AK Steel Holding Corp

Latest AK Steel Holding Corp News and Updates

US Steel and AK Steel Diverge after Q3 Earnings

AK Steel (AKS) reported its third-quarter earnings on Wednesday in after-market trading. The stock fell sharply during trading on Thursday.Materials Must-know: Understanding the major markets for AK Steel

AK Steel (AKS) gets most of its revenues from the U.S. For the past three years, more than 85% of its sales have come from the U.S. This makes AK Steel more exposed to the domestic market’s dynamics than global factors.

AK Steel Stock Fell after Q3 Earnings Miss

AK Steel (AKS) stock was trading deep in the red in after-market trade on Wednesday. Based on the YTD price action, the stock is outperforming its peers.

Why US Steel Short Sellers Might Lose on Their Bets

Things could turn around for the US steel sector, with mills pushing for price hikes. Earnings results this week could also surprise positively.

Can US Steel Stocks Gain from Trump’s Turkey Tariffs?

Trump imposed a 25% tariff on US steel imports in 2018, and he recently doubled Turkey’s Section 232 tariffs to 50%. Will this really help?

US Steel Companies’ Guidance Opens a Can of Worms

This week, three leading US steel companies provided their third-quarter earnings guidances. All these guidances were lower than analysts were expecting.

US Steel Stocks: Don’t Count Your Chickens Yet!

US steel stocks are rising today on multiple factors. There’s rising optimism over a US-China trade deal, and Chinese steel exports plummeted in August.

Layoffs for U.S. Steel: Is Trump Listening?

In a regulatory filing, U.S. Steel announced layoffs. Last week, President Trump claimed that the US steel industry is “thriving” due to his tariffs.

US Steel Companies Keep Fingers Crossed, Key Deadline Looms

U.S. Steel Corporation, AK Steel, Nucor, and Steel Dynamics will probably keep their fingers crossed as the “final” deadline approaches.

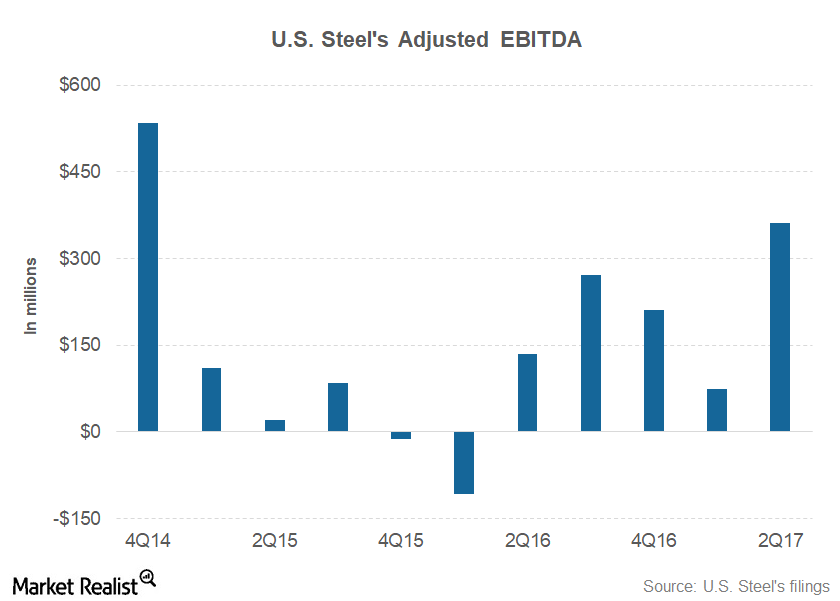

Analyzing U.S. Steel Corporation’s Disclosure Policy

Earlier this year, U.S. Steel Corporation provided its sensitivity to spot steel prices, the quarterly EBITDA guidance, and annual guidance.

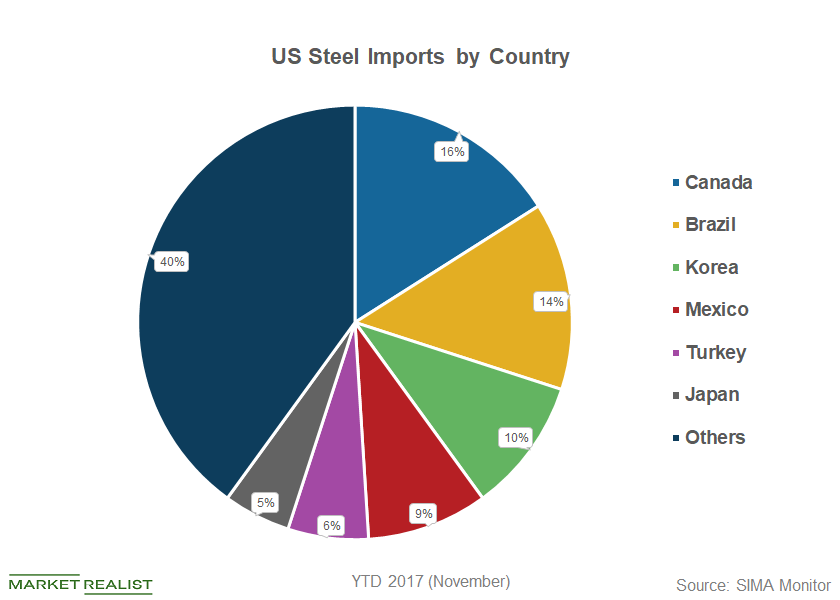

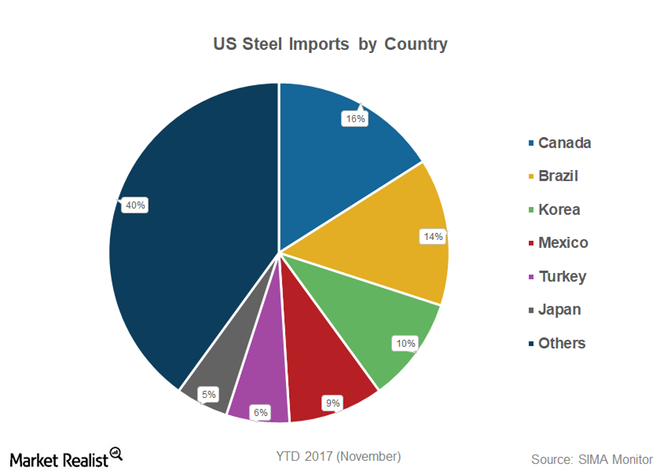

How US Steel Import Tariffs Could Affect Cleveland-Cliffs in 2018

US steelmakers (SLX) were facing an onslaught of increasing steel imports into the US, which impacted their capacity utilization and pricing power negatively.

Cleveland-Cliffs Stock Rises on Tariff Recommendations

On February 16, 2018, the US Department of Commerce released its recommendations for the Section 232 probe into steel and aluminum imports.

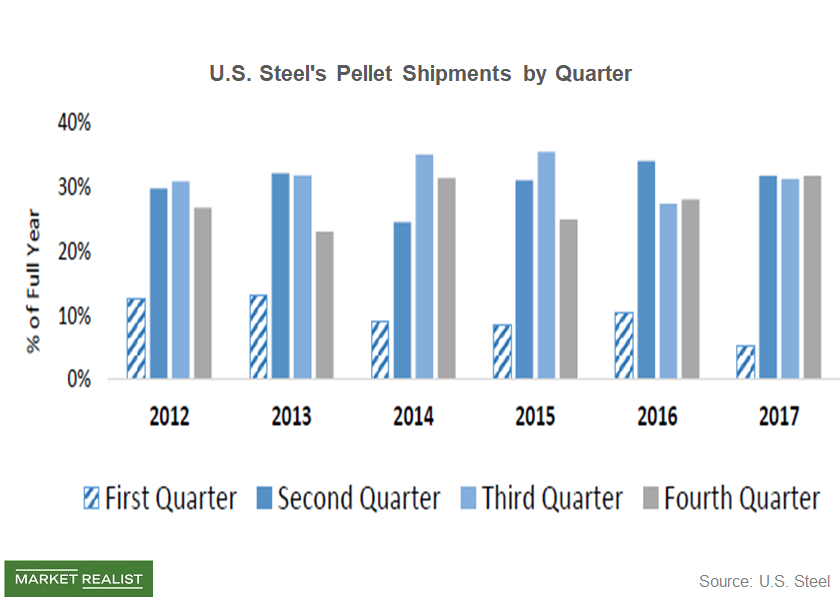

What to Expect from U.S. Steel Corporation’s 4Q17 Shipments

U.S. Steel Corporation’s 4Q17 European shipments could be higher—compared to the sequential quarter. Steel demand tends to be slow in the third quarter.

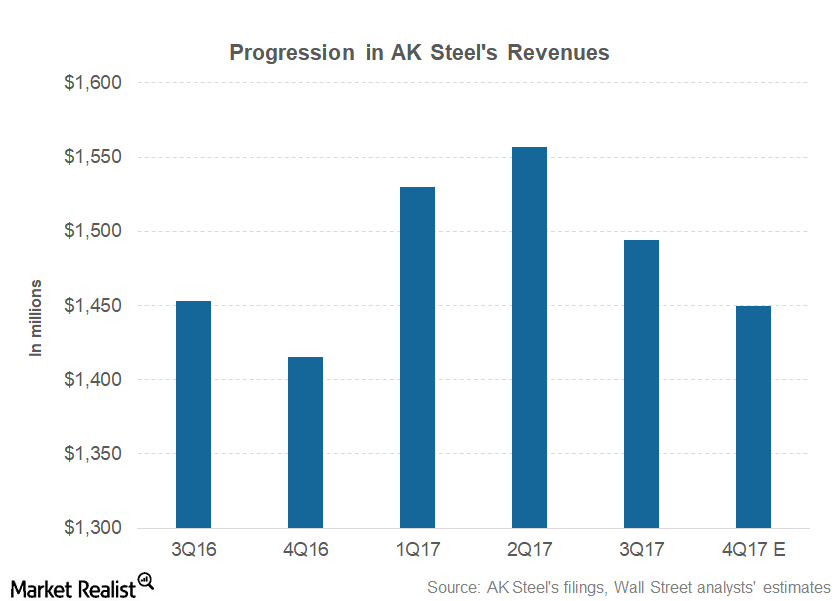

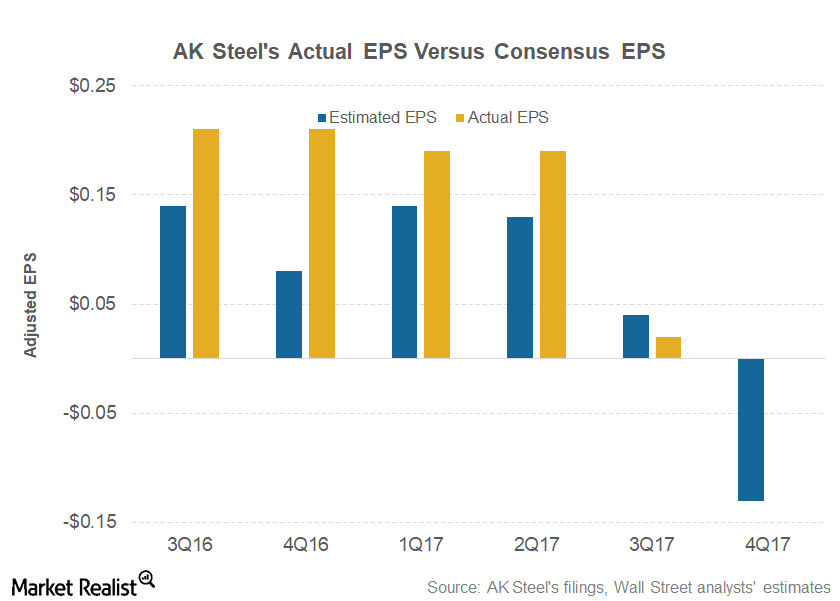

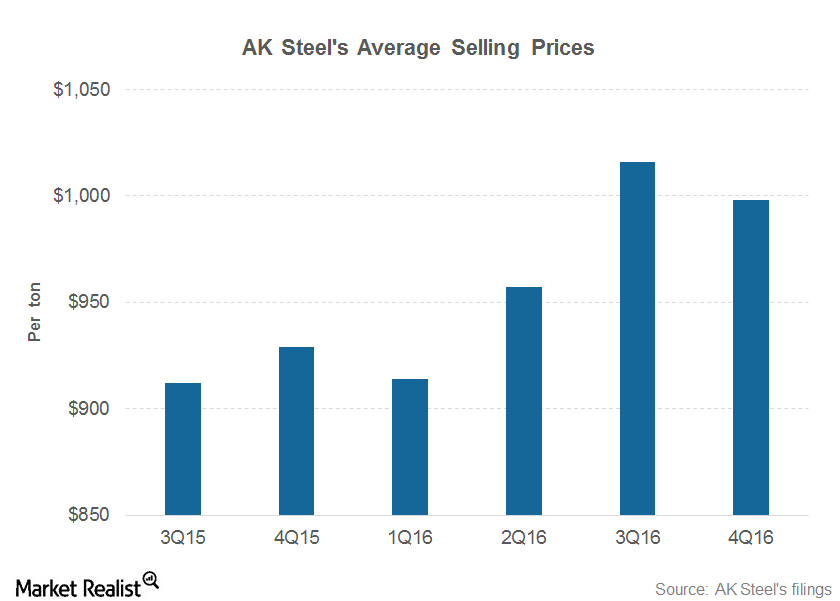

What Could Drive AK Steel’s 4Q17 Financial Performance

AK Steel’s 4Q17 financial performance AK Steel’s (AKS) 4Q17 earnings results are expected on January 30. In this article, we’ll see what analysts are projecting for AK Steel’s 4Q17 revenue. We’ll also look at what could drive AK Steel’s 4Q17 financial performance. According to analyst estimates compiled by Thomson Reuters, AK Steel is expected to post […]

Could AK Steel’s 4Q17 Results Keep Investors’ Optimism Alive?

AK Steel (AKS) is scheduled to release its 4Q17 earnings results on January 30, 2018.

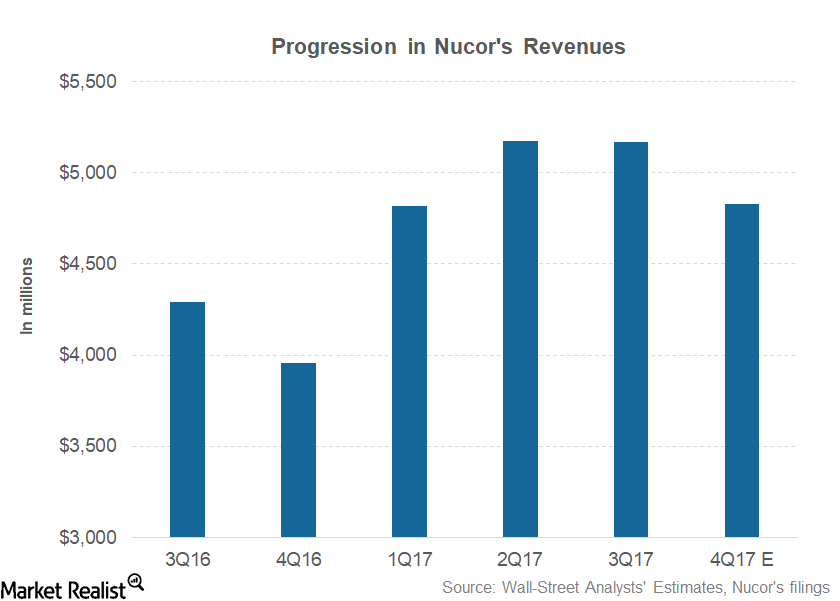

Nucor’s 4Q17 Earnings: What’s the Word on Wall Street?

Nucor (NUE), the leading US-based steel producer, is expected to release its 4Q17 earnings on January 30. Analysts polled by Thomson Reuters expect Nucor to post 4Q17 revenues of ~$4.8 billion.

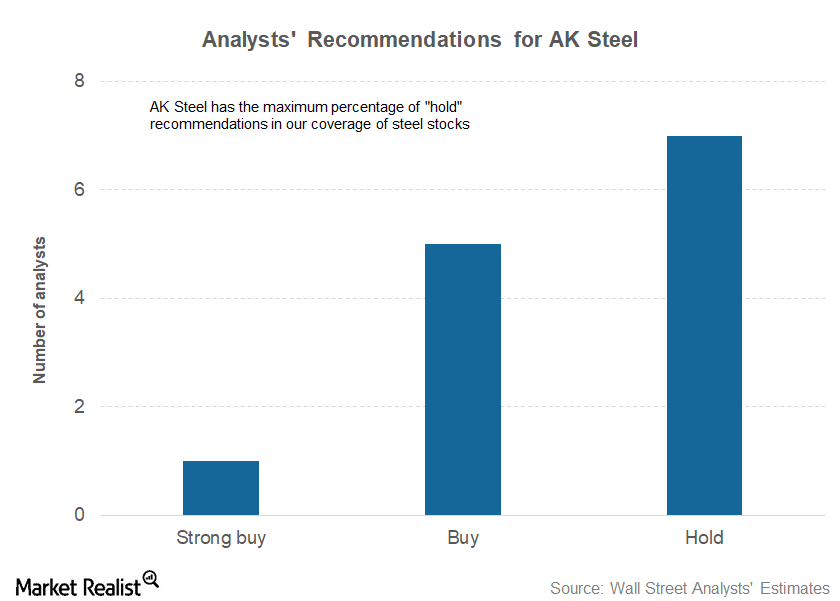

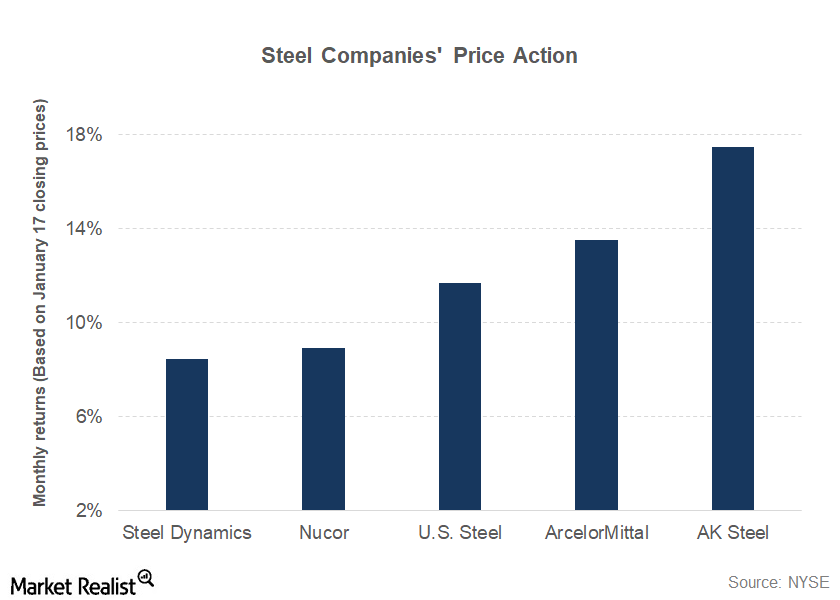

AK Steel Could See More Upside after the Strong Rally

AK Steel (AKS) has gained sharply since mid-December. The stock, which traded weak for most of 2017, has shown strength in the past month.

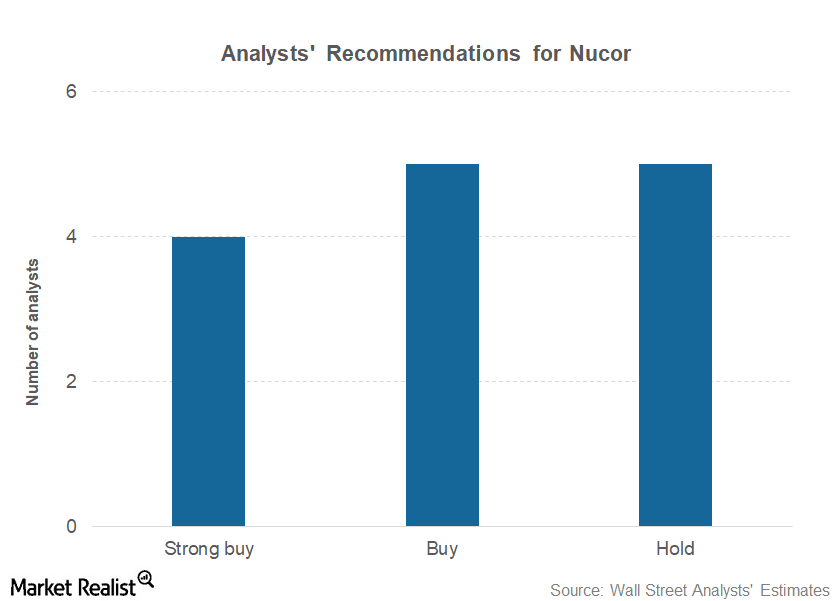

Nucor: What Analysts Expect This Earnings Season

Nucor received a “strong buy” rating from four analysts, while five analysts have a “buy” rating on the stock and five analysts have a “hold” rating.

How Markets See US Steel Stocks before 4Q17 Earnings

Steel Dynamics will release its 4Q17 financial results on January 22, 2018. AK Steel and Nucor are scheduled to release their 4Q17 earnings on January 30.

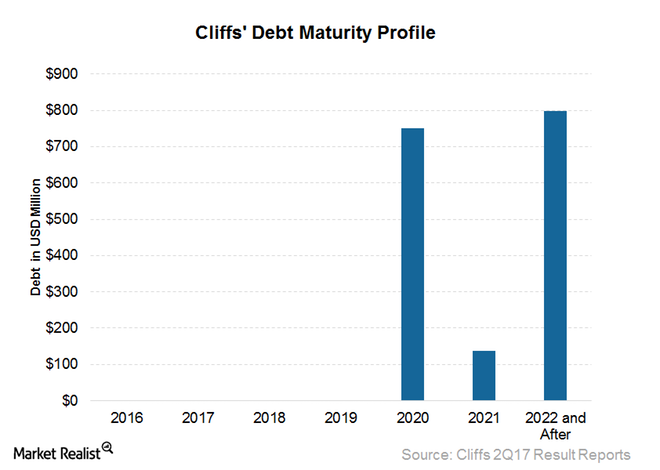

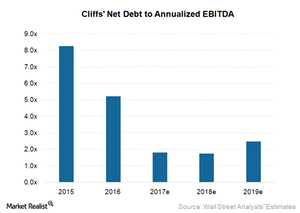

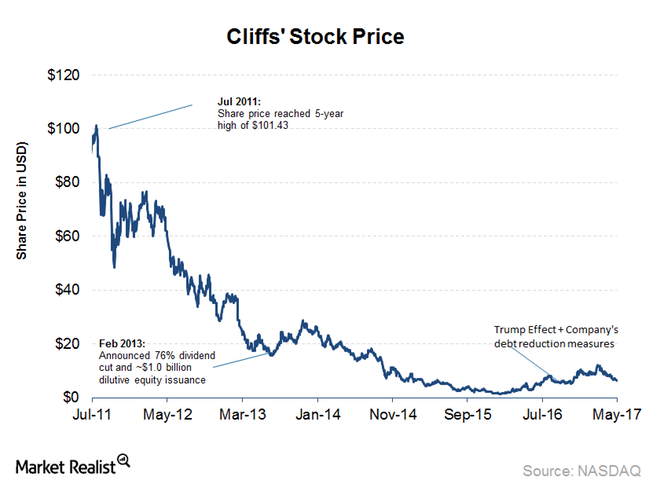

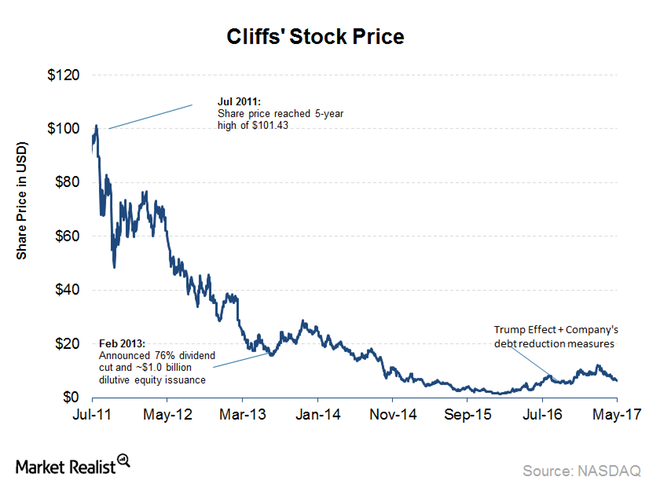

Why Analysts Project Lower Net Debt for Cliffs in 2017

Although investors are still concerned about Cleveland-Cliffs’ (CLF) debt, it has come a long way with respect to debt levels.

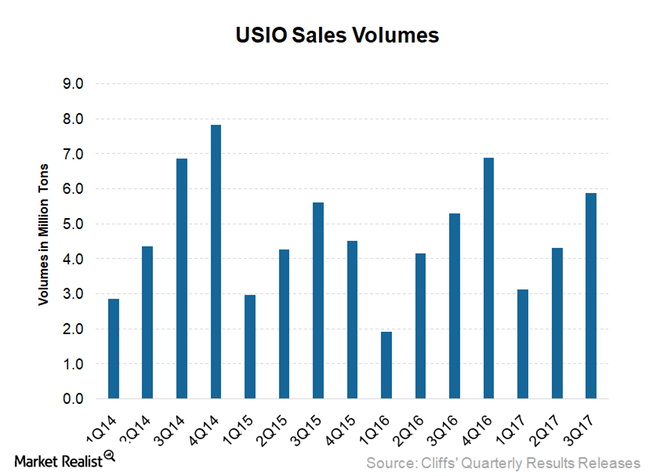

What to Expect from Cleveland-Cliffs’ 4Q17 US Volumes

Cleveland-Cliffs (CLF) achieved US volumes of ~5.9 million tons in 3Q17, an increase of 11% year-over-year (or YoY).

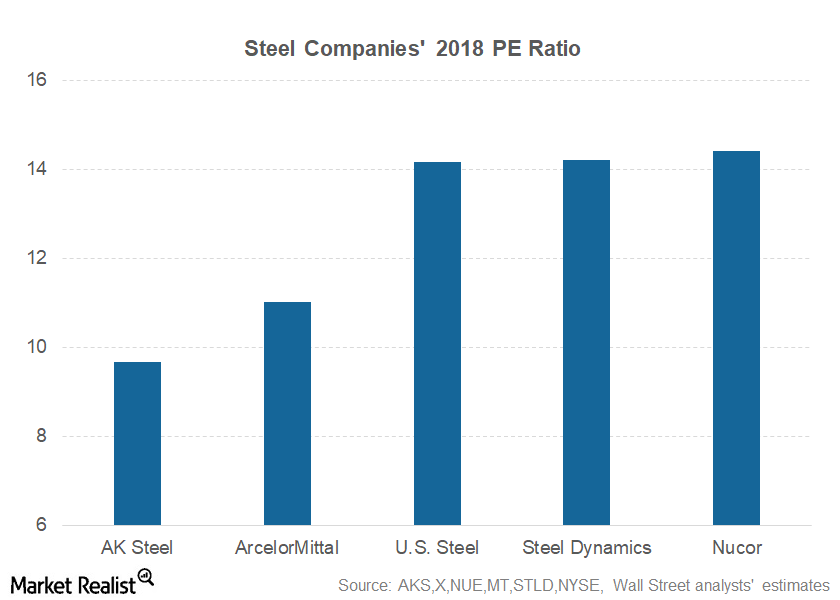

How Steel Companies’ PE Ratios Stack Up

AK Steel (AKS) has the lowest forward PE multiple of 9.7 among our select group of steel stocks.

After a Tough 2017, What Lies ahead for AK Steel in 2018?

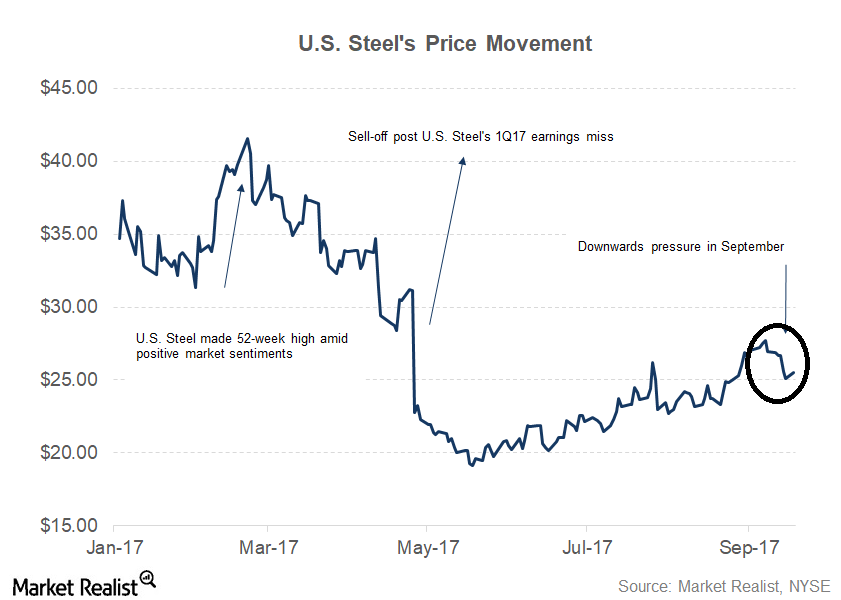

While U.S. Steel shed ~26% of its market cap after its 1Q17 earnings miss, AK Steel investors were left poorer by 21% after AKS’s 3Q17 earnings miss.

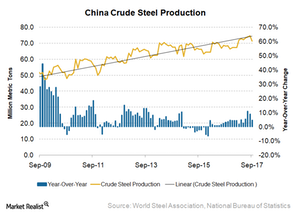

Will China’s Steel Production Take the Sheen Away from Iron Ore Prices?

The most-traded January rebar contract on the Shanghai Futures Exchange climbed 4.3% to 3,776 yuan per ton.

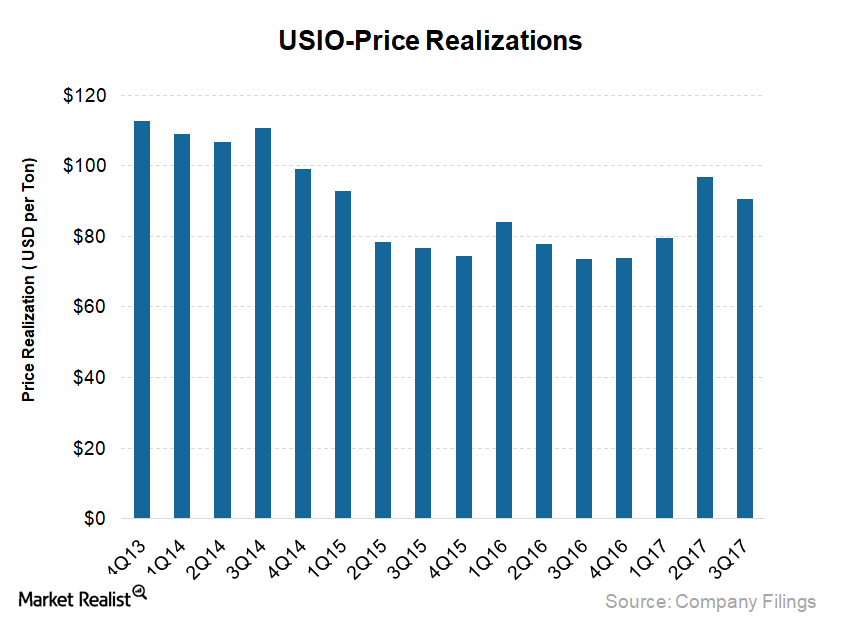

Can Cleveland-Cliffs’ Realized Prices in the US Recover in 2018?

For 3Q17, Cleveland-Cliffs reported average realized prices came in at $90.50 per ton.

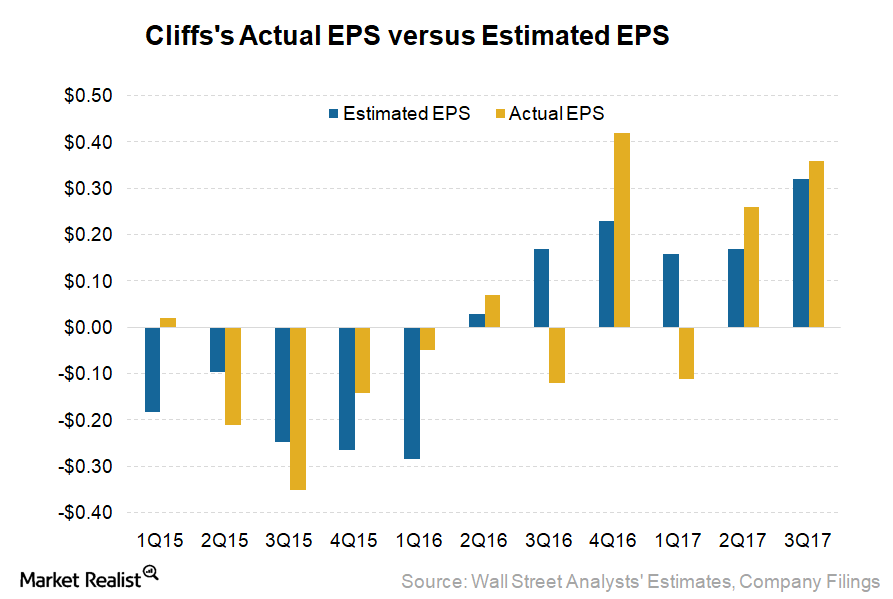

Is Cleveland-Cliffs’ Weak 4Q17 Outlook Temporary?

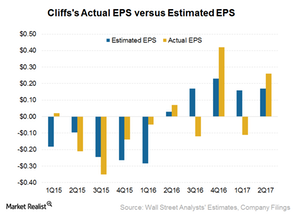

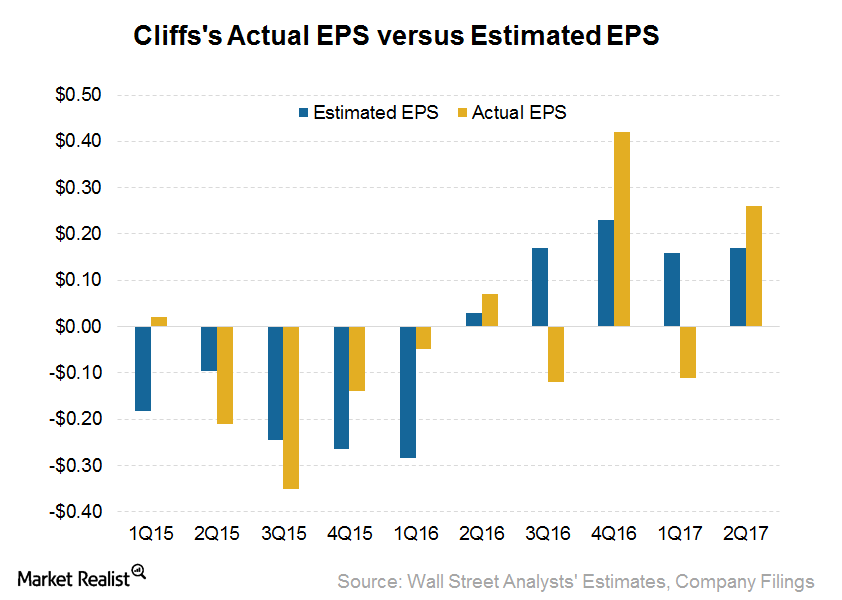

Cleveland-Cliffs (CLF) released its 3Q17 results on October 20. CLF reported earnings per share of $0.36, beating the consensus estimate by $0.04.

Factors Driving Analysts’ Forecast of a Drop in CLF’s Net Debt in 2017

According to consensus estimates, CLF’s net debt should fall 42% by the end of 2017 compared to 2016.

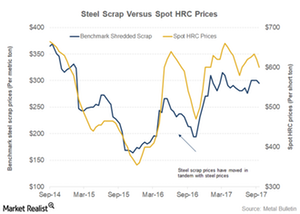

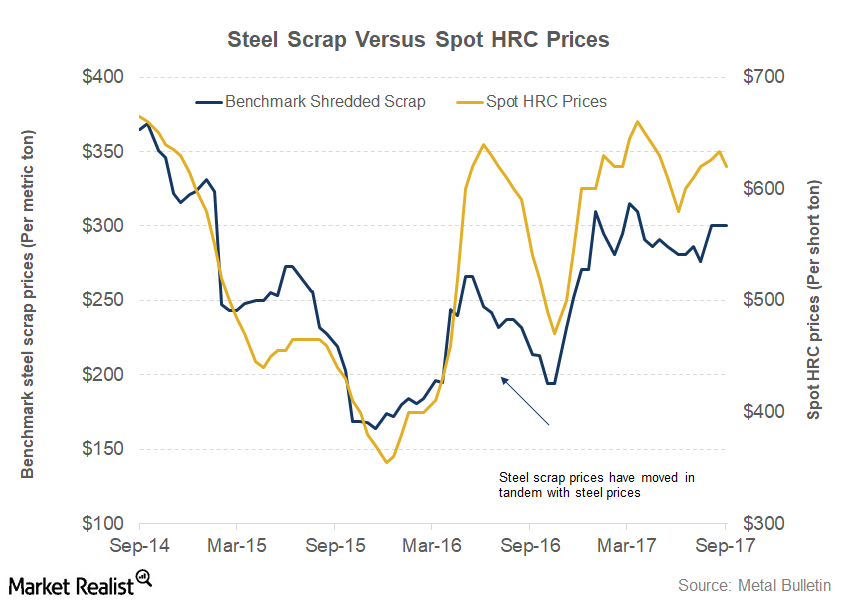

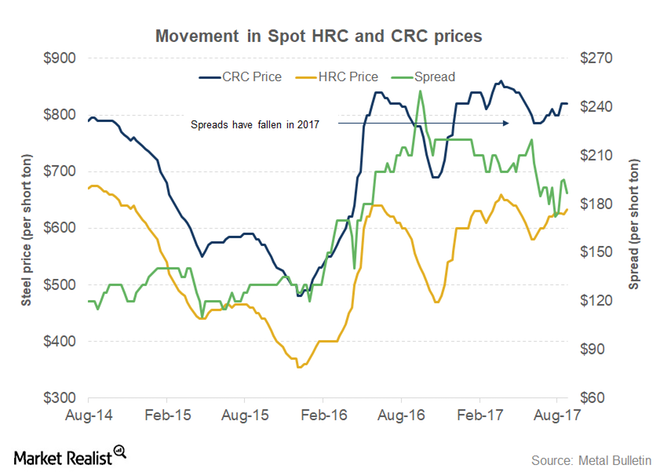

The Outlook for US Steel Prices in 4Q17

Steel prices Along with steel production, steel prices are among the most important drivers of US steelmakers’ earnings. Therefore, steel and iron ore investors should track US steel prices (SLX). After being depressed for a long period, US steel prices started their upward march in 2016 after high anti-dumping duties were levied on imported steel. Prices also […]

A Look at Trends in US Steel Production

US steel production As US (DIA) (DOW) steel production is US steelmakers’ major revenue driver, it’s very important to track it. In this part, we’ll discuss domestic production and capacity utilization. According to the World Steel Association, the United States produced 7.1 million tons of steel in August 2017, an increase of 6.3% YoY (year-over-year). Production rose 5.6% in […]

How the US Steel Industry’s Supply and Demand Looks before 4Q17

Steel stocks have recouped some of their losses in the last two trading sessions. However, U.S. Steel Corporation (X) and AK Steel (AKS) have lost 5.3% and 4.1%, respectively, month-to-date based on their September 27 closing prices.

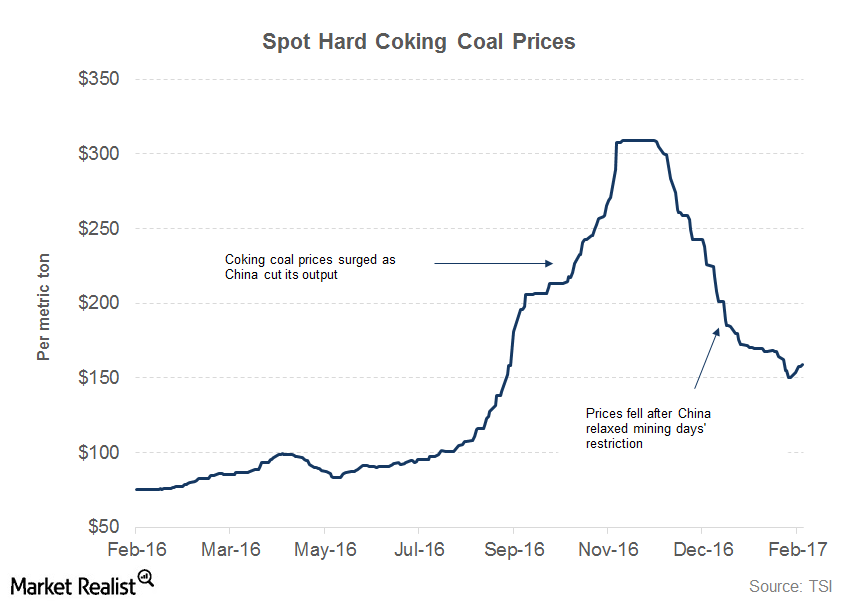

US Steel Producers Are Complaining about Higher Input Costs

Steel production is raw material–intensive in nature. Iron ore, steel scrap, and coking coal are the key raw materials that go into steel production.

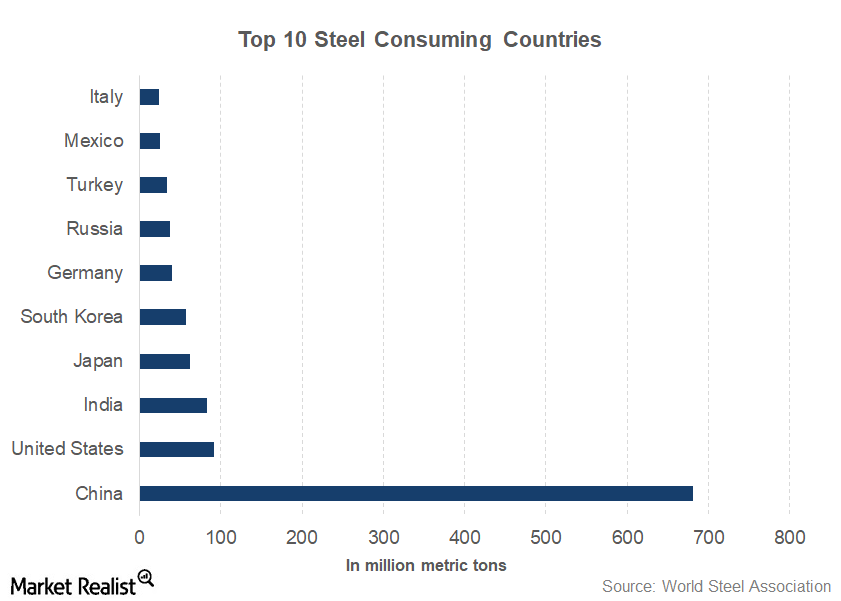

Top 10 Steel Consumers: Where Does the United States Stand?

China was the largest steel consumer last year, with the mainland’s ASC at 681.0 million metric tons.

Impact on CLF: Will the Trump Administration Listen to US Steelmakers?

The American steel industry has written to President Donald Trump requesting that he restrict steel imports immediately.

These Variables Could Drive Cleveland-Cliffs Higher

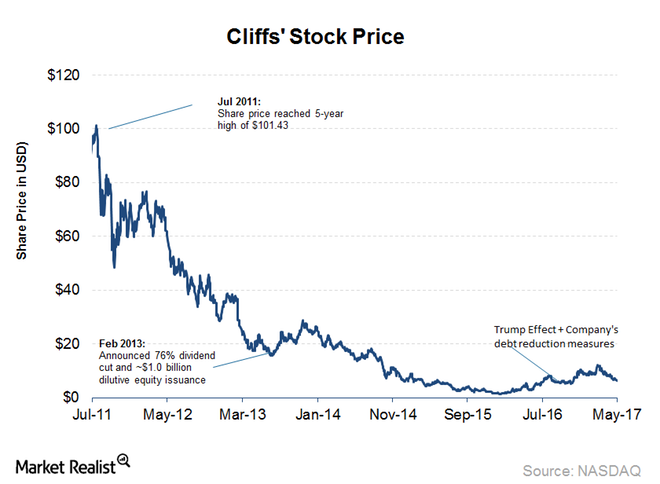

After experiencing a great 2016, US steel stocks are having a tepid 2017.

A Comparative Analysis of Steel Companies’ Leverage

Steel companies have high sensitivity to steel prices and their earnings tend to be volatile. Spot steel prices have been volatile in the last few years.

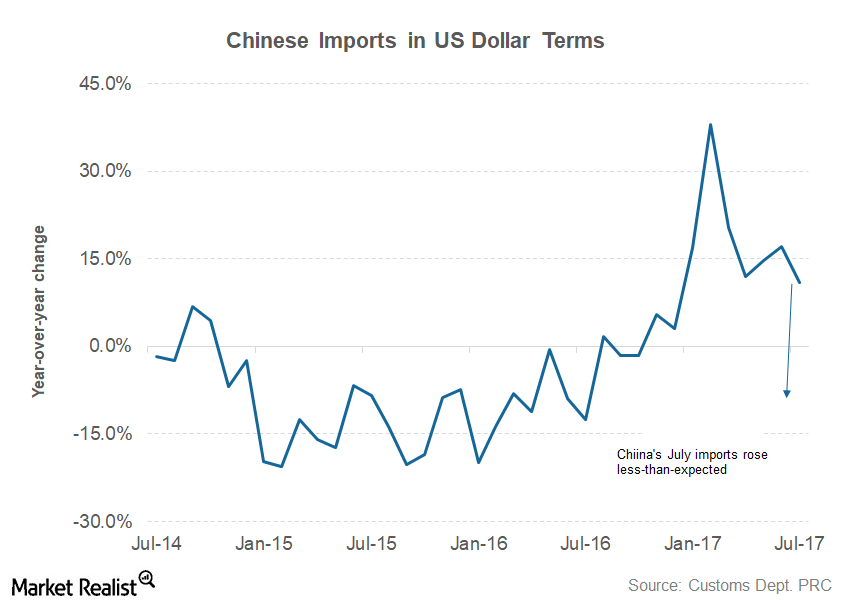

Will China’s Disappointing July Trade Deflate Metal Bulls?

On August 8, China released its trade data for July. The country’s exports in dollar terms rose 7.2% compared to July 2016 while imports rose 11%.

US Steel Prices: The Outlook for Cliffs Natural Resources

Cliffs Natural Resources (CLF) downgraded its EBITDA and net earnings guidance for 2017 due to weaker-than-expected YTD averages of US HRC and seaborne iron ore prices.

Cliffs Natural Resources: What Will Drive Performance after 2Q17?

The 2Q17 earnings season for US-based steel companies is now over. Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened.

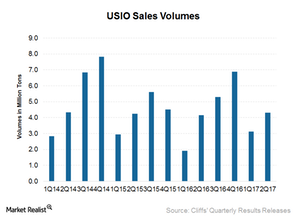

What Could Drive Cliffs Natural Resources’ US Volumes in 2H17

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices.

Key Highlights from Cliffs Natural Resources’ 2Q17 Results

Cliffs Natural Resources (CLF) achieved revenues of $569 million for 2Q17, an increase of 15% year-over-year (or YoY).

Why Cliffs Natural Resources’ Stock Fell despite an Earnings Beat

Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened. Here’s what you need to know.

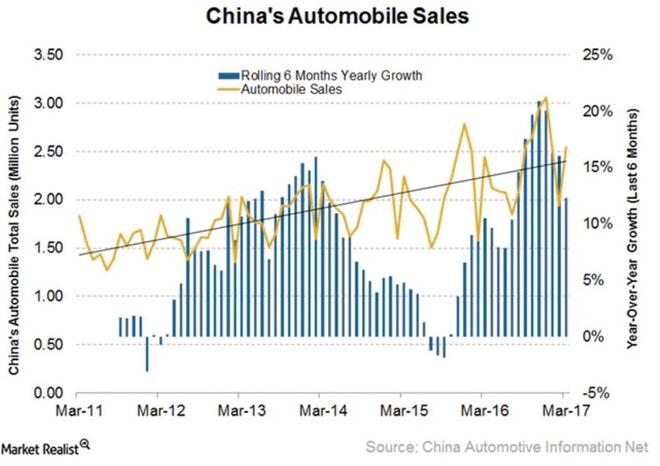

China’s Auto Sales Rebounded in June: Gauging Iron Ore’s Impact

Since China’s automobile industry is the second-largest consumer of steel after the real estate sector, it’s important to track its developments.

How’s the Industry Outlook for Cliffs for the Rest of 2017?

May 2017 was quite a volatile month for Cliffs Natural Resources (CLF) and its peers. Cliffs fell 12.4% in May alone, bringing its year-to-date losses to 30%.

Why US Steel Bears Could Have a Valid Point

US steel prices have held their ground in 2017 and have built on last year’s gains. However, the bears (SDS) also have some valid points. Let’s discuss them in perspective.

Key Updates Markets Are Waiting for in U.S. Steel’s 1Q17 Call

In this article, we’ll analyze the key updates the markets are waiting for in U.S. Steel’s 1Q17 earnings call.

Can AK Steel Regain Its Lost Mojo in 1Q17?

Previously, we looked at AK Steel’s (AKS) 1Q17 earnings estimates. In this article, we’ll look at some key updates the markets could be anticipating in the company’s 1Q17 earnings call.

Analysts Might Take a Fresh Look at U.S. Steel Corporation

U.S. Steel Corporation will release its 1Q17 earnings on April 24 after the market closes. The company’s earnings conference call will be on April 25.

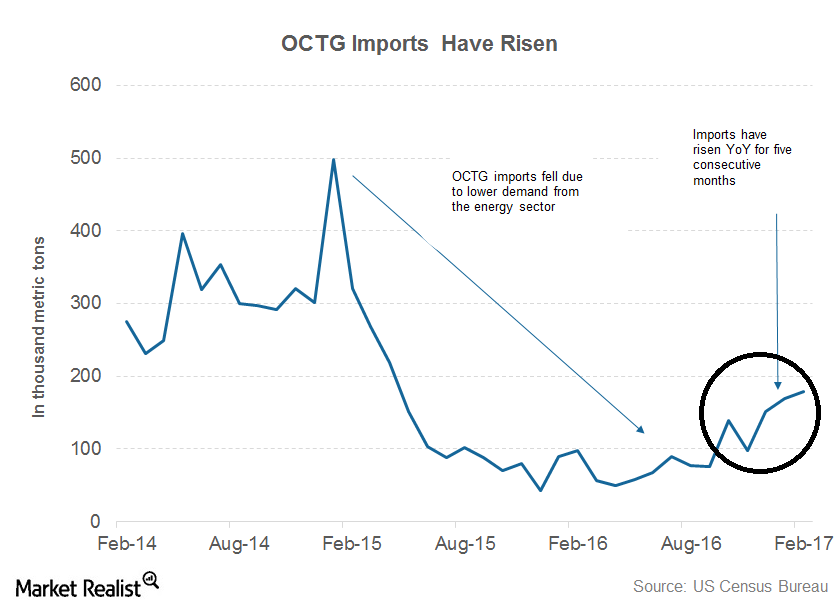

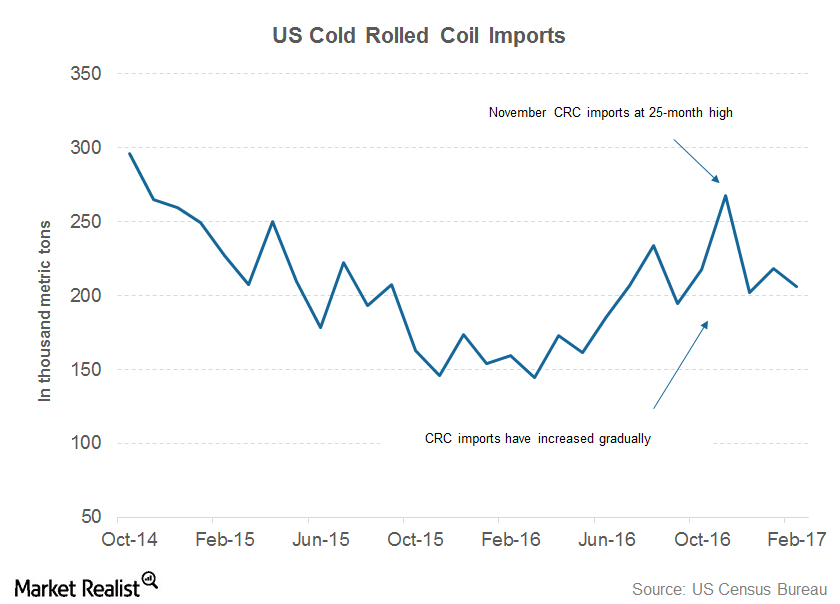

What the Divergence in Flat Rolled Steel Imports Tells Us

In this article, we’ll look at February 2017’s flat rolled steel imports and study whether there’s a divergence in the imports of these products.

How Raw Material Prices Could Impact U.S. Steel’s Performance

ArcelorMittal’s mining operations generated an operating income of $203 million in 4Q16, almost double what they generated in 3Q16.

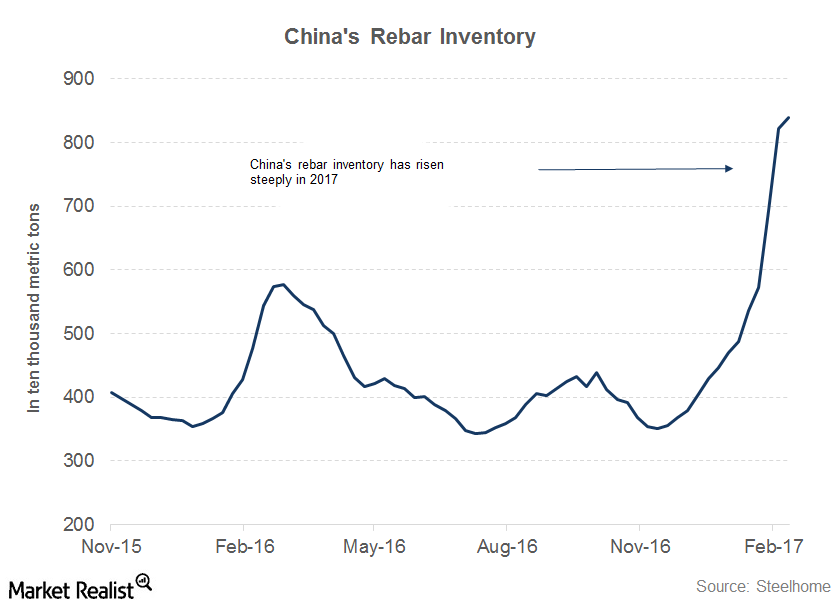

Are Rising Chinese Steel Inventories a Risk for Steel Investors?

With higher steel production and subdued demand, one would expect a tsunami of Chinese steel exports, but this wasn’t the case last month. So what did China want with so much steel?