Molson Coors Brewing Co

Latest Molson Coors Brewing Co News and Updates

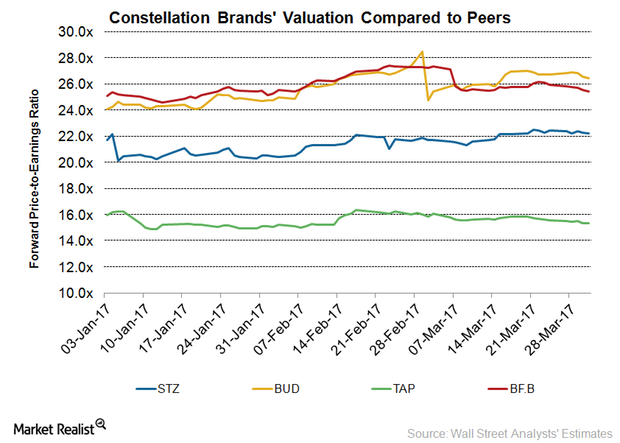

Where STZ’s Valuation Stands Prior to Its Fiscal 4Q16 Results

On March 31, 2017, Constellation Brands (STZ) was trading at a 12-month forward PE (price-to-earnings multiple) of 22.2x.

Cannabis 3.0: Is It on the Horizon?

On October 17, Cannabis 2.0 legalized edibles, beverages, and concentrates in Canada. As the country waits for the benefits, is Cannabis 3.0 next?

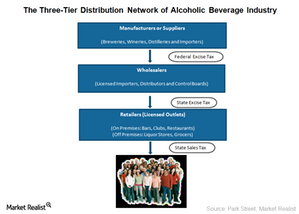

Alcoholic Beverage Industry Is Reluctant to Embrace E-Commerce

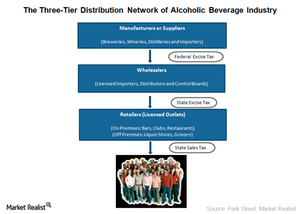

Manufacturers in the alcoholic beverage industry can’t sell directly to consumers due to a three-tier distribution system. This discourages them from having their own e-commerce channels.

Cannabis 2.0: Aurora Cannabis Gears Up for Edibles Market

Cannabis 2.0 legalization will take place in Canada next month. Cannabis players are gearing up to expand in the edibles market.

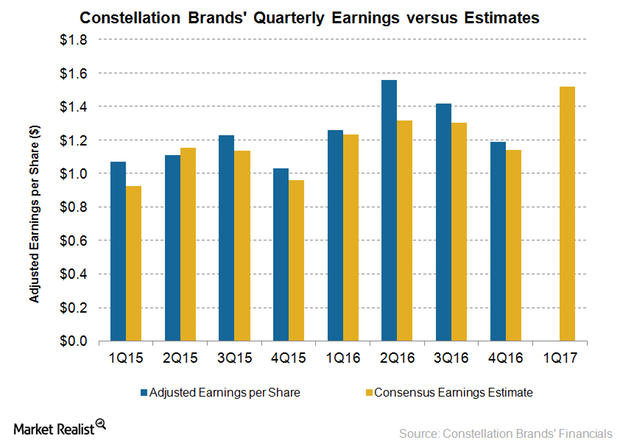

Will Constellation Brands’ Fiscal 1Q17 Earnings Beat Estimates?

For fiscal 1Q17, analysts expect Constellation Brands to deliver adjusted EPS (earnings per share) of $1.52.

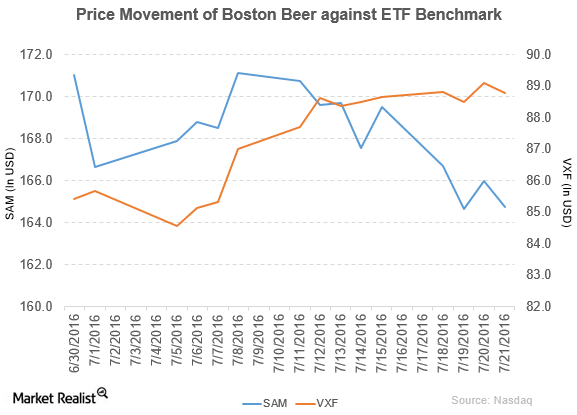

How Did Boston Beer Perform in 2Q16?

Boston Beer reported fiscal 2Q16 net revenue of $244.8 million, a fall of 2.9% compared to net revenue of $252.2 million in fiscal 2Q15.

Why Constellation Brands Has Fallen More than 12% Today

On January 9, Constellation Brands (STZ) reported its third-quarter results before the market opened. The third quarter ended on November 30.

Constellation Brands Ends Fiscal 2020 with Strong Q4 Earnings

Constellation Brands ended fiscal 2020 on a strong note with better-than-expected fourth-quarter results. The company reported sales of $1.90 billion.

Boston Beer Company: An introduction to better beer business

Boston Beer Company Inc. (SAM) is the largest craft brewer in the United States, having sold ~2.7 million barrels of proprietary core brand products.

How Constellation Brands Looks after Strong Fiscal 4Q18 Results

On April 3, Constellation Brands (STZ) declined 1.3% after Stifel downgraded its rating on the stock.

How Did Boston Beer Perform in 3Q16?

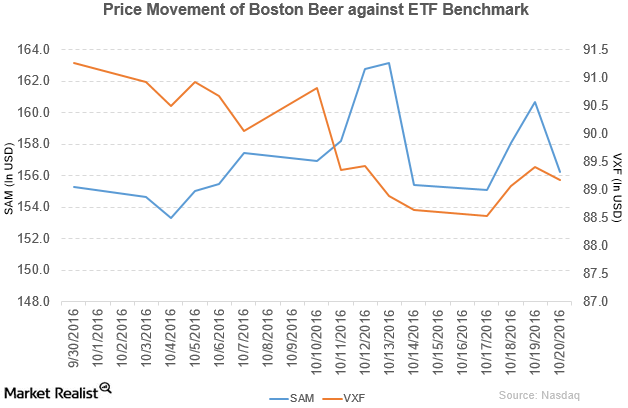

Boston Beer (SAM) has a market cap of $2.0 billion. It fell 2.7% to close at $156.25 per share on October 20, 2016.

Berenberg Downgrades Boston Beer to ‘Sell’

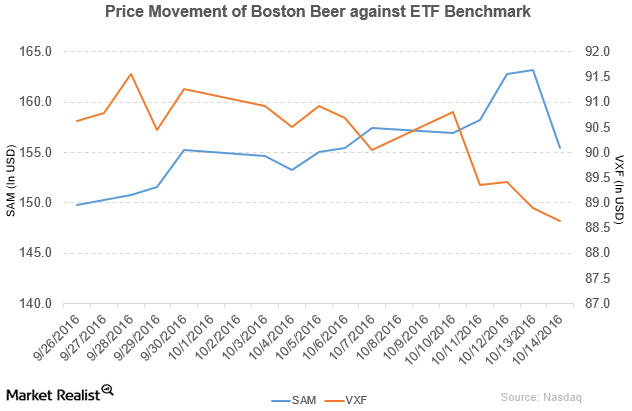

Price movement Boston Beer (SAM) has a market cap of $1.9 billion. It fell 4.8% to close at $155.41 per share on October 14, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.3%, -5.5%, and -23.0%, respectively, on the same day. SAM is trading 0.16% above its 20-day moving average, 9.5% […]

Investing in STZ for Earnings Growth Is Becoming a No-Brainer

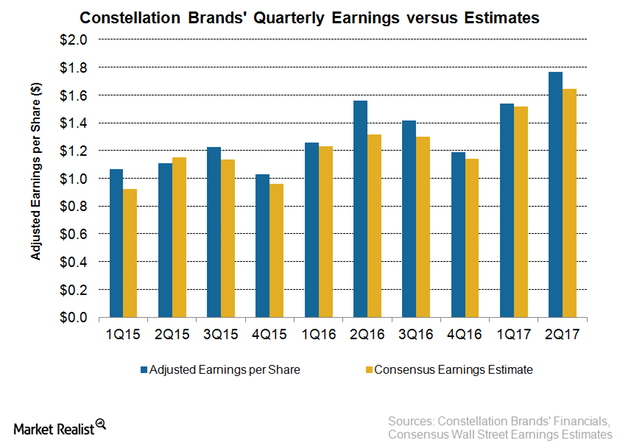

Constellation Brands (STZ) impressed investors with another quarter of strong earnings and sales growth in fiscal 2Q17. The beer, wine, and spirits producer beat the analysts’ earnings estimate for the eighth straight quarter.

Credit Suisse Has Rated Boston Beer Company ‘Underperform’

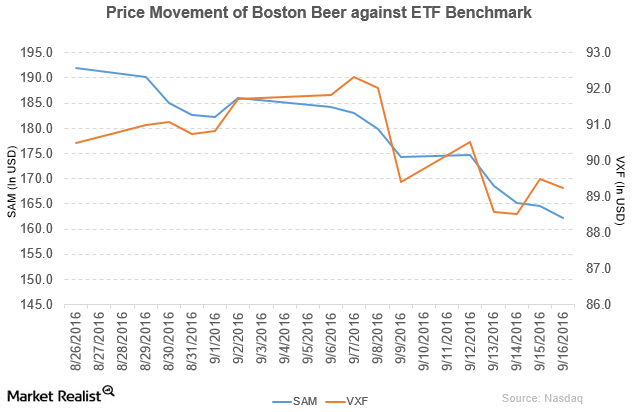

Boston Beer (SAM) has a market cap of $2.0 billion. It fell 1.4% to close at $162.15 per share on September 16, 2016.

Moody’s Downgrades Molson Coors’ Senior Notes to ‘Baa3’

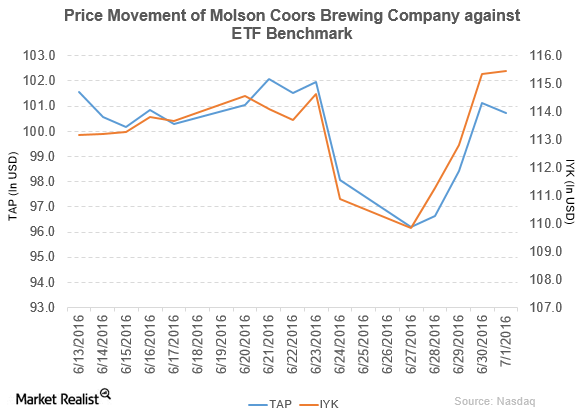

Molson Coors Brewing (TAP) rose by 2.7% to close at $100.74 per share at the end of the fifth week of June 2016.

Anheuser-Busch InBev’s Acquisition of SABMiller: Divestitures at a Glance

ABI has been one of the most active companies in the acquisition of other beer firms. The Belgium-based company itself came from a prior $52 billion deal.

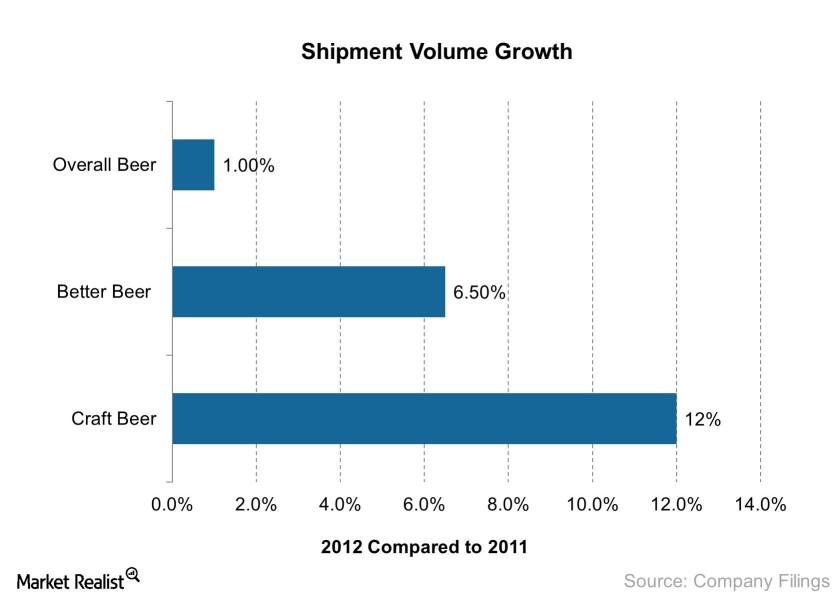

Craft Beer and Its Rising Popularity

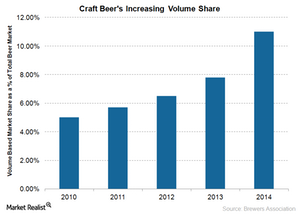

Americans are moving toward craft beer due to better taste, innovation, and brewing techniques. Its market share increased to 11% in 2014 from 7.8% in 2013.

Why is Beer Losing Ground to Wine and Spirits?

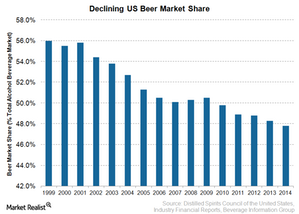

The beer market share in terms of supplier revenues has fallen from 56.0% in 1999 to 47.8% in 2014. The decline is more evident in the light beer category.

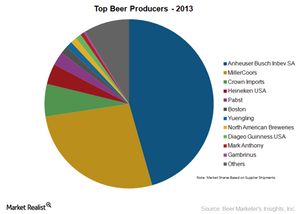

Competitive Forces: Who Rules the US Beer Industry?

Based on the US beer industry shipments of 211.7 million barrels, Anheuser-Busch InBev led the beer industry in 2013 with a 45.6% market share.

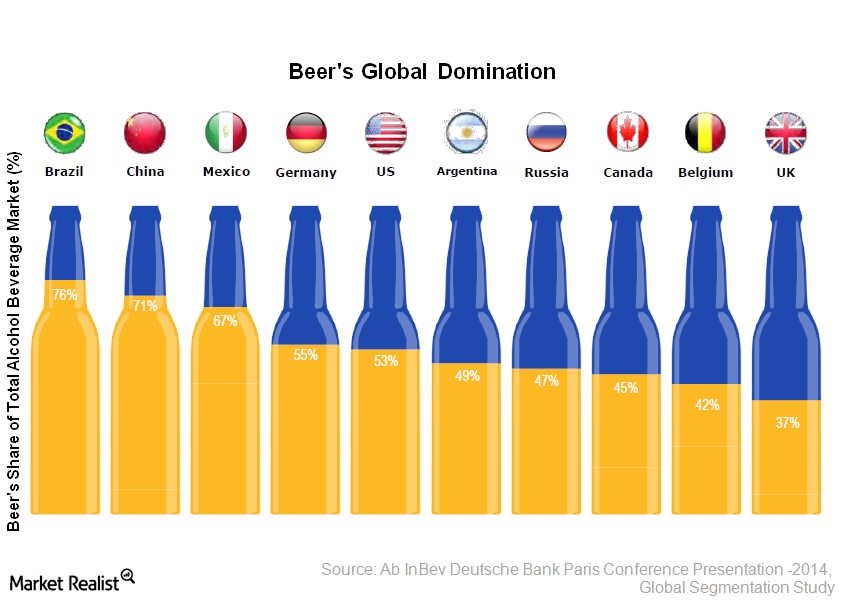

Beer Dominates Alcoholic Beverage Market

Beer is the dominant category in the alcoholic beverage industry with a 47.8% market share of the gross supplier revenue figures for 2014.

The Three-Tier Distribution of the US Alcoholic Beverage Industry

The three-tier distribution system ensures collection of taxes and prevents control of production, distribution, and selling by a single entity.

Is craft better? Boston Beer Company’s high-quality ingredients

The four main ingredients that Boston Beer Company uses are malt, hops, yeast, and apples. Malts, hops, and yeast are part of most beer-making processes.

Why Boston Beer Company and peers’ beer distribution is important

Like other brewers in the United States, Boston Beer Company (SAM) sells its products to distributors and wholesalers, which in turn sell to retailers.

The rise of craft beer: Boston Beer Company and Samuel Adams

Craft beer consumption is on the rise, as drinkers are going for more premium products these days. Boston Beer Company (SAM) stands to benefit.