Invesco CurrencyShares Canadian Dollar Trust

Latest Invesco CurrencyShares Canadian Dollar Trust News and Updates

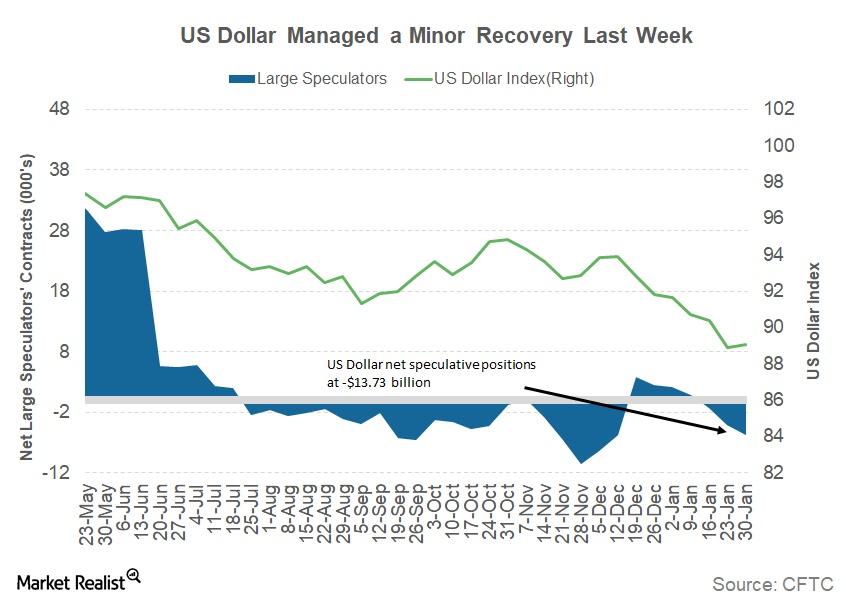

Have We Seen a Short-Term Bottom for the Dollar?

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

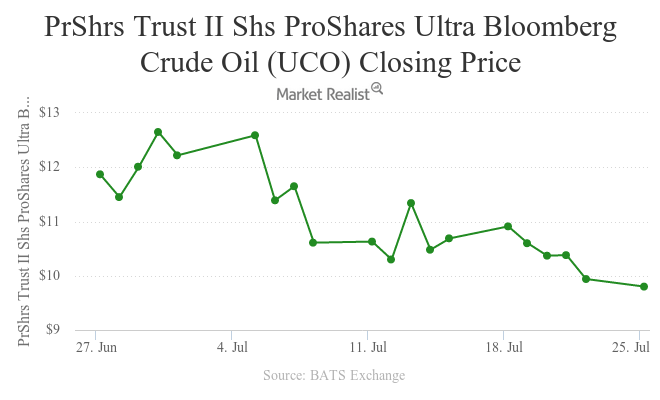

Sharp Fall in Crude Oil Price Dictate the Currencies Markets

Looking at the performance of the major commodity-driven currencies on July 25, the Nigerian naira was the biggest casualty.

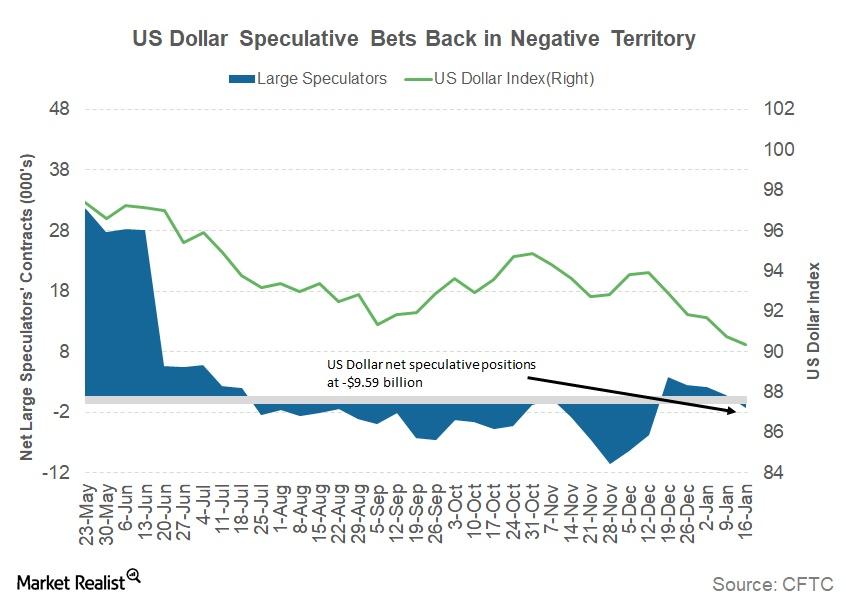

How the US Dollar Could React to a US Government Shutdown

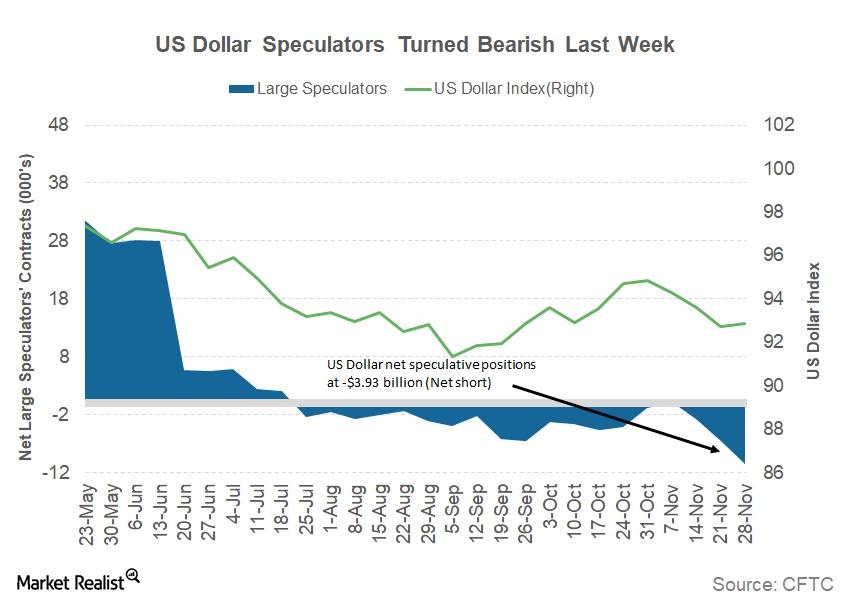

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

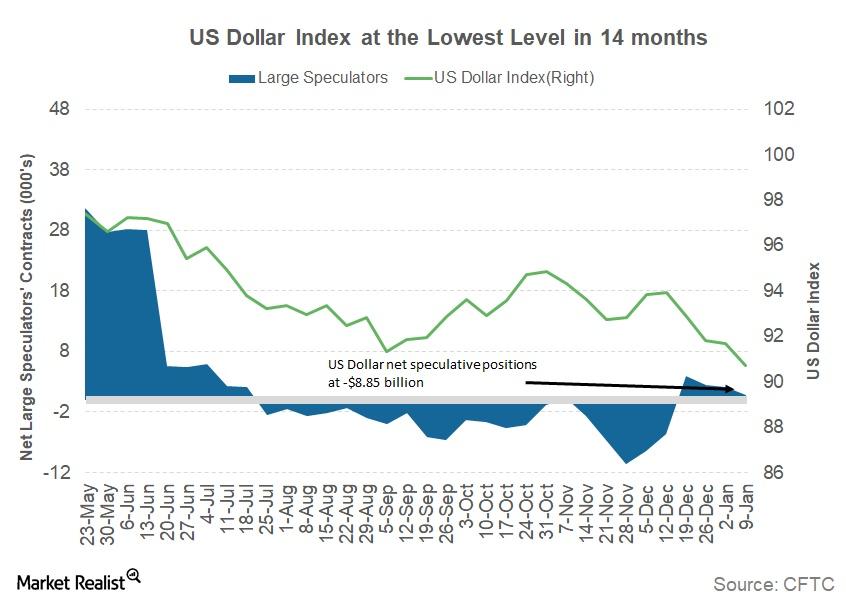

Why the US Dollar Is Losing Its Appeal

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

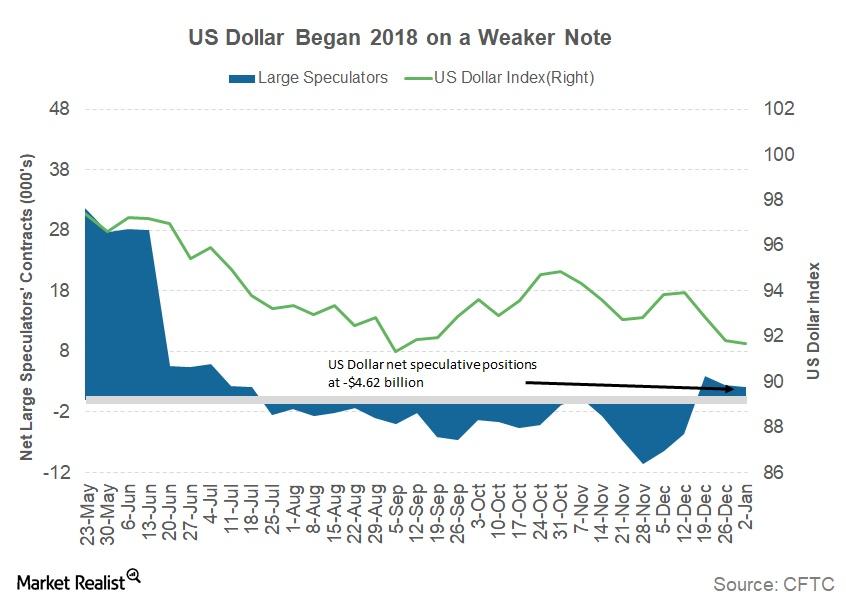

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

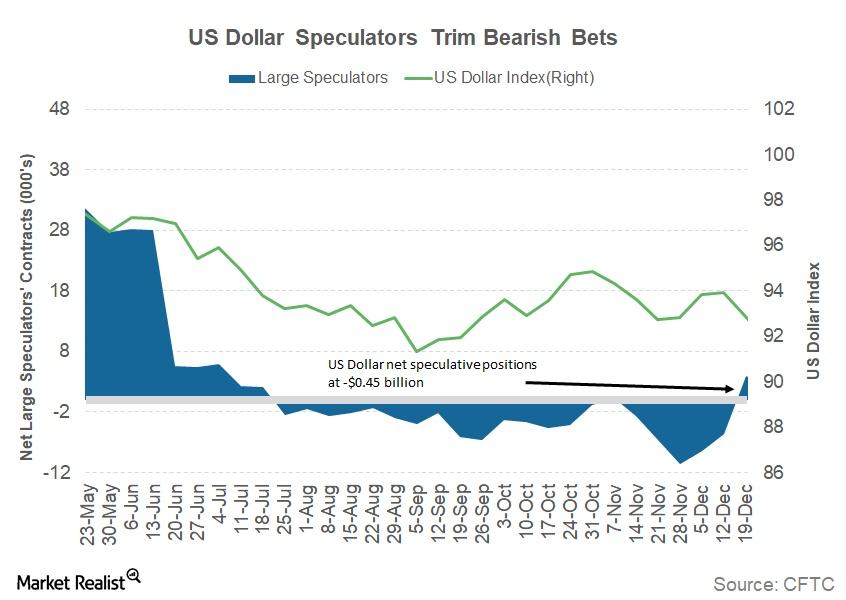

Can the US Dollar Gain Back Lost Ground This Week?

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

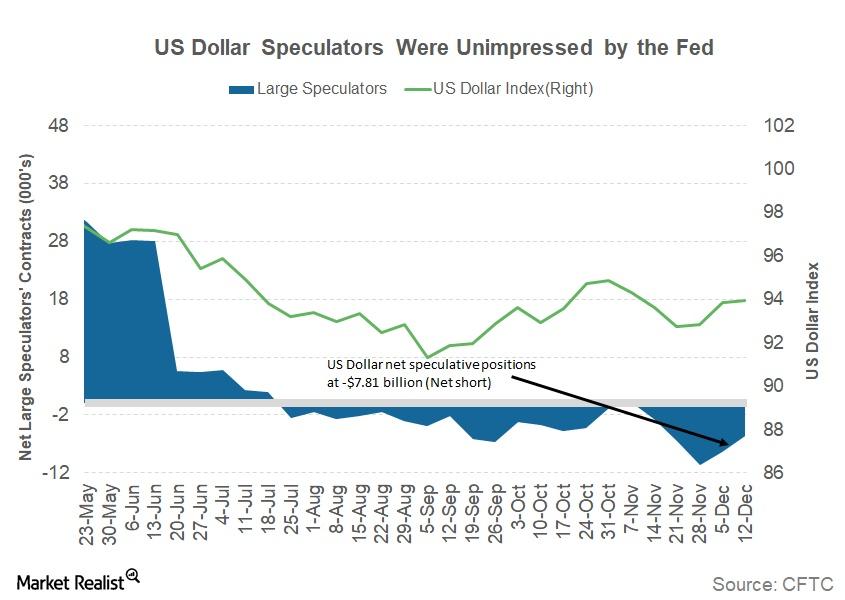

Why the US Dollar Resisted the Fed’s Latest Rate Hike

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

Has the US Dollar Rally Ended for Now?

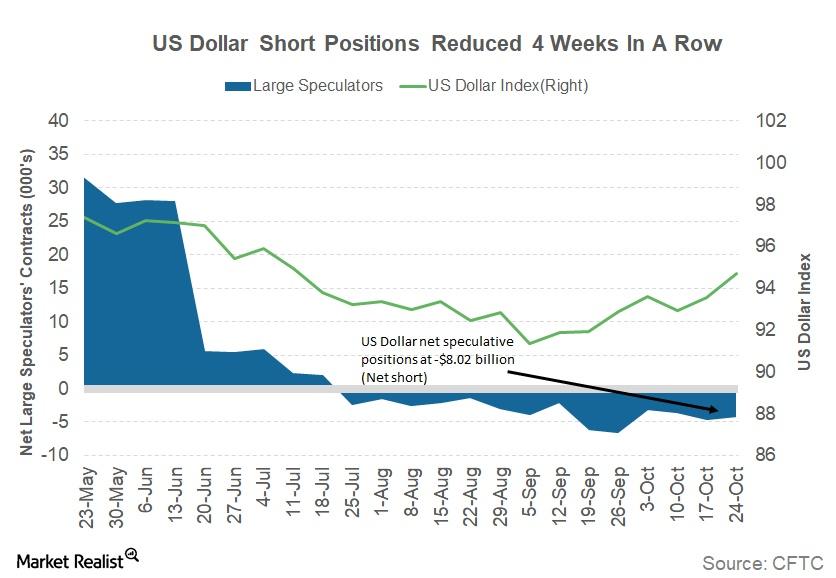

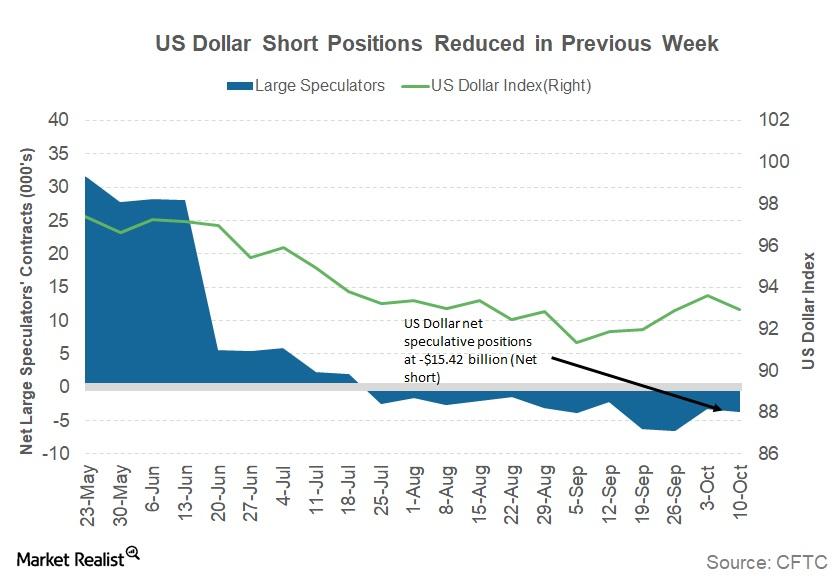

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

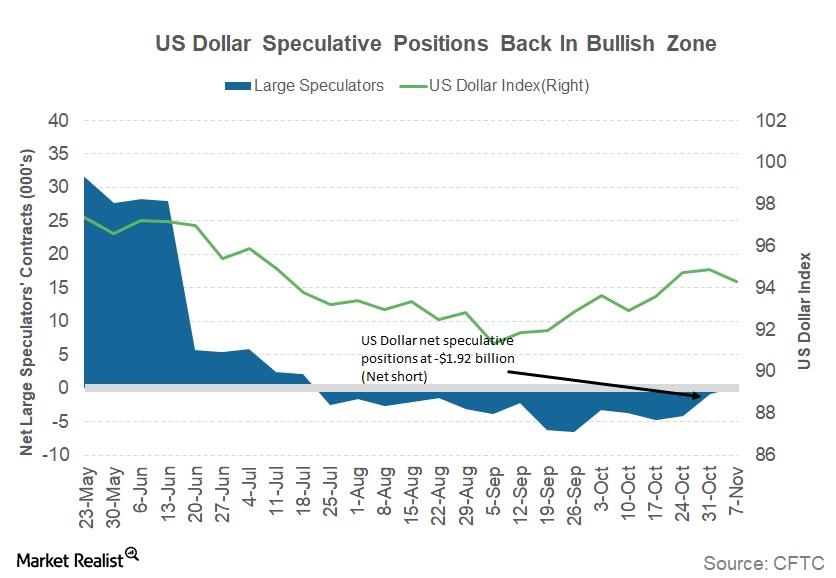

Are Investors Positioning for a US Dollar Rally?

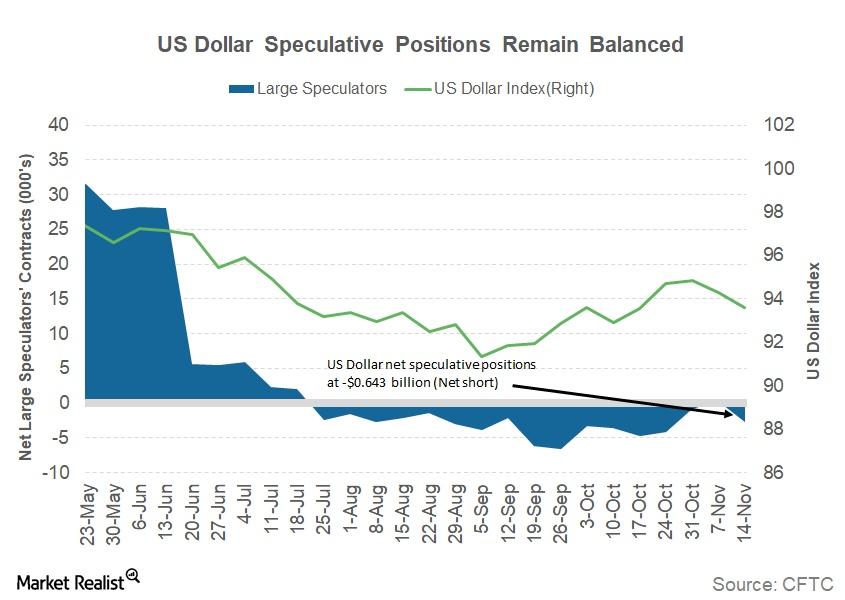

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

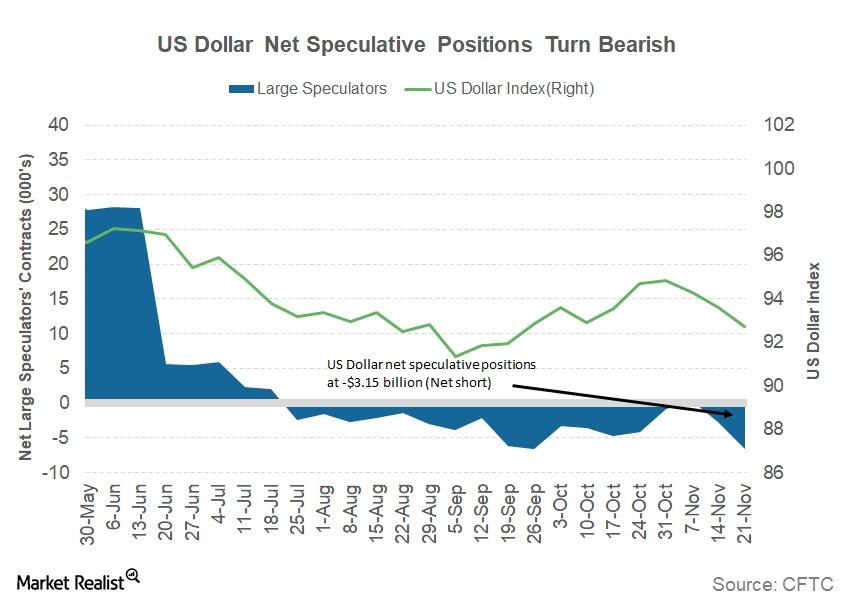

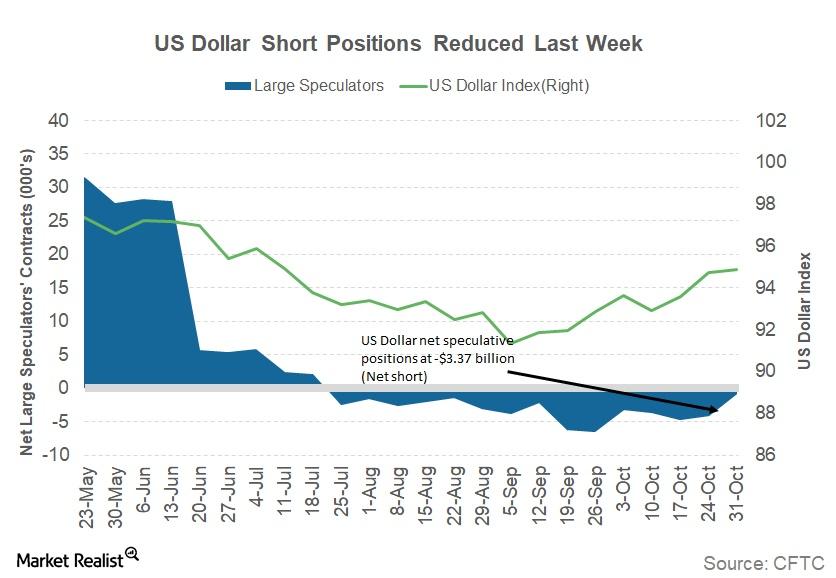

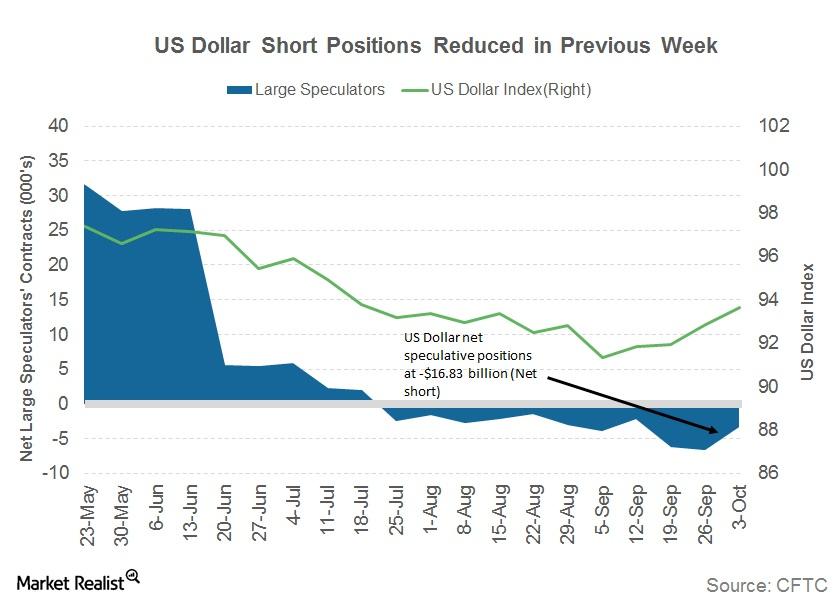

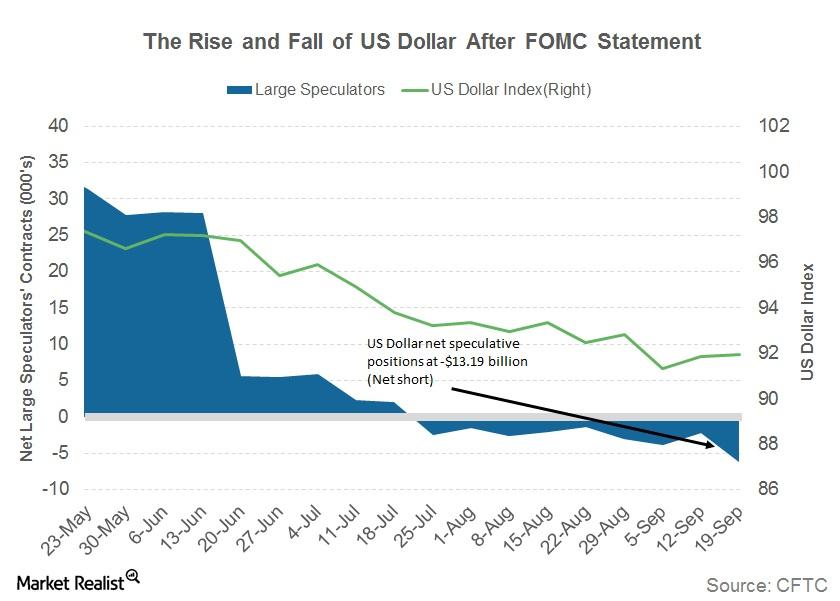

Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

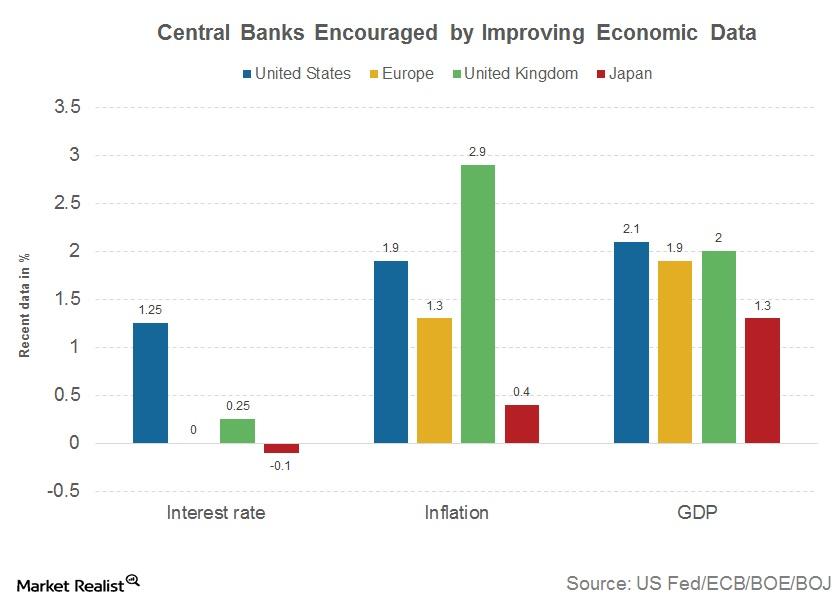

Would Markets Be Prepared for a Central Bank Surprise?

Three central banks on a path to tightening After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted […]

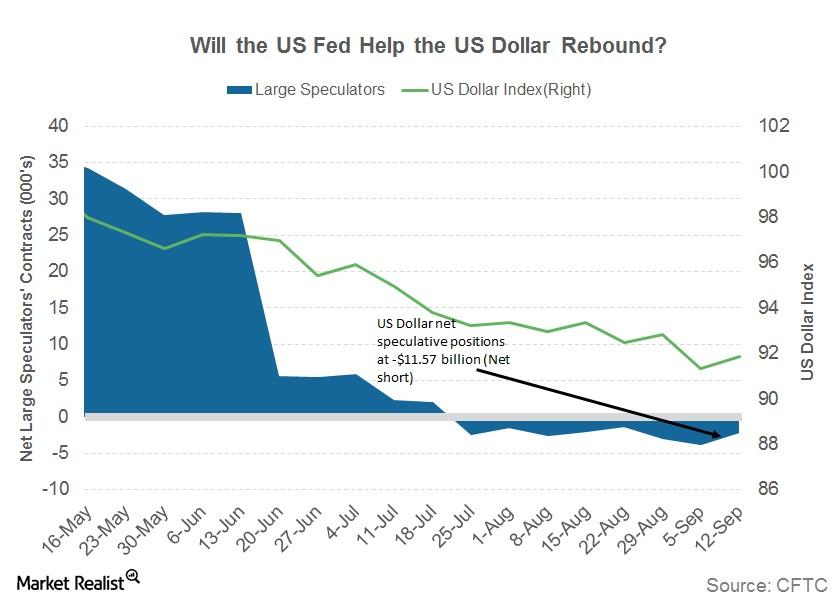

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

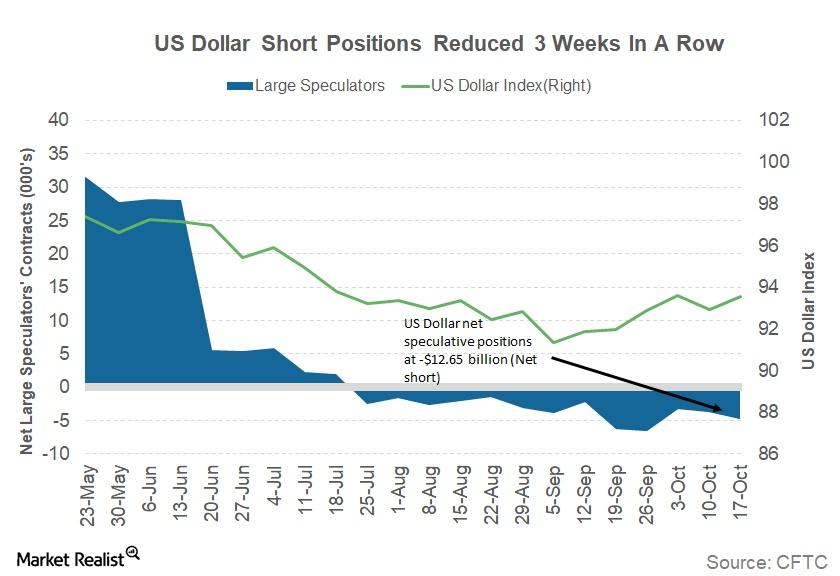

Why the US Dollar Saw a Sharp Rebound

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

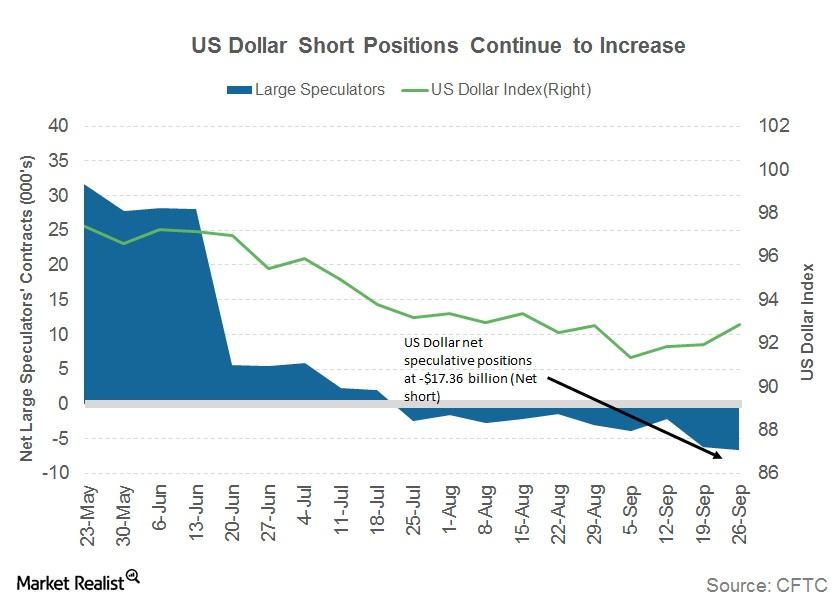

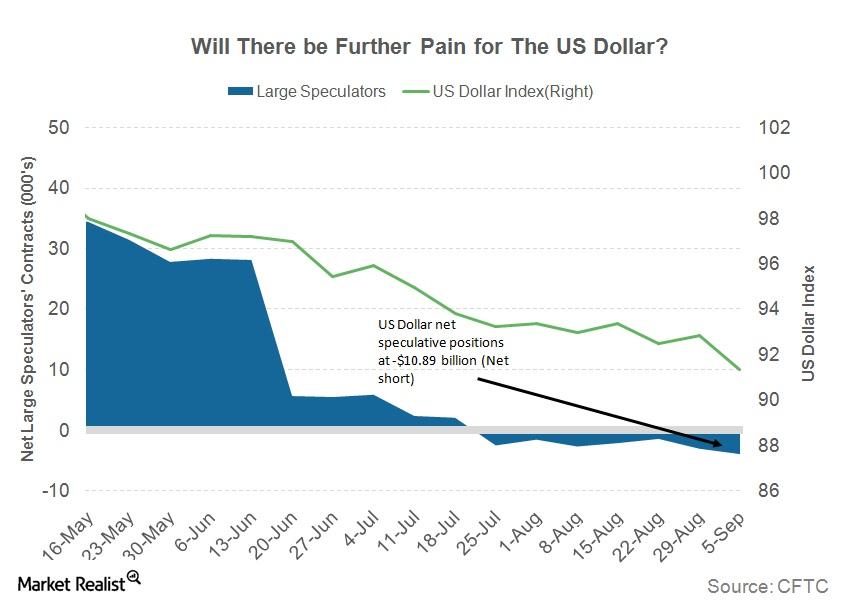

Why the US Dollar Could Be Poised for Further Losses

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

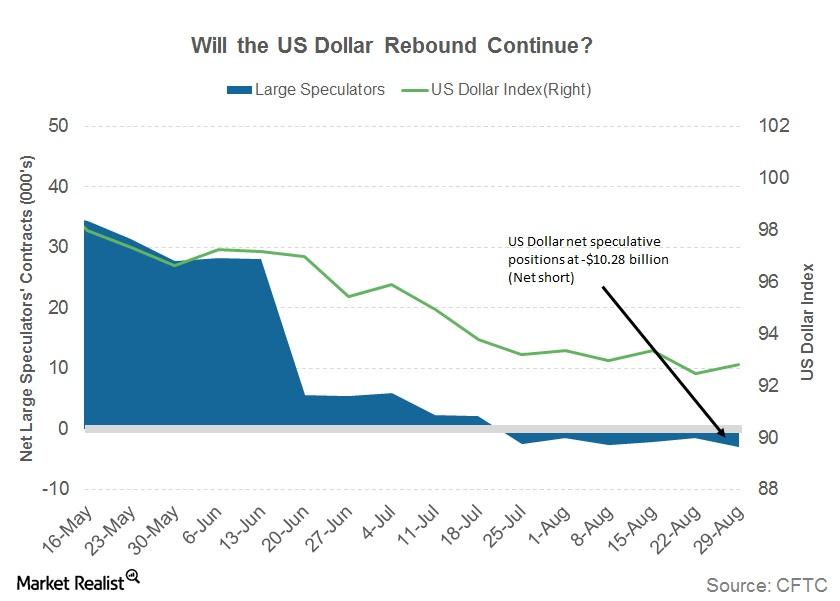

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

Is the US Dollar Dying a Slow Death?

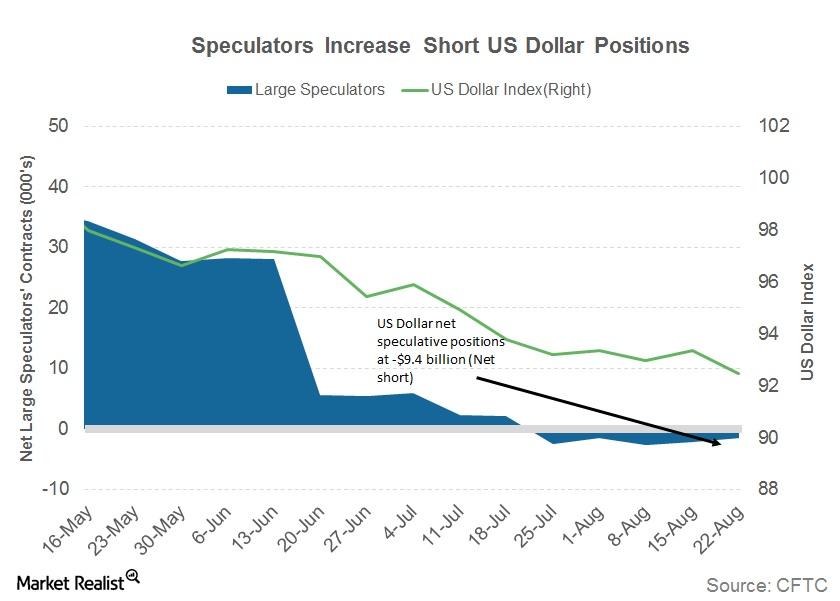

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

What to Expect from the US Dollar

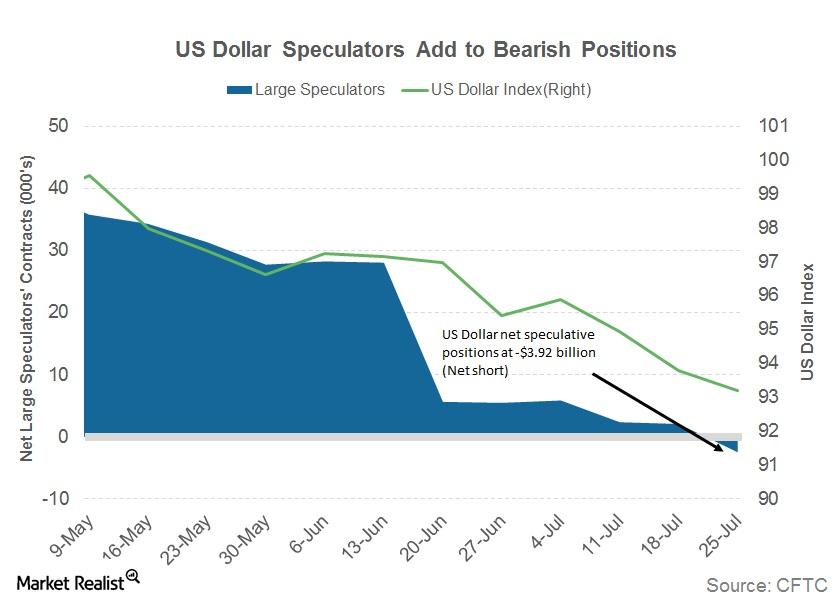

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

This Is Why the US Dollar Could Slide Further

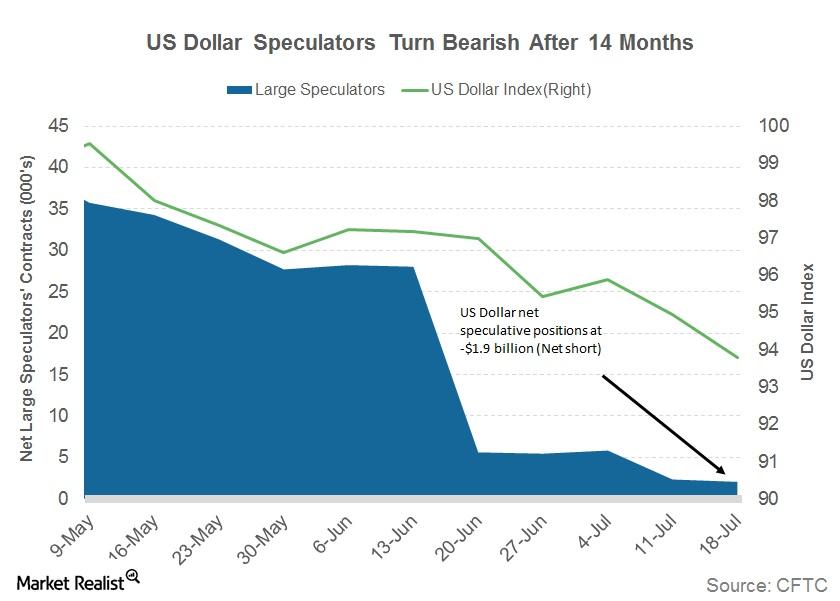

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

Have Yellen and US Economy Failed the US Dollar?

The US Dollar Index (UUP) closed at 94.9, depreciating by 0.90% last week.

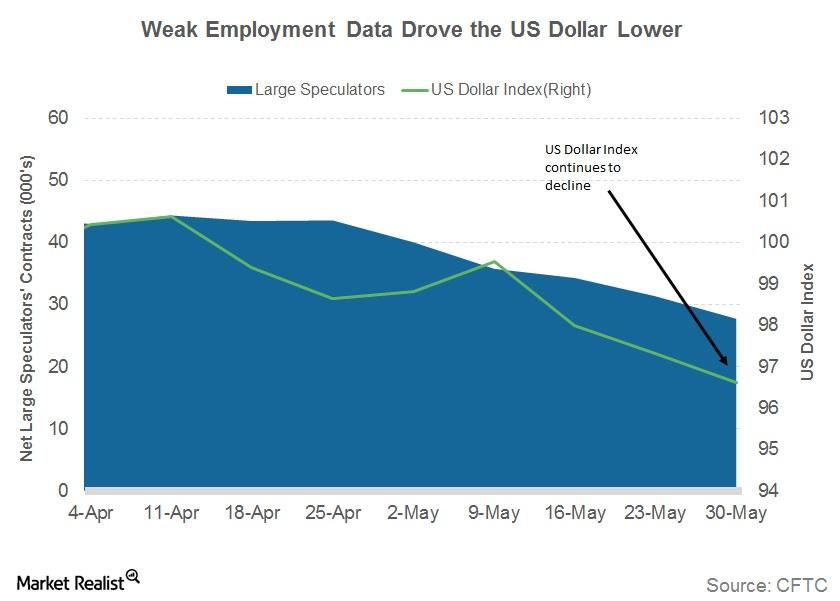

How the Weak Jobs Data Could Spell Doom for the US Dollar

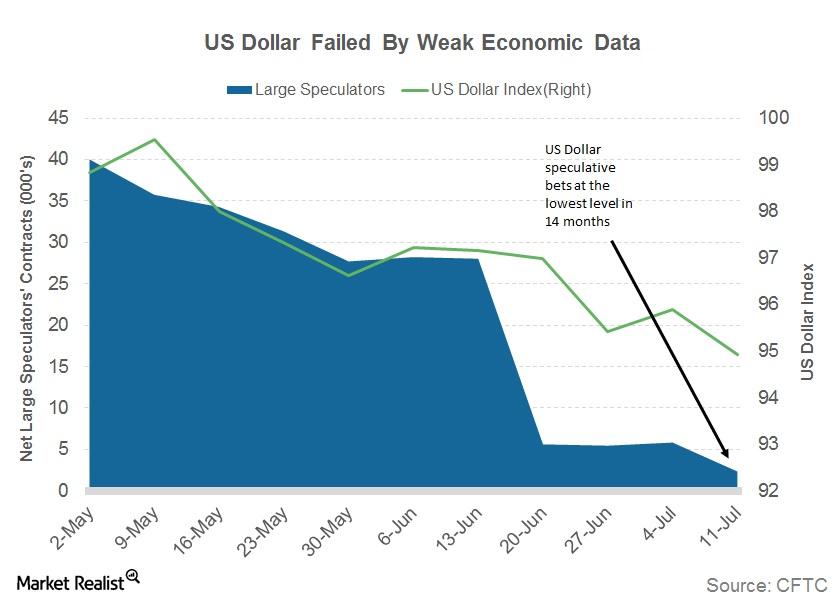

The US dollar came into focus after the weak US jobs data on June 2. The payroll data was a negative surprise, with only 138,000 jobs being added in May.

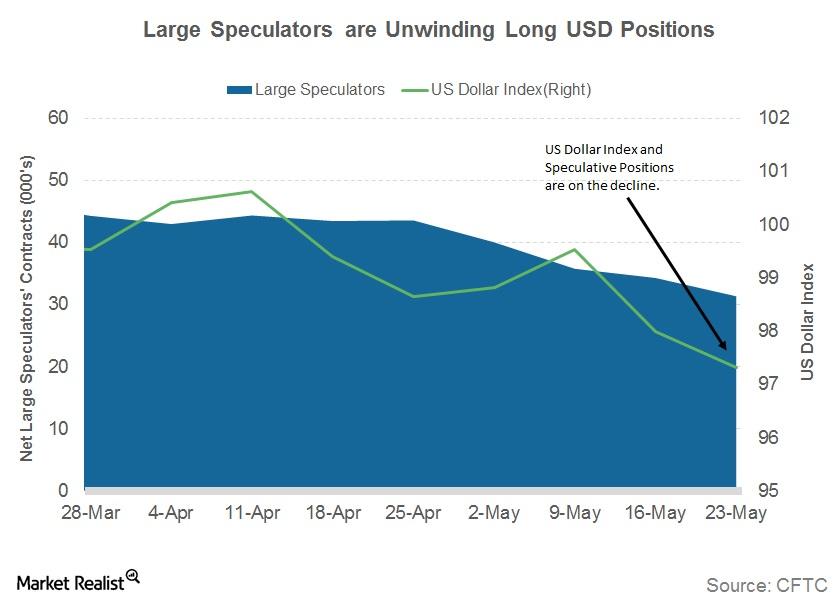

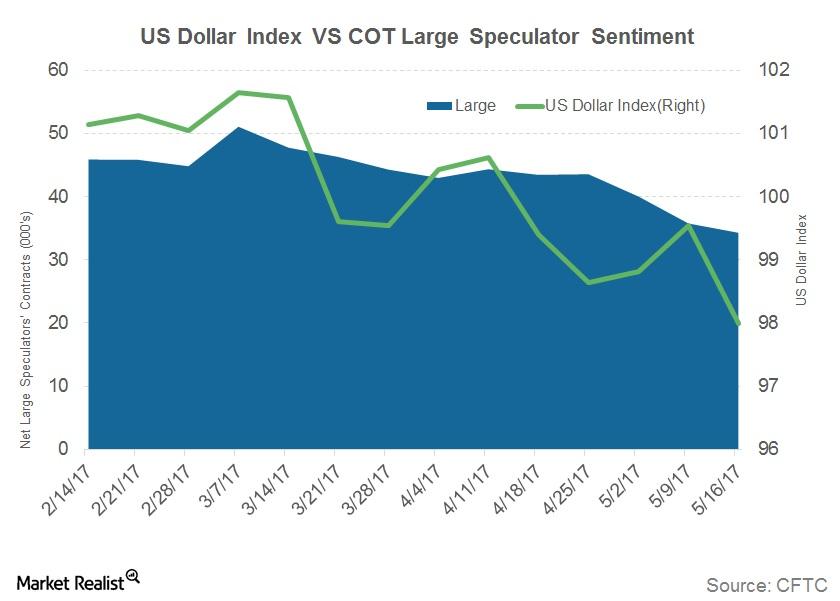

What the Falling US Dollar Could Indicate for Investors

The US dollar (UUP) has continued to lose its value with respect to its trading partners. The US Dollar Index fell 1.6% in the week ended May 26, 2017.

Is the US Dollar the Only Positive for US Economy Right Now?

The US dollar (UUP) continued to trend lower against its trading partners with the US Dollar Index (DXY) losing 2.1% in the week ending May 19, 2017.

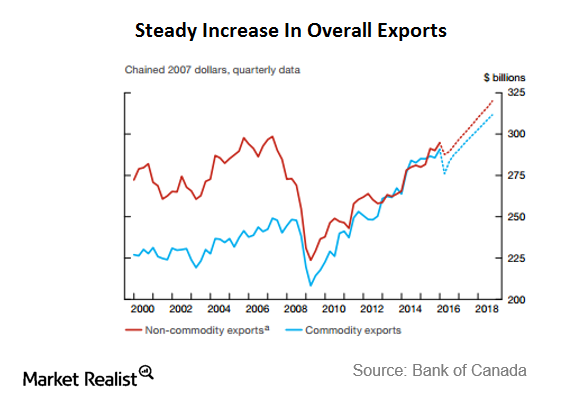

Major Takeaways from the Bank of Canada’s Monetary Policy

The Bank of Canada decided to keep the interest rates unchanged at 0.5% after the monetary policy meeting on July 13.