ProShares Ultra Bloomberg Crude Oil

Latest ProShares Ultra Bloomberg Crude Oil News and Updates

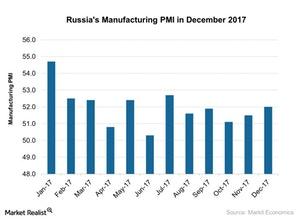

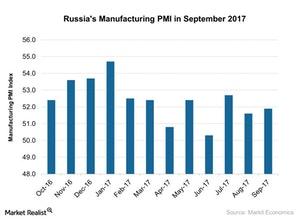

Russia’s Manufacturing PMI Improved in December 2017

According to a report by Markit Economics, the final Russia manufacturing PMI (purchasing managers’ index) improved in December as compared to November 2017.

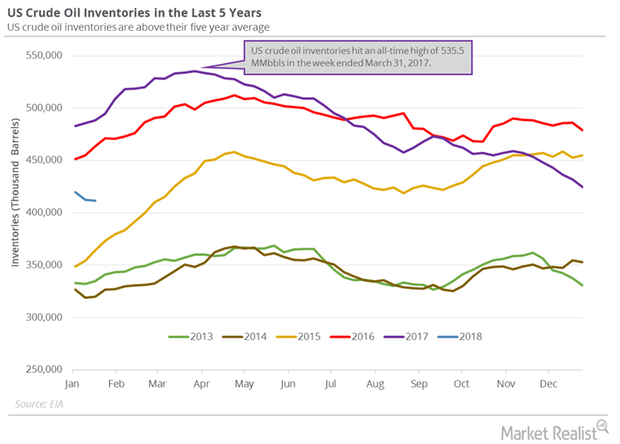

US Crude Oil Inventories Hit February 2015 Low

US crude oil inventories fell by 1.1 MMbbls (million barrels) to 411.6 MMbbls on January 12–19, 2018. Inventories decreased 0.3% week-over-week.

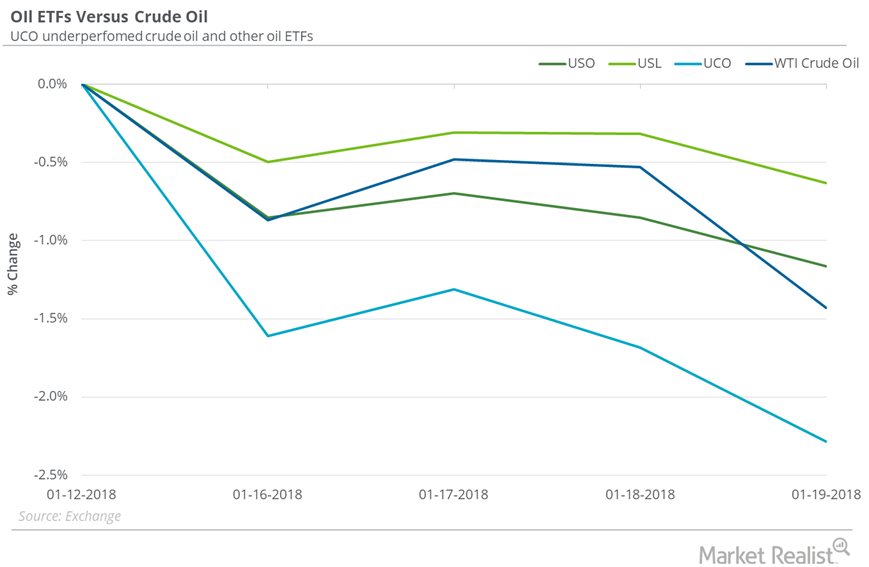

Are Oil ETFs Outperforming Oil?

Between January 12 and January 19, 2018, the United States Oil ETF (USO) fell 1.2%.

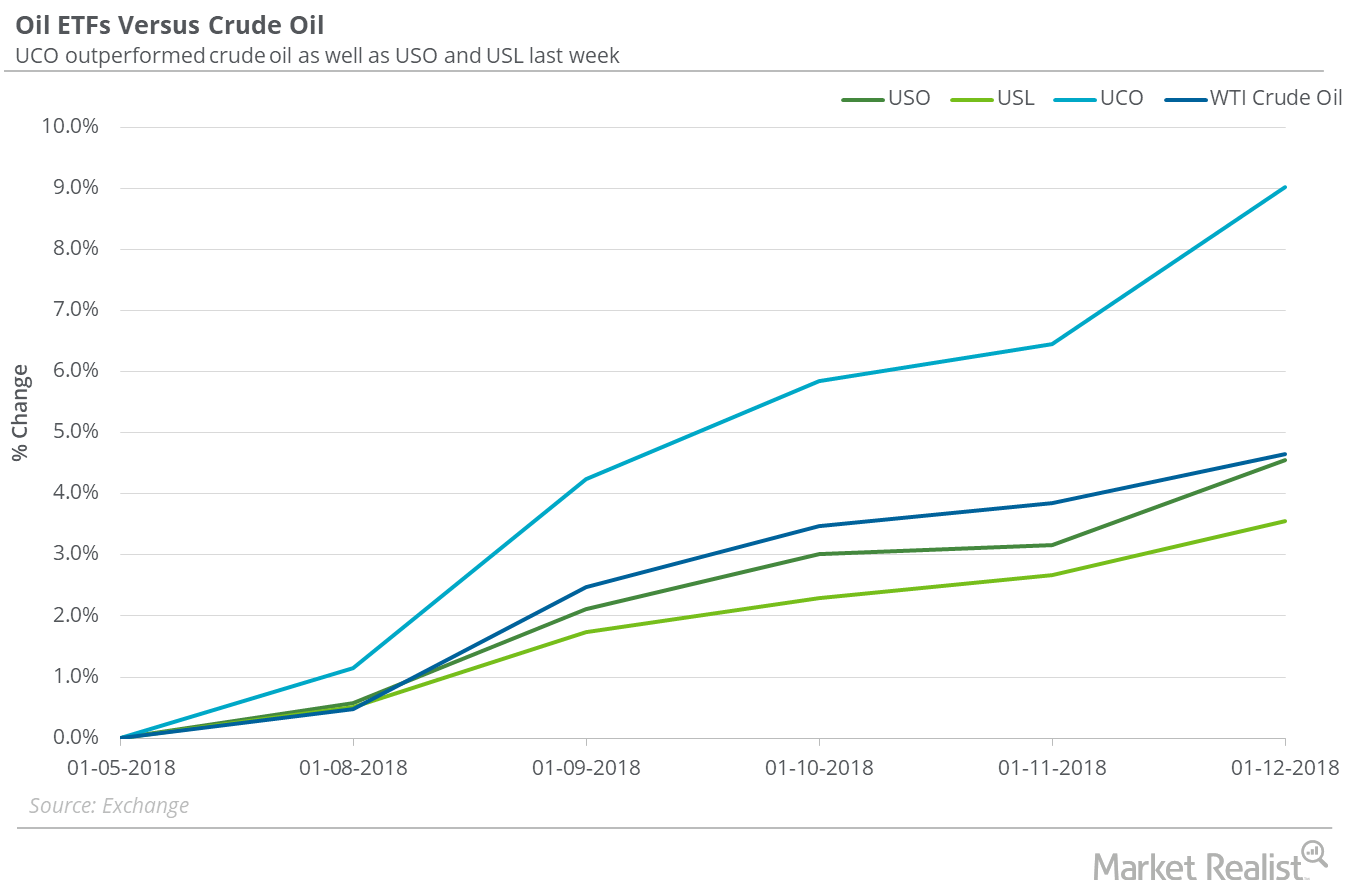

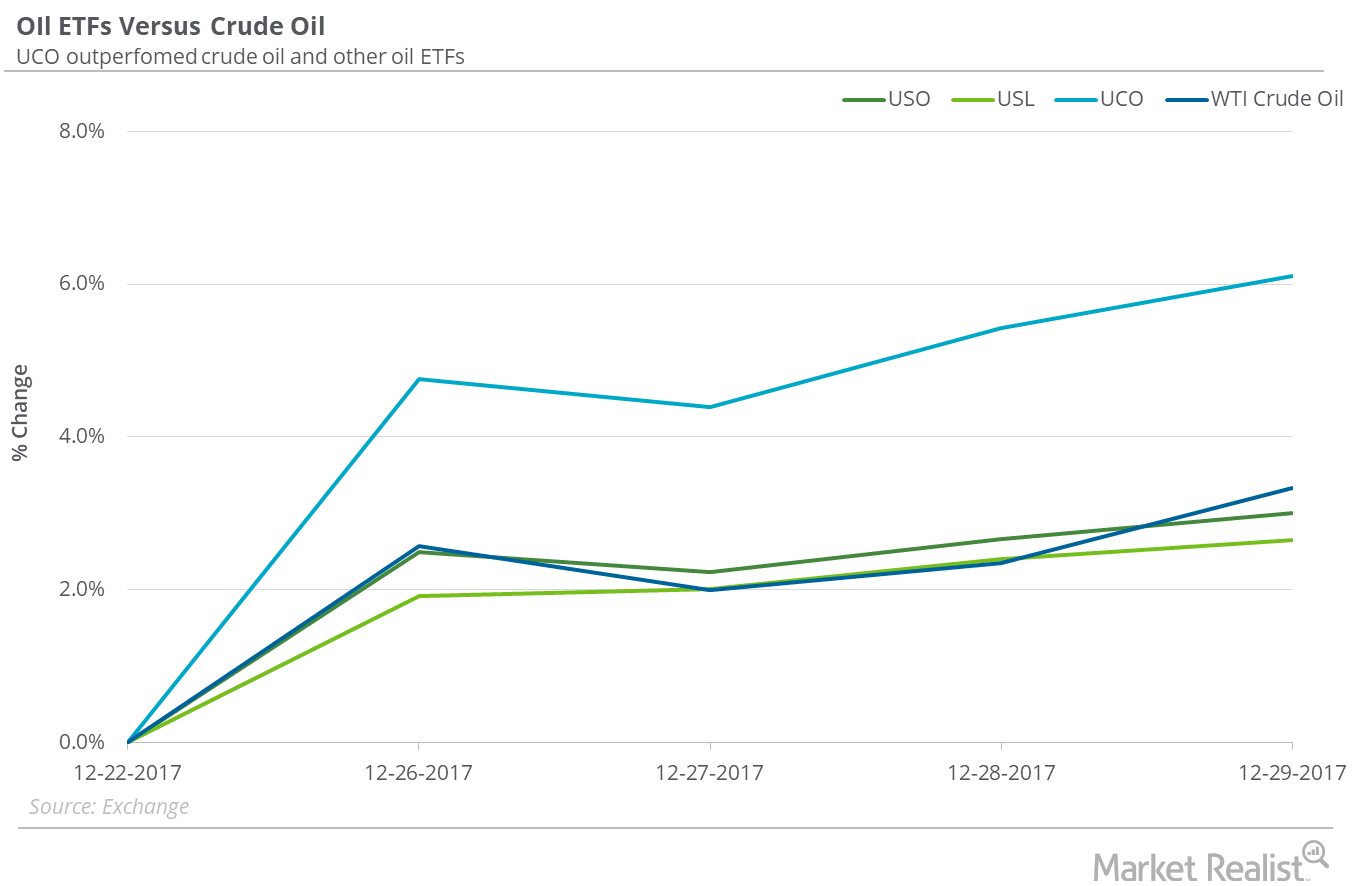

Oil ETFs: How They’re Performing at Oil’s 3-Year High

Between January 5 and January 12, 2018, the United States Oil ETF (USO), which holds positions in US crude oil active futures, gained 4.5%.

Oil Inventory Data Could Push Oil Higher

In the week ending January 5, 2018, US crude oil inventories fell by 4.9 MMbbls (million barrels)—1 MMbbls more than the market’s expected fall.

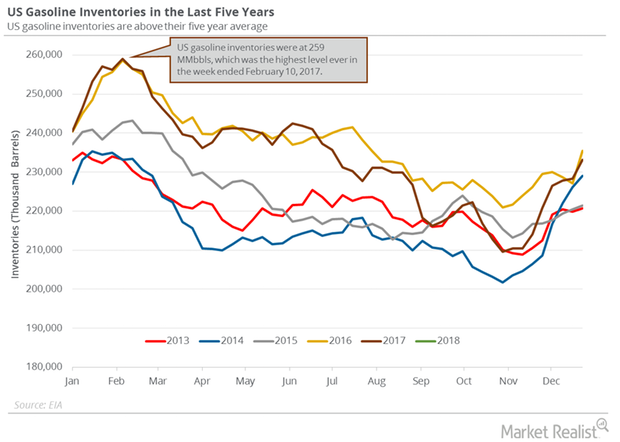

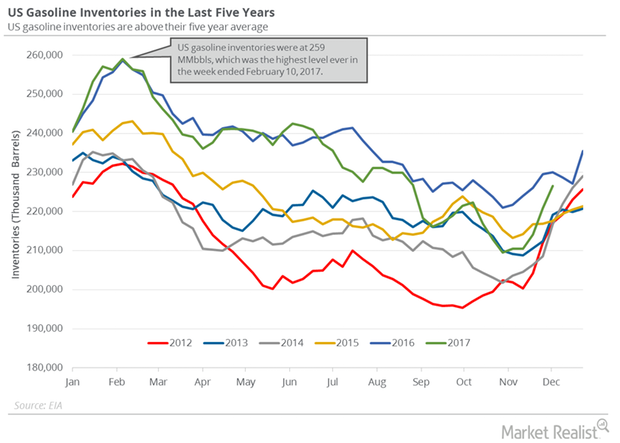

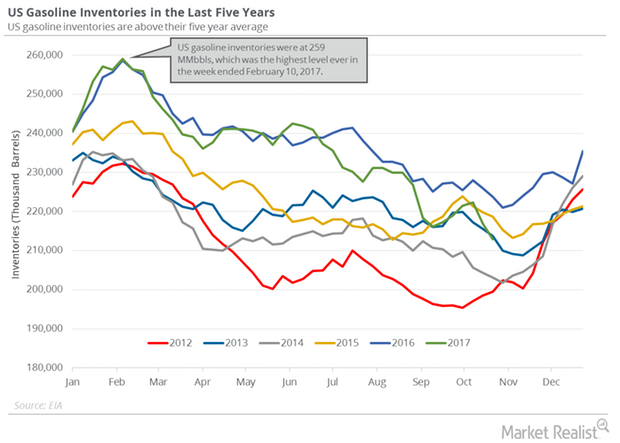

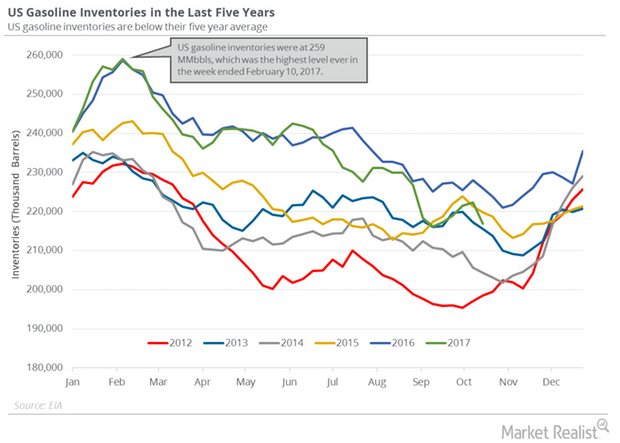

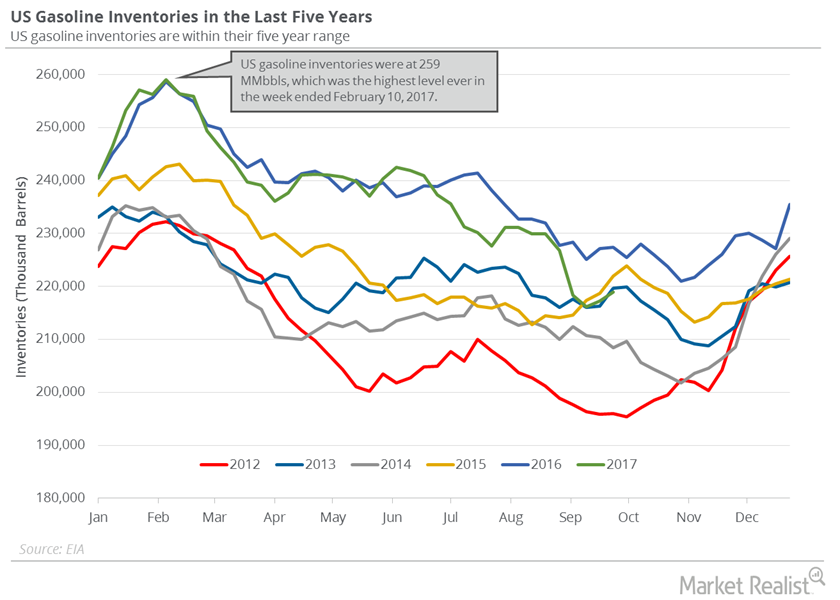

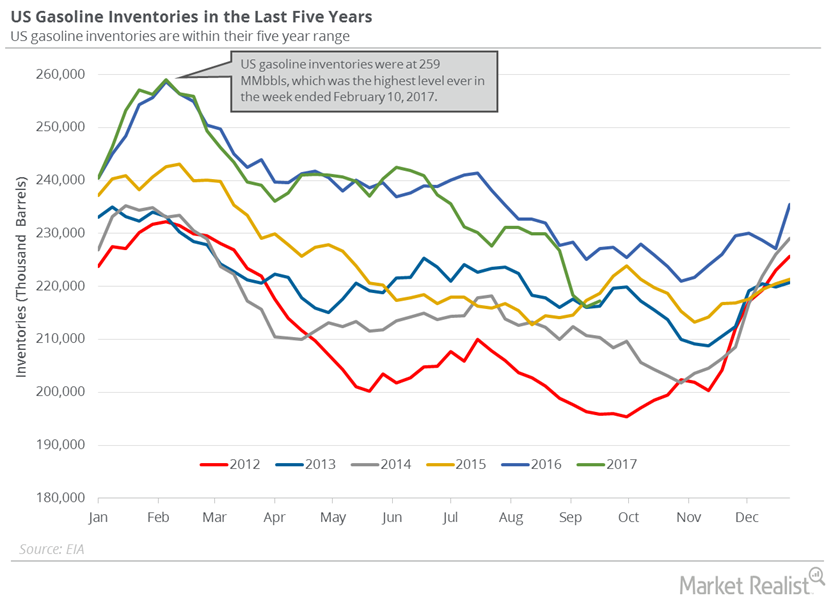

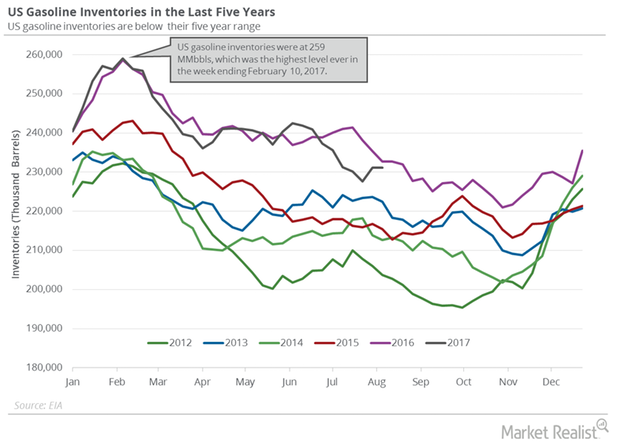

US Gasoline Inventories: More Concerns for Oil in 2018?

US gasoline inventories rose by 4.1 MMbbls (million barrels) to 237.3 MMbbls between December 29, 2017, and January 5, 2018.

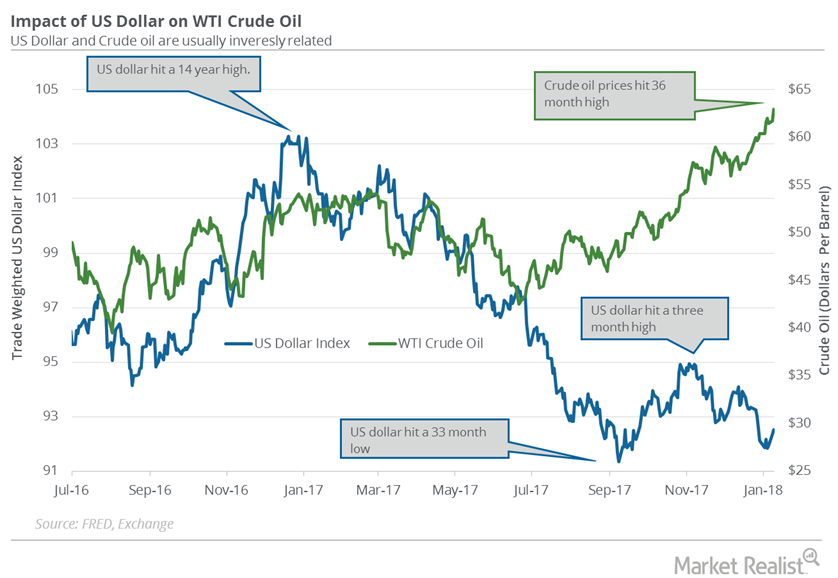

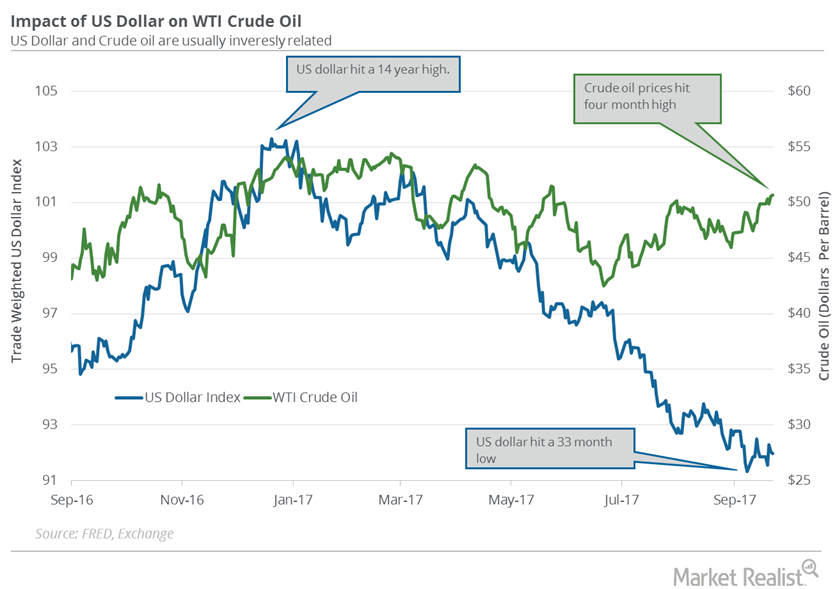

US Dollar Recovering from 3-Month Low: Bearish for Crude Oil?

The US Dollar Index fell ~9.8% in 2017. The dollar fell partly due to the improving economy outside the US. It was the worst annual drop since 2003.

Which Oil ETFs Might Be a Better Bet in 2018?

On December 29, 2017, the closing prices of US crude oil futures contracts between March 2018 and January 2019 were progressively lower.

How Much Fall in Inventories Could Support Oil This Week?

In the week ended December 22, 2017, US crude oil inventories were 431.9 MMbbls (million barrels), a fall of 4.6 MMbbls compared to the previous week.

Should Oil Traders Follow US Oil Exports in 2018?

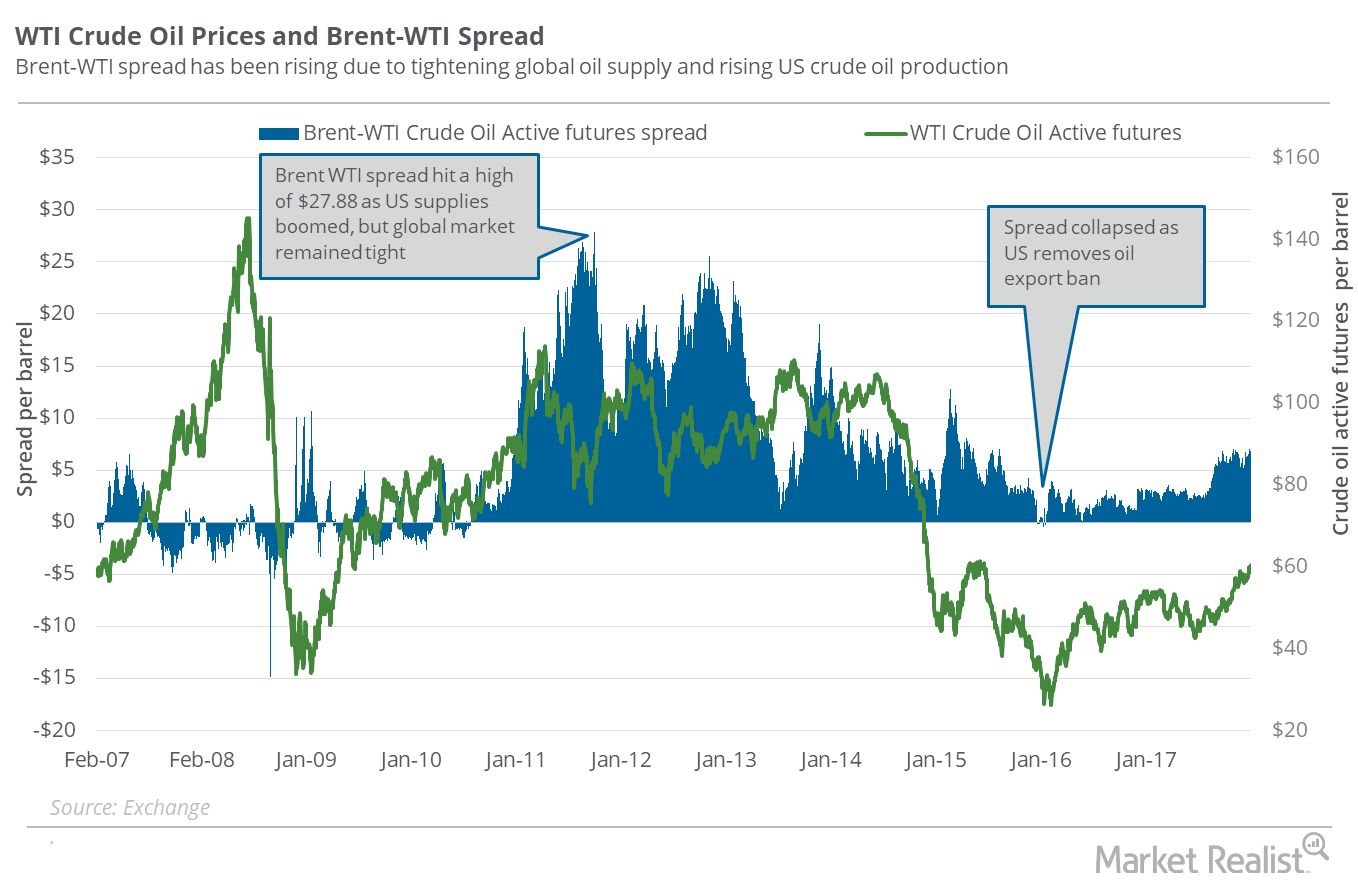

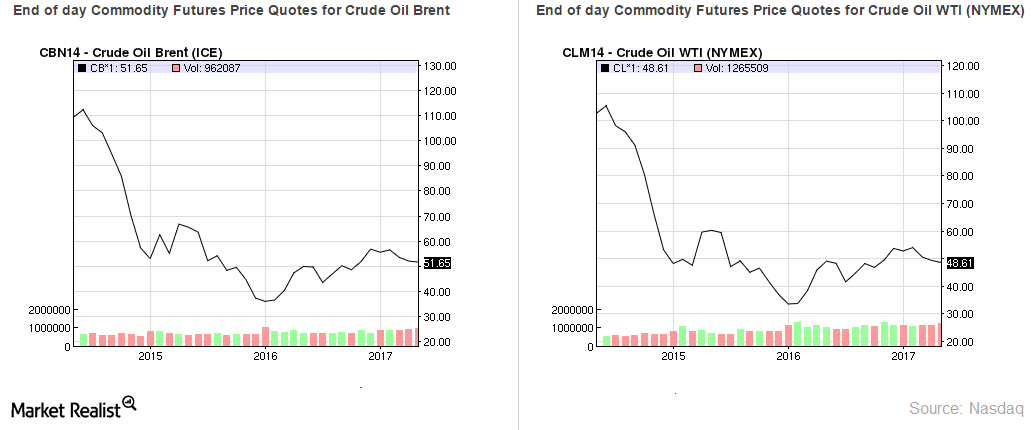

On December 29, 2017, the price difference between Brent crude oil (BNO) active futures and WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.45.

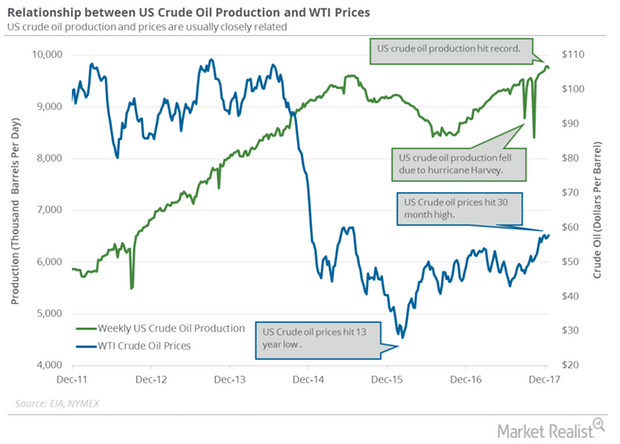

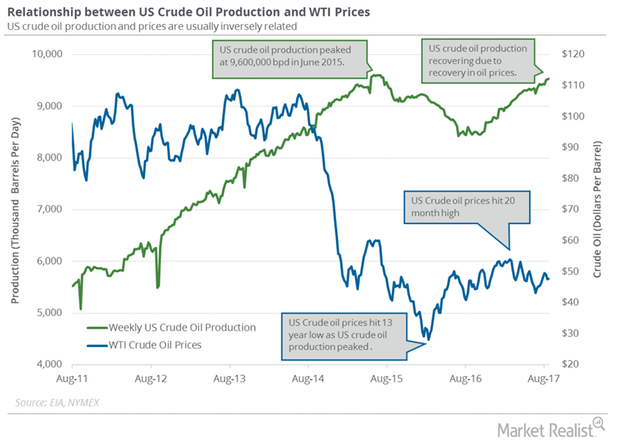

Weekly US Crude Oil Production Fell for the 1st Time since October

US crude oil production declined by 35,000 bpd (barrels per day) or 0.4% to 9,754,000 bpd from December 15 to 22, 2017, per the EIA.

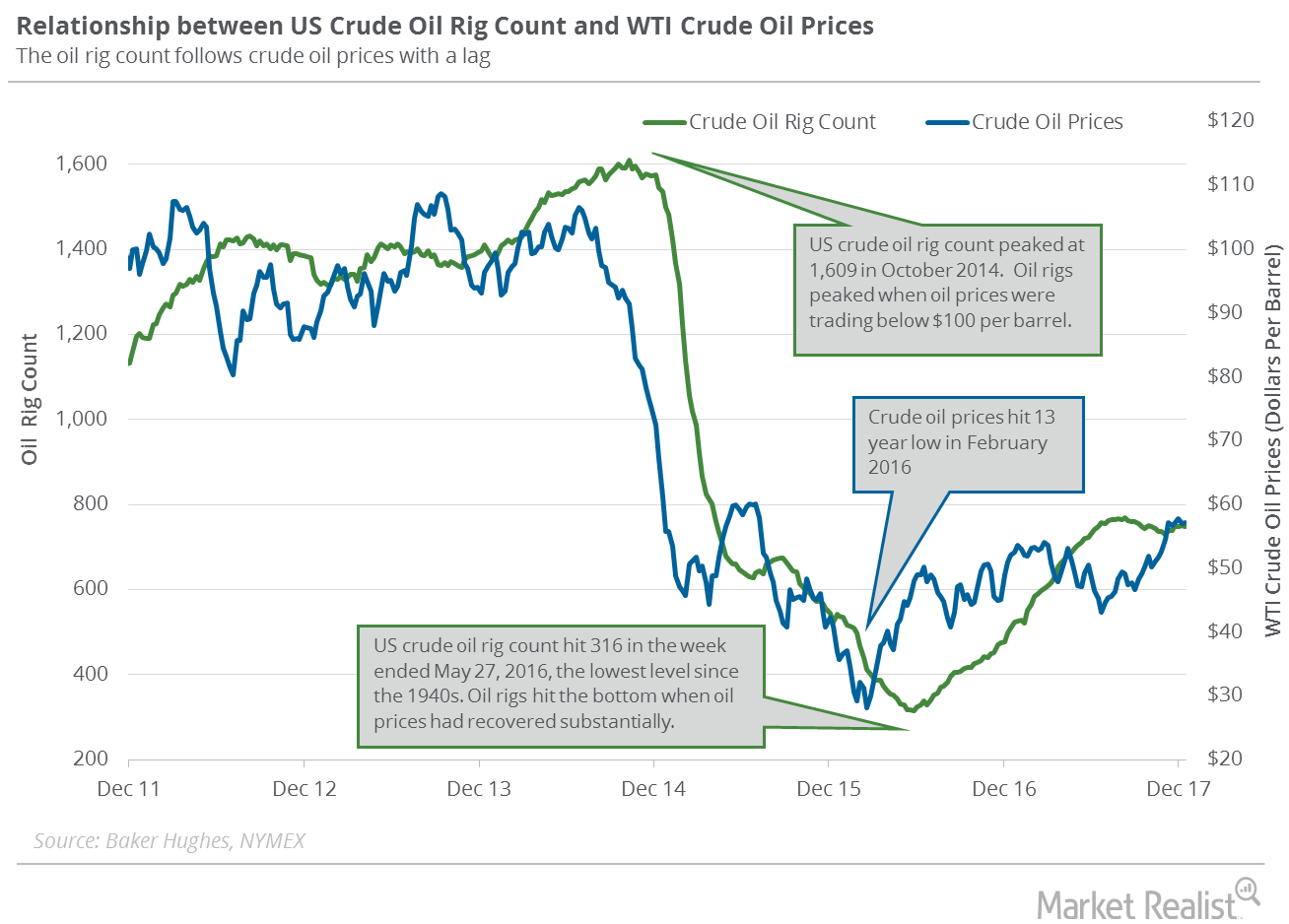

US Crude Oil Rig Count: Almost Flat in the Last 5 Weeks

Baker Hughes published its US crude oil rig report on December 22, 2017. The US crude oil rig count was flat at 747 on December 15–22, 2017.

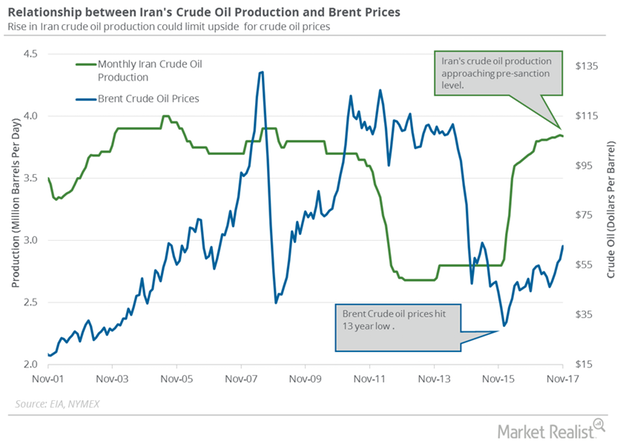

Iran’s Crude Oil Production Is near a 9-Year High

The EIA estimates that Iran’s crude oil production fell by 10,000 bpd or 0.3% to 3,840,000 bpd in November 2017—compared to the previous month.

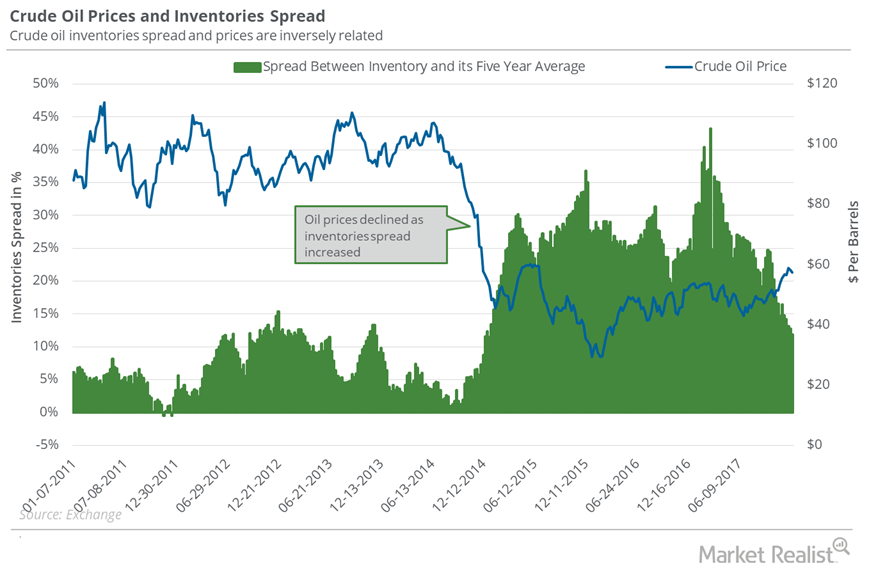

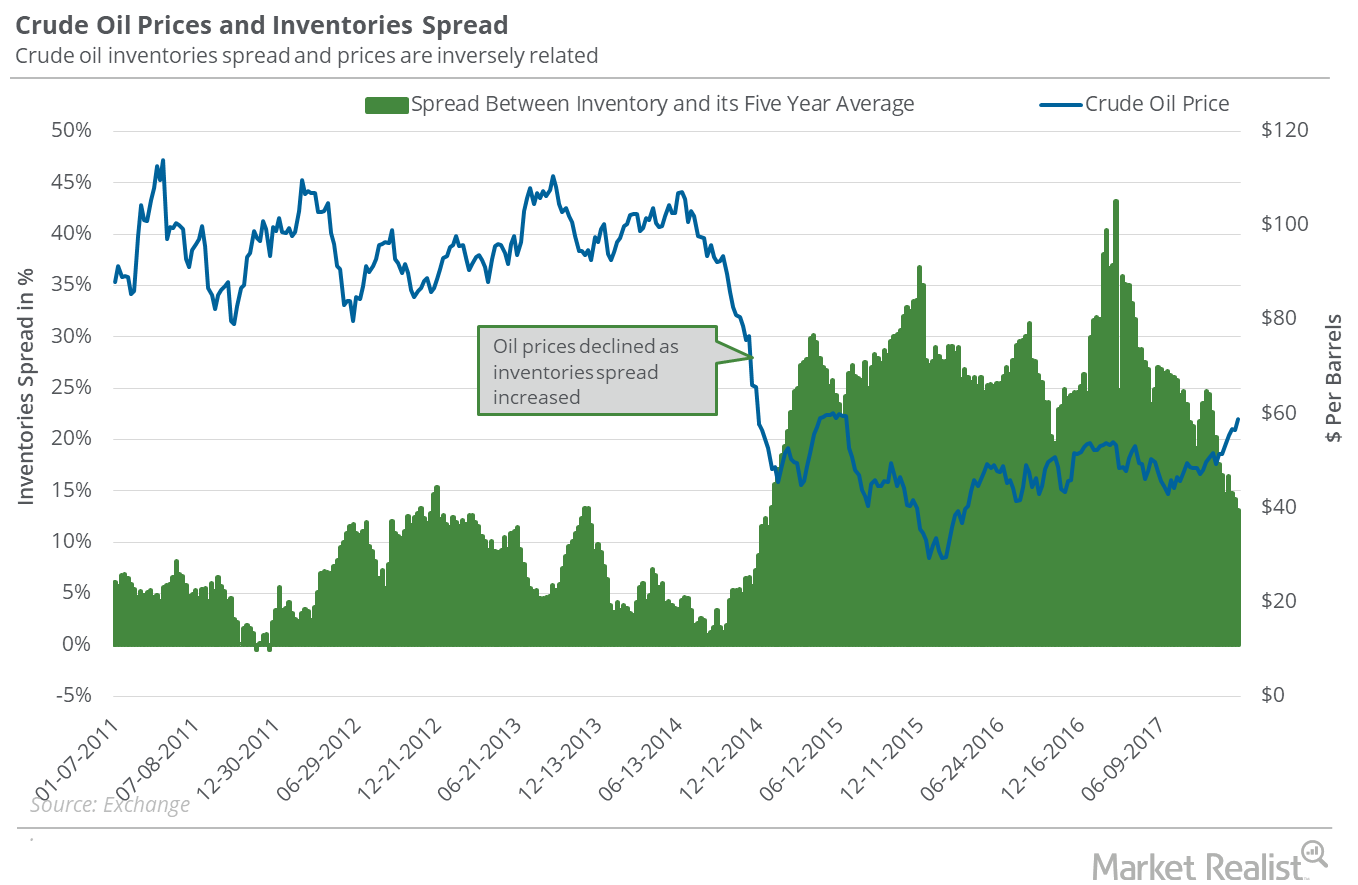

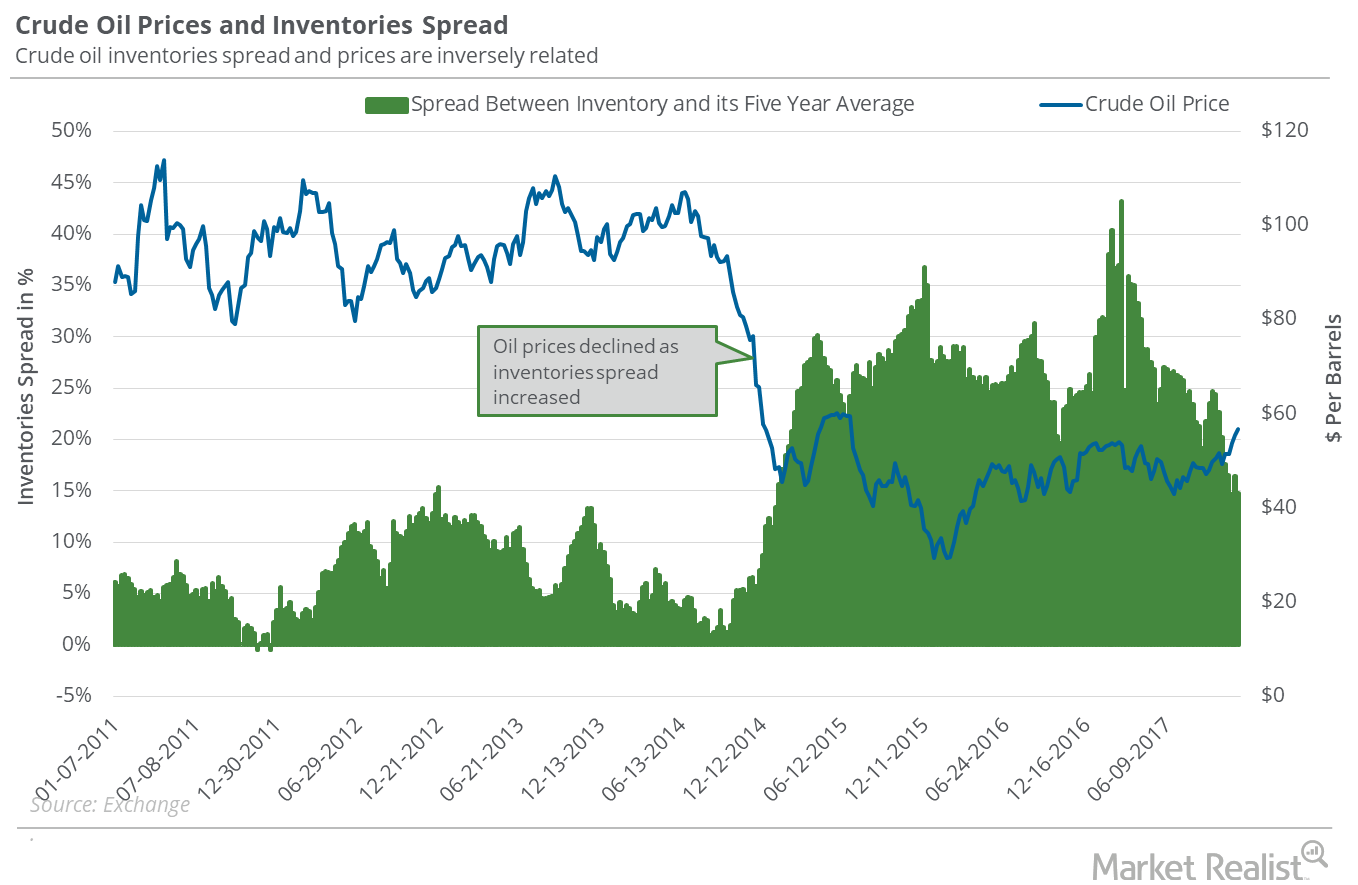

What Oil Bulls Could Expect for Oil Inventories

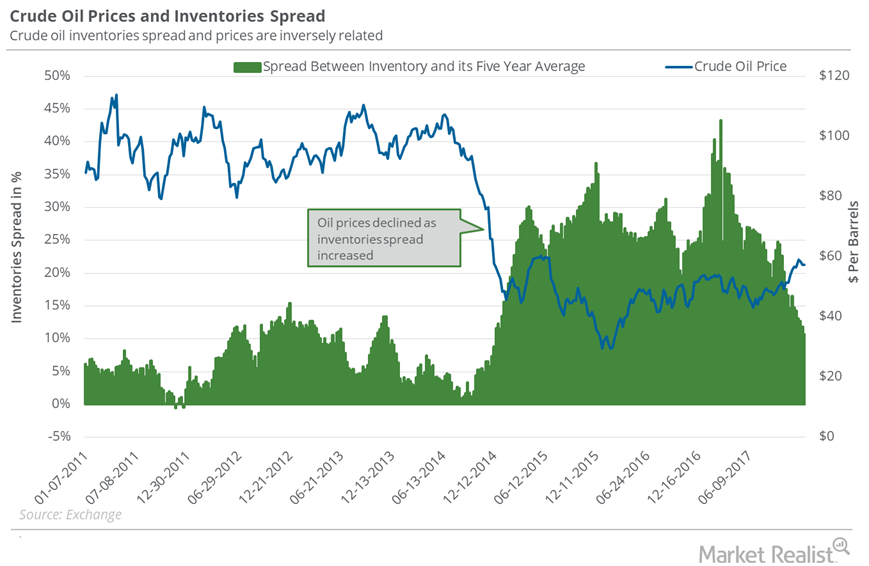

Oil stockpiles In the week ended December 8, 2017, US crude oil inventories fell by 5.1 MMbbls (million barrels) to 443 MMbbls. However, motor gasoline inventories rose 5.7 MMbbls. The data was released by the EIA (U.S. Energy Information Administration) on December 13. That day, US crude oil prices fell 0.9%. Inventory spread The gap between US oil inventories […]

US Gasoline Inventories: Turning Point for Crude Oil Futures?

US gasoline inventories rose by 5.6 MMbbls (million barrels) or 2.6% to 226.5 MMbbls on December 1–8, 2017.

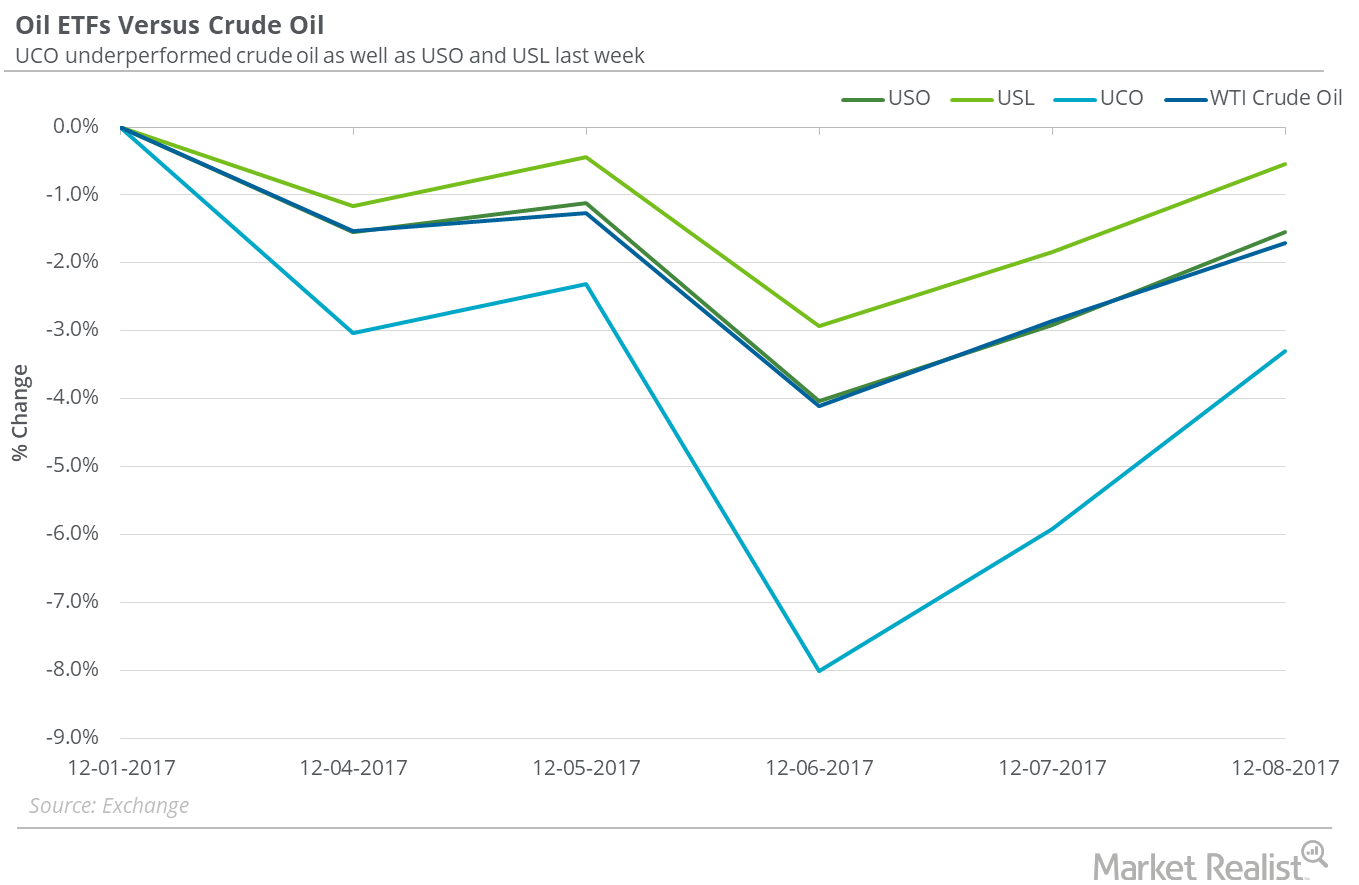

Oil ETFs That Outperformed US Crude Oil Last Week

On December 1–8, 2017, the United States Oil Fund (USO), which holds crude US oil futures contracts, fell 1.5%. US crude oil January 2018 futures fell 1.7%.

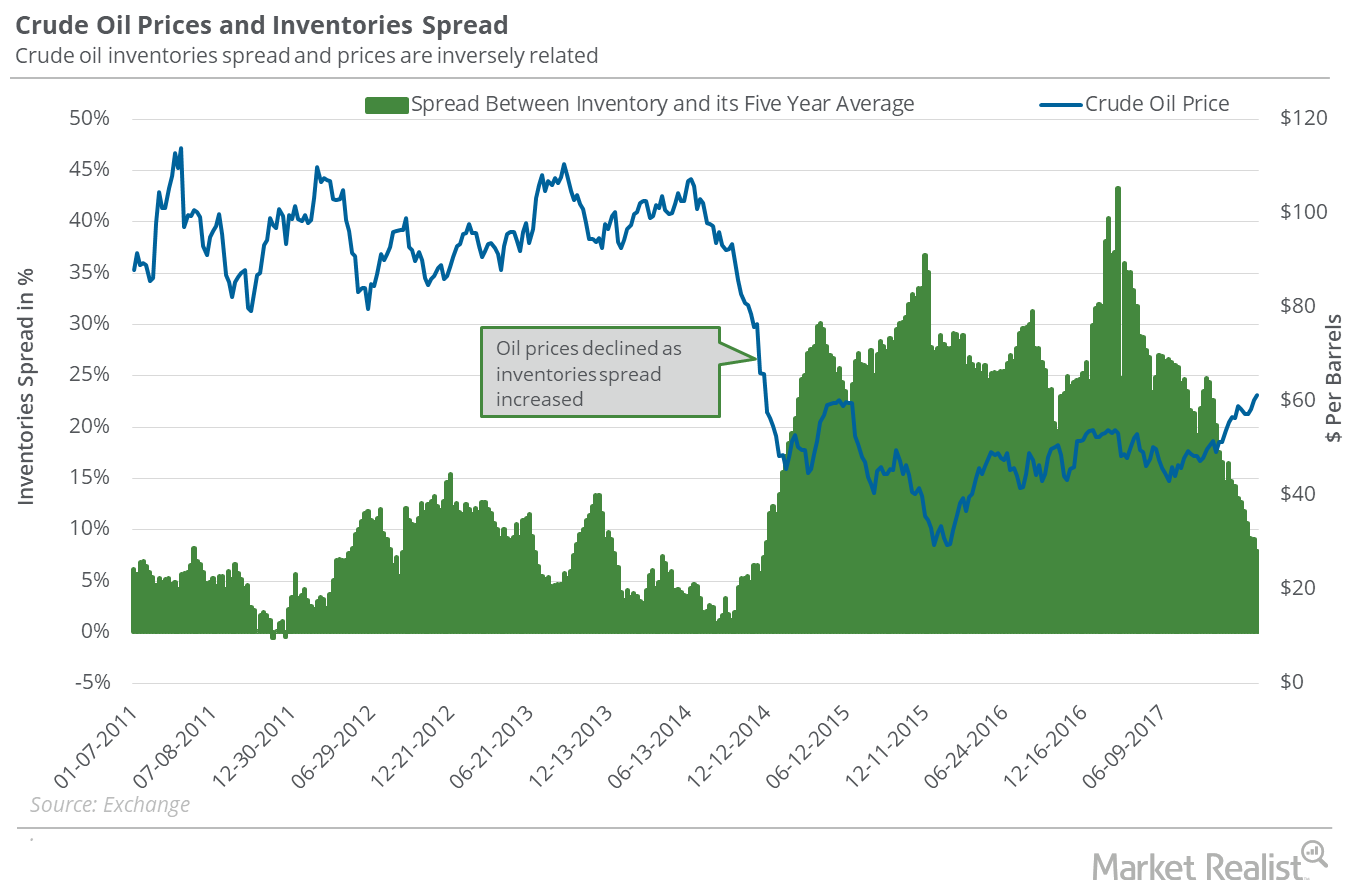

Analyzing Crude Oil Inventories and Oil Prices

In the week ending November 24, 2017, US crude oil inventories fell by 3.4 MMbbls (million barrels) to 453.7 MMbbls.

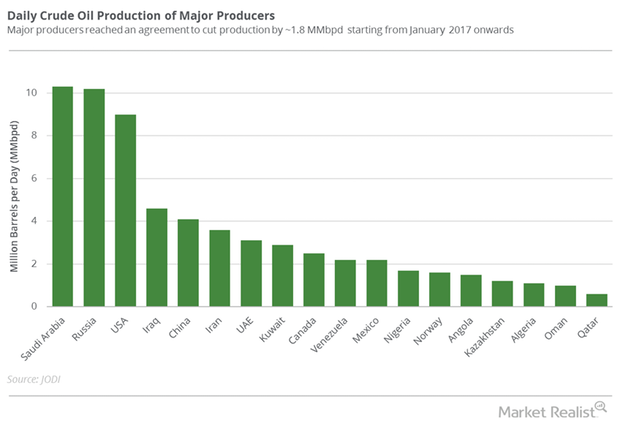

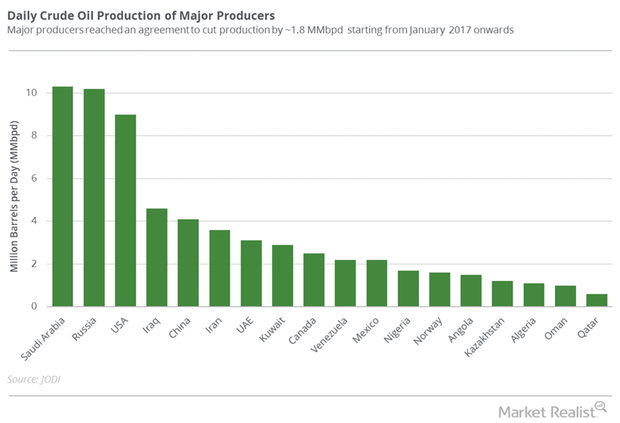

How OPEC and Russia Are Helping US Crude Oil Producers

January West Texas Intermediate (or WTI) crude oil (USO) (SCO) futures contracts fell 0.65% and were trading at $57.98 per barrel at 1:10 AM EST on December 4, 2017.

Will the Inventories Spread Impact US Crude Oil?

US commercial crude oil inventories fell by 1.9 MMbbls in the week ending November 17, 2017—0.5 MMbbls more than the market’s expected fall.

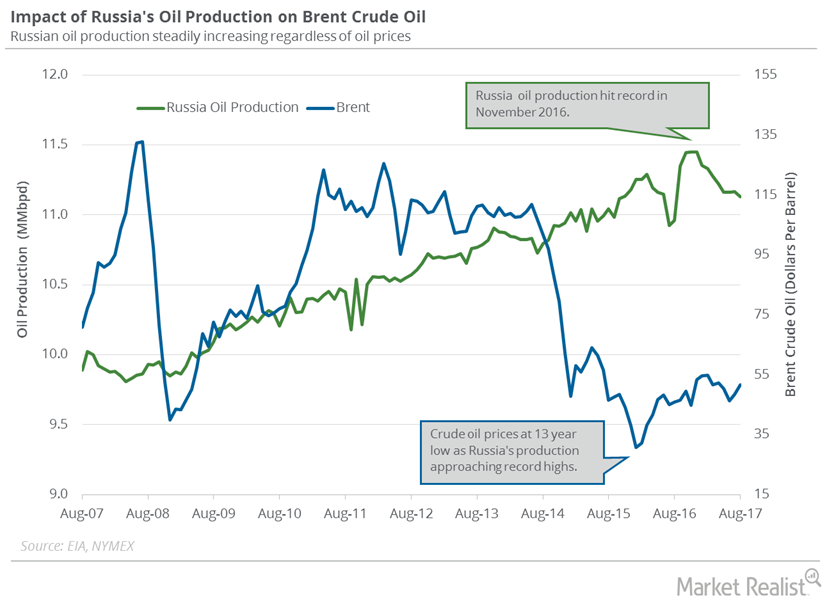

Russia’s Crude Oil Exports Could Pressure Oil Futures

Russia’s energy ministry estimates that the country’s crude oil exports rose 2% or by 160,000 bpd (barrel per day) in the first nine months of 2017.

US Gasoline Inventories Fell 18%, Bullish for Crude Oil

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell by 4,020,000 barrels to 212.8 MMbbls on October 20–27, 2017.

Massive Fall in US Gasoline Inventories Drove Gasoline Futures

The EIA reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017.

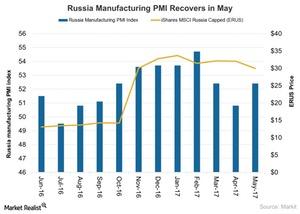

Russia’s Manufacturing PMI Improved Marginally in September

The final Russia Manufacturing PMI (Purchasing Managers’ Index) rose marginally in September 2017. It was 51.9 in September compared to 51.6 in August.

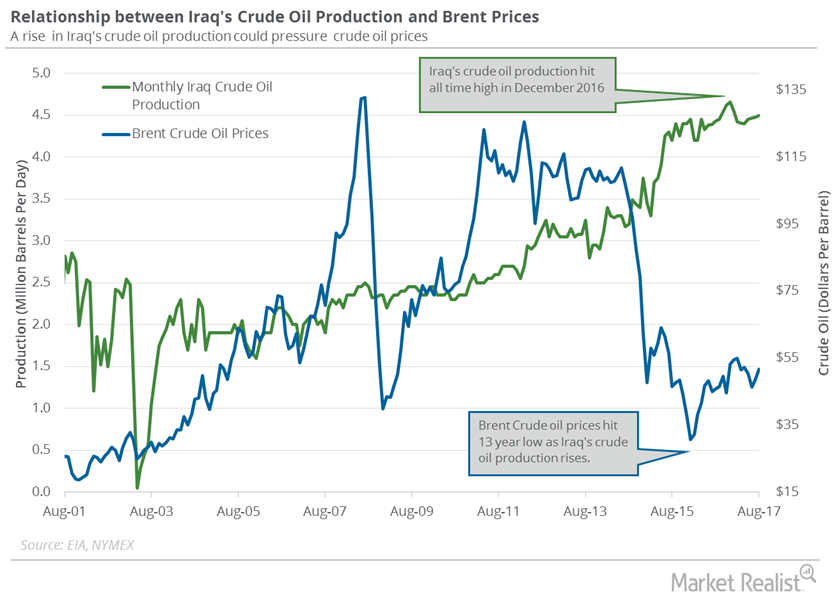

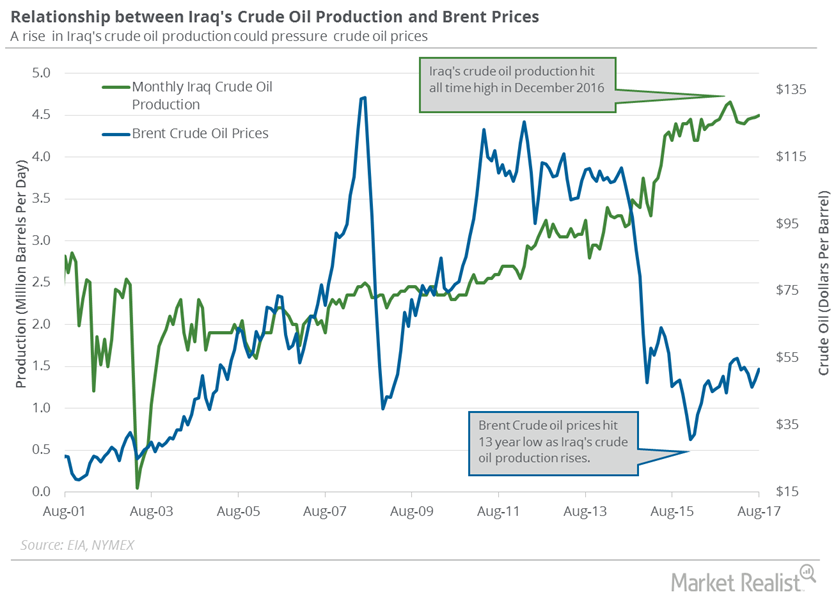

How Iran and Iraq’s Crude Oil Exports Could impact crude Oil Prices

Iraq’s crude oil exports hit 3.98 MMbpd (million barrels per day) in September 2017, according to Bloomberg—its highest level since December 2016.

Are US Gasoline Inventories a Pain for Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories rose by 1.6 MMbbls to 218.9 MMbbls on September 22–29, 2017.

Gasoline Inventories Could Pressure Crude Oil Prices

The API estimates that US gasoline inventories rose by 4.19 MMbbls on September 22–29, 2017. The market expected a build by 1.08 MMbbls.

Why Kurdish Regions Are Crucial for Iraq’s Crude Oil Exports

Iraq is the second-largest OPEC producer. The EIA (U.S. Energy Information Administration) estimates that Iraq’s crude oil production rose by 25,000 bpd (barrels per day) to 4,500,000 bpd in August 2017.

US Dollar Could Help Crude Oil Futures

The US Dollar Index fell 0.1% to 91.97 on September 22, 2017. However, the US dollar rose 0.7% on September 20, 2017, after the FOMC’s meeting.

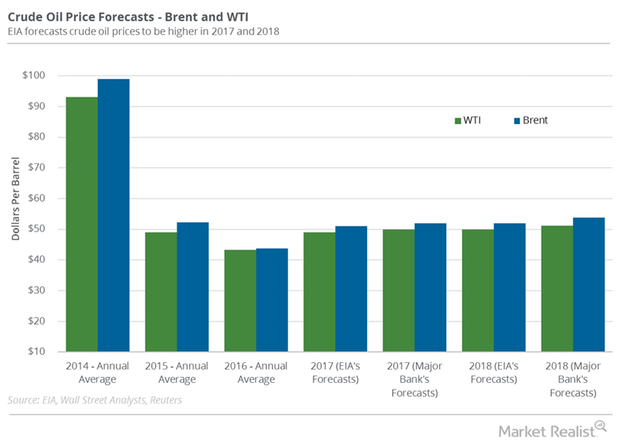

Will Major Oil Producers Extend the Output Cut Deal past March?

October WTI (West Texas Intermediate) crude oil (USO)(UCO)(DIG) futures contracts rose 0.16% and were trading at $49.98 per barrel in electronic trading at 2:10 AM EST on September 18.

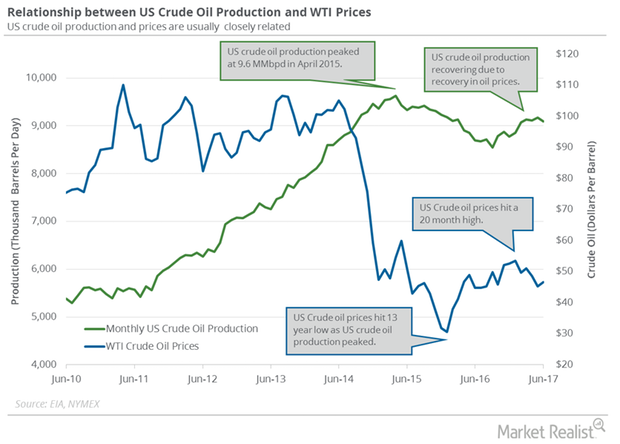

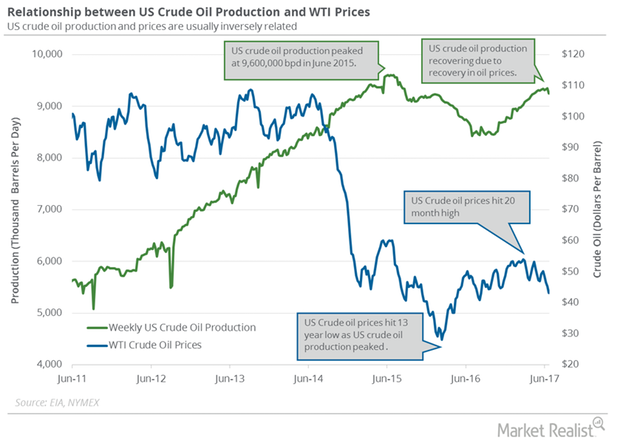

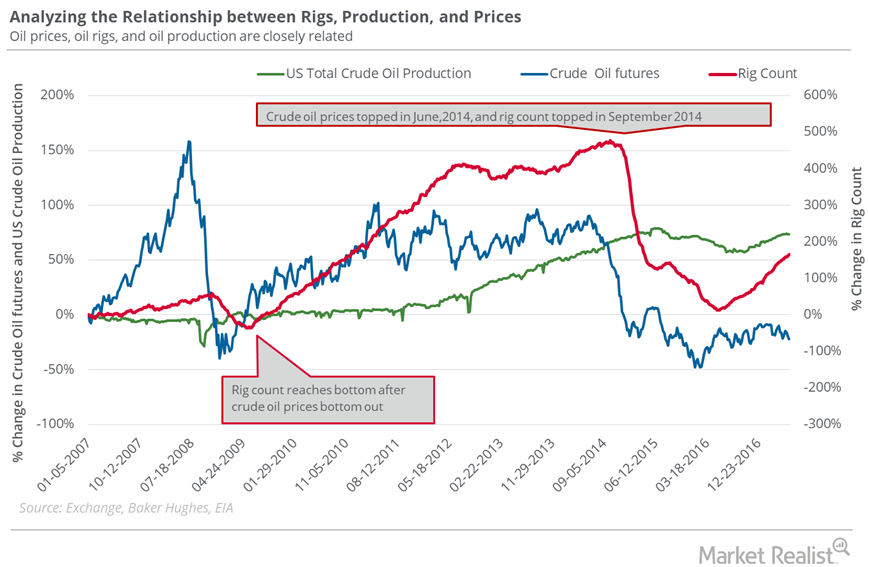

US Crude Oil Production Hit a 5-Month Low

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

Why Were Crude Oil Price Forecasts Downgraded Again?

A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

How Hurricane Harvey May Impact US Crude Oil Production

US crude oil production The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 2,000 bpd (barrels per day) to 9,530,000 bpd between August 18 and 25, 2017. Production rose 1,042,000 bpd, or 12.3%, from the same period in 2016. It has risen for three consecutive weeks to August 25, and has reached […]

US Gasoline Inventories Pressured Gasoline and Crude Oil Futures

The EIA reported that US gasoline inventories rose by 22,000 barrels or 0.1% to 231.1 MMbbls (million barrels) on August 4–11, 2017.

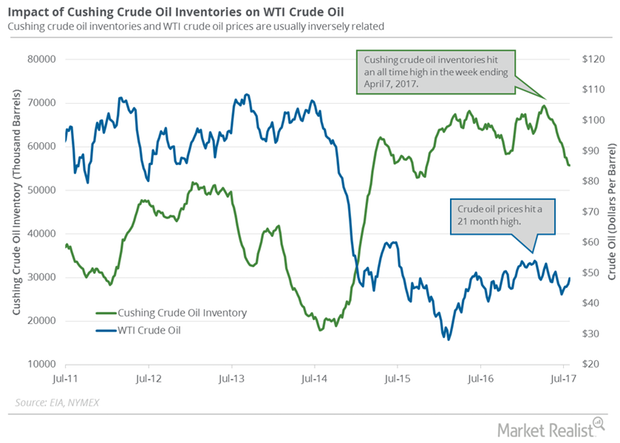

Cushing Inventories Fell 20% from the Peak

A preliminary market survey estimates that Cushing inventories fell on July 28–August 4, 2017. Inventories fell for the 11th consecutive week.

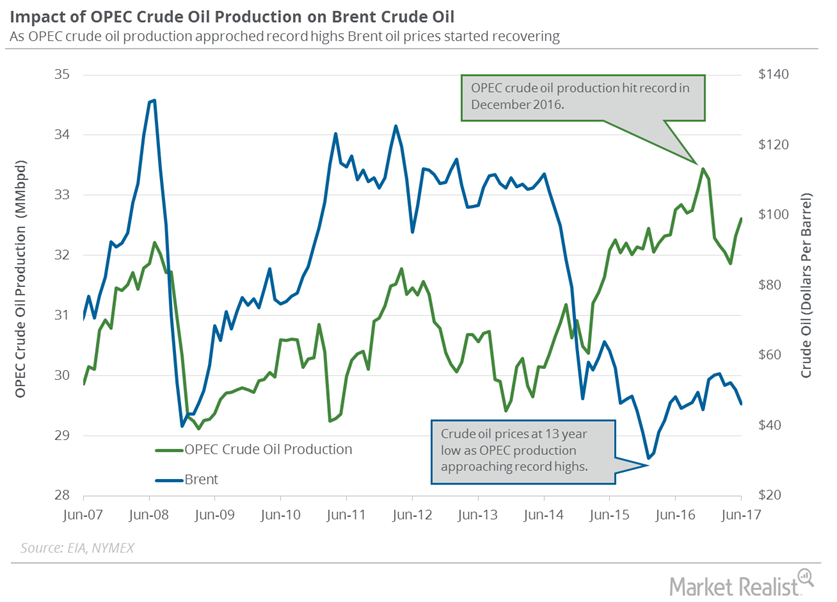

Problems for Crude Oil Bulls as OPEC Production Hits 2017 High

September US crude oil futures contracts rose 0.20% and were trading at $50.29 per barrel in electronic trading at 1:35 AM EST on August 1, 2017.

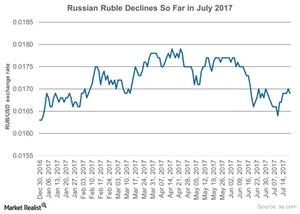

How Has the Ruble Performed in July 2017?

The Russian ruble (ERUS) tends to move in line with crude oil prices (USO) (UCO).

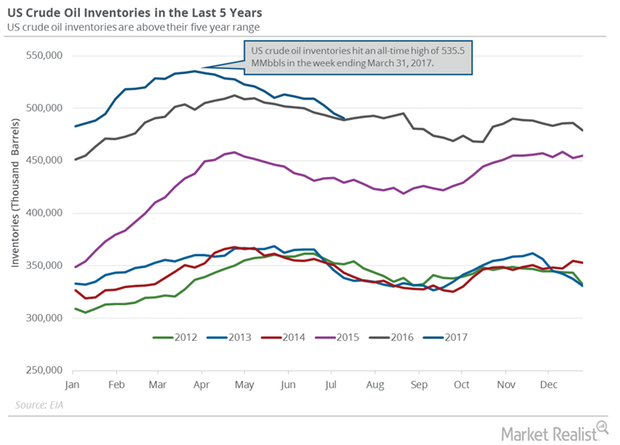

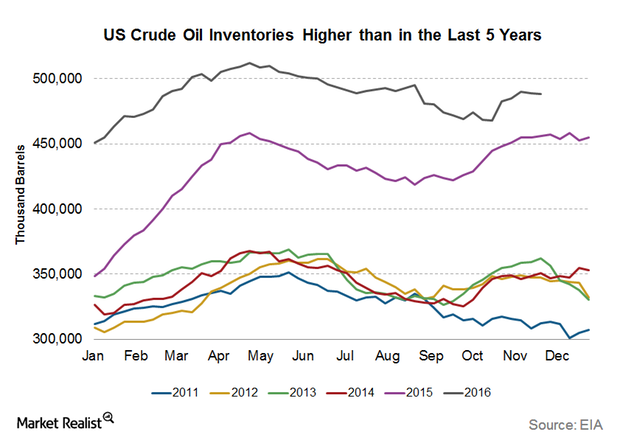

US Crude Oil Inventories Could Fall below the 5-Year Average

The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017.

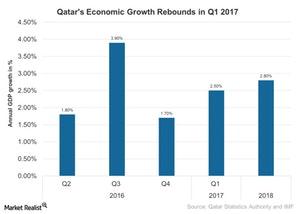

Understanding Qatar’s Resilience amid Sanctions

Qatar’s (QAT) economy continued to grow in 1Q17 amid improved oil prices since 2Q16. But more recently, oil prices have hit a downtrend.

US Crude Oil Production: Biggest Weekly Fall since July 2016

The EIA (U.S. Energy Information Administration) reported that US crude oil production fell by 100,000 bpd to 9,250,000 bpd on June 16–23, 2017.

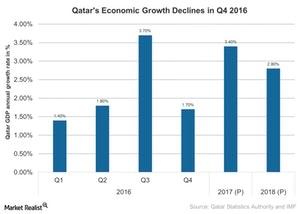

Will Qatar’s Economic Growth Continue to Fall amid the Crisis?

Qatar was expected to grow at a faster pace in 2017. However, economic sanctions by its neighbors are expected to impact its economic activity in 2017.

Rising Oil Rigs: Oil Bears’ Friend, Oil Bulls’ Foe

In the week ended June 16, 2017, the US oil rig count was 747, its highest level since the week ended April 17, 2015.

Is Russia’s Manufacturing Activity Back on Track in May 2017?

The Markit Russia manufacturing PMI increased to 52.4 in May 2017 compared to 50.8 in April 2017.

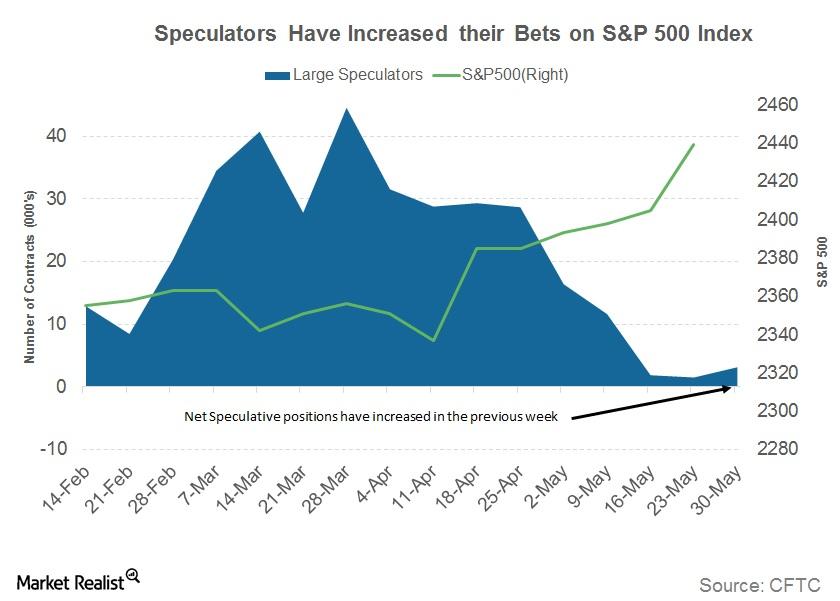

Can the S&P 500 Index Keep Rallying amid Slow Job Growth?

SPY recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week.

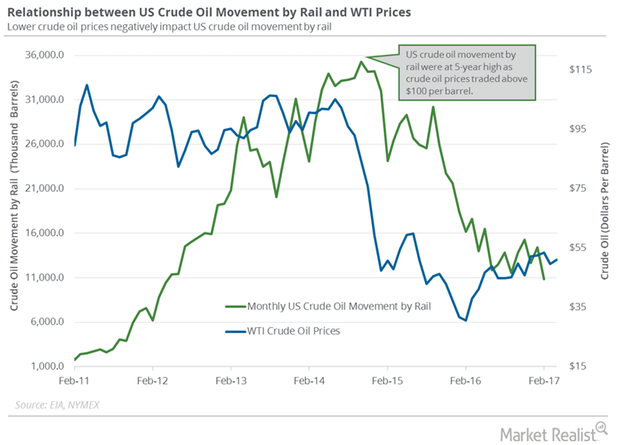

How Did Crude Oil Movement by Rail Trend in February 2017?

The US Energy Information Administration estimates that US crude oil movement by rail fell by 3,546,000 barrels to 10,850,000 barrels in February 2017.

Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

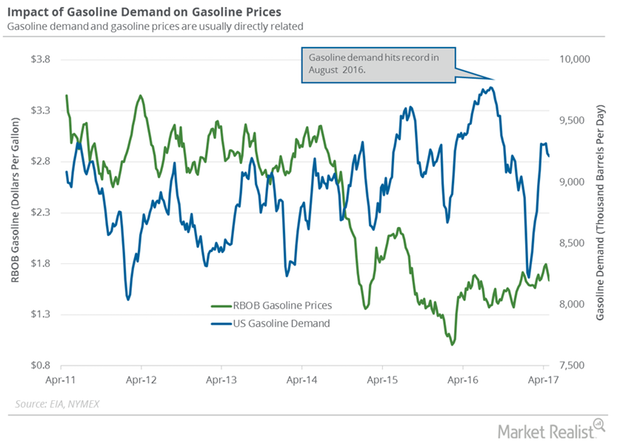

Is US Gasoline Demand Turning Bearish?

The EIA estimated that four-week average US gasoline demand fell by 22,000 bpd (barrels per day) to 9,215,000 bpd on April 21–28, 2017.

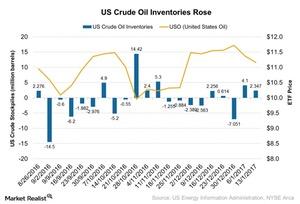

How Will Rise in Crude Oil Inventories Affect Crude Oil Movement?

According to the EIA’s (US Energy Information Administration) report on January 18, 2017, US crude oil inventories rose ~2.35 MMbbls (million barrels) for the week ended January 13, 2017.

US Crude Oil Inventories Supported Crude Oil Prices

The EIA (U.S. Energy Information Administration) reported that US crude oil inventories fell by 884,000 barrels to 488.1 MMbbls from November 18–25, 2016.

How OPEC’s Decision Will Impact Crude Oil’s Movement

According to the EIA’s (U.S. Energy Information Administration) report on September 14, 2016, US crude oil inventories fell 0.6 MMbbls (million barrels) for the week ending September 9.

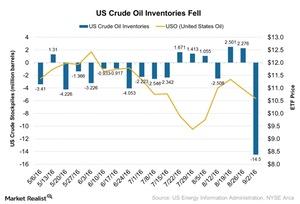

Crude Oil Prices Jumped as Inventories Fell

According to the EIA’s report on September 8, 2016, US crude oil inventories fell by 14.5 MMbbls for the week ended on September 2, 2016.