Rebecca Keats

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rebecca Keats

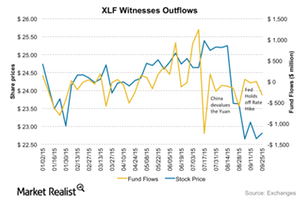

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.

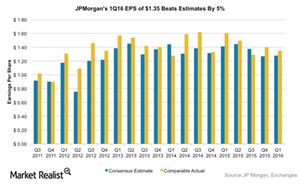

JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.

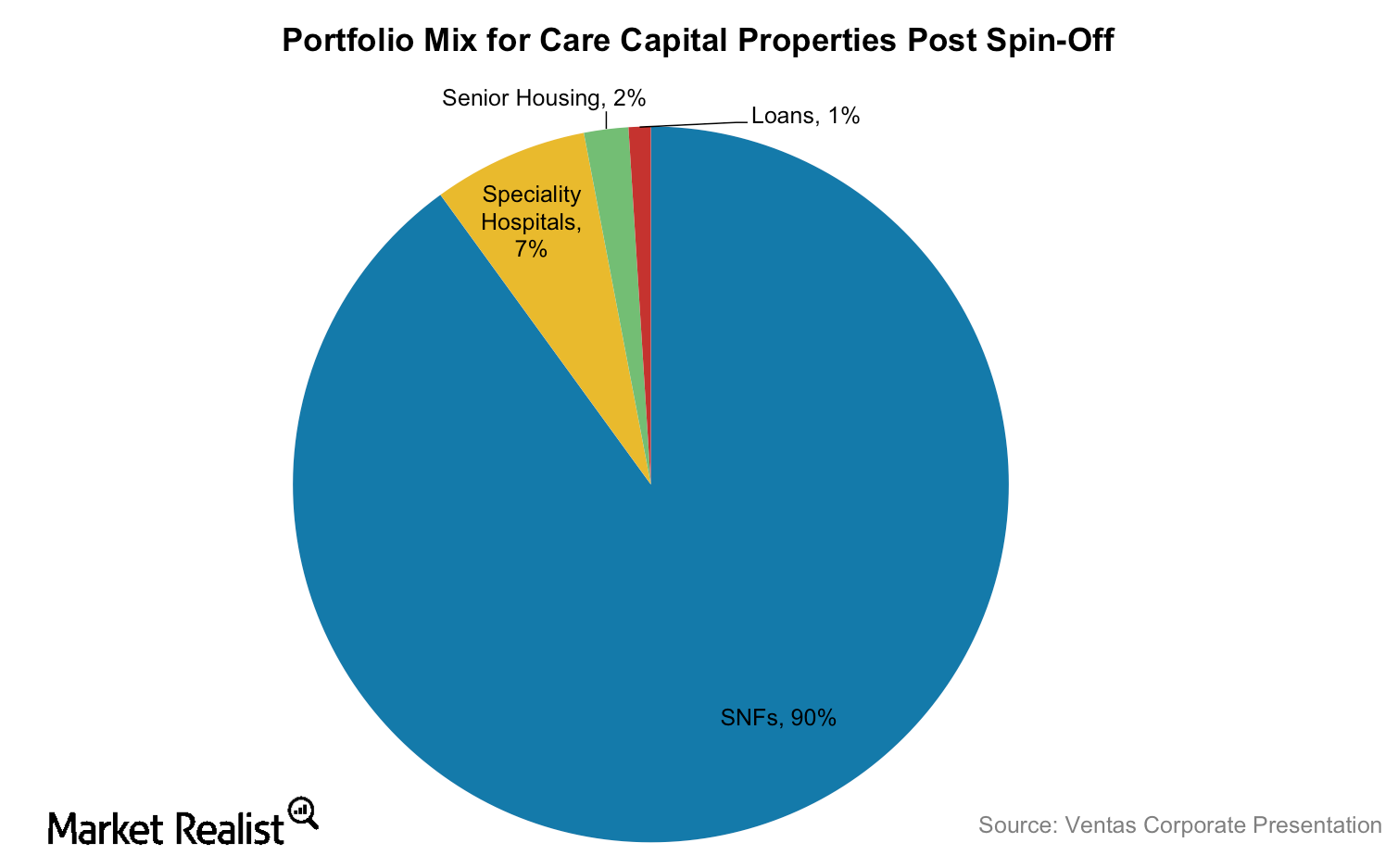

Ventas Completes Spin-Off of Care Capital Properties

Ventas’s spin-off Care Capital Properties (CCP) will issue 84 million shares ($30 to $34 per share) and expects to raise around $2.7 billion.

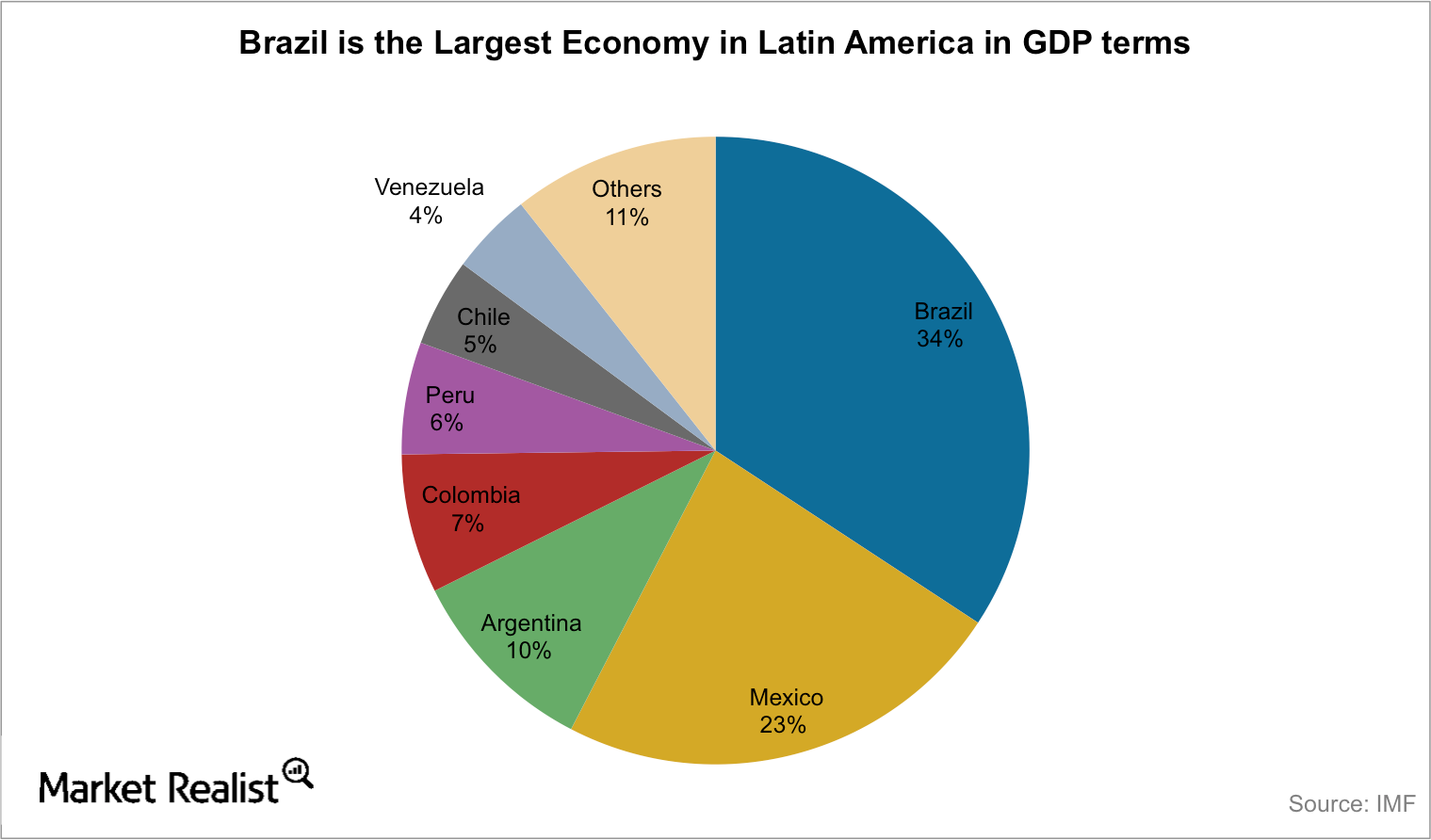

Why Latin American Economies May Be in Trouble

Worsening economic conditions in Brazil and Venezuela hit economic growth in Latin America in the first quarter of 2015.

Why Are Deutsche Bank Investors So Concerned About AT1 Coupons?

Shares of Deutsche Bank (DB) have fallen nearly 10% in the last three trading sessions. Efforts to reassure investors about its ability to pay coupons on its AT1 bonds were in vain.

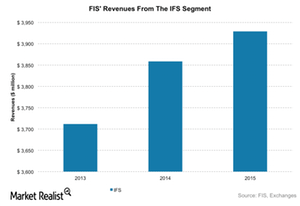

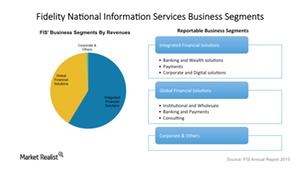

Inside FIS’s Integrated Financial Solutions Segment

FIS’s Integrated Financial Solutions segment caters to North American banks and is the largest contributor to the company’s total revenues (~60%).

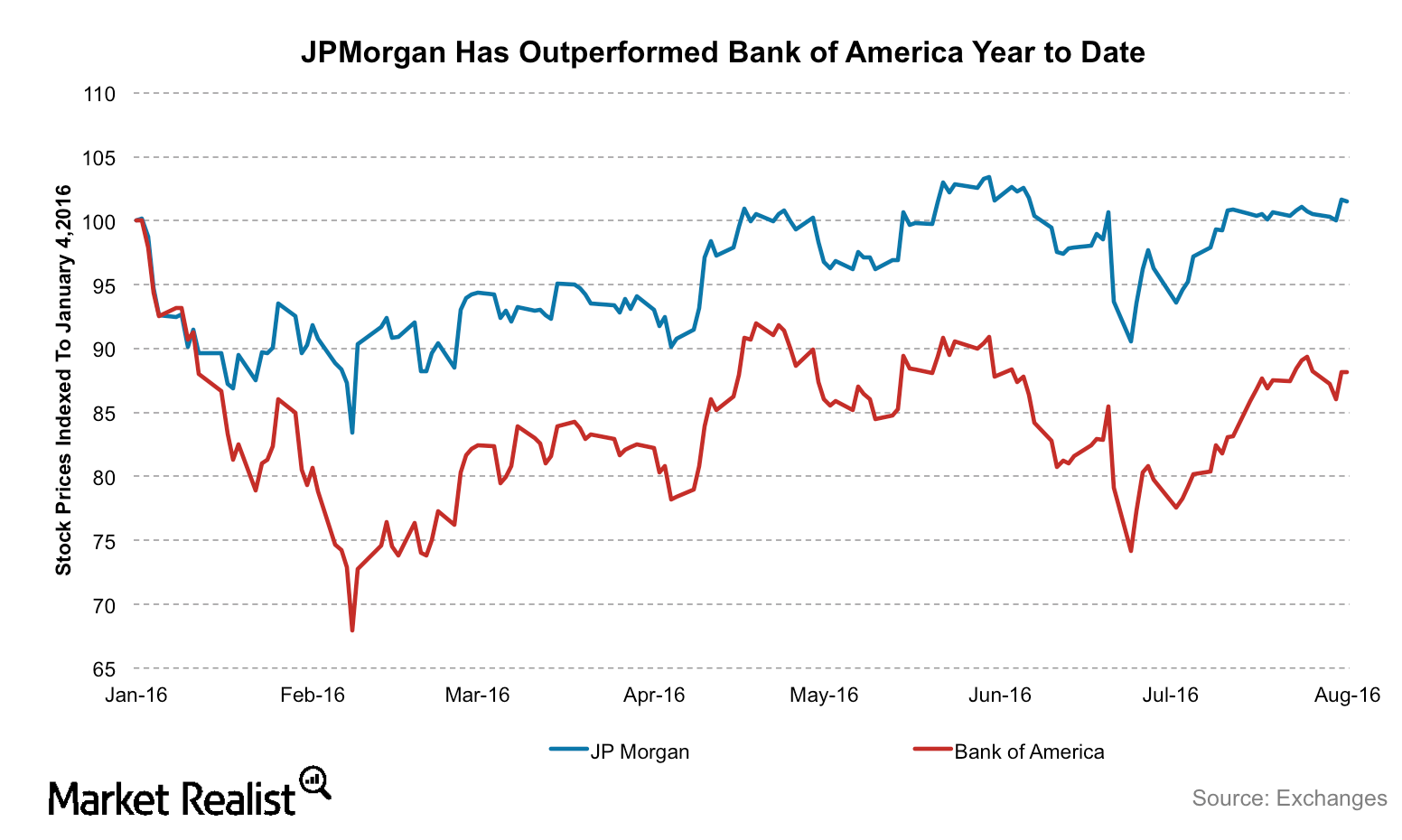

Why Deutsche Bank Prefers Bank of America over J.P. Morgan

In this series, we’ll compare Bank of America and J.P. Morgan on the basis of their 2Q earnings, profitability, cost-cutting initiatives, and interest rate sensitivities.

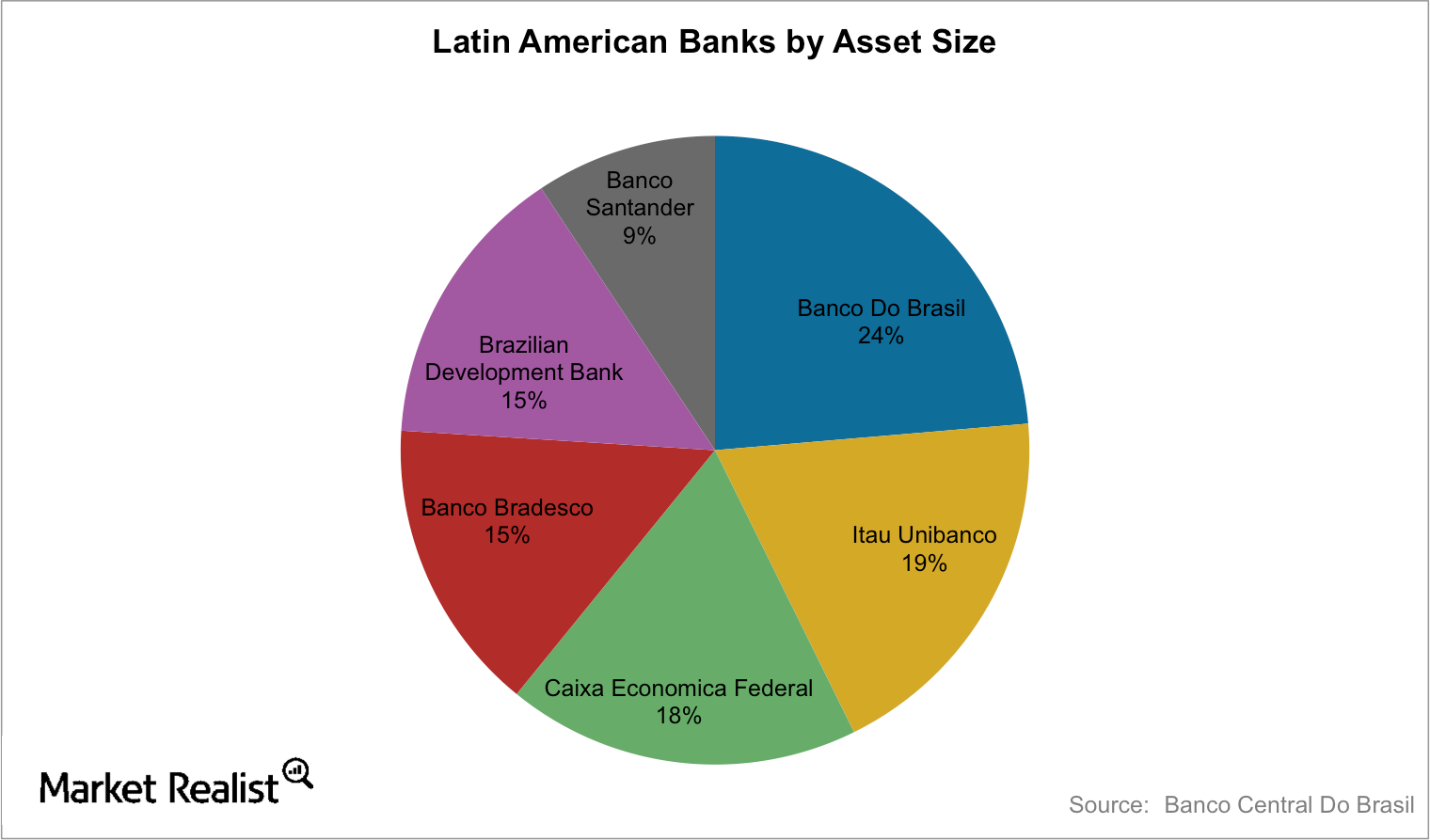

An Introduction to Brazil’s Largest Banks, Latin America’s Biggest

Since the ’80s and ’90s, Latin American banks have stabilized. Today, the largest banks in Latin America are concentrated in two countries: Brazil and Mexico.

Bank of America and Wells Fargo: Comparing Interest Rate Exposure

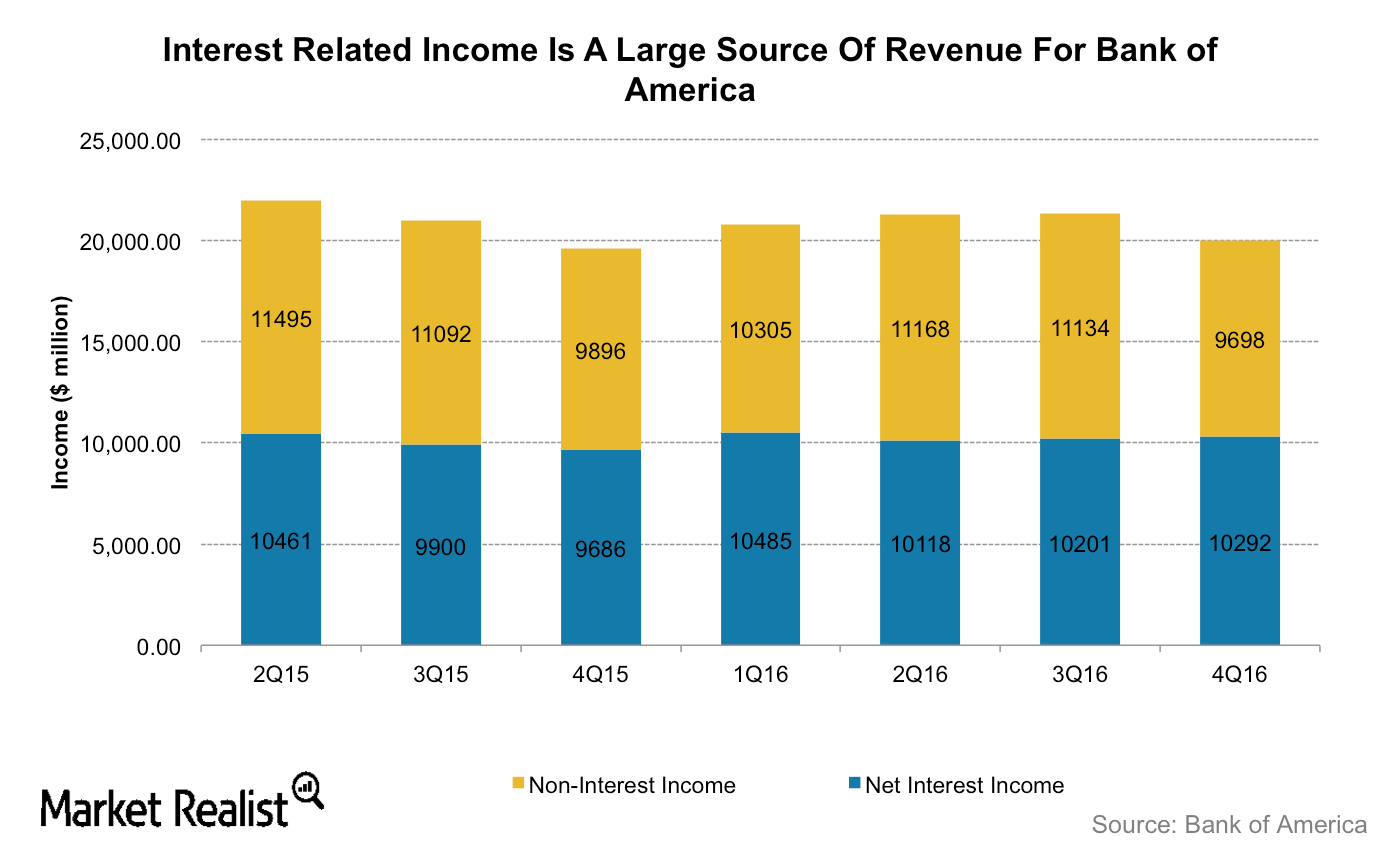

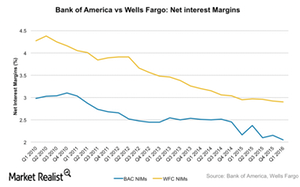

Since Donald Trump’s presidential victory, Wall Street analysts have raised their forecasts for the major banks’ (XLF) net interest margins as they anticipate rising interest rates and economic growth.

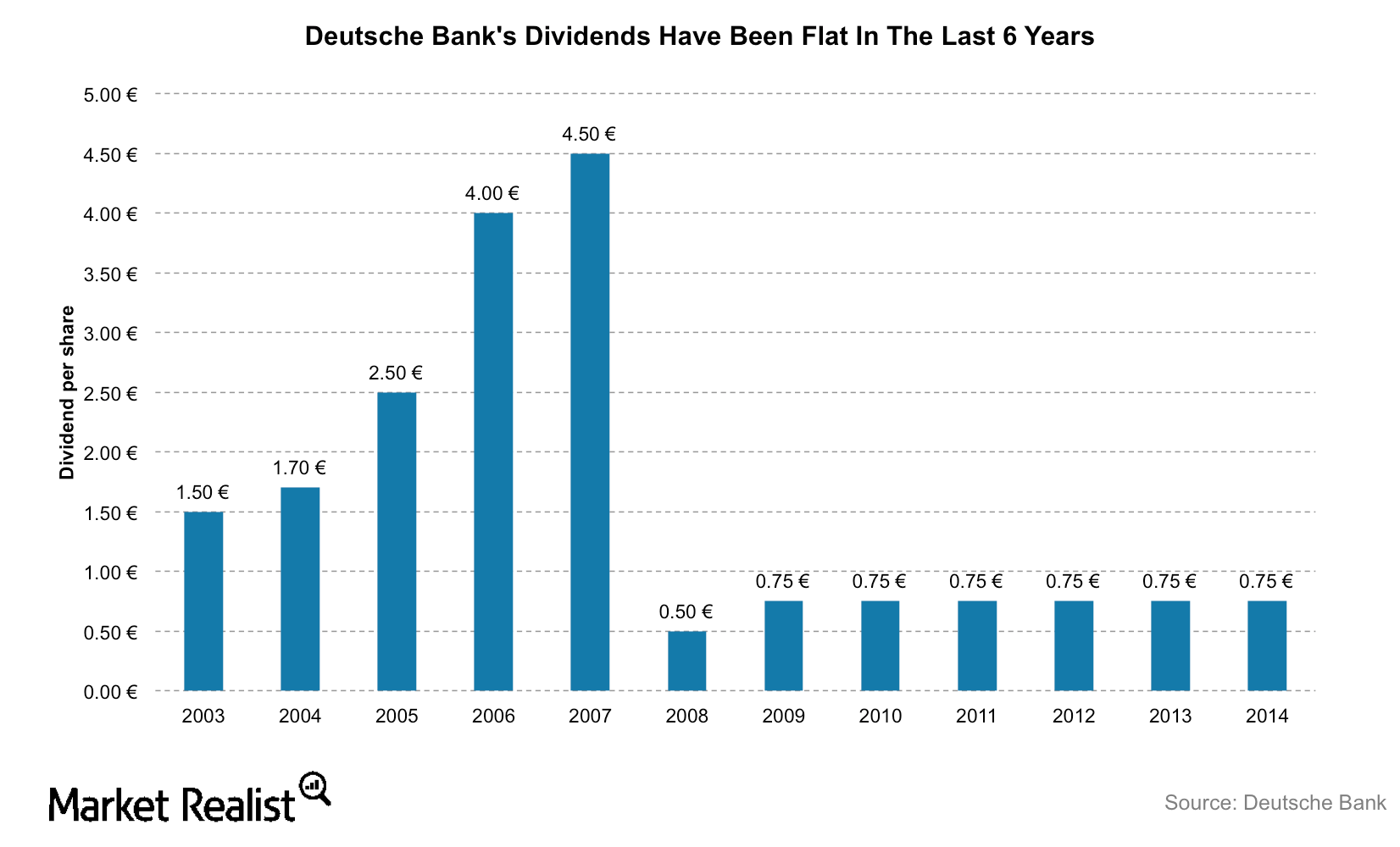

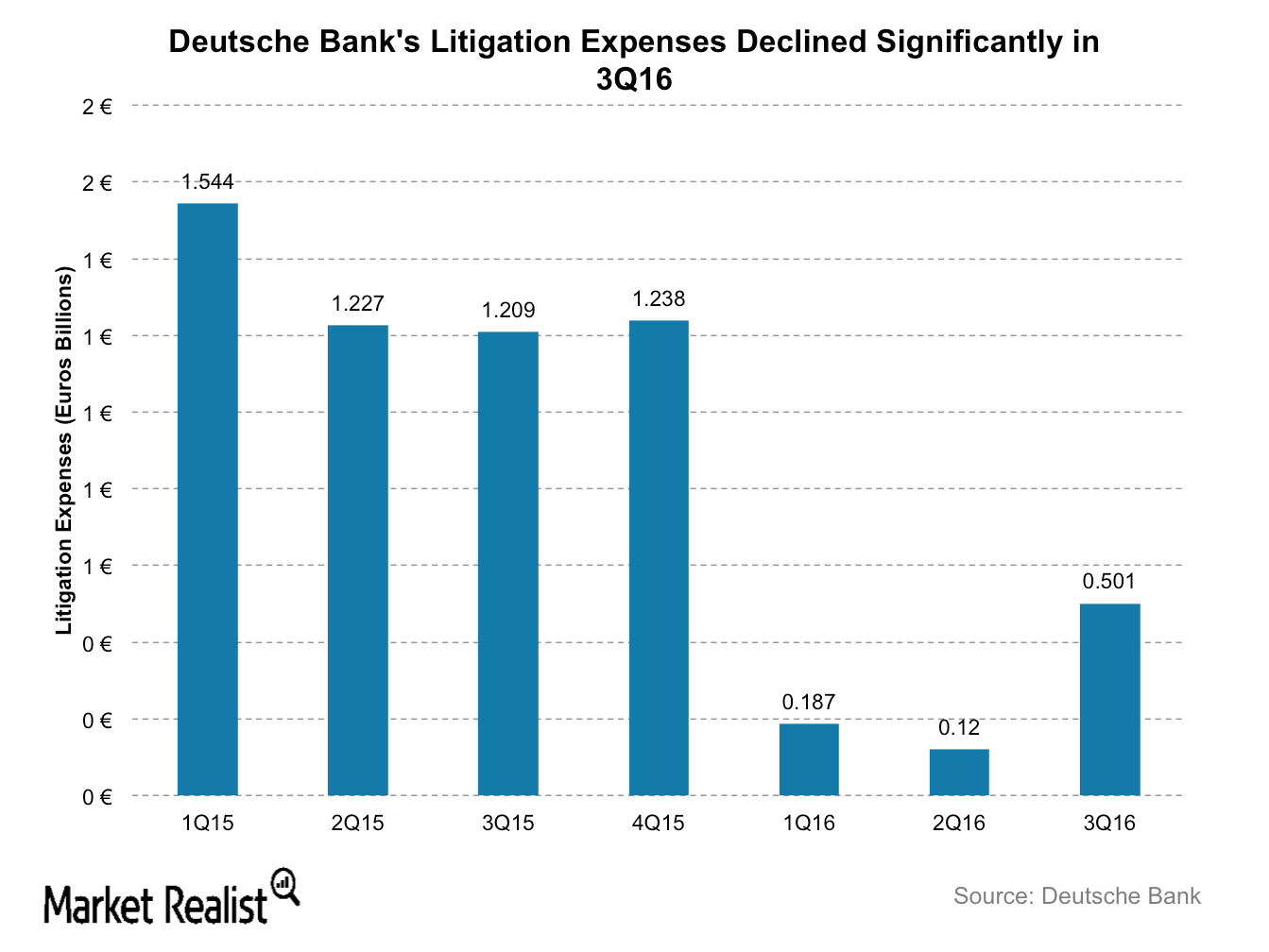

Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

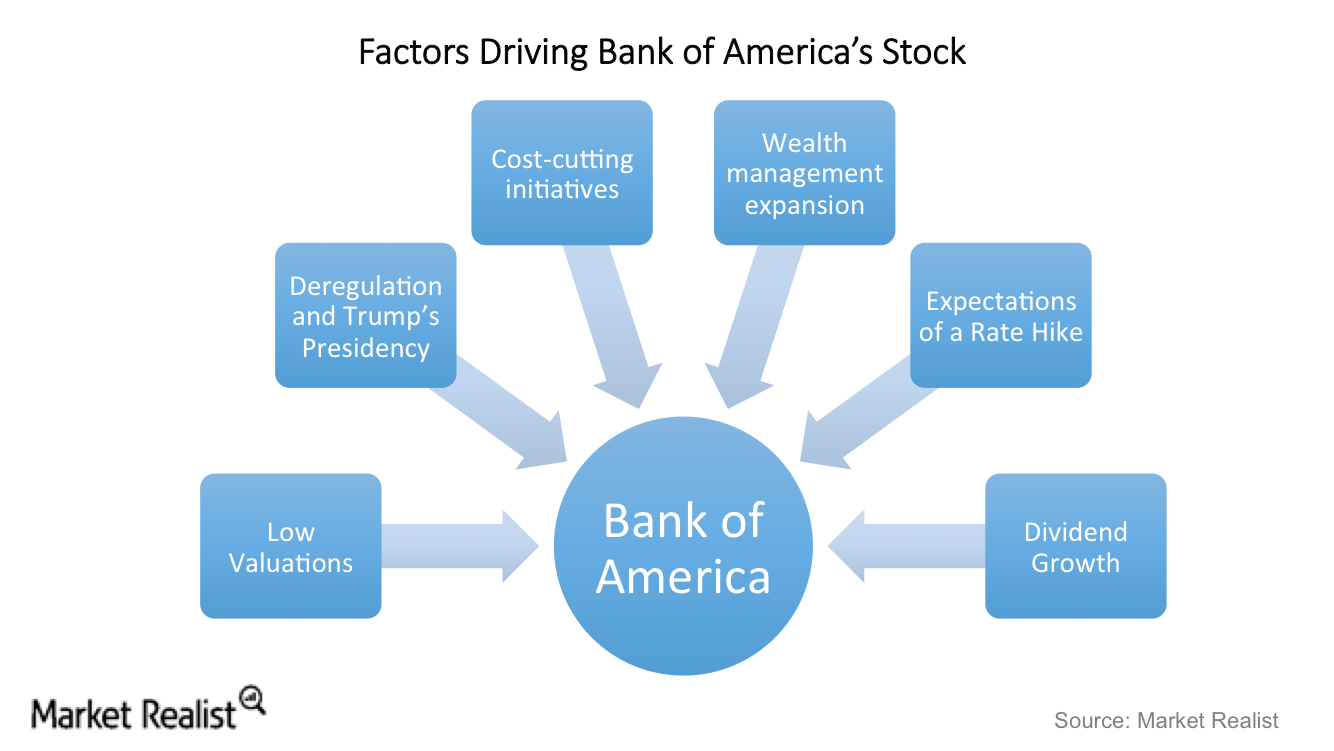

What Are Bank of America’s 2017 Growth Drivers?

Bank of America’s CEO has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years.

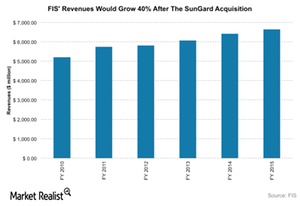

What the SunGard Acquisition Could Bring for FIS

In August 2015, FIS acquired SunGard for $9.1 billion, its largest acquisition to date. SunGard is expected to expand FIS’s top line by nearly 50%.

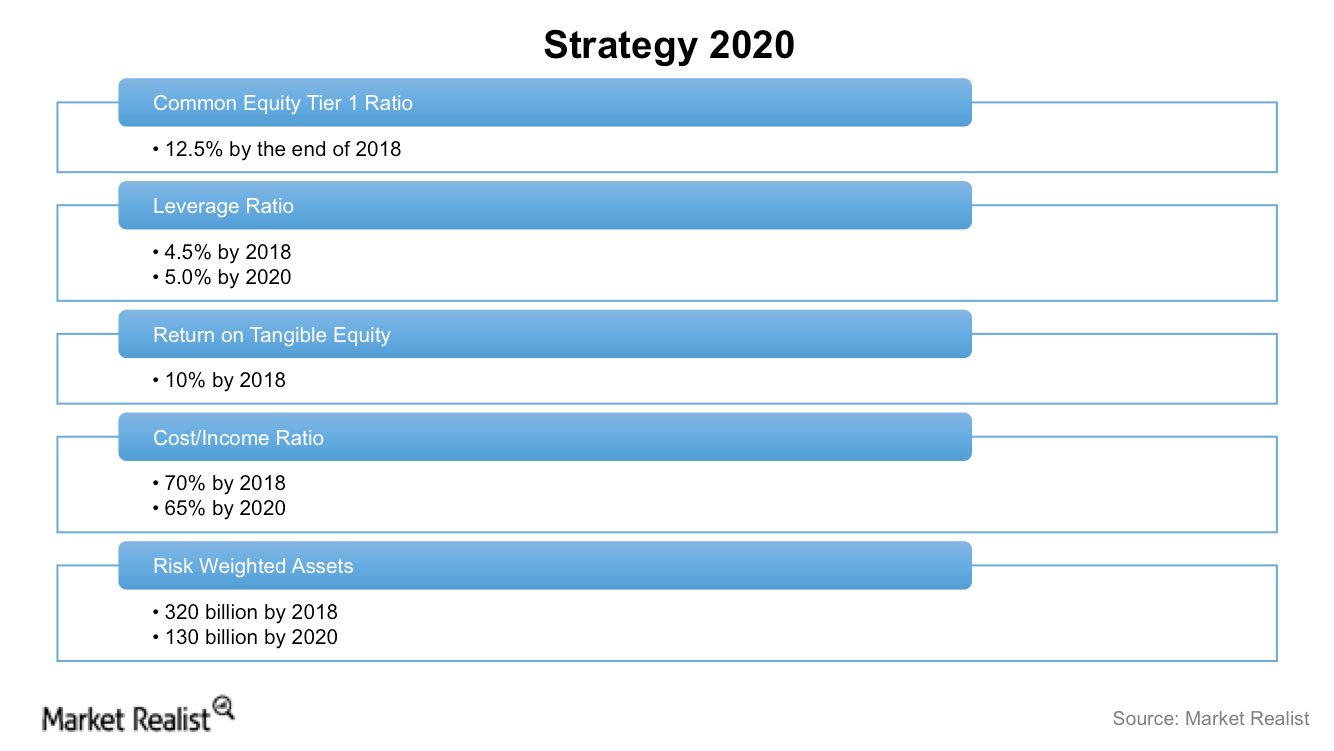

Will Deutsche Bank’s Overhaul Plan Work?

Investors who are concerned about Deutsche Bank’s bankruptcy are looking at CEO John Cryan’s plan to restructure the company’s operations.

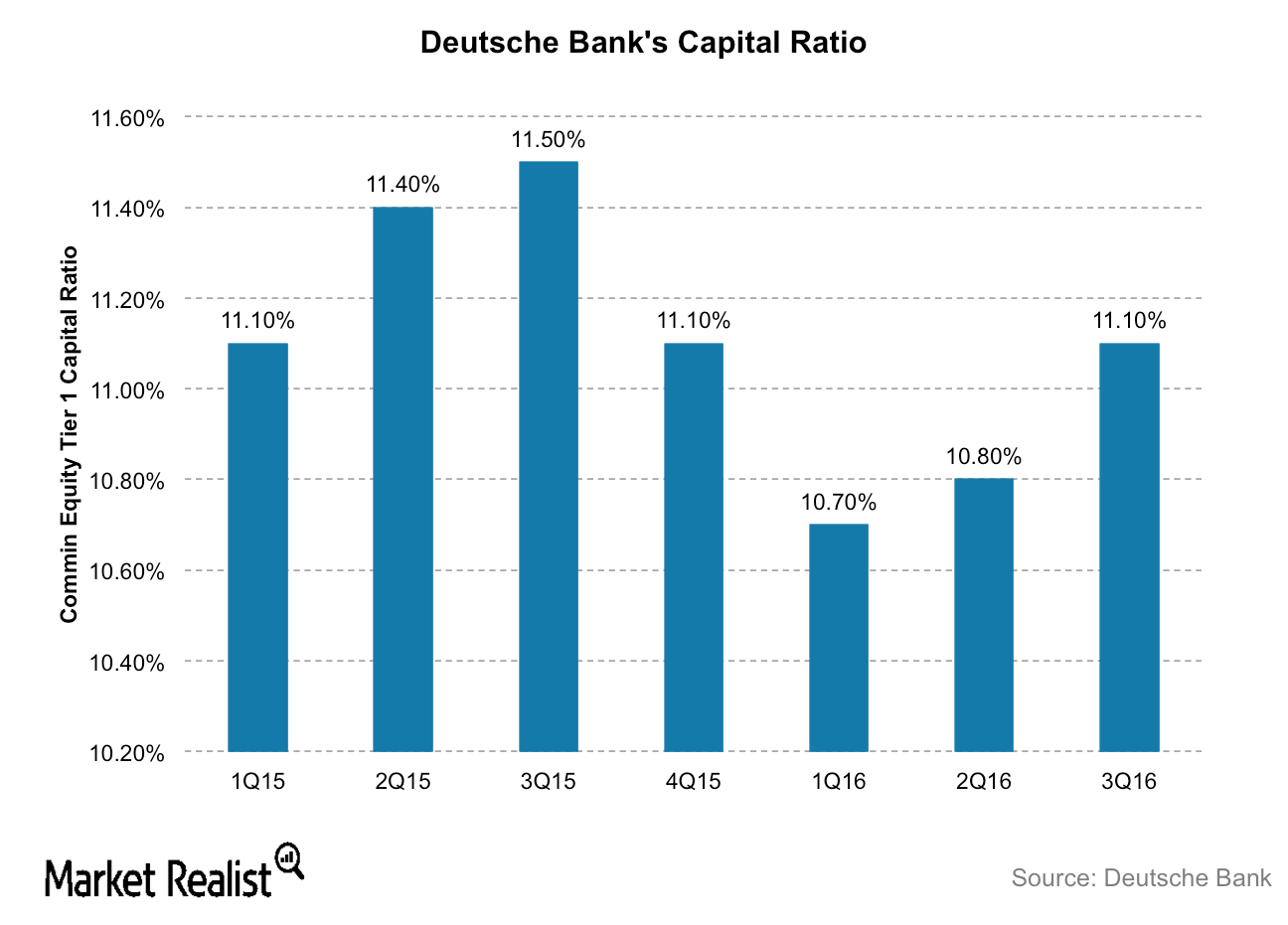

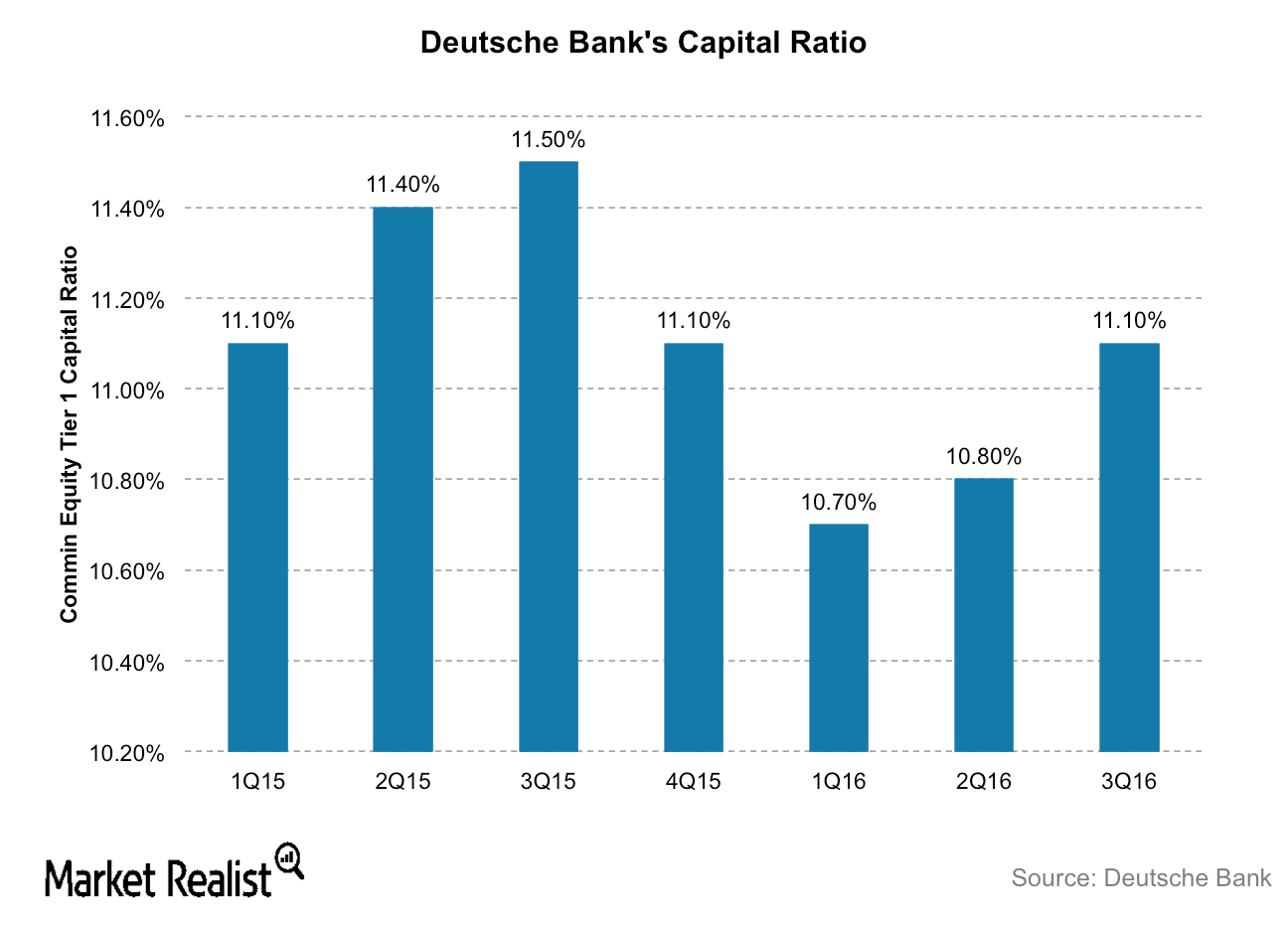

Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Can Trump Save Deutsche Bank from Bankruptcy?

Deutsche Bank could be the biggest beneficiary under Trump, having been on the brink of bankruptcy until its stock spiked nearly 20% after the election.

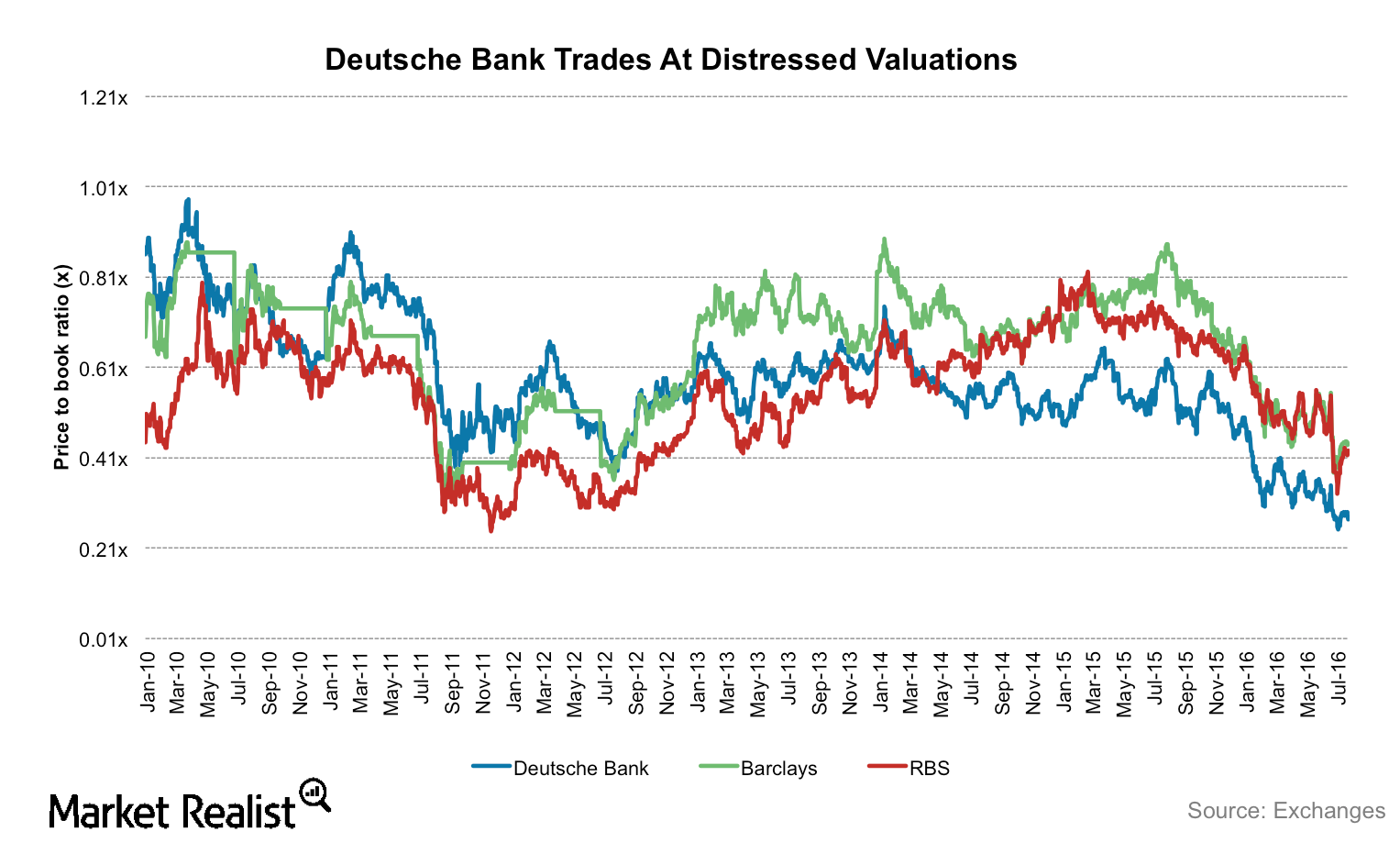

Do Distressed Valuations Offer a Good Chance to Buy Deutsche Bank?

Deutsche Bank’s (DB) shares are currently trading at distressed valuations. The bank’s shares are trading at the steepest discount to its book value, worse than the 2008 financial crisis.

Deutsche Bank’s Capital Levels Struggle to Meet Regulatory Requirements

Deutsche Bank’s stock is down nearly 40% in 2016 so far. Capital reserves are important to restore the confidence of regulators and investors.

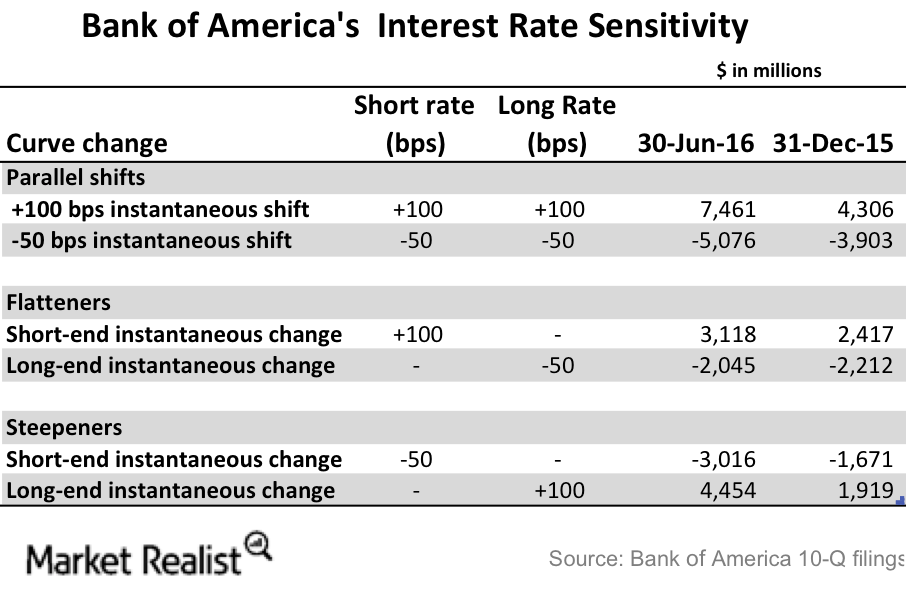

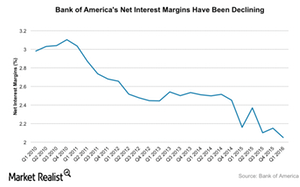

What’s Bank of America’s Interest Rate Risk?

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q15.

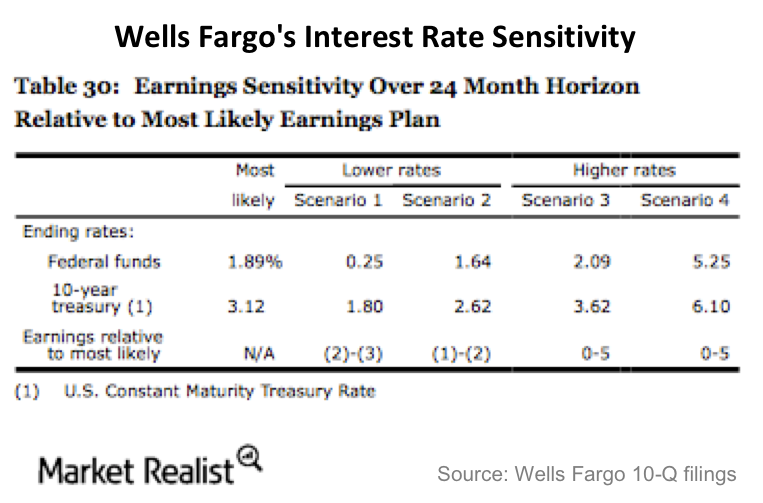

How Sensitive Are Wells Fargo’s Earnings to Interest Rates?

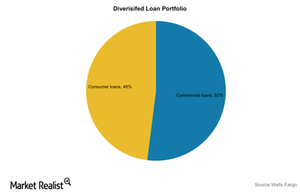

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion.

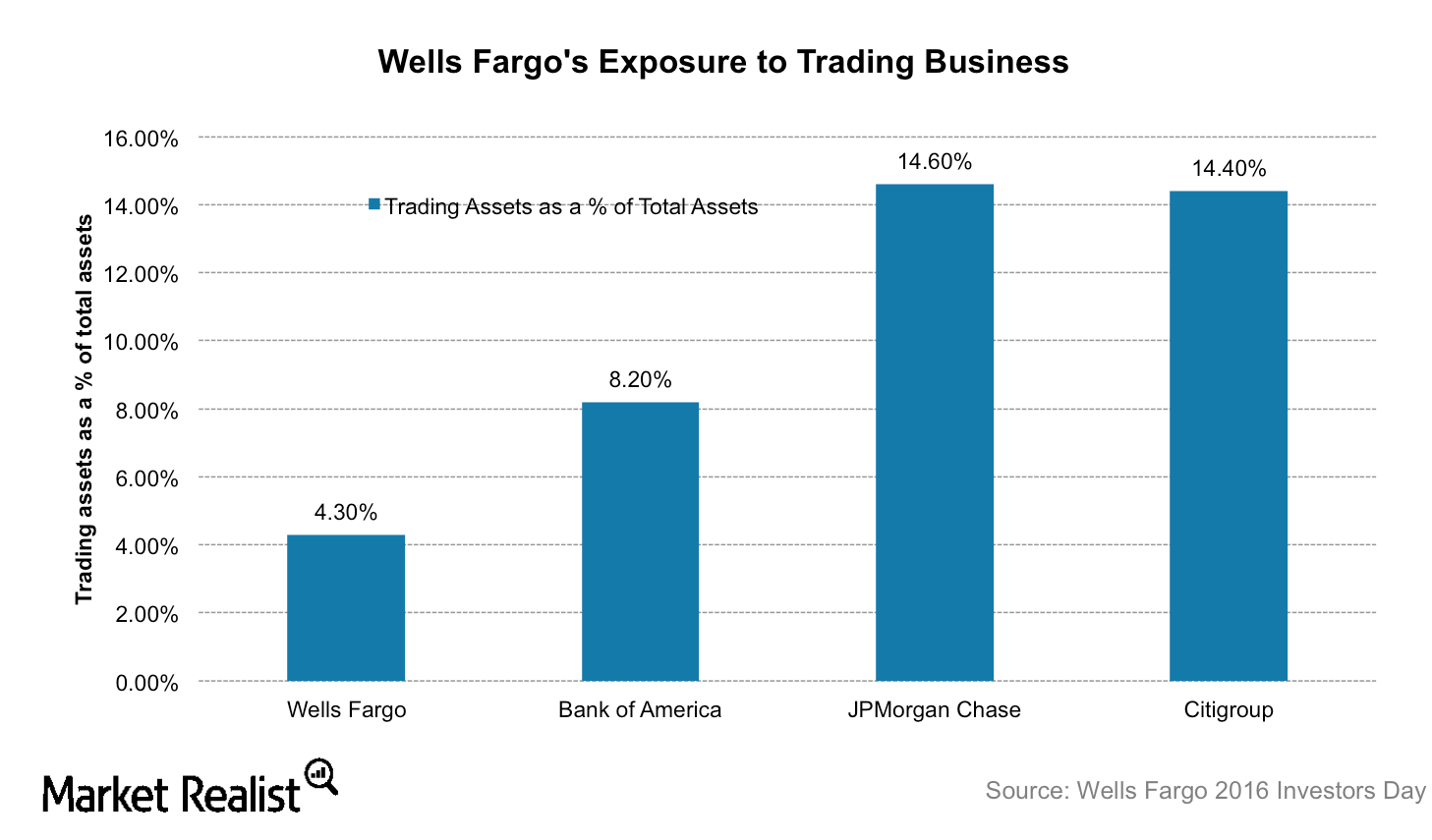

Why Wells Fargo Has a Less Risky Business Model than JPMorgan Chase

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC).

Interest Rate Sensitivity: JPMorgan Chase versus Wells Fargo

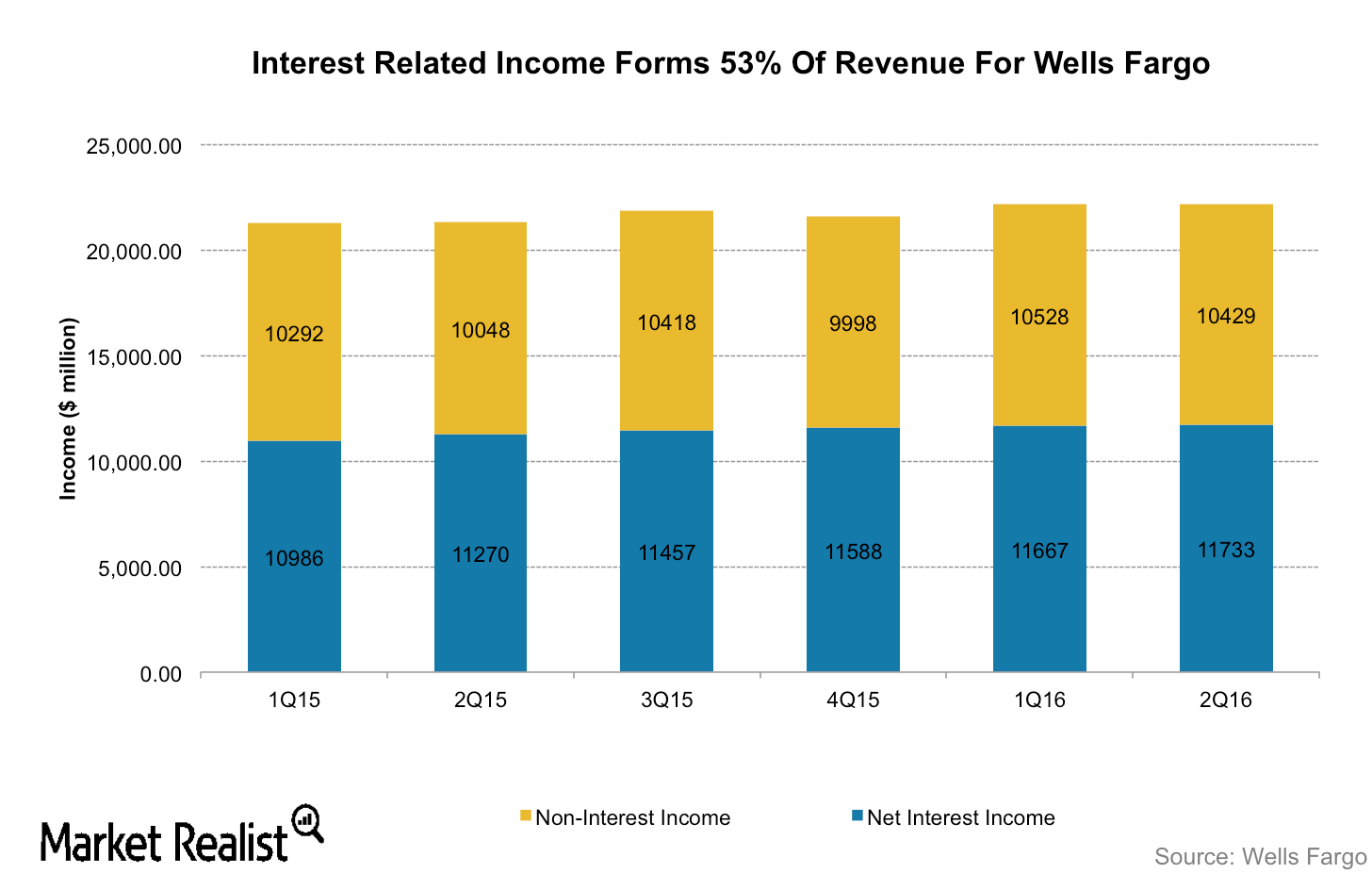

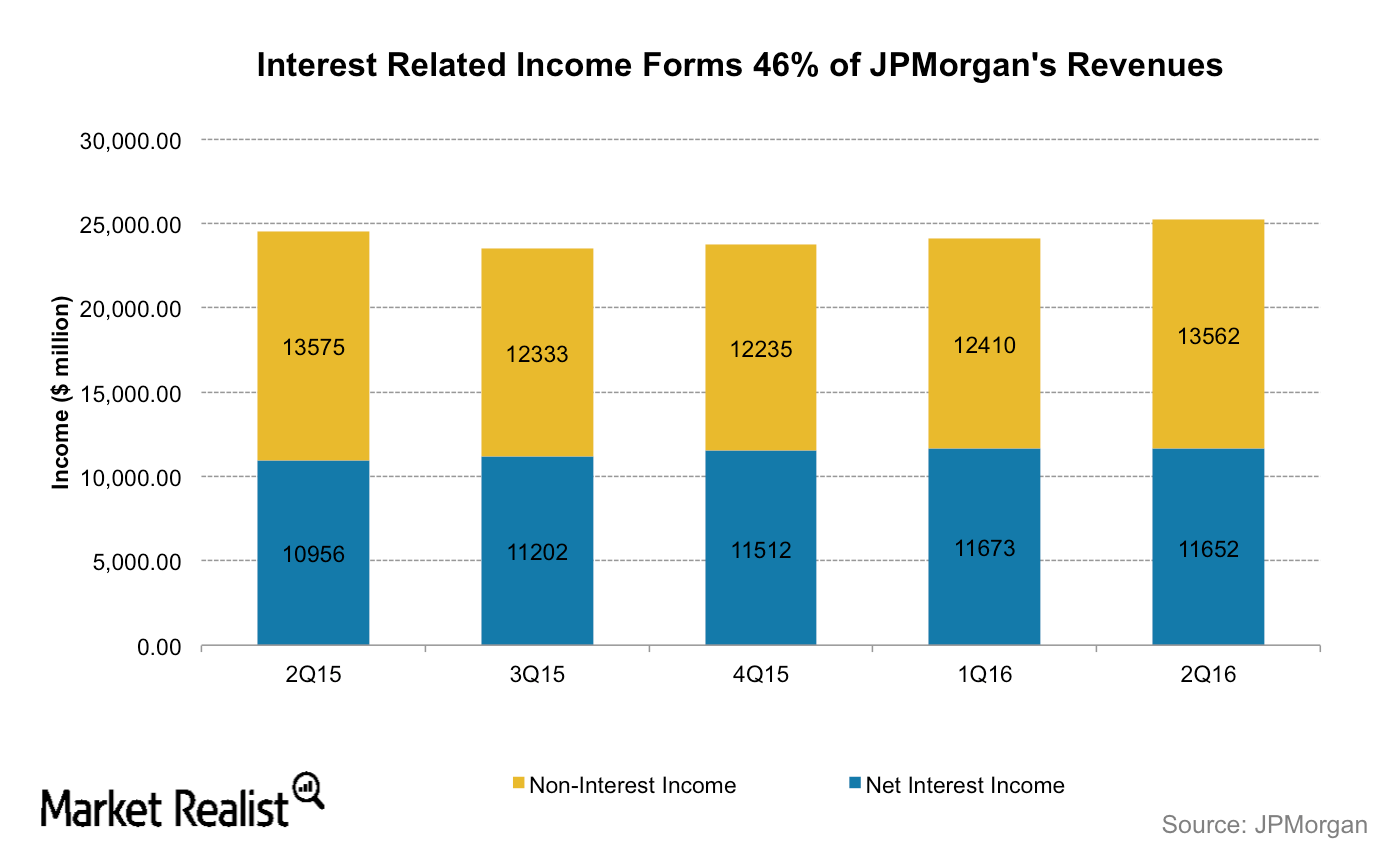

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

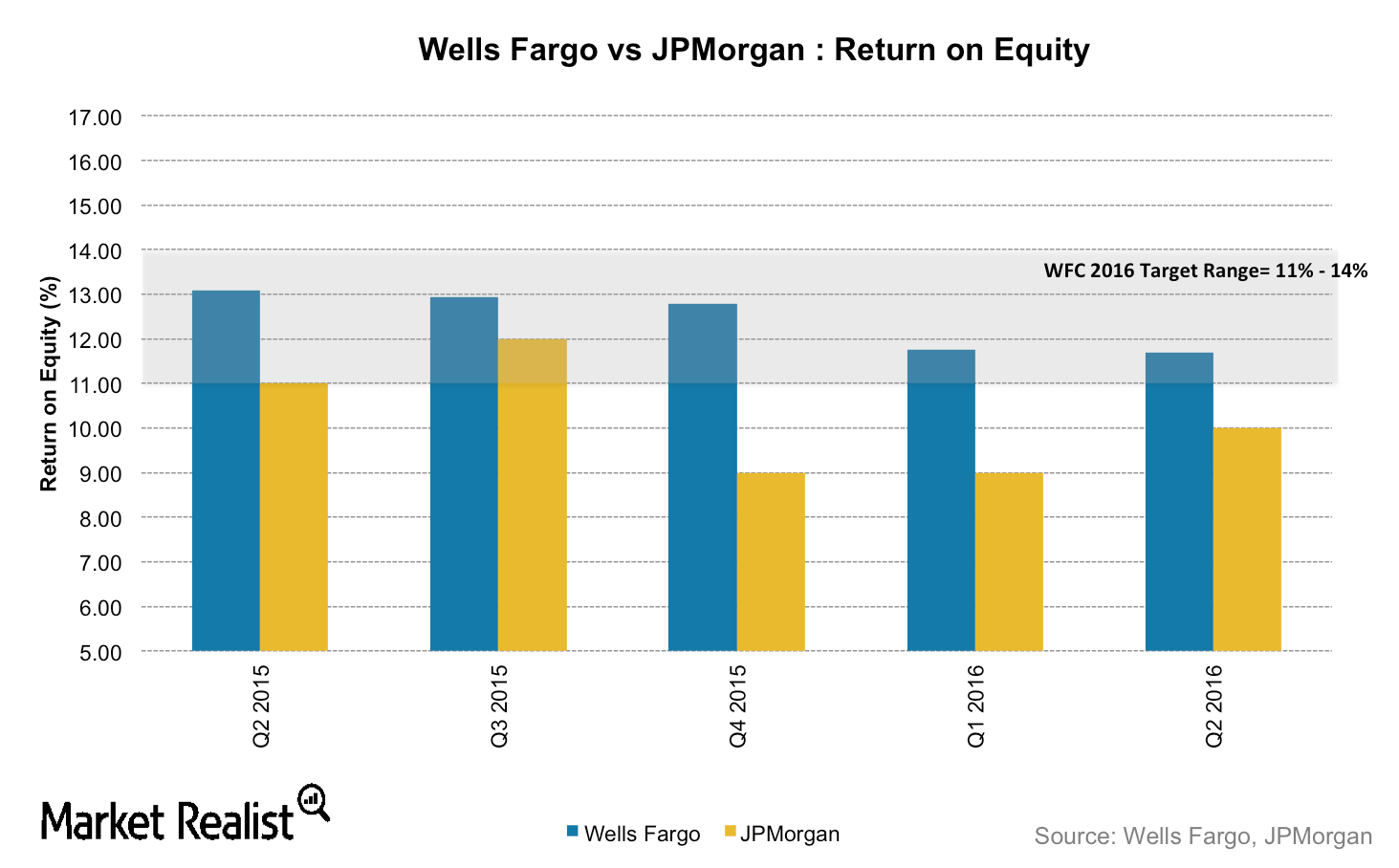

How Does Wells Fargo Compare with JPMorgan Chase on Profitability?

JPMorgan Chase (JPM) and Wells Fargo (WFC) reported profits of $6.2 billion and $5.6 billion, respectively, in the most recent quarter.

Why BAC Is Better Positioned to Gain from a Rate Hike Than JPM

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). It’s more sensitive to interest rate changes.

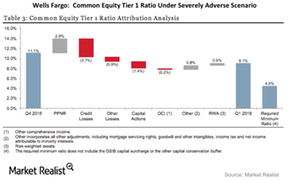

Did Wells Fargo Pass the Fed’s Stress Test?

The Federal Reserve’s stress test results indicate that Wells Fargo (WFC) has sufficient capital to absorb the estimated $25 billion in losses it is projected to incur under the test’s worst-case scenario.

Wells Fargo: What Sets It Apart from Its Peers?

Wells Fargo (WFC) is the largest mortgage lender in the US, operating primarily as a retail and commercial bank. It is been the most profitable bank in its peer group, posting a return of 10% on shareholder’s equity and ~1.3% on assets in 2015.

Wells Fargo Benefits from a Solid Business Model

Wells Fargo (WFC) has been considered the strongest and most steady among the “too big to fail” banks in the United States for years.

Comparing Wells Fargo and Bank of America’s Profitability

In 1Q16, Wells Fargo’s revenue grew 4% to $22.2 billion. Bank of America’s (BAC) revenue fell 7% YoY (year-over-year) to $19.5 billion.

How Sensitive to Interest Rates Has Bank of America Really Become?

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line.

How Are FIS’s Business Strategies Driving Growth?

FIS plans to build stronger client relationships through multidimensional offerings. Its SunGard acquisition should also help expand client relationships.

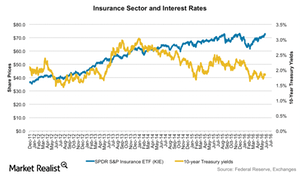

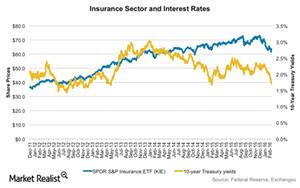

How Does a Rate Hike Impact Insurance Stocks?

Interest rates are a key performance driver for life insurance companies, affecting their margins, hedging costs, and product sales.

Inside FIS’s Operating Model

In 2015, FIS reorganized and began reporting its results under three segments. But after the SunGard acquisition, another restructuring process is underway.

Introducing Fidelity National Information Services

Headquartered in Florida, Fidelity National Information Services is a big hitter in software solutions and innovations in the financial services industry.

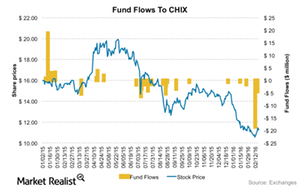

Why Fund Flows to China Financial ETFs Are Dwindling

ETF investors have withdrawn almost $35.8 million from the Global X China Financials ETF (CHIX) (FXI) in the last six months.

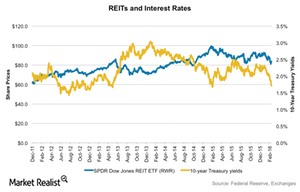

How Would Negative Interest Rates Impact REITs?

A fall in interest rates makes REITs more attractive dividend-yielding investments compared to bonds. This is because REITs have been traditionally viewed as dividend-yielding investments.

The Effect of an Interest Rate Reversal on Insurance Companies

Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales.

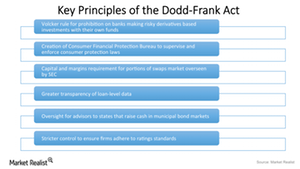

What Is the Dodd-Frank Act?

Analysts who favor the Dodd-Frank Act believe it will protect the investing community and consumers. Critics believe it will hamper economic growth and hurt competitiveness.

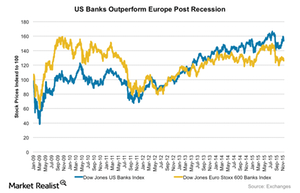

US Banks Played a Pivotal Role in the 2008 Financial Crisis

During the period between September 2008 and March 2009, US stock markets plunged, and the financial sector fell 60% in value.

What Is the Dodd-Frank Act?

The Dodd-Frank Act is a financial reform legislation passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

Understanding the Fed’s Financial Regulations Post-2008 Crisis

Since the financial crisis, the Fed has enforced regulations for the capital strength and liquidity of 16 systematically important financial institutions.

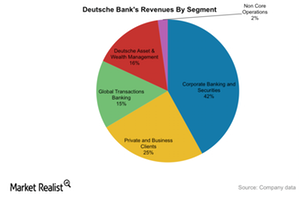

Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.

Analyzing US and European Banks’ Leverage Ratios

On average, European banks have higher leverage than US banks. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy.