American Airlines Group Inc

Latest American Airlines Group Inc News and Updates

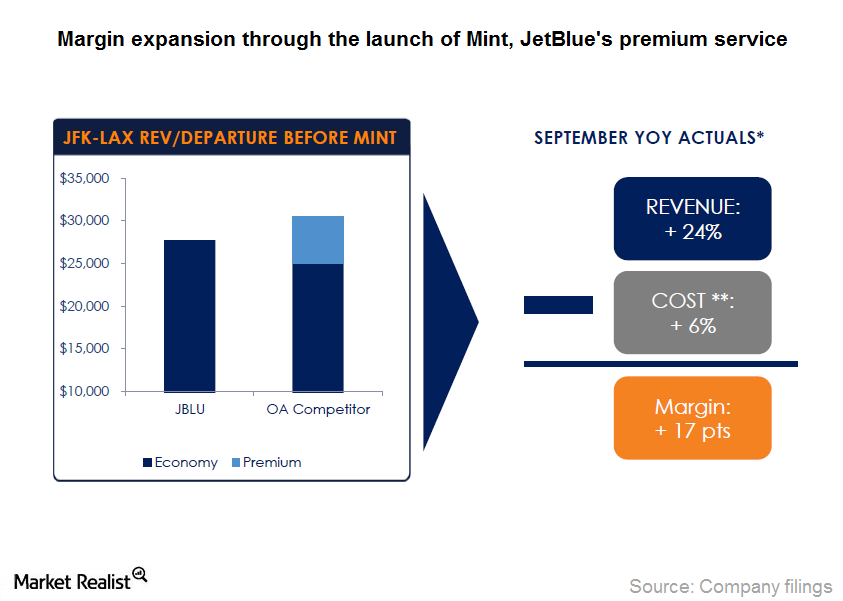

JetBlue’s: Can Investors Expect Improved Revenue in 4Q16?

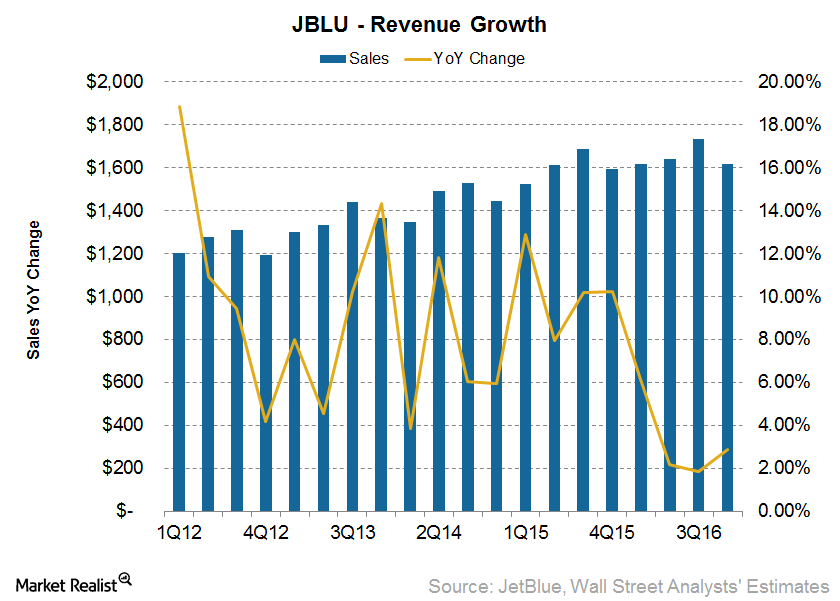

For 3Q16, JetBlue Airways’ (JBLU) revenues stood at $1.73 billion—a 2.6% year-over-year increase compared to revenue of $1.69 billion in 3Q15.

Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

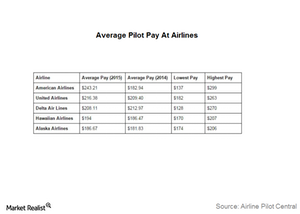

Why Is Delta’s Pilot Deal Important for the Airline Industry?

All airline pilots have their eyes on Delta Air Lines’ (DAL) final agreement with its pilots. This is because Delta’s deal will set a precedent in the industry.

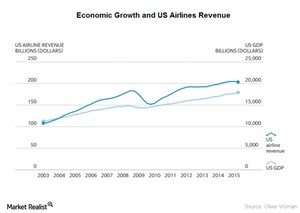

The Airline Industry’s Cyclical Nature Is a Mixed Blessing

The airline industry is cyclical, which means that its business depends on the country’s economic growth. Most analysts have revised their GDP estimates downward, resulting in a consensus estimate of 2.9% YoY growth.

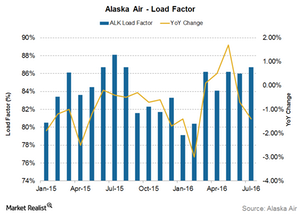

Will Alaska Air’s Unit Revenues Continue to Fall in September?

Foreign currency fluctuations and lower fuel surcharges in the international market will have a negative impact on Alaska Air Group’s unit revenues.

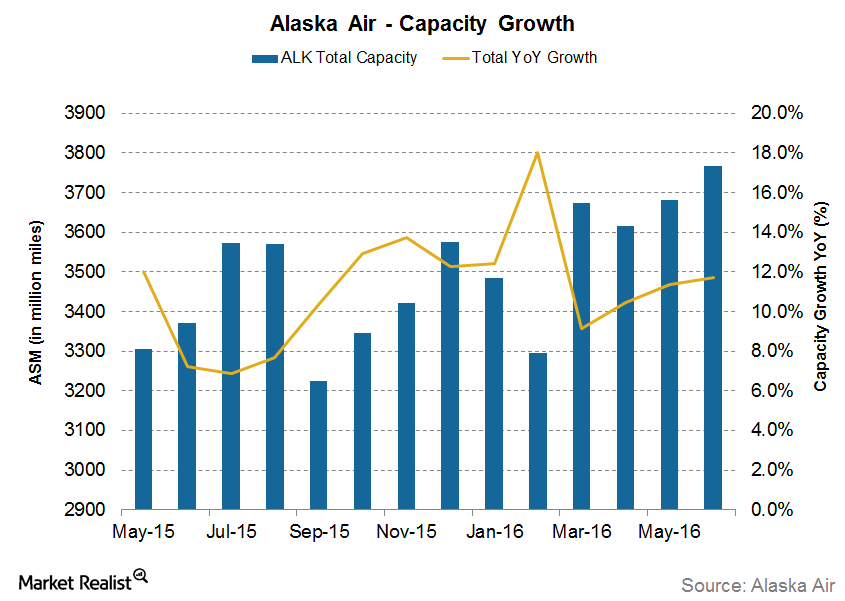

Will Alaska Air Group’s Capacity Expand More in 2016?

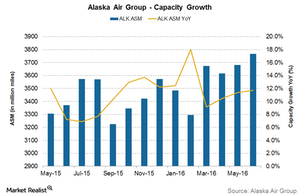

For August 2016, Alaska Air Group’s (ALK) capacity increased by 10.3% YoY. After average growth of 13% in 1Q16, its growth slowed down to 11% in 2Q16.

How Traffic Growth Lags behind Capacity at Southwest Airlines

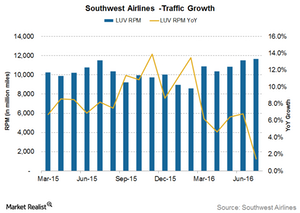

In July 2016, Southwest Airlines’ (LUV) traffic grew by 1.4% YoY, which was slightly lower than its capacity growth of 2.3% YoY.

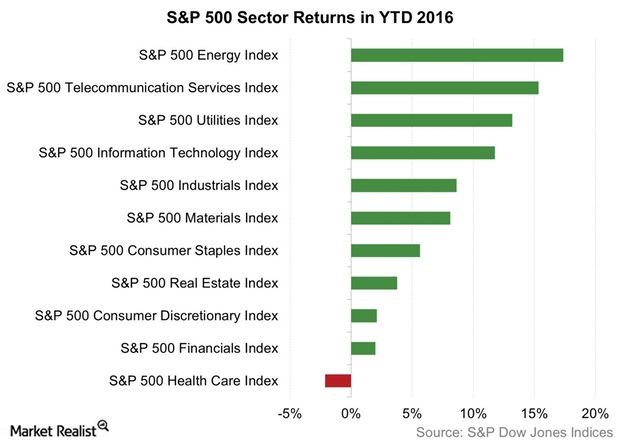

Will the Cyclical Sector Outperform the Defensive Sector?

The cyclical sector has a sizeable correlation with the different phases of the business cycle.

How Will Alaska Air Group’s Strategy Impact Unit Revenues?

Alaska Air Group (ALK) does not give any future unit revenue guidance. However, we can expect the PRASM’s decline to continue.

Can Alaska Air Group’s Capacity Growth Be Sustained for the Rest of 2016?

For July 2016, Alaska Air Group’s (ALK) capacity increased by 9.6% year-over-year. After an average growth of 13% in 1Q16, growth slowed to 11% in 2Q16 and is slowing further in the third quarter.

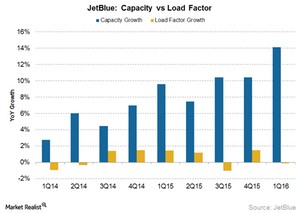

Does JetBlue Airways’s Capacity Growth Support Analyst Estimates?

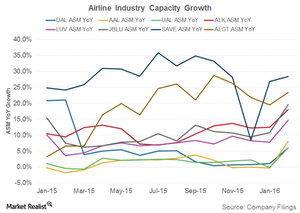

Capacity growth Like other airlines, JetBlue Airways (JBLU) has taken advantage of falling crude oil prices to expand its existing fleet. JetBlue’s double-digit revenue growth has been fueled by double-digit growth in its capacity. Historically, JetBlue Airways has seen the highest capacity growth among the seven major airlines. Spirit Airlines (SAVE) has seen the highest growth, followed by Alaska […]

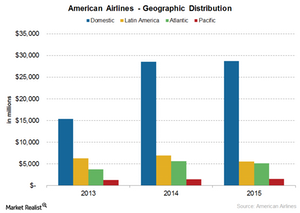

American Airlines and Its Geographic Mix of Revenues

Revenues from American Airlines’ foreign operations make up about 30% of its total operating revenues. The airline has been consistently expanding its global footprint by adding new routes.

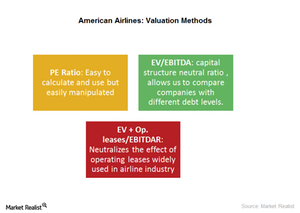

What’s the Best Approach for Valuing American Airlines?

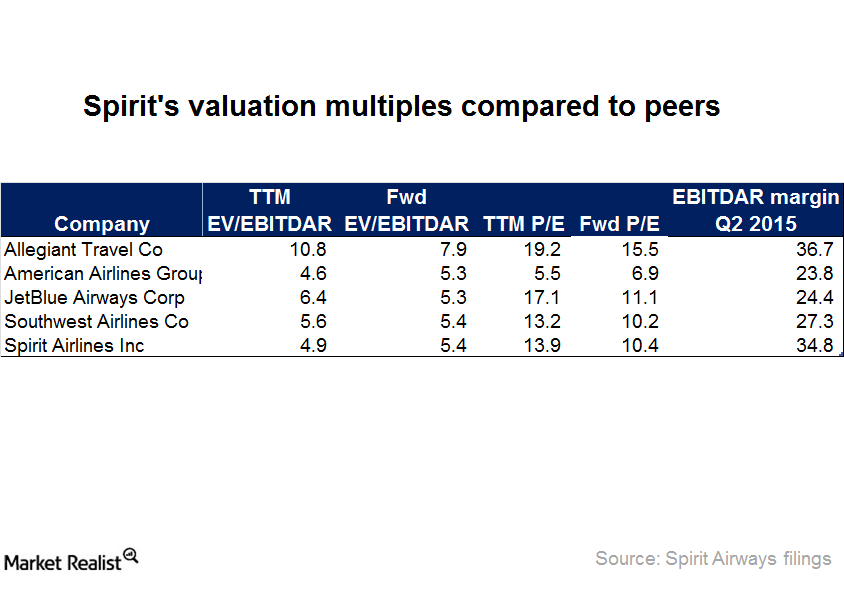

For airlines such as American Airlines (AAL), we go a step further and use an EV+ Op. leases-to-EBITDAR ratio.

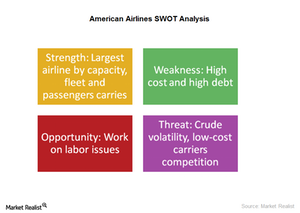

What Are American Airlines’ Key Strengths and Weaknesses?

Some key strengths keep American Airlines ahead of its competitors. It’s the largest airline in fleet, capacity, and number of passengers. It also has a strong hold on key hubs.

What Are American Airlines’ Major Revenue Drivers?

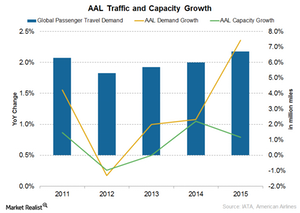

American Airlines’ (AAL) capacity growth is one of the slowest in the industry. However, it has the highest capacity among its peers.

What Are American Airlines’ Key Revenue Streams?

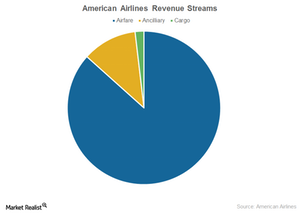

In this part of the series, we’ll look at the main services and categories that add to American Airlines’ (AAL) revenues. The major component of revenues still comes from airfares.

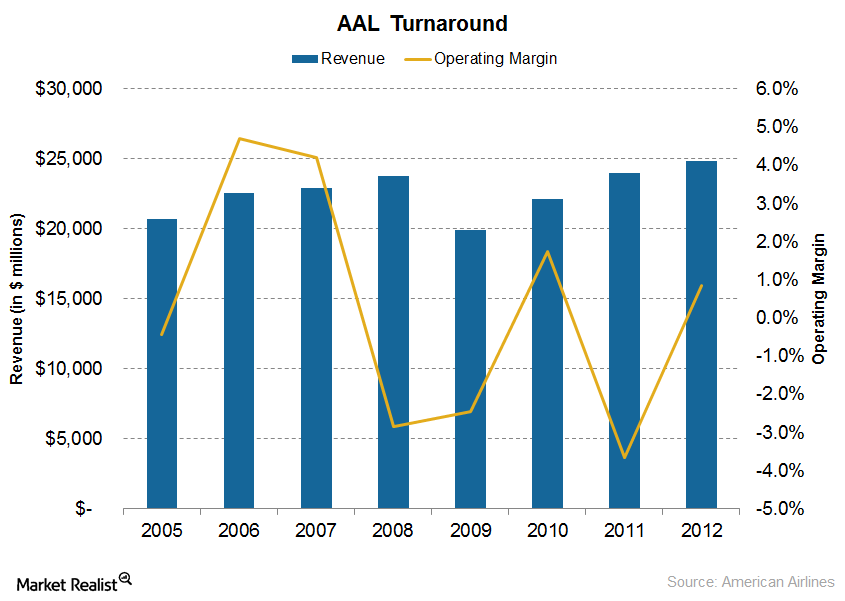

American Airlines Stock: The Past, the Crisis, the Recovery

After the merger, American Airlines became the world’s leading airline in terms of fleet size, network, and finances. American Airlines stock has risen more than 270% since 2011.

How Did American Airlines Recover from Bankruptcy?

Soon after US Airways declared its intention to merge with American Airlines, AAL started working on its weak points and restructuring costs.

Is There Overcapacity in the Airline Industry?

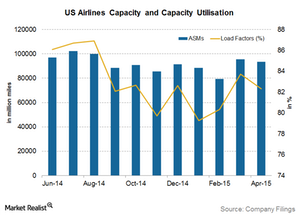

In February 2016, the airline capacity of the eight major airlines exceeded their traffic growth by an average of 2%.Industrials Must-know: External factors that influence the airline industry

The airline industry has contributed to the globalization of the world economy. It connects buyers and sellers. It also transports goods across nations. It breaks the barrier of distance and time. The industry’s future looks bright. Travel expenditure in the U.S. is expected to grow by 4.3% in 2014 and 5.1% in 2015.

Spirit Airlines’ Valuation Ratio: How Does It Stack Up?

Spirit and its competitors have seen their EV/EBITDA decrease in the last six months due to the fear of a large increase in available seat miles.

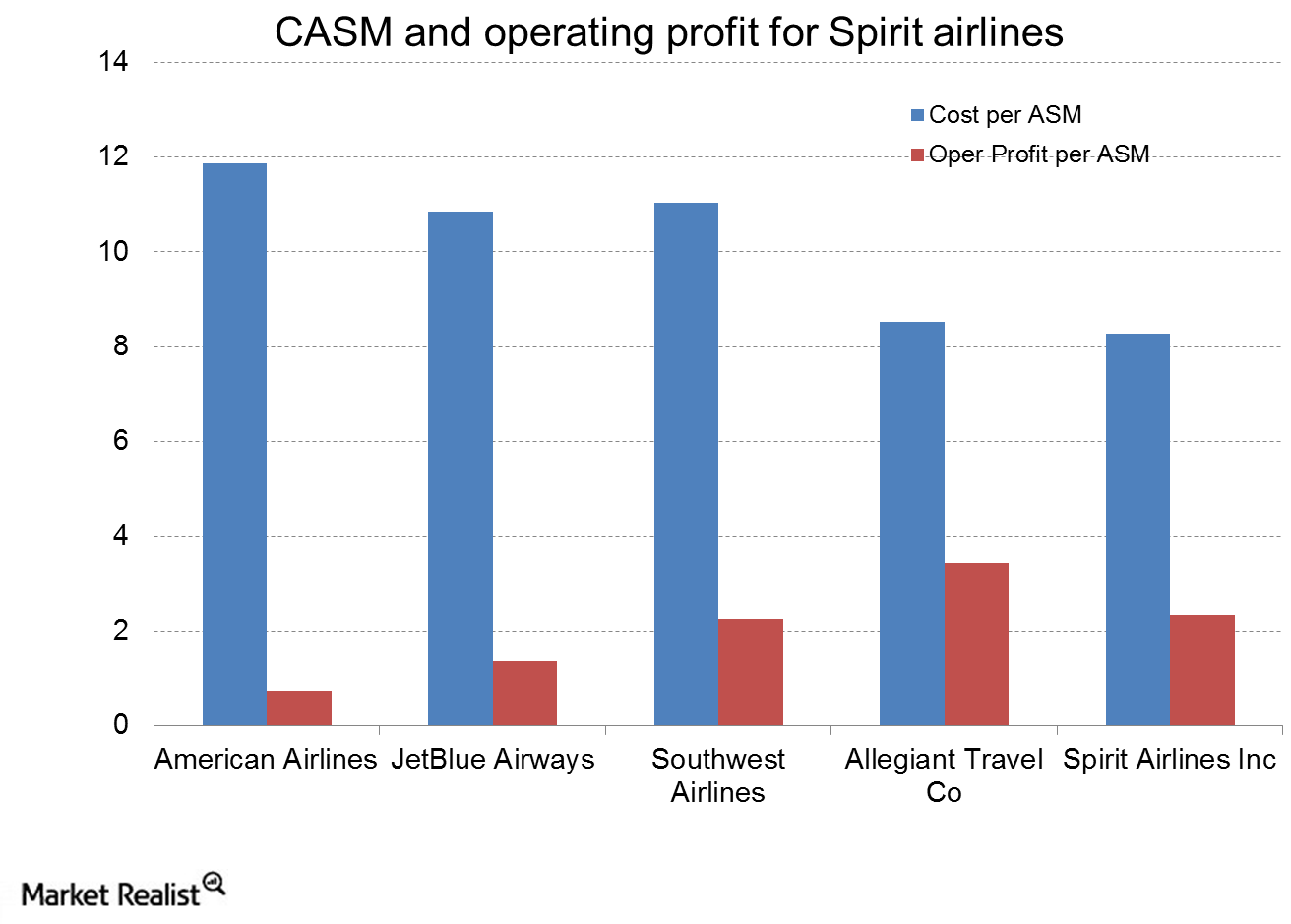

How Does Spirit Airlines Manage Its Low-Cost Structure?

Spirit (SAVE) ranks first in profitability among seven airlines in the United States. The main driver for this ranking comes from its exceptional ability to manage costs.

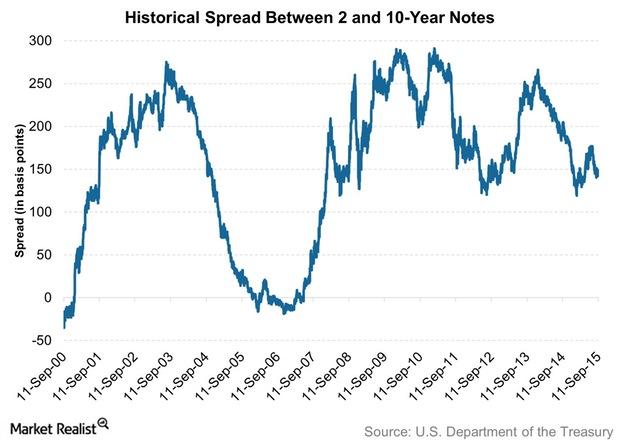

What Do Yield Spreads between 2-Year and 10-Year Notes Indicate?

While a section of the market is readying itself for a rate hike in the upcoming meeting of the FOMC, there are others who don’t believe that a rate hike would be implemented and instead, are focused on falling inflation.

Southwest’s Low Cost Strategy Helps Maintain a Competitive Edge

Southwest is known to be the pioneer of low cost travel in the industry. Its 42-year record of profitable operations is enough to prove the success of the company’s business model.

Improving Capacity Utilization Adds to Airline Profitability

Capacity utilization has improved from the lows of ~57% in the 1970s to ~76% in 2014 and 81.88% in year-to-date 2015.

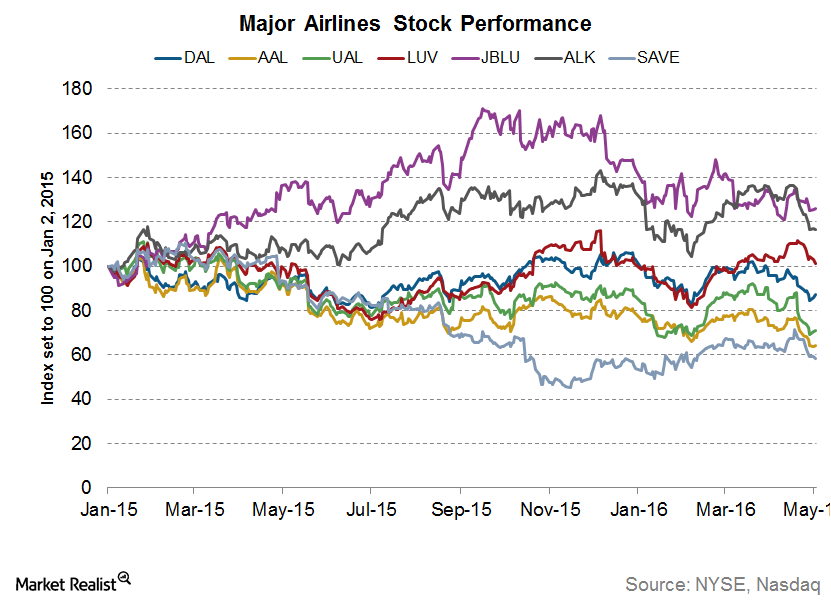

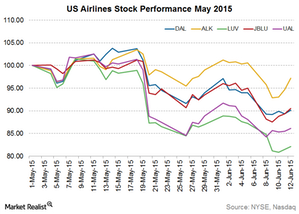

The Key Variables Impacting Airline Stocks

A strengthening dollar led to improved profitability for US airlines in 1Q15 while subduing profitability for non-US airlines. This further increased the industry’s performance gap across the globe.

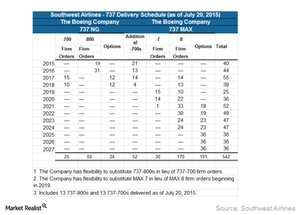

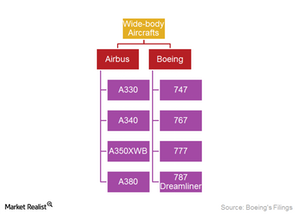

Boeing’s Fleet of Wide-Body Aircraft

Wide-body aircraft fly transoceanic routes, can accommodate 200–500 passengers, and often transport commercial cargo across the globe.Industrials Why political and legal factors impact the airline industry

The airline industry is widely impacted by regulations and restrictions related to international trade, tax policy, and competition. It’s also impacted by issues like war, terrorism, and the outbreak of diseases—such as Ebola. These issues are political. As a result, they require government intervention.

China Eastern’s operating margin declines due to rising costs

Rising costs impacted China Eastern’s (CEA) operating margins, which declined from 5% in FY09 to 1.8% in FY13.

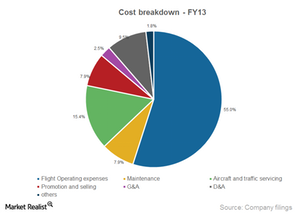

Rising operating expenses as a percentage of revenue

More than half of China Southern’s total operating expenses in FY13 were related to flight operating expenses.

Even More drives JetBlue’s ancillary revenue

Revenue from JetBlues’ Even More Space grew at a five-year compounded annual growth rate of ~30% from $45 million in fiscal year 2008 to $170 million in fiscal year 2013.Macroeconomic Analysis Freight, passenger index values show rising transportation demand

Although trucking is the most widely used mode of transportation, the fastest growing mode of transport is by air.

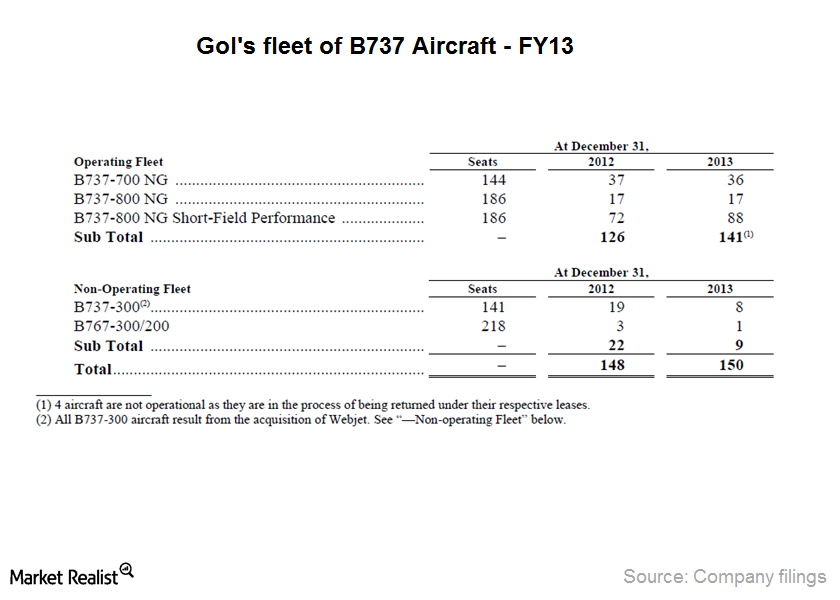

Gol maintains low-cost advantage with single fleet type

Using a single aircraft type reduces disruption of operations due to maintenance efficiencies. The airline reduces training costs with standardized pilot training and maintenance routines.

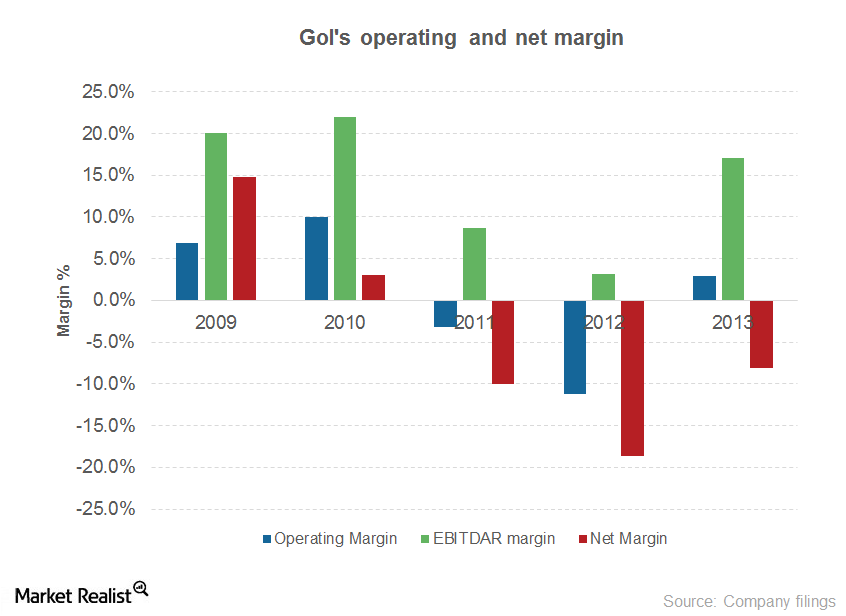

Non-operating expenses eclipse Gol’s operating profitability

Gol’s operating income turned positive in FY13 after reporting losses for two consecutive years.Industrials Must-know: SARS’ impact on the airline industry

SARS was another disease outbreak in 2003. SARS caused a panic similar to the current Ebola outbreak. SARS was a viral respiratory illness.Industrials The global airline market’s key revenue drivers and profitability

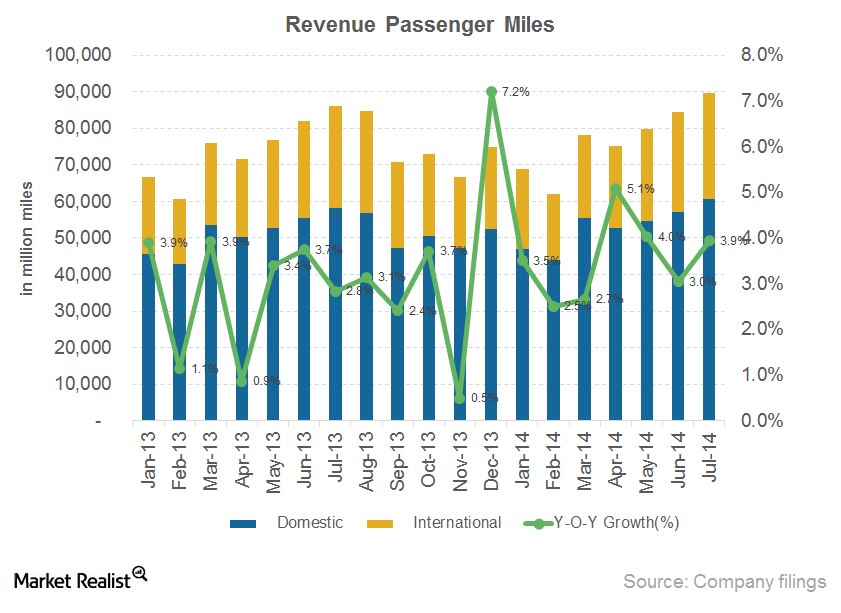

According to IATA (or the International Air Transport Association), the global airline industry passenger volume and capacity increased by 5.3% year-over-year in July 2014. Freight volume increased by 5.8%. In July load factor (or capacity utilization) for passengers was 82.3%, and for freight, it was 44.4%.Industrials Why investors should track labor costs in the airline industry

The second largest cost component for airlines is salaries, wages, and benefits. Employment in the U.S. airline industry has increased in the last couple of years when the U.S. economy recovered from the recession and demand for air travel picked up.Industrials Must-know: Why yield is another key driver for airline revenue

Yield is the average fare per passenger per mile. Passenger revenue is calculated by multiplying RPM (or revenue passenger miles) with yield. Yield varies based on demand and supply factors. Since demand for air travel is seasonal, yield is higher during peak seasons.Industrials Must-know: Why airlines should improve their load factor

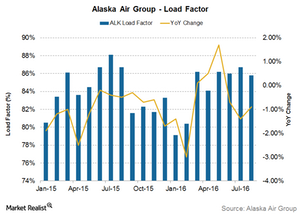

Load factor is a measure of capacity utilization. It indicates the percentage of total capacity that is utilized by an airline. Since airlines are capital intensive and have high fixed costs, the efficiency with which they utilize their assets is key to generate adequate return on investment.Industrials Must-know: Why available seat miles affect airlines’ revenue

Available seat miles (or ASM) is the measure of airline capacity. It’s calculated as the total number of seats multiplied by the total distance travelled. While RPM (or revenue passenger miles) is a measure of demand, ASM is the measure of supply.Industrials Must-know: Trends in key economic indicators that impact airlines

The airline industry is an important contributor to the U.S. economy’s growth. According to Airlines for America (or A4A), the industry drives $1.5 trillion in U.S. economic activity and more than 11 million in U.S. jobs.

Must-know: Key indicators impacting airline industry performance

Cyclical industries follow the business cycle, so their revenues are higher during economic prosperity and lower during economic contraction. The airline industry is sensitive to changes in economic growth.Industrials Must-know: Environmental awareness in the airline industry

The global aviation industry consumes over 200 million tons of fuel per year. The rising demand for air transport and the rising crude oil prices could impact the industry’s carbon emissions. The environmental impact could also influence sustainability.Industrials Must-know: The role of technology in the airline industry

Technological advancement has been the driving factor for improving airlines’ operational efficiency. Airlines have been able to reduce costs and improve operations by using advanced aircraft engine technology, IT solutions, and mobile technology. The technology has created better connectivity and enhanced passengers’ travel experience.Industrials Travel preferences for millennials versus non-millennials

The Boston Consulting Group researched the millennial generation’s travel preferences in the business and leisure segment. This will provide a better understanding of how social and demographic factors influence air travel. It will also show how the factors influence company strategies to adopt to the changing trends.Industrials Why social and demographic factors influence air travel demand

Categorizing generations in the U.S. according to the year of birth provides insight into the changing trends in the travel and tourism industry. The demand for air travel has increased significantly over the years. Demographic factors also play an important role in forecasting demand.Industrials Why economic factors support airline industry growth

Like most industries, the airline industry is impacted by the economic cycle’s peaks and troughs. The current growth in developed economies—like U.S.—has resulted in a rise in business confidence, industrial production, and international trade.Industrials PESTEL framework analyzes the industry’s external environment

The Political, Economic, Social, Technological, Environmental, and Legal (or PESTEL) framework covers the six external factors that impact the airline industry. The framework provides a broad perspective on opportunities and threats that surround the industry. The factors can’t be controlled by the industry.

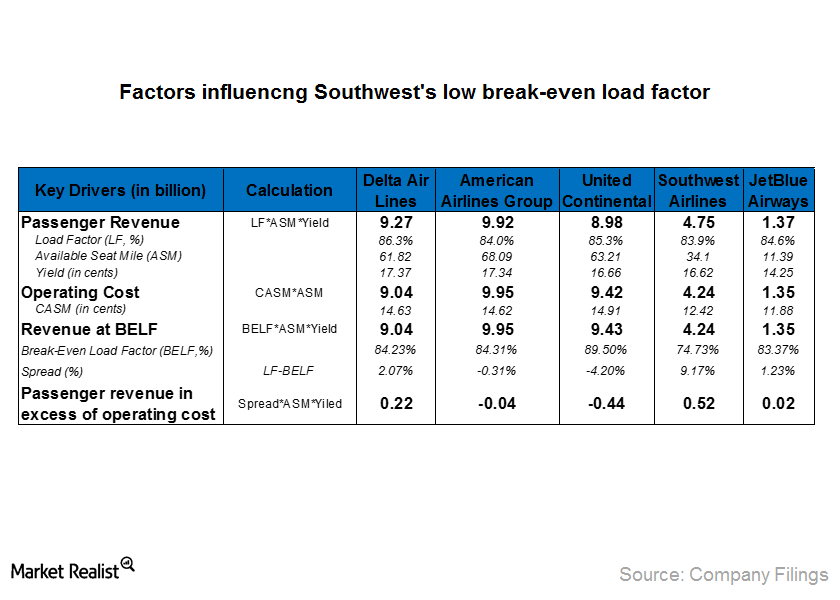

How Yield and Cost structure contribute to Southwest’s low break-even load factor?

As mentioned in the previous article, break-even load factor is calculated by dividing cost per available seat mile (or CASM) with yield per passenger mile and Southwest has the lowest break-even load factor compared to its peers. In this article we will analyze yield and cost structures of Southwest with its peers’ to determine how […]Industrials Must-know: Factors that affect aircraft utilization

Higher aircraft utilization will result in lower fixed costs per unit, as the costs spread across more air trips and passengers and results in lower cost per available seat mile.