Anheuser-Busch In Bev SA/NV

Latest Anheuser-Busch In Bev SA/NV News and Updates

The Ultimate Guide to Bud Light Ownership: Who Really Calls the Shots?

Curious about who owns Bud Light? Our article explains everything you need to know about the beer brand's ownership.

Who Is Todd Allen? New Bud Light Executive Comes in After Transgender Influencer Fiasco

Todd Allen's net worth may get a boost after taking over Bud Light's marketing executive role in the wake of the Dylan Mulvaney controversy.

Anheuser-Busch CEO Brendan Whitworth Is Worth Millions, Speaks Out About Controversy

Anheuser-Busch CEO Brendan Whitworth recently responded to the controversy surrounding Bud Light and Dylan Mulvaney. What is Whitworth's net worth?

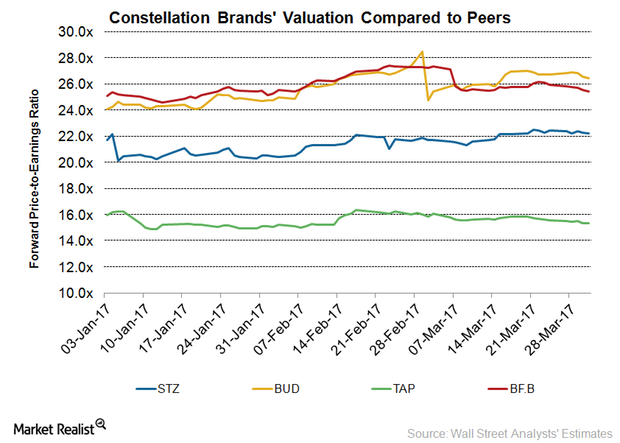

Where STZ’s Valuation Stands Prior to Its Fiscal 4Q16 Results

On March 31, 2017, Constellation Brands (STZ) was trading at a 12-month forward PE (price-to-earnings multiple) of 22.2x.

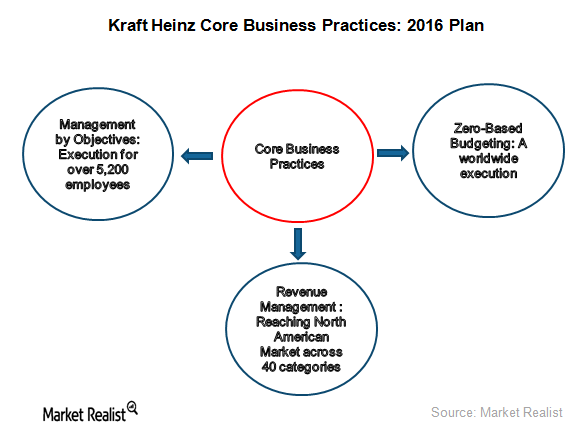

Evaluating Kraft Heinz’s Core Business Strategies

Kraft Heinz is focusing on core business practices, including ZBB (zero-based budgeting), revenue management, and MBO (management by objectives).

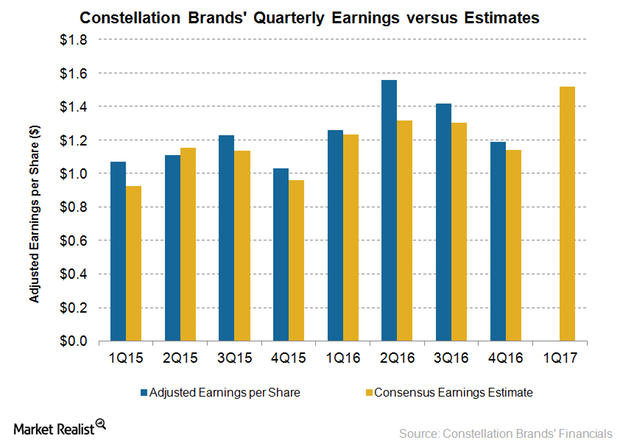

Will Constellation Brands’ Fiscal 1Q17 Earnings Beat Estimates?

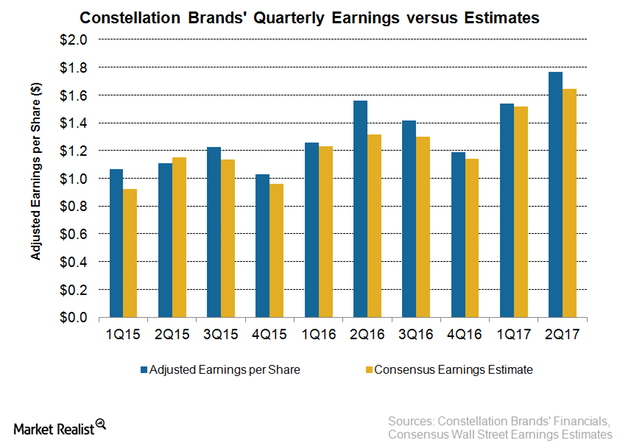

For fiscal 1Q17, analysts expect Constellation Brands to deliver adjusted EPS (earnings per share) of $1.52.

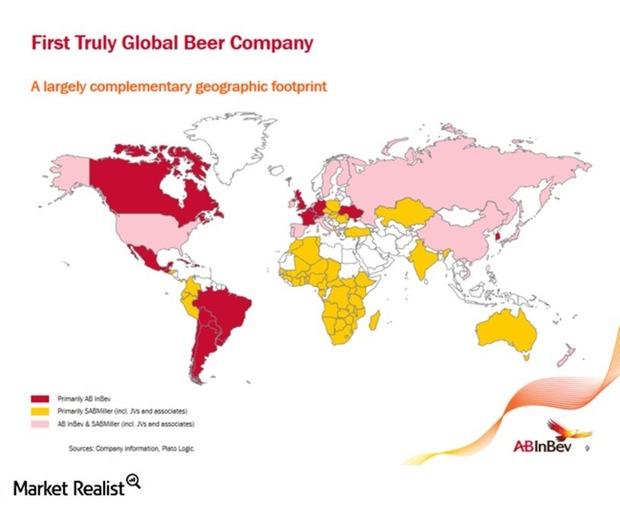

Anheuser-Busch InBev Bids for SABMiller: Analysis

On October 7, Anheuser-Busch InBev announced a formal cash bid of 42.2 pounds per share to SABMiller’s board. This was the third offer rejected by SABMiller.

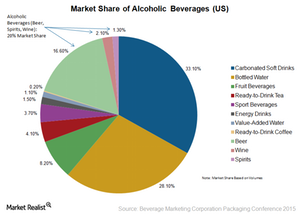

Alcoholic Beverages: A Key Category of the Beverage Industry

According to the Beverage Marketing Corporation, alcoholic beverages such as beer, wine, and distilled spirits, account for 20% of the US beverage market.

Why Constellation Brands Has Fallen More than 12% Today

On January 9, Constellation Brands (STZ) reported its third-quarter results before the market opened. The third quarter ended on November 30.

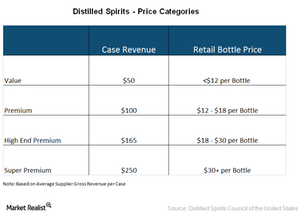

Demand for Expensive Liquor Is Growing

The performance of liquor business in 2014 reflects the premiumization trend, or a preference for better, premium, or expensive liquor brands.

Constellation Brands Ends Fiscal 2020 with Strong Q4 Earnings

Constellation Brands ended fiscal 2020 on a strong note with better-than-expected fourth-quarter results. The company reported sales of $1.90 billion.

What to Expect from Constellation Brands’ Q3 Earnings

Constellation Brands (STZ) is scheduled to release its earnings results for the third quarter of fiscal 2020 on January 8.

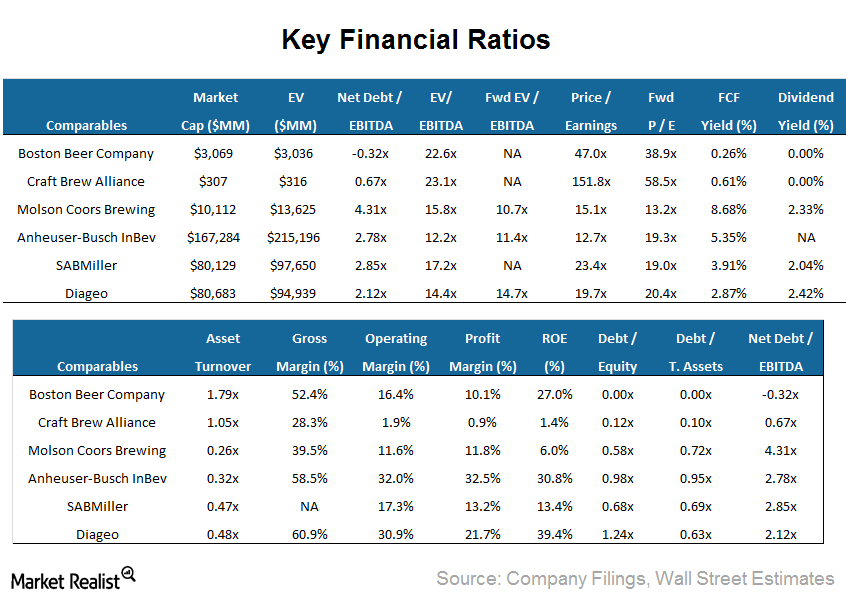

Boston Beer Company: An introduction to better beer business

Boston Beer Company Inc. (SAM) is the largest craft brewer in the United States, having sold ~2.7 million barrels of proprietary core brand products.

Will Constellation Brands Stock Rise on Q1 Results?

Constellation Brands (STZ) plans to announce its results for the first quarter of fiscal 2020 on June 28. Constellation Brands stock has risen 14.4% since the start of this year. Analysts expect the company’s adjusted EPS to decline 6.8% to $2.05 in the first quarter.

How Constellation Brands Looks after Strong Fiscal 4Q18 Results

On April 3, Constellation Brands (STZ) declined 1.3% after Stifel downgraded its rating on the stock.

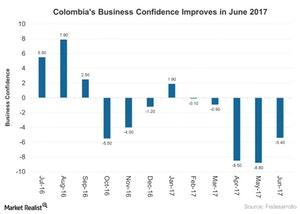

Marginal Rise in Industrial Confidence in Colombia in 2017

Industrial confidence in Colombia (GXG) improved in June 2017 to -5.4% as compared to -8.8% in May 2017.

Investing in STZ for Earnings Growth Is Becoming a No-Brainer

Constellation Brands (STZ) impressed investors with another quarter of strong earnings and sales growth in fiscal 2Q17. The beer, wine, and spirits producer beat the analysts’ earnings estimate for the eighth straight quarter.

Moody’s Downgrades Molson Coors’ Senior Notes to ‘Baa3’

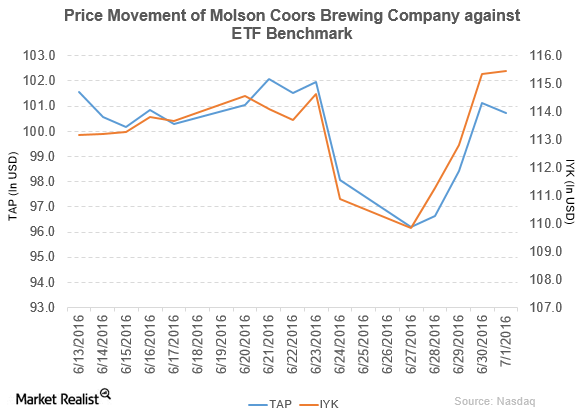

Molson Coors Brewing (TAP) rose by 2.7% to close at $100.74 per share at the end of the fifth week of June 2016.

Anheuser-Busch InBev’s Acquisition of SABMiller: Divestitures at a Glance

ABI has been one of the most active companies in the acquisition of other beer firms. The Belgium-based company itself came from a prior $52 billion deal.

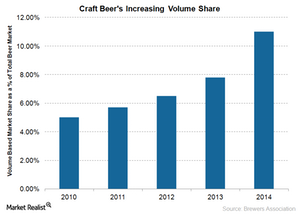

Craft Beer and Its Rising Popularity

Americans are moving toward craft beer due to better taste, innovation, and brewing techniques. Its market share increased to 11% in 2014 from 7.8% in 2013.

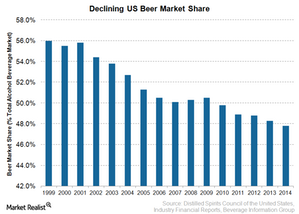

Why is Beer Losing Ground to Wine and Spirits?

The beer market share in terms of supplier revenues has fallen from 56.0% in 1999 to 47.8% in 2014. The decline is more evident in the light beer category.

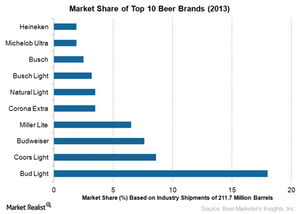

Beer Brands That Make a Difference in the US Market

Bud Light is the leader among major beer brands, with 18% share of the beer market based on the 2013 total beer industry shipments of 211.7 million barrels.

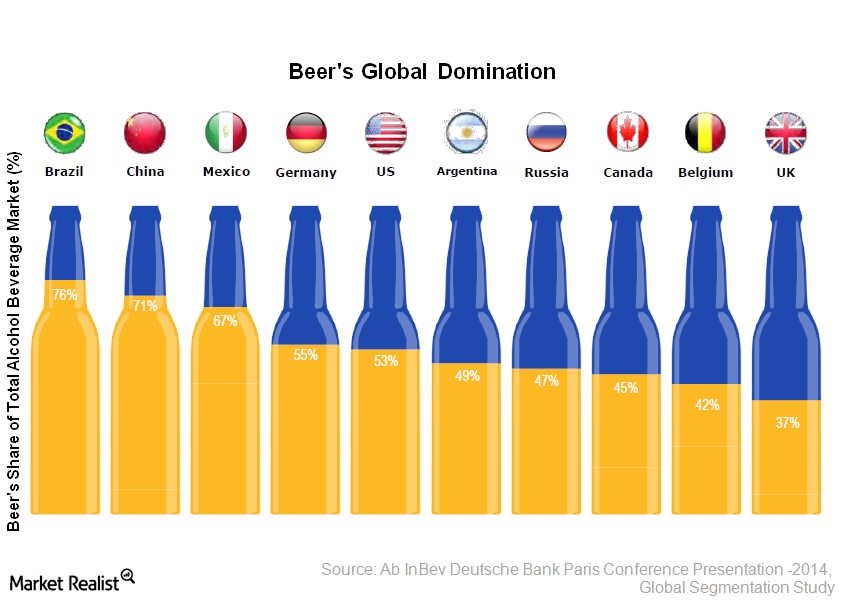

Beer Dominates Alcoholic Beverage Market

Beer is the dominant category in the alcoholic beverage industry with a 47.8% market share of the gross supplier revenue figures for 2014.

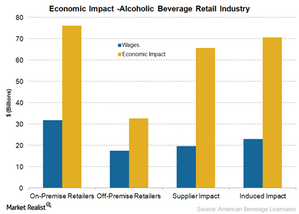

How Important Is the Alcoholic Beverage Industry to the Economy?

In an economic study, the American Beverage Licensees estimated the economic impact of the alcoholic beverage industry in 2014 to be more than $245 billion.