SolarCity Corp

Latest SolarCity Corp News and Updates

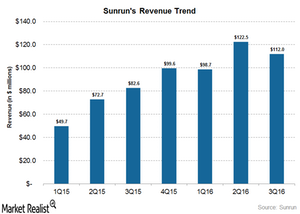

Why Did Sunrun Miss Analysts’ 3Q16 Revenue Estimates?

For 3Q16, Sunrun’s (RUN) consolidated revenue came in at ~$112 million against analysts’ expectations of $135 million.

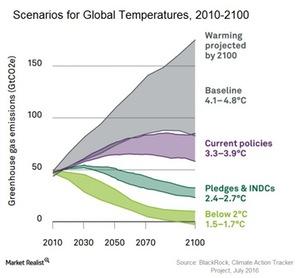

How the World Is Dealing with the Climate Challenge

Extreme climate change events hamper productivity, thus affecting industries such as agriculture, fishing, energy, trade, transportation, and tourism.

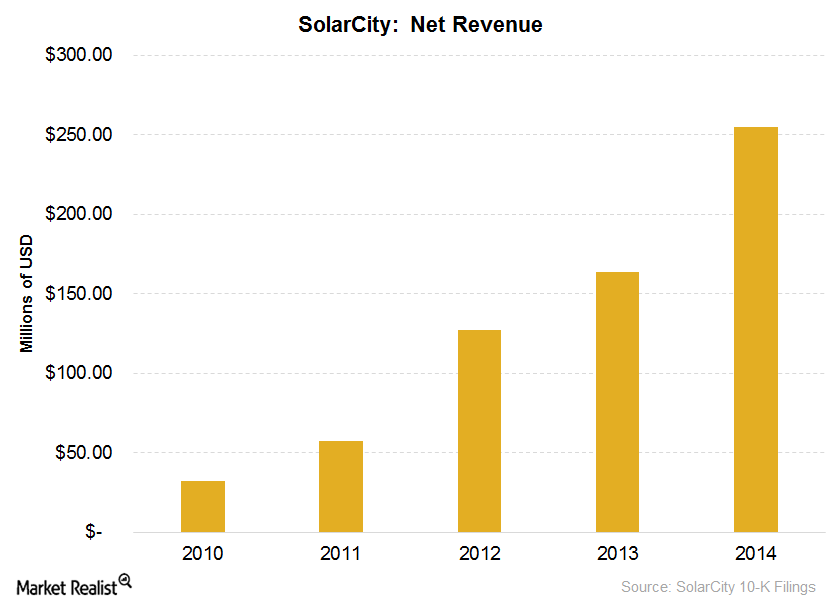

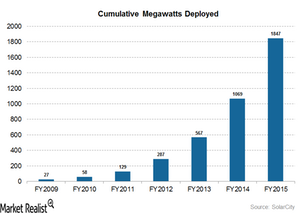

Introducing SolarCity, a Powerhouse in Solar Technology

SolarCity is a vertically-integrated solar company. Despite advancing technology and expanding reach, it has seen negative earnings most years since 2007.

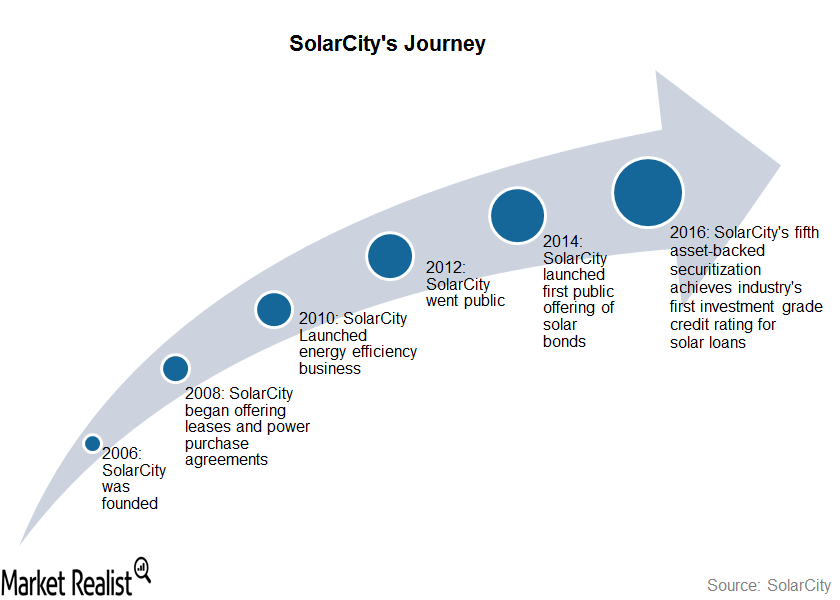

SolarCity: A Quick Trip down Memory Lane

SolarCity was founded in 2006 with the initial focused on selling, financing, and installing solar energy systems for residential and commercial customers.

Sunrun: The Beginning of a Residential Solar Major

Sunrun was co-founded in 2007 as a startup by Ed Fenster and Lynn Jurich, with an aim to create worldwide use of solar energy. It began offering solar services in 2008.

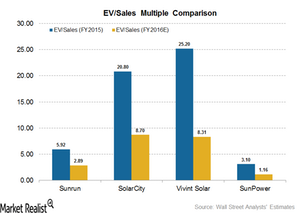

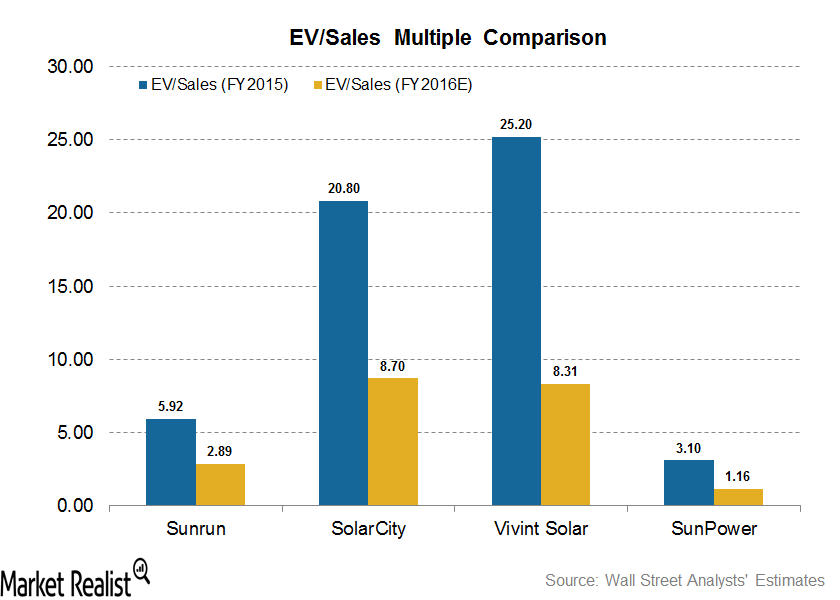

Understanding SolarCity’s Valuation Compared to Peers: Who’s Trading at a Discount?

Among the downstream solar companies, SolarCity (SCTY) has the highest EV-to-sales value of 8.70x, which is closely followed by Vivint Solar at 8.31x.

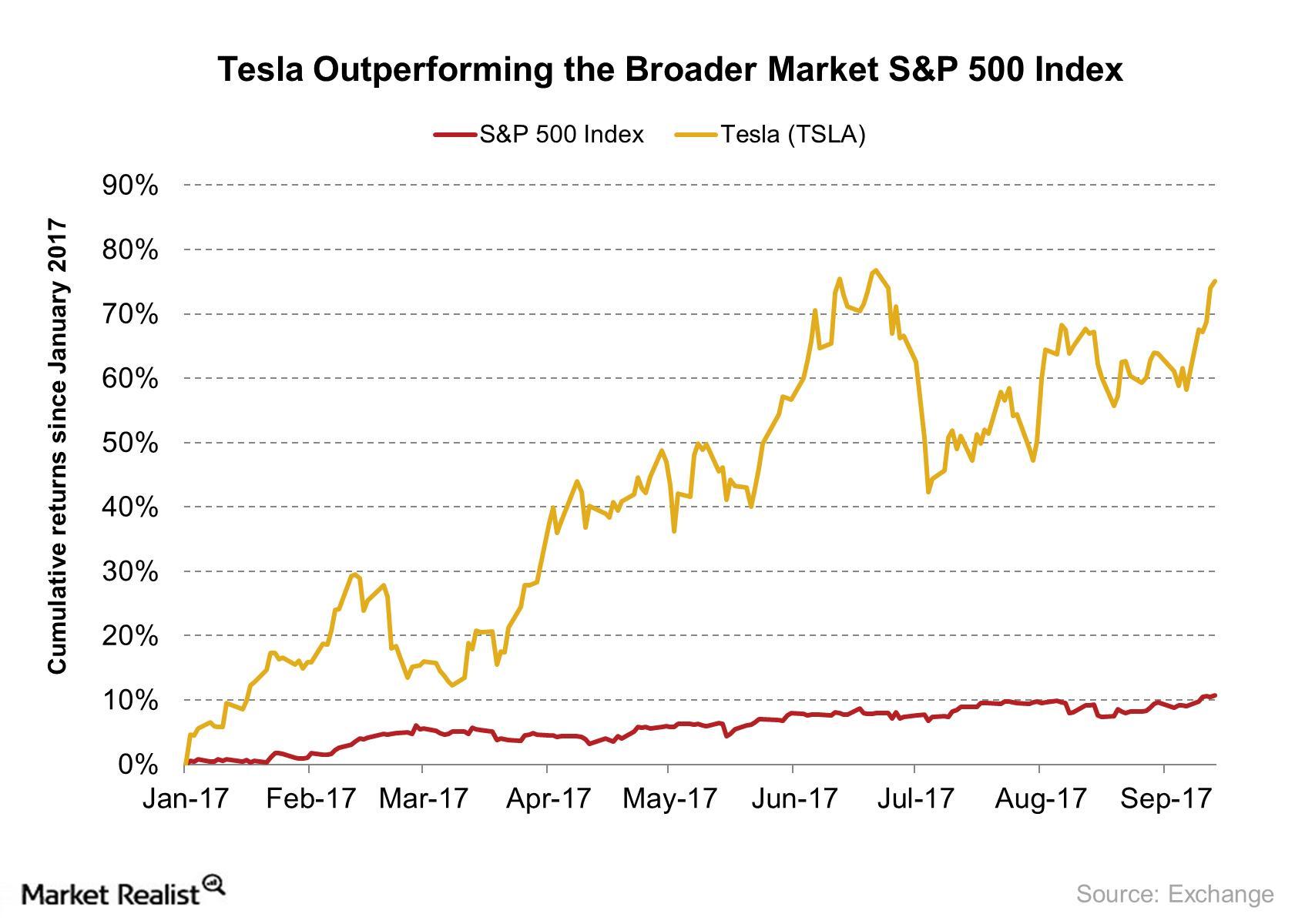

Why Jim Chanos Is Continuing His Short Position in Tesla

Jim Chanos, the billionaire investor and a well-known short seller in the hedge fund industry, said at the Delivering Alpha Conference on Tuesday, September 12, 2017, that he is continuing his short position in Tesla (TSLA).

Jim Chanos on Tesla: ‘We Think the Equity Is Worthless’

Jim Chanos, a prominent short seller, discussed his view on Tesla in a recent interview with CNBC. He has a short bet on Tesla (TSLA) and said, “we think the equity is worthless.”

Vivint Solar Reported Rise in Estimated Retained Value in 3Q17

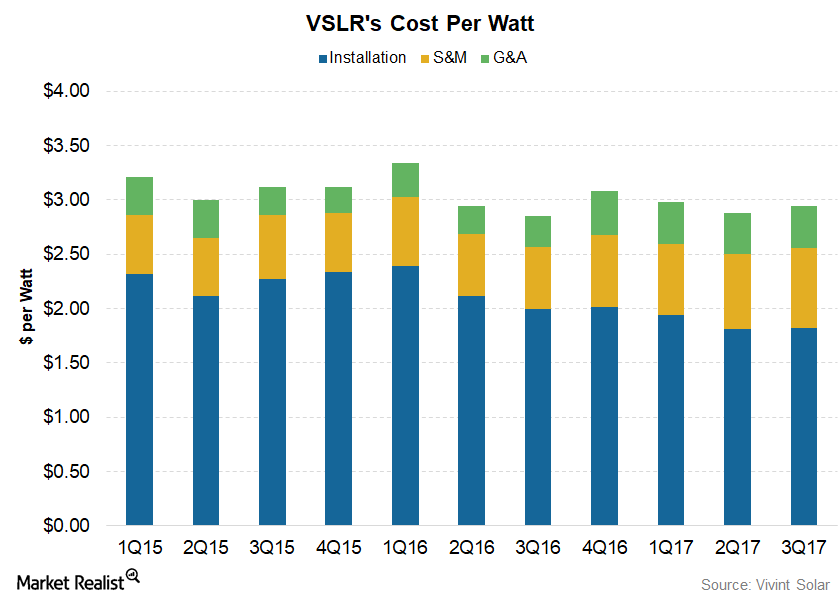

Vivint Solar (VSLR) reported a cost per watt of $2.94 for 3Q17, higher than the $2.88 it reported in 2Q17 and $3.85 in 3Q16.

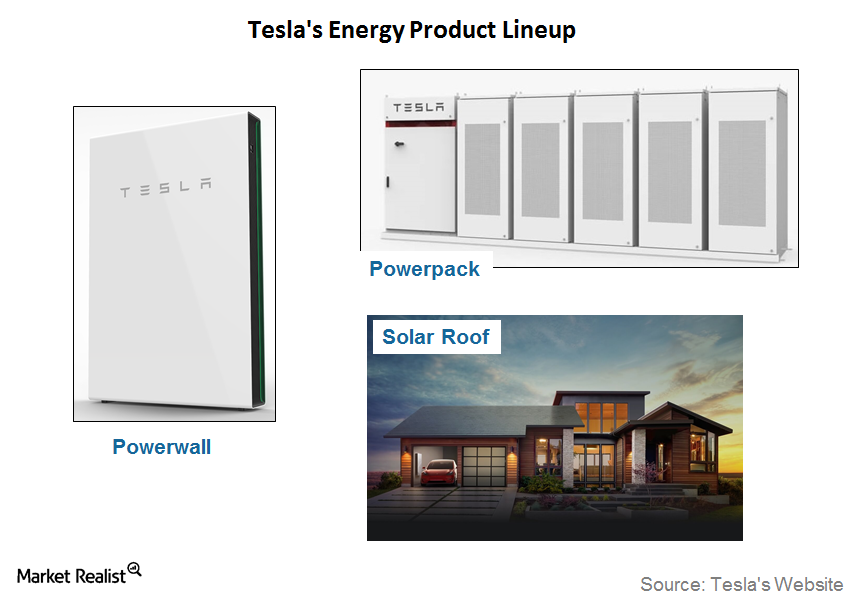

Analyzing Tesla’s Updated Energy Products

In October, Tesla unveiled the second version of the Powerwall and Powerpack. The second version comes with higher energy storage capacity.

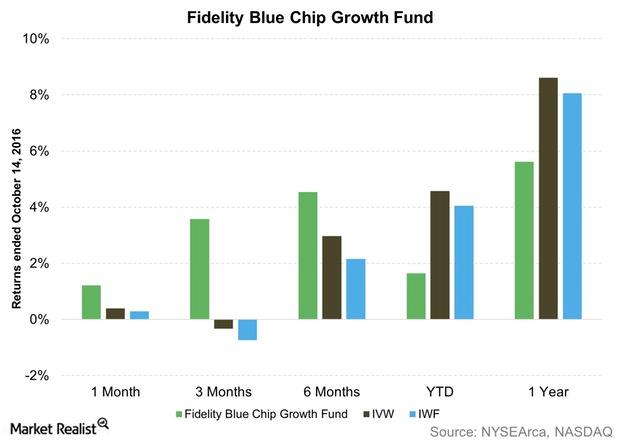

Behind the Fidelity Blue Chip Growth Fund’s Disappointing Performance in 2016

FBGRX has had a below-average 2016 so far, placing seventh in our select peer group of 12 funds in terms of point-to-point returns.

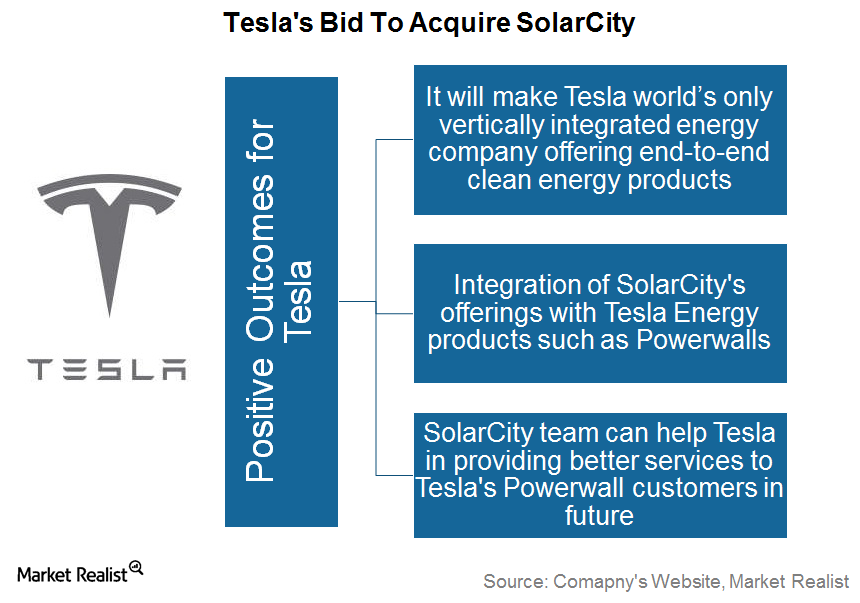

Why Tesla’s SolarCity Acquisition Could Pay Off

According to Tesla’s (TSLA) SolarCity acquisition proposal, it’s ready to pay $26.50 to $28.50 per share for SolarCity.

Understanding SolarCity’s Business Strategy

Business expansion is crucial for companies like SolarCity, which intends to expand its presence via partnerships with homebuilders and industry leaders.

How Does SolarCity Make Money?

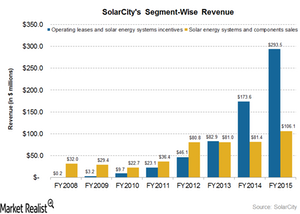

SolarCity’s business is divided into two segments: Operating Leases and Solar Energy Systems Incentives and Solar Energy Systems and Component Sales.

Is Vivint Solar Trading at a Discount Compared to Its Peers?

One out of four analysts covering Vivint Solar (VSLR) has rated the stock a “buy,” two analysts rated the stock a “hold,” and one analyst recommends a “sell” for the stock.

How Vivint Solar’s Customers Benefited from Solar Tax Credits

ITCs (investment tax credits) are a dollar-for-dollar reduction on an income tax bill. It is applicable to both residential and commercial deployment of solar systems.

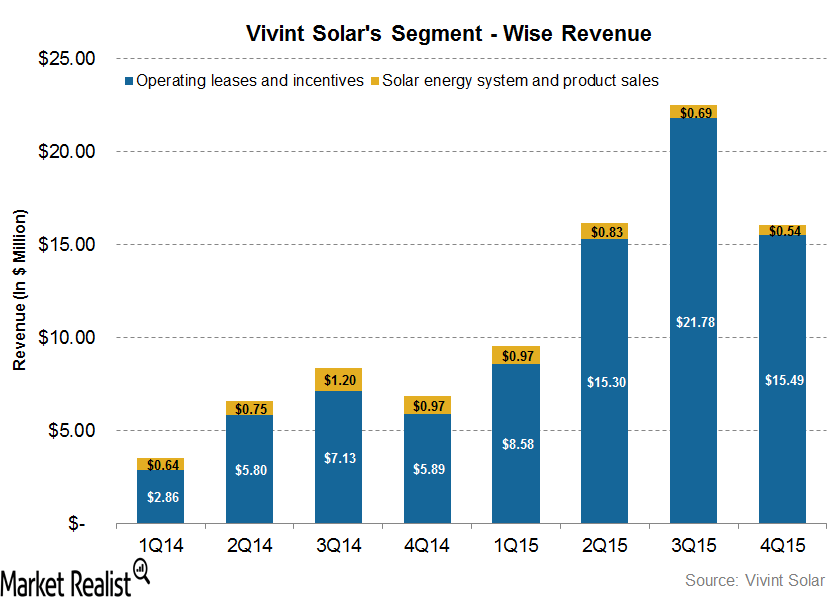

How Does Vivint Solar Make Money?

Vivint Solar’s business model is divided into two revenue segments: Operating Leases and Incentives and Solar Energy Systems and Product Sales.

Analyzing Key Elements of Sunrun’s Business Strategy

Unlike its peers, Sunrun is building an open platform of services and tools to provide a differentiated customer experience and, at the same time, gaining a wide customer base.

Need to Know: Sunrun’s Major Acquisitions

In February 2014, Sunrun (RUN) acquired the residential business of REC Solar, AEE Solar, and SnapNrack from Mainstream Energy Corporation for $78.8 million.

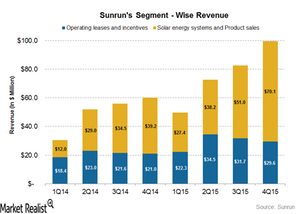

How Does Sunrun Make Money?

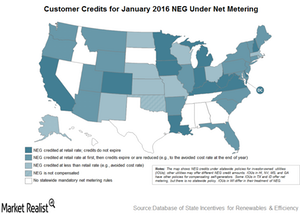

Extension of ITCs for investments in solar energy has been key for the rapid expansion of downstream solar companies like Sunrun, Vivint Solar (VSLR), SolarCity (SCTY), and SunPower (SPWR).

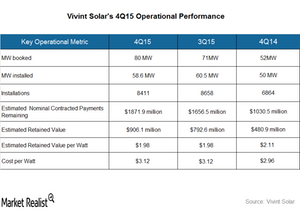

Behind Vivint Solar’s Key Operational Metrics

Vivint Solar’s estimated nominal contracted payments remaining increased by $251.4 million during 4Q15, compared to $214 million during 3Q15.

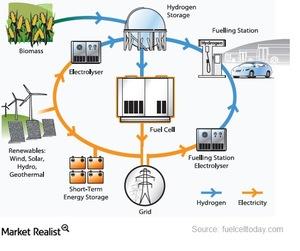

What Paris Climate Agreement Means for Fuel Cells and Solar Energy

Clean energy was one of the important issues in the Paris Climate Agreement. Fuel cells produce clean energy from a chemical reaction between anodes and cathodes.

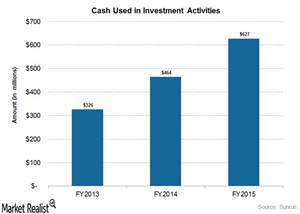

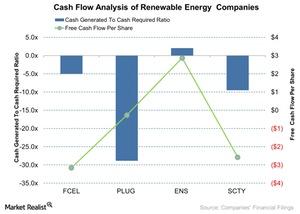

Cash Flow Analysis for Renewable Energy Companies

The cash flow is an important part of a company’s financials. Lower cash flows increase a company’s chances of being caught in a vicious cycle of debt raising and refinancing.