Direxion Daily Natural Gas Related Bull 3x Shares

Latest Direxion Daily Natural Gas Related Bull 3x Shares News and Updates

How Much Natural Gas Could Fall Next Week

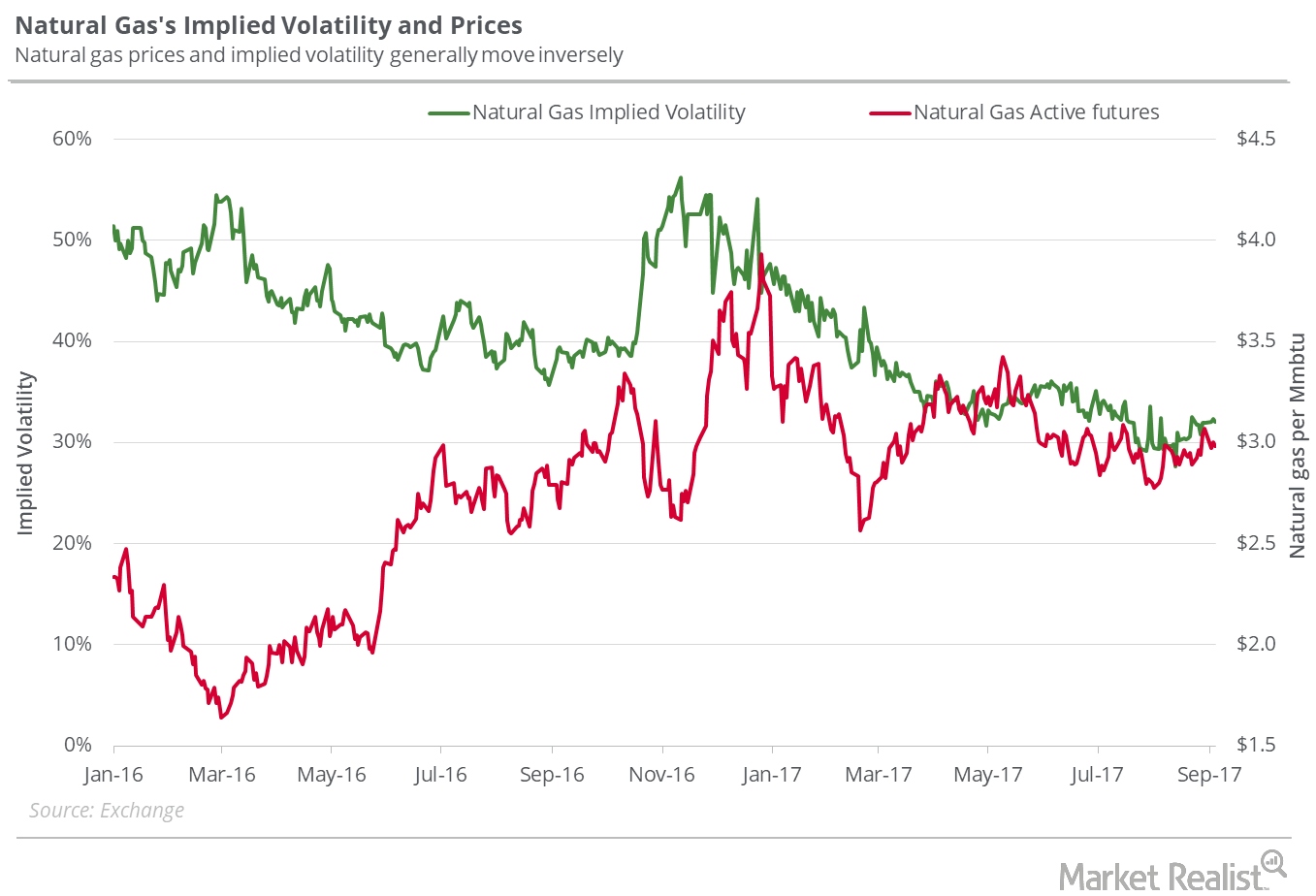

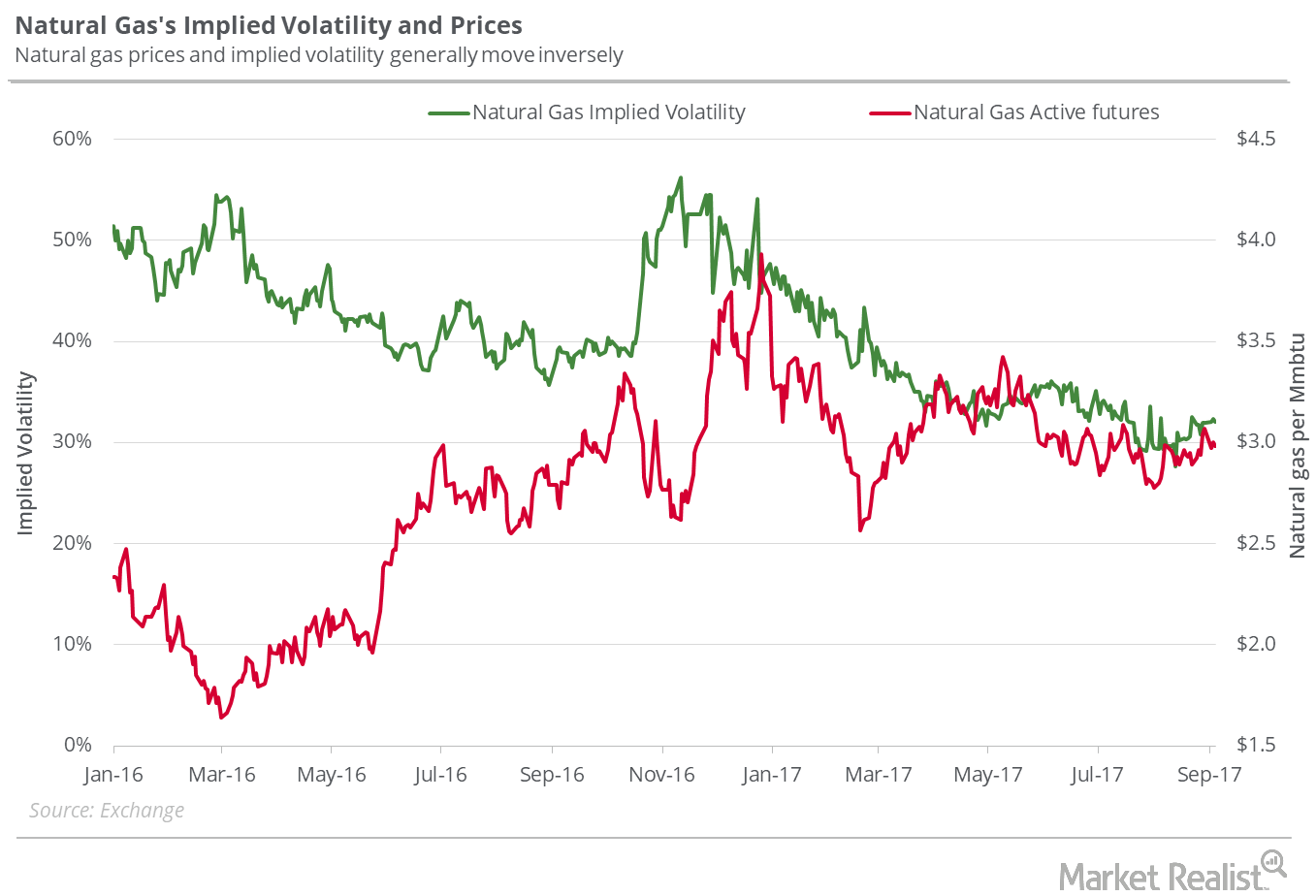

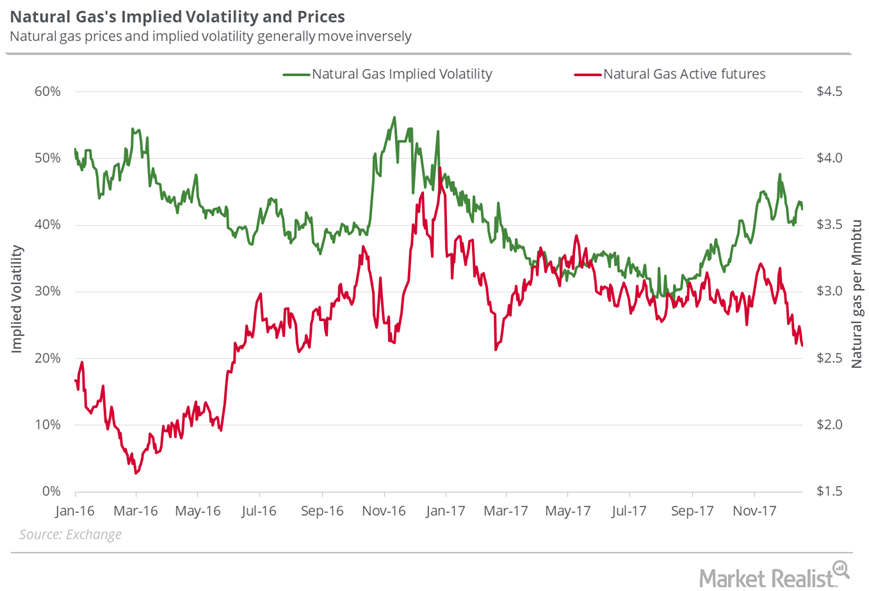

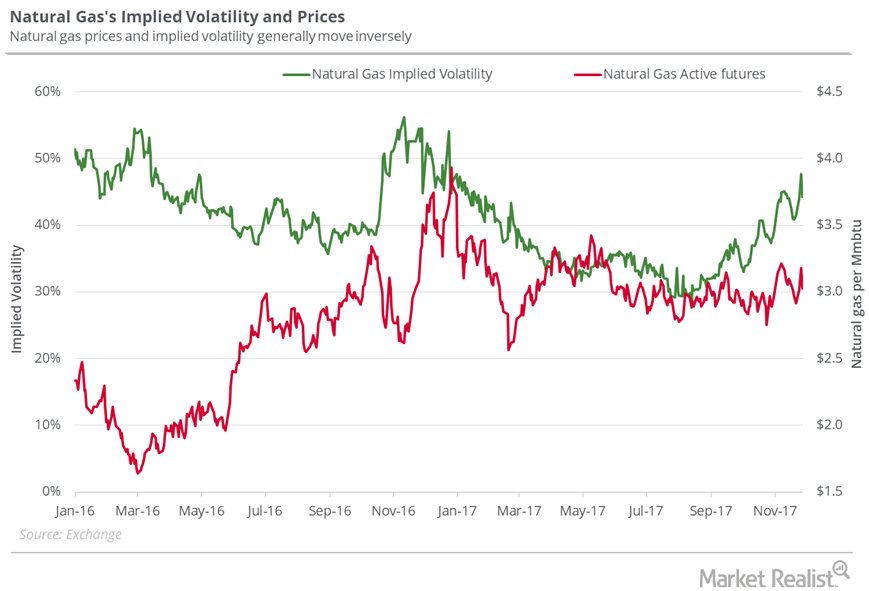

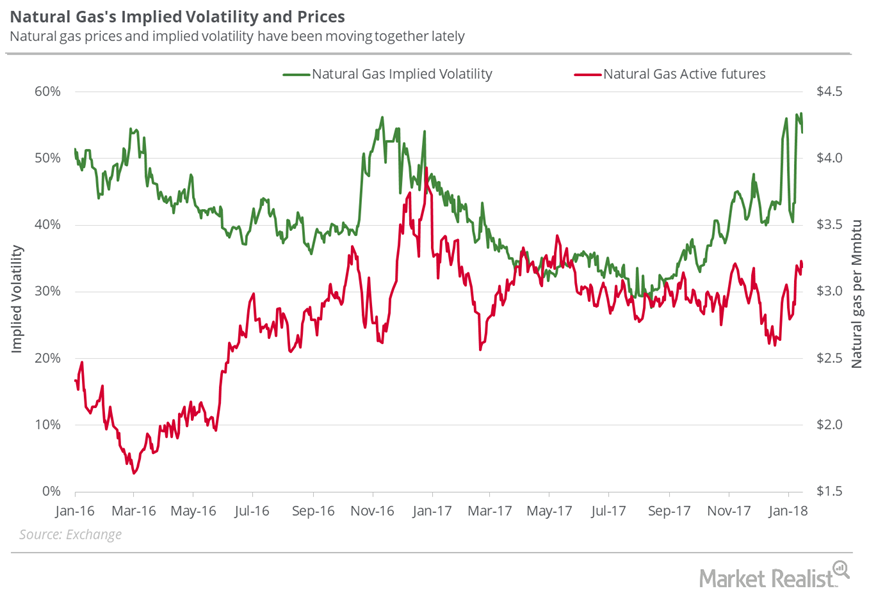

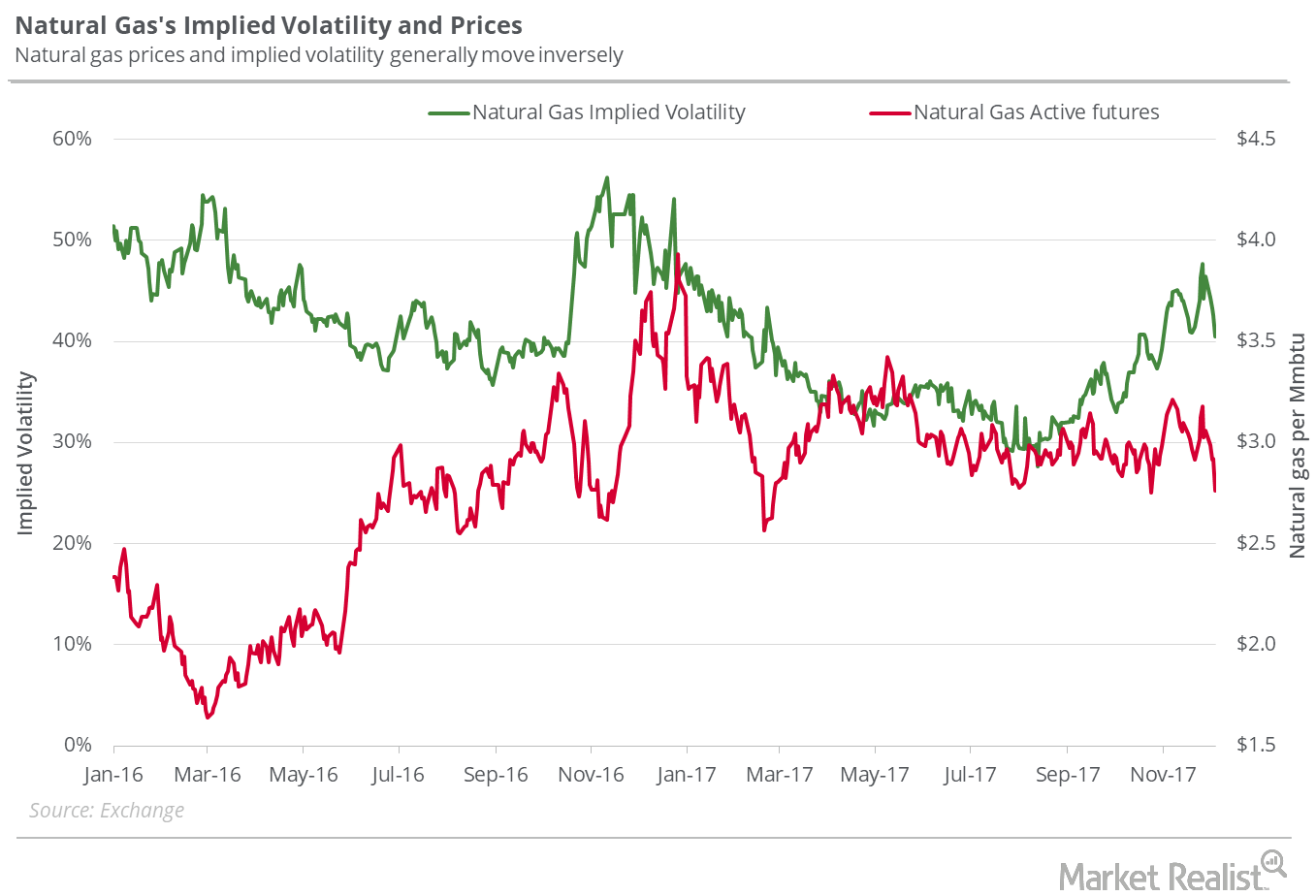

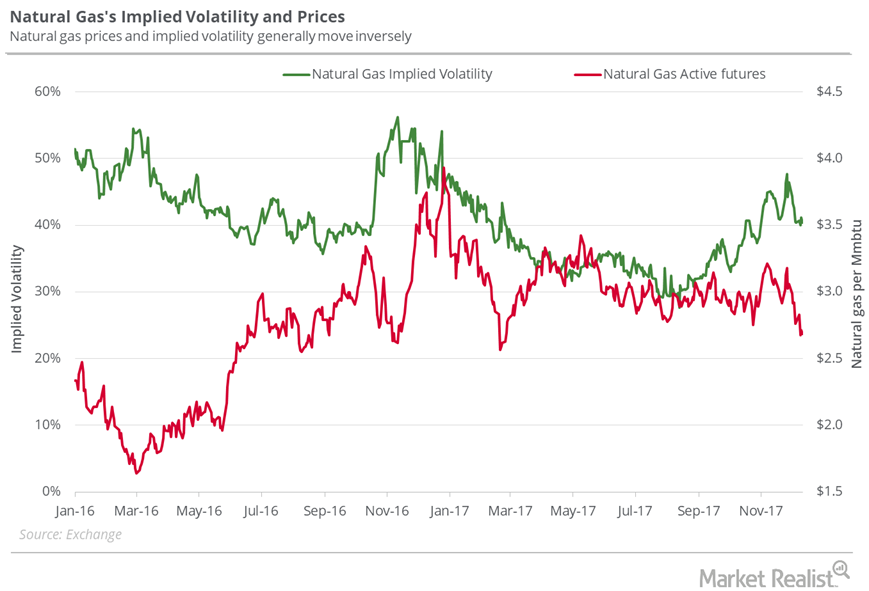

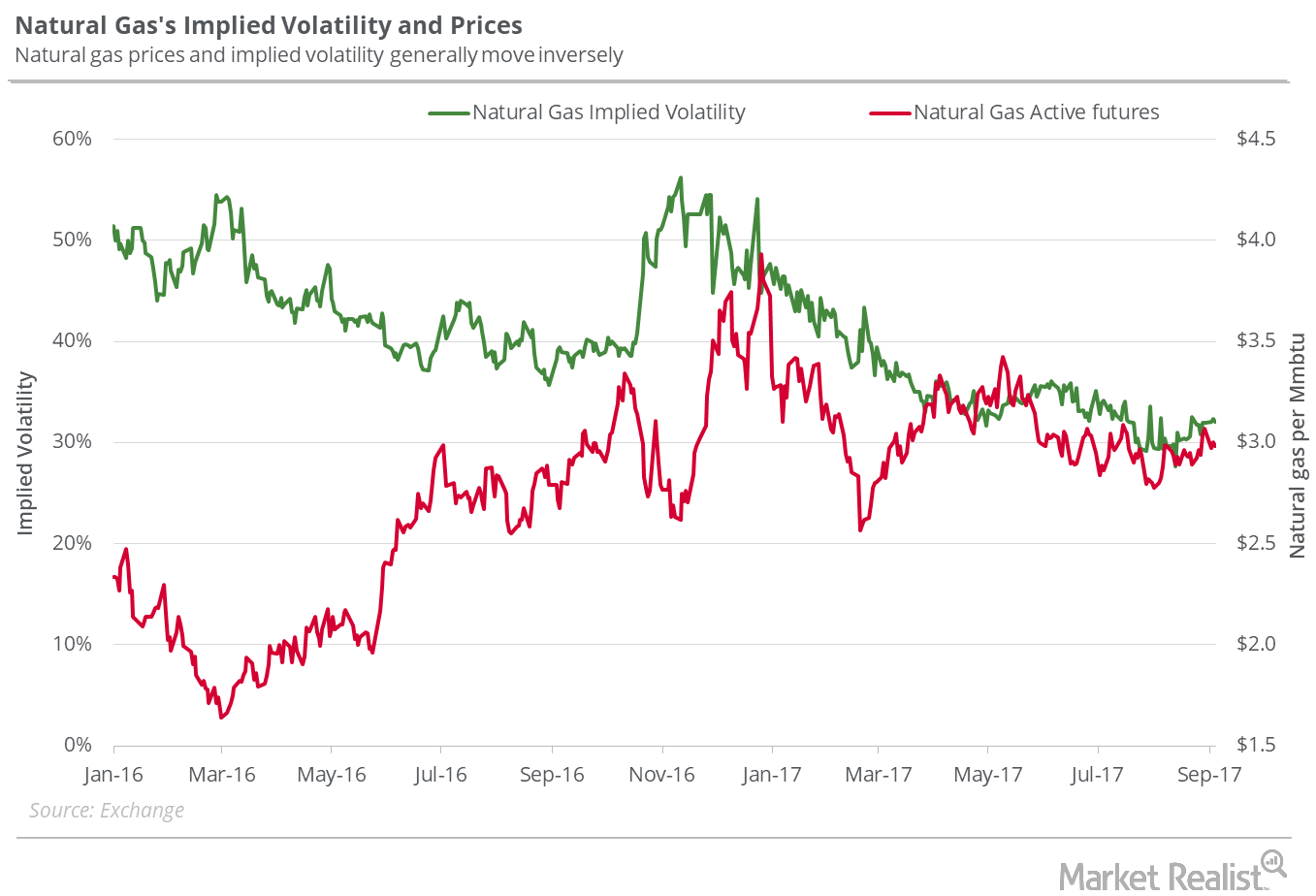

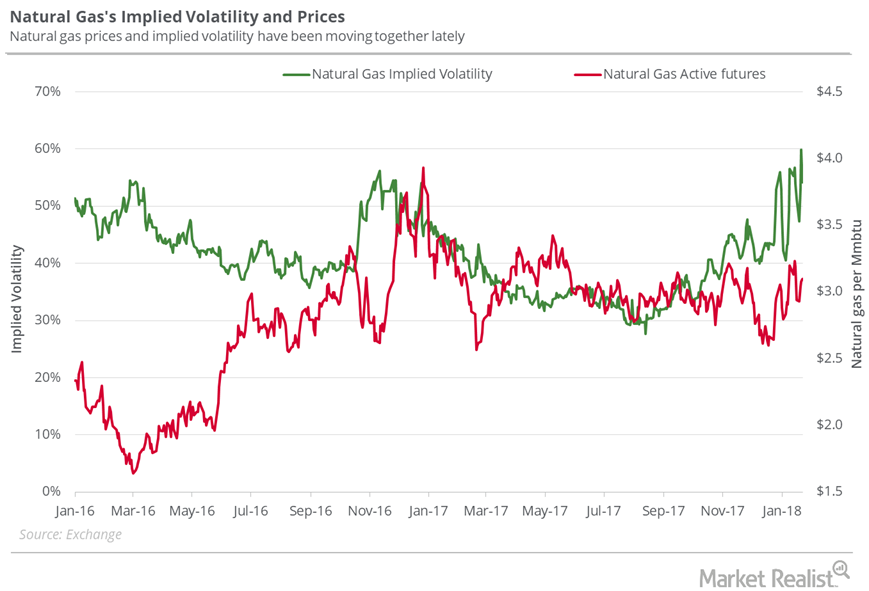

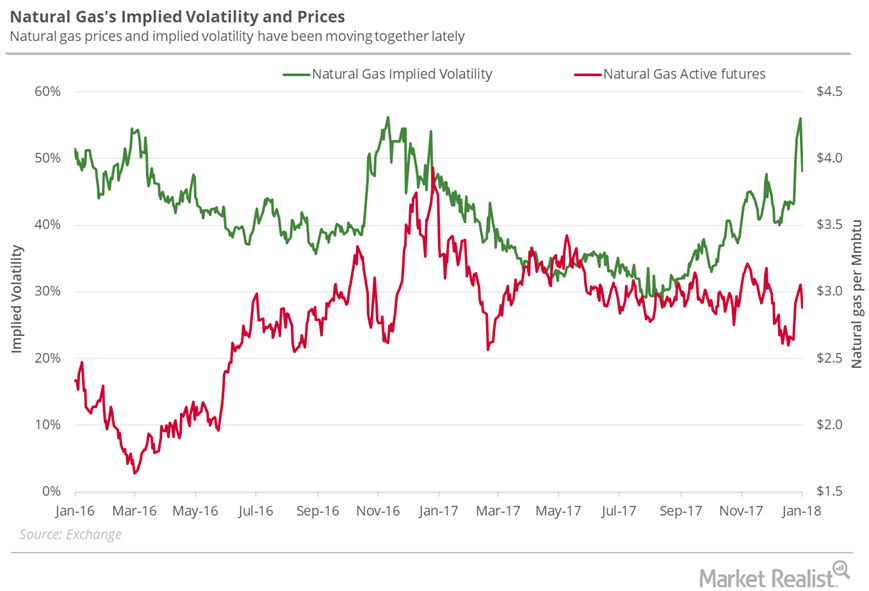

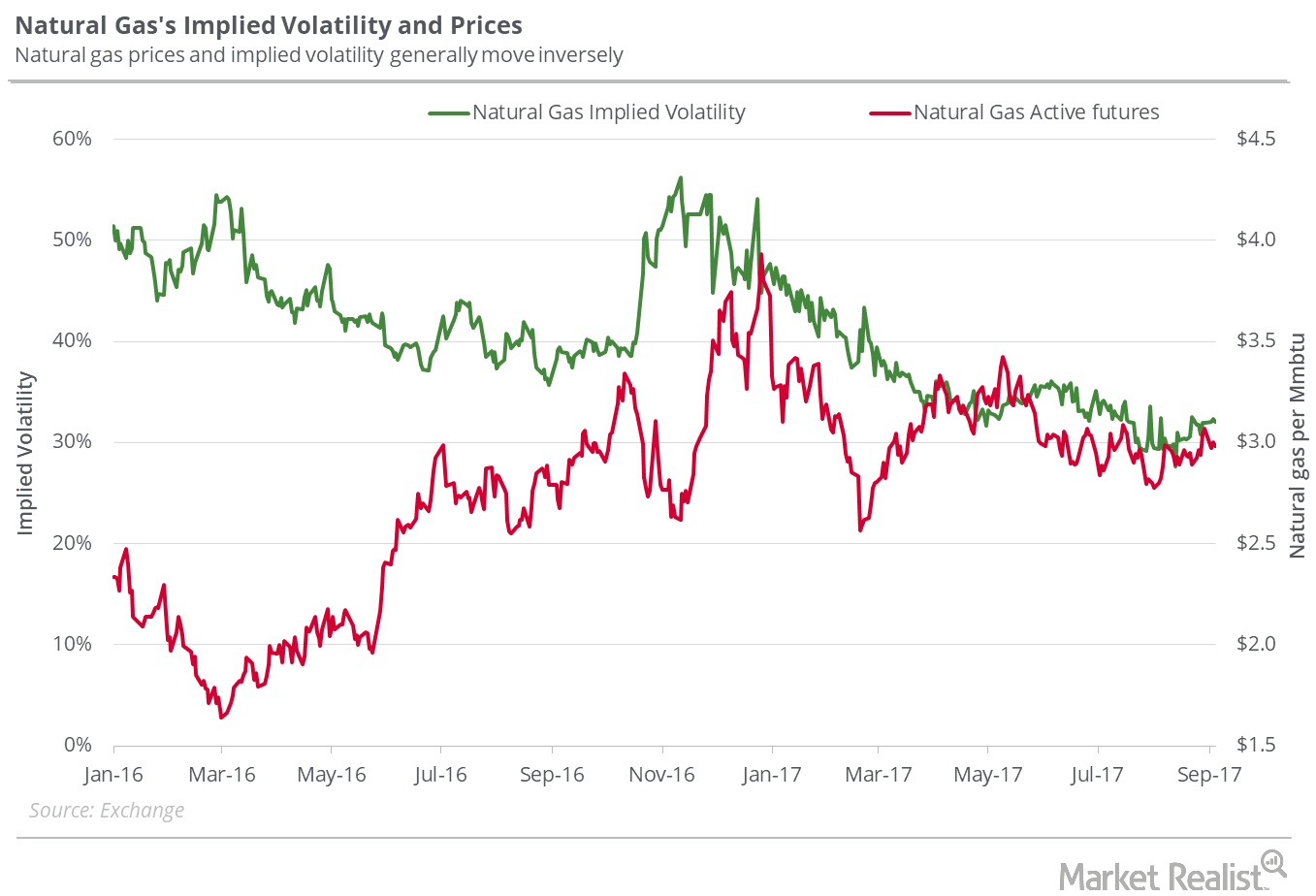

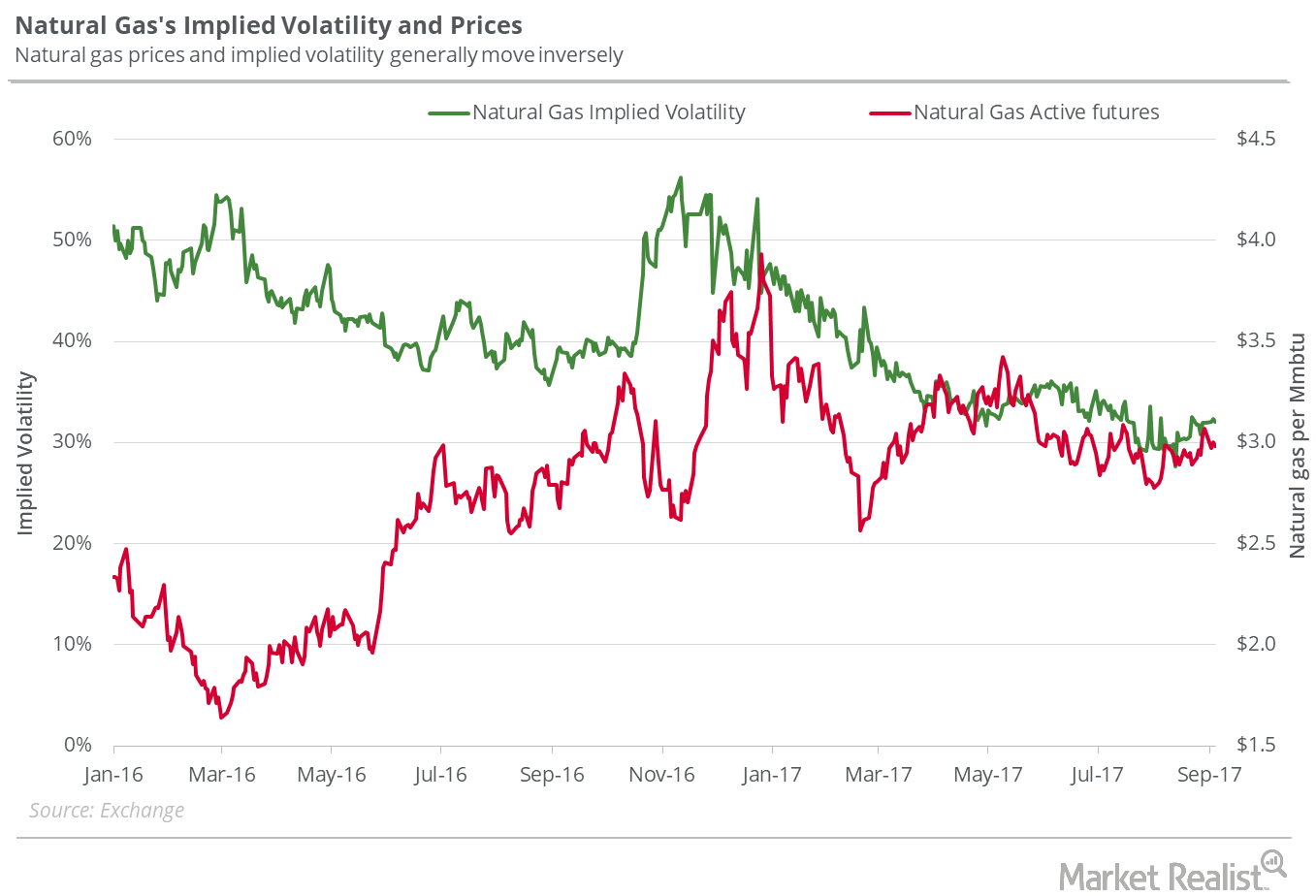

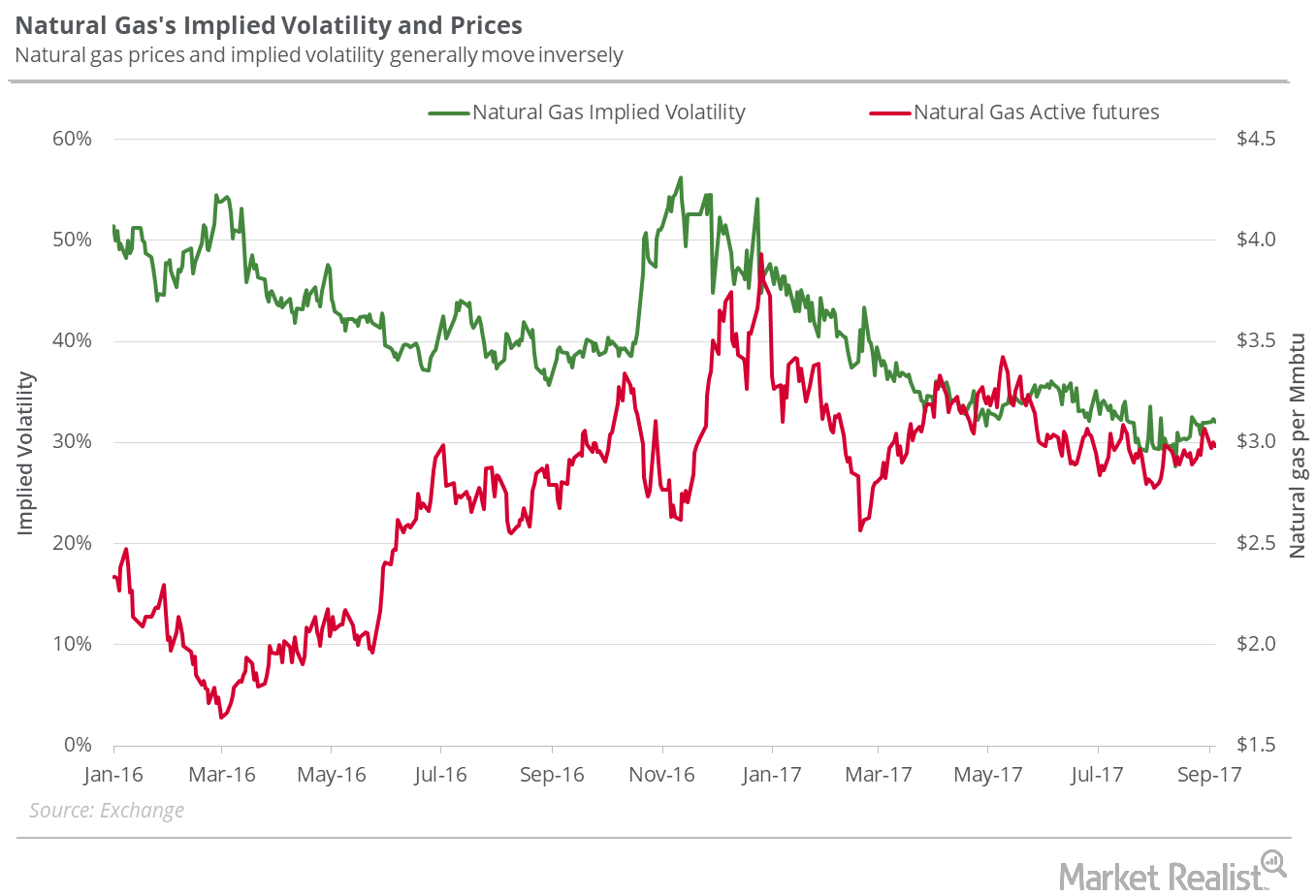

On November 16, 2017, the implied volatility of natural gas was 44%—6.4% above its 15-day average.

Will Natural Gas Prices Fall to $2.8 Next Week?

On November 2, 2017, natural gas’s (GASL) (GASX) implied volatility was 38.2%, 1.8% below its 15-day average.

How Natural Gas ETFs Fared Last Week

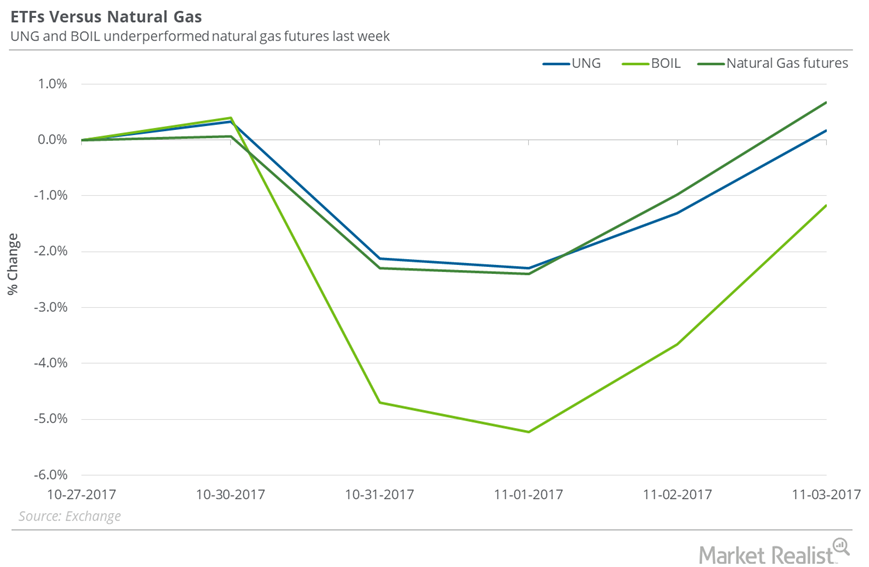

Between October 27 and November 3, 2017, the United States Natural Gas Fund LP (UNG) rose just 0.2%, and natural gas December futures rose 0.7%.

Where Natural Gas Prices Could Go Next Week

On September 21, 2017, natural gas implied volatility was 35.1%, or 5.1% above the 15-day average.

Does the Natural Gas Fall Relate to Oil’s Decline?

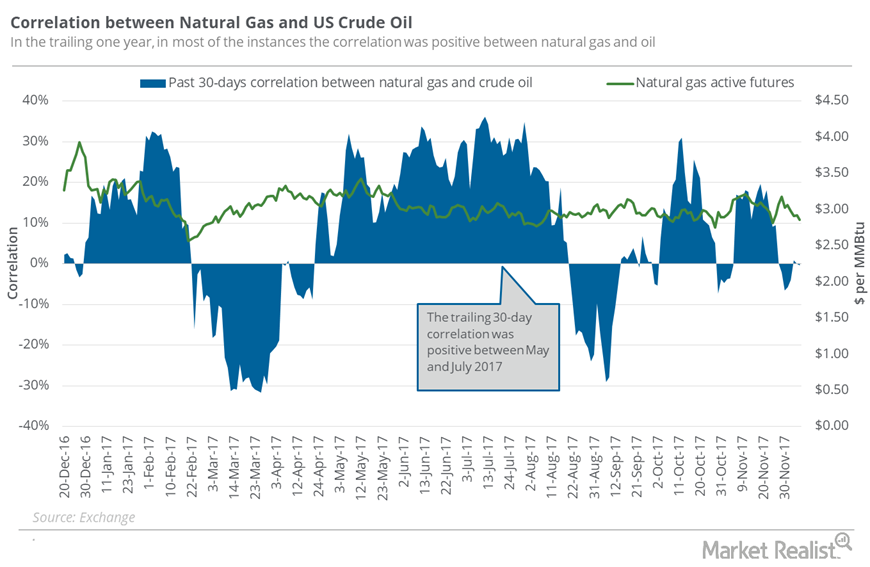

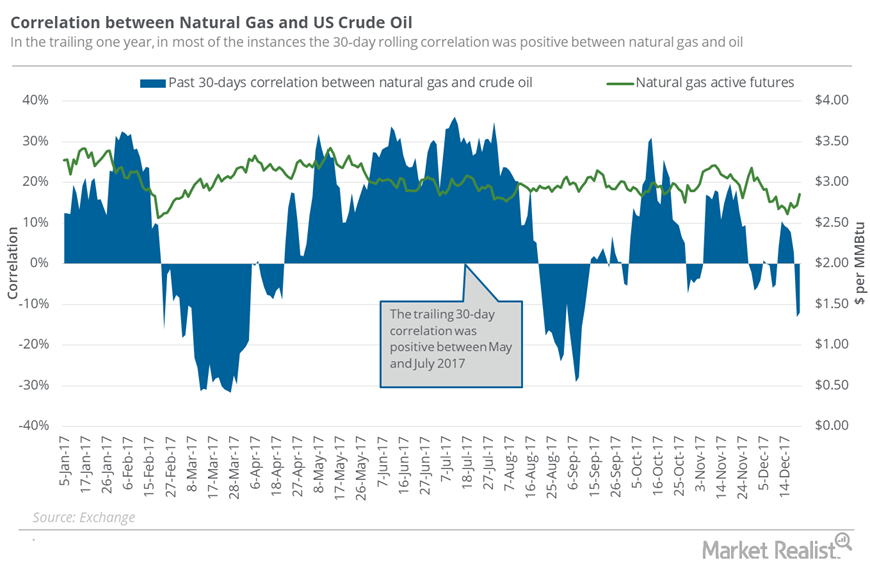

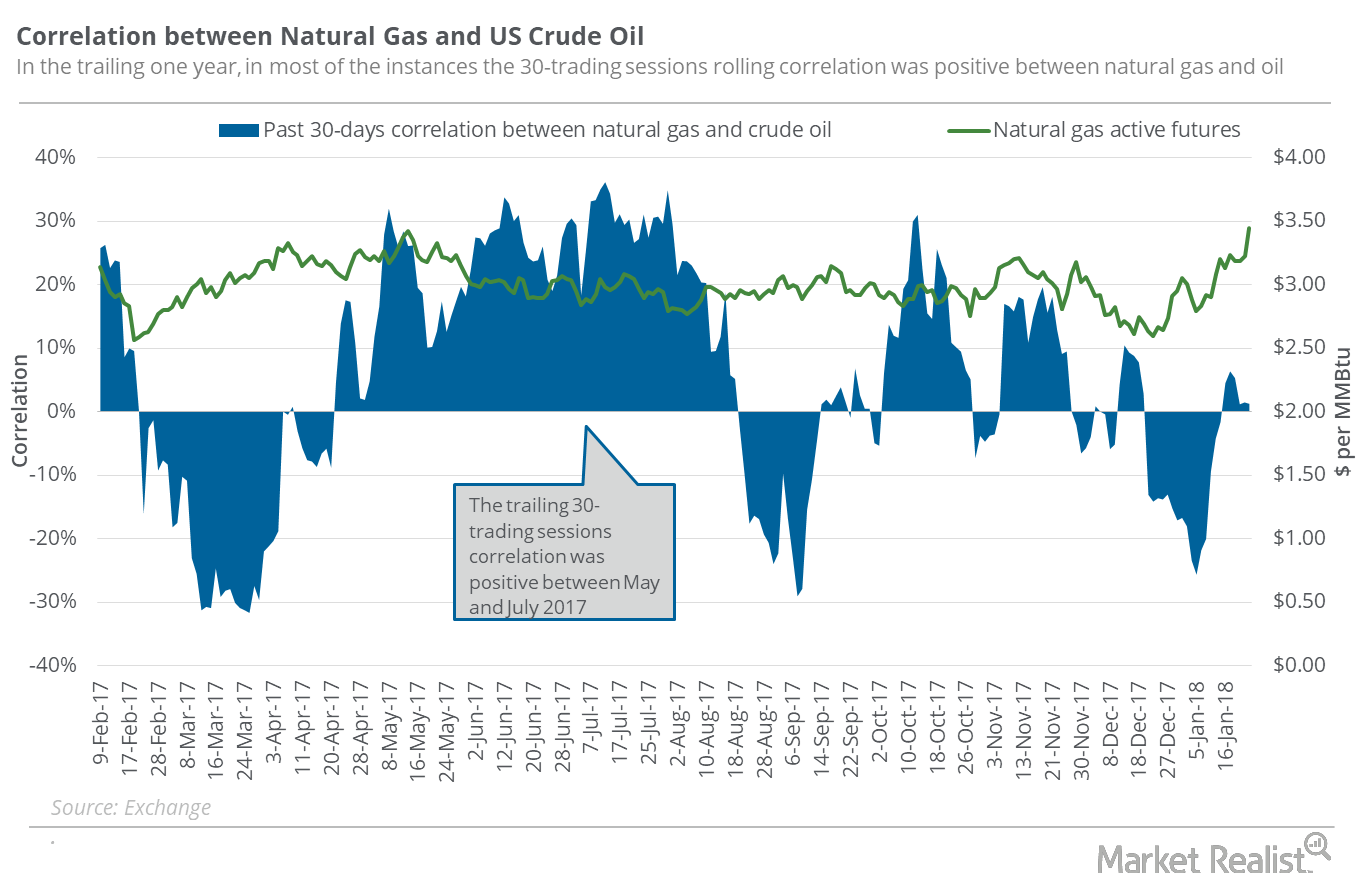

Between November 29 and December 6, natural gas (GASL)(GASX)(FCG) January 2018 futures had a correlation of -1.6% with US crude oil January futures.

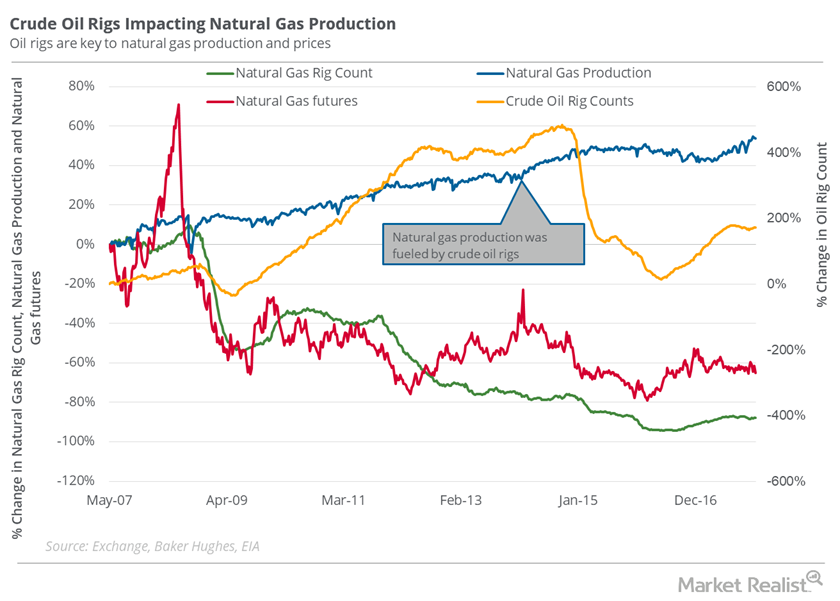

Natural Gas Traders Should Stay Cautious of Oil Rigs

On December 29, the natural gas rig count was 88.7% below its record high of 1,606 in 2008. However, natural gas supplies have risen drastically since 2008.

Could Natural Gas Reach a New 2017 Low Next Week?

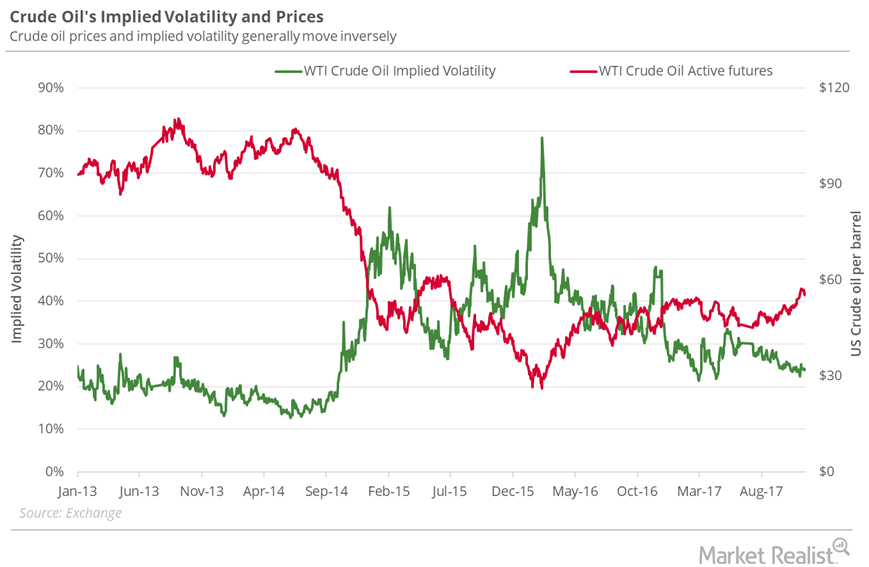

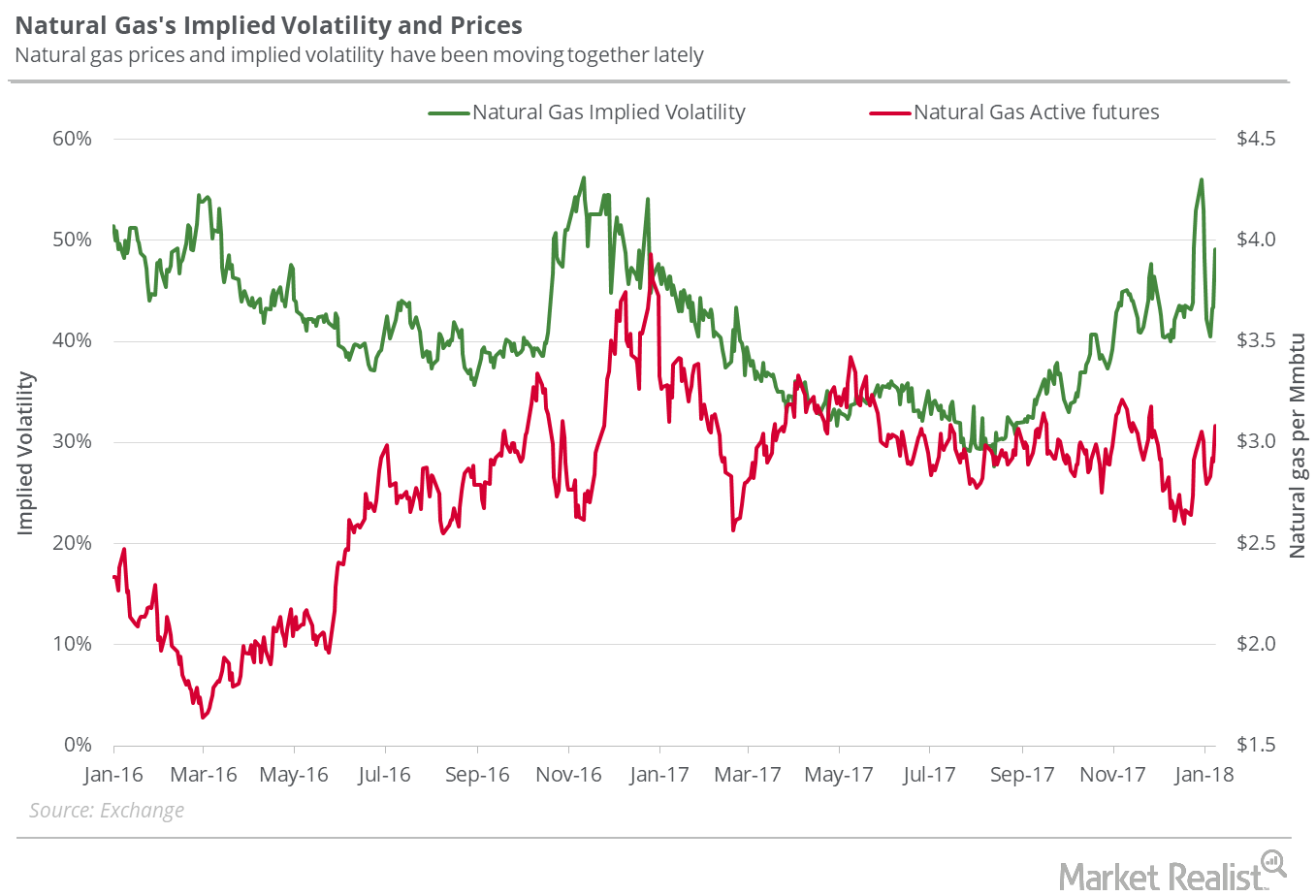

Implied volatility On December 21, 2017, natural gas futures’ implied volatility was 42.4%. In the last trading session, their implied volatility was on par with the 15-day average. Supply-glut concerns pushed natural gas (UNG) (BOIL) futures to a 17-year low on March 3, 2016, with an implied volatility of 53.8%. From this multiyear low, natural gas prices […]

Can Natural Gas Stay above $3 Next Week?

On November 30, 2017, natural gas’s implied volatility was 44.3%, about 1% above its 15-day average.

Is Natural Gas Moving with Oil Prices?

The correlation between natural gas (GASL)(GASX)(FCG) active futures with US crude oil active futures was 99.8% between December 12 and December 19.

What to Expect from Natural Gas Next Week

On January 18, 2018, natural gas’s implied volatility was 53.9%, 10.2% above its 15-day average.

Will US Natural Gas Futures Fall More?

US natural gas (GASL) futures contracts for January delivery were below their 20-day, 50-day, and 100-day moving averages on December 14, 2017.

Possibilities for Natural Gas Prices Next Week

On December 7, 2017, natural gas’s implied volatility was 40.5% or ~7.5% less than its 15-day average. On November 29, the implied volatility rose to 47.7%.

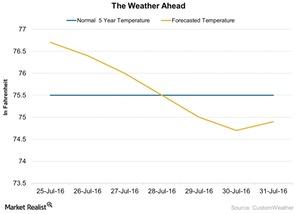

What to Expect from the Weather Forecast and Natural Gas Prices

On July 21, the EIA announced a 34 Bcf (billion cubic feet) addition to natural gas (UNG) (GASL) (GASX) (BOIL) inventory levels for the week ending July 15.

Could Natural Gas Hit a New 2017 Low Next Week?

On December 14, 2017, the implied volatility of natural gas futures was 40.4%. It was ~5.9% below its 15-day average.

Will Natural Gas Reclaim $3 Next Week?

On October 12, 2017, natural gas implied volatility was 35.9%, 1.7% above its 15-day average.

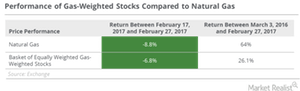

Analyzing Gas-Heavy Stocks amid Falling Natural Gas Prices

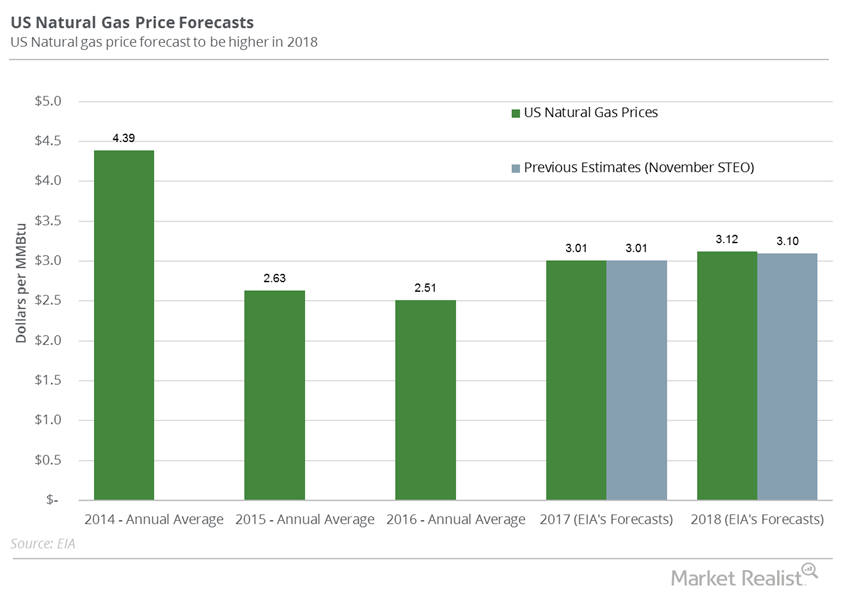

From February 17–27, 2017, natural gas futures contracts for April 2017 delivery fell 8.8%. On March 3, 2016, natural gas futures touched a 17-year low.

Natural Gas Could Reach the $3.4 Mark Next Week

On November 9, 2017, natural gas had an implied volatility of 43.5%—9.4% more than its 15-day average. Natural gas active futures settled at $3.2 per MMBtu.

US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

Where Could Natural Gas Prices Close Next Week?

On January 25, 2018, natural gas’s implied volatility was at 54.8%, 8% above its 15-day average.

Does Natural Gas’s Rise Depend on Crude Oil?

Between January 16 and January 23, 2018, natural gas (GASL) (UNG) (FCG) had a correlation of 84.6% with US crude oil (OIIL) (USL) (DBO) active futures.

Is Natural Gas Pricing in Colder Weather?

On January 23, 2018, natural gas February 2018 futures settled $0.34 above February 2019 futures.

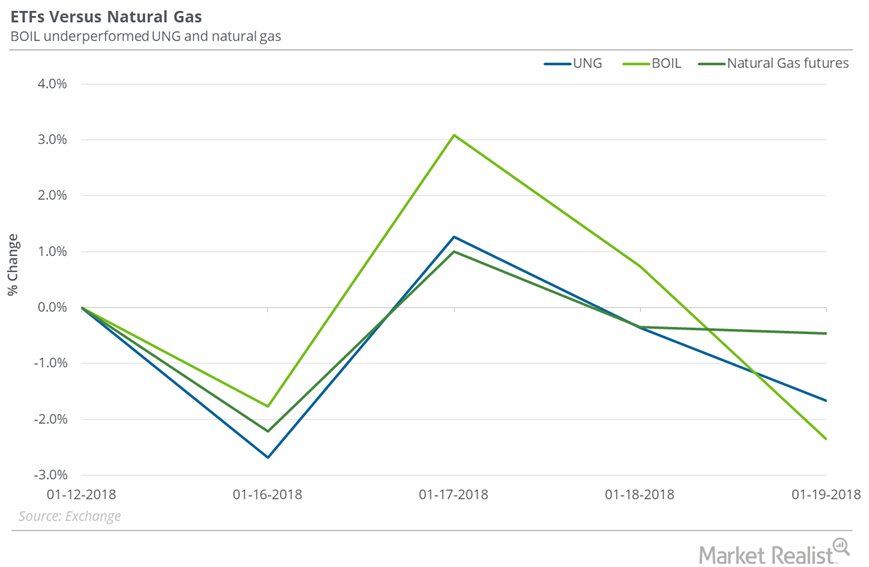

How Natural Gas ETFs Performed Last Week

Between January 12 and January 19, 2018, the United States Natural Gas ETF (UNG), an ETF that has exposure to natural gas futures, fell 1.7%.

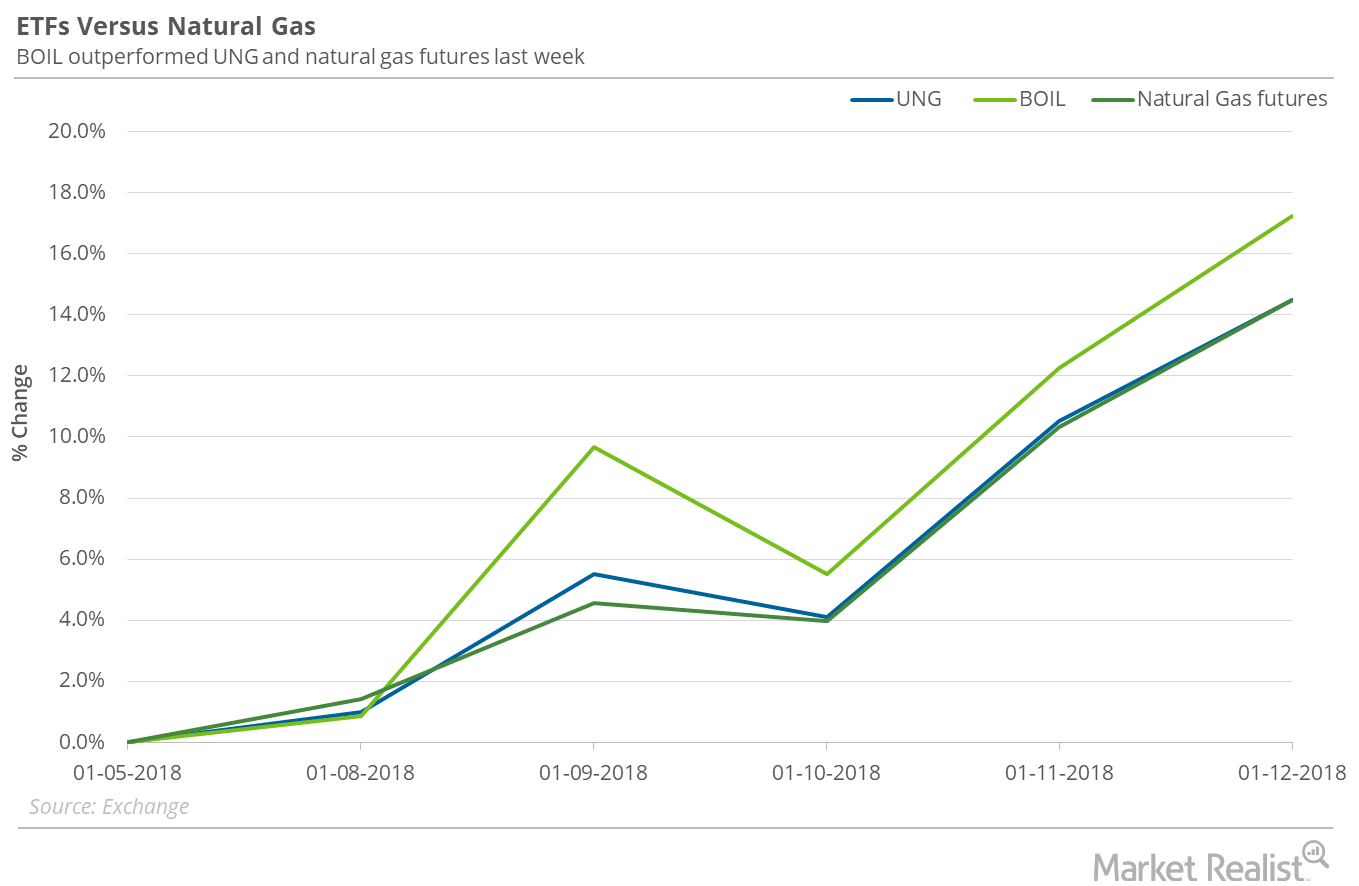

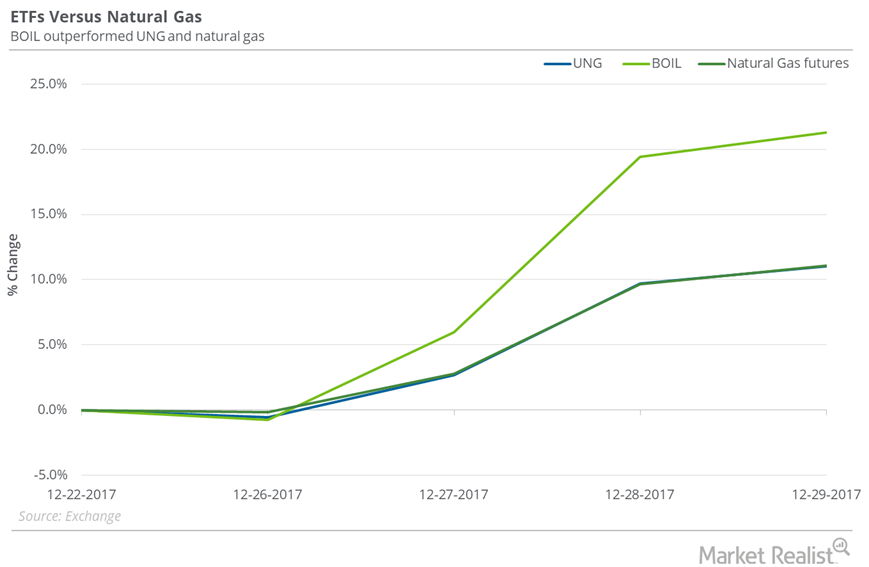

How Natural Gas ETFs Are Reacting to Spike in Natural Gas

Between January 5 and January 12, 2018, the United States Natural Gas ETF (UNG), which holds positions in active natural gas futures, gained 14.5%.

Is $3.30 Possible for Natural Gas Next Week?

On January 11, 2018, natural gas’s implied volatility was 49.1%. That’s 7% above its 15-day average.

Possible Downside in Natural Gas Next Week

On December 21, 2017, natural gas prices closed at the lowest closing level since February 23, 2017. Since that day, natural gas futures have risen 11.1%.

Natural Gas ETFs to Watch in 2018

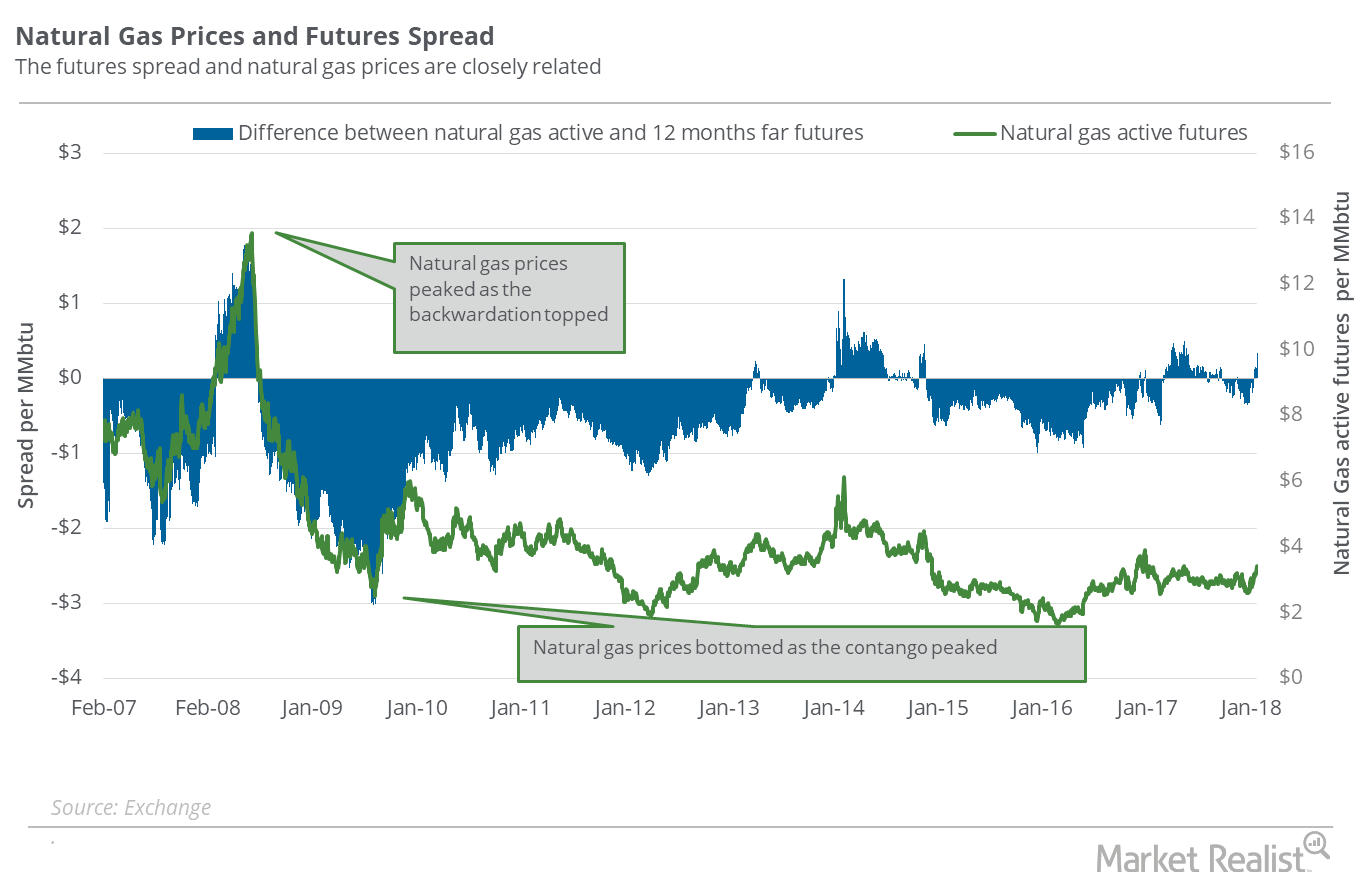

On December 29, 2017, the closing prices of natural gas futures contracts between March 2018 and May 2018 were progressively lower.

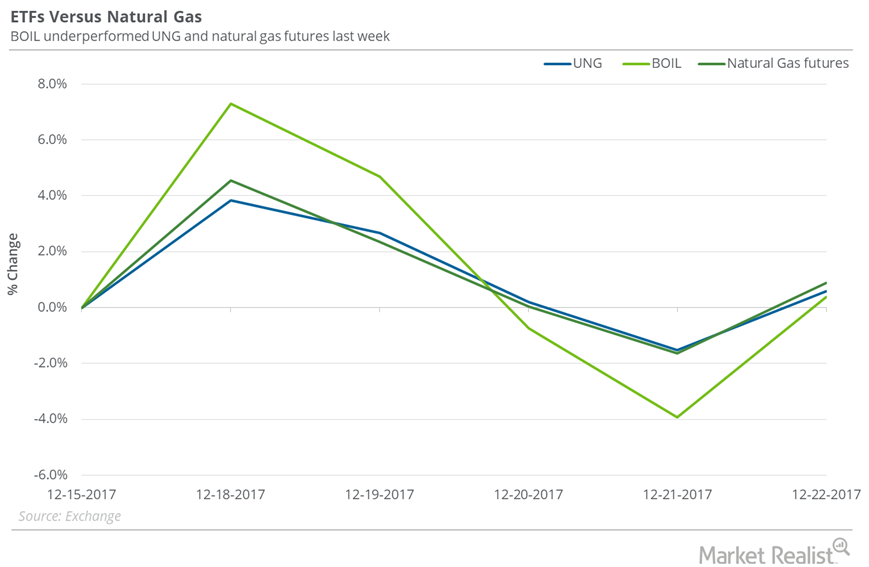

Natural Gas Returns and Natural Gas ETFs

From December 15–22, 2017, the United States Natural Gas Fund (UNG) rose 0.6%.

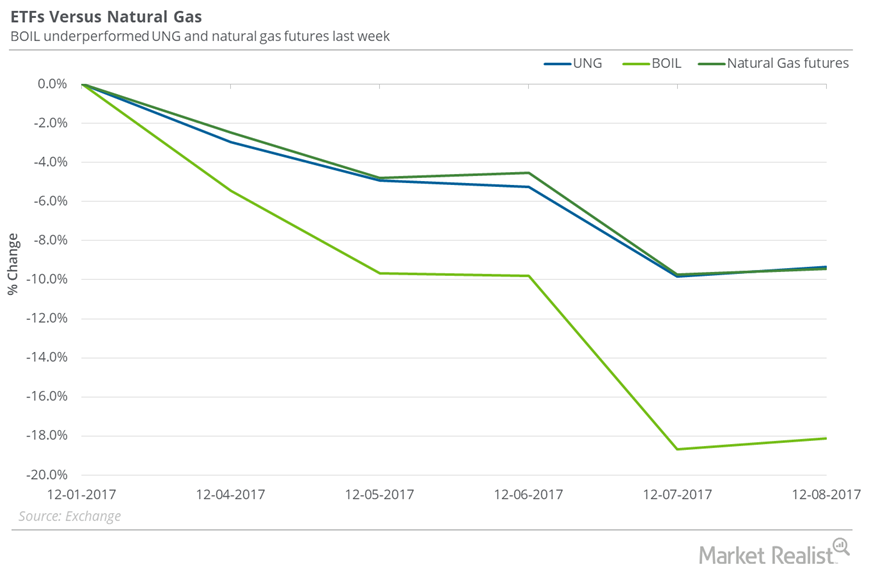

Natural Gas: Fall Impacts Natural Gas ETFs

On December 1–8, 2017, the United States Natural Gas Fund (UNG), which holds near-month natural gas futures contracts, fell 9.3%.

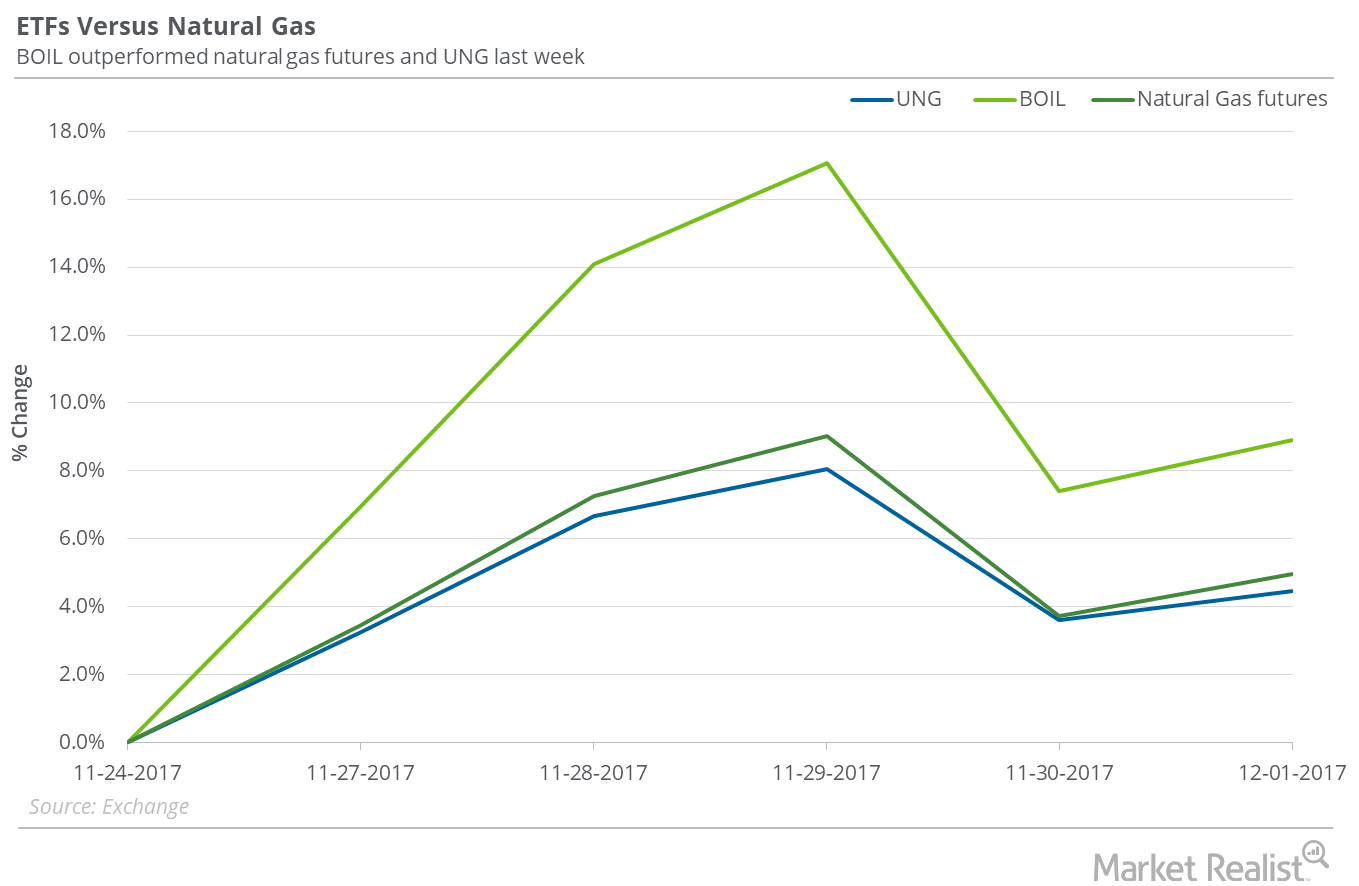

Rise in Natural Gas Impacts Natural Gas ETFs

On November 24–December 1, 2017, the United States Natural Gas Fund (UNG), that follows near-month natural gas futures contracts, rose 4.5%.

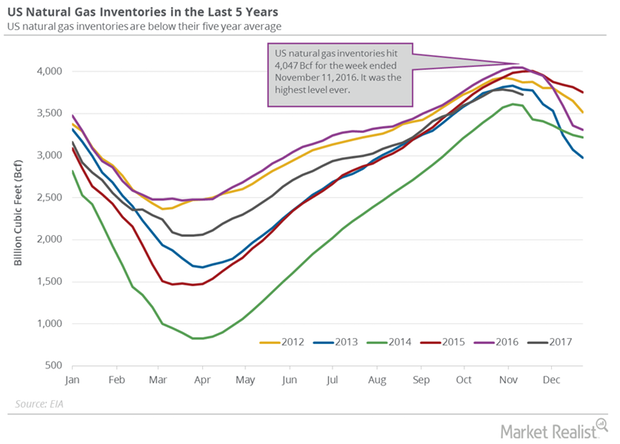

US Natural Gas Future Fell after the Natural Gas Inventory Report

The EIA released its natural gas inventory report on November 30, 2017. US natural gas inventories fell by 33 Bcf to 3,693 Bcf on November 17–24, 2017.

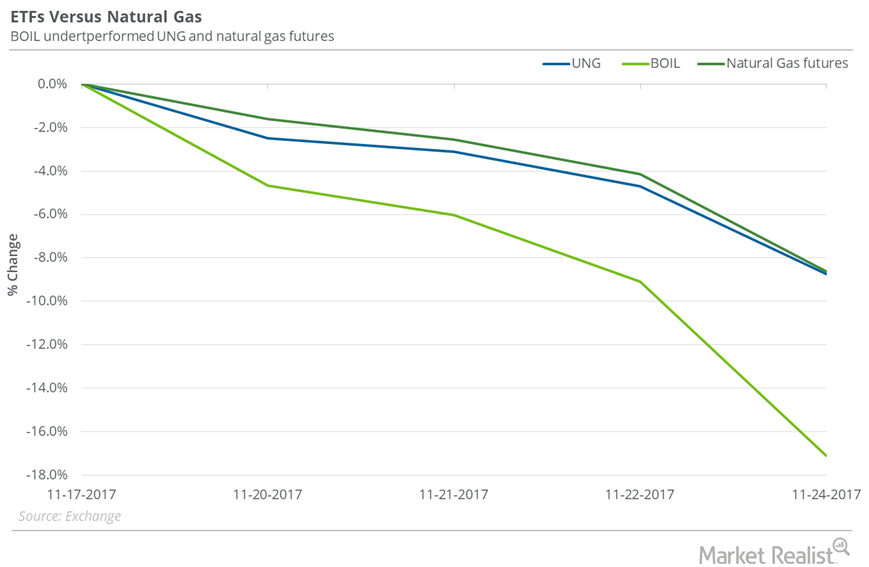

How Are Natural Gas ETFs Adjusting to Fall in Natural Gas Prices?

Between November 17 and November 24, 2017, the United States Natural Gas Fund LP (UNG) fell 8.8%.

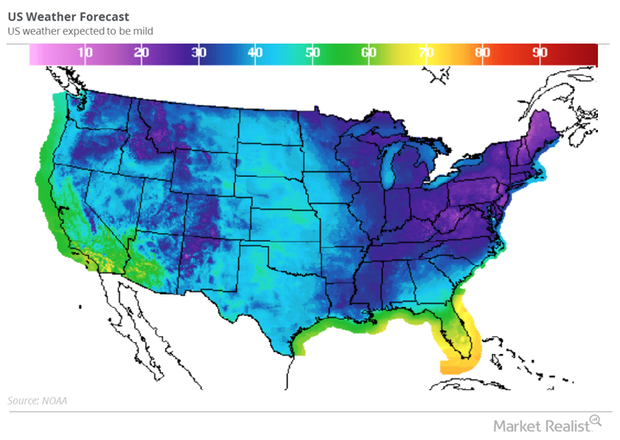

Weather Impacts the US Natural Gas Market

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu in electronic trading at 1:05 AM EST on November 24, 2017.

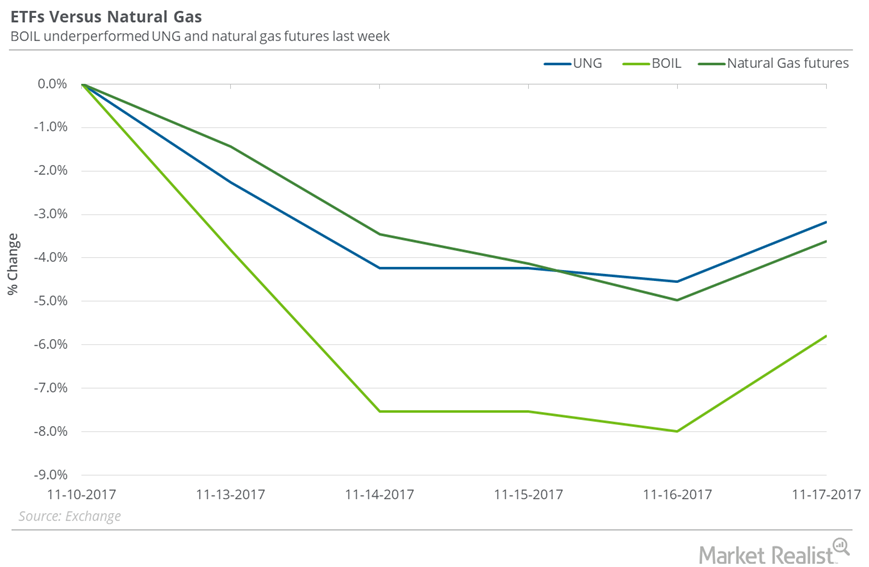

Are Natural Gas ETFs Doing Any Better than Natural Gas?

Between November 10 and November 17, the United States Natural Gas Fund LP (UNG) fell 3.2% while natural gas active futures fell 3.6%.

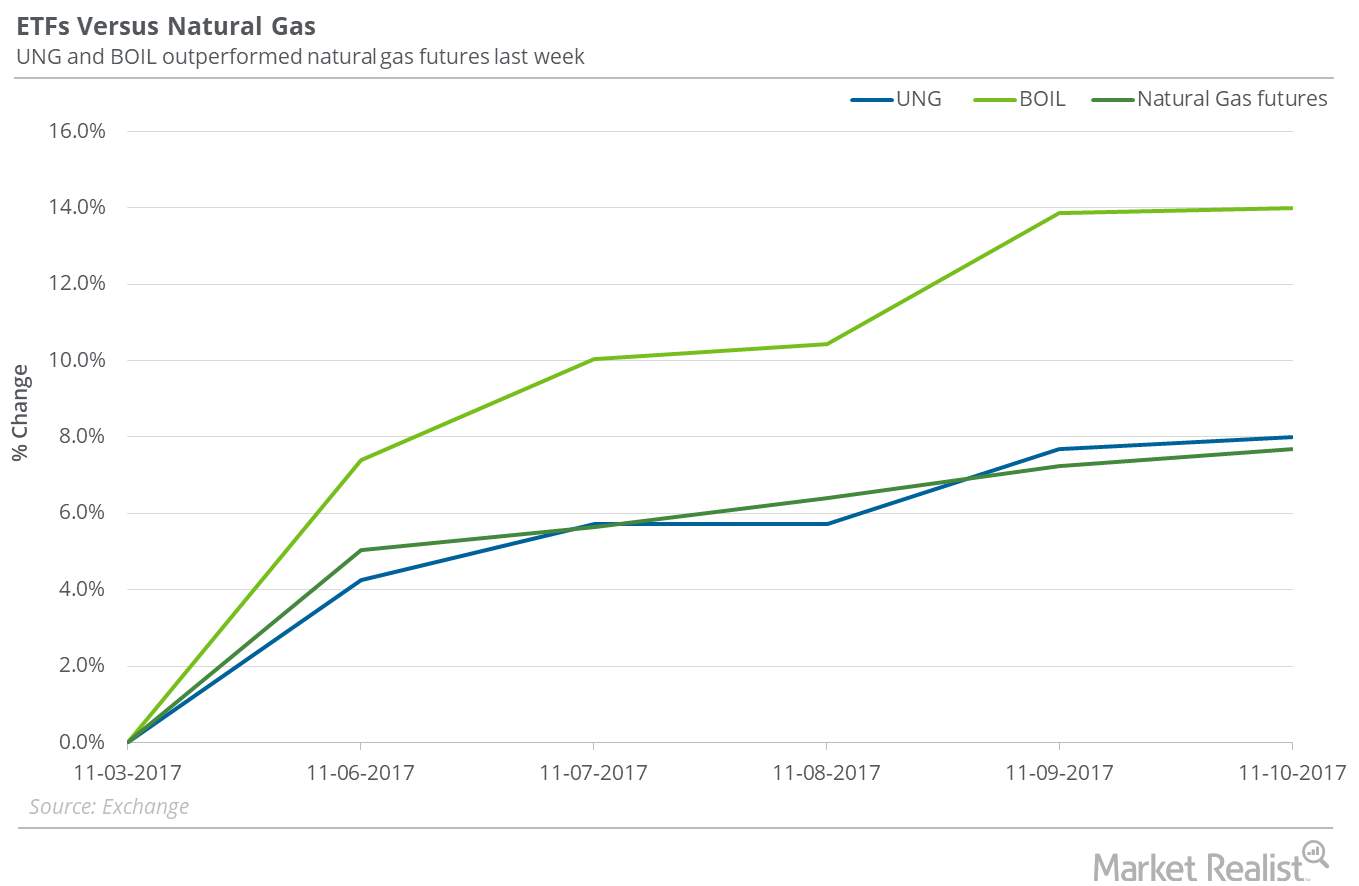

Did Natural Gas ETFs Outperform Natural Gas Last Week?

Between November 3 and November 10, 2017, the United States Natural Gas Fund LP (UNG) rose 8%, only 30 basis points above the gain in natural gas December futures.

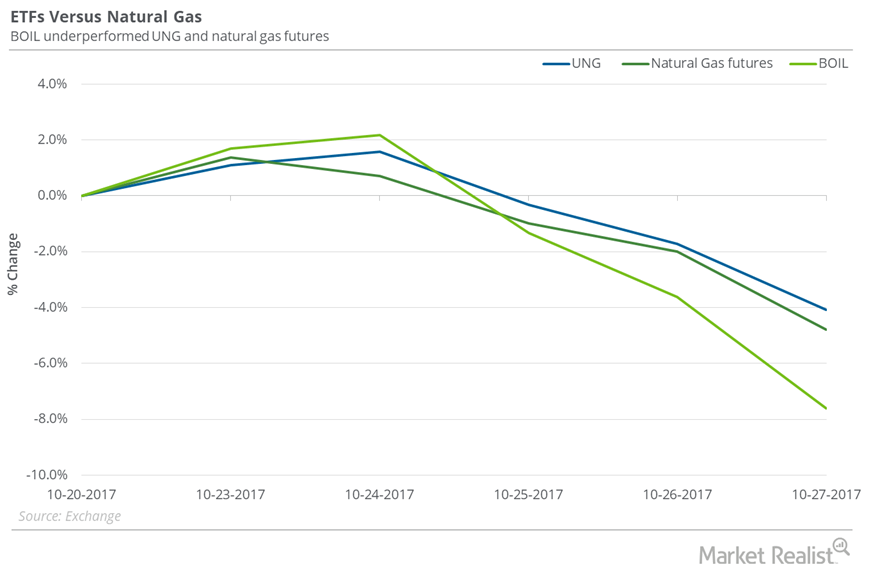

Natural Gas versus Natural Gas ETFs Last Week

On October 20–27, natural gas (FCG) (GASL) (GASX) December futures fell 4.8%. During this period, the United States Natural Gas Fund LP (UNG) fell 4.1%.

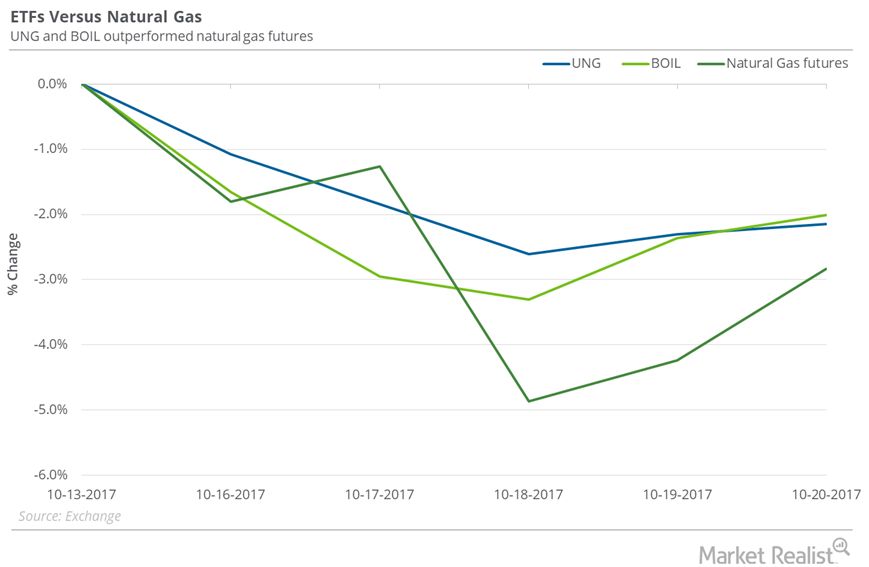

Where Natural Gas ETFs Stood next to Natural Gas Last Week

Between October 13 and October 20, 2017, the United States Natural Gas Fund LP (UNG) fell 2.2%, and natural gas November futures fell 2.8%.

Will Natural Gas Fall to $2.7 Levels Next Week?

On October 19, 2017, natural gas futures’ implied volatility was 38.8%, 9.6% above its 15-day average.

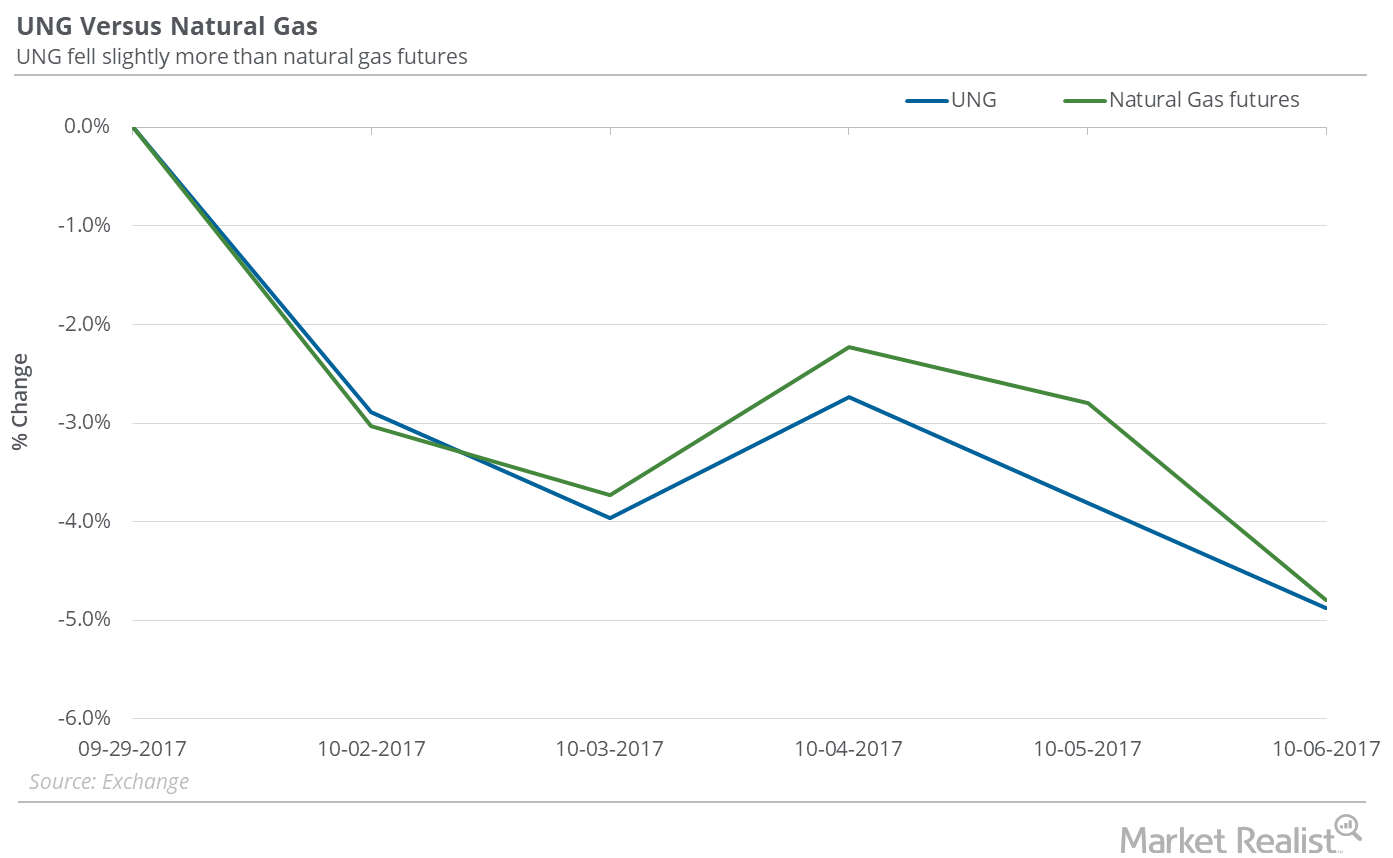

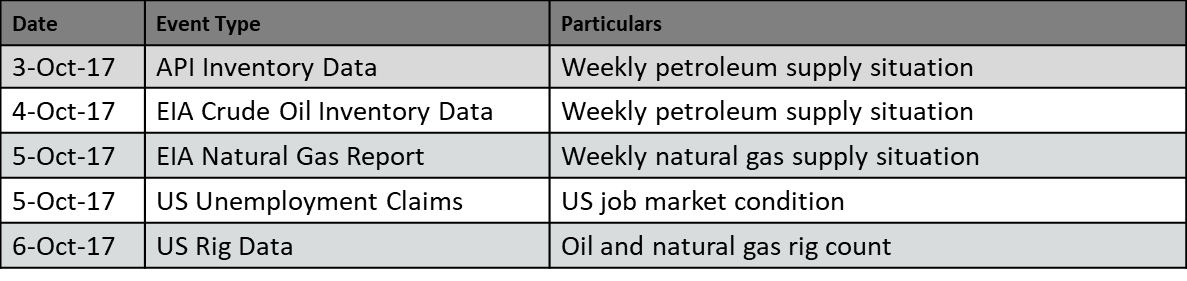

Did UNG Outperform Natural Gas in the Week Ended October 6?

Between September 29 and October 6, 2017, the United States Natural Gas Fund ETF (UNG) fell 4.9%, while natural gas (BOIL) (GASX) November futures fell 4.8%.

Could Natural Gas Fall below the $2.8 Mark Next Week?

On October 5, 2017, the implied volatility of US natural gas active futures was at 33.1%, or 7.3% below the 15-day average.

How UNG Fared Compared to Natural Gas Last Week

On September 22–29, 2017, the United States Natural Gas Fund LP (UNG) rose 0.2%, while natural gas (BOIL) November futures fell 0.5%.

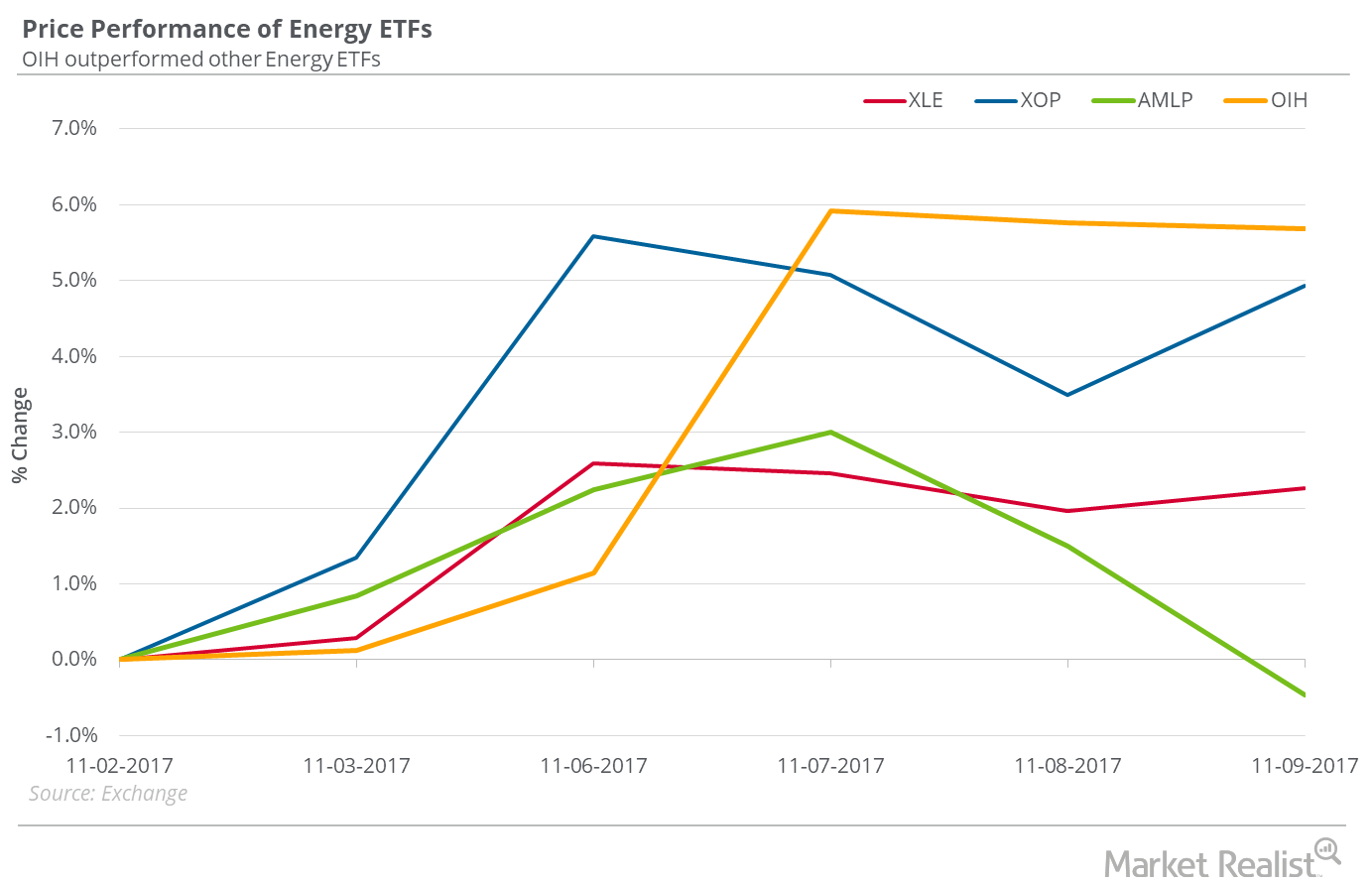

Should Energy Stocks Go in Your Back-to-School Shopping Basket?

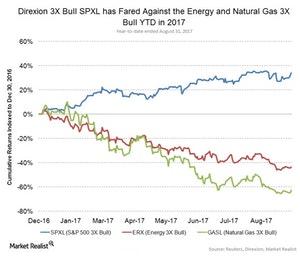

The energy sector, as tracked by the Energy Select Sector SPDR Fund (XLE), has lost ~17.0% year-to-date as of August 31.

Natural Gas Could Regain the $3 Mark Next Week

In the next seven days, natural gas October futures could close between $2.85 and $3.11 per MMBtu (million British thermal units).

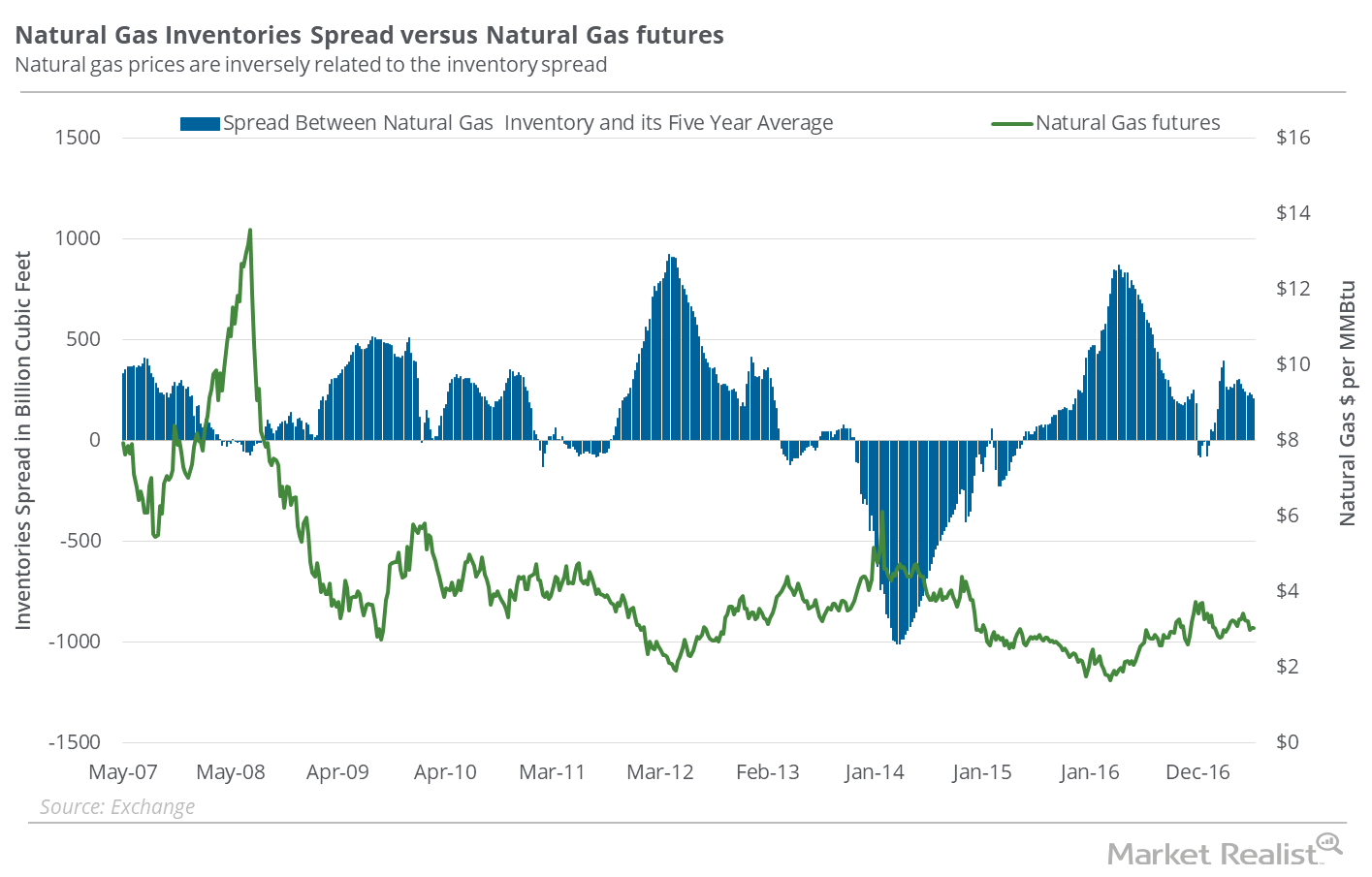

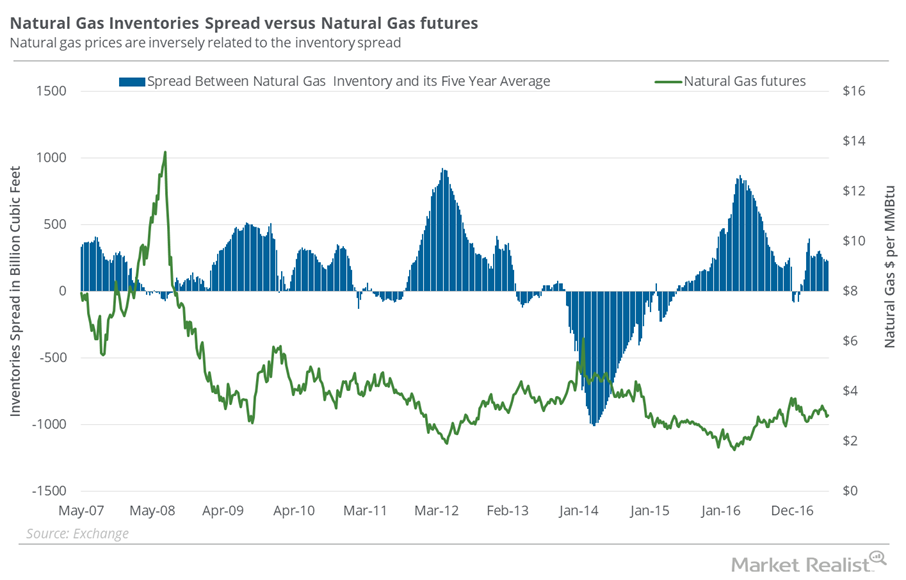

Why the Natural Gas Inventory Spread Supports Its Recent Recovery

In the week ended June 16, 2017, natural gas inventories rose 61 Bcf (billion cubic feet) to 2,770 Bcf based on EIA data released on June 22, 2017.

Natural Gas Inventories Spread: Savior for Natural Gas Bulls?

The EIA reported that natural gas inventories rose by 78 Bcf (billion cubic feet) to 2,709 Bcf in the week ending June 9, 2017.

What’s in the Natural Gas Inventory Spread—Bears?

In the week ended June 2, 2017, natural gas inventories rose by 106 Bcf.

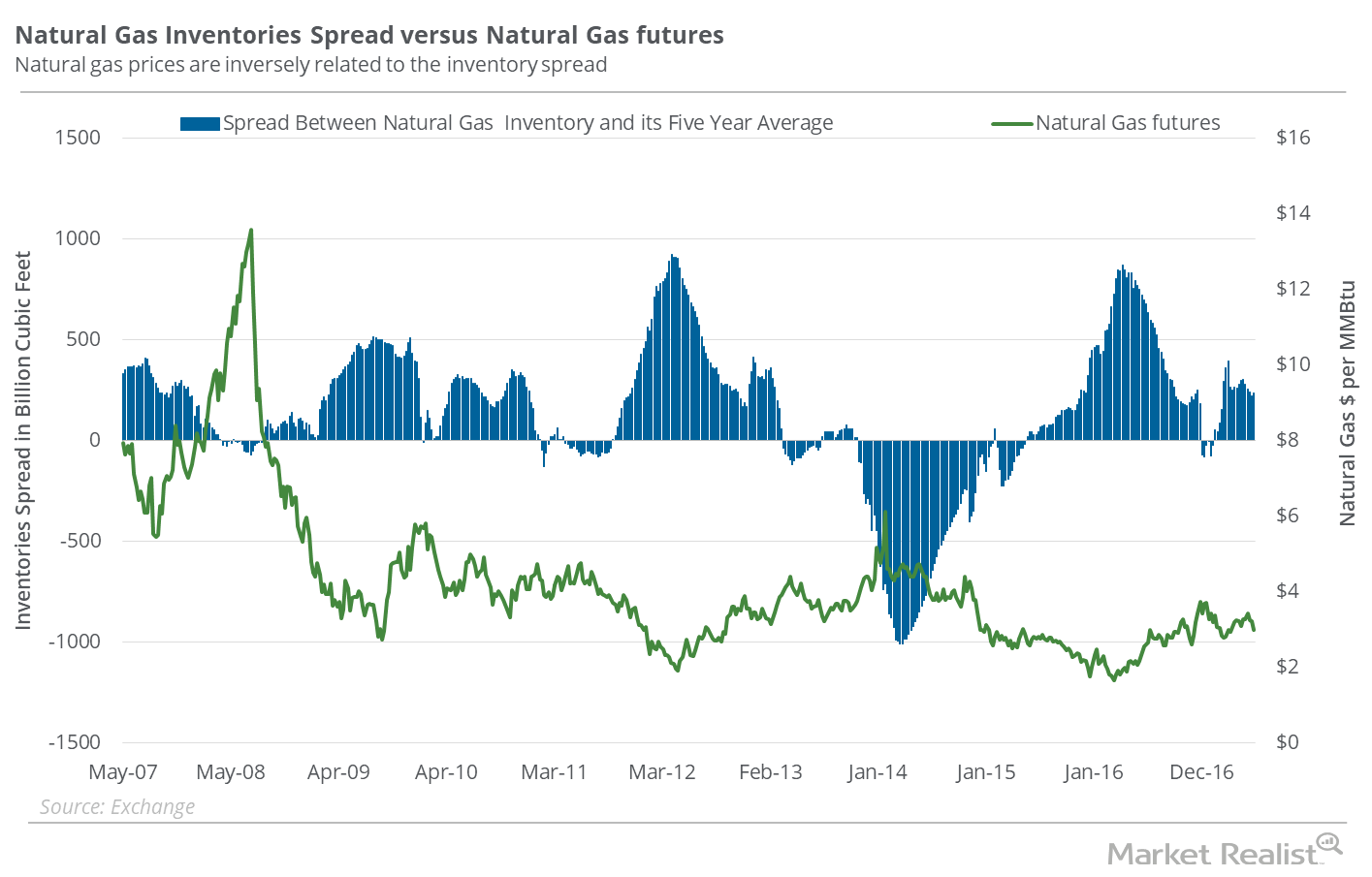

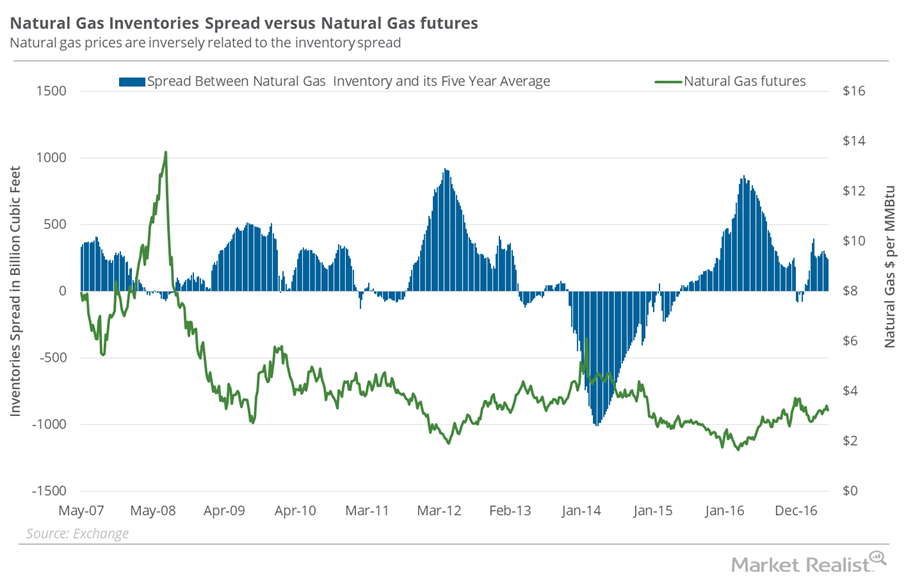

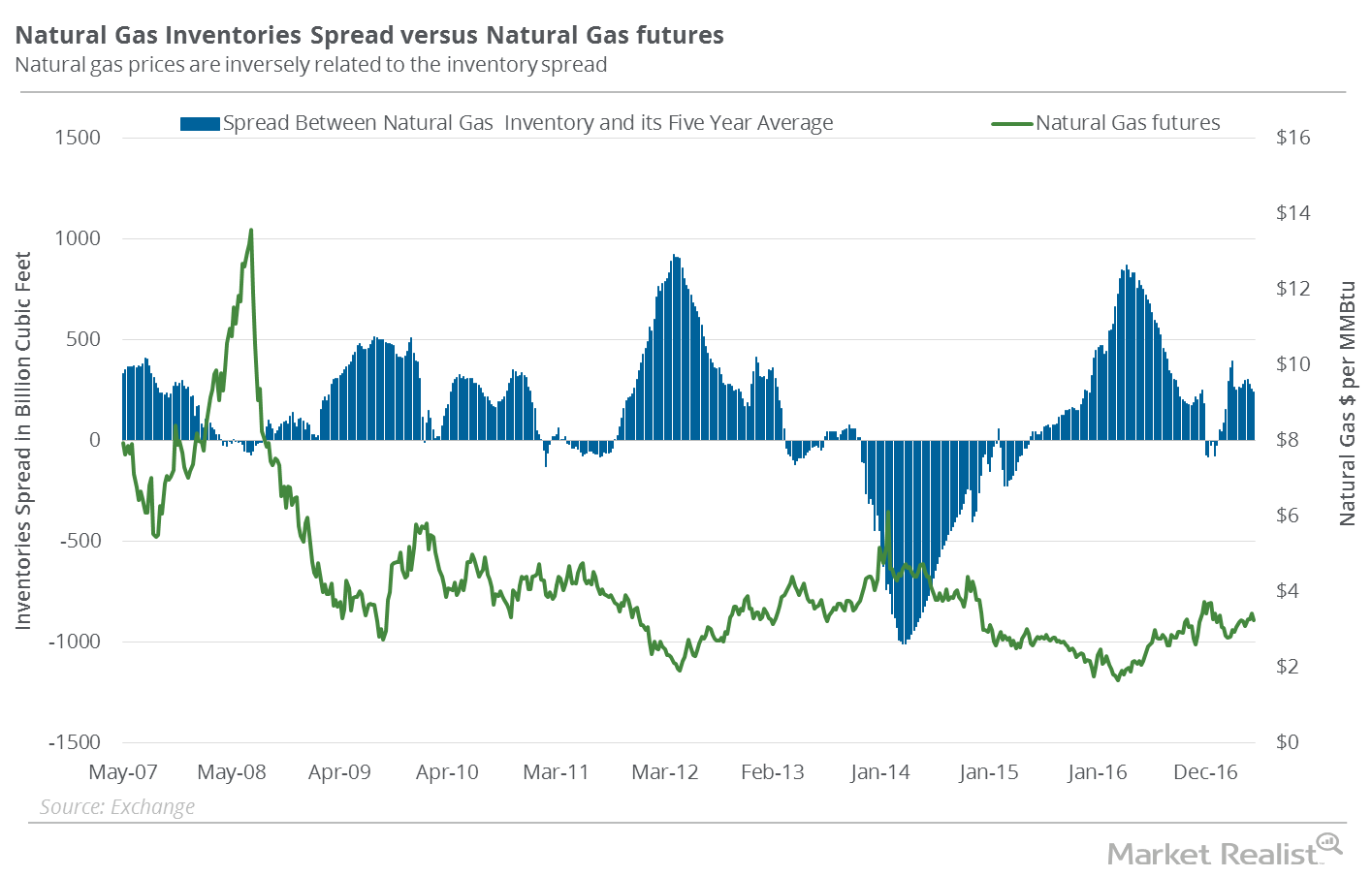

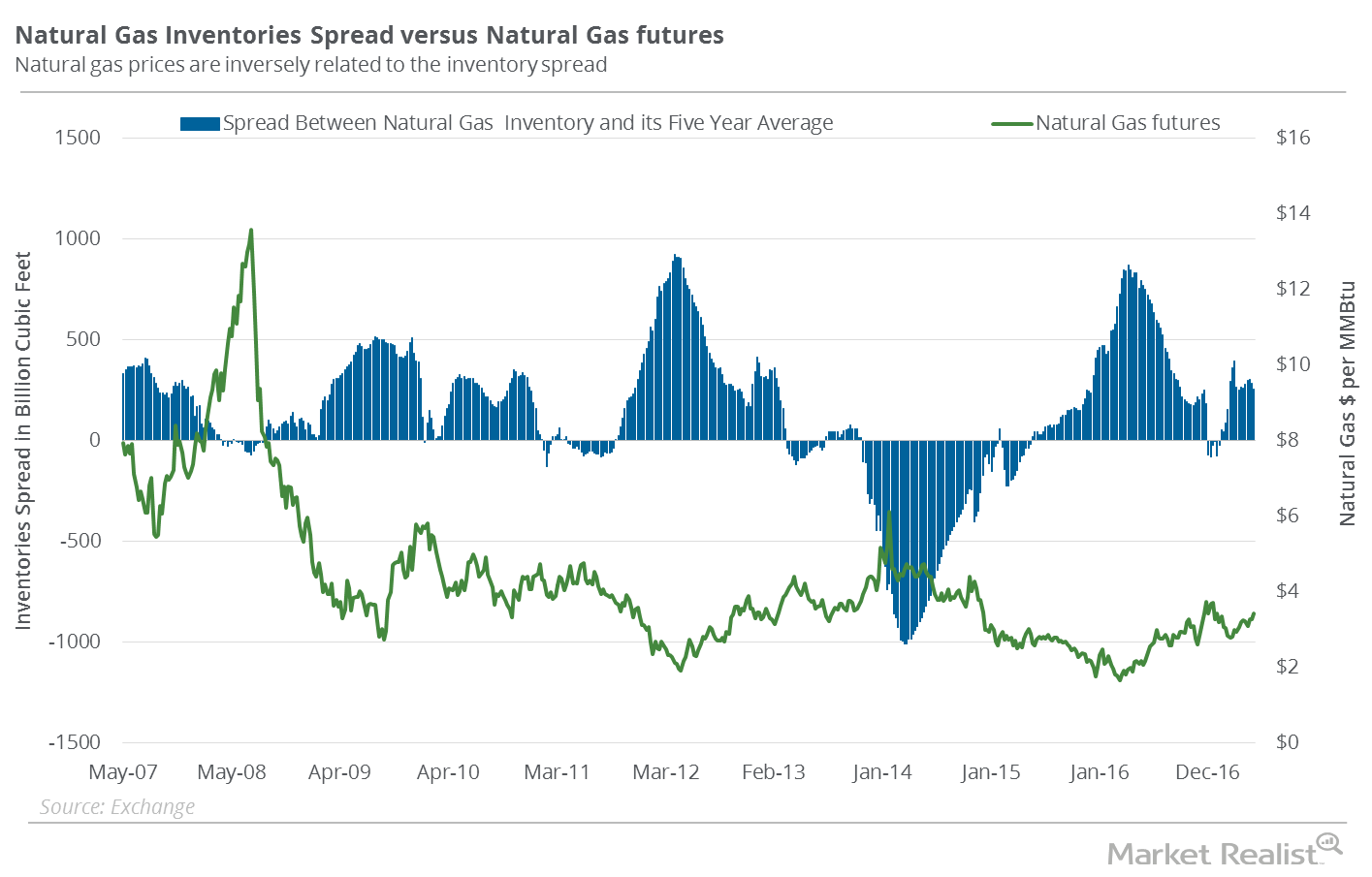

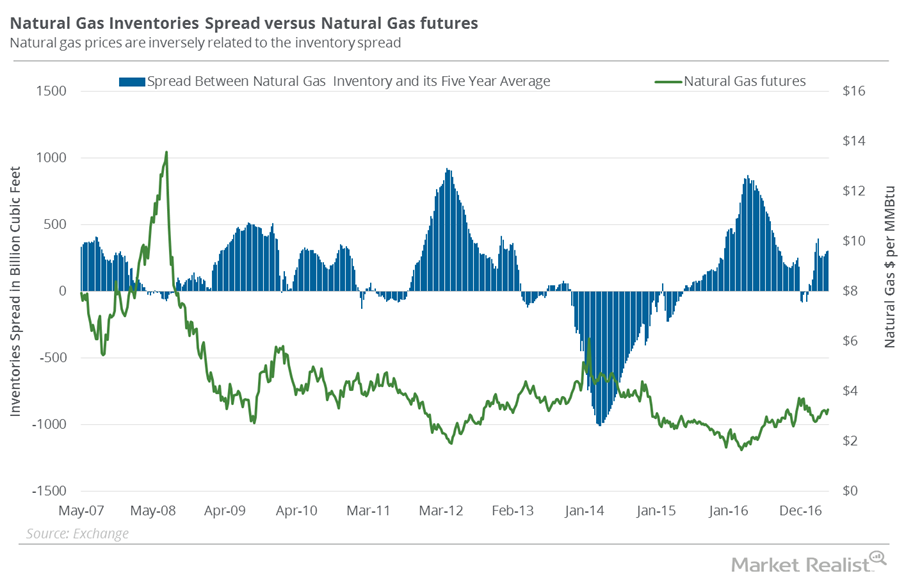

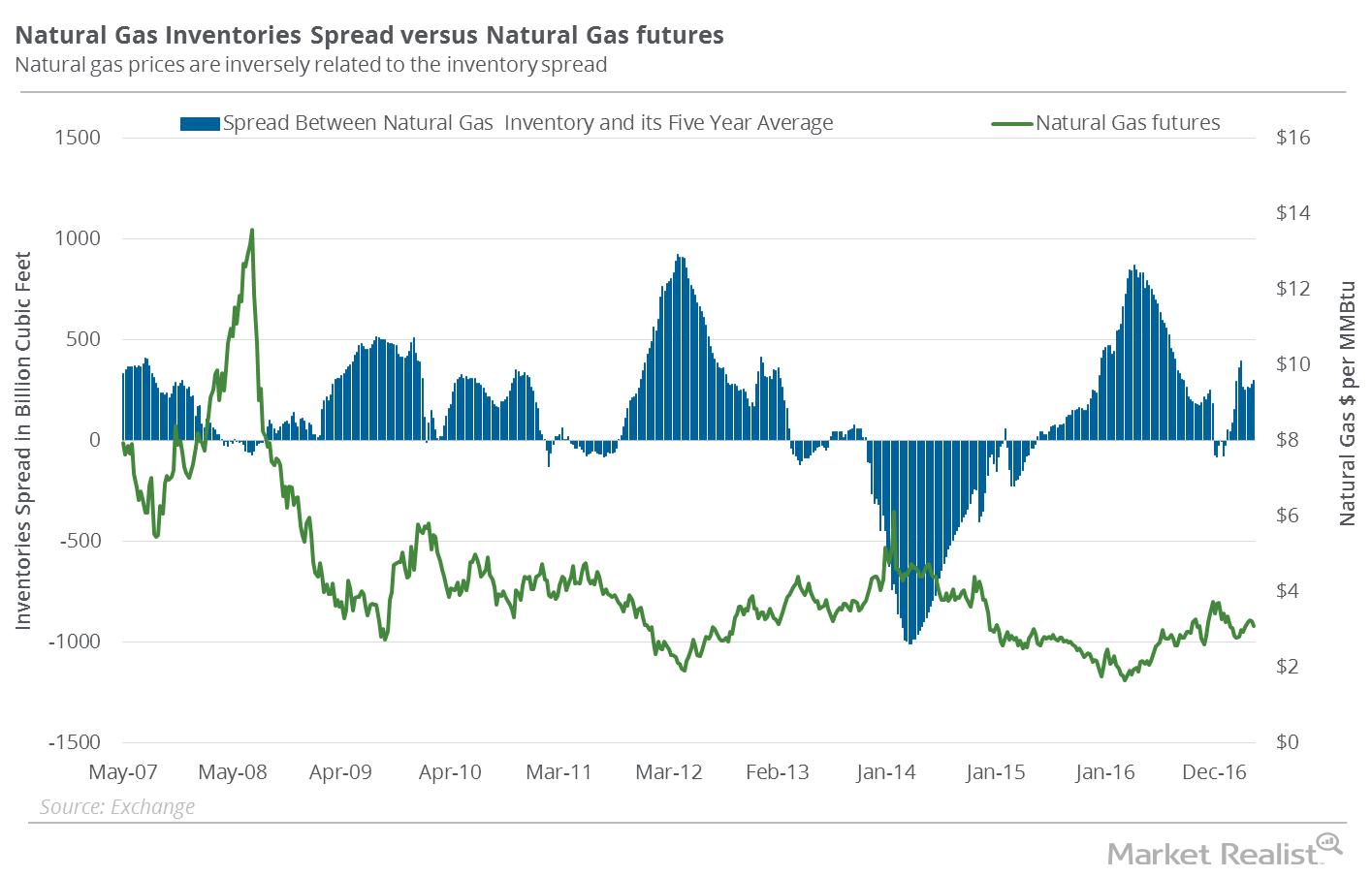

Chart in Focus: The Natural Gas Inventory Spread

Between January 27–June 7, 2017, natural gas active futures fell 10.9%. Natural gas inventories moved above their five-year average in the week ended January 27, 2017.

Why the Inventory Spread Could Make Natural Gas Bulls Happy

On a week-over-week basis, natural gas inventories rose by 75 Bcf (billion cubic feet) and were at 2,444 Bcf for the week ended May 19, 2017.

Natural Gas Inventory Spread Is Falling: Will Gas Prices Soar?

According to EIA data announced on May 18, there was an addition of 68 Bcf to natural gas (GASX) (FCG) (GASL) inventories for the week ending May 12, 2017.

Is the Natural Gas Inventory Spread Optimistic?

According to data from the EIA on May 4, natural gas (GASX) (FCG) (GASL) inventories rose by 67 Bcf (billion cubic feet) during the week ending April 28.

The Natural Gas Inventory Spread: Another Bearish Indicator?

According to data from the EIA released on April 27, 2017, natural gas inventories rose 74 Bcf (billion cubic feet) during the week ended April 21, 2017.