WisdomTree Japan Hedged Equity Fund

Latest WisdomTree Japan Hedged Equity Fund News and Updates

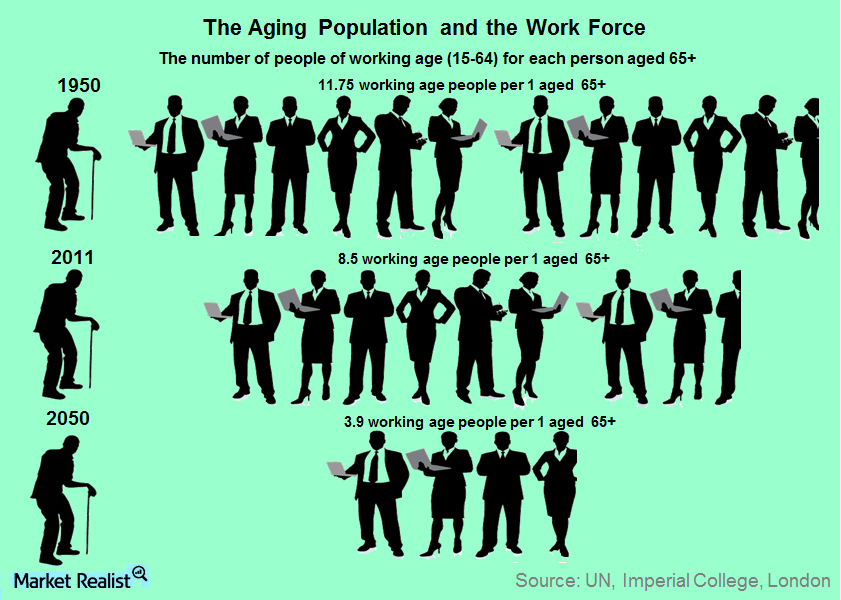

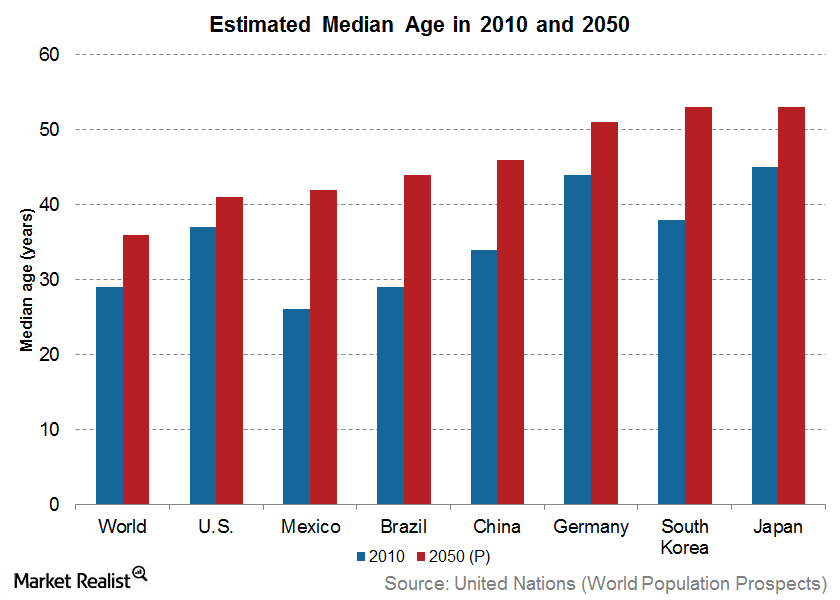

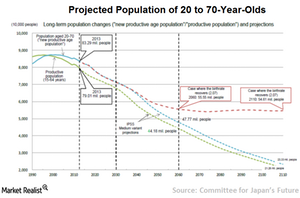

Aging Population May Keep Global Growth Muted

An aging population is likely to keep global economic growth muted in the years to come. This is primarily because the dynamics of the population are rapidly changing.

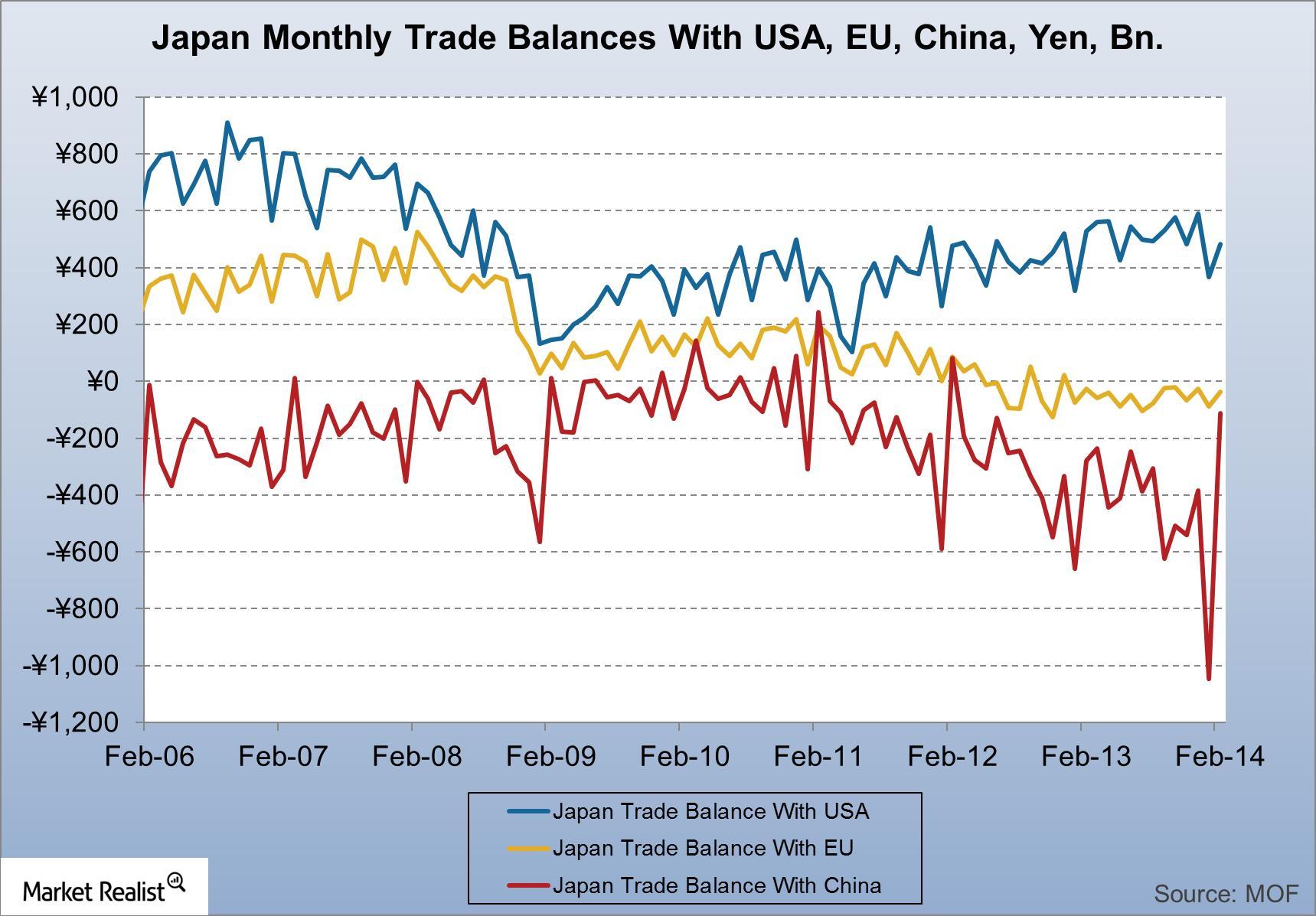

Japan’s trade deficit with China: Worse for GM than the recall

This article considers the impact of Japan’s trade dynamics on Japanese automakers like Toyota (TM) versus General Motors (GM) from a macroeconomic perspective.

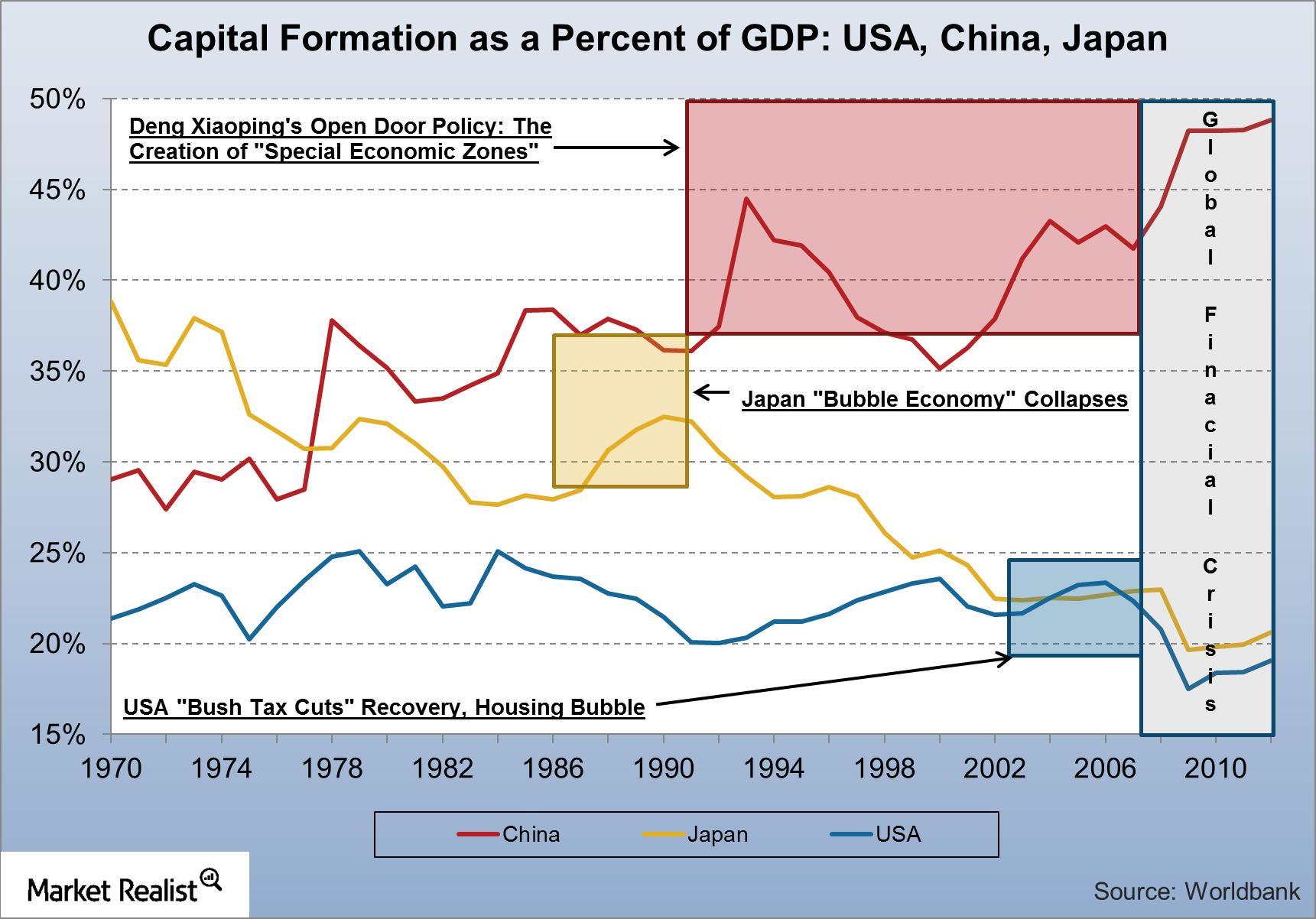

GM’s long-term competitive threat: Japan’s investment recovery

Japan is showing signs of investment recovery with its new economic policies coming into play.

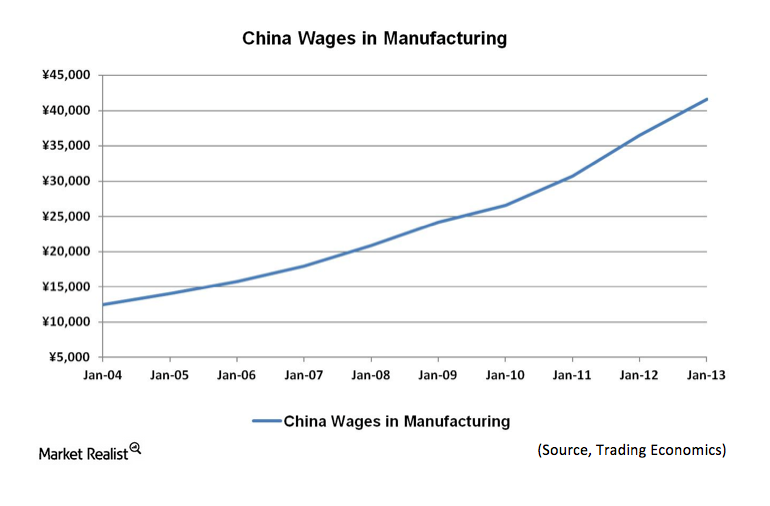

China’s wage inflation: Bad news for corporate profits and banks

Wage inflation in Chinese manufacturing With an appreciating currency and growing economy, Chinese manufacturers have experienced wage inflation. The cost of Chinese labor is simply becoming more expensive, as the below graph indicates. Private sector wage growth in China was 14% in 2012, while GDP growth is slowing to around 7.5% per annum. Wages are […]

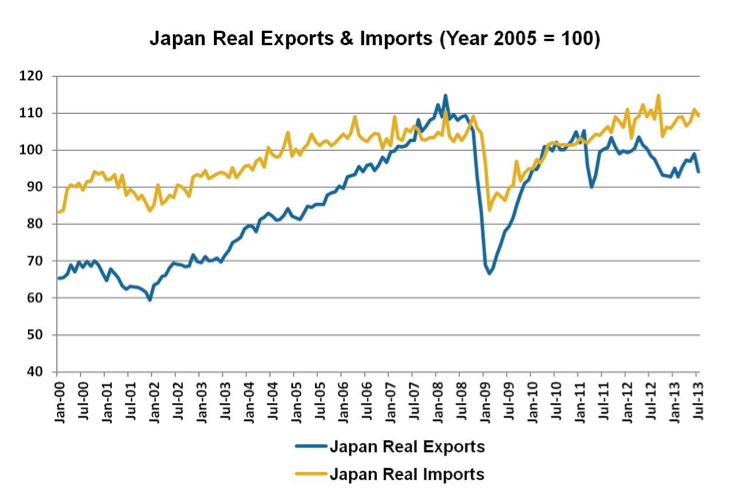

Why we could see a new trend in Japan’s exports and imports

Japan’s import and export dynamics The below graph provides a clearer picture of the import and export dynamics of the Japanese economy. By using 2005 as a base year and adjusting for inflation or deflation, the graph shows how exports and imports have changed on a “real” basis, as opposed to a “nominal” basis. Viewing […]

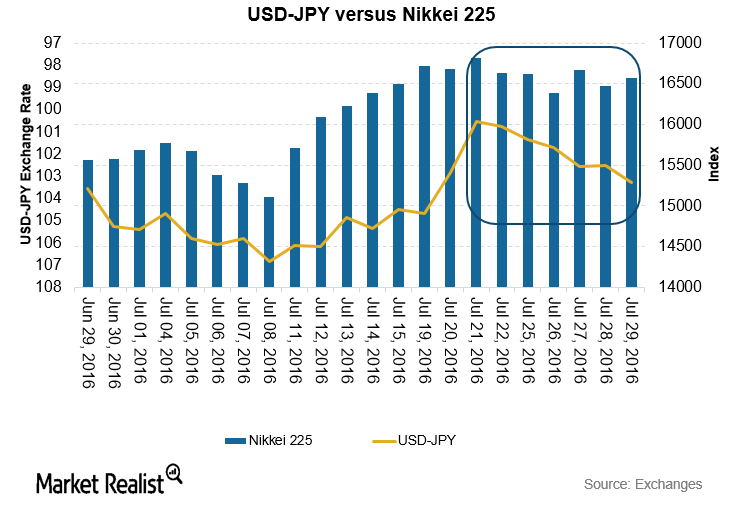

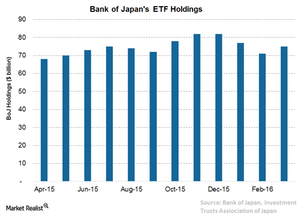

Analyzing the BoJ’s Monetary Policy Enhancement Measures

The BoJ’s monetary policy was the most awaited macro event this week. It was the first major central bank to expand its easing program after the Brexit vote.

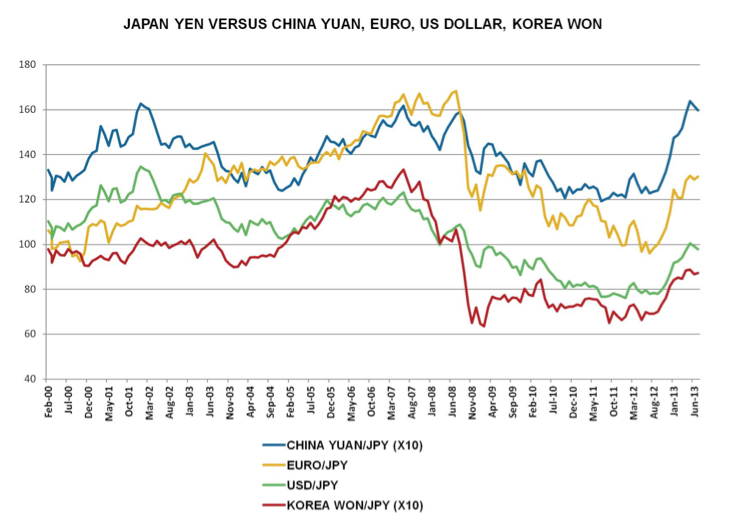

Does “Abenomics” mean a new era of yen depreciation?

A change in yen appreciation? The below graph reflects a potential big change in Japan post-2012—has yen appreciation turned the corner as a result of post-2012 “Abenomics“? In the mid 1970’s, the U.S. dollar bought 300 yen, and by the mid-1980’s, the U.S. dollar bought 250 yen. By the end of the 1980s, the dollar […]Financials Bank of Japan announces QQE2, expanded monetary stimulus

At its monetary policy meeting held on October 31, the Bank of Japan (or BOJ) announced new stimulus measures. The measures come in addition to those it announced earlier.

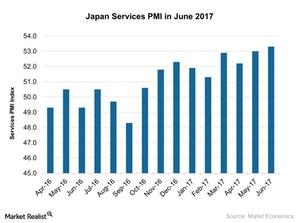

Why the Japan Services PMI Improved in June 2017

The Japan Services PMI (EWJ) (DXJ) stood at 53.3 in June 2017 compared to 53.0 in May 2017. It met the market expectation of 53.2.

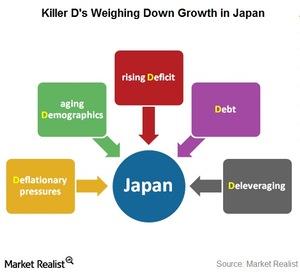

Dalio: Japan Is Undergoing an ‘Ugly Deflationary Deleveraging’

“Deleveraging” refers to reducing the debt level. With Japan’s debt burden, deleveraging the economy’s balance sheet seems more than imperative.

Japanese Trade Surplus Rose in June, Imports Fell More than Exports

The trade surplus for Japan increased to 692.8 billion yen for June—compared to a deficit of 60.9 billion yen in the same month last year.

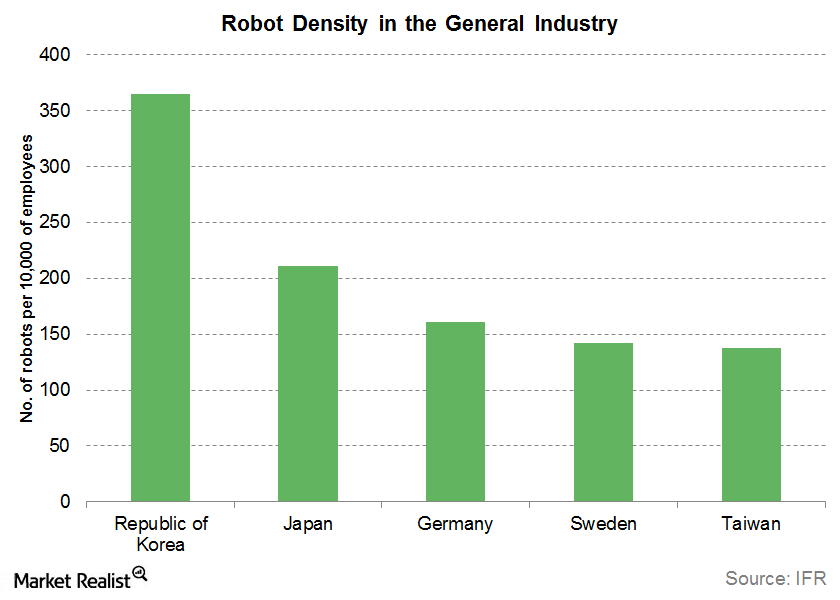

The Rise of Factory Automation in China

The rise of factory automation in China (GCH) has been rapid and unprecedented. China is the largest market for robots and automated parts.

The Aging World Means a Graying Workforce

We’re in a rapidly aging world. According to the United Nations World Population Prospects report, the median age of the world is estimated to grow from 29 years in 2010 to 36 years by 2050.

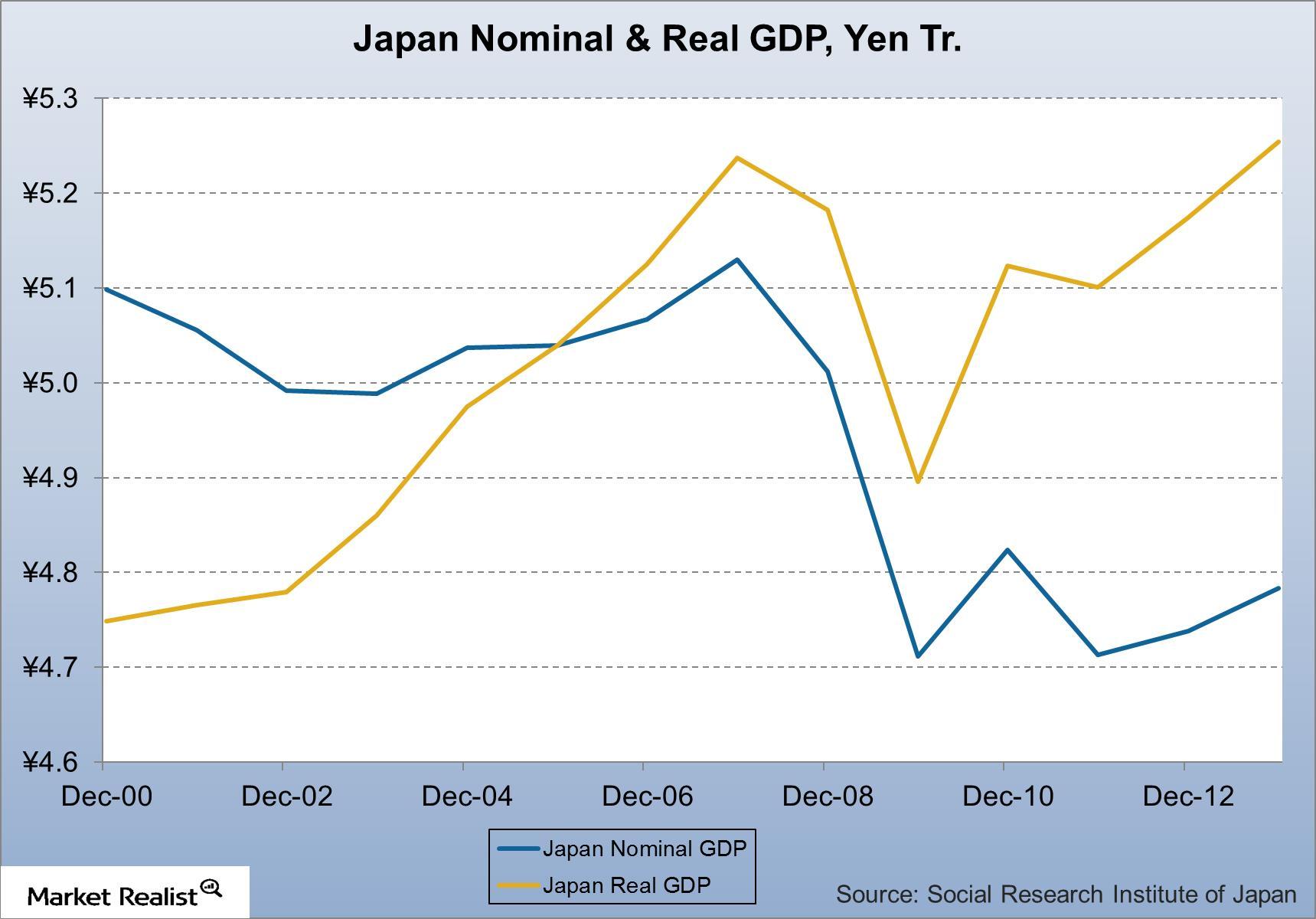

Japan’s GDP back to peak levels: Auto sales and Toyota benefit

This article considers the prospects for further real GDP growth acceleration and the implications for Japanese exporters like Toyota.

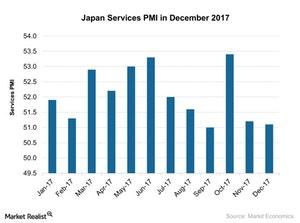

How Japan’s Services PMI Trended in December 2017

According to a report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) remained weaker in December 2017.

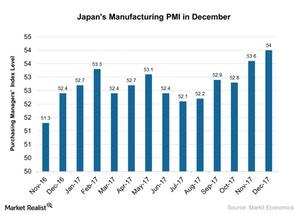

Why Japan’s Manufacturing Activity Improved in December 2017

Japan’s manufacturing activity in December Japan’s manufacturing PMI (purchasing managers’ index) improved in December 2017, rising to 54 from 53.6 in November 2017. Whereas the index was slightly below the preliminary market estimate of 54.2, it marked the strongest expansion in manufacturing activity since February 2014. The solid rise in Japan’s manufacturing PMI in December 2017 was mainly due […]

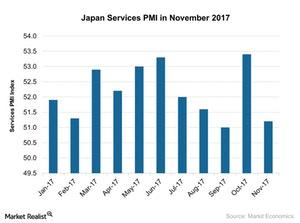

Why Japan Services PMI Didn’t Meet Expectations in November

The Japan Services PMI fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

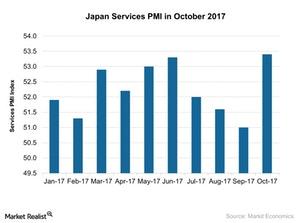

Why Japan’s Services PMI Improved Solidly in October 2017

Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017.

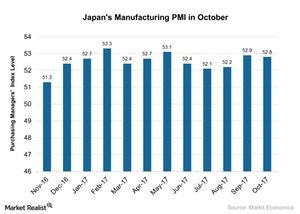

Key Insight into Japan’s Manufacturing PMI in October

Japan’s manufacturing PMI stood at 52.8 in October 2017, compared with 52.90 in September 2017, and beat the preliminary market estimation of 52.5.

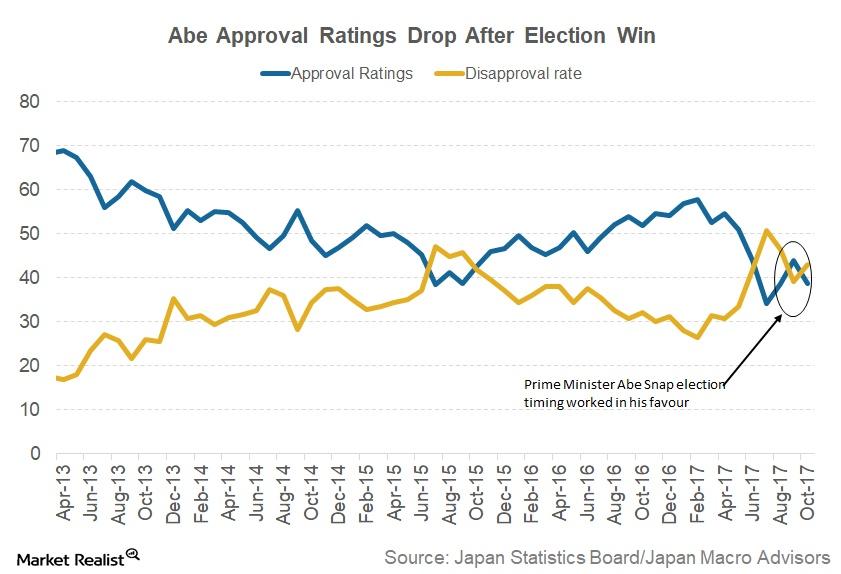

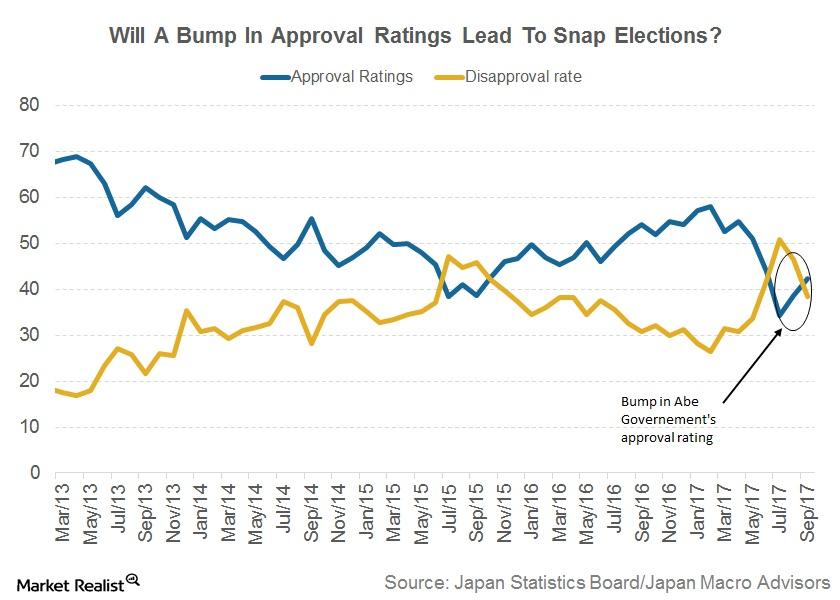

Why the Recent Election Results Are Positive for Japan

Japanese Prime Minister Shinzo Abe’s call for an early election worked in his favor. He called for a snap election to take advantage of his high ratings.

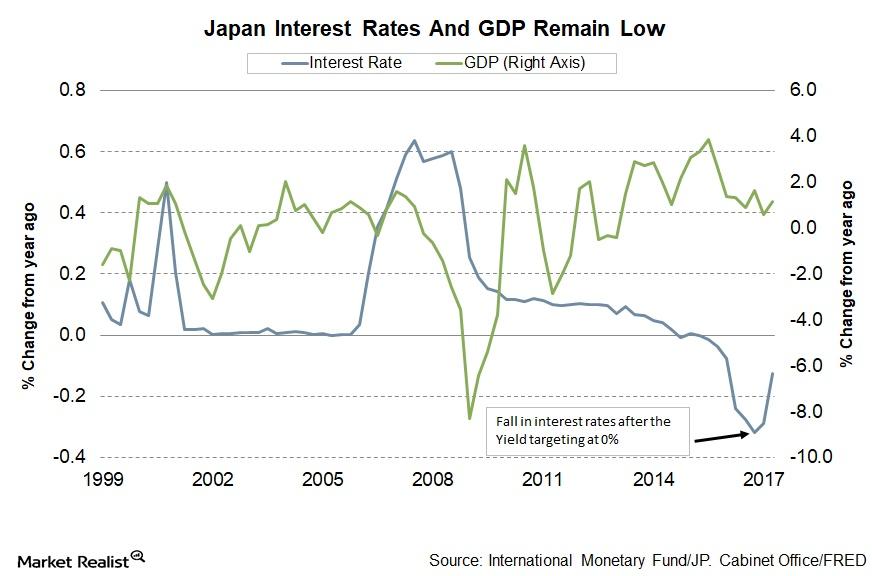

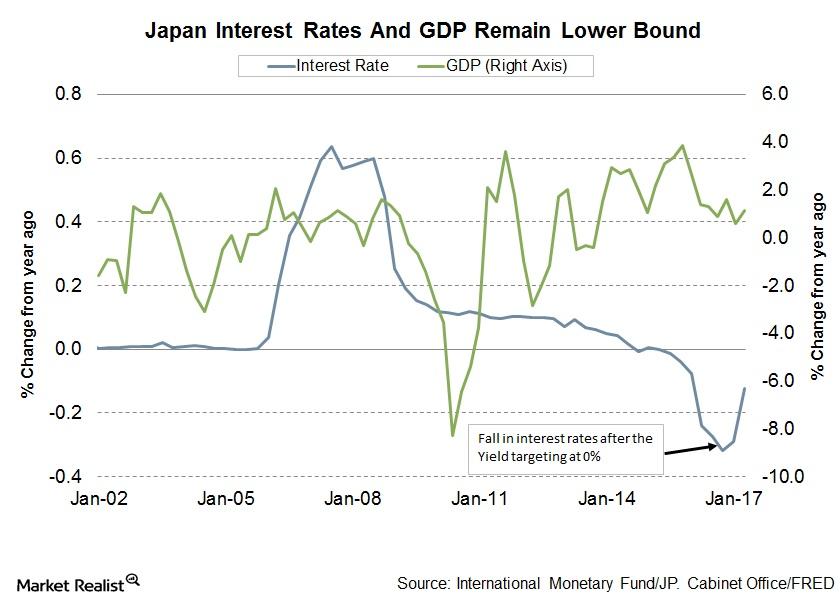

Bank of Japan: No Changes in the October Policy Meeting

At its October policy meeting, the Bank of Japan left its ultra-loose monetary policy unchanged. The decision was made by an 8-1 majority vote.

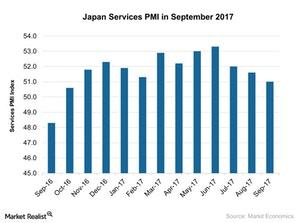

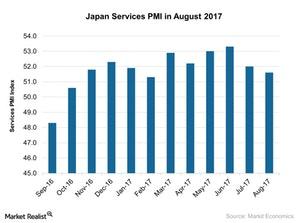

Why Japan’s Services PMI Has Been Falling Gradually

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017.

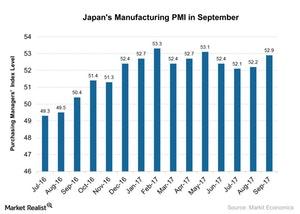

Insight into Japan’s Manufacturing in September 2017

Japan’s manufacturing PMI stood at 52.90 in September 2017, compared to 52.20 in August 2017. The PMI figure beat the preliminary market estimation of 52.5.

Bank of Japan Sees Rising Political Uncertainty as a Risk

According to news reports, Japanese Prime Minister Shinzo Abe could be calling for a snap election next month to capitalize on the increased approval ratings in August.

Update on the Bank of Japan’s September Policy Meeting

The Bank of Japan left its policy unchanged at its September meeting. By an 8–1 majority vote, the policy board decided to leave its policy and its QQE with a yield curve control unchanged.

How Japan’s Service Activity Trended in August 2017

According to the latest report by Markit Economics, the Japan Services PMI (EWJ) (DXJ) stood at 51.6 in August 2017, compared with 52 in July 2017.

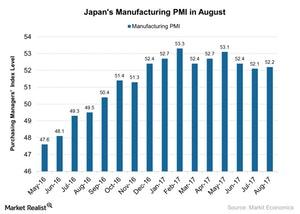

How Japan’s Manufacturing Activity Trended in August 2017

Japan’s manufacturing PMI stood at 52.2 in August 2017 as compared to 52.1 in July 2017.

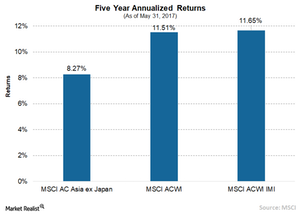

An Asian Rally Will Likely Hinge on This

Although Asian markets have outperformed most of the other regions this year, their performance over the past few years has remained sluggish overall.

Will North Korea Undermine Broader Asian Markets?

Under Kim Jong-Un, North Korea has adopted a more aggressive stance toward its regional adversaries, fueling unprecedented tension in the region.

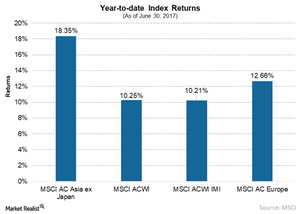

Is It Time to Focus on Asian Markets?

Asian nations (AAXJ) are experiencing a continuation of the economic recovery that has been going on for a couple of quarters now.

The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.Macroeconomic Analysis What Japan’s Manufacturing Suggests for Its Economy

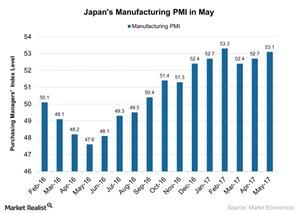

Japan’s manufacturing PMI (purchasing managers’ index) stood at 52.4 in June 2017 compared to 53.1 in May.

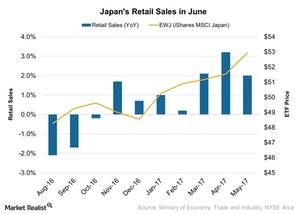

What Japan’s Falling Retail Sales Indicate for the Economy

According to the data provided by Japan’s Ministry of Economy, Trade and Industry, Japan’s retail sales rose to 2% in May 2017 on a yearly basis.

Japan’s Manufacturing PMI in May, and What to Make of It

The Japan Manufacturing PMI stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.

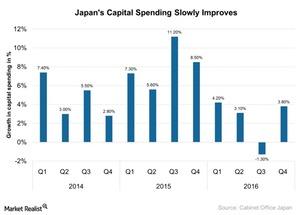

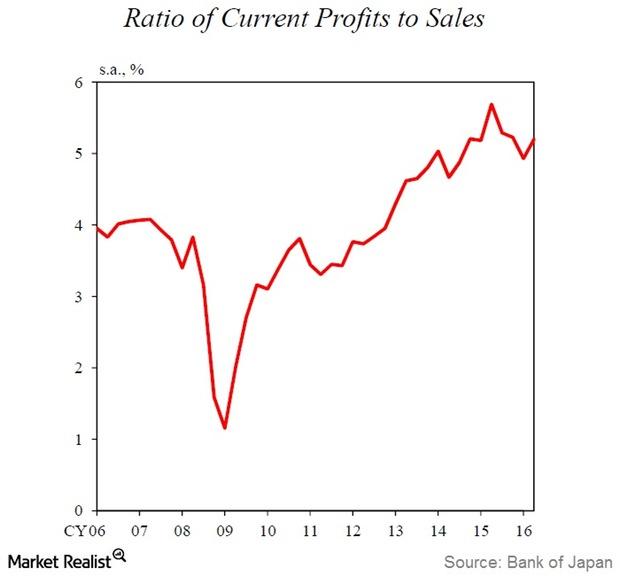

How Does Capital Spending Affect Japan’s Economic Growth?

The Japanese economy (JPN) continued its trend of moderate recovery in 2016 and could move at the same pace in 2017.

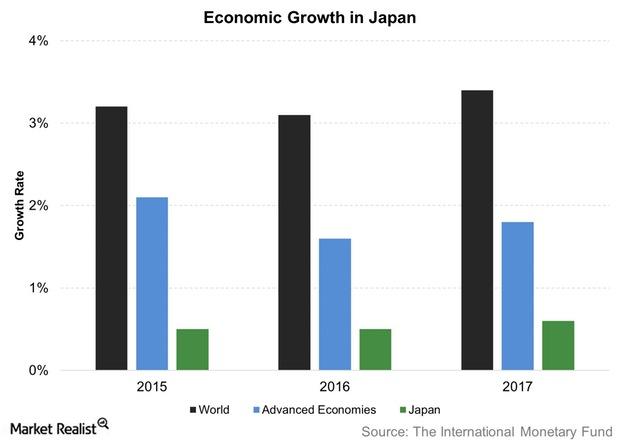

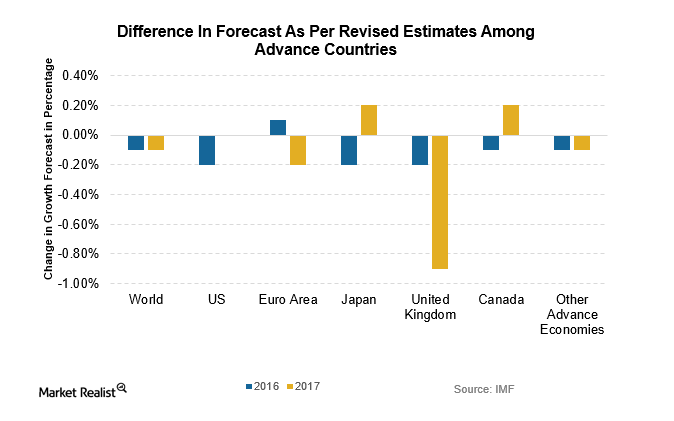

The IMF Sees Improvement in Japanese Economic Growth Forecasts

The IMF expects Japanese economic growth to be 0.5% in 2016—the same as in 2015—and to tick up to 0.6% in 2017.

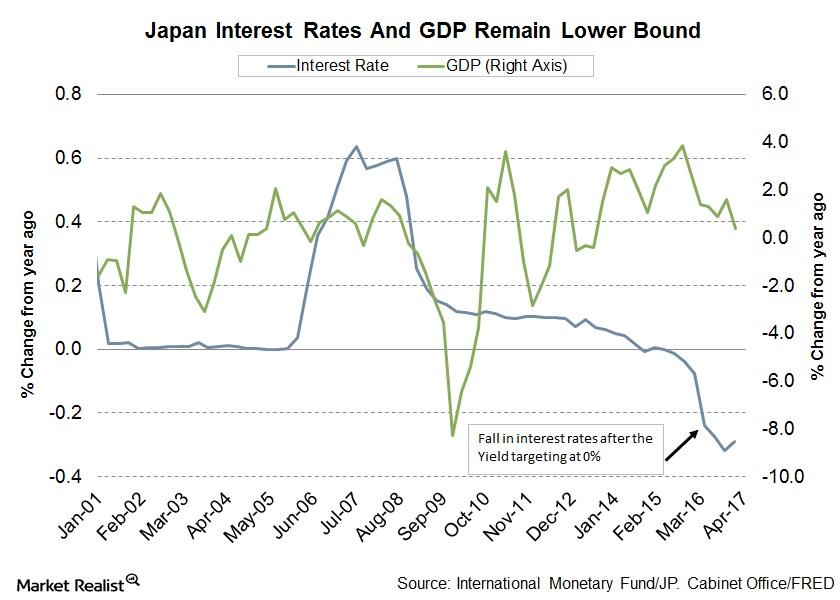

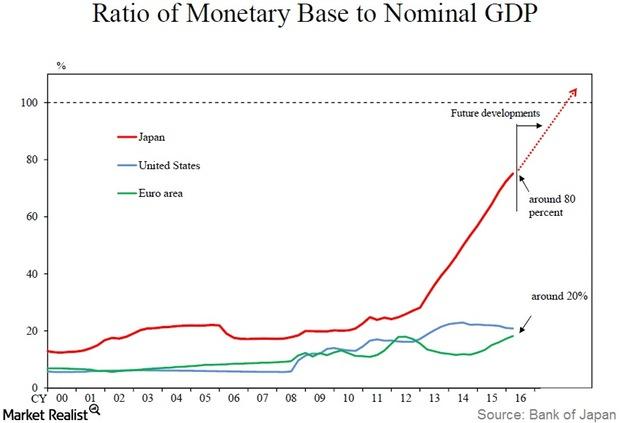

Why the Bank of Japan Wants to Overshoot Its Inflation Commitment

One of the key features of Japan’s new monetary policy framework is its inflation-overshooting commitment.

Why Haruhiko Kuroda Says Japan Is out of Deflation

According to Kuroda, “Japan’s economic activity and prices, as well as financial conditions, have improved substantially, and Japan’s economy is no longer in deflation.”

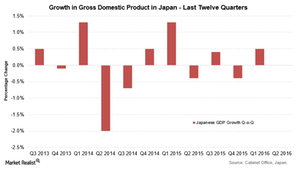

Japan’s Economy Exhibits Flat Growth, Abe Feels the Pressure

Japan’s economy showed no growth on a quarterly basis in 2Q16—compared to growth of 0.5% in the previous quarter and forecasts of a 0.2% expansion.

Why Were the United Kingdom’s Growth Forecasts Slashed?

Looking at the change in growth forecasts in advanced economies, the United Kingdom suffered the largest downward revision of estimates.

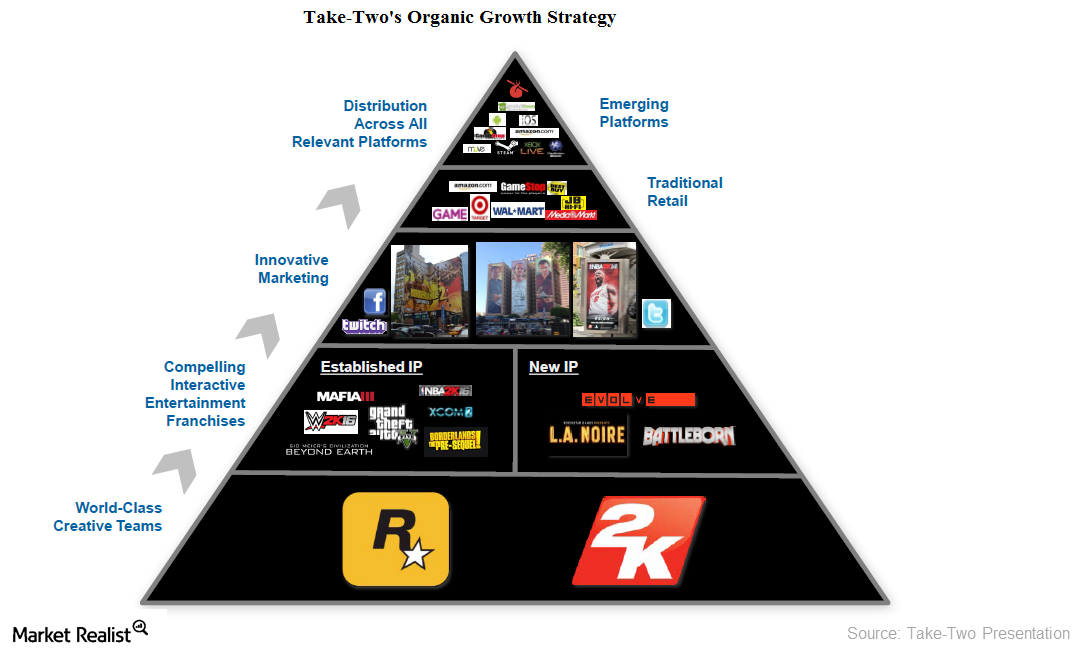

Take-Two Interactive Software Banks on Diverse Portfolio for Revenue Growth

Take-Two Interactive Software (TTWO) has seen its revenues increase from $825 million in fiscal 2012 to ~$1.4 billion in fiscal 2016.

Why Structural Reforms Are Needed to Spur the Japanese Economy

Market participants believe that the BoJ (Bank of Japan) needs to do more to beat deflation and propel the Japanese economy to sustainable long-term growth.

Why Monetary Policy Isn’t Enough to Boost the Japanese Economy

The BoJ is the one of the largest holders of Japanese (DFJ) government bonds and also a major player in equity markets.

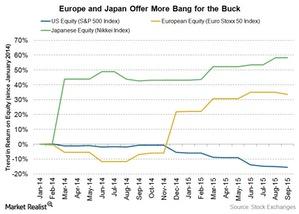

Japanese and European Equities Offer Relative Value

A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”

Ray Dalio’s Economic Principles: Why Is Japan Still Lagging?

Reviewing Ray Dalio’s economic principles template is helpful to understand the situation in Japan. It’s important to understand Japan’s challenges.

Which Parts of Japan’s Economy Most Need Reform Right Now?

Japan needs to work on reducing the regulatory, political, and social barriers that hinder productivity and profitability in its economy.

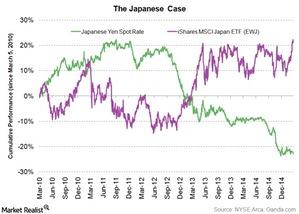

Currency war: Did it boost growth in Japan?

Japan is a classic case of how depreciating currency can boost economic growth. The stimulus package, launched in October 2010, worked over the short term.

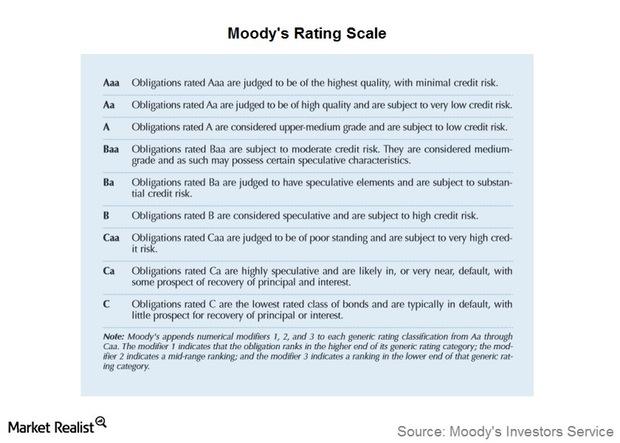

What rating action did Moody’s announce for Japan?

On December 1, 2014, Moody’s Investors Service, a business unit of Moody’s Corporation (MCO), downgraded Japan’s debt rating by one notch, from Aa3 to A1, with a stable outlook.