AK Steel Holding Corp

Latest AK Steel Holding Corp News and Updates

What Rising OCTG Imports Mean for U.S. Steel

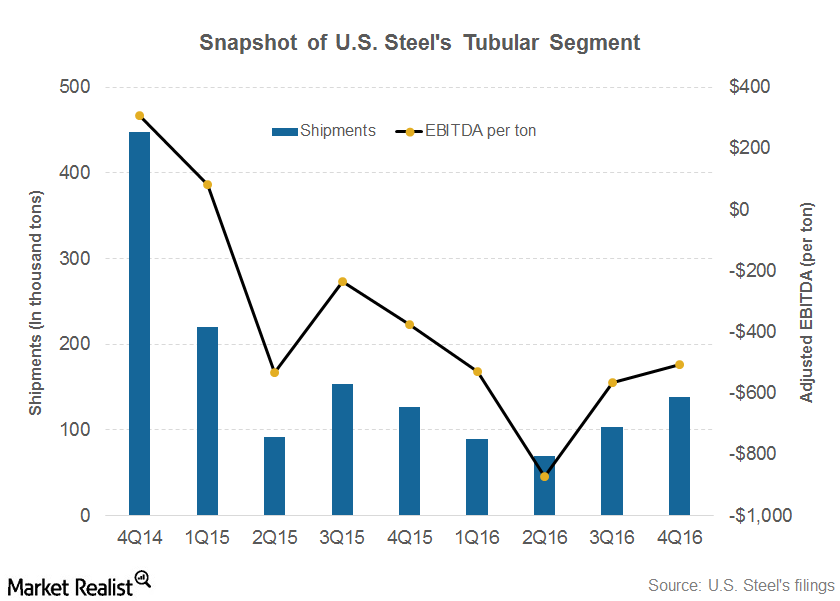

U.S. Steel Corporation has three segments: Flat Rolled, Europe, and Tubular. The company’s Tubular segment produces OCTG (oil country tubular goods) that are used in the energy sector.

ArcelorMittal’s Expected 4Q16 Revenues: The Word on Wall Street

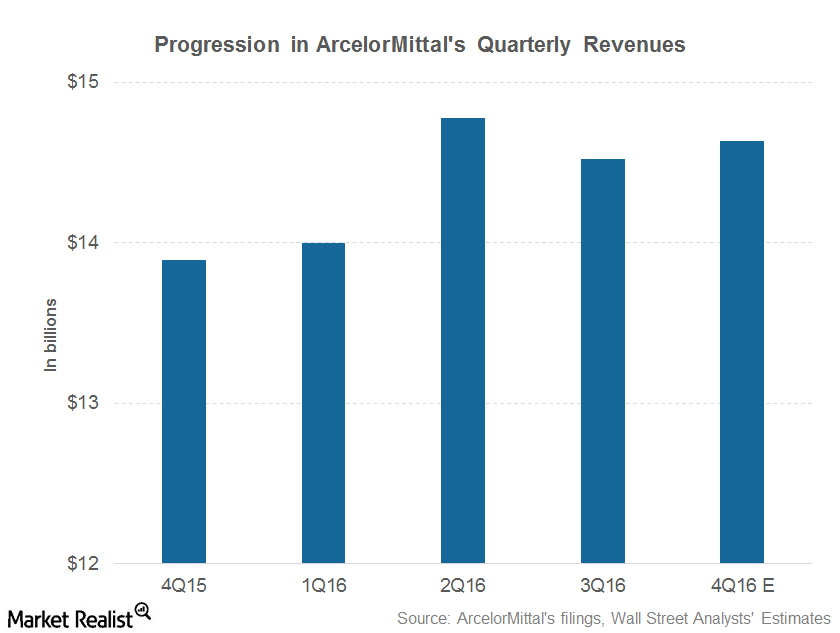

Analysts expect ArcelorMittal (MT) to post revenues of $14.6 billion in 4Q16. The company posted revenues of $14.5 billion in 3Q16 and $13.9 billion in 4Q15.

What Could Affect Iron Ore Prices in 2017?

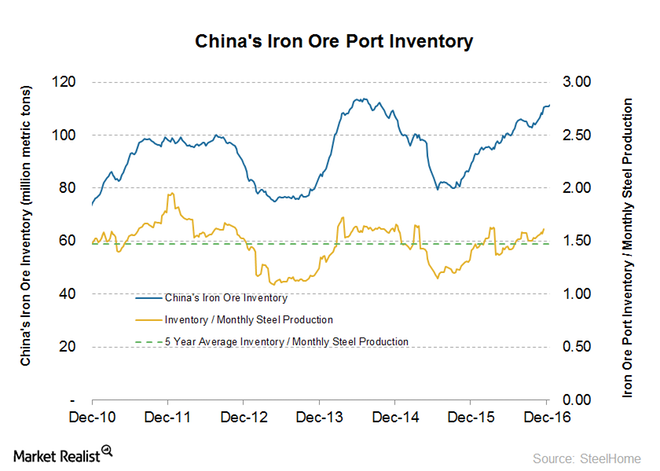

Chinese demand is the key driver of iron ore prices, as the country accounts for more than two-thirds of seaborne demand (CLF) (BHP).

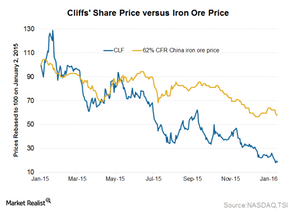

Can Cliffs Natural Resources Scale Greater Heights in 2017?

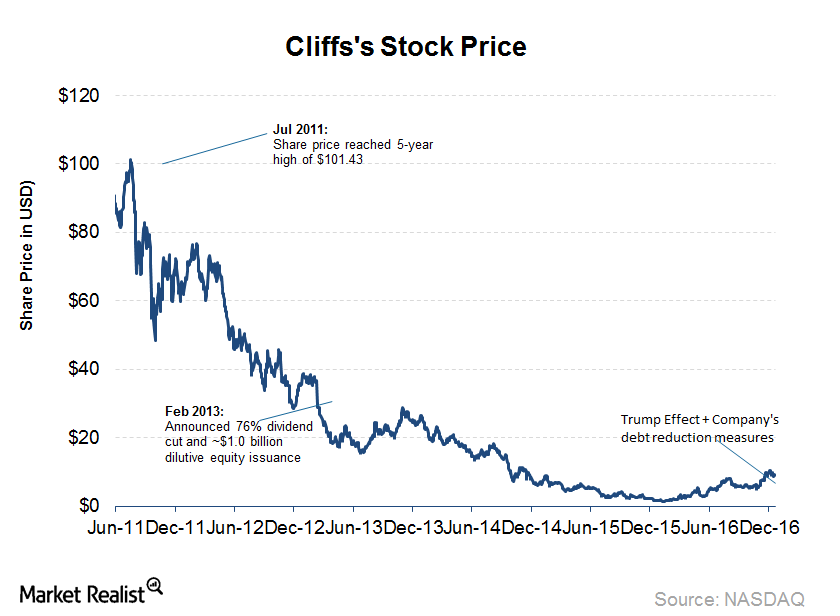

Cliffs Natural Resources (CLF) was trading at $8.85 on December 23, 2016, which represents a 46% rise since Donald Trump’s win in the US presidential election. That brings the year-to-date rise to a whopping 430.0%.

Why U.S. Steel Investors Should Look at Steel Price Spreads

The United States is the largest steel importer globally. Steel companies such as U.S. Steel Corporation frequently blame steel imports for the US steel industry’s woes.

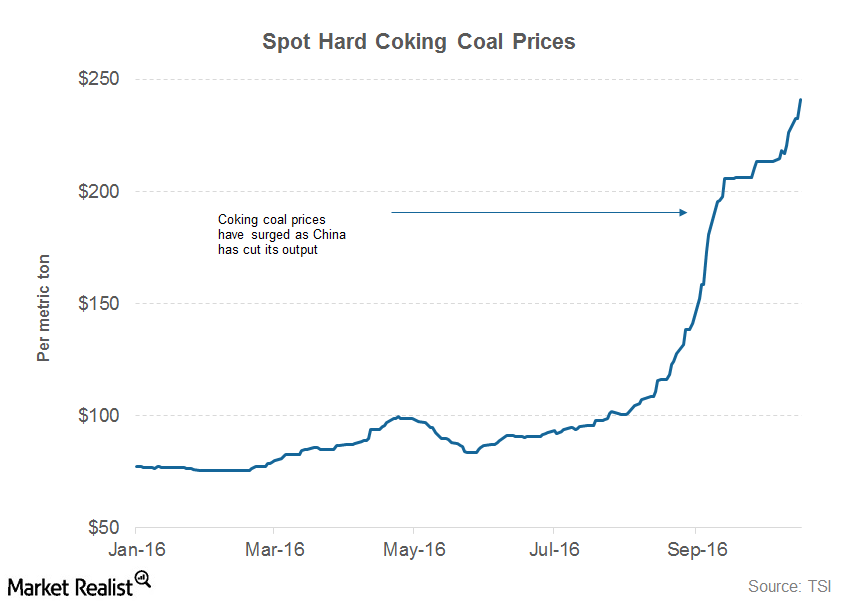

What Factors Are Supporting Steel Prices?

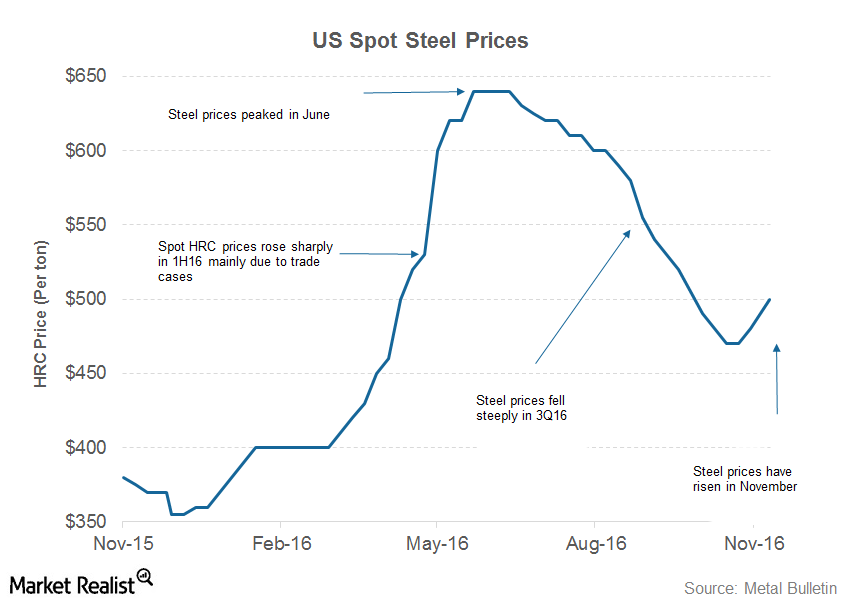

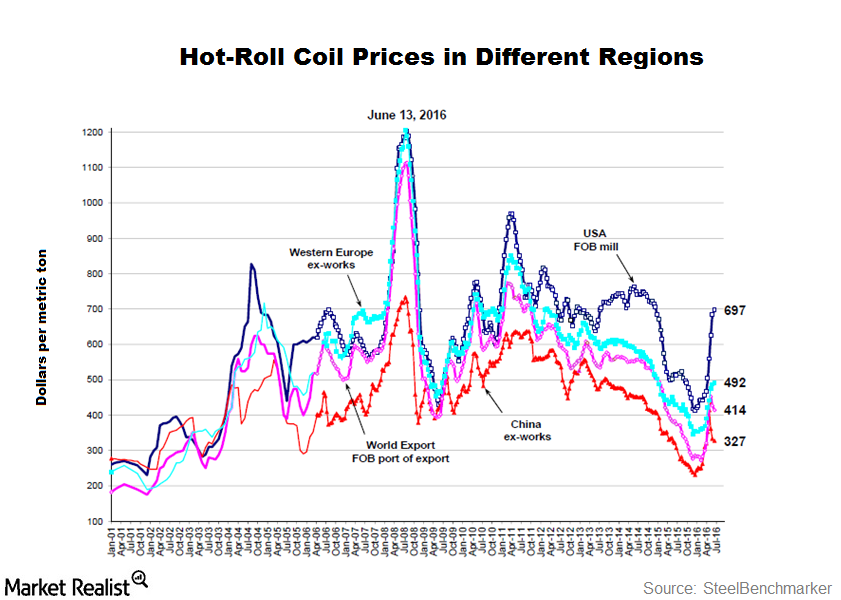

According to data compiled by Metal Bulletin, spot HRC (hot rolled coil) prices rose from $380 per short ton to $640 per short ton between January 2016 and June 2016.

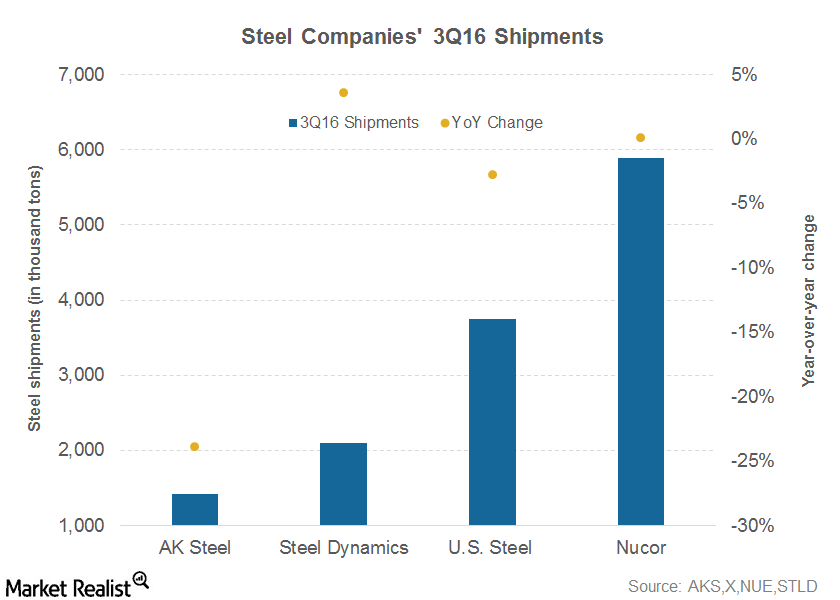

Revenue Miss Was a Hallmark of Steel Companies’ 3Q16 Earnings

One of the key features of steel companies’ 3Q16 financial performance was lower-than-expected revenues.

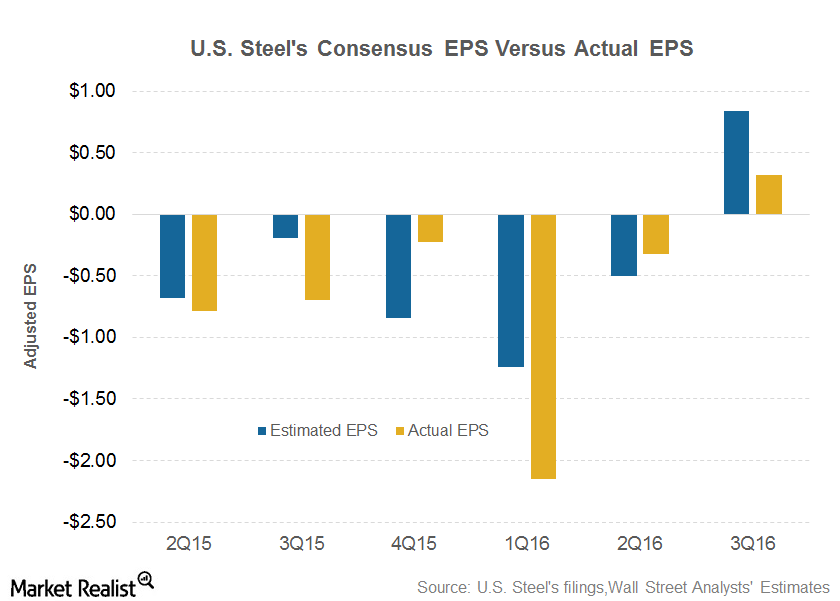

U.S. Steel Bulls Left Heartbroken After 3Q16 Earnings Miss

U.S. Steel Corporation (X) released its 3Q16 financial results on November 1 after the market closed, and it held its earnings conference call on November 2.

Analyzing the Bullish Argument for U.S. Steel

The bulls and bears have their own sets of arguments about U.S. Steel. U.S. Steel (X) and AK Steel (AKS) mainly use iron ore as a raw material.

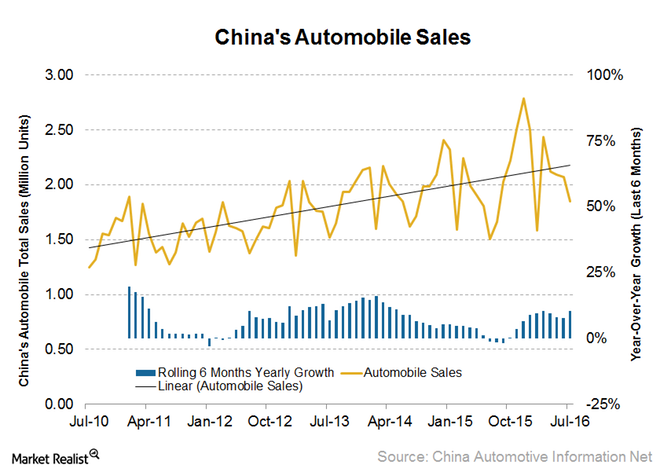

The Outlook for China’s Automobile Sales and Why It Matters

China’s passenger car sales rose 26% year-over-year in August. This is the fourth consecutive month that car sales have risen in the double digits.

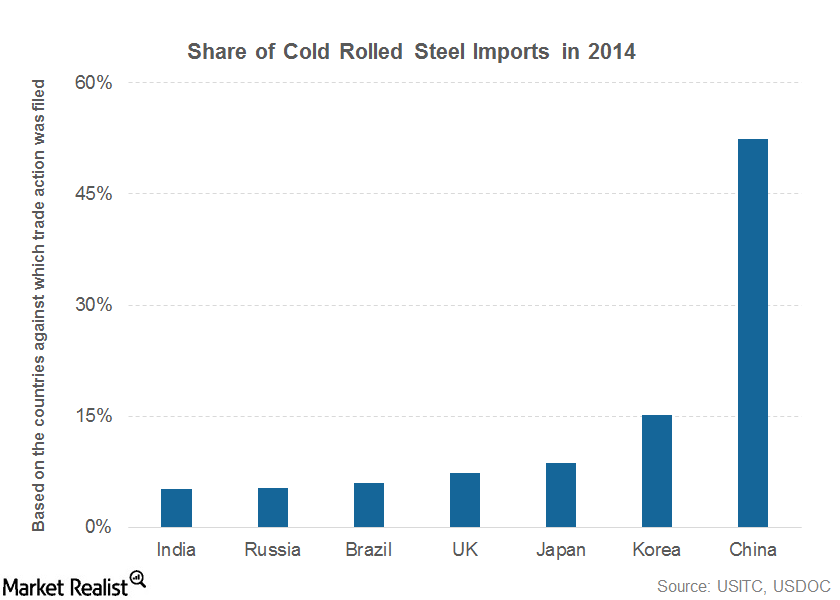

What’s Driving the Record Spread Between HRC and CRC Prices?

US Spot hot rolled coil prices have risen in the ballpark of $200 per short ton in 2016. Spot cold rolled coil prices have risen by ~$300 per short ton.

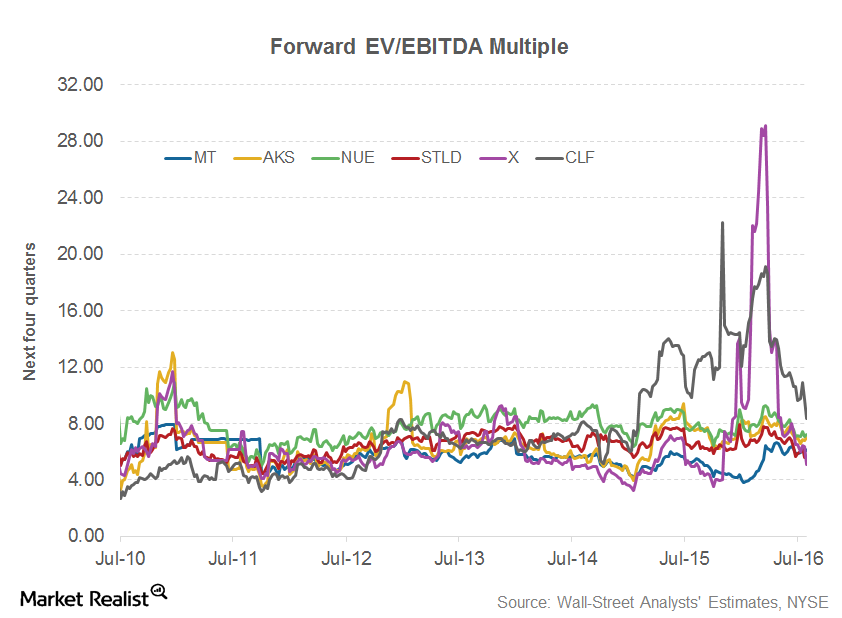

What’s Been Driving Cliffs Natural Resources’ Valuation

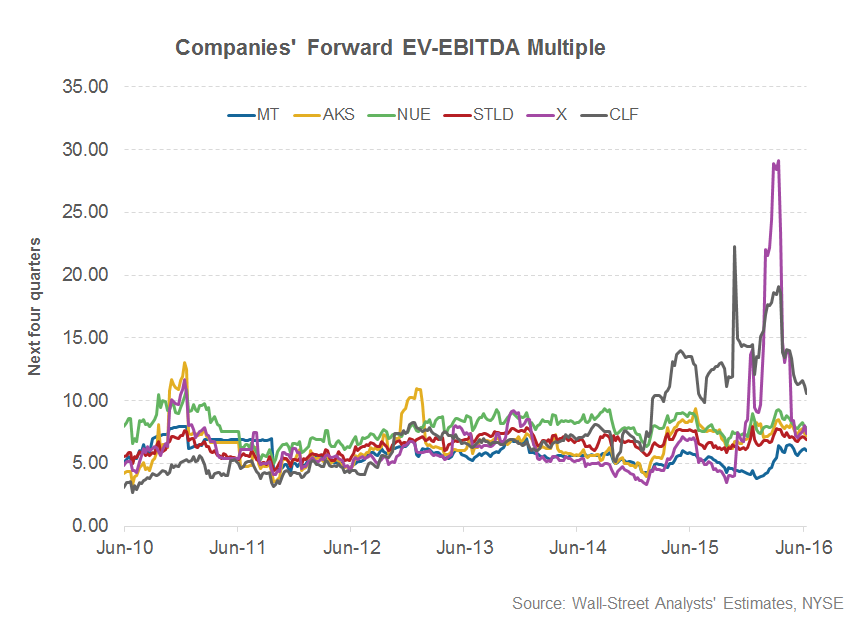

Valuations Valuation multiples are key metrics that investors consider carefully. With the help of relative valuations, we can compare a company’s valuation with its closest peers’ valuations. There are several valuation metrics that we can use. For companies in cyclical industries such as steel and mining, the EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) […]

Could Brexit Shake the European Steel Industry?

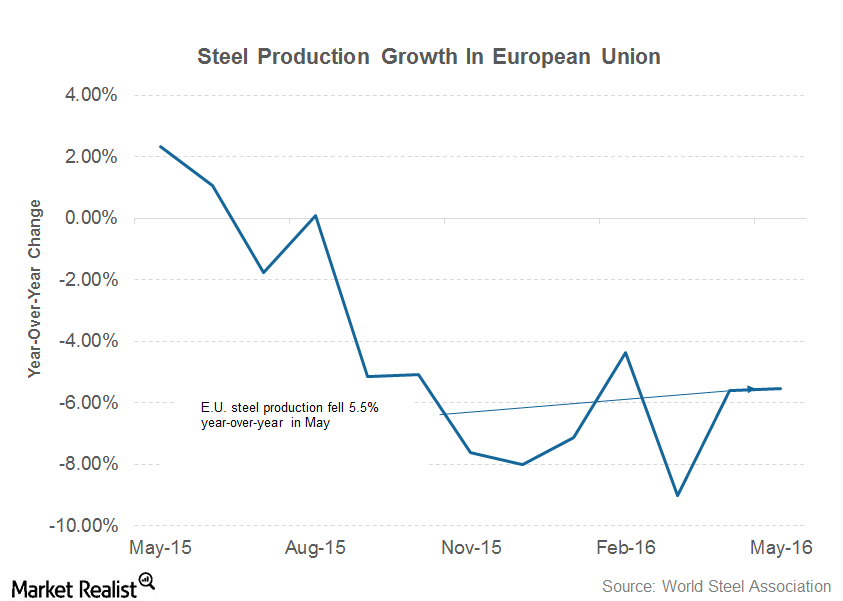

The EU hasn’t been able to act decisively against higher Chinese steel imports. European steel production has fallen much steeper this year.

Is Cliffs’s Valuation Justified?

Cliffs Natural Resources (CLF) is trading at a forward EV/EBITDA multiple of 11.0x compared with its last five-year average of 8.0x.

Brexit or No Brexit, the European Steel Industry Is in Shambles

In May, ~14.5 million metric tons of steel were produced in the European Union. That was a YoY decline of 5.5%.

Will Global Overcapacity Weigh Heavy on Steel Prices?

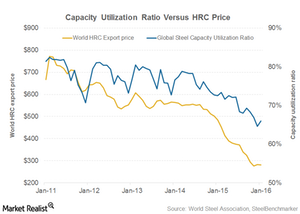

The excess global steel capacity will take a lot of time to balance out. The capacity closures in China, if they happen at all, will be gradual.

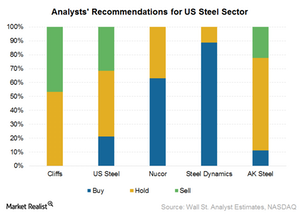

Cliffs Natural Resources: 4Q15 Market Expectations

Of 15 analysts covering Cliffs Natural Resources, eight have given it a “hold” recommendation, and seven have given it a “sell” recommendation.

What to Look for in Cliffs Natural Resources’ 4Q15 Results

In its 4Q15 earnings release on January 27, 2016, Cliffs Natural Resources (CLF) may provide a further update on its venture into a direct reduced iron business.

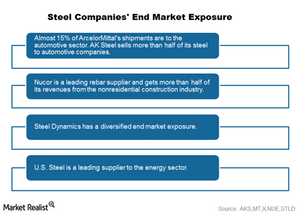

The Importance of Diversified End Market Exposure

Steel companies’ product portfolios and end market exposures can have significant impacts on company performance.

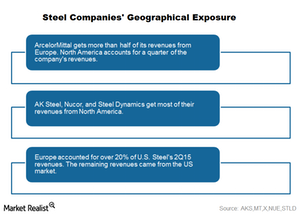

How Geographical Exposure Varies Between Steel Companies

A look at the geographical exposure of different steel companies, which are exposed to the overall economic activity of the regions in which they operate.

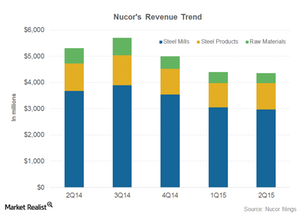

The Hows and Whys of Nucor’s Recent Falling Revenues

Nucor’s net revenues fell ~18% in 2Q15, compared to the corresponding quarter last year. Most steel companies have reported lesser revenues in 2Q15 as well.

Key Investor Takeaways from US Steel’s 1Q Earnings Release

US Steel’s 1Q earnings results came in lower than analyst estimates, and the company’s share price tanked more than 10%.

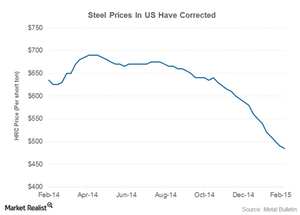

Steel prices hit rock bottom, the lowest level since 2009

Steel prices crashed by almost two-thirds at the peak of the global financial crisis in 2009. Last year, they dropped by 10%.

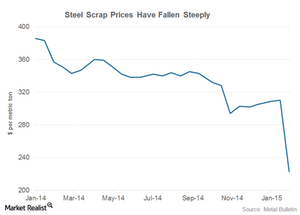

Steel Scrap Prices Have Fallen Sharply in 2015

Steel scrap prices fell by ~20% in 2014. Lower steel scrap prices should bring down unit production costs for steel plays.

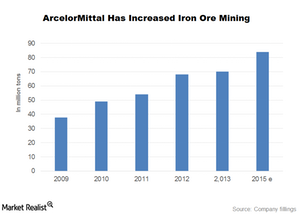

Vertically Integrated Steel Mills Are At A Disadvantage

While iron ore prices crashed, production costs for iron ore haven’t come down. Steel plays’ mining operations have been hit by the fall in iron ore prices.

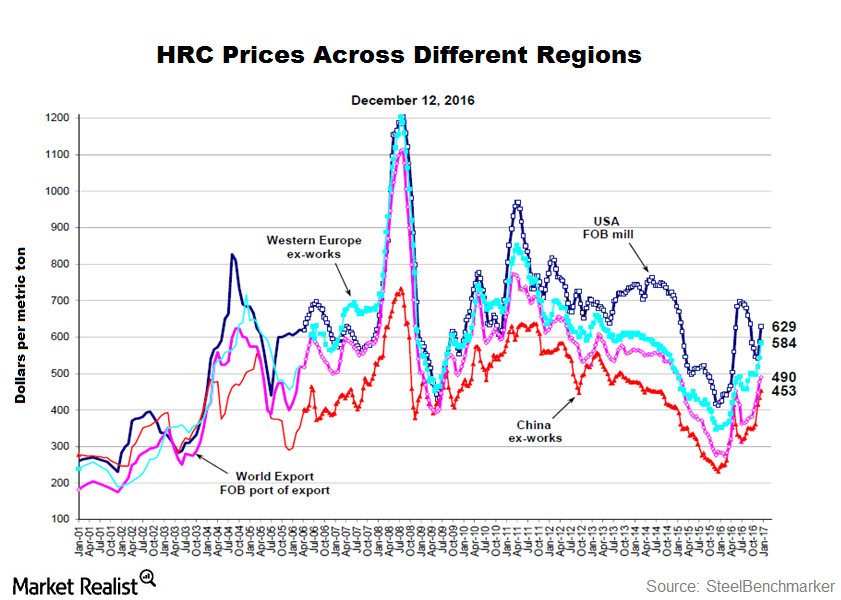

Difference Between Chinese And US Steel Prices Narrows

The difference between Chinese and US steel prices is still quite high to encourage imports. Marginal narrowing of the price difference won’t deter imports.

An Investor’s Guide To China’s Shadow Banking System

China’s shadow banking includes the trust sector, the off balance sheet lending by commercial banks, and financing vehicles of commercial banks.

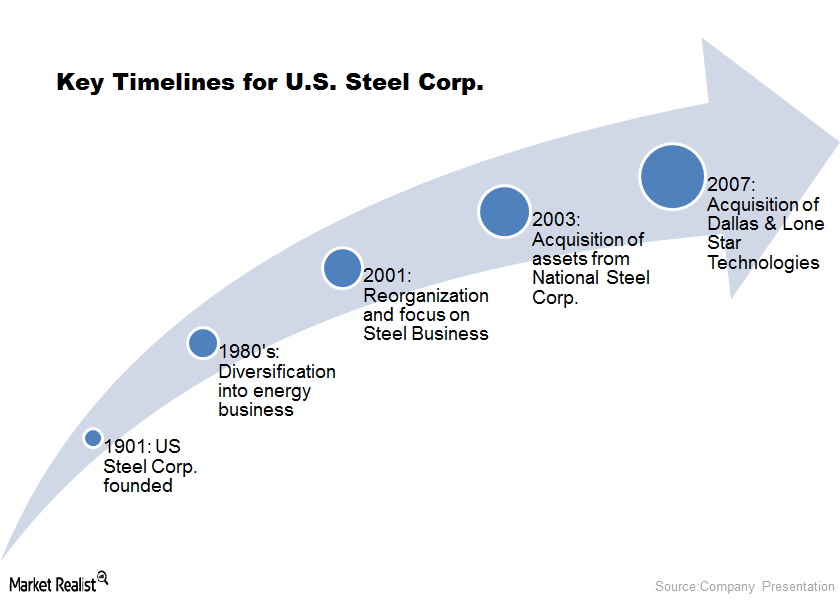

Everything you need to know about US Steel Corporation

U.S. Steel Corporation’s stock has surged in the past few months, delivering more than 150% growth in the last year.