Community Health Systems, Inc.

Latest Community Health Systems, Inc. News and Updates

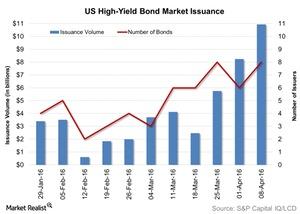

High Yield Bond Issuance Hit 2016 Record Last Week

High yield bond issuance surged last week and hit its highest level in 2016 yet due to continued growth in volume.

Must-read: Is the US hospital industry truly non-cyclical?

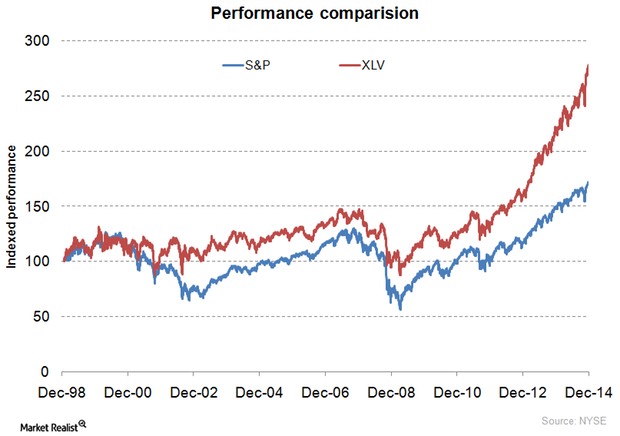

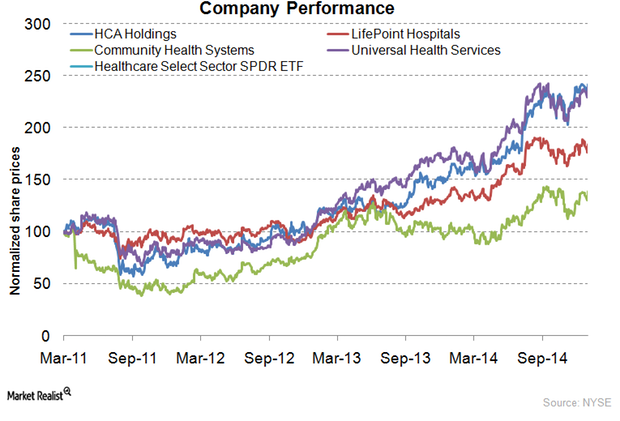

The hospital sector is widely considered a non-cyclical or defensive industry, meaning demand for hospital services doesn’t change with the economic cycle.

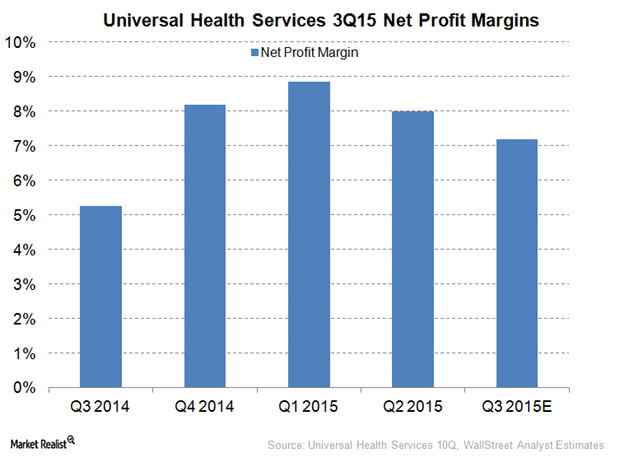

Universal Health Services’ Net Profit Margin Expected to Rise

Wall Street analysts expect that Universal Health Services (UHS) will report higher net profit margins in 3Q15 compared to margins in 3Q14.

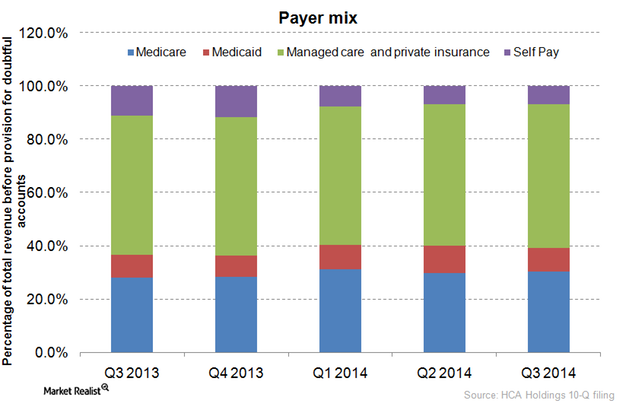

Exploring payer mix trends at HCA Holdings

In terms of payer mix, the percentage of HCA Holdings revenues contributed by Medicare rose from 28.0% in 3Q13 to 30.3% in 3Q14.Healthcare Overview: Assessing hospital companies’ capital expenditures

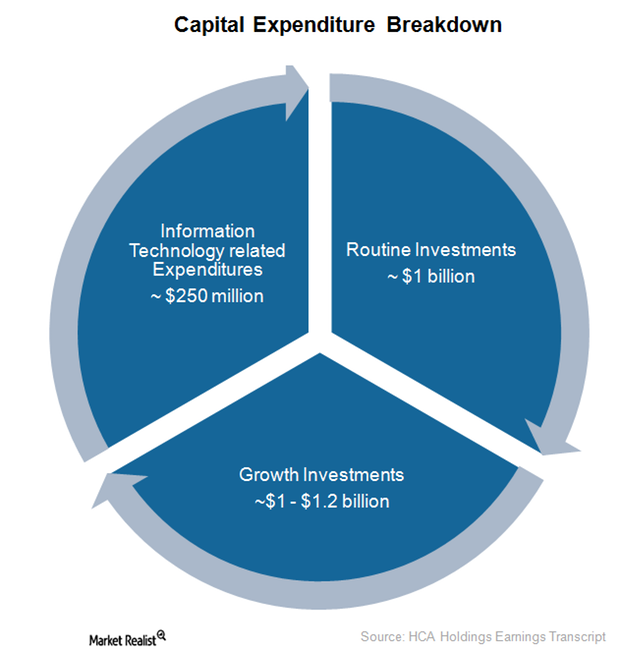

Capital projects in the hospital sector include purchasing new facilities, purchasing medical equipment, renovating and replacing existing hospitals, and investing in information systems infrastructure.Healthcare Understanding hospitals’ size, technology, and operating expenses

In the capital-intensive hospital industry, economies of scale offer a competitive advantage by spreading out the high fixed costs, providing for higher margins.

HCA Holdings’s Strong Capital Expenditure Strategy for 2016

In 2015, HCA Holdings deployed ~$2.4 billion in capital expenditure. It planned to increase capital spending to $2.7 billion in 2016.

An overview of LifePoint Hospitals

With 67 hospitals, acquisitions continue to strengthen its position in rural markets, especially where LifePoint Hospitals is the sole healthcare provider.

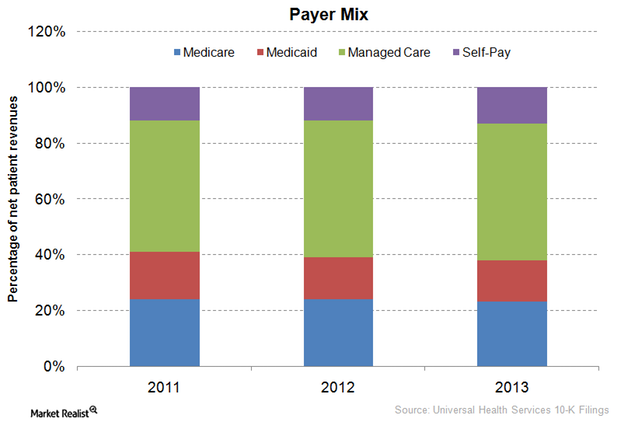

Universal Health Services’ payer mix differs from other companies’

Universal Health Services (UHS) has displayed a trend in payer mix from 2011 to 2013 that differs from other companies in the healthcare industry (XLV).

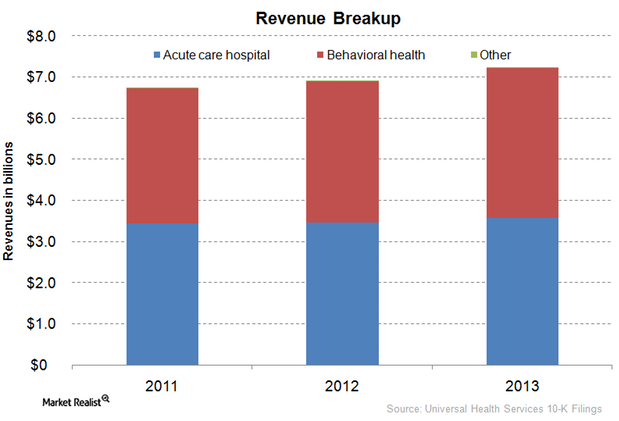

Exploring Universal Health Services’ revenue streams

Universal Health Services’ (UHS) net revenues increased by 4.6% from $6.96 billion in 2012 to $7.28 billion in 2013.

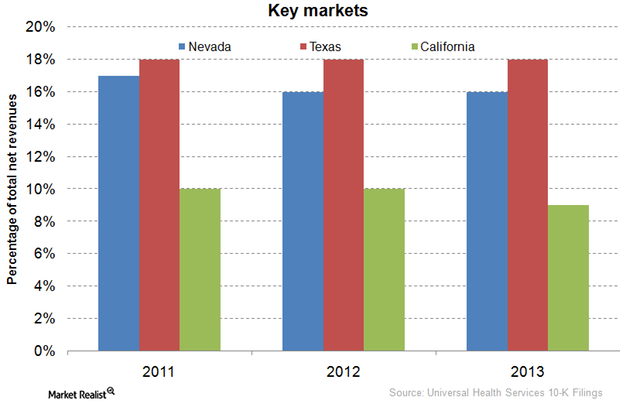

Exploring Universal Health Services’ major markets

Universal Health Services (UHS) earns more than 50% of its total revenues from the Texas, Nevada, Florida, California, and District of Columbia markets.

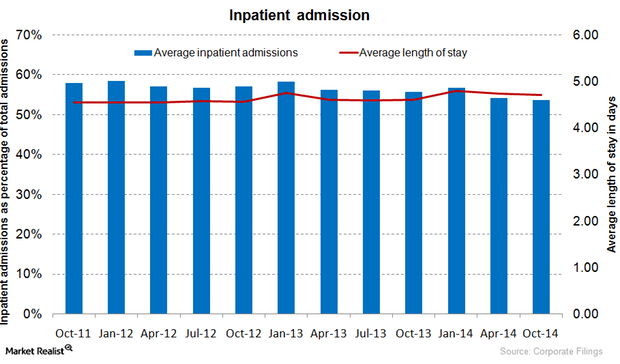

Analyzing the important current trends in hospital admissions

Hospital admissions are classified in two categories, inpatient admissions and outpatient admissions. Patients who are admitted overnight are inpatients.

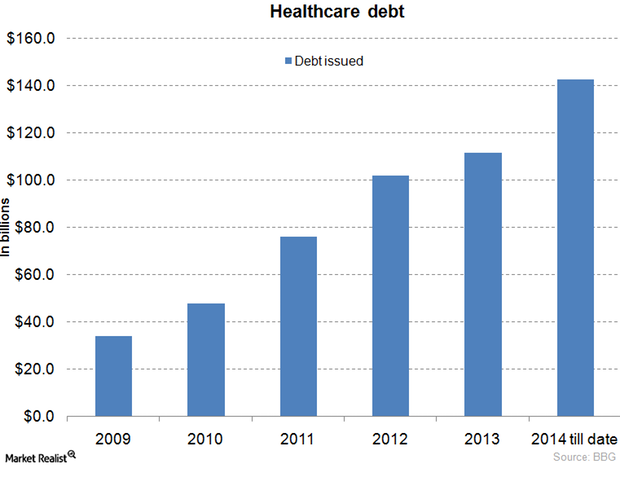

Why changes in interest rates affect the hospital industry

Economic changes in interest rates affect hospital companies, depending on the company’s cost-structure and expansion strategies.

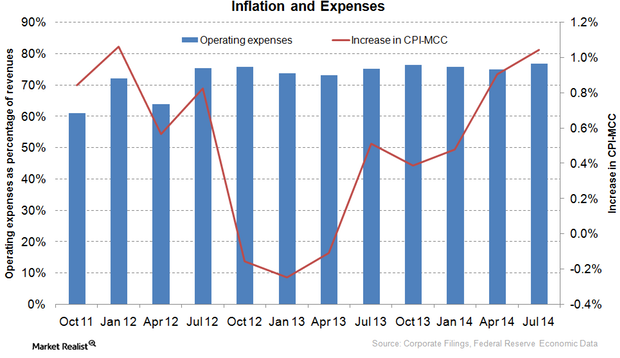

Gauging inflation’s effects on the hospital industry

Inflation closely relates to the performance of the healthcare industry (XLV), as it affects the rates that hospitals charge and the costs of medical care.

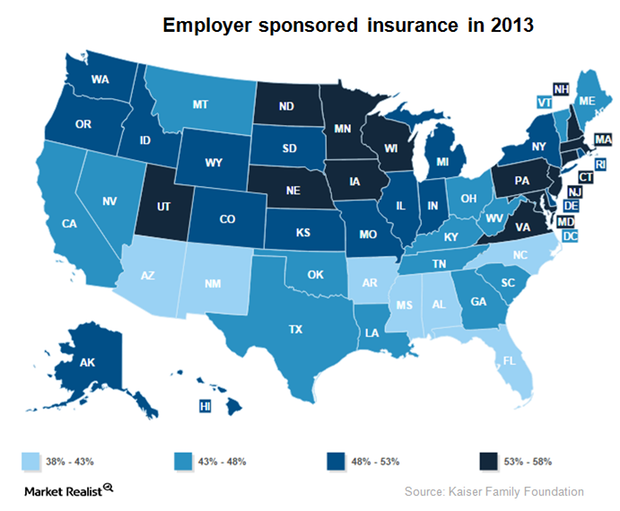

Why the unemployment rate affects hospital performance

The healthcare industry, represented by the Healthcare Select Sector SPDR, is affected by the unemployment rate. Income affects people’s health choices.

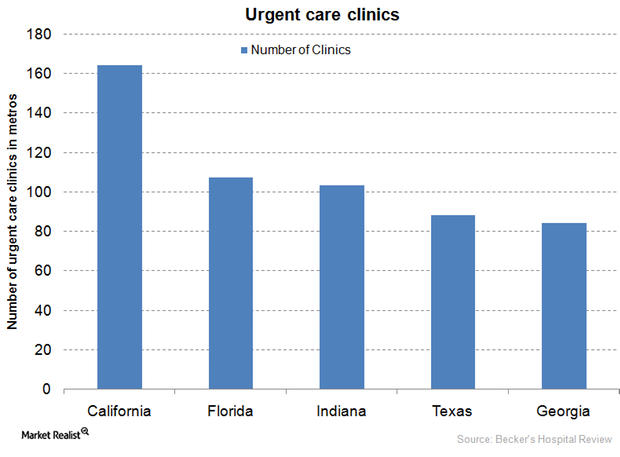

Standalone urgent care strategies

HCA Holdings is capturing market share in the $15 billion urgent care clinic market field by focusing on acquiring or opening standalone urgent care clinics.

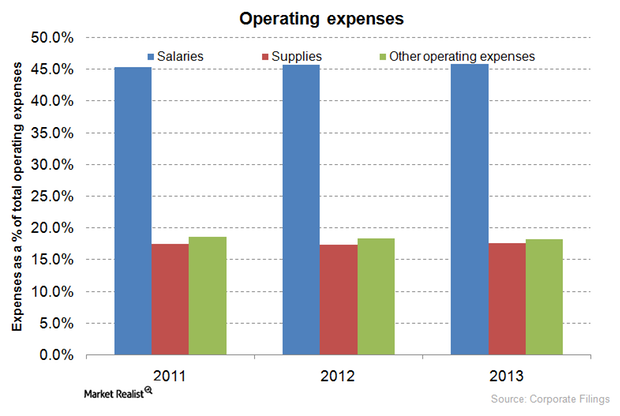

Exploring HCA Holdings’ operating expenses

With solutions such as flexible staffing and optimal group purchasing provided by Parallon, HCA Holdings has better operating margins as compared to its peers.

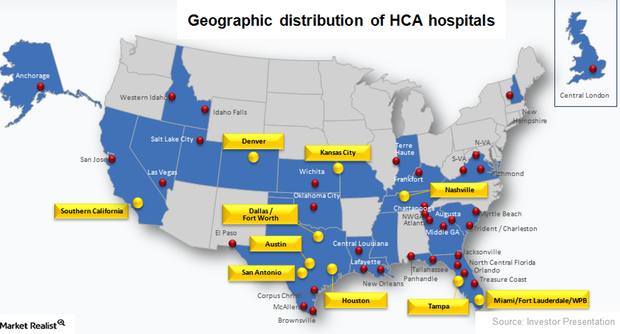

HCA’s diversification strategy

HCA Holdings’ diversified suite of services enables it to retain patients at their facilities, which bolsters revenues per patient.

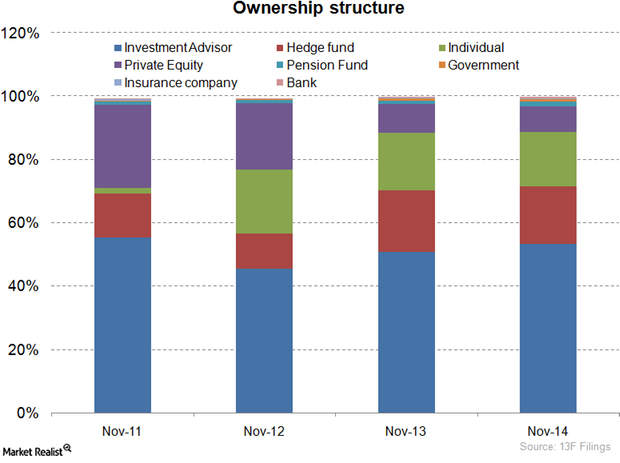

Exploring HCA’s ownership structure

Passive investments account for more than 56% of HCA Holdings’ total ownership structure.

An overview of HCA Holdings

HCA Holdings went private in 1988 through a leveraged buyout, but it again became a public company in 1992.Earnings Report The benefits of Community Health Systems’ acquisition strategy

Community Health Systems acquires two to four hospitals each year as a part of its growth strategy. Reducing duplicate functions at the corporate level reduces overhead salary costs.Company & Industry Overviews Healthcare reform’s impact on Community Health Systems

The Patient Protection and Affordable Care Act (or ACA) and Health Care and Education Affordability Reconciliation Act are together called “Reform Legislation.”