Will the Inventories Spread Impact US Crude Oil?

US commercial crude oil inventories fell by 1.9 MMbbls in the week ending November 17, 2017—0.5 MMbbls more than the market’s expected fall.

Nov. 29 2017, Updated 9:55 a.m. ET

Inventory data

US commercial crude oil inventories fell by 1.9 MMbbls (million barrels) in the week ending November 17, 2017. The fall was 0.5 MMbbls more than the market’s expected fall. In the same week, US crude oil stockpiles were at 457.1 MMbbls. The EIA (U.S. Energy Information Administration) released the data on November 22. On that day, US crude oil prices rose 2.1%.

Inventories and their five-year average

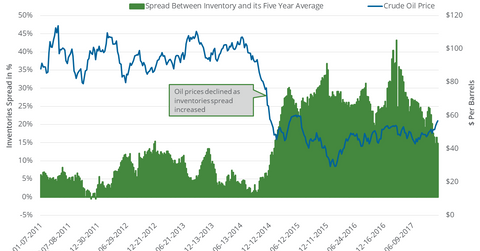

The spread between US commercial crude oil inventories and their five-year average or the “inventories spread” might be a concern for oil (UCO) (BNO) prices. If the inventories spread increases, we could see a fall in oil prices and vice versa.

In the week ending November 17, the inventories spread was 14.3%—50 basis points less than the week ending November 10. US crude oil prices fell 0.1% from November 22, 2017, to date.

Forecast

US commercial crude oil stockpiles could fall by 2.5 MMbbls—based on market expectations. However, the American Petroleum Institute reported a rise of ~1.8 MMbbls in oil inventories. If the EIA reports a similar rise, it would exceed the ~0.6 MMbbls rise and the inventories spread would remain at a constant level. So, a possible rise in the inventories spread might prevent oil (DBO) (OIIL) (USL) prices from making a new 2017 high. The EIA will release its oil inventory data on November 29, 2017.