Ross Stores Inc

Latest Ross Stores Inc News and Updates

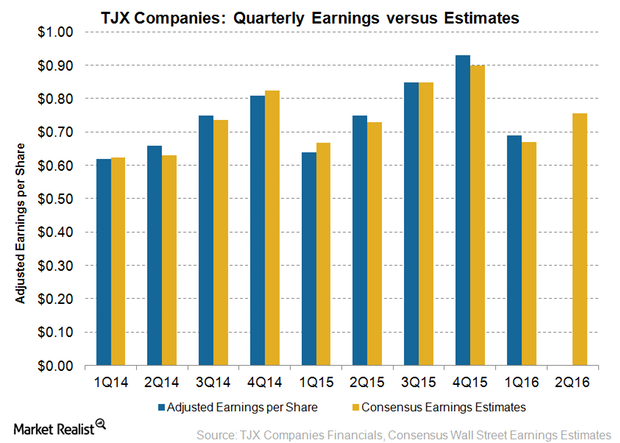

Why TJX Companies Might Post Tepid Earnings Growth in 2Q16

TJX Companies (TJX) will announce its results for the second quarter of fiscal 2016 on August 18. The second quarter ended on August 1, 2015.

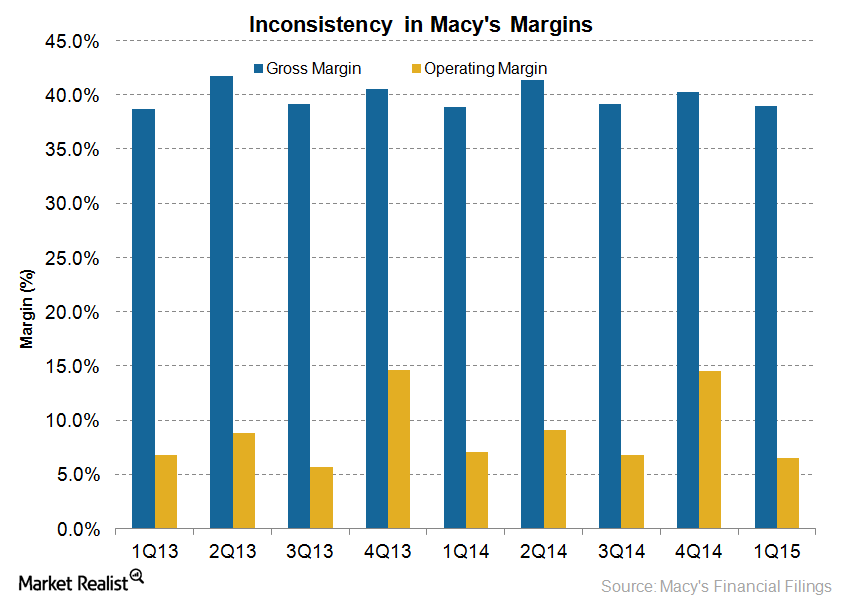

What Went Wrong with Macy’s 1Q15 Operating Margins?

Macy’s (M) operating margins declined to 6.6% in 1Q15—ending May 2, 2015—from 7.1% in the same quarter last year. The operating income declined by 7.7%.

Burlington Stores Stock Soars on Impressive First-Quarter Earnings

Burlington Stores stock was up 8.4% as of 11:15 AM EST today in reaction to better-than-expected results for the first quarter, which ended on May 5.

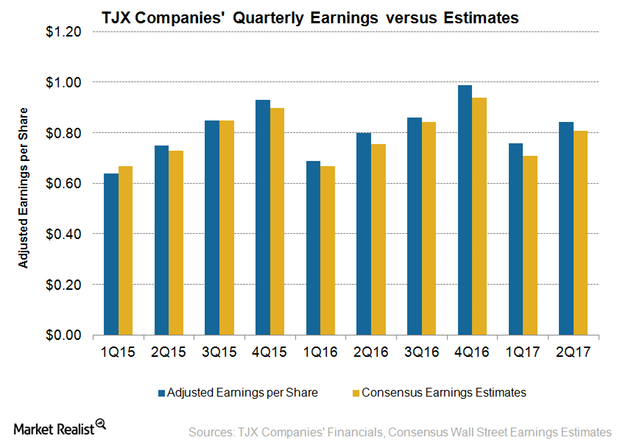

Can TJX Companies Sustain Its Earnings Growth after Fiscal 2Q17?

Following the strong results in fiscal 2Q17, TJX Companies raised its earnings outlook for fiscal 2017. TJX expects its fiscal 2017 EPS to be in the $3.39–$3.43 range.

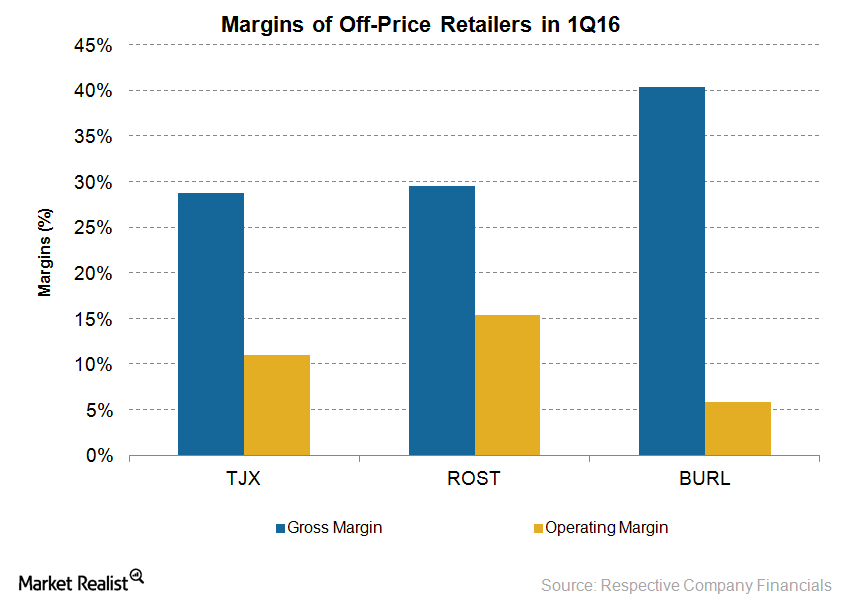

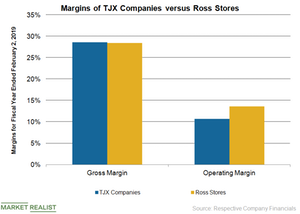

Which Off-Price Retailer Is Operating at the Highest Margins?

Major off-price retailers have strong margins supported by lean operating models, efficient inventory management, and strong vendor relationships.

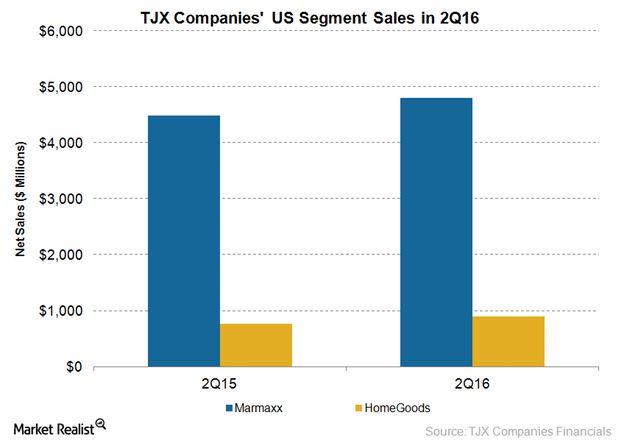

TJX Companies: Pricing Strategy Benefits US Sales in 2Q16

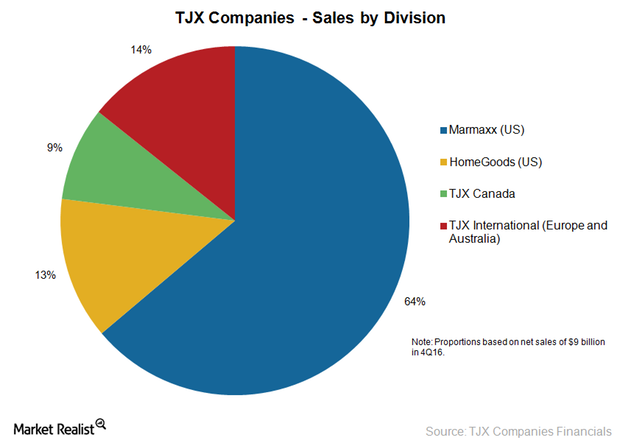

In the first six months of fiscal 2016, HomeGoods accounted for 12.2% of the consolidated net sales of TJX Companies. That’s up from 11.2% in the comparable period of the previous year.

Ross Stores or Burlington Stores: Which Looks Better in 2019?

Ross Stores and Burlington Stores stocks have risen 8.9% and 1.2%, respectively, on a year-to-date basis as of January 14.

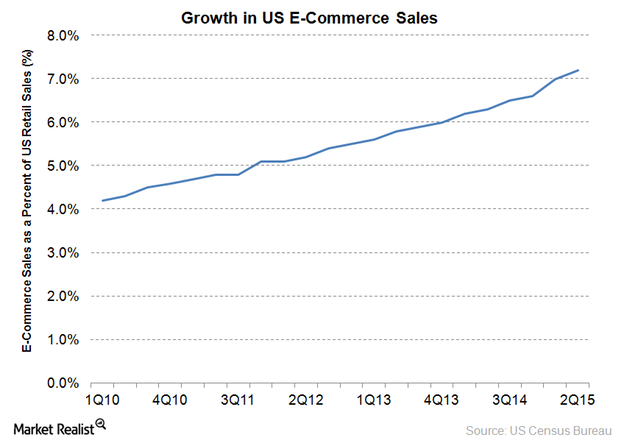

Why Ross Stores Isn’t Keen on E-Commerce Growth

Ross Stores, which falls in the moderate off-price space, does not seem to be keen on expanding its e-commerce business and does not have an online store.

TJX Companies’ HomeGoods Segment Impressed in Fiscal 3Q16

TJX Companies’ HomeGoods segment reported strong same-store sales growth of 6%. The segment’s net sales grew by 12.8% to $959.8 million in 3Q16.

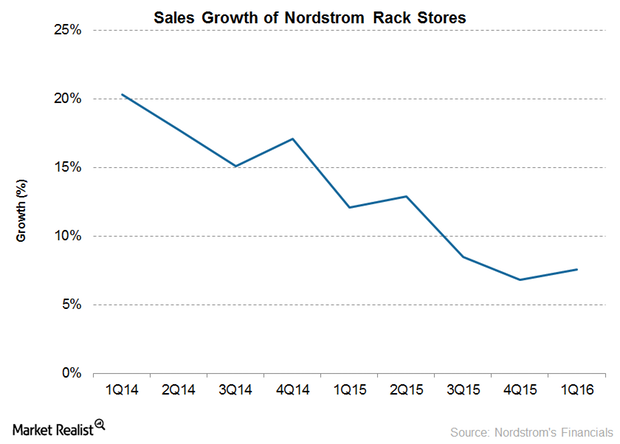

Will Nordstrom’s Rack Stores Continue to Be a Key Growth Driver?

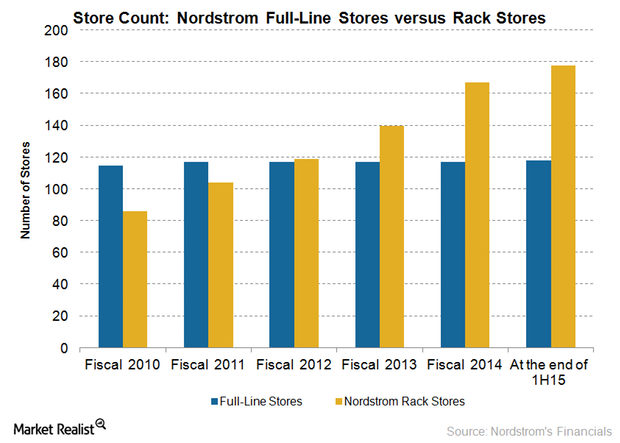

In 2Q15, Nordstrom Rack store sales increased by 12.9% to $857 million from the comparable quarter of the previous year.

Will Burlington Stores Get Stronger in 2020?

Burlington Stores (BURL) beat analysts’ earnings expectations in the first three quarters of fiscal 2019. Here’s what to expect in 2020.

TJX Companies and Ross Stores Finish the Year Strong

Off-price retailers emerged as consistent performers in the retail space. The stock of Ross Stores (ROST) and TJX Companies (TJX) surged 38.8% and 34.9%

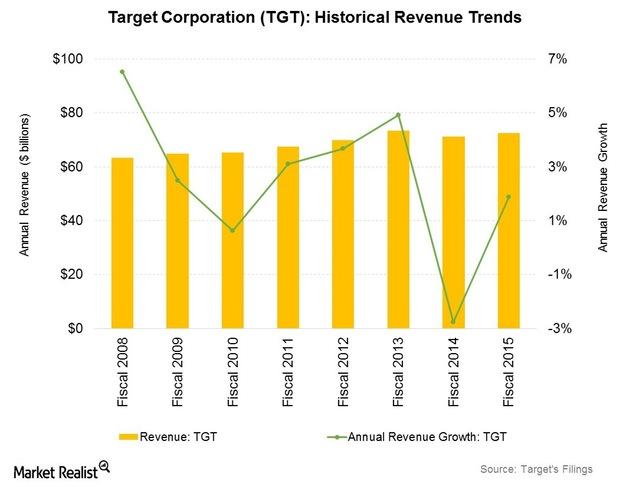

How Does Target’s Historical Sales Growth Compare to Its Peers’?

Target opened 15 new stores in fiscal 2016. Its same-store sales rose 2.1%, with customer traffic at stores up 1.3%.

TJX Companies’ Q3 Earnings Impress Investors

TJX Companies (TJX) reported better-than-expected earnings results for the third quarter of fiscal 2020, which ended on November 2.

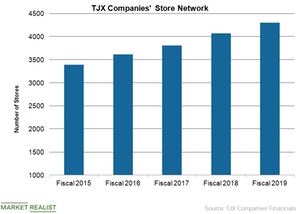

TJX Companies and Ross Stores: Assessing Store Growth Plans

While several retailers and department stores are closing down stores amid intense competition from online retailers, off-price retailers TJX Companies and Ross Stores (ROST) see a tremendous opportunity to grow their store base.

TJX Companies or Ross Stores: Whose Margins Look Better?

Margins of both TJX Companies (TJX) and Ross Stores (ROST) have been under pressure due to higher freight costs and wages.

Burlington Stores’ Growth Strategies

Burlington Stores (BURL) is taking several initiatives to deliver continued strong sales growth rates in a challenging market.

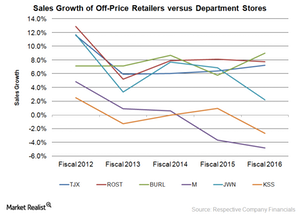

Off-Price Retailers Look to Outperform Department Stores in 2017

Despite a rough retail environment, off-price retailers TJX Companies (TJX), Ross Stores (ROST), and Burlington Stores (BURL) have been delivering strong sales growth. In this series, we’ll compare their margins, stock price movements, and analyst recommendations.

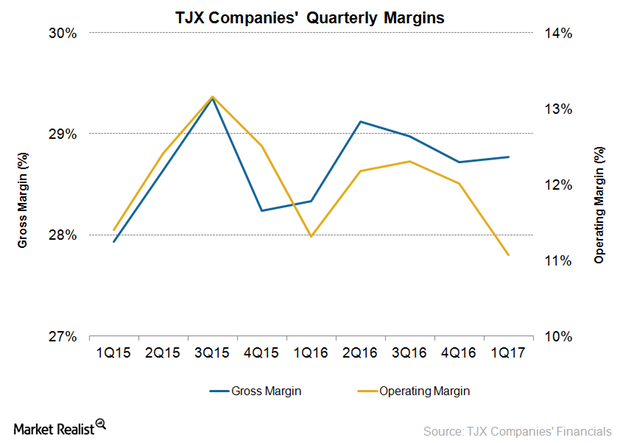

Why TJX Companies’ 2Q Margins Could Be Under Pressure

TJX Companies’ (TJX) gross margin in fiscal 1Q17 rose by 50 basis points on a year-over-year basis to 28.8%.

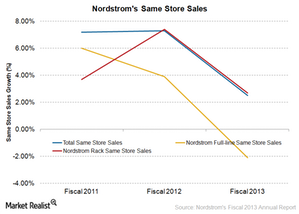

Could Nordstrom’s Rack Stores Have Saved the Day in Q2?

Aside from operating full-line upscale stores, Nordstrom also conducts off-price business through its Nordstrom Rack stores and off-price digital channels.

TJX Companies’ US Business in Fiscal 4Q16

The US business of TJX Companies consists of 1,156 T.J. Maxx stores, 1,007 Marshalls stores, 526 HomeGoods stores, and eight Sierra Trading Post stores.

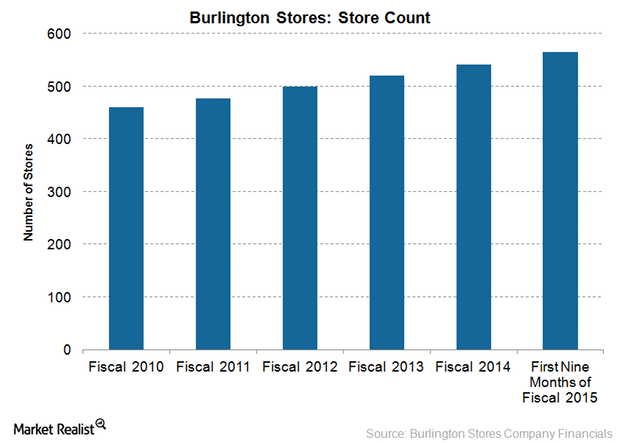

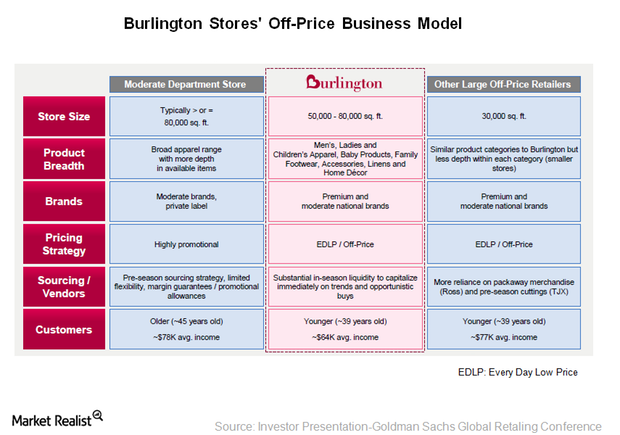

Why Smaller Stores Provide a Better Growth Option for Burlington Stores

Burlington has been focusing on opening smaller stores. The average size of the new stores opened in 2013 and 2014 was a little over 60,000 square feet.

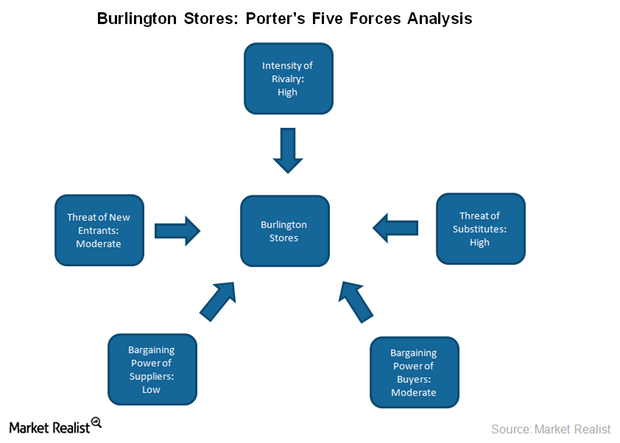

Burlington Stores’ Market Positioning in 2015 and Beyond

Burlington Stores targets the value-conscious, middle-class consumer. The number of customers making purchases at the company’s stores is large.

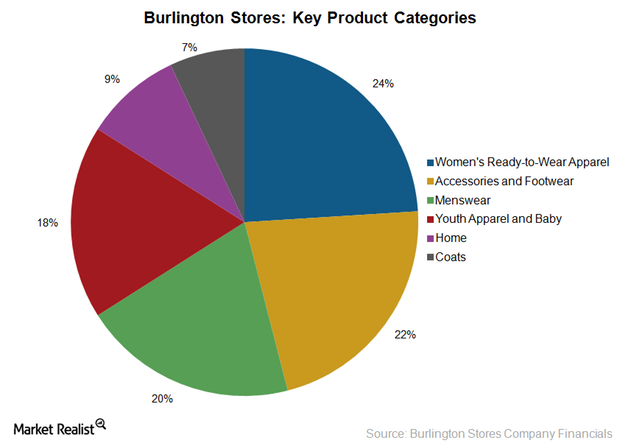

Understanding Burlington Stores’ Key Product Categories

Burlington Stores derives its revenue from the sale of value-priced apparel, coats, and family footwear, baby furniture, accessories, home décor, and gifts.

An Inside Out Look at Burlington’s Business Model

Burlington follows an EDLP model, which helps customers get up to 60–70% savings off prices of similar merchandise in department and specialty stores.

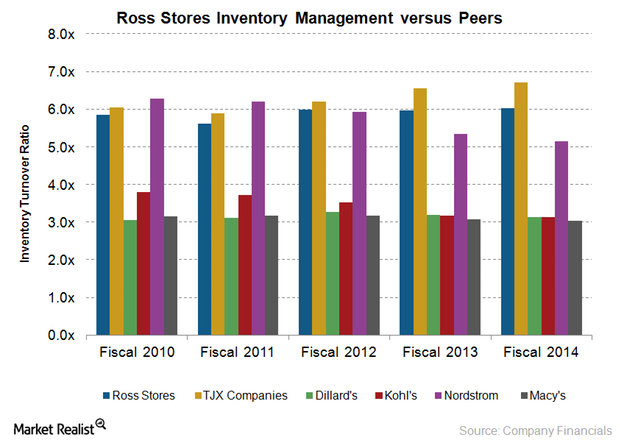

A Look at Ross Stores’ Superior Inventory Management Skills

Ross Stores’ inventory management system is supported by its strong supplier relationships and the strategic location of its buying offices.

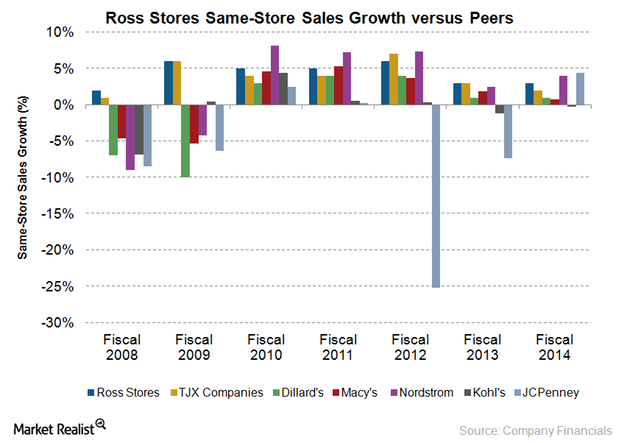

Ross Stores’ Same-Store Sales Growth: A Consistent Track Record

2Q15 marked the 26th consecutive quarter of positive same-store sales growth for Ross Stores. Its last fall in same-store sales growth was in the 4Q08.

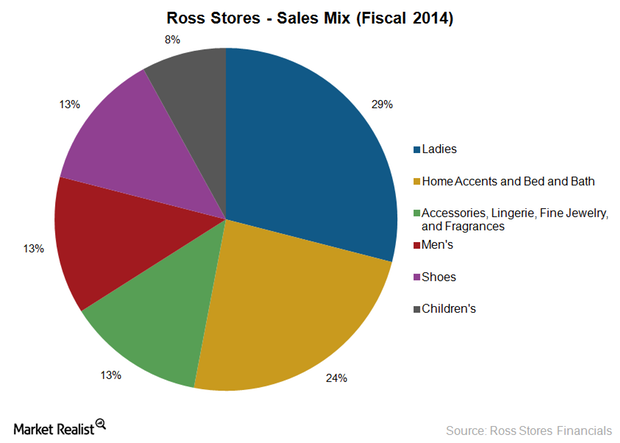

Key Components of Ross Stores’ Sales Mix

In fiscal 2014, women’s apparel accounted for 29% of Ross Stores’ sales of $11 billion. Home accents is also a key category at 24% of total sales.

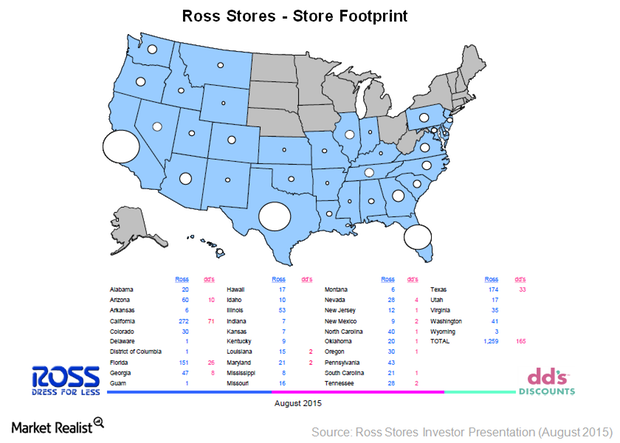

Understanding Ross Stores’ Business Model

Ross Stores operates under two trademarks: Ross Dress for Less and dd’s DISCOUNTS. There are 1,259 Dress for Less and 165 dd’s DISCOUNTS stores in the US.

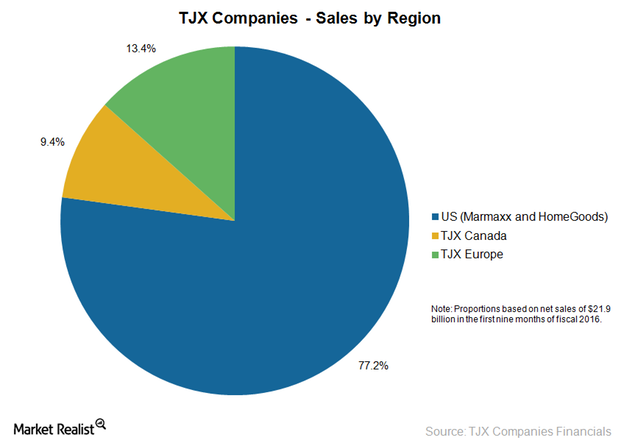

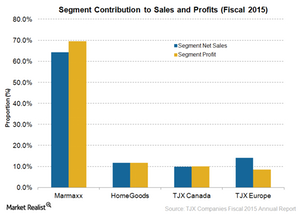

TJX Companies – A Profitable Business Structure

Among TJX Companies’ business segments, Marmaxx is the largest with 2,094 stores under the T.J. Maxx and Marshalls brands, and 64.3% of net sales.

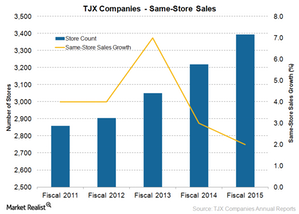

Gauging TJX Companies’ Same-Store Sales Growth

The growth in TJX Companies’ same-store sales slowed down in fiscal 2015, growing by 2.0% compared to 3.0% in fiscal 2014.

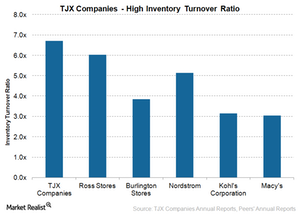

TJX Companies’ Best-in-Class Inventory Management

TJX Companies (TJX) has a very efficient internally developed inventory management system that helps the company ensure the proper flow of merchandise.

Nordstrom’s target customers

Nordstrom is an upscale department store that competes with other high-end stores. However, not all of Nordstrom’s target customers are high-end shoppers.