Moody’s Downgrades Molson Coors’ Senior Notes to ‘Baa3’

Molson Coors Brewing (TAP) rose by 2.7% to close at $100.74 per share at the end of the fifth week of June 2016.

July 4 2016, Published 6:03 p.m. ET

Price movement

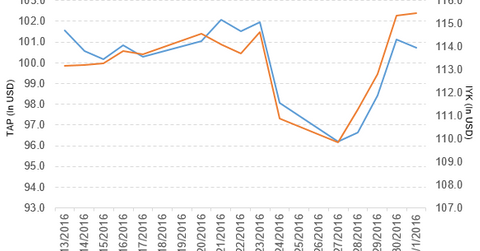

Molson Coors Brewing (TAP) rose by 2.7% to close at $100.74 per share at the end of the fifth week of June 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 2.7%, -1.2%, and 8.2%, respectively. TAP is trading 0.17% below its 20-day moving average, 1.7% above its 50-day moving average, and 10.2% above its 200-day moving average.

Related ETFs and peers

The iShares Dow Jones US Consumer Goods Sector Index ETF (IYK) invests 0.81% of its holdings in Molson Coors Brewing. The ETF tracks a market-cap-weighted index of stocks in the US consumer goods sector. The YTD price movement of IYK was 7.6% on July 1.

The Vanguard Large-Cap ETF (VV) invests 0.05% of its holdings in Molson Coors Brewing. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market.

The market caps of TAP’s competitors are as follows:

Molson Coors prices its senior notes

Molson Coors priced its $5.3 billion principal amount of senior notes, which consists of the $500 million principal amount of 1.5% senior notes due 2019, $1.0 billion principal amount of 2.1% senior notes due 2021, $2.0 billion principal amount of 3.0% senior notes due 2026, and $1.8 billion principal amount of 4.2% senior notes due 2046. It expects net proceeds from the offering of $5.3 billion.

The company also priced its 800 million euro principal amount of 1.3% Senior Notes due 2024. It expects net proceeds from the offering of 794.6 million euros.

The company also priced its private placement issued in Canada by Molson Coors International, of the $1 billion Canadian dollar principal amount of senior notes, which consists of the $500 million Canadian dollar principal amount of 2.8% senior notes due 2023 and $500 million Canadian dollar principal amount of 3.4% senior notes due 2026. Molson Coors International is a wholly-owned indirect subsidiary of Molson Coors. These offerings are expected to close on or about July 7, 2016.

Moody’s downgrades Molson Coors

Moody’s Investors Service has downgraded the following ratings for Molson Coors Brewing and its subsidiaries:

- the senior unsecured regular bond/debenture from “Baa2” to “Baa3”

- the senior unsecured commercial paper from “Prime-2” to “Prime-3”

It rated proposed senior unsecured notes in various tranches as “Baa3.””

Performance in fiscal 1Q16

Molson Coors reported fiscal 1Q16 net sales of $657.2 million, 6.1% lower than the $700.0 million in fiscal 1Q15. The company’s cost of goods sold as a percentage of net sales fell by 3.1% and its operating income rose to 94.2% between fiscals 1Q15 and 1Q16

Its net income and EPS (earnings per share) rose to $158.8 million and $0.78, respectively, in fiscal 1Q16, compared with $81.1 million and $0.43, respectively, in fiscal 1Q15.

The company’s accounts receivable and inventories rose by 7.5% and 28.5%, respectively, between fiscals 4Q15 and 1Q16. It reported cash and cash equivalents of ~$2.6 billion in fiscal 1Q16, compared with $430.9 million in fiscal 4Q15. Its current ratio rose to 3.1x and its DE (debt-to-equity) ratio fell to 0.53x in fiscal 1Q16, compared with 1.0x and 0.74x, respectively, in fiscal 4Q15. In the next and final part of the series, we’ll take a look at Brunswick.