Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.

Nov. 20 2020, Updated 11:02 a.m. ET

Natural gas–weighted stocks and natural gas

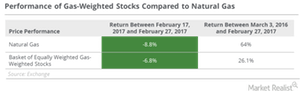

In the previous part, we looked at the fall in natural gas prices due to warmer temperature forecasts. Between February 17, 2017, and February 27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%.

An equally weighted basket of natural gas–weighted stocks fell 6.8% during the same period. These stocks operate with production mixes of at least 60.0% in natural gas (UNG) (GASX) (FCG) (GASL). They’re also all part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

Best and worst natural gas stocks

The natural gas–weighted stocks that outperformed their peers from February 17, 2017, to February 27, 2017, included:

The stocks that underperformed their peers during the period included:

Apart from their correlation with natural gas in the short term and their earnings in the long term, the performances of these natural gas–weighted stocks could also be impacted by movements in crude oil (USO) (UCO) prices. Crude oil prices can drive the sentiment of the entire energy sector, not just crude oil stocks.

Natural gas–weighted stocks and natural gas since 2016 lows

On March 3, 2016, natural gas futures touched a 17-year low of $1.64. From March 3, 2016, to February 27, 2017, natural gas (UNG) (BOIL) (UGAZ) (FCG) rose 64% on a closing price basis. Our basket of equally weighted upstream stocks rose 26.1% during the same period.

The smaller rise in gas-weighted stocks compared to natural gas could be attributed to the weaker position of some of these natural gas–heavy companies due to chronically low natural gas prices over the last few years. They’re also likely pricing in weaker natural gas prices in the future due to rising natural gas production despite weak prices.

Since March 3, 2016, the following natural gas–weighted stocks were among the outperformers:

The following natural gas–weighted stocks didn’t fare as well during this period:

So, natural gas–weighted stocks outperformed natural gas in the trailing week but underperformed since its low in March 2016. We’ll have to wait and see if the trend continues, particularly if natural gas looks bearish as the winter winds down.