BTC iShares 3-7 Year Treasury Bond ETF

Latest BTC iShares 3-7 Year Treasury Bond ETF News and Updates

Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.

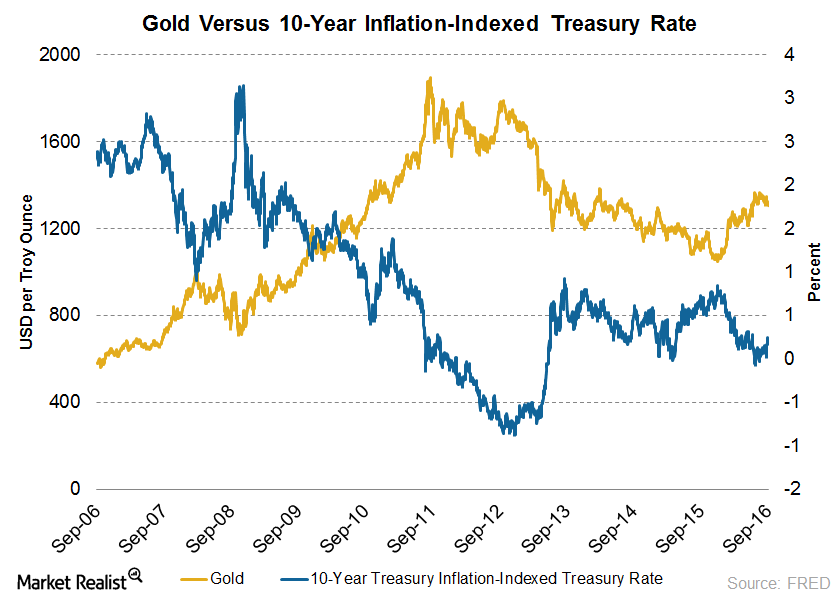

Gold versus 10-Year Treasury Bonds

The negative interest policy of the central banks is casting government bonds as a futile choice for investors compared to stocks and gold. As a result, bond prices dipped and yields started rising.

Janet Yellen: A Key Question for the Future

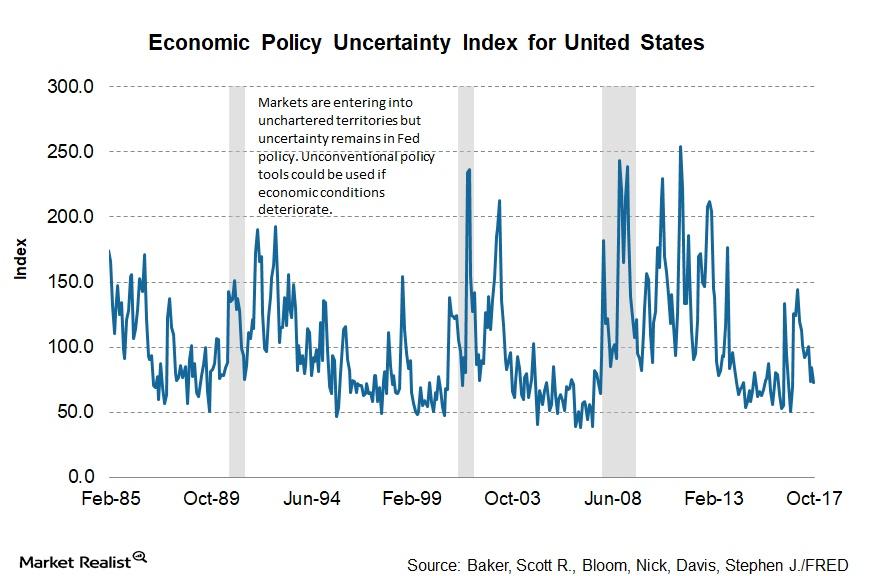

In a speech at the 2017 Herbert Stein Memorial Lecture, Fed Chair Janet Yellen shared her thoughts on monetary policy for the future and discussed whether there will be any role for unconventional policy again.

Janet Yellen Balance Sheet Strategy a Closer Look

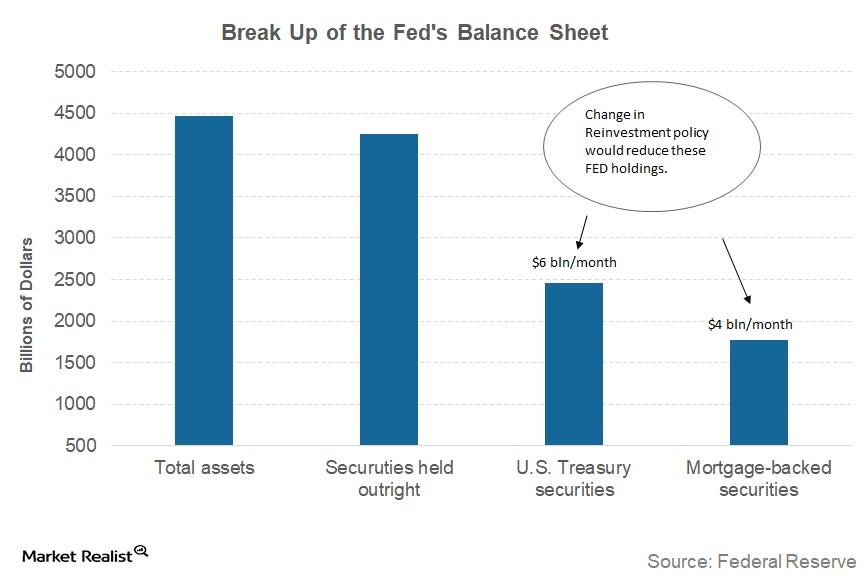

Fed Chair Janet Yellen, in her speech at the 2017 Herbert Stein Memorial Lecture, offered some more insight into the Fed’s balance sheet reducing strategy.

Why the Fed Has Initiated Balance Sheet Normalization

Atlanta Federal Reserve president and CEO, Raphael Bostic, recently spoke at a conference about the Fed’s balance sheet normalization program.

Why FOMC Members Aren’t Worried about the Market Reaction to Balance Sheet Trimming

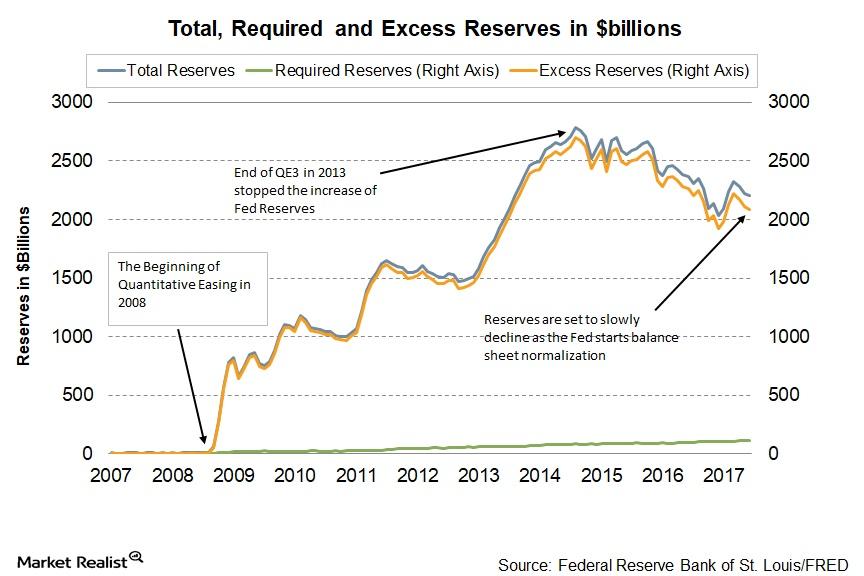

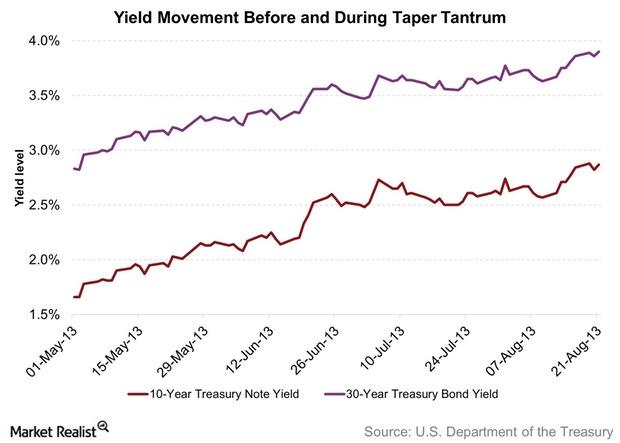

The September meeting minutes indicated that the members underscored that the reduction in the Fed’s balance sheet would be gradual.

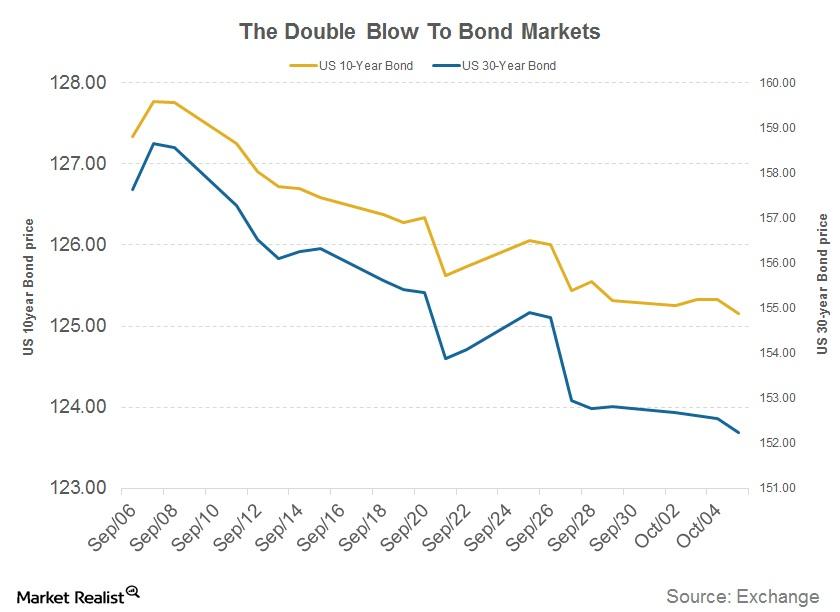

A Double Blow for Bond Markets?

The announcement of the GOP tax reform plan added to the pressure on bond markets.

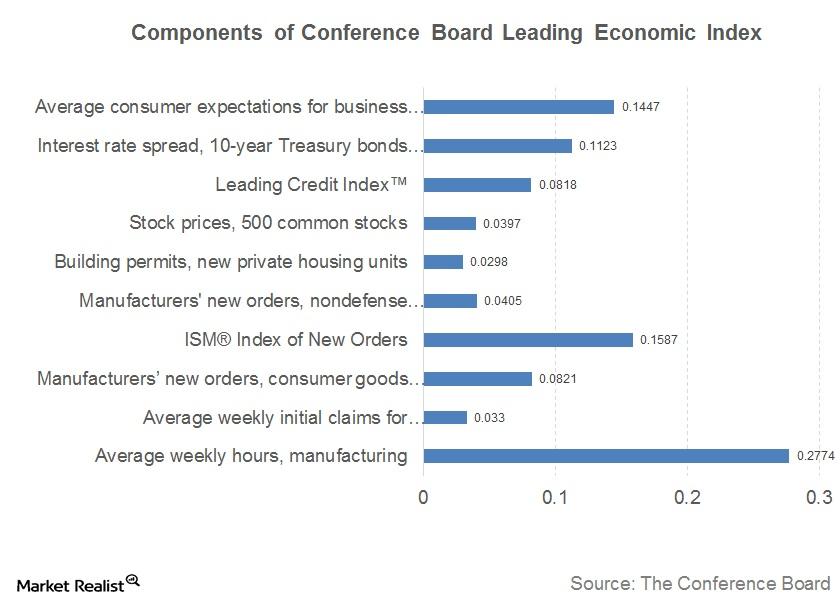

Tracking the Conference Board Leading Economic Index

In this series, we’ll analyze each component of the Conference Board Leading Economic Index and understand its implications for the consumer discretionary (XLY), industrial (XLI), and housing (XHB) sectors and the overall market (SPY).

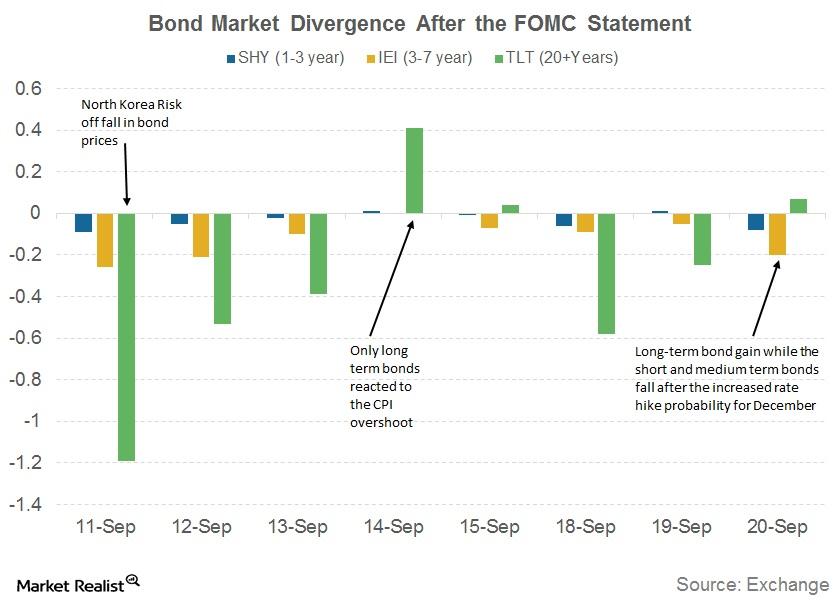

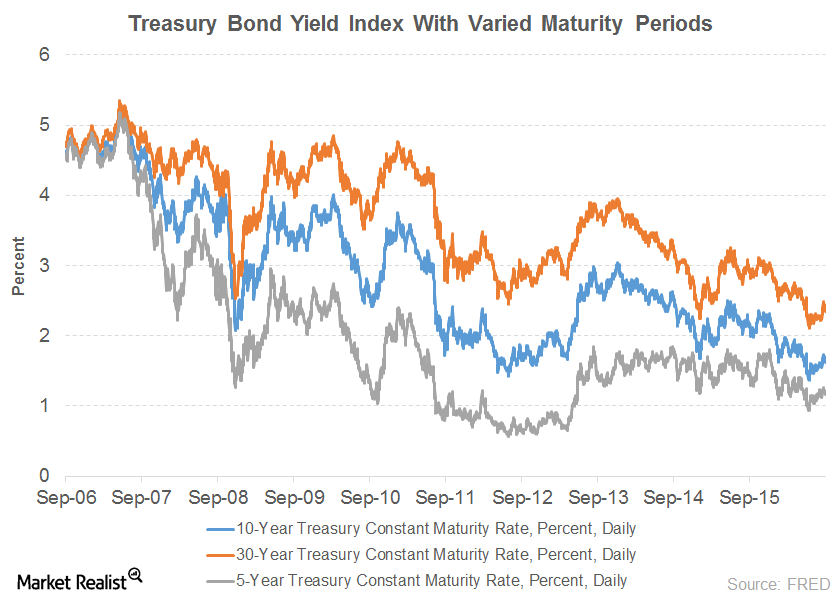

Why Maturity Bonds Reacted Differently to the Fed’s September Statement

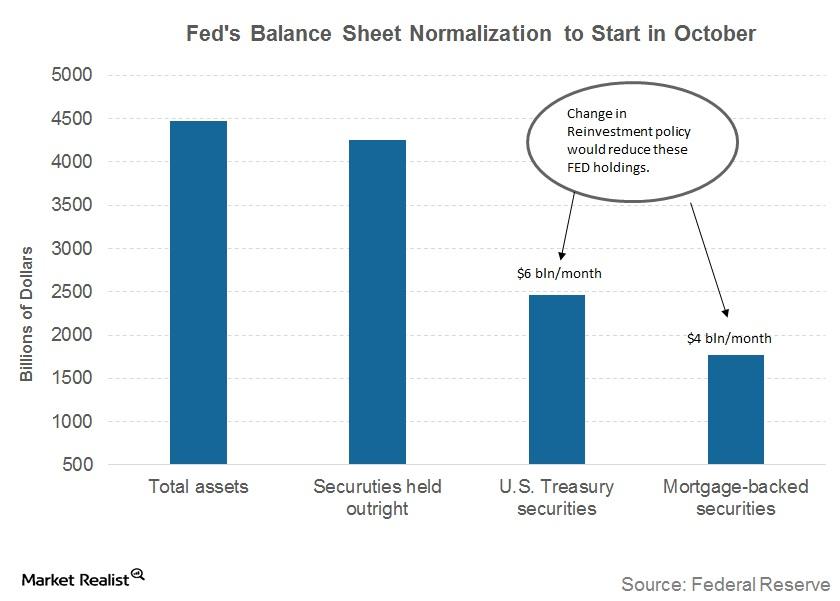

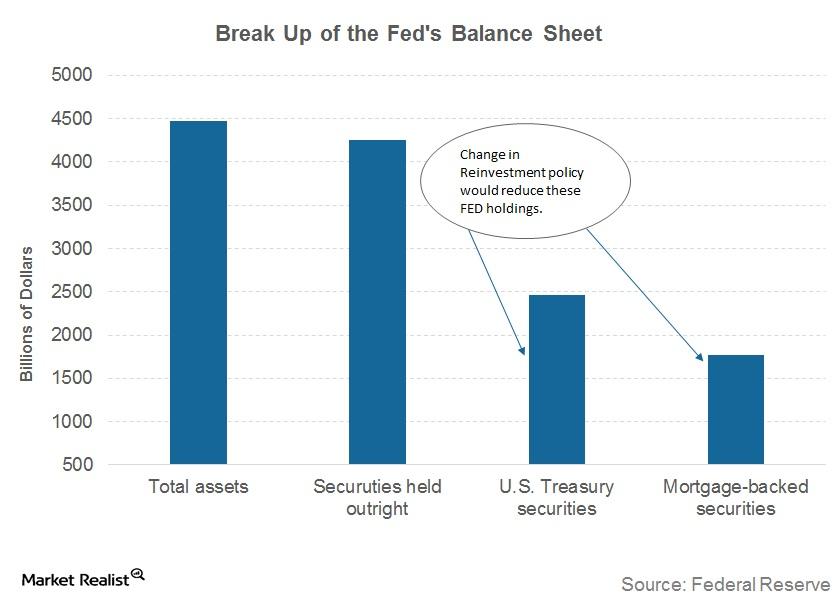

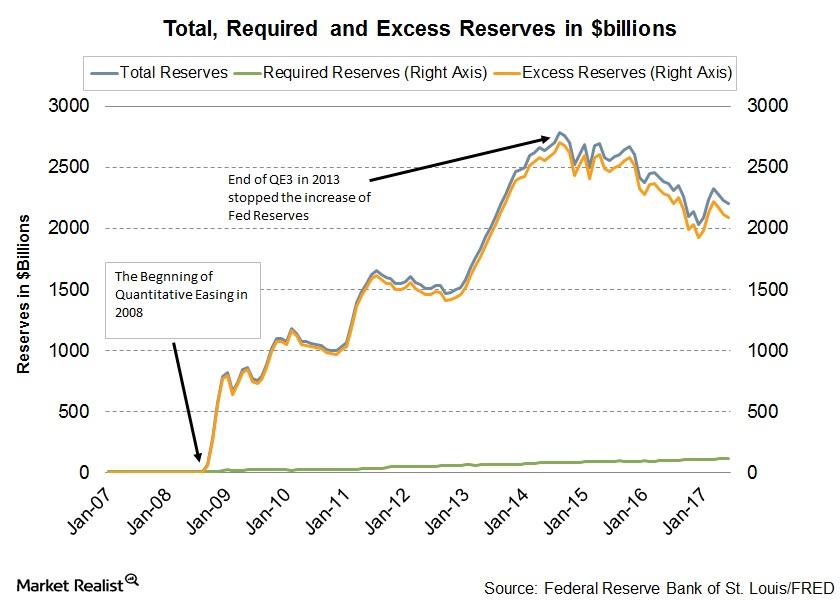

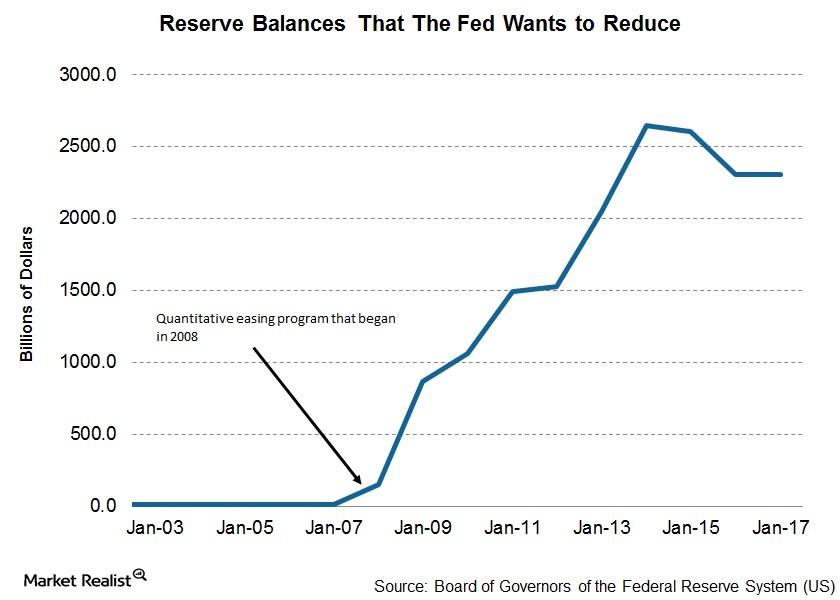

The Fed’s balance sheet has $4.4 trillion in bond market securities, and it intends not to reinvest a small portion of the maturing securities every month.

Why Is FOMC Starting to Unwind Its Balance Sheet without a Target?

In the September 20 meeting, FOMC (US Federal Open Market Committee) finally announced the start date of its balance sheet unwinding program.

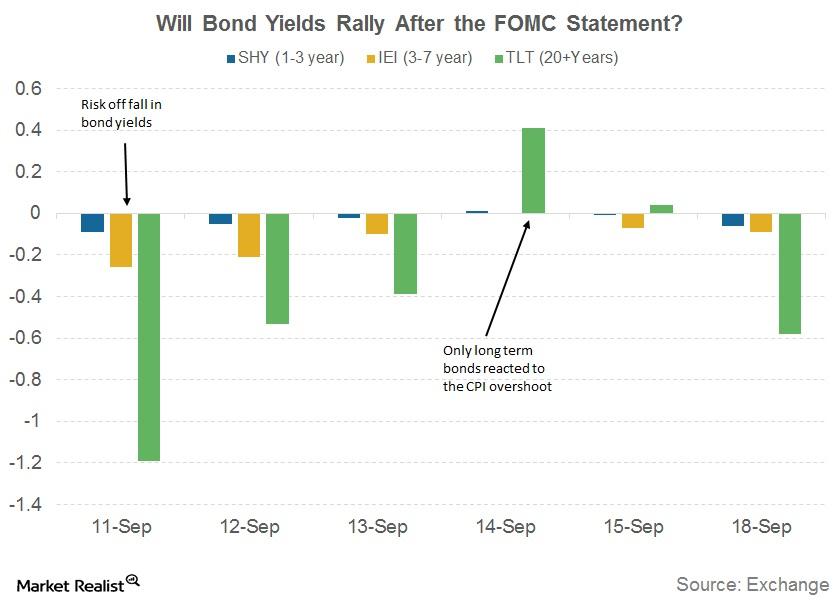

Will US Bond Yields Rally after the FOMC Statement?

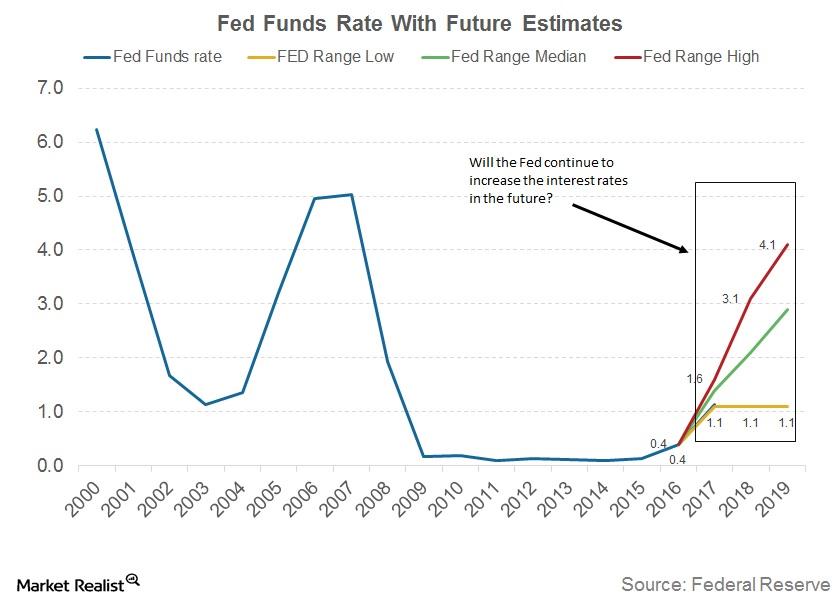

The bond markets are the most impacted asset class by any changes to the Federal interest rates.

Markets Are Confident on Fed Balance Sheet Trimming Announcement

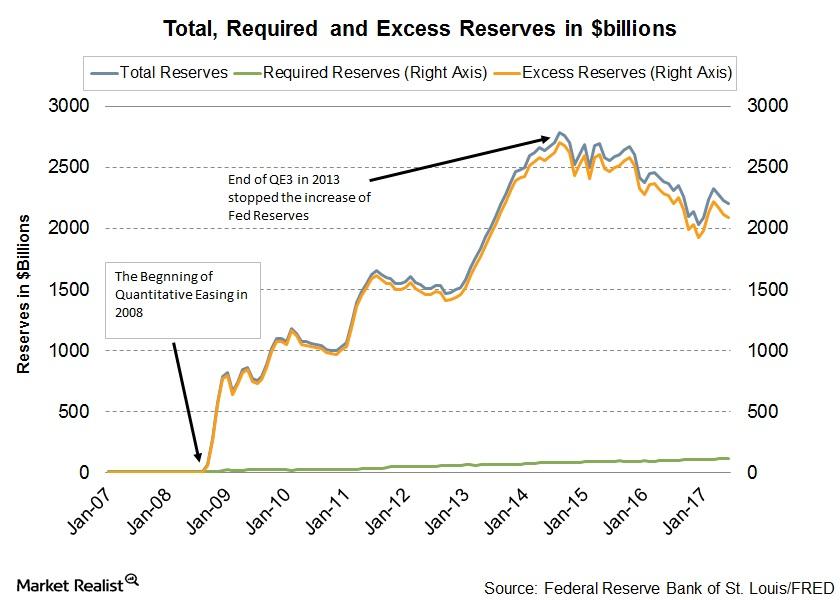

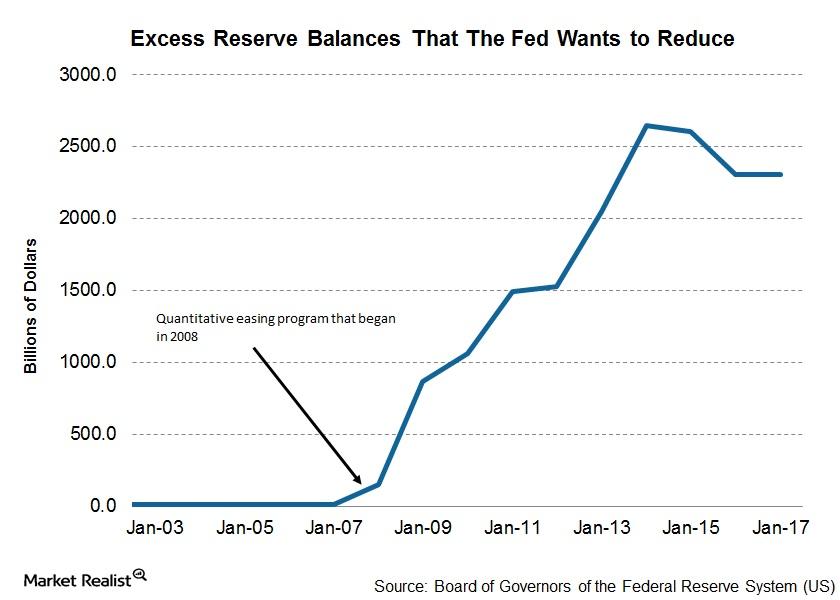

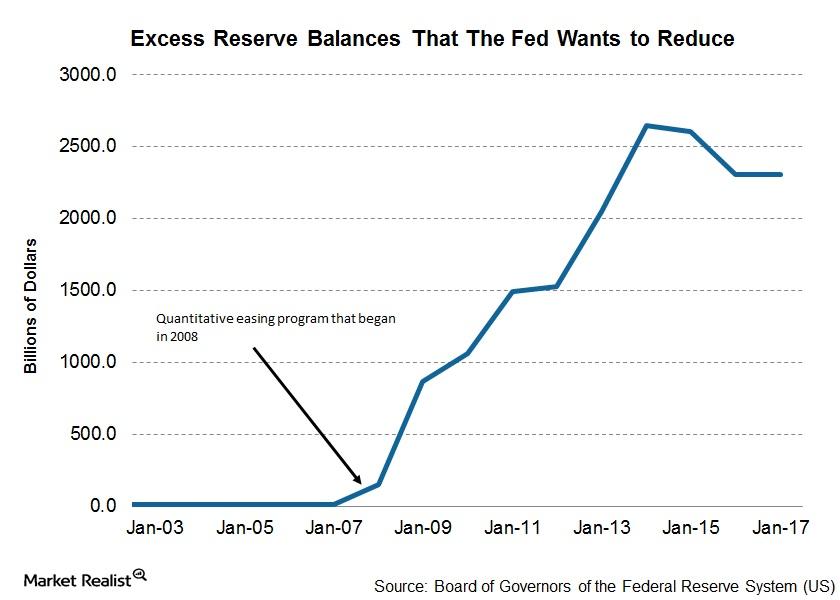

In its efforts to revive the US economy from the Great Recession, the US Fed started purchasing US government-backed securities in 2008.

Why the US Debt Ceiling Fight Has Been Postponed

The key reason for the debt ceiling deal was to approve aid to Hurricane Harvey victims. A US government shutdown could have adversely impacted relief operations.

Stanley Fisher’s Solution for Low Interest Rates

Stanley Fisher, vice chair of the U.S. Federal Reserve, has shared his views on low interest rates and some solutions to get rates back to normal levels.

Could the Fed Announce Balance Sheet Shrinking in September?

The Fed, in its efforts to normalize policy, announced that it is starting the balance sheet unwinding program soon.

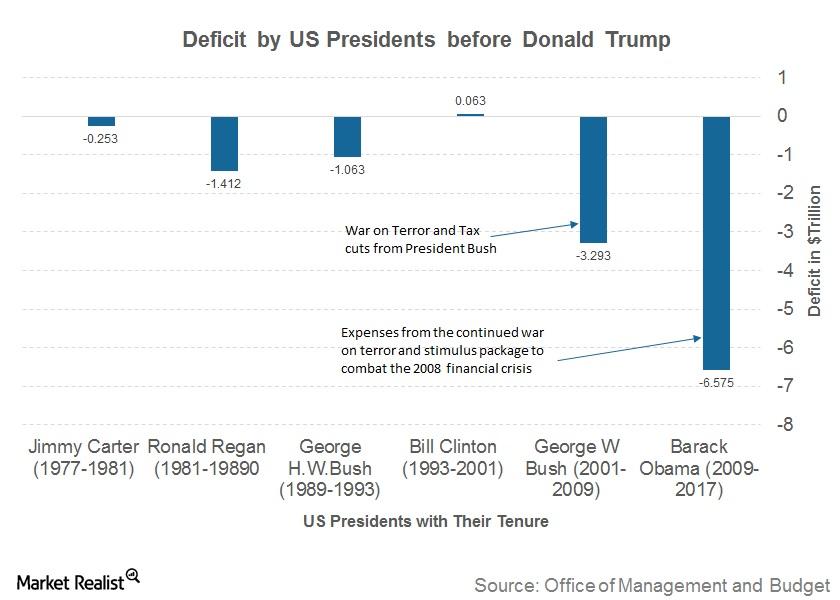

How the US’s Debt Has Become So Big

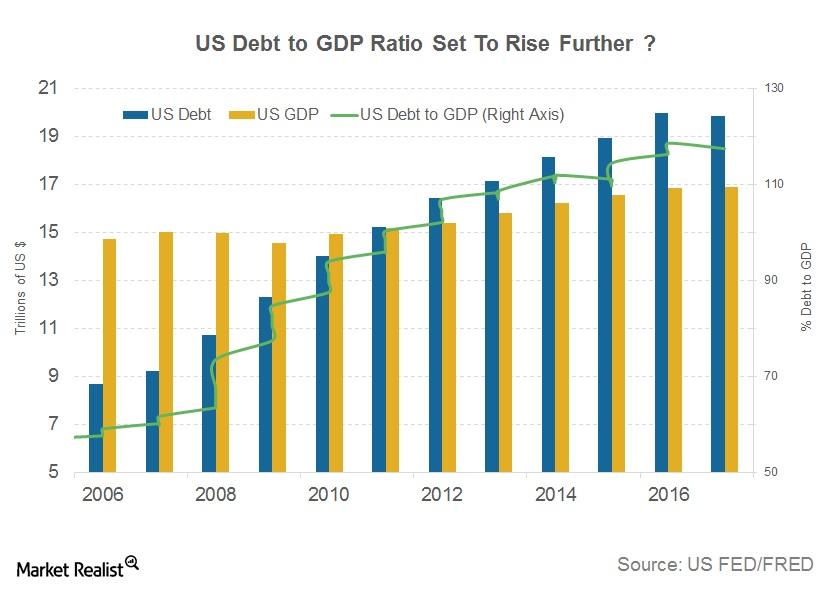

The US debt-to-GDP ratio now stands at 106.1%, which means that the total US debt is more than the annual US GDP.

The Fed Could Announce Balance Sheet Reduction Plan in September

In its June meeting, FOMC (Federal Open Market Committee) members detailed plans to shrink the $4.5 trillion balance sheet.

Will the US Balance Sheet Unwind Affect the Markets?

After the July FOMC meeting statement was released, market participants came to believe that the Fed would begin the process of balance sheet normalization soon.

Fed Chair Yellen Warns about Its $4.5 Trillion Balance Sheet Unwinding

In her post-meeting press conference, Janet Yellen warned that the Fed could implement its balance sheet unwinding process soon if the economy continues to perform as expected.

Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

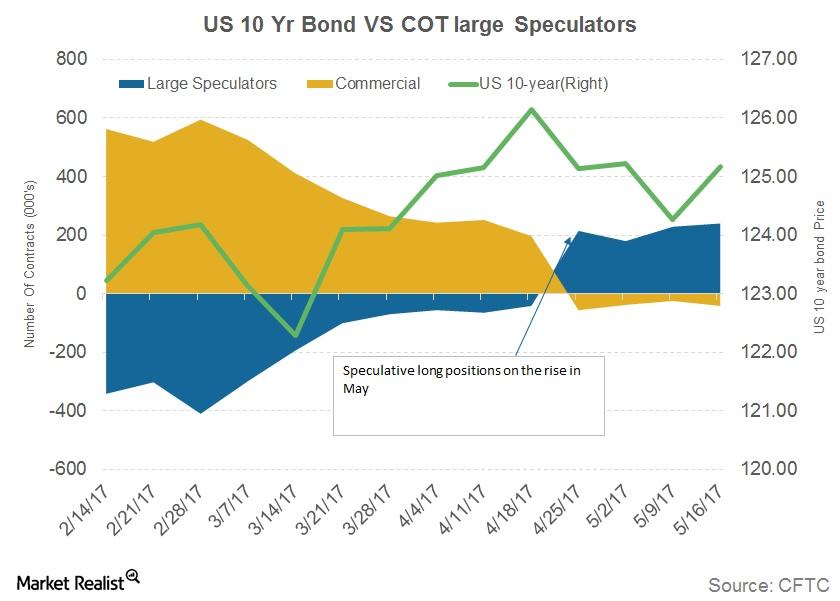

Why Are Bond Traders Increasing Their Net Positions?

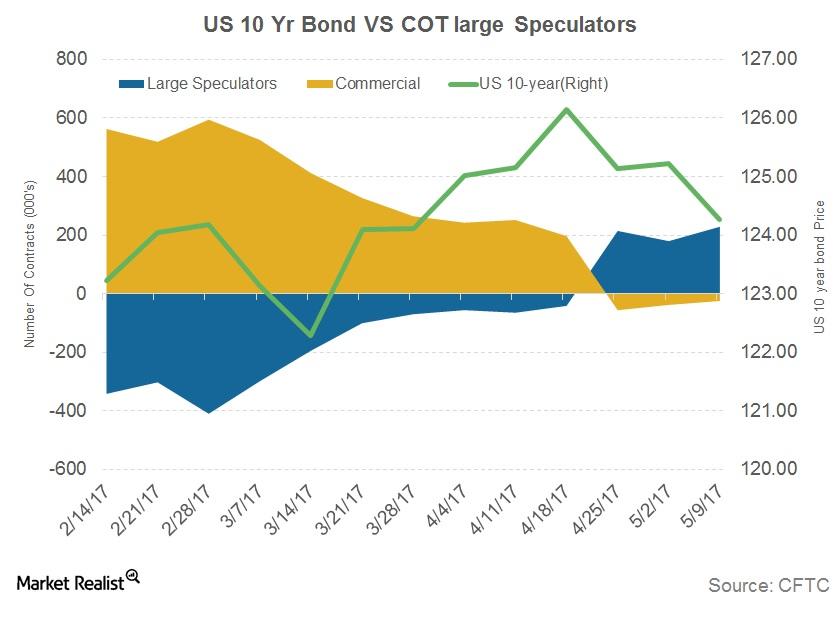

US bond markets are trading on the expectation of an interest rate hike by the US Federal Reserve in June 2017. Last week, bond yields extended their slides.

Why Were Fed Policymakers Worried about Clear Communication?

The credibility of the Federal Reserve was a concern raised by some policymakers at the September FOMC (Federal Open Market Committee) meeting.

Why Did Treasury Bonds Record a Fall in Yield?

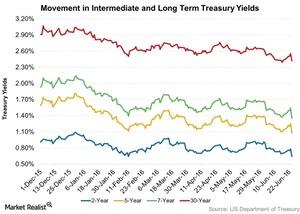

The yield on US ten-year Treasury securities fell below the 1.6% mark for the first time on September 26, 2016 due to a rise in demand.

Interest Rate Outlooks Don’t Affect All Asset Classes: Here’s Why

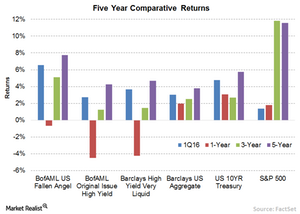

Historically, it seems that fallen angels generally perform well across interest rate environments.

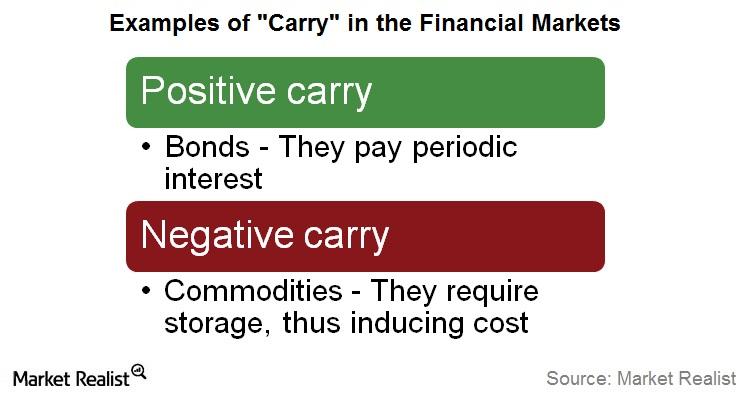

Bill Gross Talks about Compressed ‘Carry’ in Financial Markets

In his latest monthly investment outlook for June 2016, bond market veteran Bill Gross talked about “carry” in financial markets.