Equity Residential Properties Trust

Latest Equity Residential Properties Trust News and Updates

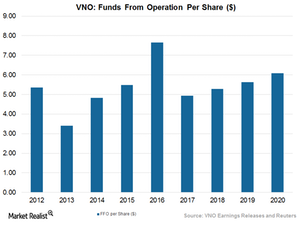

Vornado Realty: A Commercial REIT Thriving amid a Retail Crisis

Vornado Realty Trust (VNO) is selling off its non-performing assets and focusing on its core business in a move to improve its profitability. Analysts are encouraged by Vornado’s strategy of optimizing its profits.

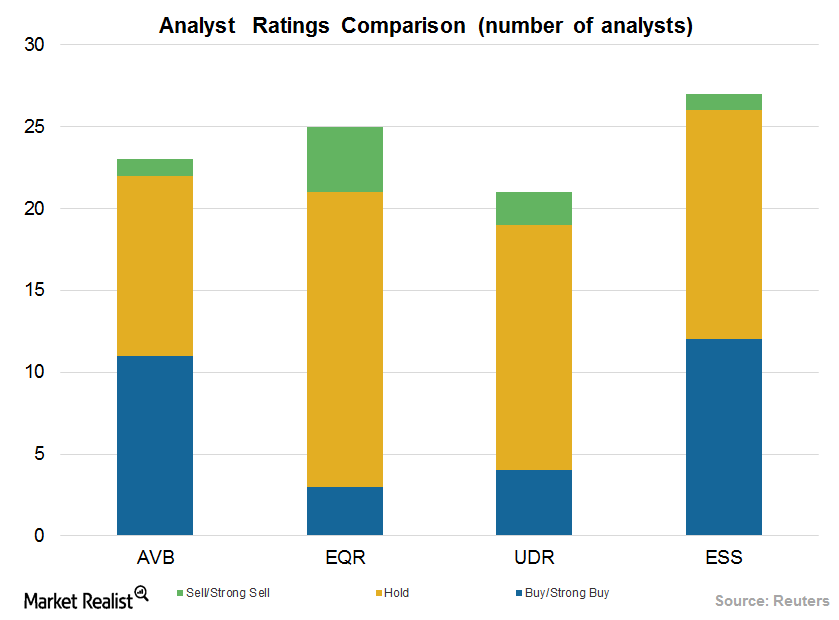

How Wall Street Analysts View AvalonBay Stock

In May 2017, 11 of 23 analysts covering AVB stock issued “buy” or “strong buy” ratings.

AvalonBay—Comparison with Other Retail REITs in Its Industry

Currently, AvalonBay Communities is offering a next-12-month (or NTM) dividend yield of 3%, which is in line with its close competitors.

AvalonBay, Residential REITs Target Headwinds through Diversification

During 1Q17, AvalonBay Communities (AVB) had completed the development of projects worth $650 million at an initially projected yield of 5.6%.

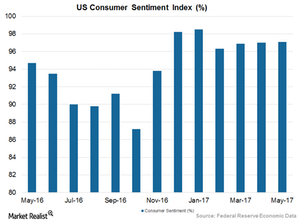

Could Rising Consumer Sentiment Boost REITs Like AVB?

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%.

The Impact of Trump’s Proposed 2018 Budget on Residential REITs

According to President Trump’s proposed budget for fiscal 2018, the administration is expected to slash $6 million from the U.S. Department of Housing and Urban Development budget, decreasing its funding by 13.2% to $40.7 billion.

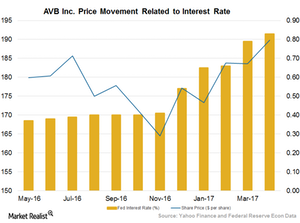

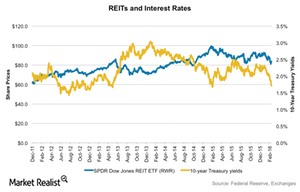

How Rising Interest Rates Impact AVB and Residential REITs

There is wide anticipation in the market that the Federal Reserve could raise interest rates again during its upcoming meeting on June 14, 2017.

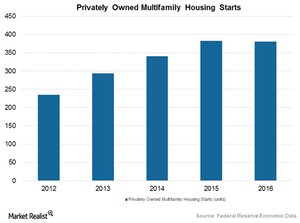

AvalonBay Communities and the Residential REIT Industry Overview

According to NHAB’s Housing Economics survey, housing starts are expected to rise 6.2% in 2017 and ~6.3% in 2018, backed by respective 9.6% and ~11.8% gains in single-family home sales.

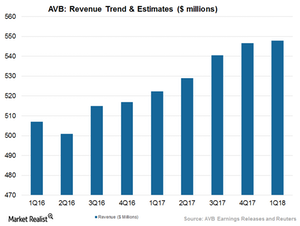

AvalonBay Maintains Revenue Growth amid Industrial Headwinds

AvalonBay’s 1Q17 revenues came in at ~$522.3 million and surpassed estimates by 0.3%.

AvalonBay: Weathering Ups and Downs in Residential REITs

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

How Would Negative Interest Rates Impact REITs?

A fall in interest rates makes REITs more attractive dividend-yielding investments compared to bonds. This is because REITs have been traditionally viewed as dividend-yielding investments.

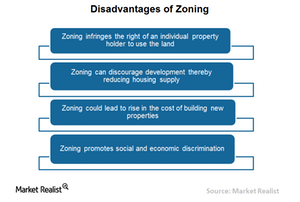

How Zoning Can Be a Hindrance to Housing Market Growth

Zoning restricts the freedom of property holders and REITs to use land however they want, given their specific development and investment interests.

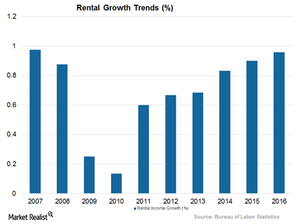

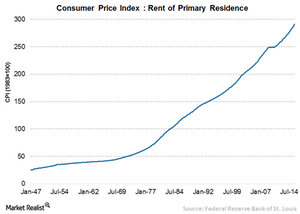

Why Rent Is Going through the Roof

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US.

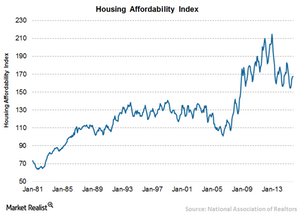

What Are the Factors Driving Housing Affordability?

Housing affordability took a beating in July 2015 after reaching its high in January 2013. The higher ratio of the home affordability index signifies relatively higher home affordability to buyers.

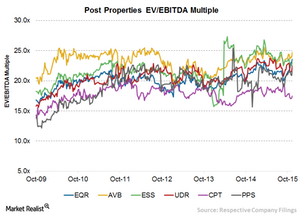

What Post Properties’ Higher-than-Average EV-to-EBITDA Multiple Means

Post Properties’ EV-to-EBITDA ratio is in line with its historical valuation, ranging between 12.2x–25.5x, with a current EV-to-EBITDA ratio of ~21.7x.

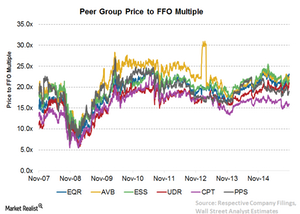

Assessing Post Properties’ Average Price-to-FFO Multiple

Post Properties’ TTM price-to-FFO multiple is in line with its historical valuation at around 18.9x.

A Must-Read Company Overview of Post Properties

Headquartered in Atlanta, Georgia, Post Properties is structured as an REIT and completed its initial public offering in 1993.

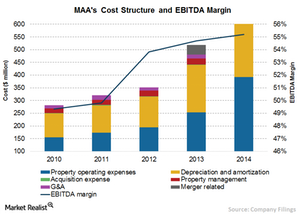

MAA’s EBITDA Margin: Lower than Industry Average

MAA’s EBITDA margin is lower than the industry average of 57.7%, as well as the margins reported by some of the company’s peers.

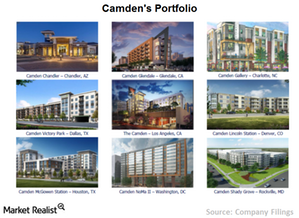

Camden Property Trust: Its History and Its Business

Camden Property Trust (CPT) is the fifth largest apartment REIT in the United States. At the end of fiscal 2014, it had 181 multifamily properties comprised of 63,163 apartment homes.

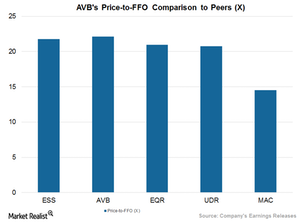

Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

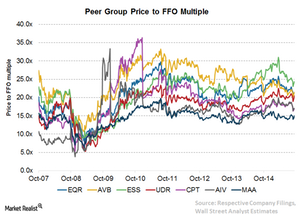

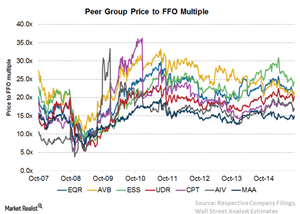

Analyzing Equity Residential’s Higher Price-to-FFO Multiple

The most common way to calculate the relative value of a REIT like Equity Residential (EQR) is the price-to-FFO (funds from operations) multiple.

What Are the Major Brands of AvalonBay Communities?

AvalonBay Communities’ brands focus on consumer preference as well as location and price. They help differentiate its apartments from the competition.

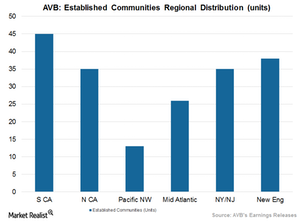

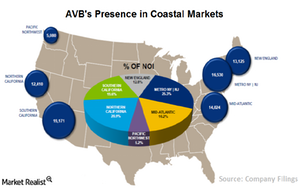

An Overview of AvalonBay Communities’ Geographic Coverage

The distribution of properties in attractive US coastal markets reflects AvalonBay Communities’ geographic diversification strategy.

Investing in Equity Residential: A Company Overview

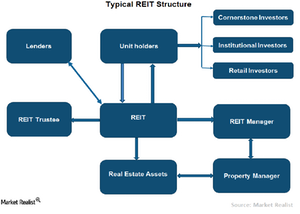

Equity Residential was formed as a REIT. It became a publicly traded company in 1993. It’s part of the S&P 500 Index. It employs about 3,500 people.

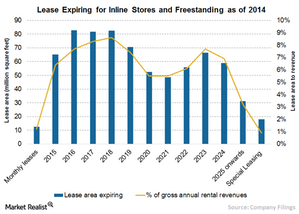

Simon Property Group’s Lease Length Exposure

Only 1.2% of Simon Property’s gross annual revenues from inline or freestanding stores comes from month-to-month leases. 6.5% of leases will expire in 2015.

Simon Property Group’s Acquisition Growth Strategy

Simon Property has a strong track record of aggressive acquisitions. Since its IPO in 1993, the company has completed acquisitions worth $40 billion.

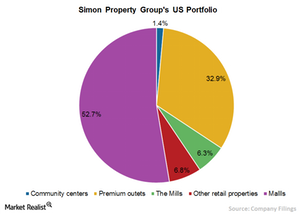

Simon Property Group’s Retail Mall Business

Simon Property’s US properties consist of malls, premium outlets, community centers, and retail properties that make up ~182 million square feet of GLA.

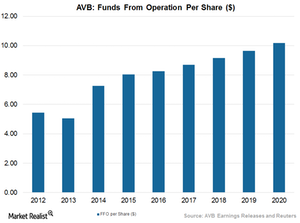

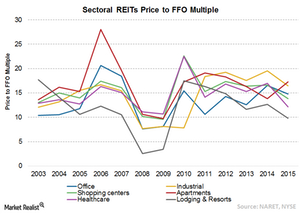

Most of the REITs Are Trading near Historic Multiples

The most common way of calculating the relative value of a REIT is the price-to-FFO multiple. FFO is widely used because it’s the main earnings metric for REITs.

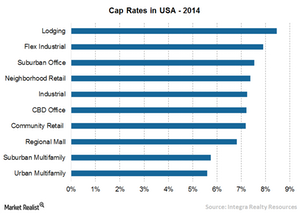

Why Are Capitalization Rates Important for Investors?

The capitalization rate, or cap rate, is an important concept in the commercial real estate industry. It’s defined as an initial yield on a real estate investment.

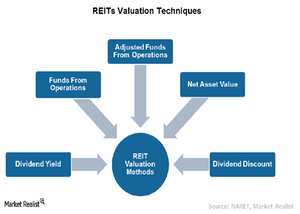

What Methods Are Used to Determine REITs’ Valuation?

Traditional valuation methods don’t apply to REITs because their operations are different from traditional companies. REITs are valued based on three main techniques.

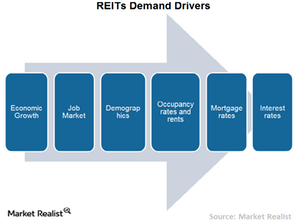

What Factors Drive REIT Earnings?

Economic growth is the major factor that determines REITs’ growth. An uptick in economic fundamentals positively affects the REITs by increasing business growth.

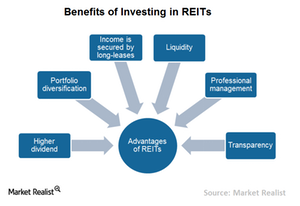

Advantages and Disadvantages of Investing in REITs

Every investment comes with certain advantages and disadvantages. REITs are no exception. There are benefits and risks associated with investing in REITs.

Why Did REITs Come into Existence?

US REITs came into existence in 1960 when President Eisenhower signed the REIT Act contained in the Cigar Excise Tax Extension.

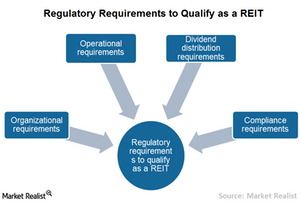

What Are the Regulatory Requirements to Qualify as a REIT?

To qualify as a REIT, a company must make REIT election by filing a Form 1120-REIT with the IRS. This is essential to reduce or eliminate corporate tax.