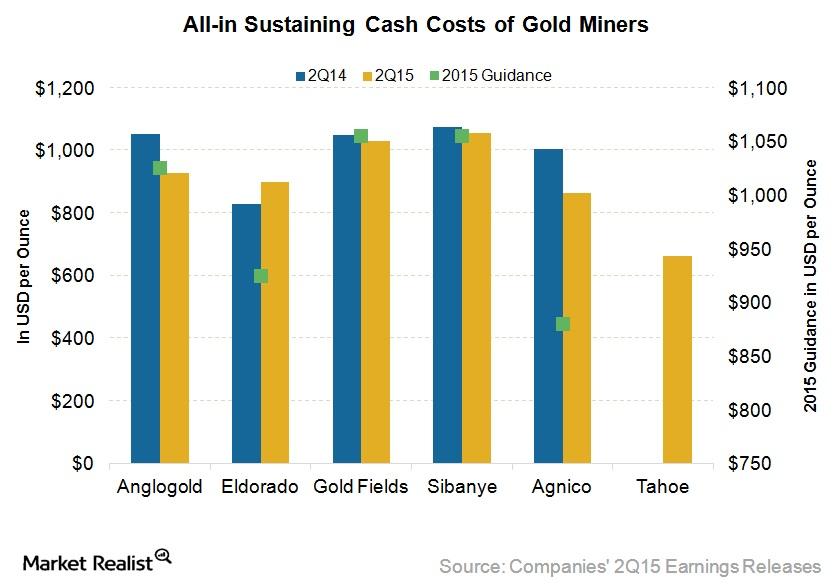

Which Intermediate Gold Miners Have Cost Advantages in 2H15?

All-in sustaining costs make up a comprehensive and important cost metric for gold mining companies. A lower AISC is better for gold miners.

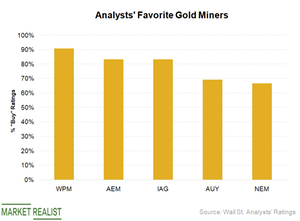

Which Gold Stocks Do Analysts Love and Hate?

Gold price’s reversal this year has created opportunities in gold stocks. The SPDR Gold Shares ETF (GLD) had gained 11% year-to-date as of Friday.

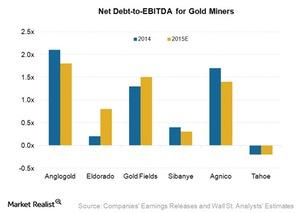

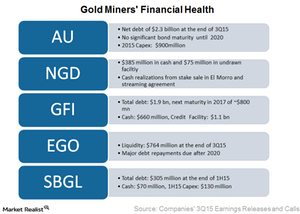

Net Debt-to-EBITDA Expectations for Intermediate Gold Miners in 2015

In 2015, the average net debt-to-EBITDA ratio of the six intermediate gold miners we’ve been evaluating in this series is 0.9x—a similar level to 2014.

An Overview of Gold Miner Performance in 2015

Gold miners’ stocks have underperformed most of the market indices and gold itself. GDX has significantly underperformed GLD since 2008.

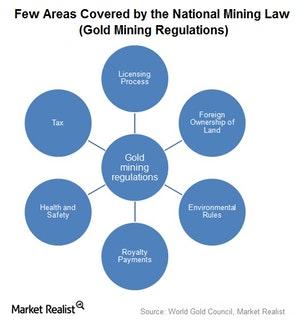

How Strict Is the Gold-Regulated Market?

Bitcoin (ARKW) has seen its price plunge since the start of 2018 due to news that world leaders are planning to implement regulations on digital currencies.

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

The Five Gold Stocks Wall Street Is Loving Lately

Gold miners usually act as a leveraged play on gold prices. In 2018, the VanEck Vectors Gold Miners ETF (GDX) fell 9.3%, amplifying the 1.9% fall in gold prices (GLD).

A Quick Look at the Technicals of the 4 Precious Metals

Gold’s price dipped 0.13% to $1,312.8 per ounce on May 9. The fall in gold was extended for a number of reasons.

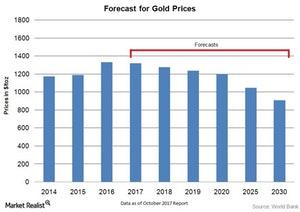

Gold’s Outlook for 2018

Looking ahead for 2018, industry analysts stated in a Bloomberg article that they expect gold to perform better early in the year led, by the “January effect.”

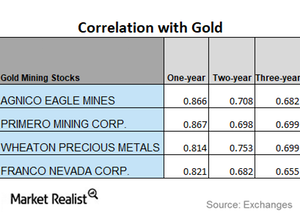

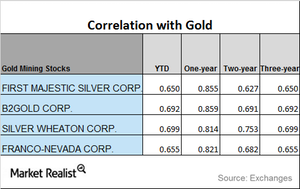

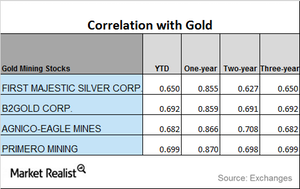

Analyzing the Correlation of Gold to Miners in January 2018

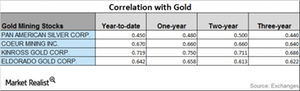

First Majestic Silver saw correlation drop during the past three years. On a three-year basis, its correlation with gold was 0.57.

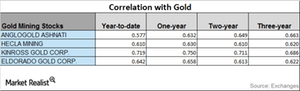

A Look at Miners’ Correlation Trends

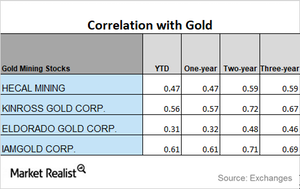

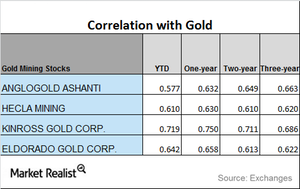

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

Correlation Reading of Miners and Funds in the Last 3 Years

During the past year, IamGold has seen the highest correlation to gold, while Eldorado Gold has the lowest correlation.

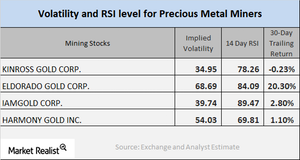

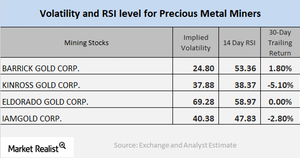

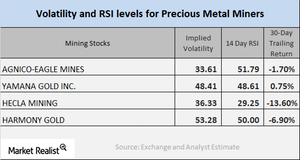

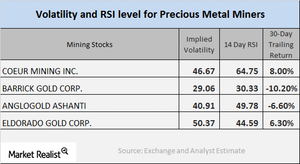

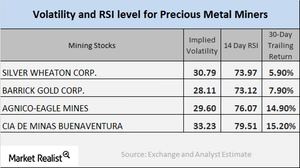

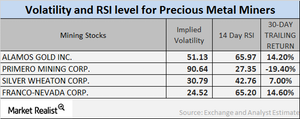

Reading Key Mining Stock Technicals as of December

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver.

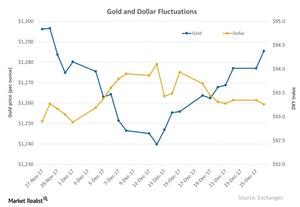

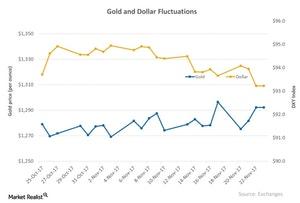

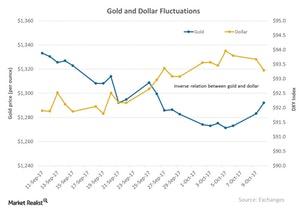

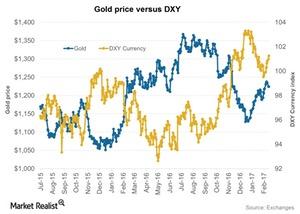

How the Dollar and Gold Moved in December

Gold and the US dollar are mostly inversely related to each other.

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

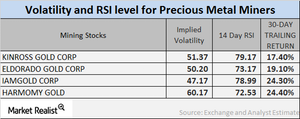

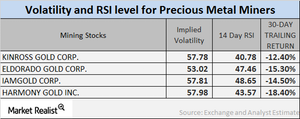

Reading Miner Volatility in December 2017

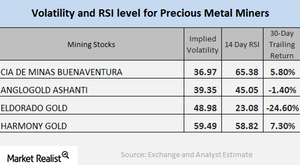

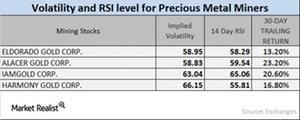

In this article, we’ll take a look at the call-implied volatilities and RSI scores of Barrick Gold, Kinross Gold, Eldorado Gold, and IAMGOLD.

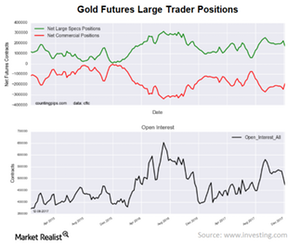

How Is Gold, Commercial and Non-Commercial, Moving?

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016.

Correlation and Mining Stocks this Month

We’ll briefly analyze mining stocks’ correlation with gold. Gold is the most crucial of the precious metals, and mining stocks tend to increasingly take their price changes from gold.

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

Is the Dollar-Gold Relationship Getting Stronger?

Precious metals have been closely associated with the movement of the US dollar over the last few months.

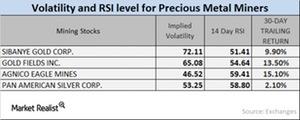

Mining Stocks: Analyzing the Technical Details

In this part, we’ll concentrate on the technical readings of key mining stocks, including their call implied volatilities and RSI (relative strength index) levels.

Behind the Correlations of Key Miners Today

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year.

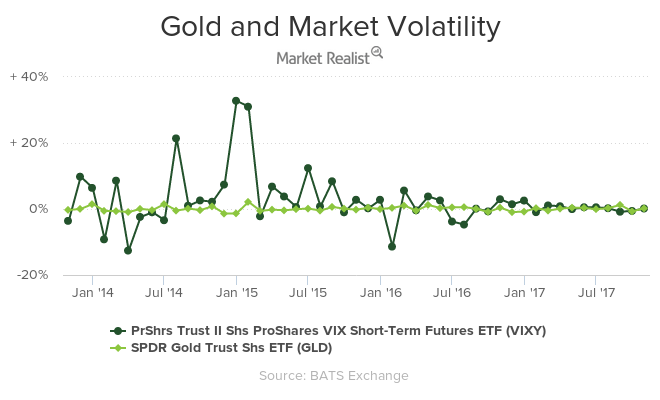

Gauging Global Risk against Gold

All four precious metals rose on Monday, October 30, as multiple speculations in the market gripped investors’ attention.

Reading the Drop in Precious Metals on Monday, October 16

After the rise we saw on Friday, October 13, precious metals had a down day on Monday, October 16.

How Key Mining Stocks Are Correlated with Gold in October 2017

The PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ) have risen 12.1% and 12.95, respectively, year-to-date, taking strong cues from gold.

Precious Metals and Companies That Mine Them

Precious metal miners got a boost on Tuesday, October 3, 2017, despite the marginal fall of precious metals.

Miners Followed Precious Metals Downhill on September 18

On September 18, Coeur Mining, Barrick Gold, Kinross Gold, and Eldorado Gold had volatilities of 42.3%, 26.4%, 40.8%, and 50.1%, respectively.

Reading Miners’ Correlation Trends

Mining stocks Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the […]

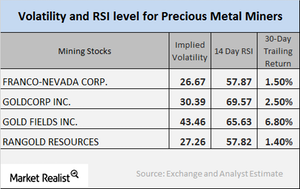

What Miners’ Technical Indicators Suggest

Most of the miners have seen an upswing in their prices over the past week.

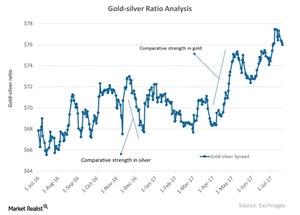

How the Gold-Silver Spread Is Trending

The gold-silver spread measures the price of one ounce of gold in relation to silver.

A Look at Volatilities for Precious Metal Miners

In this part of the series, we’ll look at some important technical indicators, including volatility figures and RSI levels for major miners.

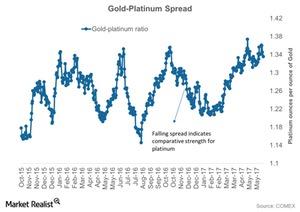

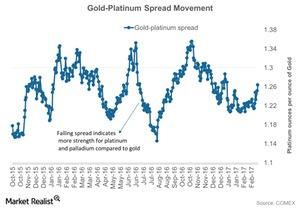

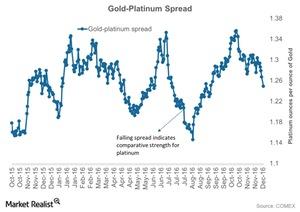

Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

Why Mining Stocks’ Relative Strength Levels Keep Falling

In this article, we’ll take a look at the variables that determine how attractive particular mining stocks or shares are or could become.

How the Dollar’s Revival Is Impacting Precious Metals in May

The US Dollar Index, which prices the dollar against a basket of six major world currencies, has risen ~0.46% on a trailing-five-day basis.

Platinum Is the Worst Performer So Far—Reading Its Spread

The gold-platinum spread was ~1.3 on April 26, 2017. The gold-platinum spread RSI on that day was 59.

How Miners’ Correlations to Gold Are Trending

As global tumult grips markets and investors turn to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals.

Behind Mining RSI Levels and Volatility Now

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

Reading Mining Companies’ Volatilities and RSI Levels

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

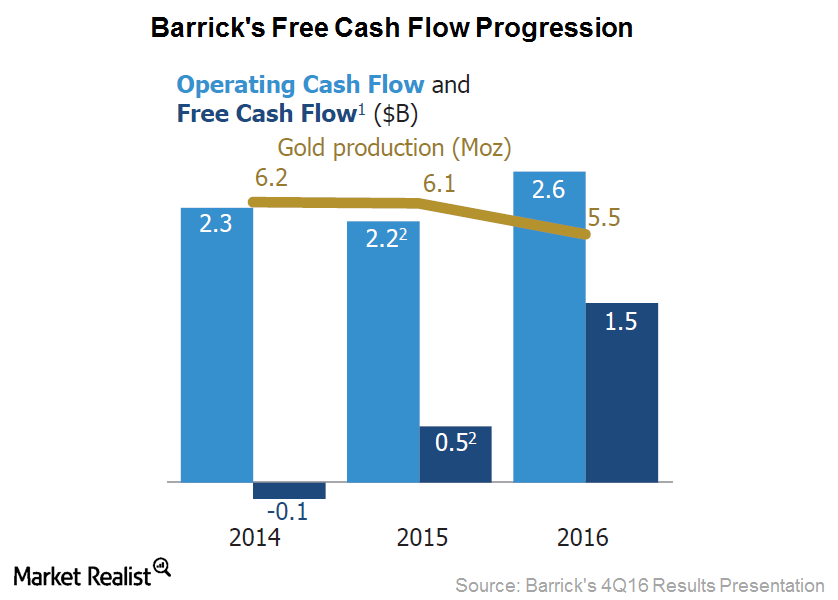

This Is Barrick Gold’s Focus: To Improve Free Cash Flow

Barrick Gold’s (ABX) management has defined value creation for shareholders in terms of FCF (free cash flow) per share.

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

Why Mining Stocks Are Seeing Rising RSI Levels

In this part, we’ll look at the implied volatilities of large mining stocks and their RSI levels in the wake of precious metal prices.

Which Intermediate Gold Miners Could Run into Financial Concerns?

Eldorado Gold is well placed financially. It had a liquidity of $763.8 million, including $388.8 million in cash, cash equivalents, and term deposits.

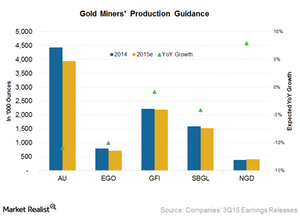

Decelerating Production Growth for Some Intermediate Gold Miners

New Gold produced 123,000 ounces in 3Q15. It has guided for a production toward the higher end of the guidance range of 390,000–410,000 ounces for 2015.

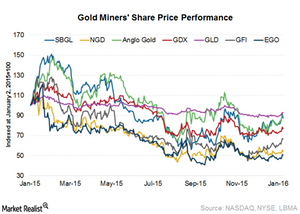

Intermediate Gold Miners Fell in 2015 and Beyond

From the start of 2015 to January 8, 2016, the prices of gold (GLD) have fallen by 7% and the VanEck Vectors Gold Miners Index (GDX) has fallen by 23%.