Gold Fields Ltd

Latest Gold Fields Ltd News and Updates

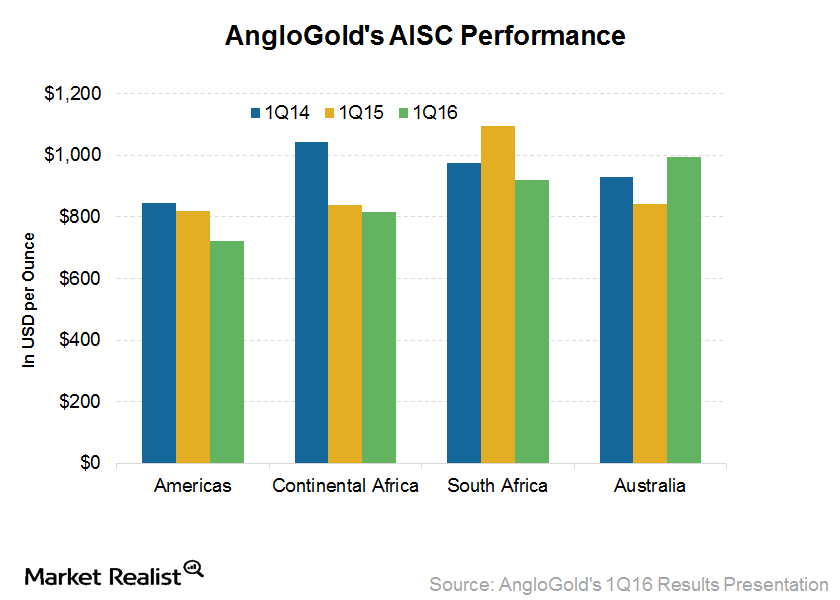

How Did AngloGold Reduce Its Costs despite Lower Production?

AngloGold Ashanti that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

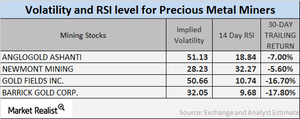

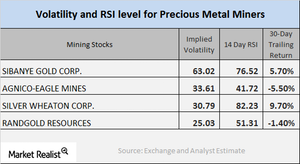

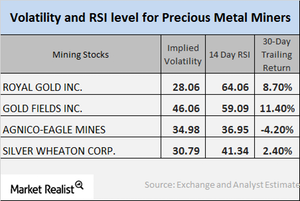

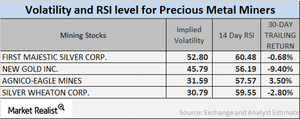

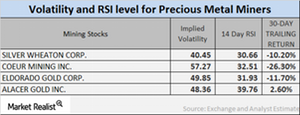

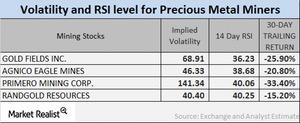

What Falling Miner RSI Levels Suggest

The RSI levels of our four select mining giants have all increased lately due to their higher stock prices.

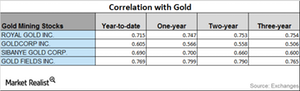

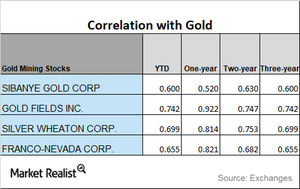

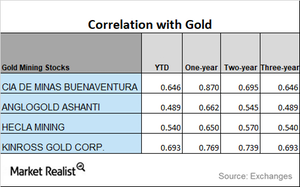

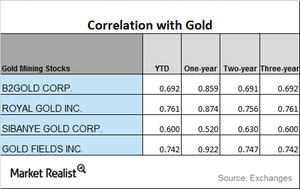

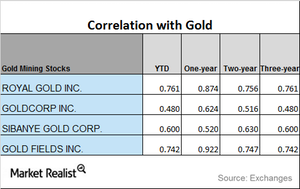

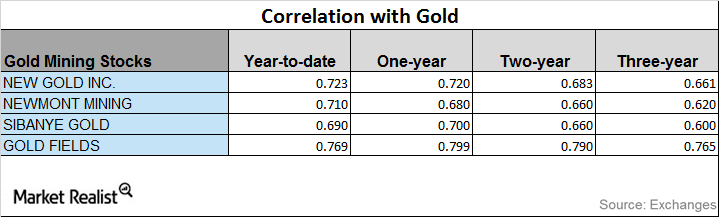

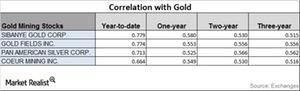

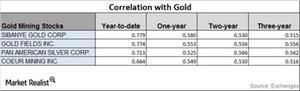

Which Stocks Are Uptrending in Their Correlations to Gold?

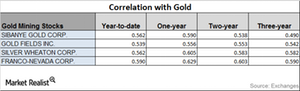

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals.

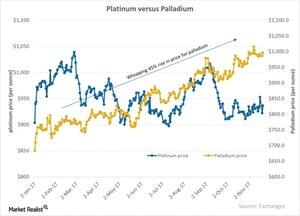

Platinum Touched Its Six-and-a-Half-Year Low in 2015

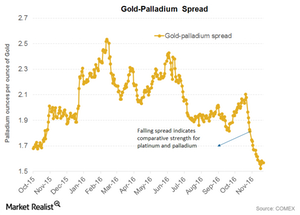

As automobile catalysts comprise ~44% of the demand for platinum, the Volkswagen scandal curbed the demand for diesel-fueled cars that use platinum as a catalyst. This pulled down the already depressed platinum and comparatively strengthened palladium.

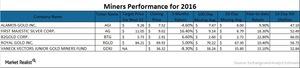

An Overview of Gold Miner Performance in 2015

Gold miners’ stocks have underperformed most of the market indices and gold itself. GDX has significantly underperformed GLD since 2008.

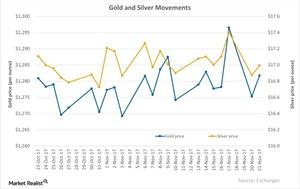

Reading the Performance of Mining Shares amid Surging Metals

On January 12, 2018, precious metals were once again on a rising streak, which also led to increasing prices for mining shares.

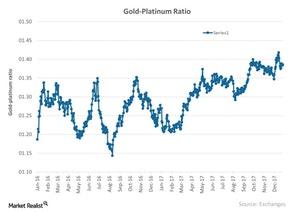

Understanding the Recent Gold-Platinum Cross Rate

When analyzing platinum markets, it’s important to compare the metal’s performance with that of gold, which is the most crucial of the precious metals.

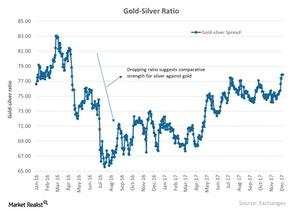

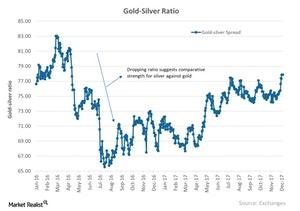

A Brief Look at December 2017’s Precious Metal Spread Measures

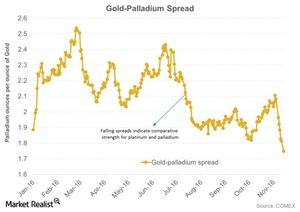

In this article, we’ll discuss the gold-silver, gold-platinum, and gold-palladium spreads. These three spreads stand at 77.9, 1.38, and 1.23, respectively.

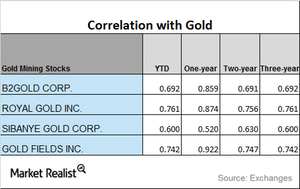

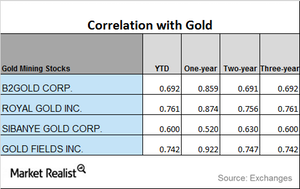

The Correlation Trends of Miners in 2017

If we look at the YTD correlations of the select mining shares to gold, there has been a reasonable fall. On a YTD basis, Sibanye Gold has the least correlation to gold.

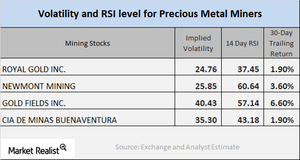

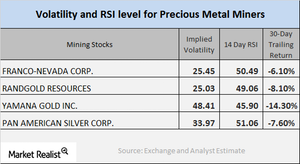

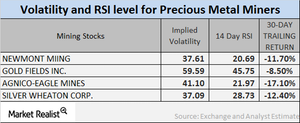

Analyzing Mining Stocks’ Technical Indicators

Gold Fields, Coeur Mining, Hecla Mining, and IamGold have call implied volatilities of 40.4%, 46.7%, 33.6%, and 44.3%, respectively.

Where Are Precious Metal Spreads Moving?

In this part of the series, we’ll look at the gold-silver spread, the gold-platinum spread, and the gold-palladium spread.

An Overview of the Platinum and Palladium Markets in 2017

In September 2017, palladium prices overtook the price of platinum.

What Led to the Recent Rebound in Precious Metals?

After a substantial slump on Monday, gold futures for December delivery rose 0.5% on Tuesday and closed at $1,281.7 per ounce.

Your Brief Correlation Study of Major Mining Stocks Last Week

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) have seen YTD (year-to-date) gains of 6.4% and 9%, respectively.

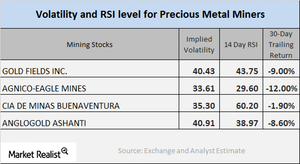

What’s the Directional Trend in Key Miners’ Correlation?

AngloGold Ashanti has had the lowest correlation with gold this year, while Gold Fields has had the highest correlation with gold.

A Brief Analysis of Mining Stock Correlations with Gold

The iShares MSCI Global Gold Min (RING) and the Sprott Gold Miners (SGDM) rose with metals on Monday, climbing 1.2% and 0.83%, respectively.

Reading the Correlation Movements of Precious Metal Miners with Gold

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Junior Gold Miners (GDXJ) fell 2.6% and 1.5%, respectively, on October 26.

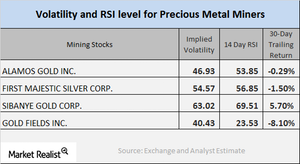

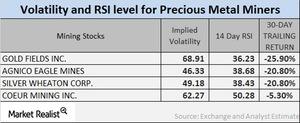

A Technical Analysis of Mining Shares in October

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks.

A Brief Correlation Study of Mining Stocks as of October 23

The iShares MSCI Global Gold Min (RING) and the VanEck Vectors Gold Miners (GDX) have fallen 1.3% and 1.4%, respectively, on a five-day-trailing basis.

How Mining Stocks Have Moved in October

On October 23, Alamos, First Majestic Silver, Sibanye Gold, and Gold Fields had call implied volatilities of 46.9%, 54.6%, 63%, and 40.4%, respectively.

Inside Mining Stock Technicals on October 12

Most precious metals had a down day on Tuesday, October 10, despite the recent overall upward movement in precious metals.

A Correlation Analysis of Some Important Miners

Among the miners that we’re looking at in this part of the series, Sibanye Gold has the lowest correlation to gold on a YTD basis, while Gold Fields has the highest correlation to gold.

Mining Stocks Today: Your Technical Updates

On October 5, Gold Fields, Agnico-Eagle, Cia De Minas Buenaventura, and AngloGold had implied volatility readings of 40.4%, 33.6%, 35.3%, and 40.9%, respectively.

Mining Stocks so Far in 2017: A Correlation Study

Among these four mining stocks, Goldcorp has the lowest correlation with gold on a YTD basis, while Royal Gold (RGLD) has the highest correlation.

The Latest in Correlation Trends between Mining Stocks and Gold

Among the four miners that we’re analyzing here, Sibanye Gold has the lowest correlation with gold on a one-year basis, while Gold Fields has the highest.

A Correlation Study of Mining Stocks in September 2017

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD basis, while Sibanye Gold has the lowest correlation to gold.

How Strongly Can North Korea Move the Precious Metals Market?

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

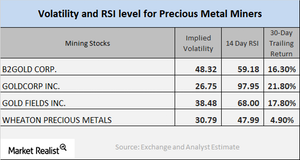

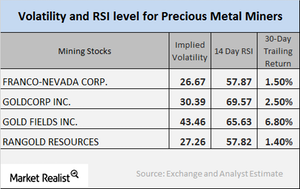

A Look at Volatilities for Precious Metal Miners

In this part of the series, we’ll look at some important technical indicators, including volatility figures and RSI levels for major miners.

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

Are RSI Numbers Moving Away from or Close to Critical Levels?

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

How Is Gold Fields’ Correlation with Gold Trending?

Turbulence in markets due to the viability of the Trump Administration, the upcoming French elections, and the Brexit vote caused precious metals to rise.

Are Miners Rebounding from Last Week’s Slump?

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

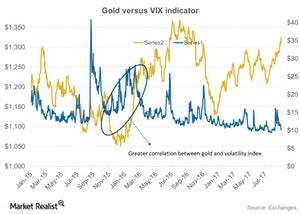

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

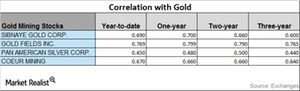

Reading the Correlation Movement of Mining Stocks

Sibanye Gold has the closest correlation to gold on a YTD basis among the four miners under review.

How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.

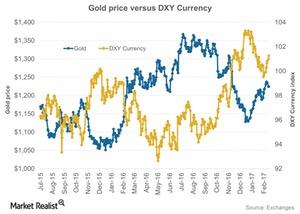

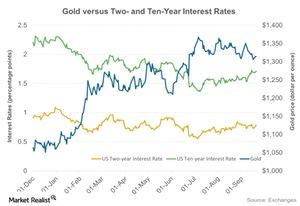

Why Gold and the US Dollar Are Moving in Opposite Directions

Gold prices tumbled on Tuesday, February 14, as the US dollar rose after the US Federal Reserve chair, Janet Yellen, seemed optimistic about raising interest rates.

How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.

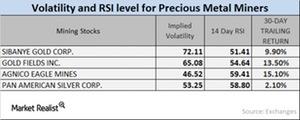

Volatility among the Miners in 2017

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

Reading the Movement in the Gold-Palladium Spread

The gold-platinum spread was approximately 1.6 on January 11, 2017. Its RSI (relative strength index) was as low as 40.

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

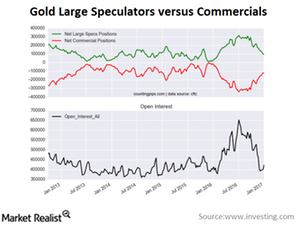

Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

What Were Mining Stocks’ Correlations during December?

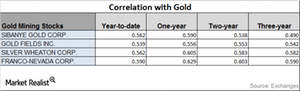

Precious metals had a great start to 2016. Franco-Nevada’s correlation rose from an ~0.59 three-year correlation to an ~0.63 one-year correlation.

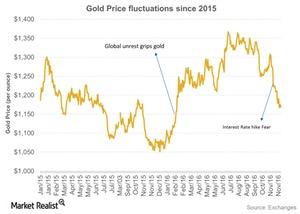

Why Did Gold Fluctuate in 2016?

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

Analyzing Upward and Downward Correlations among Miners

Precious metals had a great start to 2016, but they’ve been falling since Donald Trump won the US presidential election. As a result, mining stocks have also been falling.

Why the Gold-Palladium Spread Is Falling Drastically

Palladium has seen a YTD rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

Which Mining Stock Is Most Correlated to Gold?

Mining companies that have high correlations with gold include Sibanye Gold (SBGL), Gold Fields (GFI), Silver Wheaton (SLW), and Franco-Nevada (FNV).

How Palladium Outperformed Gold: The Gold-Palladium Spread

Palladium has seen a year-to-date rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.Macroeconomic Analysis How Has the US Dollar Affected Platinum Prices?

The current weakness in the rand made it fall to all-time lows against the US dollar in early 2016 but has helped mining companies.