Columbia Sportswear Co

Latest Columbia Sportswear Co News and Updates

How Markets Are Pricing Under Armour Stock

Markets expect the strong growth trend to continue, and value Under Armour stock higher than the overall market and comparable firms.

What to Expect from Skechers’ Q1 Earnings

Skechers will likely release its first-quarter results after the financial markets close on Thursday. The company withdrew its Q1 guidance on March 18.

Lululemon Stock: What’s behind Its Exceptional Growth?

Lululemon stock is beating the broader markets by a wide margin. Barclays has initiated coverage on LULU with an “overweight” rating.

Skechers Footwear: Design, Sourcing, and Manufacturing Overview

Skechers designs footwear with its own in-house design team. However, it doesn’t own or operate any factories in which to conduct its manufacturing.

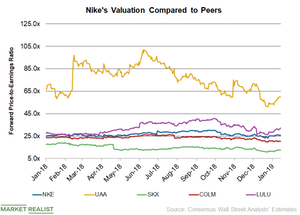

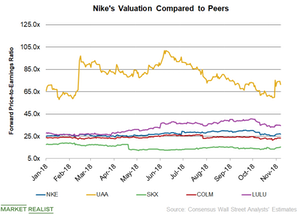

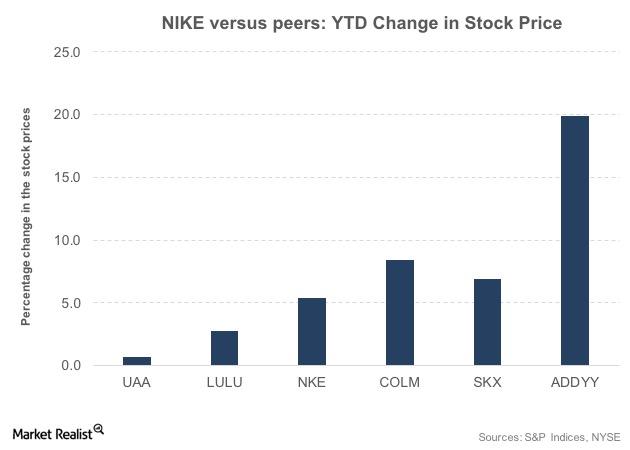

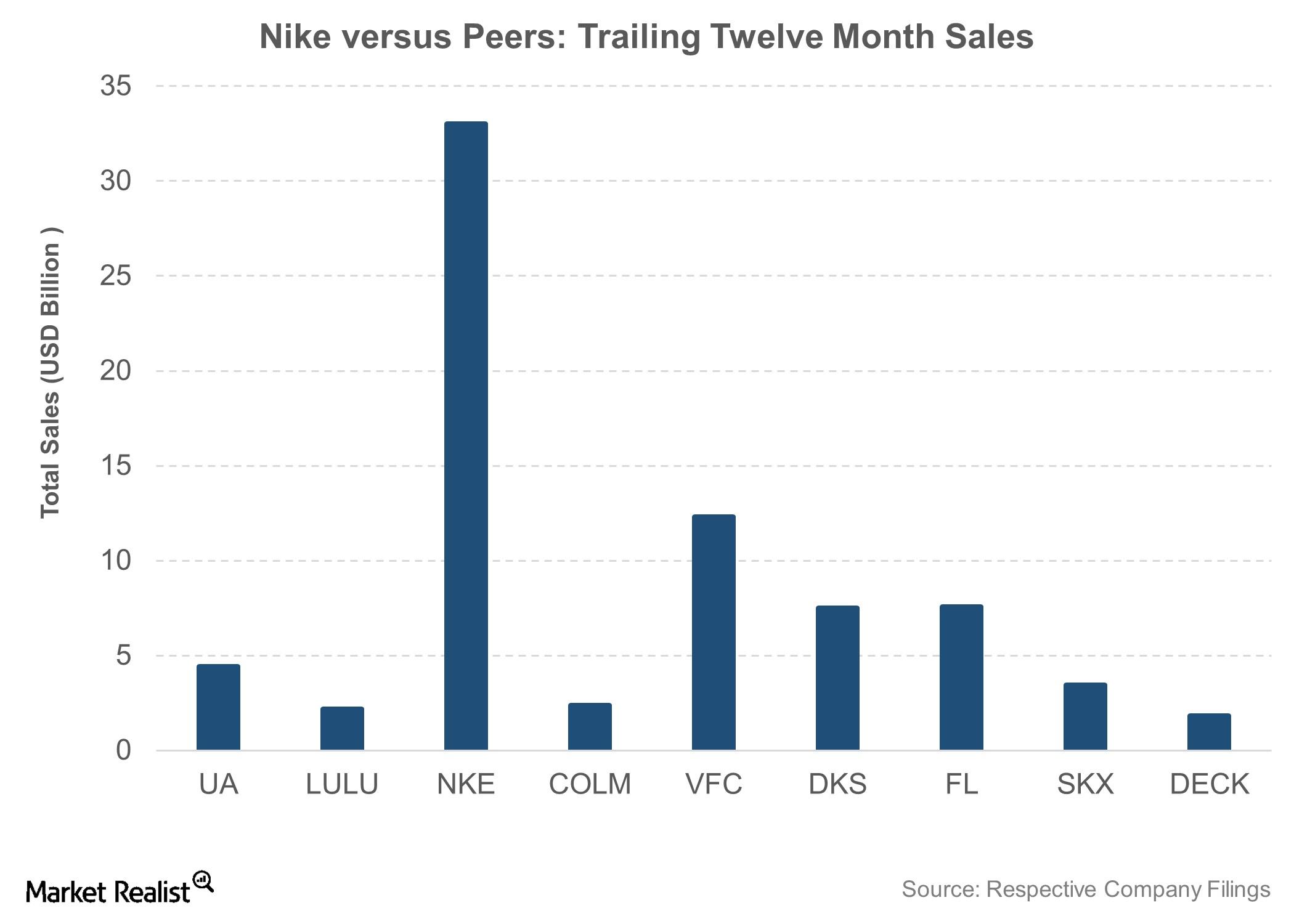

Comparing Nike’s PE Ratio with Its Peers

On January 14, Nike’s 12-month forward PE ratio was 25.8x. For fiscal 2019, analysts expect Nike’s adjusted EPS to increase 10.9% YoY to $2.65.

How Nike’s Valuation Compares to Those of Its Peers

In fiscal 2019, analysts expect Nike’s sales to rise 7.6% to $39.2 billion and its EPS to surge ~11.0% to $2.65.

Nike: Top Dow Stock in 2018

Currently, 37 analysts track Nike stock. Of these analysts, ~59% recommended a “buy,” 35% recommended a “hold,” and 5% recommended a “sell.”

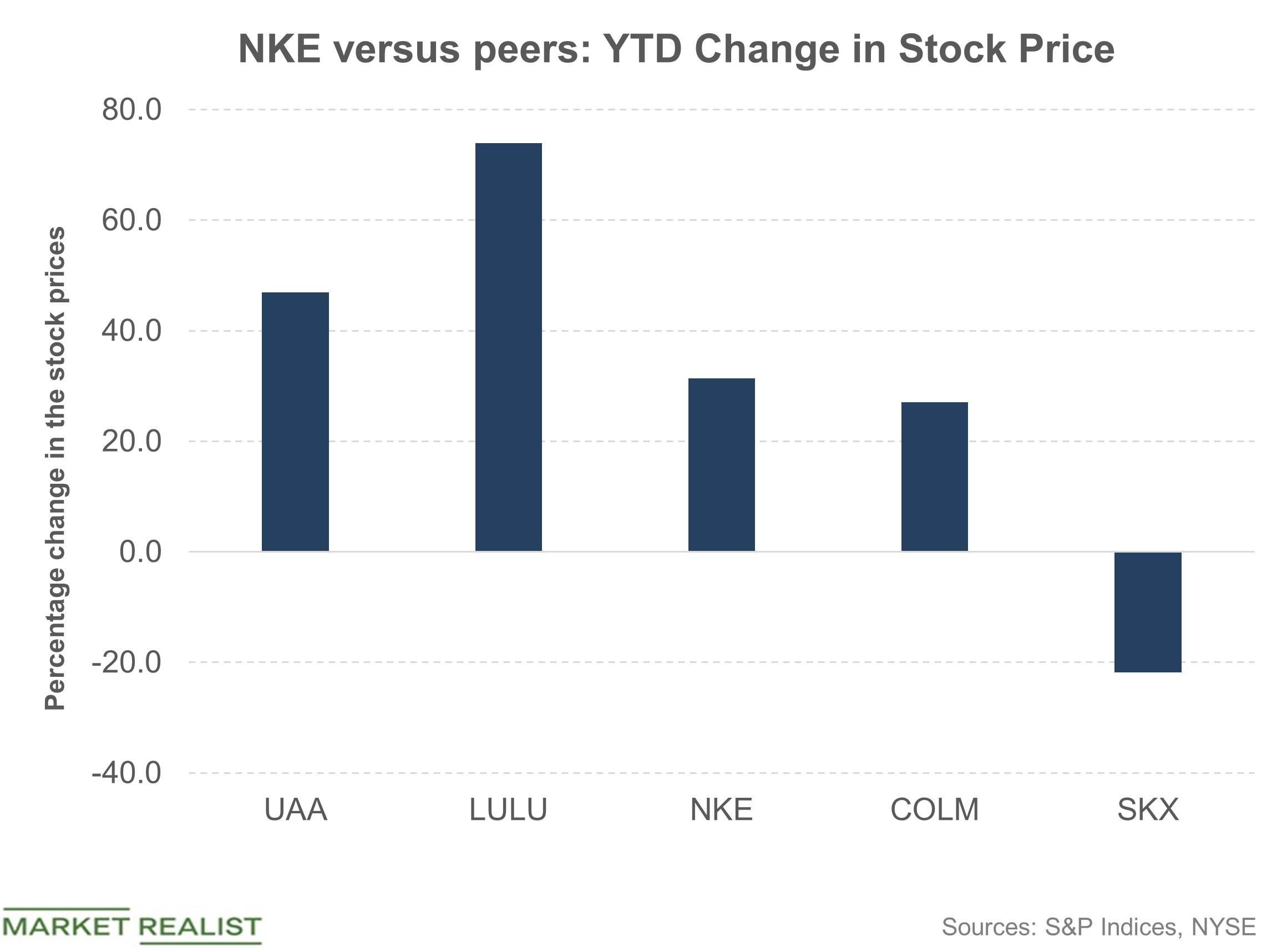

How Nike Stock Has Performed in 2018

Nike (NKE) delivered a strong performance in the stock market during 2017 with a 23% rise during the year.

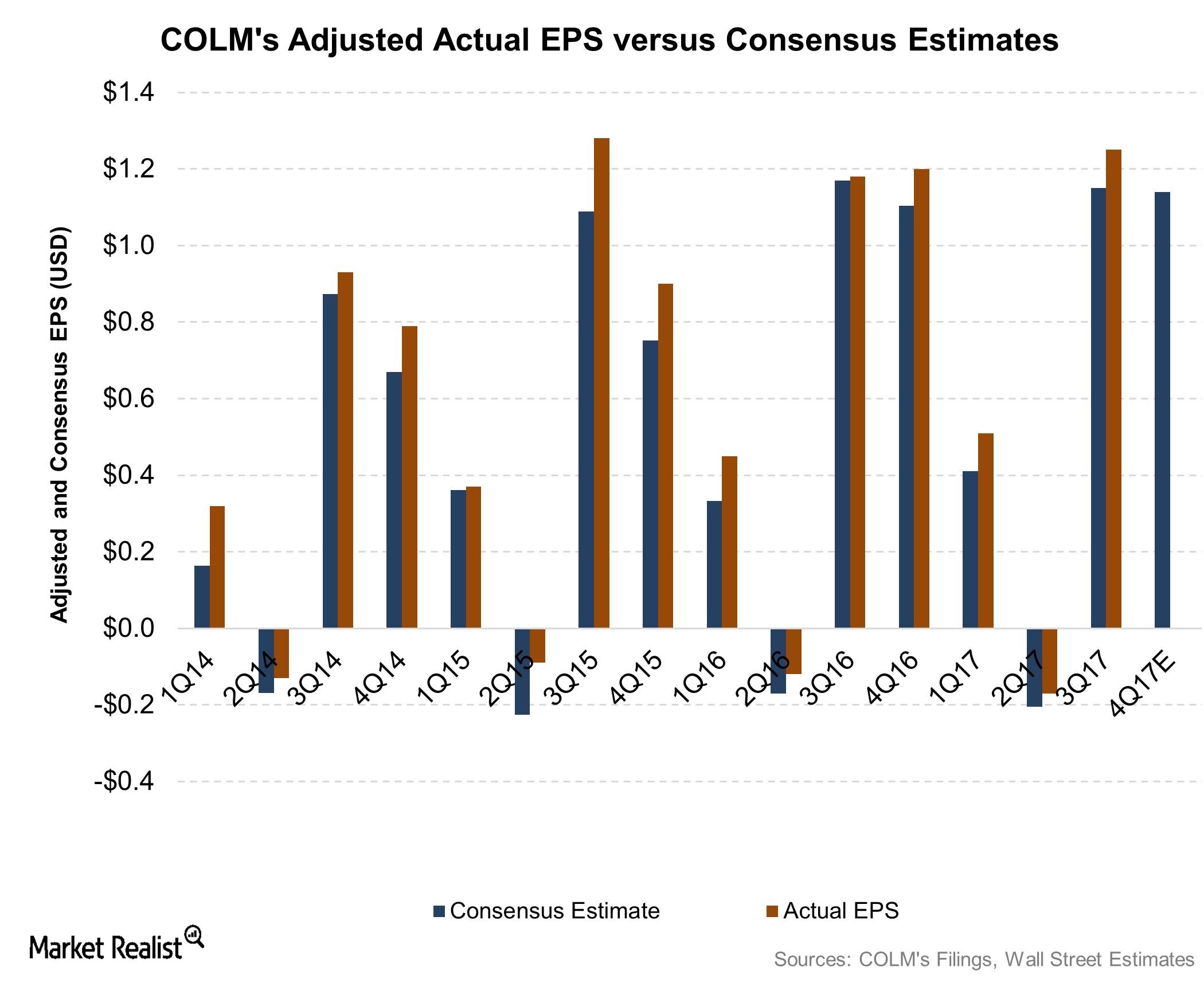

Columbia’s 4Q17 Preview: Can COLM Post Solid Results Again?

Portland-based Columbia Sportswear (COLM) plans to release its 4Q17 financial results on Thursday, February 8, 2018.

Under Armour Stock Slides after Macquarie Downgrade

Under Armour (UAA) started 2018 on a positive note and surged more than 10.0% in the first three trading days of the new year.

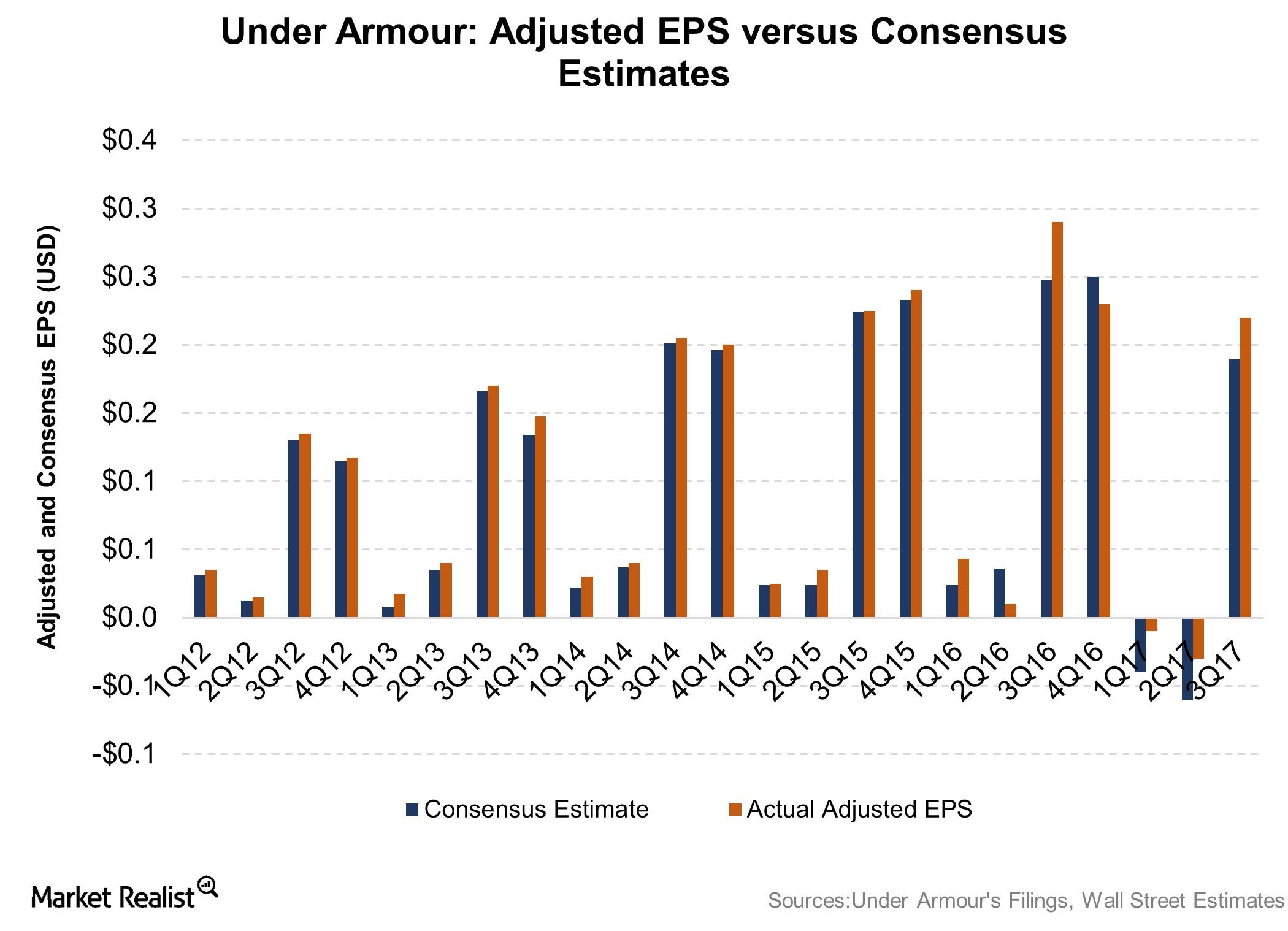

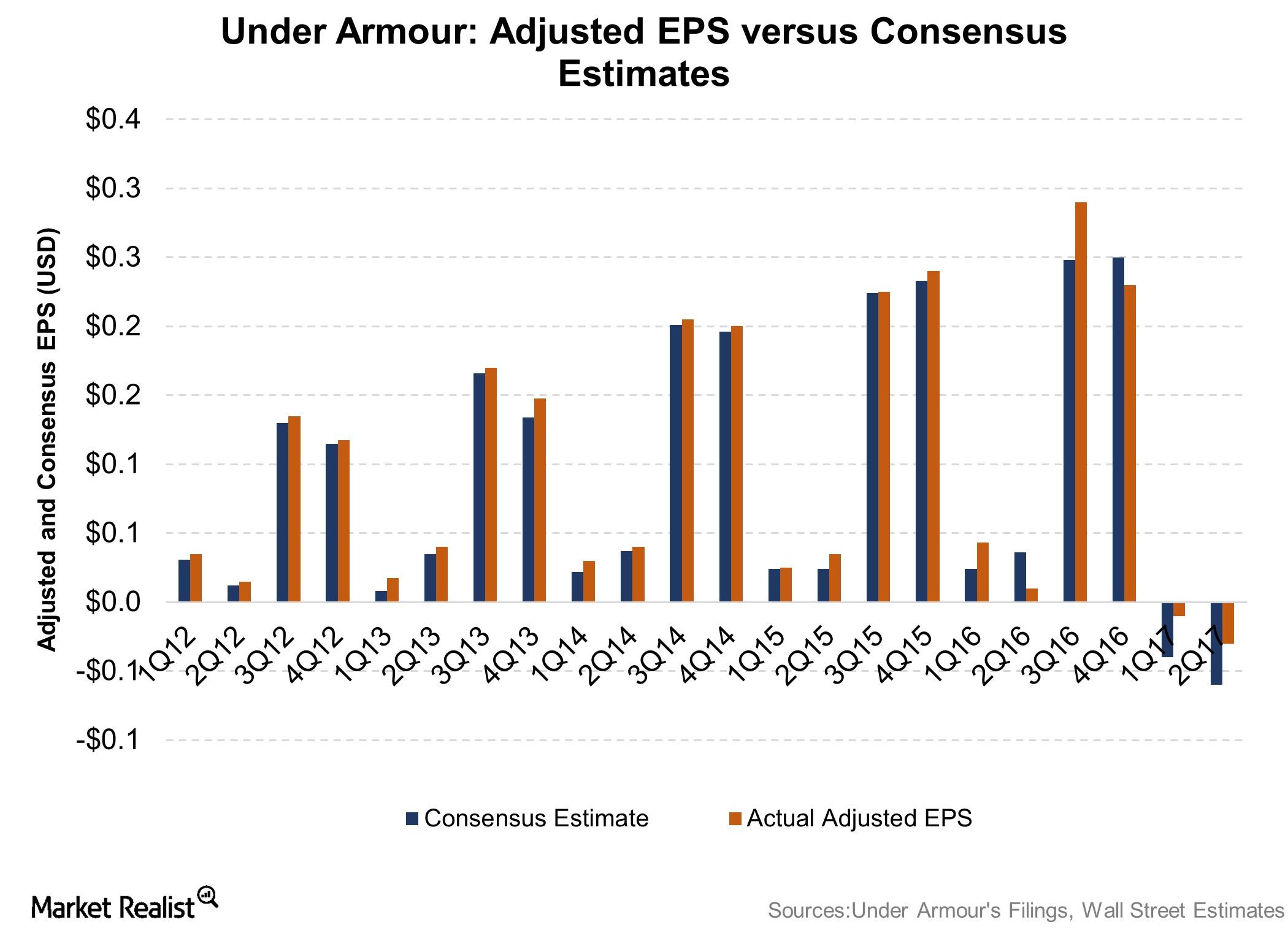

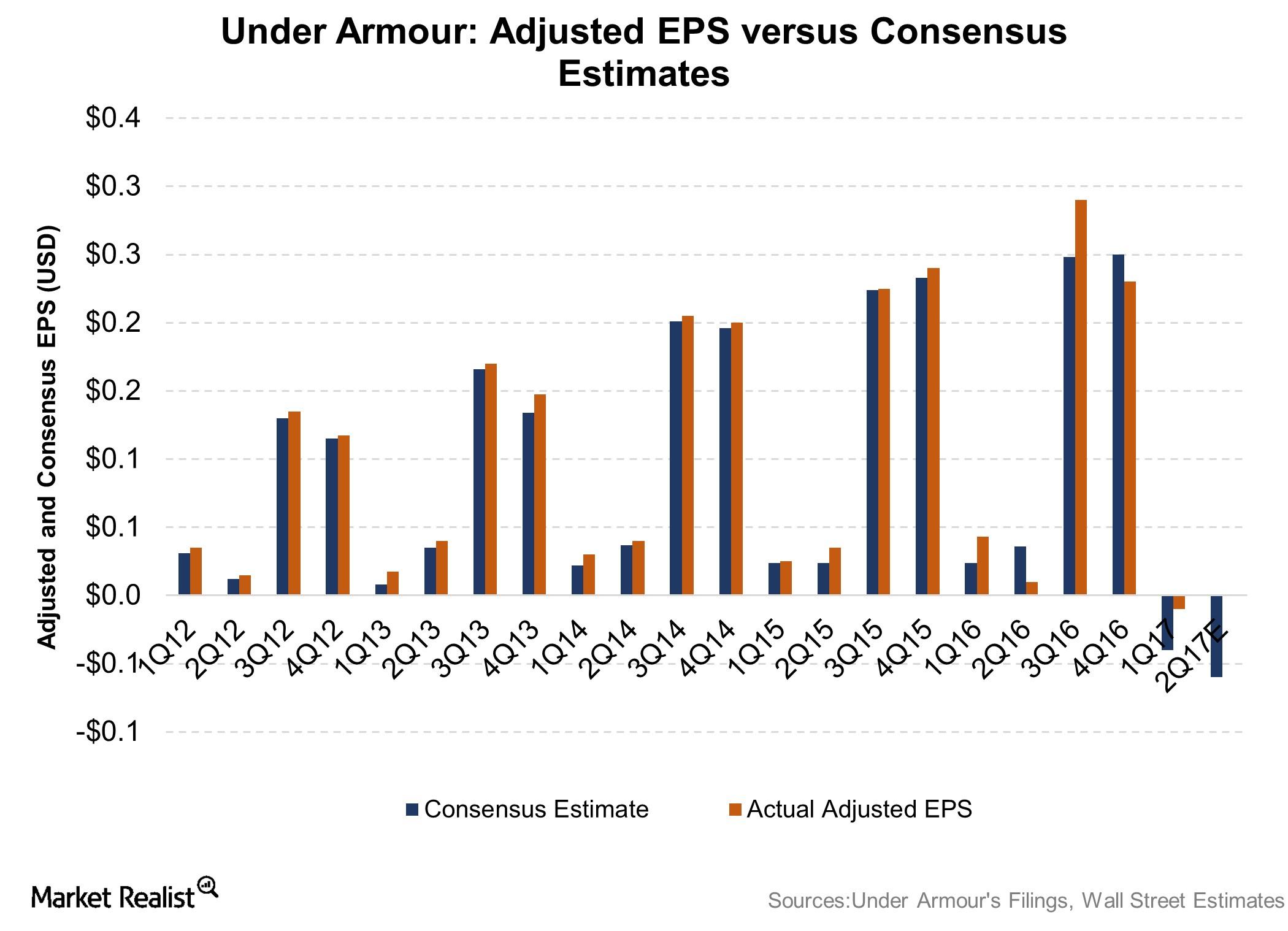

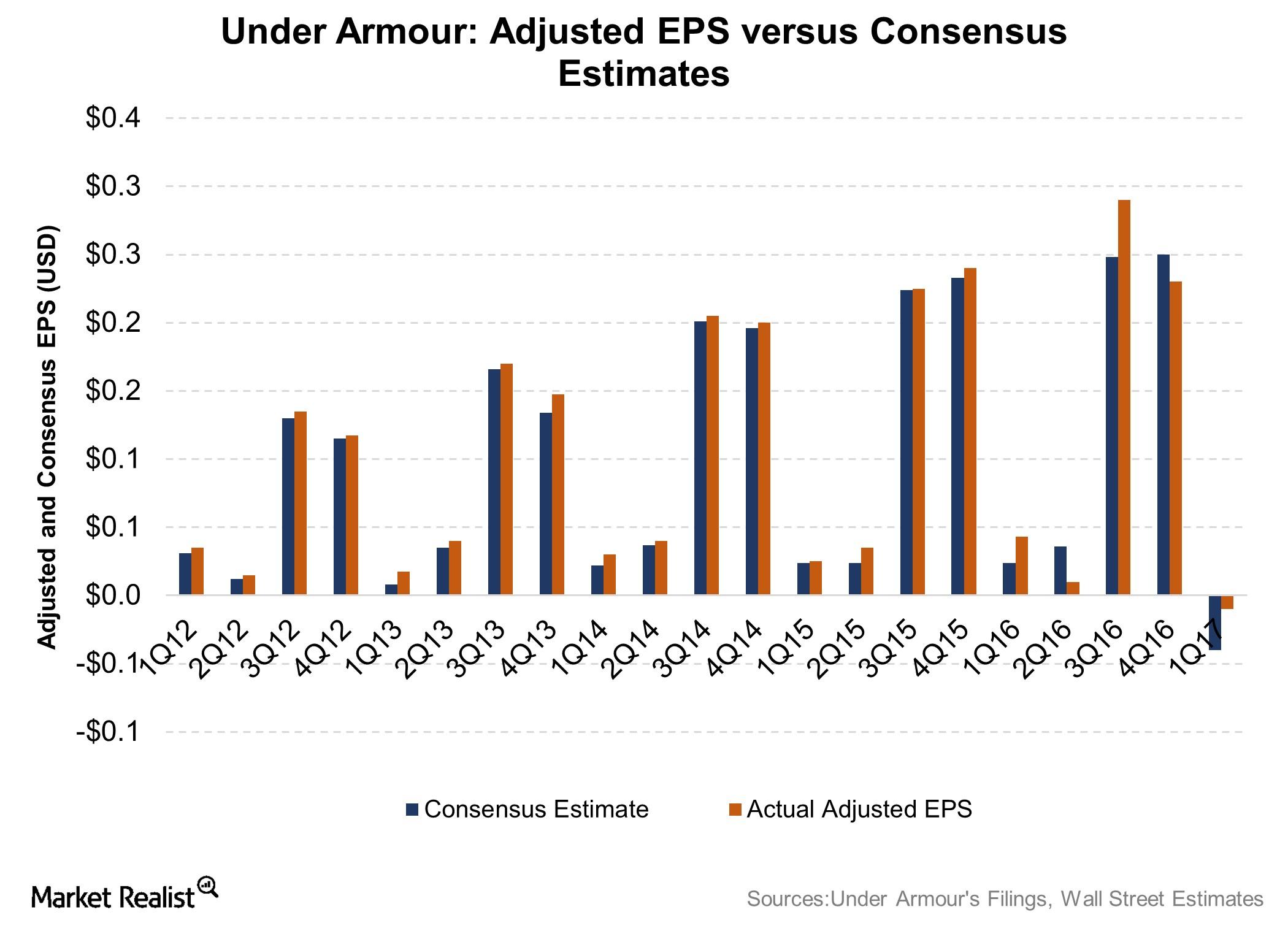

Under Armour Beats Earnings per Share Estimate by $0.03

Baltimore-based Under Armour (UAA) reported its 3Q17 results on October 31.

Under Armour Faces Target Price Cuts

Wall Street’s reaction to 2Q17 earnings Under Armour’s (UAA) 2Q17 results were followed by a host of analyst actions, ranging from target price cuts to downward revisions. The stock’s target price was revised by UBS (from $21 to $19), Canaccord Genuity (from $21 to $18), Stifel (from $19 to $18), Wedbush (from $18 to $17), […]

Under Armour Beats Top- and Bottom-Line Expectations

Baltimore-based Under Armour (UAA) reported its 2Q17 results on Tuesday, August 1. This series is an overview of Under Armour’s 2Q17 results.

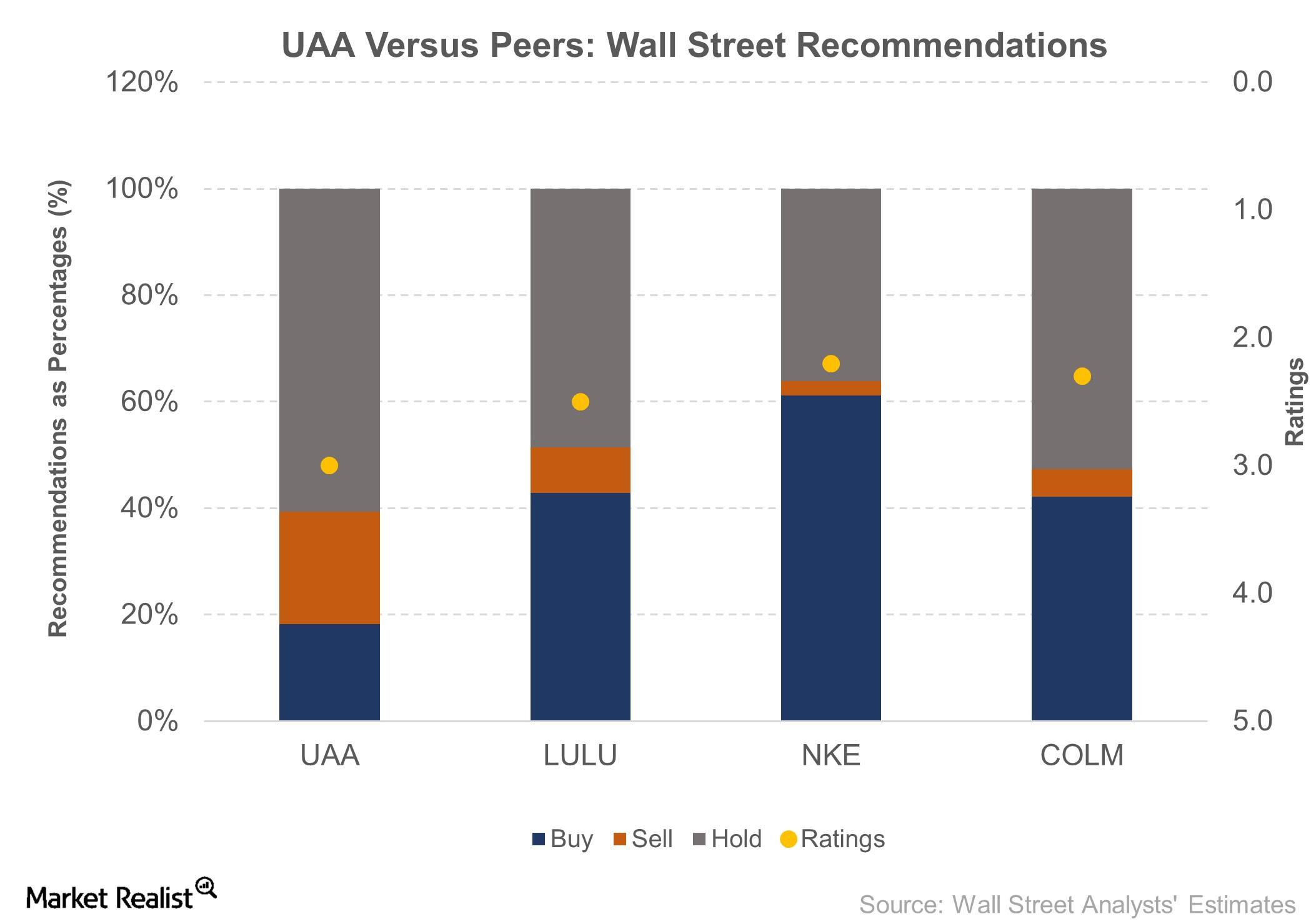

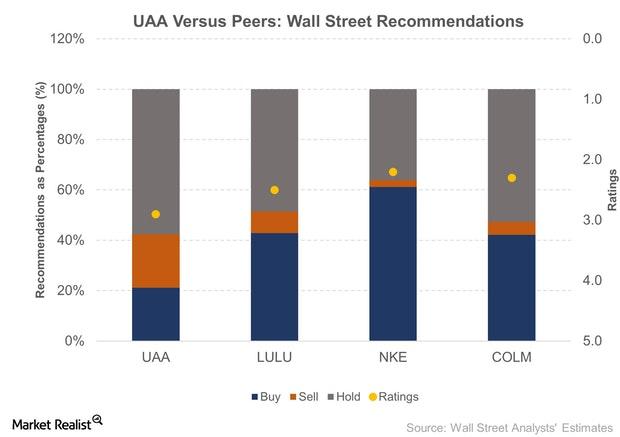

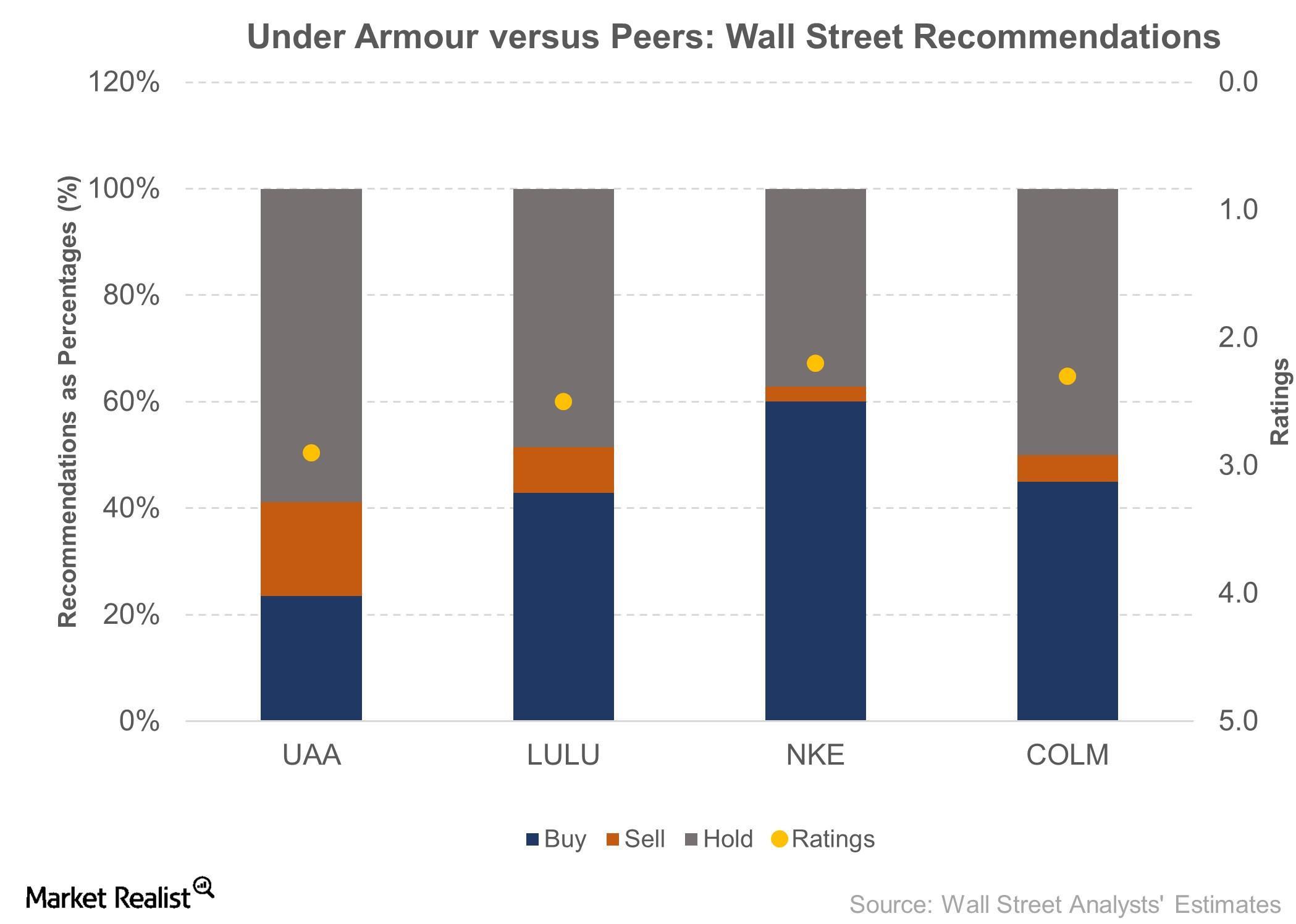

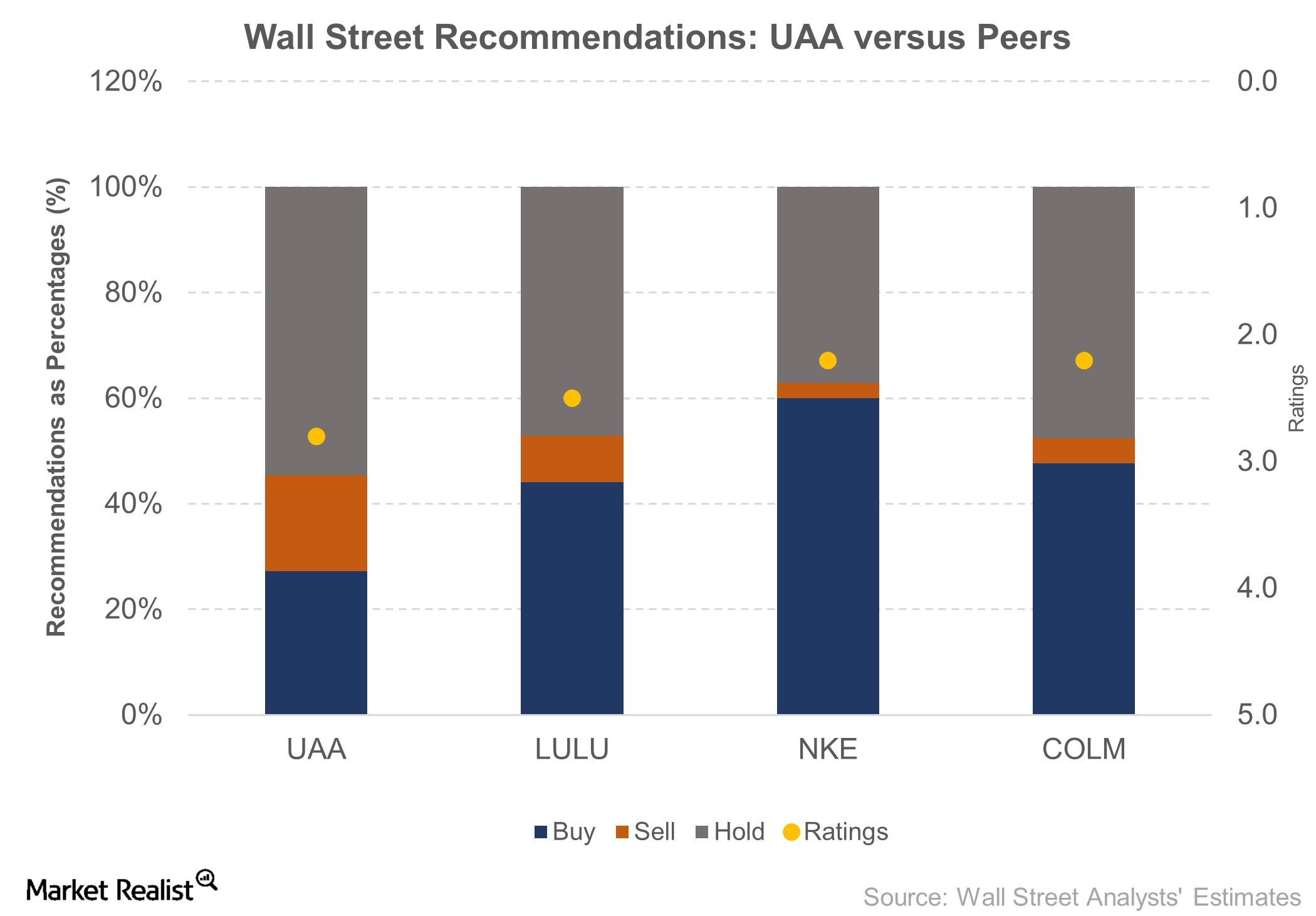

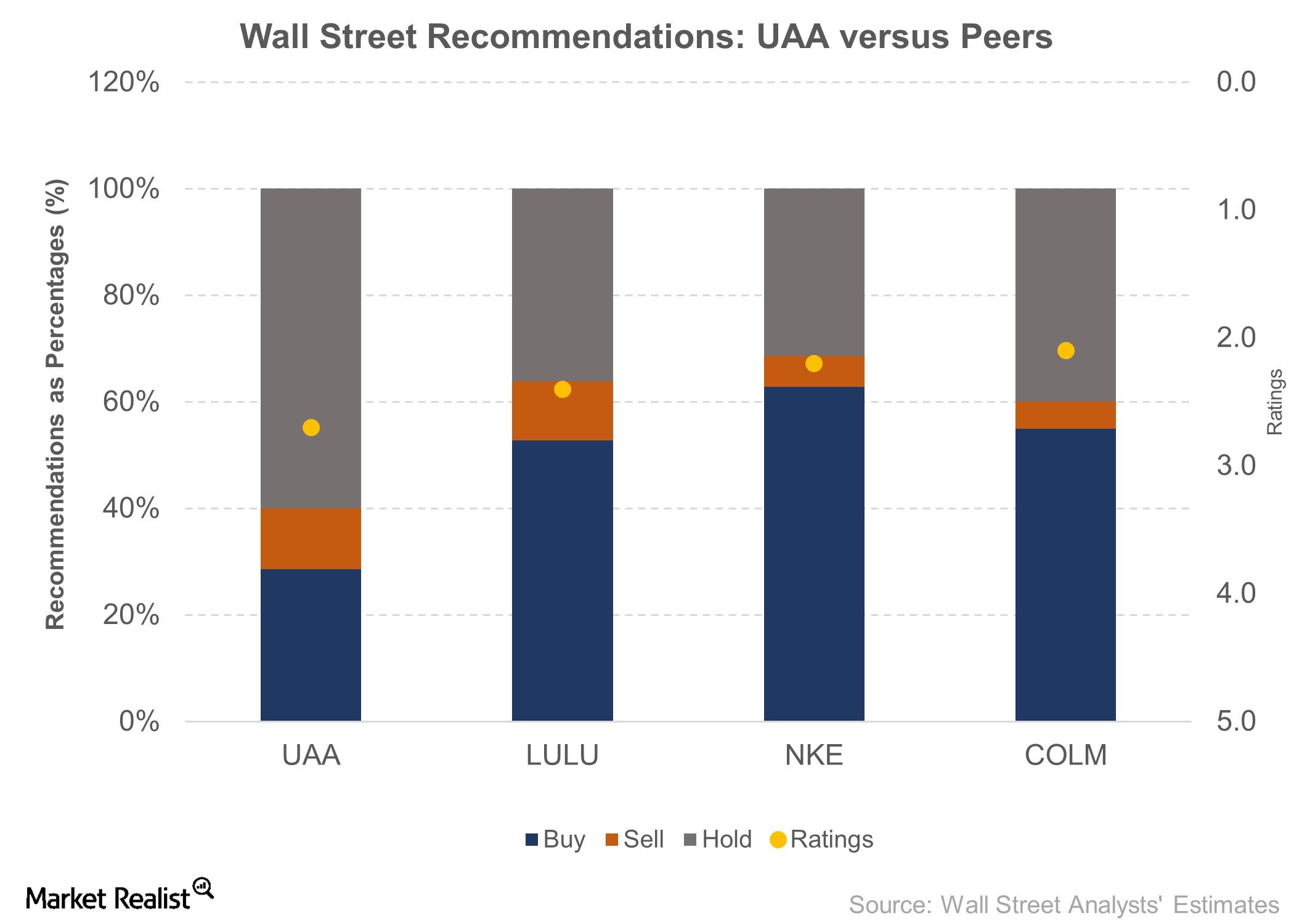

What Wall Street Thinks of Under Armour

Under Armour has a 2.8 rating on a scale where one is a “strong buy” and five is a “strong sell.”

Operating Loss Could Be in the Cards for Under Armour in 2Q17

Under Armour is expected to report a loss of six cents per share in 2Q17, which follows a loss per share of one cent during the first quarter.

Under Armour’s 2Q17 Earnings: What to Expect

Under Armour (UAA) is expected to report results for 2Q17 on Tuesday, August 1, 2017.

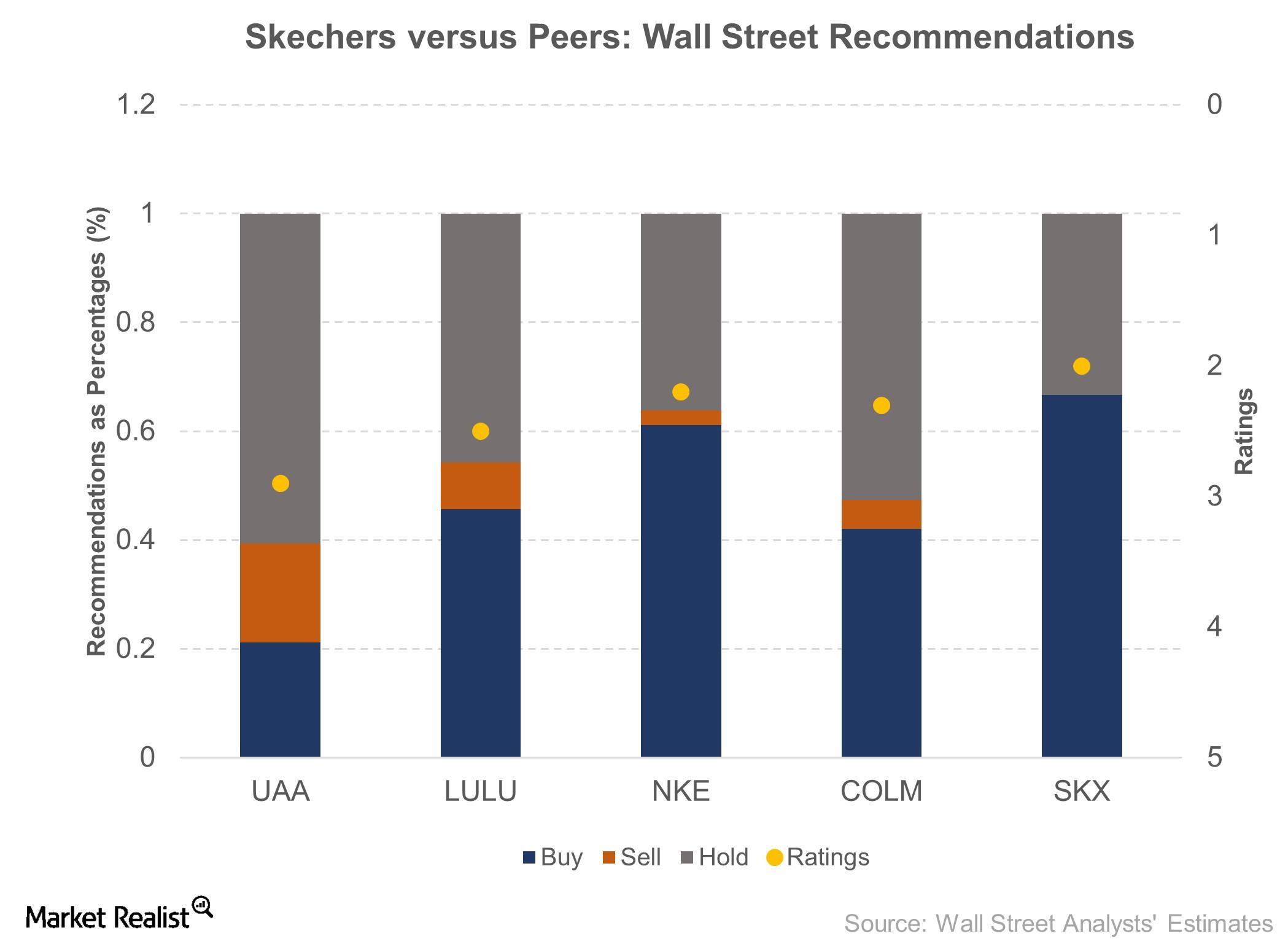

Discussing Wall Street’s View on Skechers

Skechers (SKX) is covered by 12 Wall Street analysts who jointly rate the company as a 2 on a scale of 1 (“strong buy”) to 5 (“sell”).

Susquehanna: Under Armour Changes Are ‘Temporary Pause’ to Growth

UAA is covered by 34 Wall Street analysts who together rate the company a 2.9 on a scale of 1.0 for “strong buy” to 5.0 for “sell.”

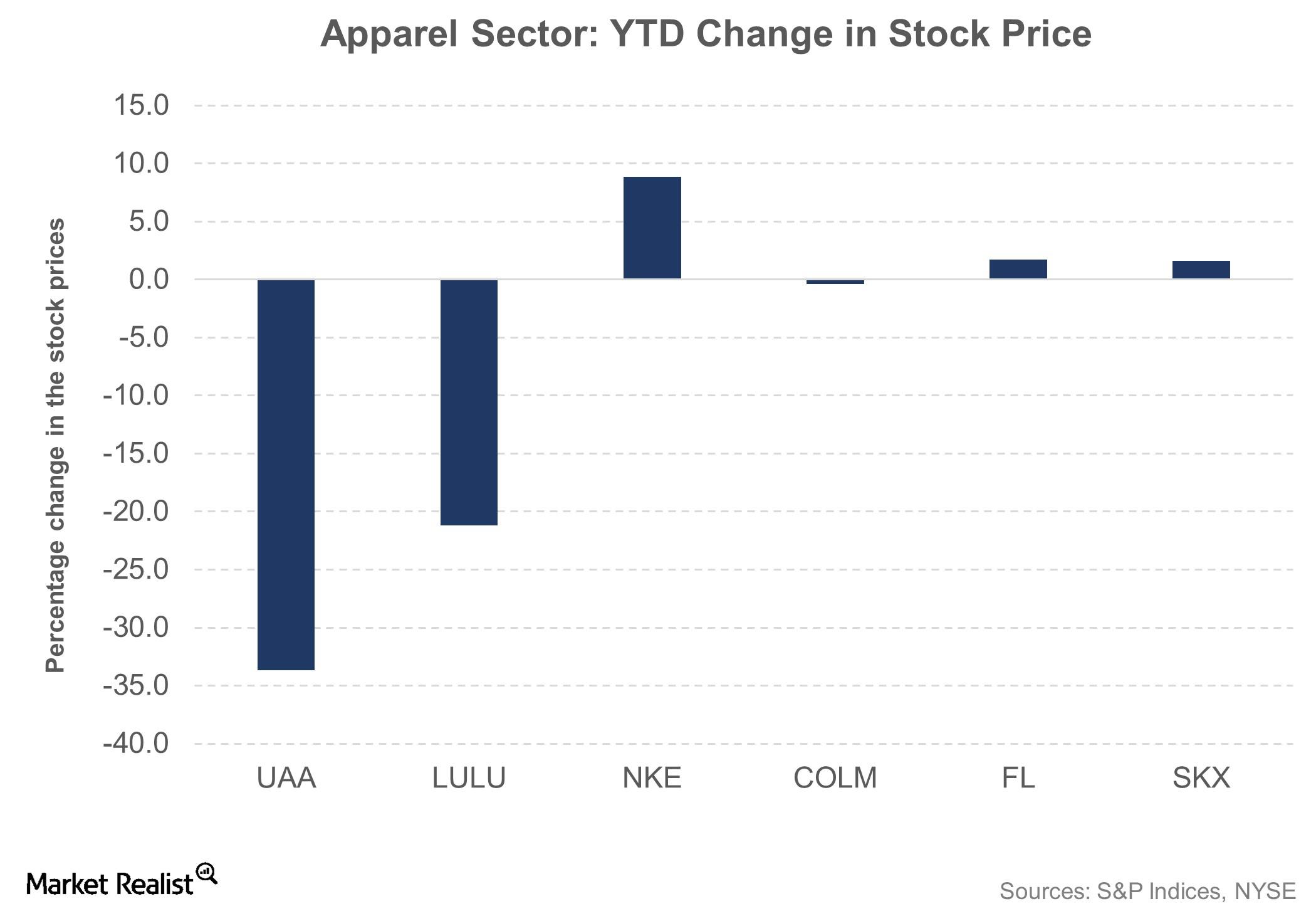

Under Armour Trading 40% Lower Than a Year Ago

Under Armour (UAA) stock remained unfazed after the company announced its new senior level executives, rising ~1.0% and closing at $25.06.

Under Armour’s Stock Surges after 1Q17 Earnings

Under Armour’s (UAA) stock rose 10% as the company reported better-than-expected 1Q17 top and bottom lines and maintained its fiscal 2017 guidance.

Under Armour Beats 1Q17 Earnings and Revenue

The Baltimore-based Under Armour (UAA) reported its results for 1Q17 on Thursday, April 27. Here’s what you need to know.

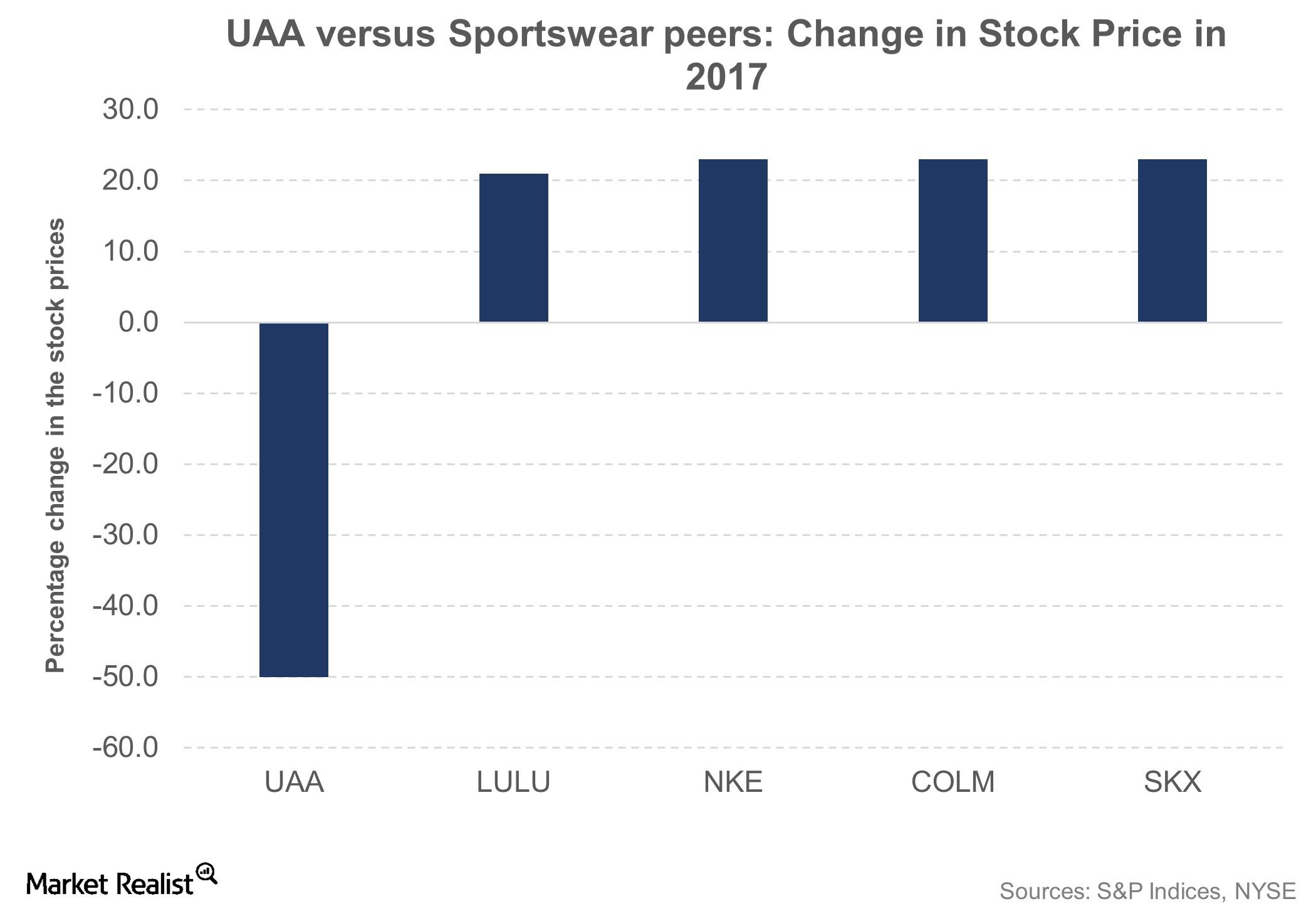

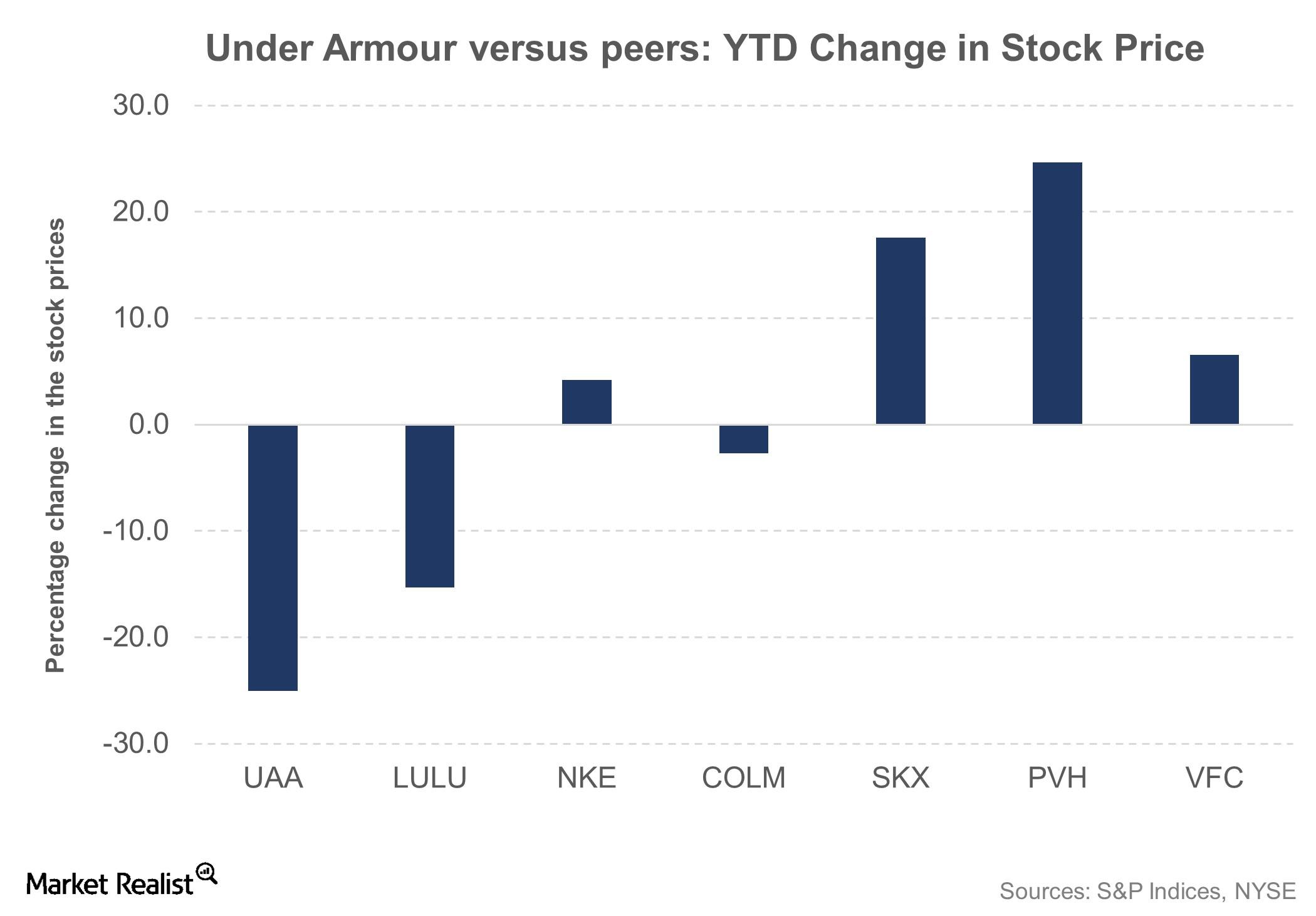

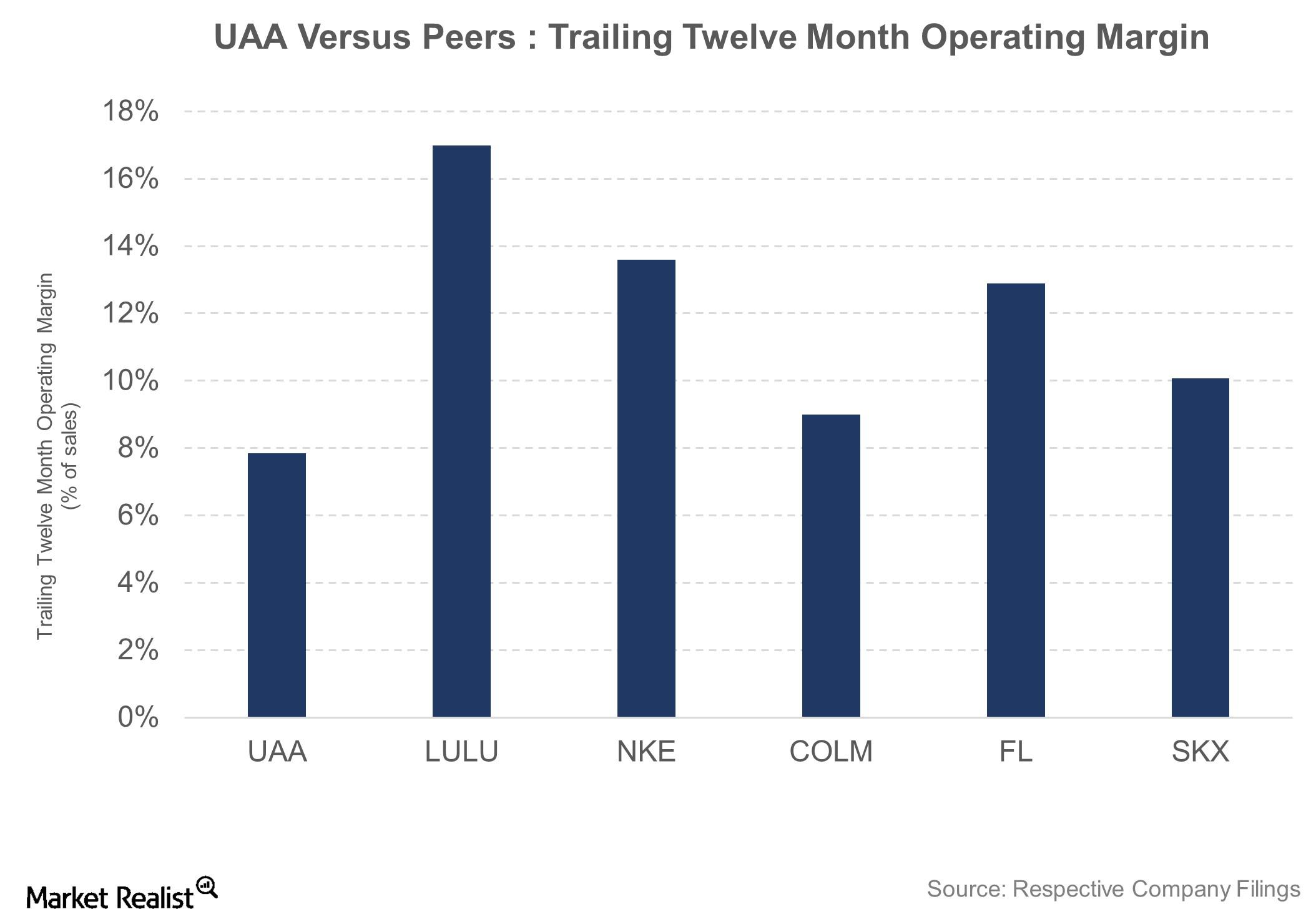

Behind Under Armour’s Poor Stock Performance

Under Armour (UAA) was among the worst performers on the S&P 500 Index (SPY) in 2016, losing 30% of its value during the year.

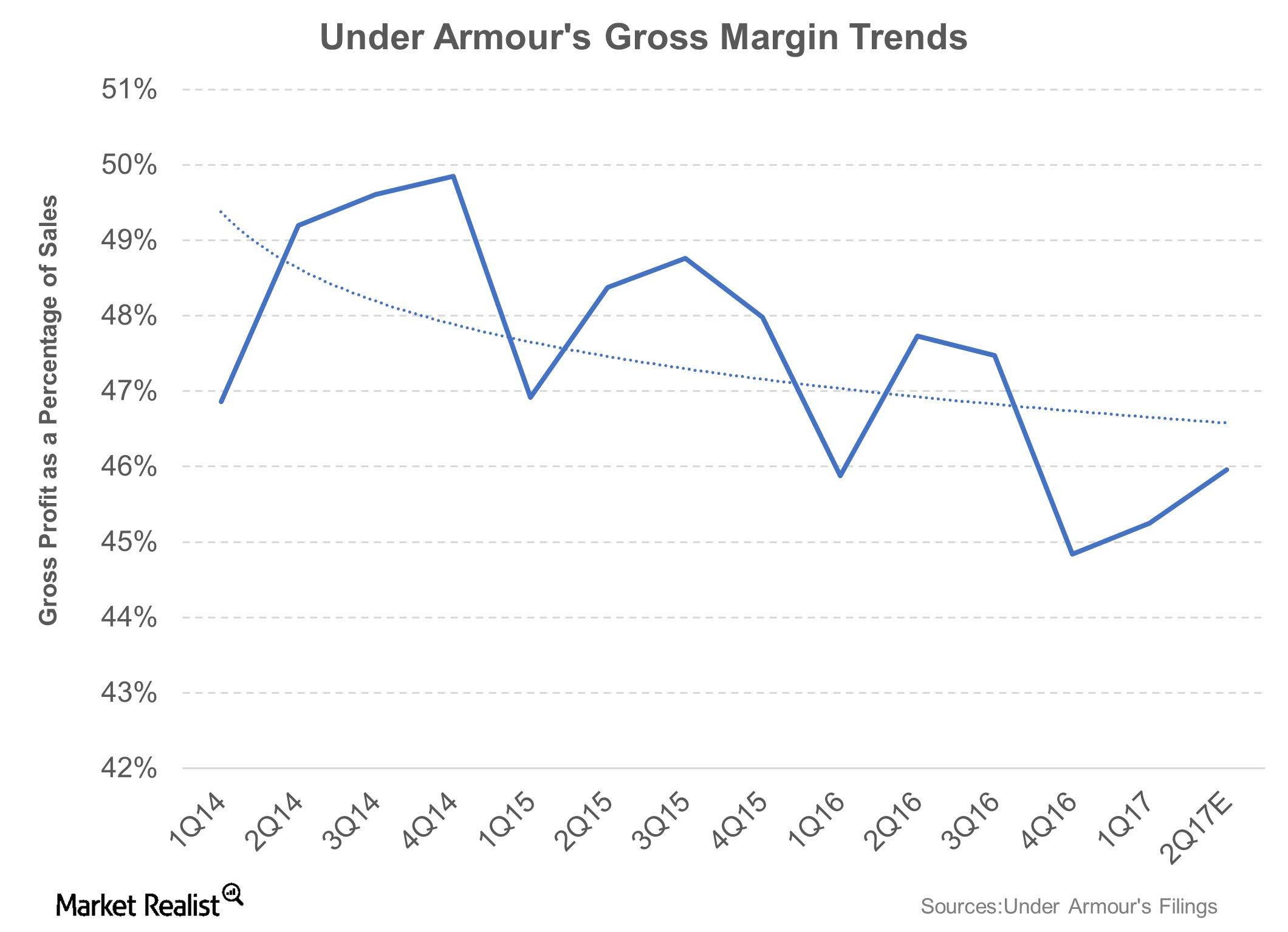

Underneath Under Armour’s Compressed Margins

Under Armour’s (UAA) gross margin fell 160 basis points to 46.5% in fiscal 2016, and its gross margin took the worst hit in the fourth quarter of 2016.

Under Armour Stock Lost 29% during the Week after Its 4Q16 Results

Under Armour (UAA), which is covered by 35 Wall Street analysts, has ten “buy” recommendations, four “sell” recommendations, and 21 “hold” recommendations.

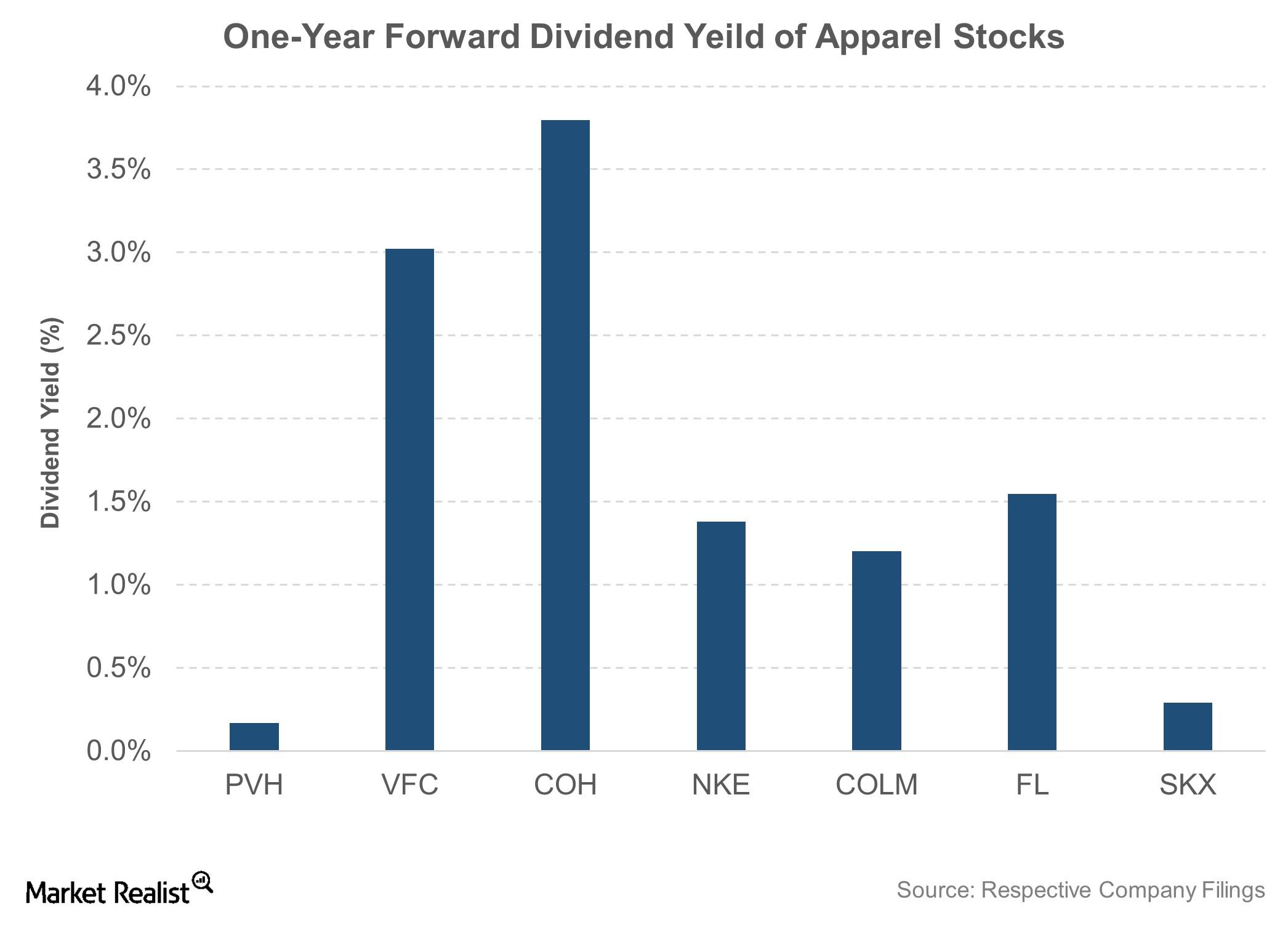

What’s Nike’s Dividend Policy?

Nike (NKE) is a consistent dividend payer and has increased dividends over the last 14 years.

Why Star Power and Sponsorships Are Key for Nike

Endorsement deals and sponsorships have been key for Nike since the beginning.

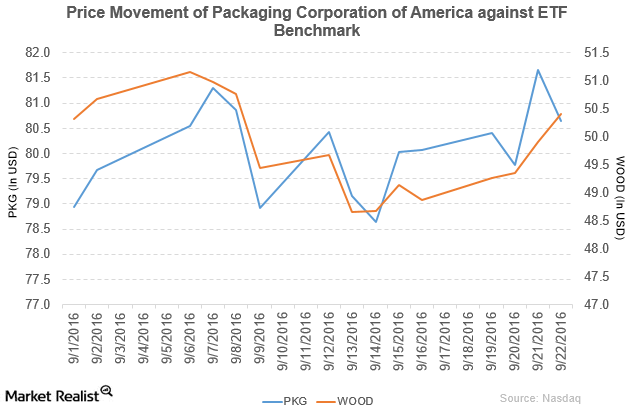

Goldman Sachs Rated Packaging Corporation of America as ‘Sell’

Packaging Corporation of America (PKG) has a market cap of $7.6 billion. It fell 1.3% to close at $80.64 per share on September 22, 2016.

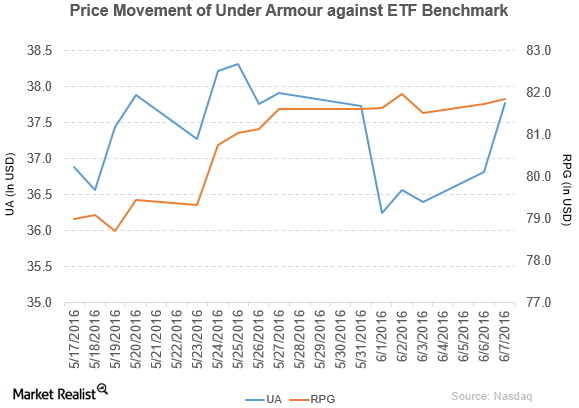

What Boosted Under Armour on June 7?

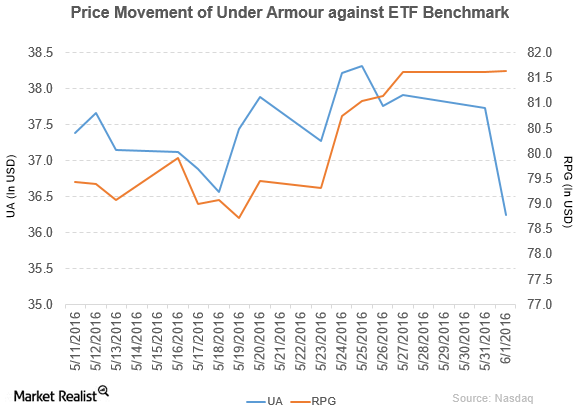

Under Armour rose by 2.6% to close at $37.77 per share on June 7. Its weekly, monthly, and YTD price movements were 0.11%, -2.4%, and -6.3%, respectively.

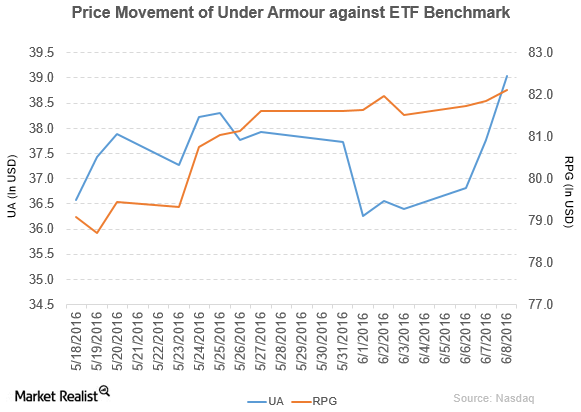

What Drove Under Armour’s Rise on June 8?

Under Armour (UA) has a market cap of $7.1 billion. It rose by 3.4% to close at $39.04 per share on June 8, 2016.

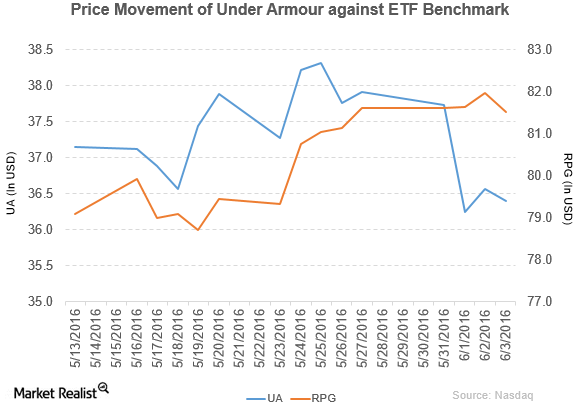

Under Armour Has Declared a Dividend for Its Class C Stock

Under Armour (UA) has a market cap of $6.7 billion. It fell by 0.44% to close at $36.40 per share on June 3, 2016.

Under Armour Saw Its Price Target after Its Revised Outlook

Under Armour (UA) has a market cap of $6.6 billion. It fell by 3.9% to close at $36.25 per share on June 1, 2016.

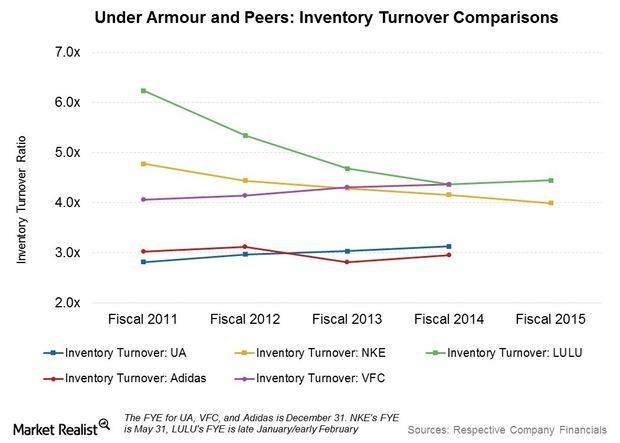

What’s Different about Under Armour’s Inventory Management?

Under Armour (UA) anticipates higher inventory growth over the next few quarters. It has made a number of changes on the inventory and supply chain side.

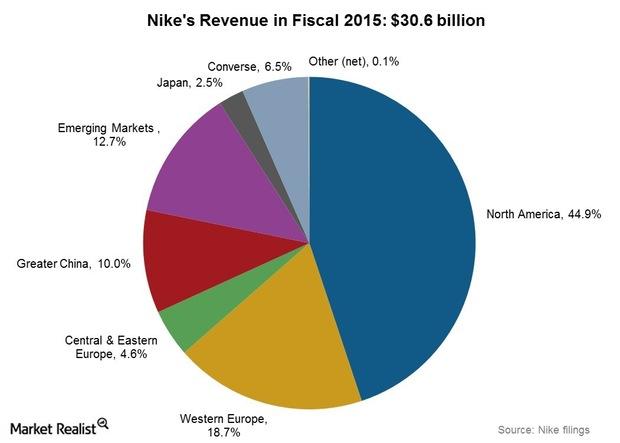

Overseas Markets and Nike: Obstacles on the Leading Footwear Company’s Revenue Racetrack?

In fiscal 2015, Nike derived ~55% of its sales from overseas markets—18.7% from Western Europe, 12.7% from Emerging Markets, and 10% from Greater China.

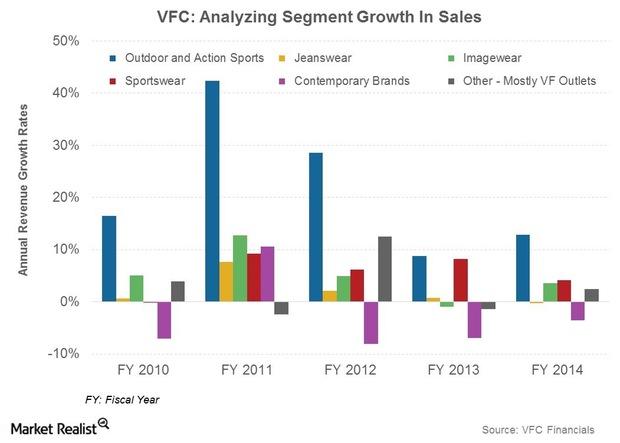

VF Corporation’s Big 3 And Other Brands In The Making

The company’s three major brands—The North Face, Vans, and Timberland—all reported double-digit growth rates in the quarter.

Lululemon Supplier, Manufacturer, And Distribution Overview

Manufacturer base: There were about 35 manufacturers producing the company’s products as of the fiscal year ending February 2, 2014.