LifePoint Hospitals Inc

Latest LifePoint Hospitals Inc News and Updates

Which Hospital Stocks Are Expected to Benefit Most?

Trumpcare’s failure is considered to be a boon by hospital companies treating a significant portion of Medicaid members.

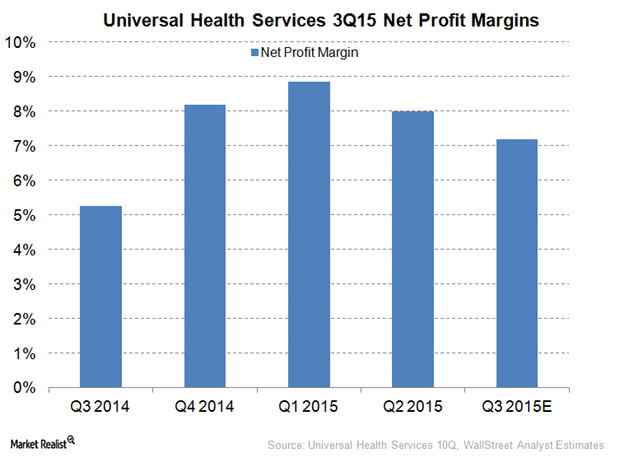

Universal Health Services’ Net Profit Margin Expected to Rise

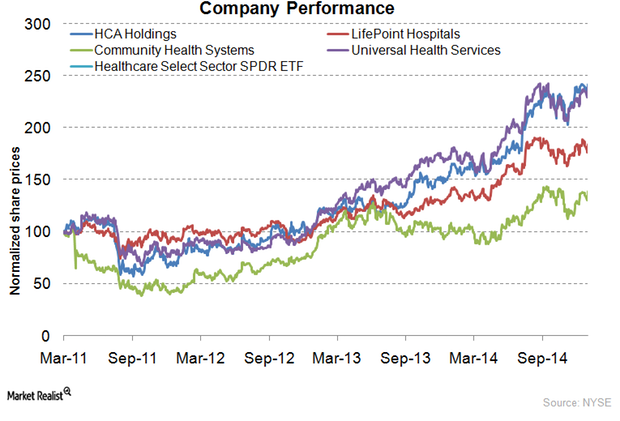

Wall Street analysts expect that Universal Health Services (UHS) will report higher net profit margins in 3Q15 compared to margins in 3Q14.Healthcare Overview: Assessing hospital companies’ capital expenditures

Capital projects in the hospital sector include purchasing new facilities, purchasing medical equipment, renovating and replacing existing hospitals, and investing in information systems infrastructure.Healthcare Understanding hospitals’ size, technology, and operating expenses

In the capital-intensive hospital industry, economies of scale offer a competitive advantage by spreading out the high fixed costs, providing for higher margins.

A Closer Look at Mednax’s Business Strategy

Mednax (MD) has a proven track record of expertise in the administration of physician services and a methodical approach to clinical data warehousing in fields such as research, education, and quality.

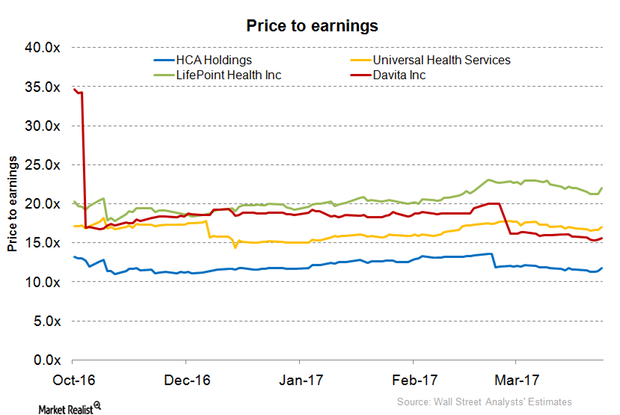

Hospital Industry Reacts to the Failed Healthcare Bill

On March 24, 2017, House Speaker Paul Ryan pulled back the American Health Care Act, also known as “Trumpcare,” before votes were cast.

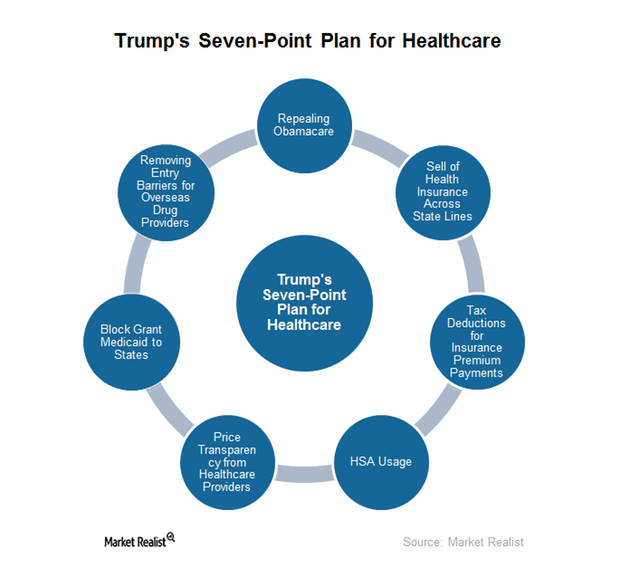

What Is Donald Trump’s Seven-Point Health Plan?

Trump’s healthcare agenda During his campaign, Trump came up with a seven-point plan for the healthcare industry. In this plan, he proposed to repeal the Affordable Care Act. Although a complete repeal doesn’t seem feasible, if applied, it would definitely take a toll on hospitals and insurance companies. In the next article, we’ll discuss the severity of […]

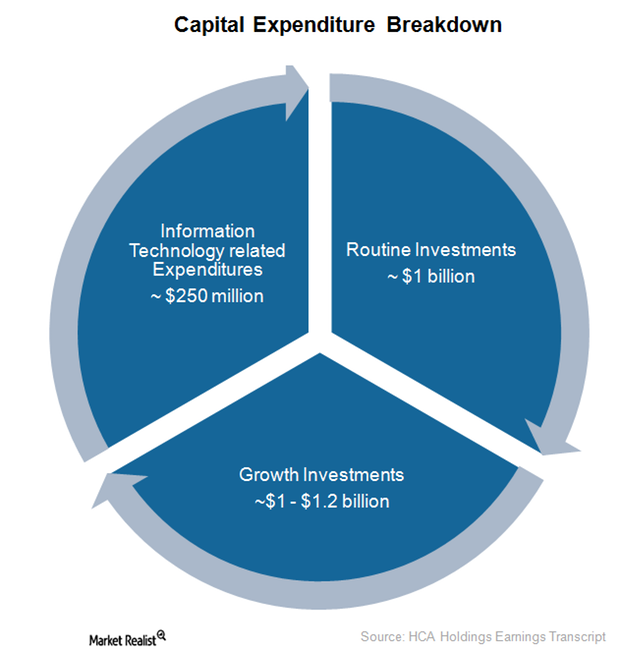

HCA Holdings’s Strong Capital Expenditure Strategy for 2016

In 2015, HCA Holdings deployed ~$2.4 billion in capital expenditure. It planned to increase capital spending to $2.7 billion in 2016.

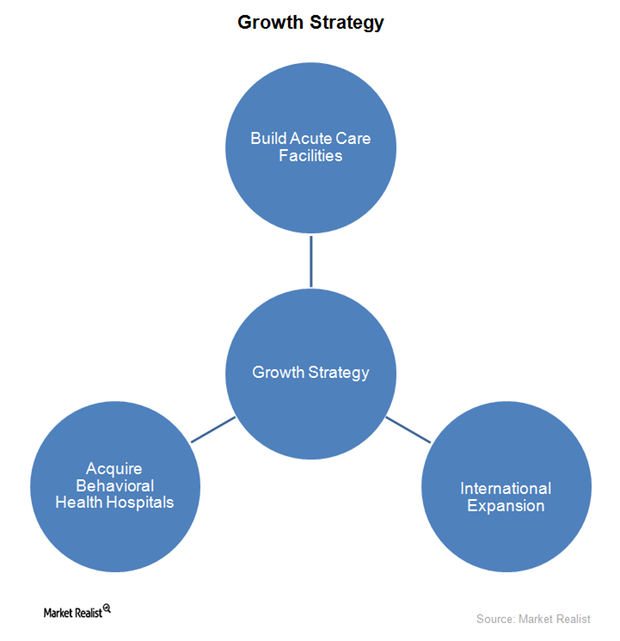

Universal Health Services Explores Growth Opportunities in 3Q15

In 3Q15, Universal Health Services was actively involved in exploring growth opportunities, both in its acute care as well as behavioral health business.

An overview of LifePoint Hospitals

With 67 hospitals, acquisitions continue to strengthen its position in rural markets, especially where LifePoint Hospitals is the sole healthcare provider.

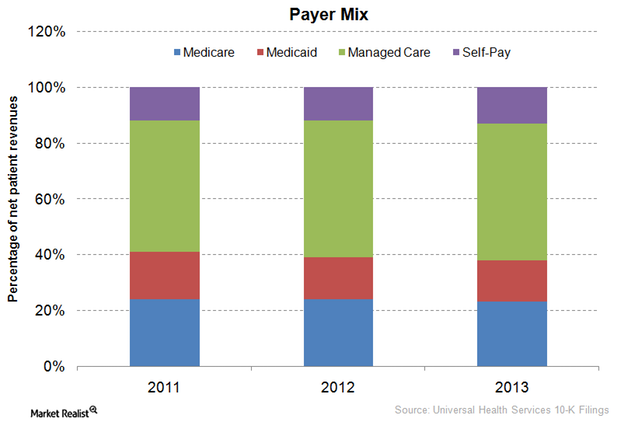

Universal Health Services’ payer mix differs from other companies’

Universal Health Services (UHS) has displayed a trend in payer mix from 2011 to 2013 that differs from other companies in the healthcare industry (XLV).

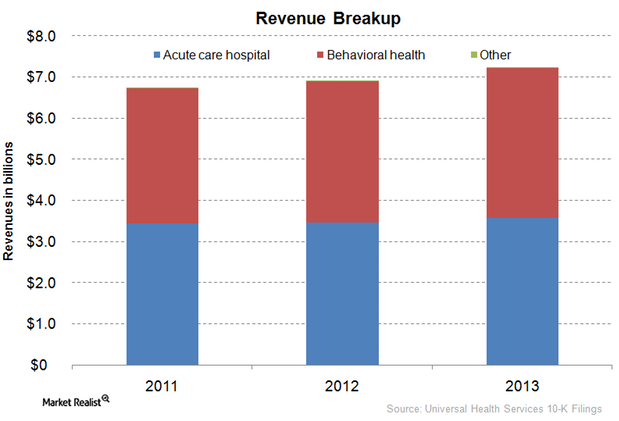

Exploring Universal Health Services’ revenue streams

Universal Health Services’ (UHS) net revenues increased by 4.6% from $6.96 billion in 2012 to $7.28 billion in 2013.

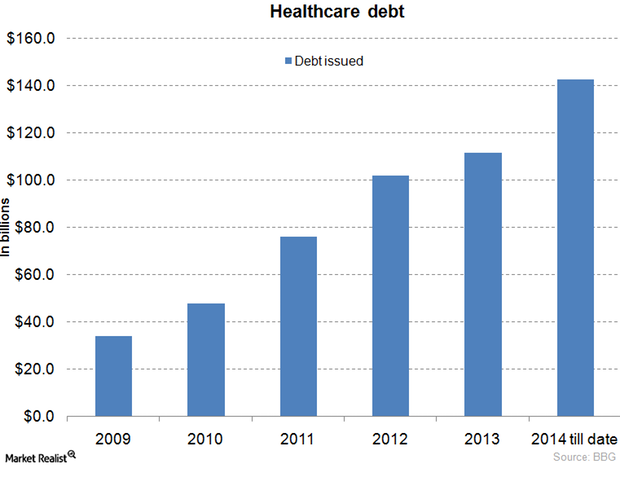

Why changes in interest rates affect the hospital industry

Economic changes in interest rates affect hospital companies, depending on the company’s cost-structure and expansion strategies.

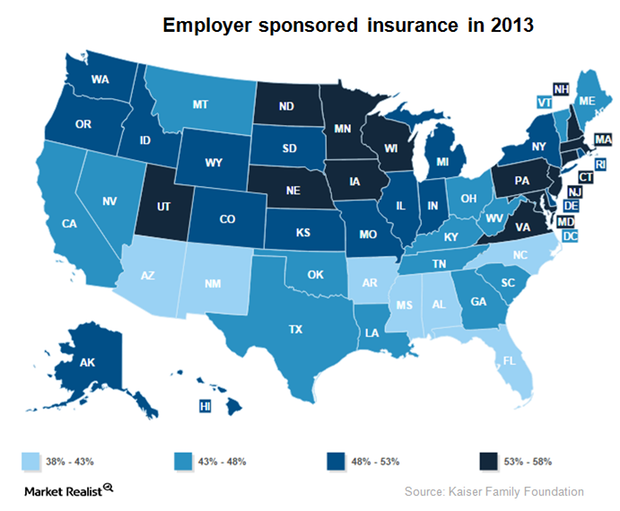

Why the unemployment rate affects hospital performance

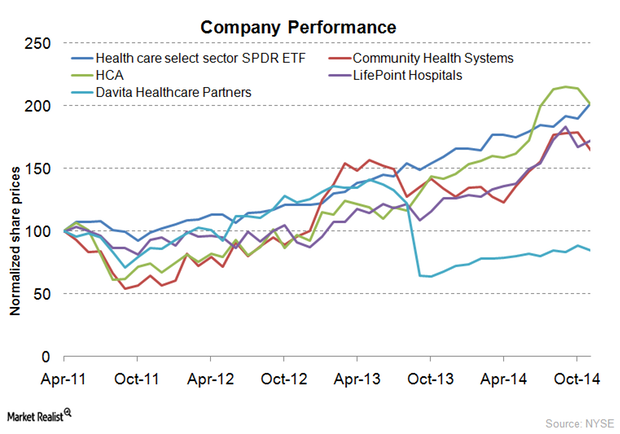

The healthcare industry, represented by the Healthcare Select Sector SPDR, is affected by the unemployment rate. Income affects people’s health choices.

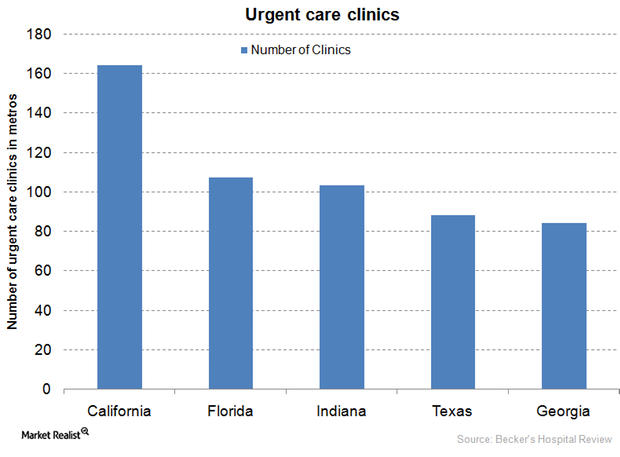

Standalone urgent care strategies

HCA Holdings is capturing market share in the $15 billion urgent care clinic market field by focusing on acquiring or opening standalone urgent care clinics.

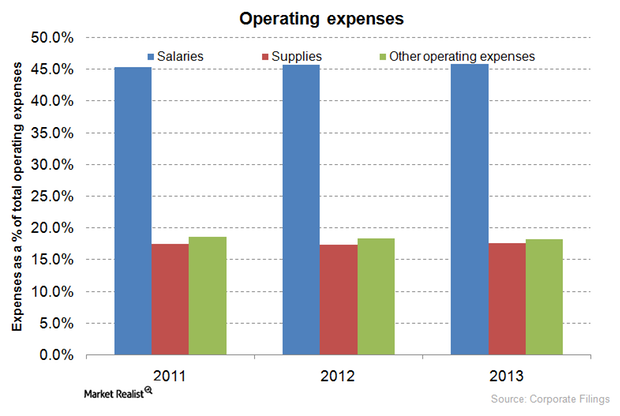

Exploring HCA Holdings’ operating expenses

With solutions such as flexible staffing and optimal group purchasing provided by Parallon, HCA Holdings has better operating margins as compared to its peers.

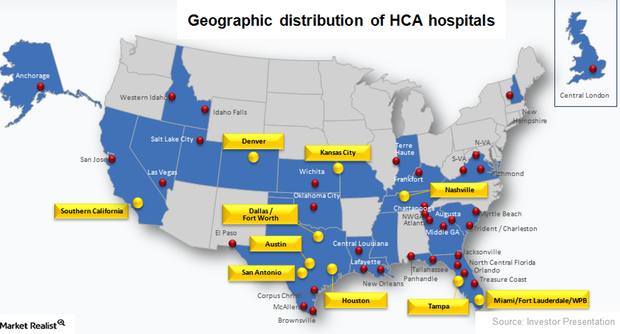

HCA’s diversification strategy

HCA Holdings’ diversified suite of services enables it to retain patients at their facilities, which bolsters revenues per patient.

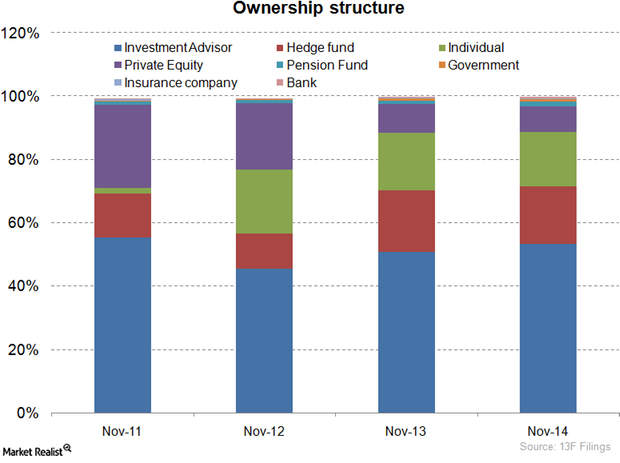

Exploring HCA’s ownership structure

Passive investments account for more than 56% of HCA Holdings’ total ownership structure.

An overview of HCA Holdings

HCA Holdings went private in 1988 through a leveraged buyout, but it again became a public company in 1992.Earnings Report The benefits of Community Health Systems’ acquisition strategy

Community Health Systems acquires two to four hospitals each year as a part of its growth strategy. Reducing duplicate functions at the corporate level reduces overhead salary costs.Company & Industry Overviews Healthcare reform’s impact on Community Health Systems

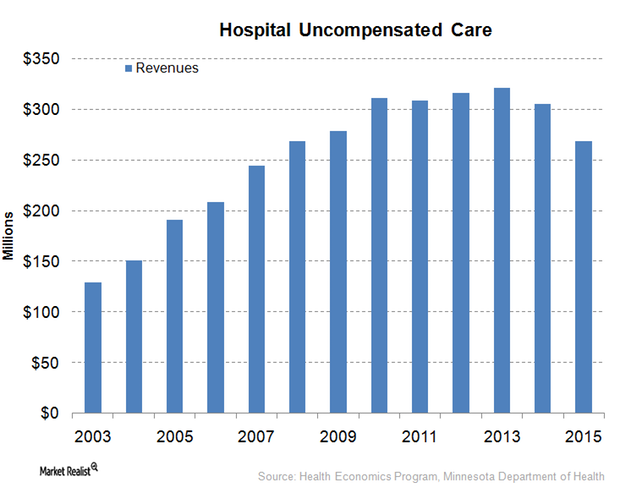

The Patient Protection and Affordable Care Act (or ACA) and Health Care and Education Affordability Reconciliation Act are together called “Reform Legislation.”