BTC iShares MSCI Australia ETF

Latest BTC iShares MSCI Australia ETF News and Updates

Why FireEye Partnered with Microsoft

Following in the footsteps of tech giants IBM (IBM) and Microsoft (MSFT), which partnered to expand and strengthen their offerings, FireEye is also entering an industry partnership with Microsoft.

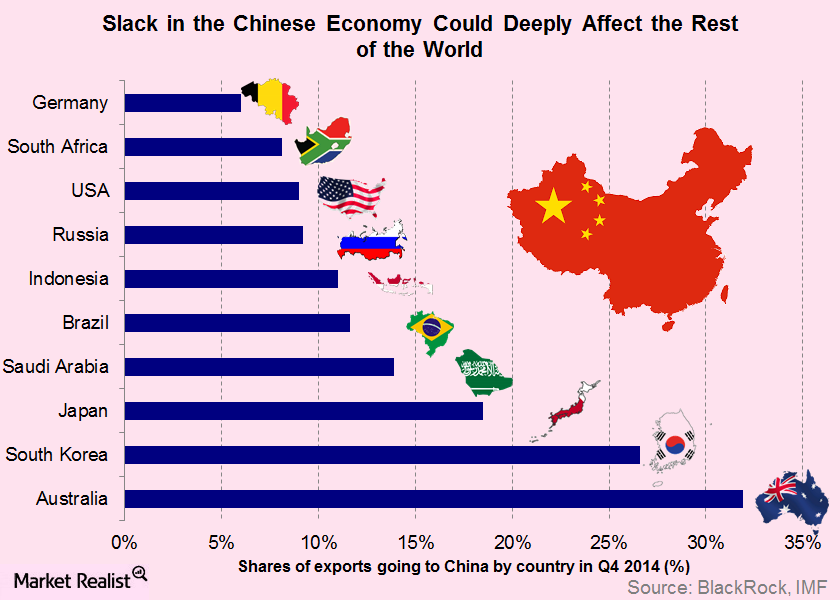

Why China Matters in the Long Run

China matters in the long run—and not just for investors in the country’s equity markets. Slack in the Chinese economy could affect the global economy (FAM) in a big way.

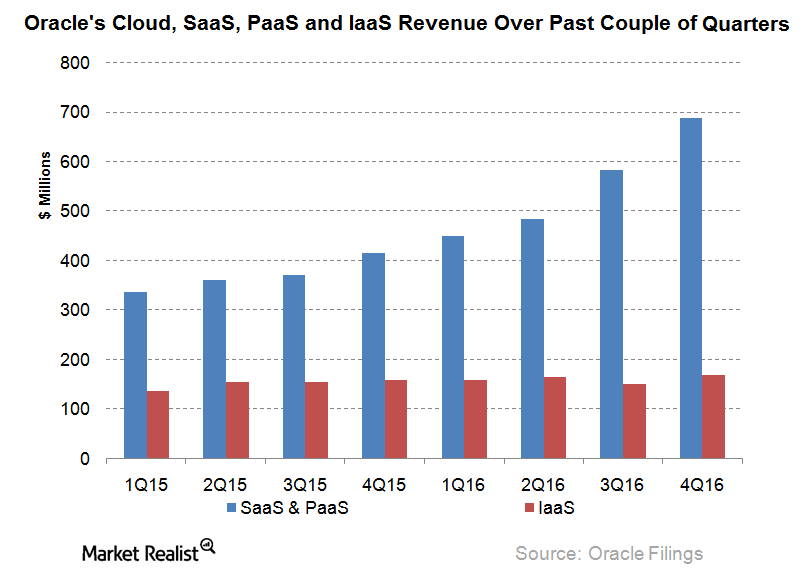

How NetSuite Will Improve Oracle’s Position in the Cloud Space

In fiscal 2016, Oracle reported ~$2.9 billion in cloud revenue. Oracle is making progress in the space and expects 65% growth in the space in fiscal 2017.

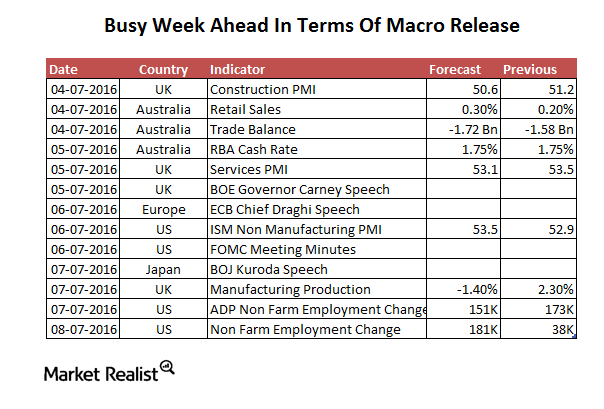

Why Employment Numbers Are this Week’s Center of Attention

Strong non-farm employment required to maintain any rate hike hopes Non-farm employment changes are one of the most important indicators the US Fed considers in deciding on monetary policy. May non-farm employment changes hit a multi-year low, which took away all probabilities of a June hike. Check out the following article for further detail on May’s […]

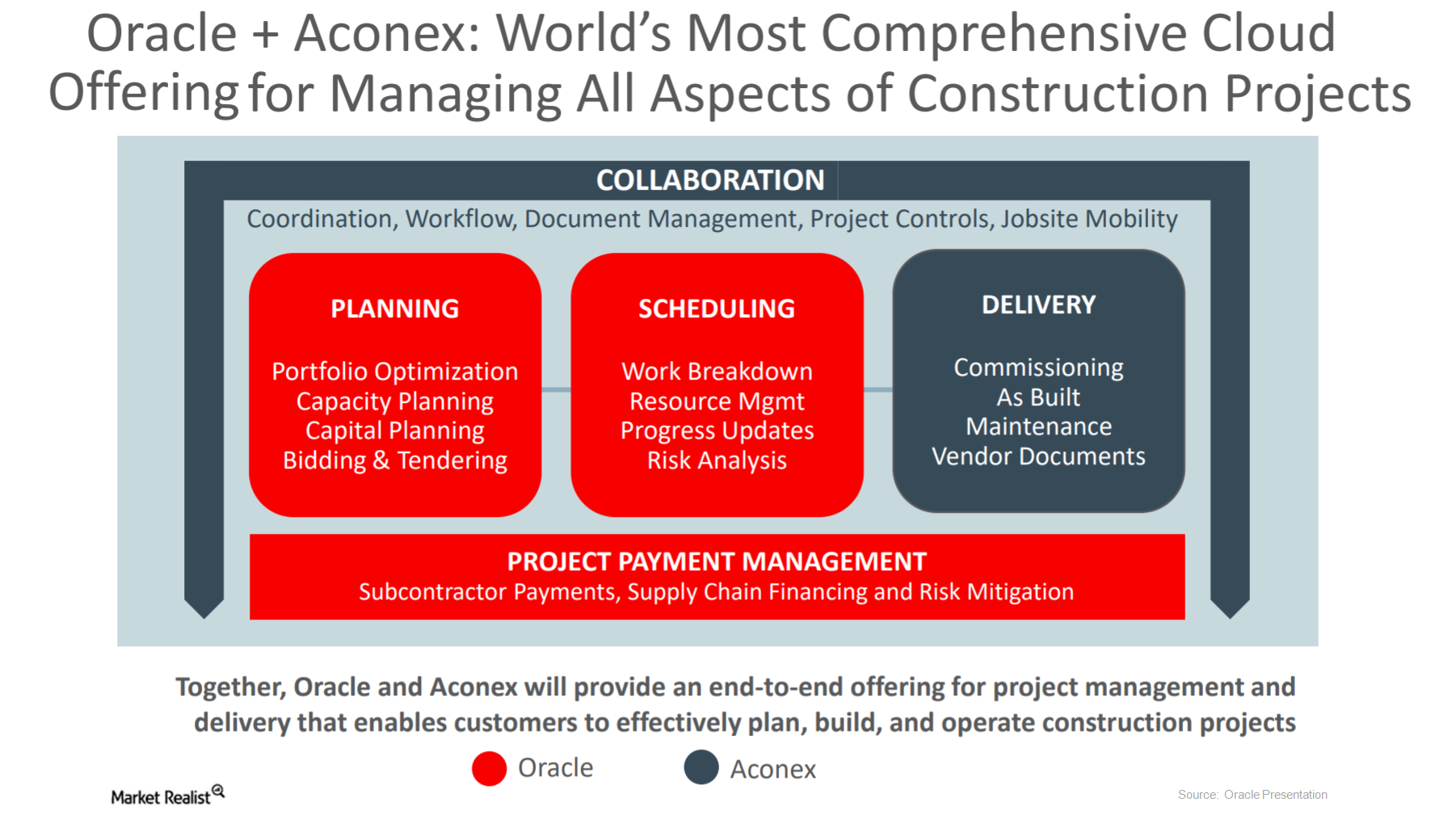

How Industry Analysts Feel about Oracle-Aconex Deal

Oracle is not expected to face major competition from domestic players.

How NZ50, ASX, Singapore, KOSPI Indexes Fared Today

Australia’s ASX200 lost marginally today. Although the index was trading higher until noon, it erased those gains afterward. 70 stocks gained, while 118 fell. BHP Group (BHP) outperformed the index with marginal gains, while Rio Tinto (RIO) gained 0.64%.

Will 2018 Be a Smooth Road for Investors?

2018 also brings with it many geopolitical events that could bring uncertainty and turn the market around.

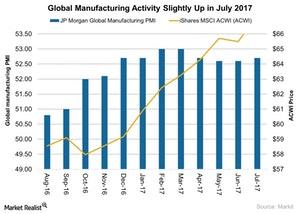

Global Manufacturing Activity Picks Up the Pace in July 2017

In this series, we’ll look at the performance of global (ACWI) manufacturing indexes and manufacturing activity in emerging markets.

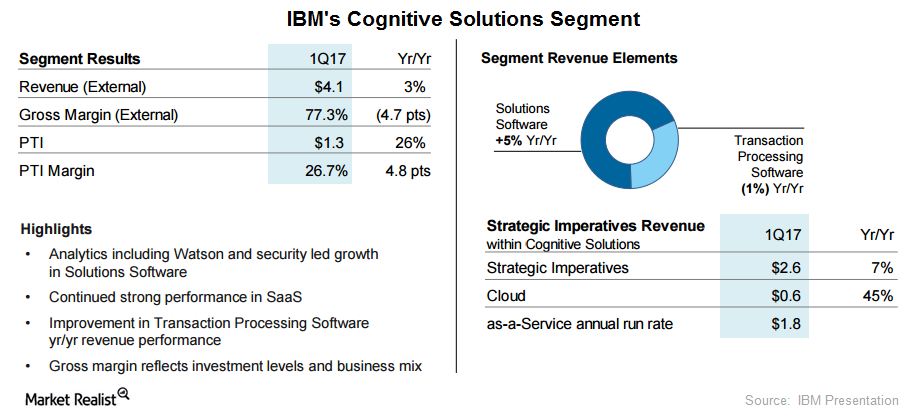

How Has IBM’s Cognitive Solutions Segment’s Performance Been?

Despite its aggressive measures to tap growth, top line growth continues to be elusive for IBM. The company’s 1Q17 results marked its 20th straight quarter without revenue growth.

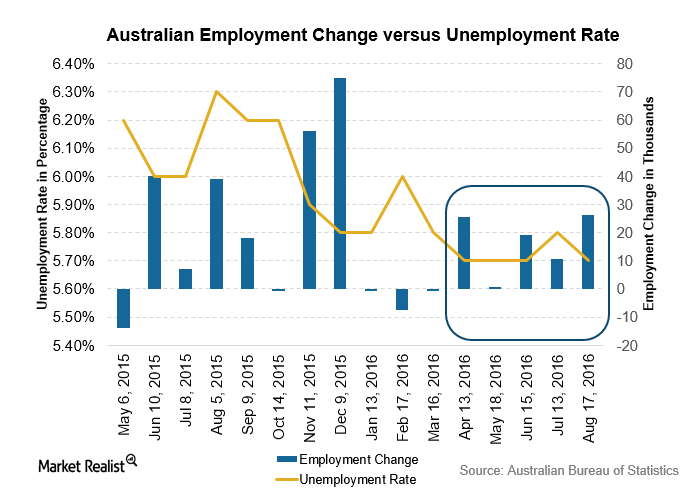

Australian Unemployment Fell: Is More Easing Needed?

The Australian Bureau of Statistics published the employment report for July on August 18, 2016. The unemployment rate fell by 0.1% to 5.7%.

RBA Minutes Exhibit Dovish Bias, Wholesale Prices Rise in India

The RBA released its minutes. Inflationary pressures were subdued—noted by a sluggish rise in consumer prices in Australia of 1% in 2Q16.

China’s Trade Surplus Expands, Australian Indices Still Rise

China’s trade surplus widened to $52.3 billion in July from $48.1 billion in the previous month. It’s expected to narrow to $47.6 billion.

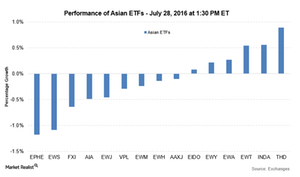

EWA Rises despite Lower Growth in Export and Import Prices

Recently, the trade surplus for Thailand increased as imports fell lower than exports in the Thai economy. THD rose by 0.81% at 1:30 PM EST on July 28.

Inflation Levels in Australia Exhibit a Sluggish Increase

Inflation levels in Australia rose by 1.0% in 2Q16—slightly below estimated forecasts of a 1.1% rise and softer than the previous quarter’s rise of 1.3%.

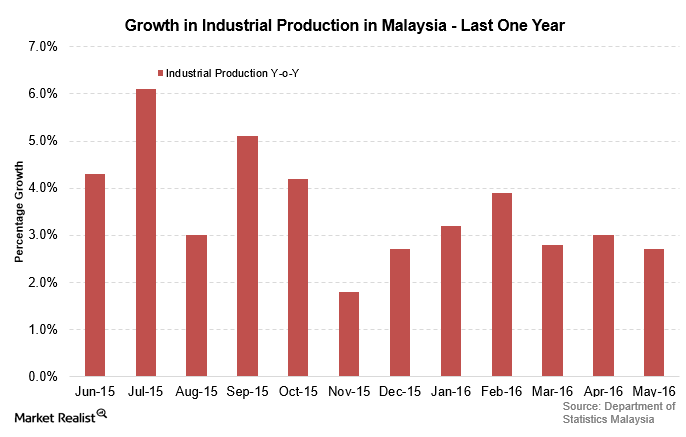

Inflation Levels in Malaysia Ease, Taiwanese Export Orders Drop

The inflation rate in Malaysia increased by 1.6% on an annual basis in June—compared to 2.0% in the previous month and below forecasts of 1.6%.

Australian Dollar Rises ahead of the RBA’s Minutes

The Australian dollar could gain more if the RBA doesn’t provide a strong hint of cutting interest rates. The central bank is concerned about economic growth.

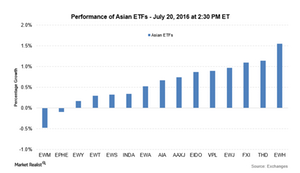

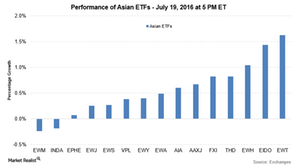

Asian Markets Rise as Investors Focus on Chinese GDP Release

On a quarterly basis, the advance GDP for Singapore rose by 0.8%, marginally below estimated forecasts of 0.9%.

Central Bank of Malaysia Cuts Rates by 25 Basis Points

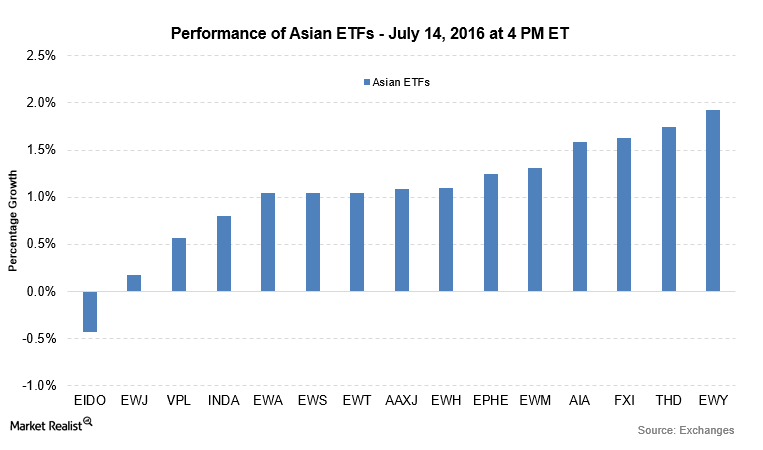

The Central Bank of Malaysia unexpectedly reduced the benchmark interest rate by 25 basis points to 3% on July 13—bringing the rates to two-year low levels.

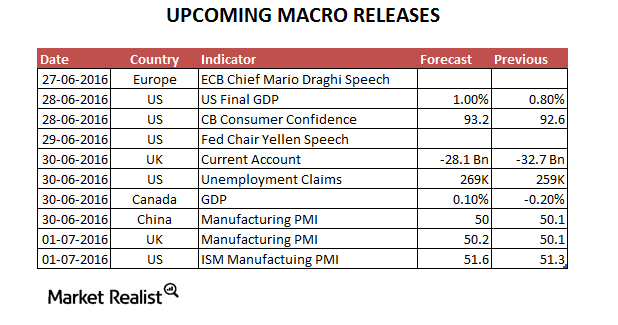

Major Macro Events in the Week Starting June 27

The final GDP is scheduled for June 28, 2016. It will be the major driver of markets in the week starting June 27. The GDP is expected to rise by 1.0%.

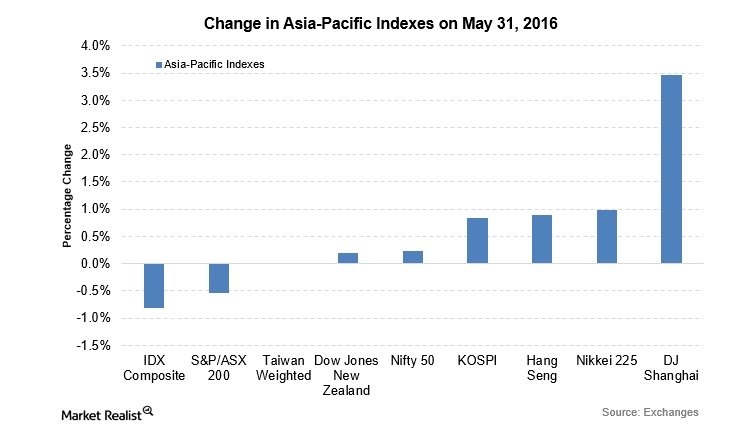

Brexit Threat Spreads Risk around Global Markets

Major European indexes (DBEU) fell on May 31 as polls conducted by the Guardian and ICM suggested voters are in favor of Brexit.

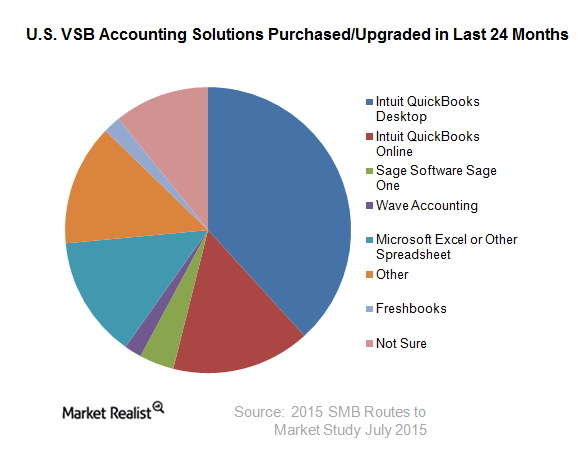

Intuit’s Persistent Focus on Small Business Benefits Investors

Intuit’s tax and accounting software and offerings dominate the very small business (or VSB) accounting market in the United States.

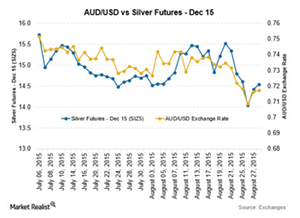

Silver Prices Show Positive Correlation with the Australian Dollar

Drop in silver prices among other precious metals With global commodity and metal prices falling in the volatile month of August, silver has been no exception. The economic slowdown in China has been slowing the demand across various commodities. Precious metals like gold and silver have been under pressure. The strength in the US dollar […]