iShares 20+ Year Treasury Bond

Latest iShares 20+ Year Treasury Bond News and Updates

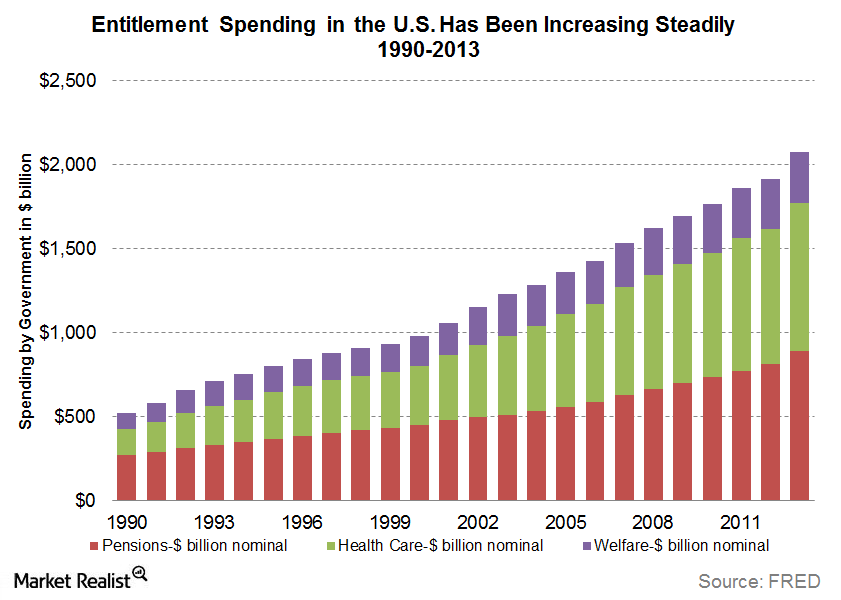

How Can Changing Demographics Impact Investors?

Changing demographics impact investors in many ways. The demand for bonds could increase, putting downward pressure on yields.

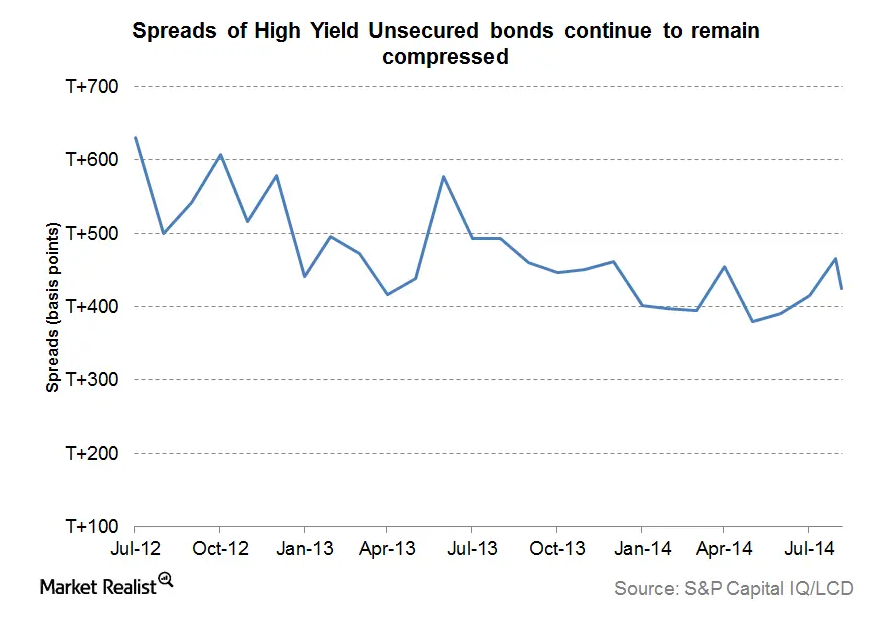

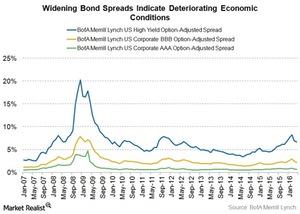

Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

Why investors are preferring high-quality debt

High-quality bonds can be an investor refuge when there’s market volatility. These securities provide relatively stable cash flows. The default probability is low.

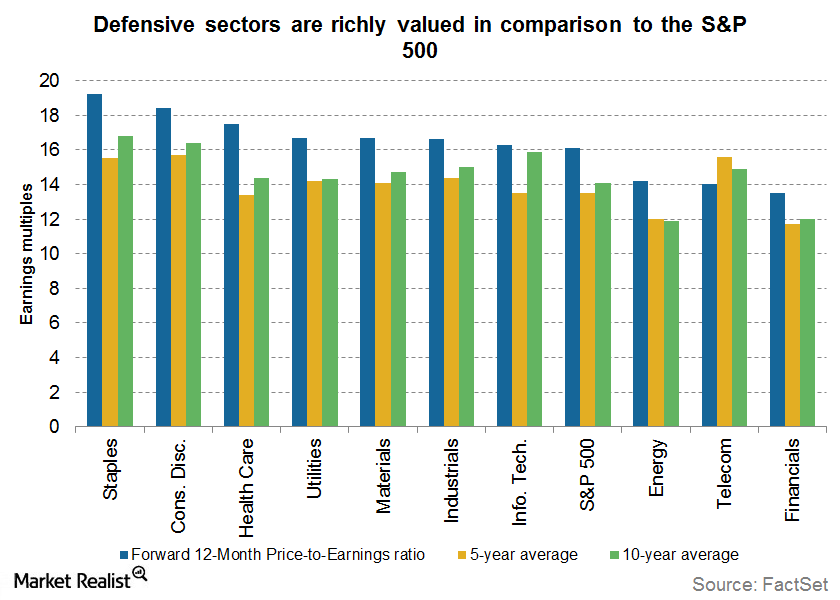

Investors Should Avoid Defensive Sectors If Rates Rise

Valuations are at the higher end of their historical range. Investors should avoid defensive sectors, which are highly sensitive to interest rate changes.

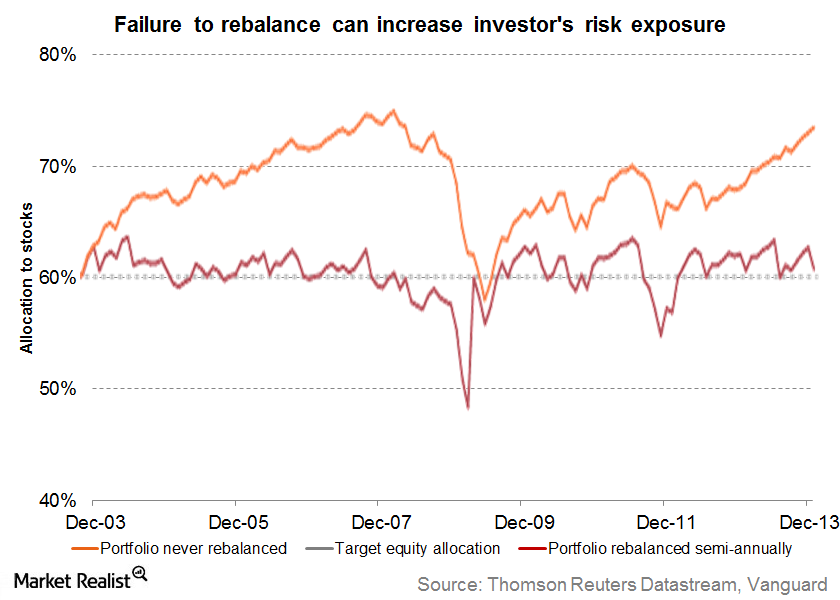

The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.

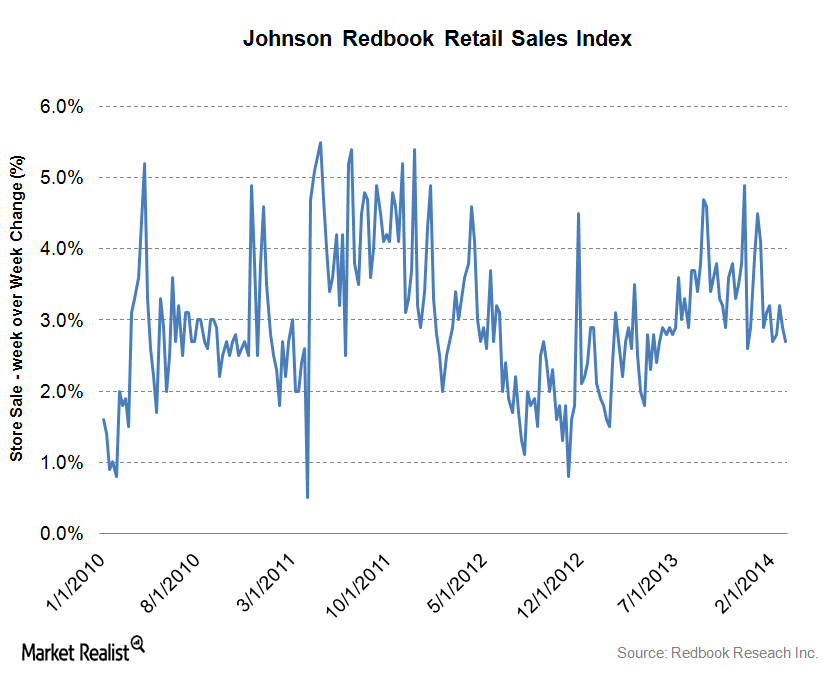

Must-know update: Redbook Index same-store sales data released

The Redbook Index released the same-store weekly data on Tuesday, March 11, 2014.

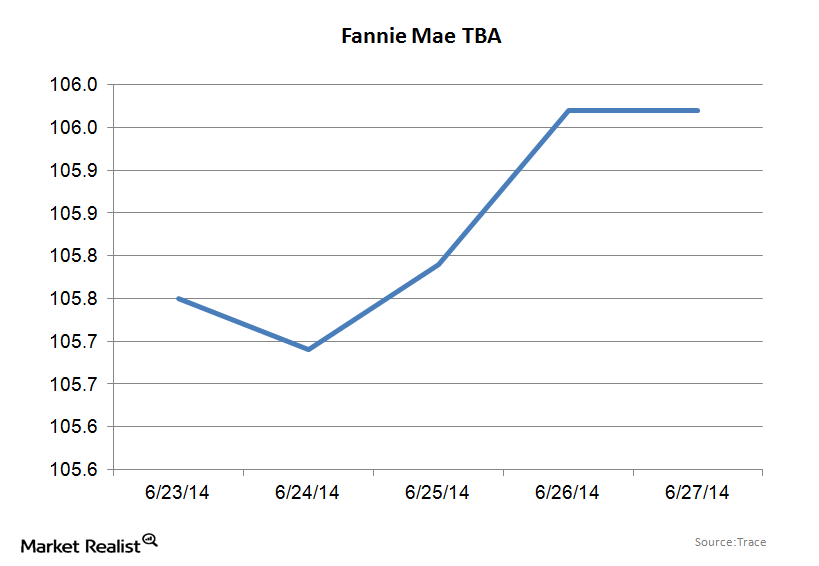

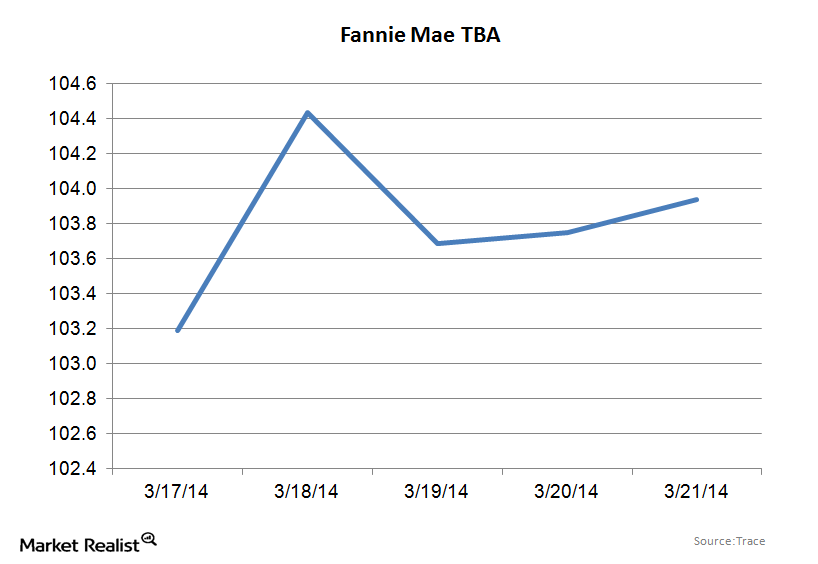

Why Fannie Mae securities rallied with bonds about 1/4

The main action driving TBAs specifically seems to be out of Washington, between the Fed purchases and the government’s policies to drive origination.

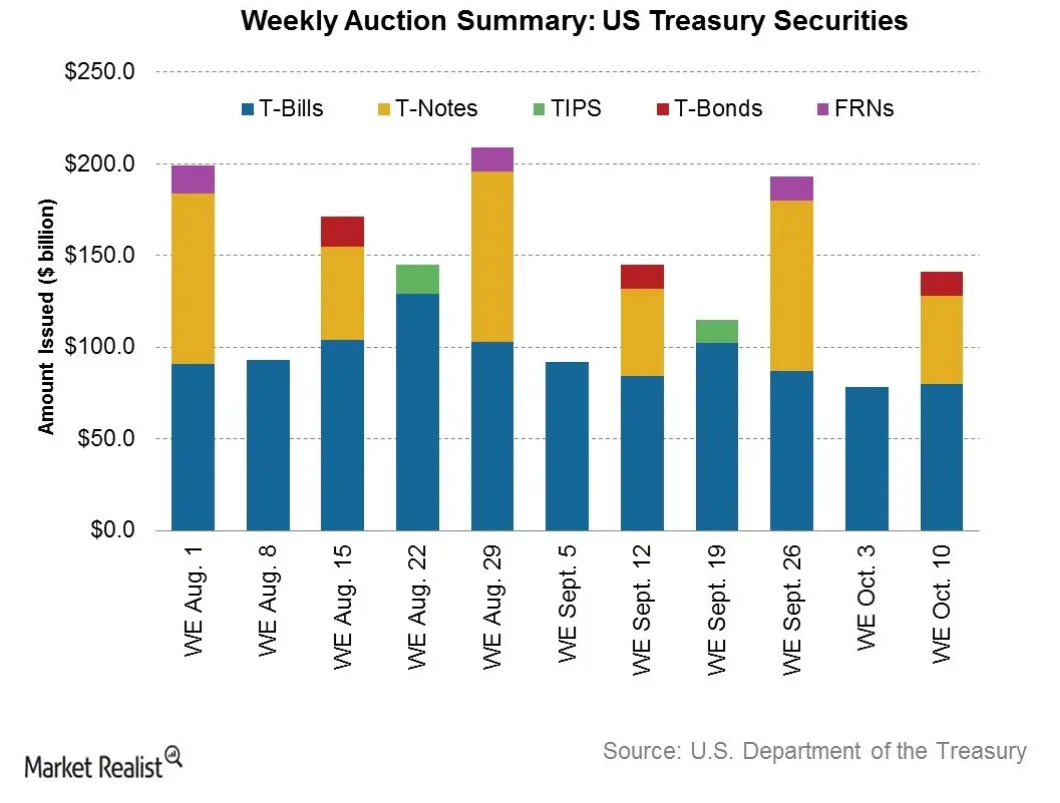

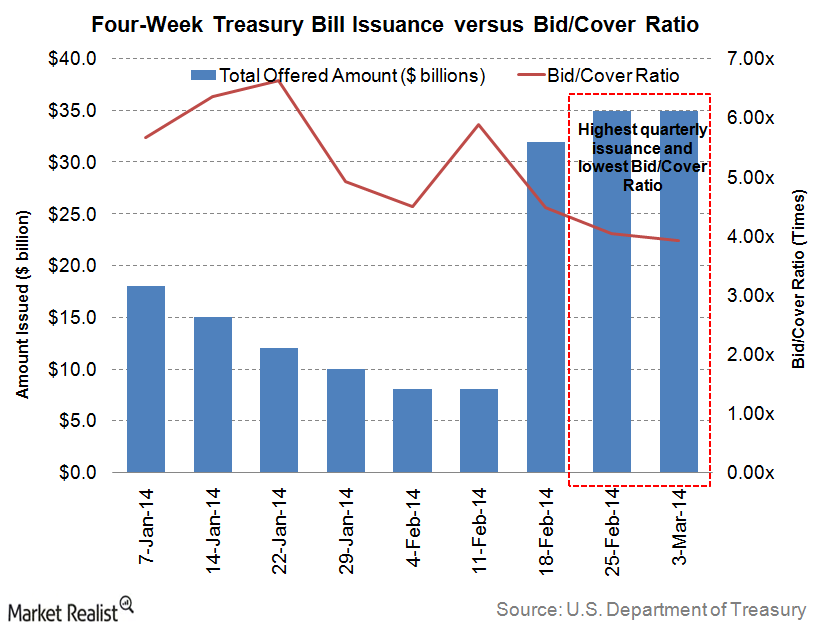

The demand for 4-week Treasury bills remained subdued last week

A considerable amount of $35 billion was offered for the weekly four-week T-bills auctioned on Tuesday, March 4, 2014.

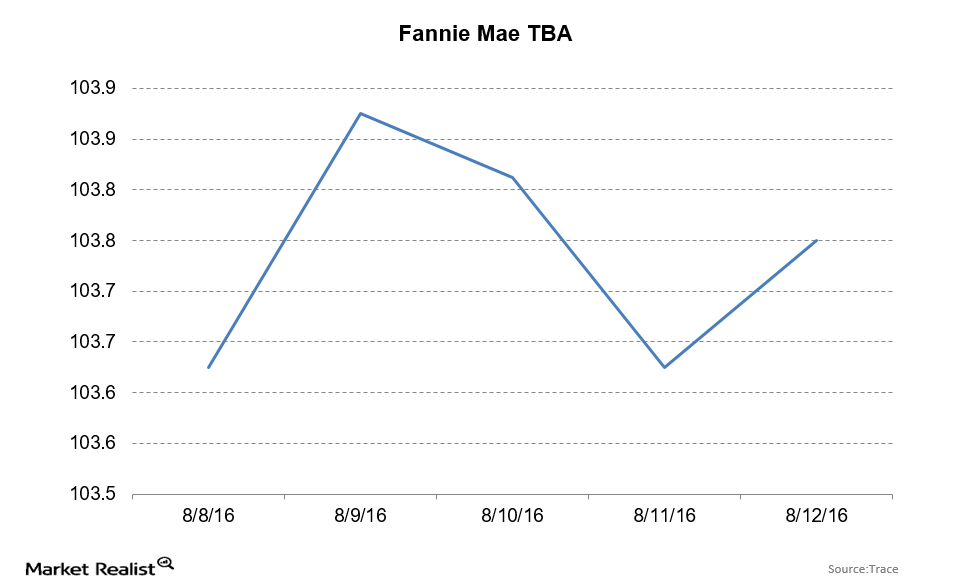

Fannie Mae TBAs Rise with the Bond Market

For the week ending August 12, 2016, Fannie Mae TBAs ended at 103 24/32—up 4 ticks for the week. The ten-year bond yield fell by 8 basis points to 1.51%.

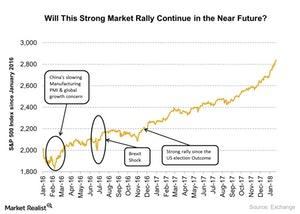

Miller: Bond Bear Market to ‘Propel Stocks Significantly Higher’

Legendary value investor Bill Miller has an optimistic view on the equity market.Must-know: Why the Fed drove up emerging market asset prices

Many economists, like the Nobel Prize–winning Paul Krugman, believe that the Fed acted as a “white knight” in 2008, saving the global economy in the dire aftermath of the financial crisis.

The Tails Of The Yield Curve May Provide Value

The tails of the yield curve may provide more value due to low inflation.

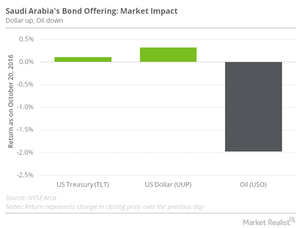

Saudi Arabia Enters International Bond Market, Raises $17.5 Billion

On October 20, the government of Saudi Arabia raised about $17.5 billion in an international bond issuance, marking the emerging market’s first foray into the international bond market.

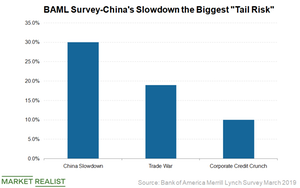

Markets Look at US-China Trade Talks as Slowdown Concerns Multiply

Today, another round of trade talks started in Beijing.

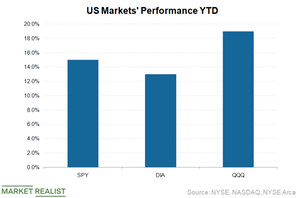

Strong Economy and a Rate Cut: Can Trump Have It Both Ways?

Today, President Donald Trump told reporters, “Our country’s doing unbelievably well economically.”

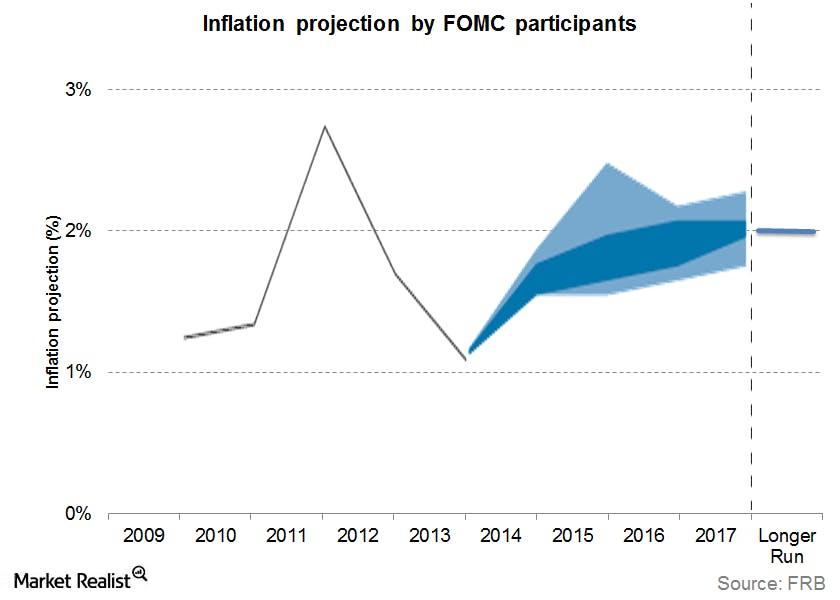

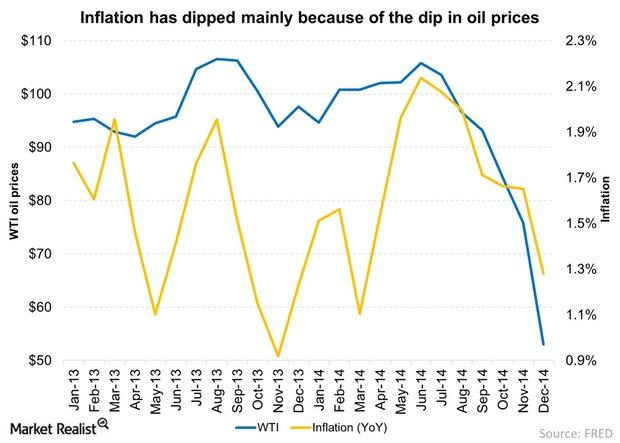

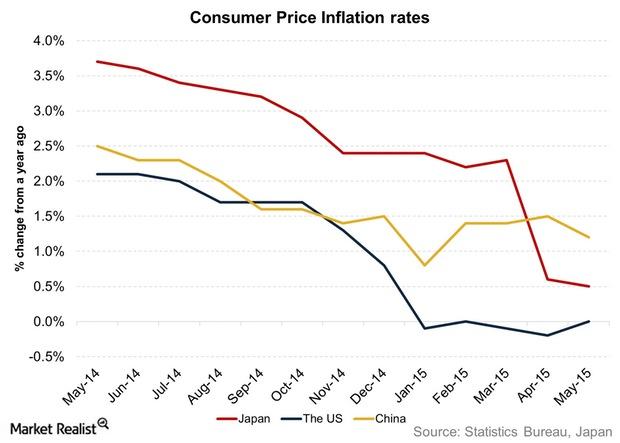

Key for Investors: Understanding Inflation and Its Implications

Inflation represents a rise in the general price level in a country or region. The higher the inflation, the lower the quantum of a particular good that can be purchased.Financials Bank of Japan announces QQE2, expanded monetary stimulus

At its monetary policy meeting held on October 31, the Bank of Japan (or BOJ) announced new stimulus measures. The measures come in addition to those it announced earlier.

Ray Dalio: The Next Downturn May Be a Difficult One to Reverse

“The next downturn may be a difficult one for central banks to reverse,” warned Ray Dalio, CEO of the world’s largest hedge fund.

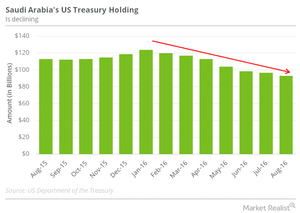

How Saudi Arabia’s Bond Sale Affects US Treasury Bonds

Saudi Arabia has also been involved in the sale of US Treasuries. The country is the 15th-largest holder of US Treasury bonds in the world.

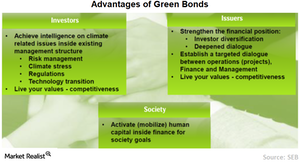

How Green Bonds Can Help Diversify Investor Base

Even if we assume that green bonds don’t offer any significant premium over conventional bonds, there are many who believe in other noteworthy advantages of green investing.

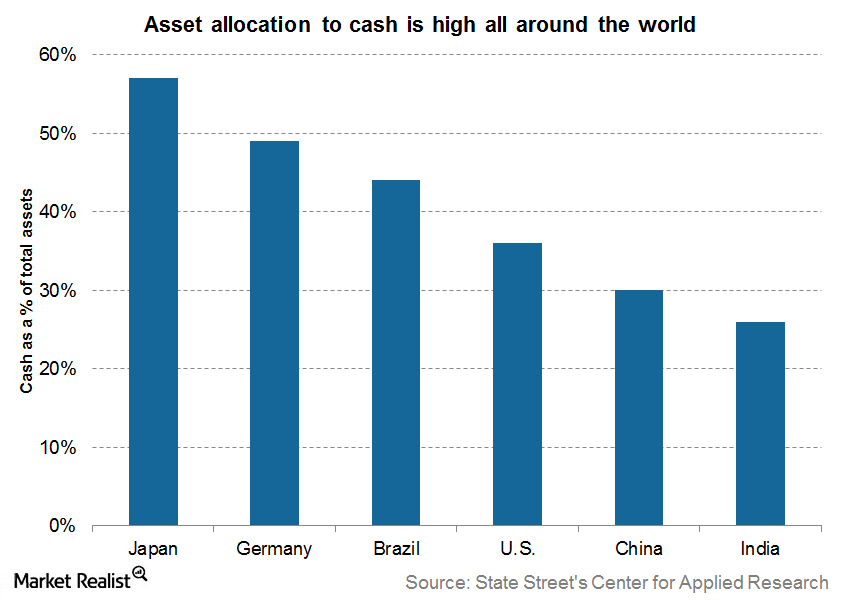

What Should Be The “Right Amount” of Cash Allocation?

If you’re preparing your portfolio for the short term, the allocation to cash should be high. As the horizon increases, allocation to cash should go down.

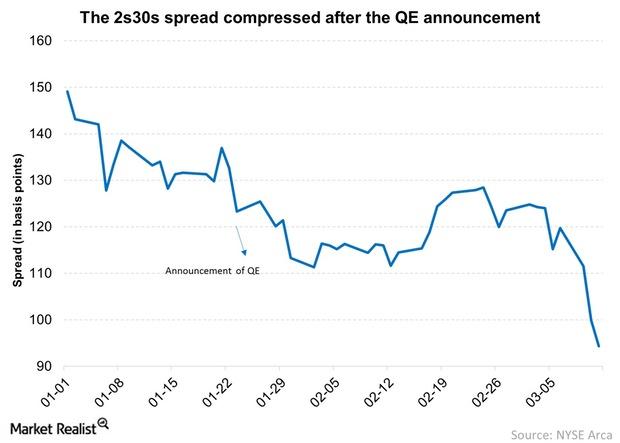

Why Did the German 2s30s Spread Dip on Quantitative Easing?

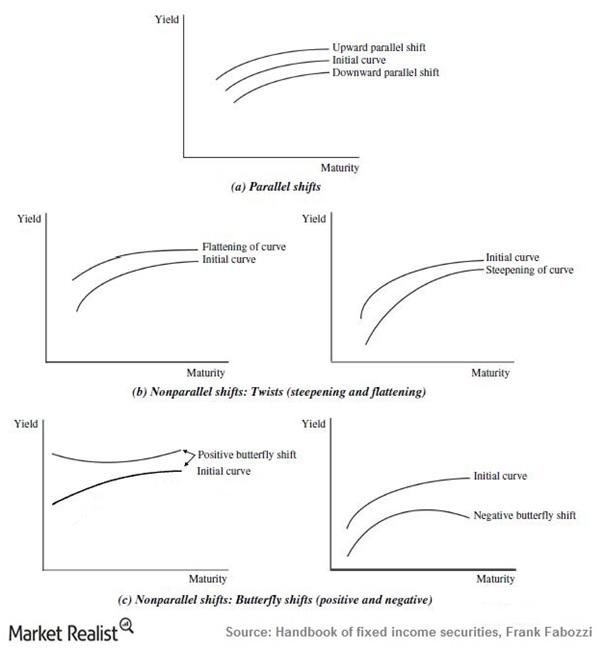

The 2s30s spread is the difference between the yield on the 30-year bond (TLT) and the yield on the two-year bond (SHY).

When The Net Asset Value Of A Bond ETF Differs From Market Price

The Intraday Indicative Value gives us a more real-time value than the bond ETF’s NAV. It’s considered an implied value of an ETF.

Fannie Mae TBA securities shrug off the March FOMC meeting

Given that another $10 billion in tapering was already priced in, TBAs didn’t react to the FOMC meeting. MBS spreads tightened as MBS rallied in the face of a bond market sell-off.Financials Key differences between PCE and CPI as inflation measures

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.Financials Why unemployment data moves bond yields

Private and government construction both reported declines. The construction value chain has a multiplier effect on other sectors of the economy, and can significantly impact both stock and bond markets.

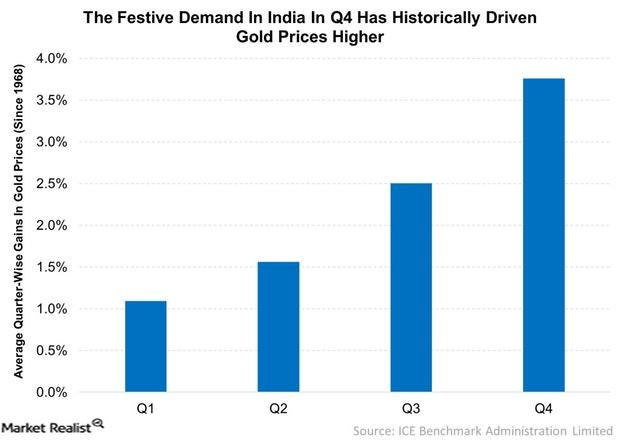

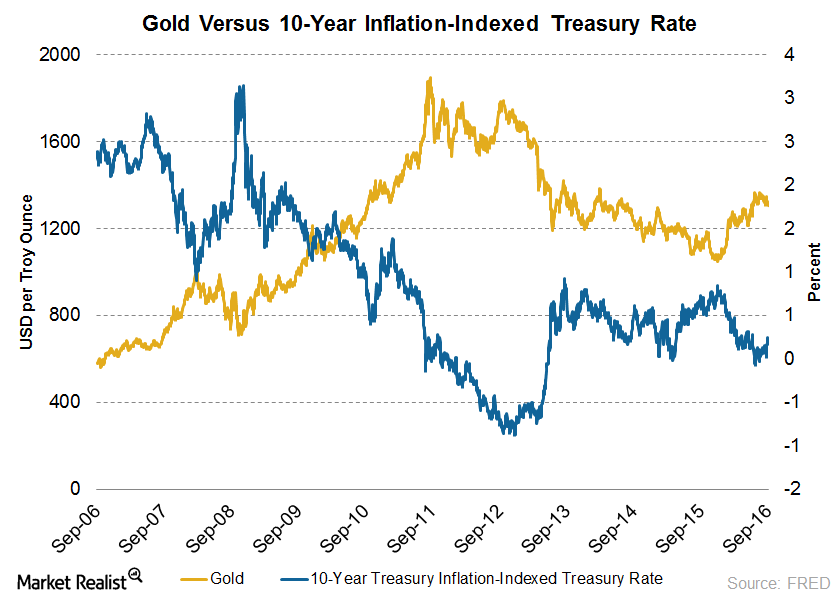

Gold Prices Could Test $1,300

Gold prices tend to rise in the fourth quarter of the calendar year. Gold prices have gained an unannualized ~3.8% in the fourth quarter.

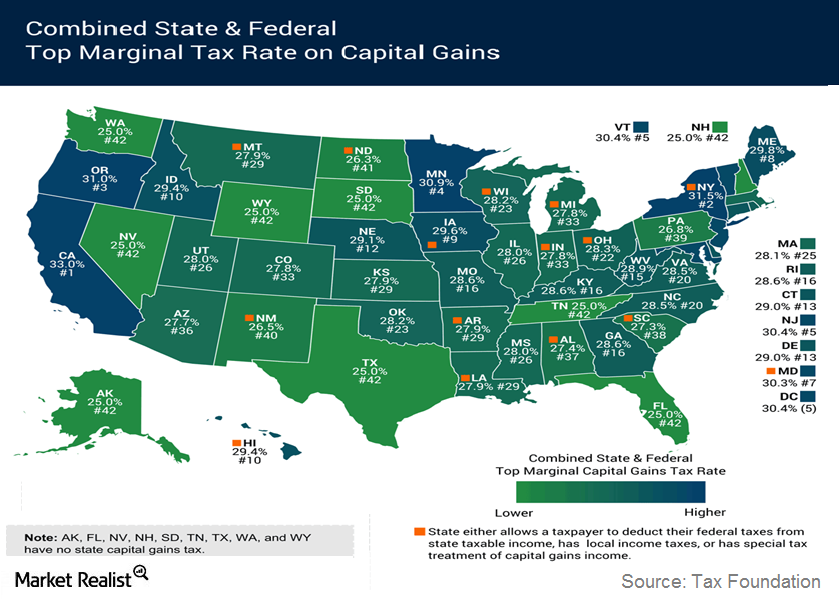

Basics About The Capital Gains Tax

The rates for capital gains tax depend on the asset’s holding period. If the holding period is less than one year, short-term capital gains tax is payable.Why US inflation data is important and how we measure it

U.S. inflation is not just a measure of growth and price pressure in the U.S. economy. It has more far-reaching consequences.

The Difference between Corporate Bonds and Treasuries

Bond investors should understand the difference between Corporate Bonds and Treasuries. Below is a list of the key differences between the two.

Gold versus 10-Year Treasury Bonds

The negative interest policy of the central banks is casting government bonds as a futile choice for investors compared to stocks and gold. As a result, bond prices dipped and yields started rising.Financials Hawks and doves: Why Fed-watching isn’t for the birds

The FOMC is made up of hawks and doves, and their balance could affect future policy. Investors who follow the Fed need be able to tell the differences.Financials How bond prices, interest rates, and credit spreads correlate

Bond prices and interest rates have an inverse relationship. If an interest rate increases, the price on a bond declines, and vice versa.Financials Why do floating rate notes, or FRNs, differ from regular bonds?

The U.S. Treasury Department’s latest issue on January 29, the floating rate note (or FRN) will fulfill two investor needs: participating in anticipated future interest rates increases and protecting principal against default.Financials Why investors should look at floating rate notes as an option

On January 29, 2014, the U.S. Treasury Department issued a new class of security: the floating rate note (or FRN). This is the first new security introduced by the Treasury since 1997.Financials Why credit upgrades and downgrades affect bond returns

A ratings upgrade or downgrade has a direct impact on fixed income yields, and therefore directly affects bond prices.Financials Why the yield curve impacts bank profitability

Historically, a flatter yield curve had an adverse impact on the financial institutions’ returns. It lowered their net interest margins. The Fed continues to stress an accommodative monetary policy. The policy and strong overseas demand have kept yields low at the long end of the curve. As a result, the difference between 30-year and five-year Treasury yields fell to 154 basis points on September 5, 2014.Financials Overview: Investment-grade bond ETFs

U.S. investment-grade bonds can provide investors with a safe and steady income stream. They’re issued by the U.S. Department of the Treasury and corporates. The issuers have a very high ability to service the debt issued. There’s little risk of default.Financials Why Treasury auctions impact investors and financial markets

The purpose of Treasury auctions is to obtain financing from markets at the most competitive cost. The yield on these securities is determined through a public auction process. These yields affect the secondary market for U.S. Treasuries. Yields and bond prices move in opposite directions.

What Do Widening Bond Spreads Indicate?

Widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, credit risk related to their bonds rises.Financials Must-know: The difference between high-yield and leveraged loans

Historically, high-yield securities have outperformed investment grade securities in good times and vice versa in hard times.

Why investors should follow shifts and twists in the yield curve

Yields on bonds don’t remain constant. When they change by the same magnitude across maturities, we call the change a “parallel shift.”Financials Key takeaways: Why is the yield curve normally upward-sloping?

In normal conditions, the yield curve is upward-sloping. As bonds pay only interest (the coupon) until maturity and pay face value at maturity, investors take longer to recover their principal.

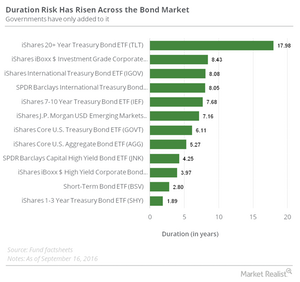

Investors Beware: Duration Risk Has Risen across the Bond Market

If you’re a bond (BSV) (AGG) investor or fund manager, fluctuation in interest rates is one of the key risk drivers for the returns you get from your portfolio.Financials Must-know: Why expense ratios have affected TLT and MUB

We note that net or effective returns (that is, returns after expenses) fall to 7.95% versus perceived returns of 8.44% for TLT for the past three years.

Knowing the Treasury discount rate and yields before investing

Investors can take an informed decision by knowing the rate of return on their investment.Financials Why do floating rate notes, or FRNs, differ from leveraged loans?

FRNs are usually issued in capital markets, whereas leveraged loans are arranged by commercial and investment banks. While FRNs are typically unsecured and investment-grade, leveraged loans are secured.Financials Richard Fisher explains why excess reserves can create velocity

Richard Fisher also discussed the impact of quantitative easing (or QE) on excess reserve balances held by depository institutions at his speech at the London School of Economics on Monday, March 24.

How do interest rate expectations impact financial markets?

The inflation and interest rate expectations of consumers and firms are important variables determining bond prices.

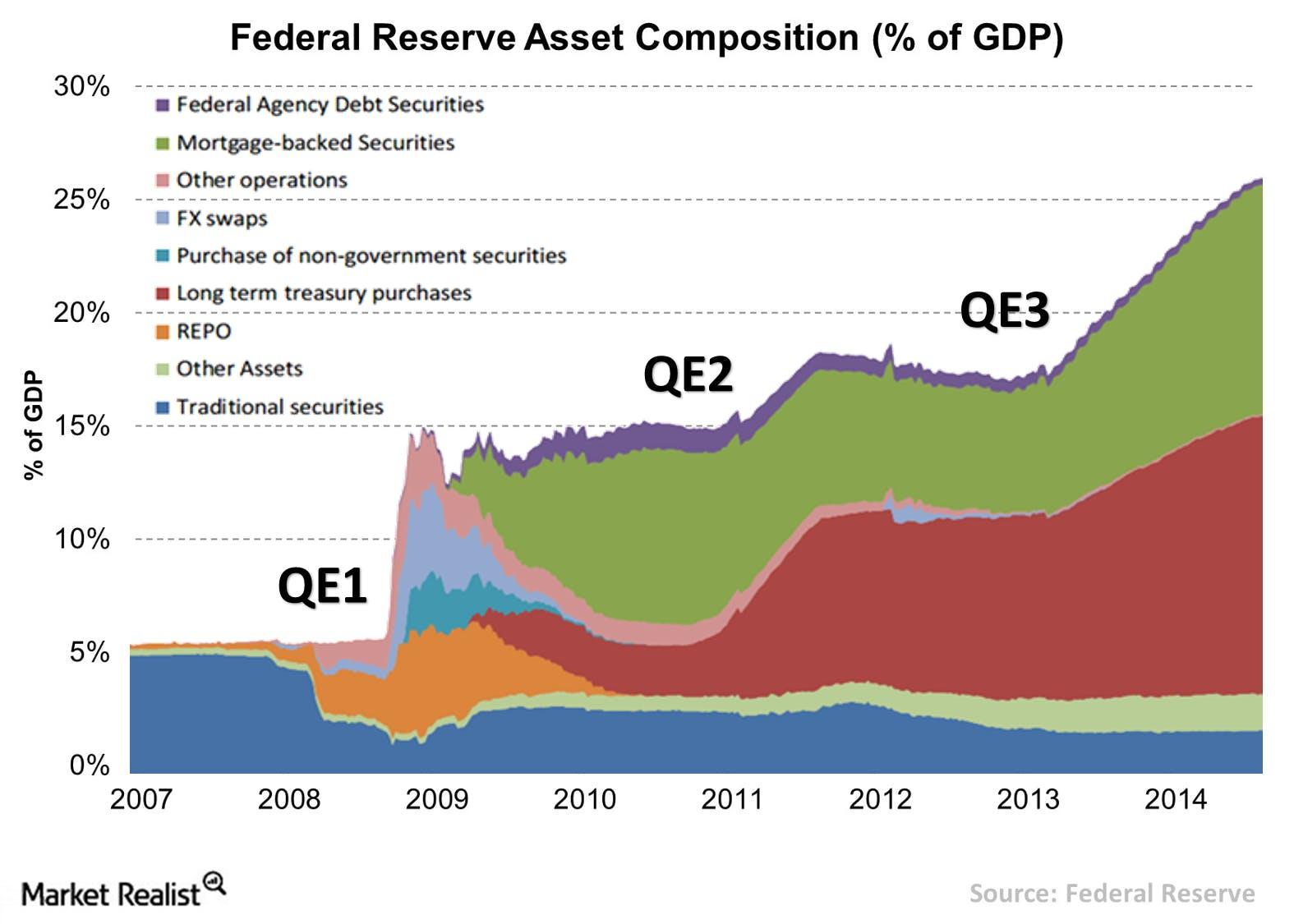

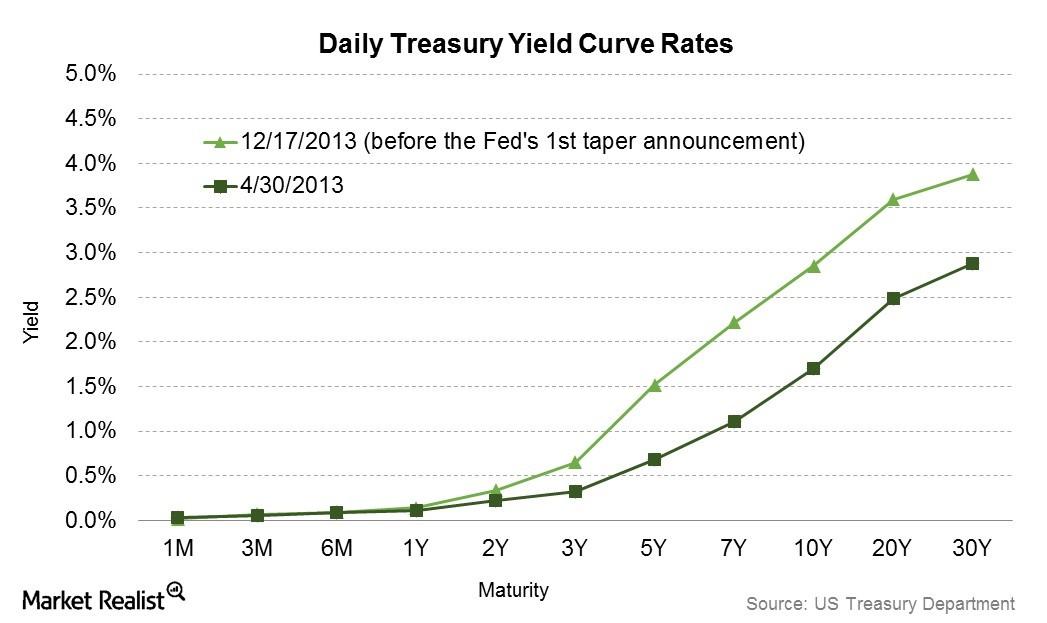

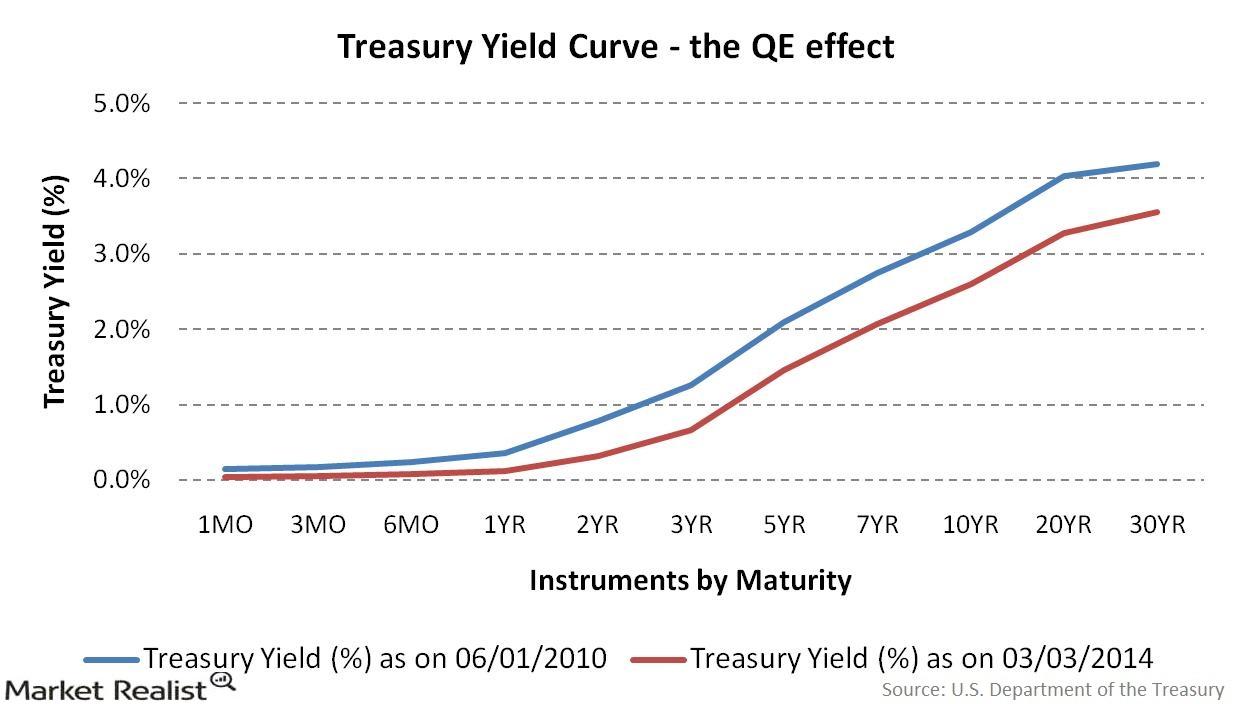

The Fed taper: How quantitative easing affects the yield curve

QE is an unconventional form of monetary easing—the Fed’s way of putting in more money into circulation in the economy.