Dow Inc

Latest Dow Inc News and Updates

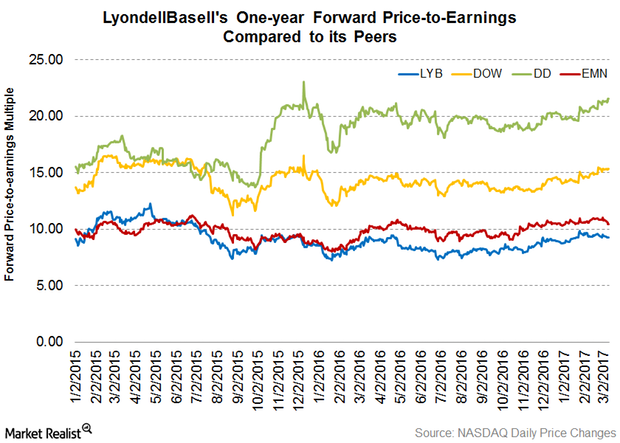

Can LyondellBasell’s Valuation Come Out of Its Peers’ Shadow?

As of March 9, 2017, LyondellBasell (LYB) was trading at a one-year forward PE (price-to-earnings) multiple of 9.3x.

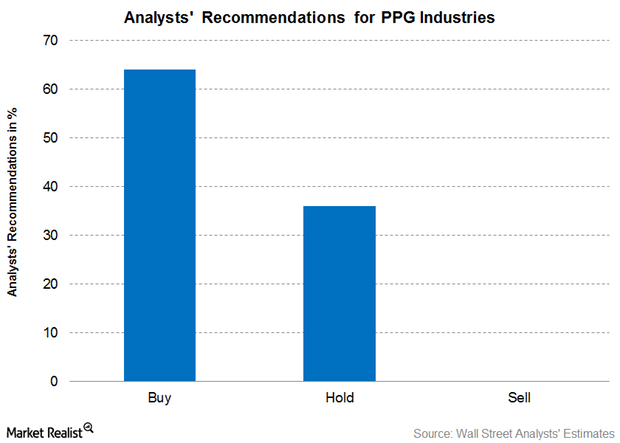

Analysts’ Recommendations and Target Price for PPG Industries

As of March 1, 2017, 22 brokerage firms were actively tracking PPG Industries (PPG) stock. About 64.0% of them have recommended a “buy” for the stock.

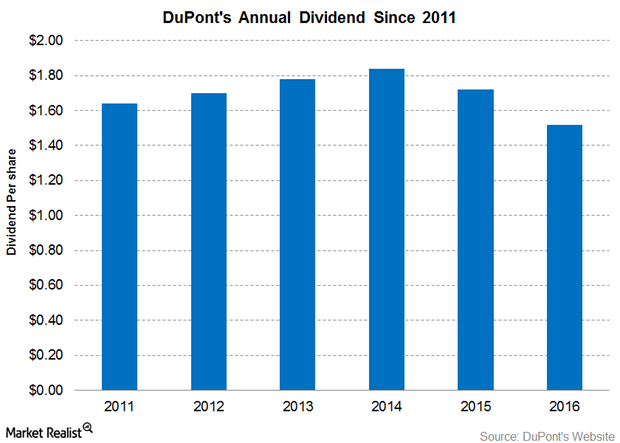

DuPont Set to Pay Its 450th Consecutive Quarterly Dividend

On January 27, 2017, DuPont (DD) declared a dividend of $0.38 per share for 1Q17 on the company’s outstanding common stock.

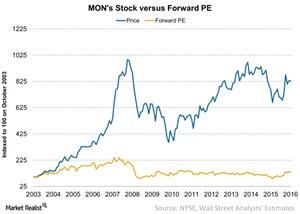

How Monsanto’s Stock Has Tracked Its Historical Price-to-Earnings

The price-to-earnings ratio is a popular multiple investors use to determine the value of their investments in companies such as Monsanto (MON).

Company Overview: A Look at Monsanto’s Key Executives

In 2016, Monsanto (MOO) had 21,000 employees. Let’s take a look at some of the company’s key executives.

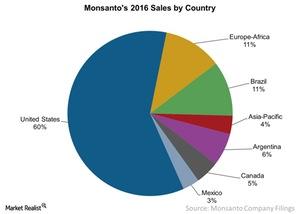

What Geographic Segments Contribute to Monsanto’s Sales?

Including the United States, Mexico, and Canada, Monsanto’s total North American sales contribution stood close to 68% of its 2016 sales.

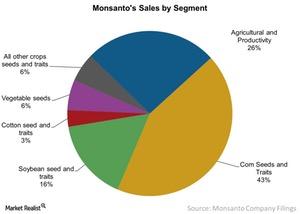

This Segment Has Become Important for Monsanto in the Last Decade

Monsanto (MON) conducts its global sales through two broad segments known as the Seeds & Genomics and Agricultural Productivity segments.

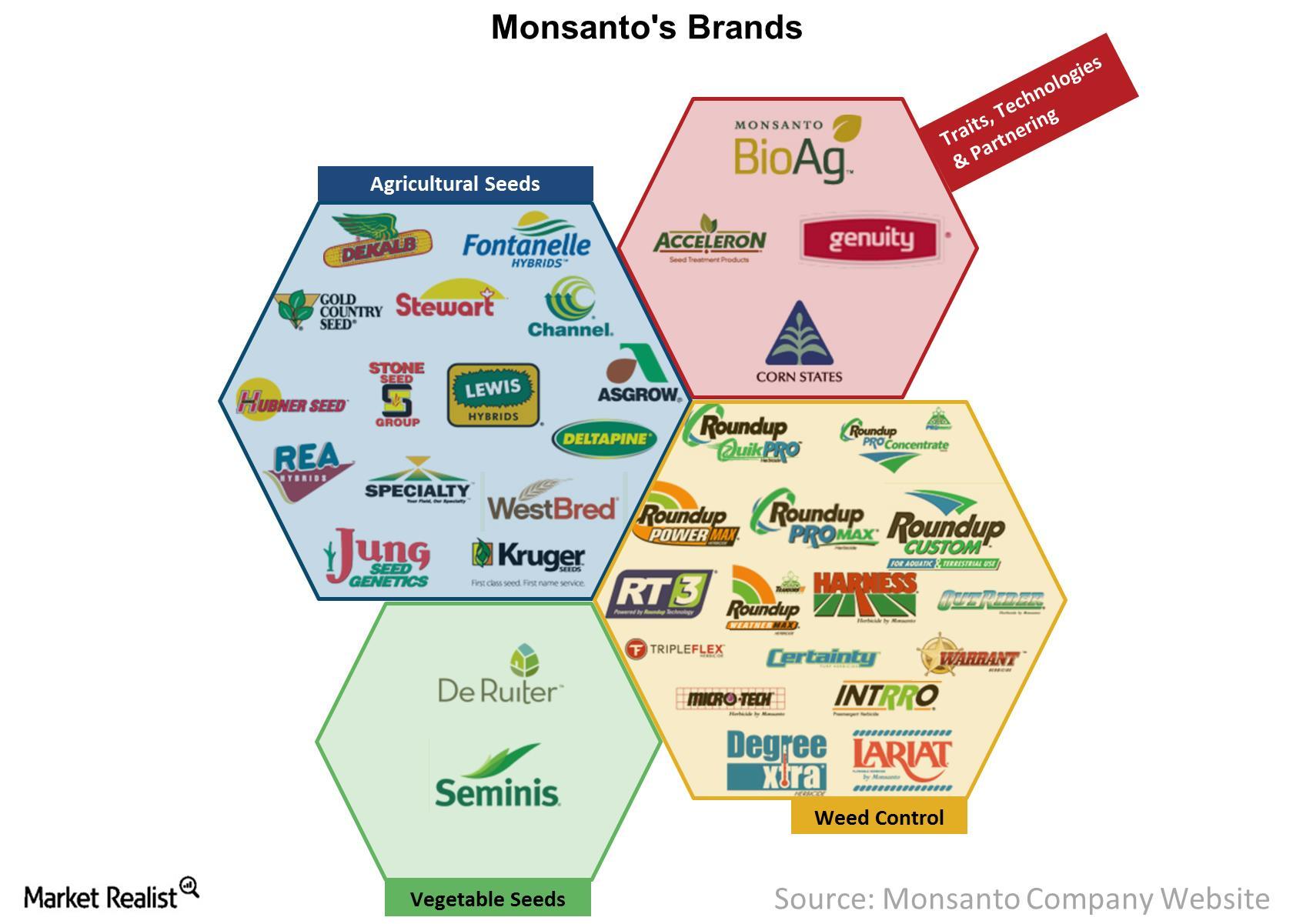

Understanding Monsanto’s Products and Brands

Back in 1901, Monsanto’s (MON) first product was saccharin. However, the company’s Agricultural Chemicals business only arrived in 1945.

Monsanto’s History Dates Back to 1901

In 1964, Monsanto introduced its first herbicide by the name of Ramrod. Four years later, in 1968, the company commercialized an herbicide called Lasso.

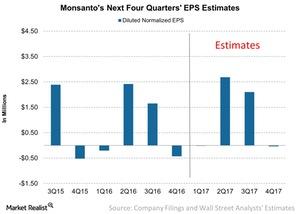

Can Monsanto Report Earnings Growth in Fiscal 1Q17?

For 2017, Wall Street analysts are estimating that Monsanto (MON) could report EPS of $4.70, which would translate into earnings growth of 5.3% year-over-year.

At What Valuation Is the Market Investing in Monsanto?

Monsanto’s (MON) forward PE valuation multiple has recently trended higher, and so has the price of its stock.

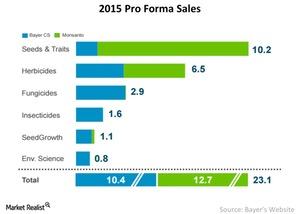

Synergies Monsanto and Bayer Could Exploit through a Merger

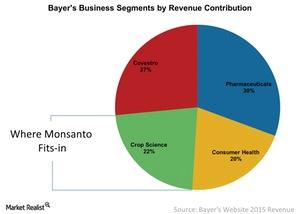

Monsanto’s business is the best fit for Bayer’s Crop Science segment—it contributes ~22% of Bayer’s revenue. The segment is similar to Monsanto’s business.

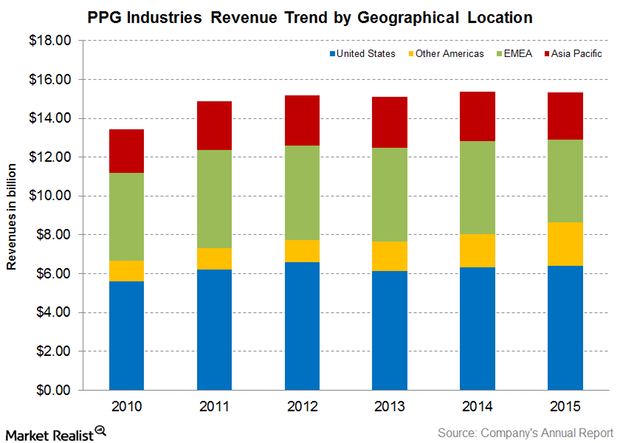

PPG Industries’ Geographical Revenue Mix

PPG Industries (PPG) is a leading global player in the paint and coatings segment, operating in 70 global locations. Let’s look at their revenue contributions to PPG.

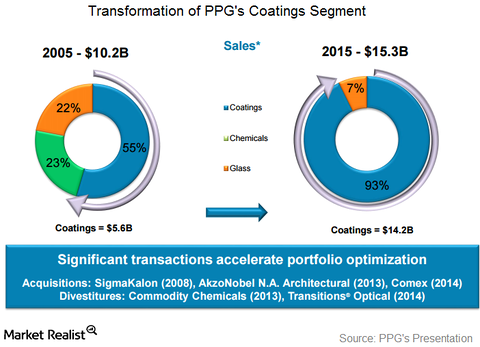

PPG Industries’ Business Model Aids Its Coatings Segment

PPG Industries’ (PPG) coatings segment has been growing at a CAGR of 7.1% since 2010. PPG has been able to increase its revenues basically through acquisitions.

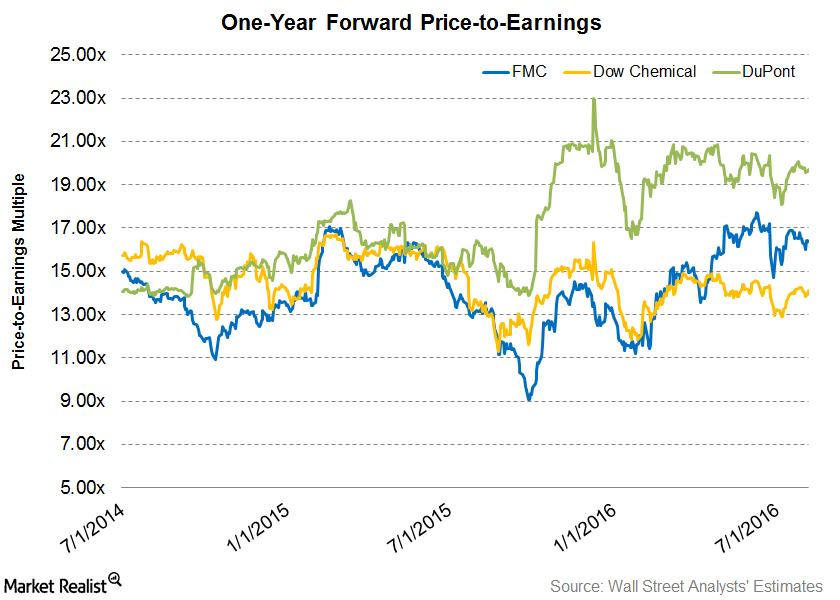

Where Do FMC’s Valuations Stand after Its 2Q16 Earnings?

Forward price-to-earnings (or PE) is a relative valuation method that considers a company’s future earnings for calculation.

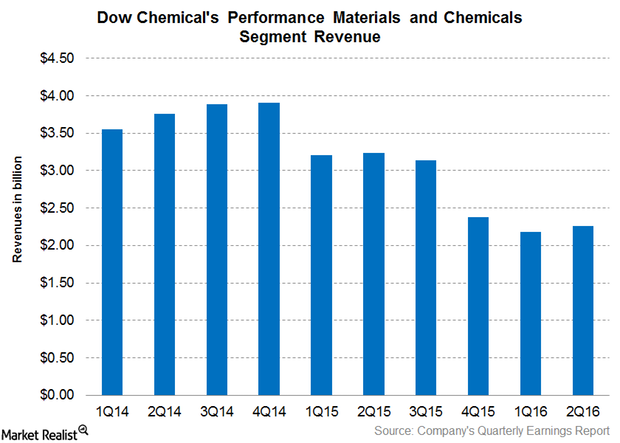

Why Dow’s Performance Materials and Chemicals’ Revenue Fell

Dow Chemical’s Performance Materials and Chemicals segment is the second largest revenue contributor to its total revenue.

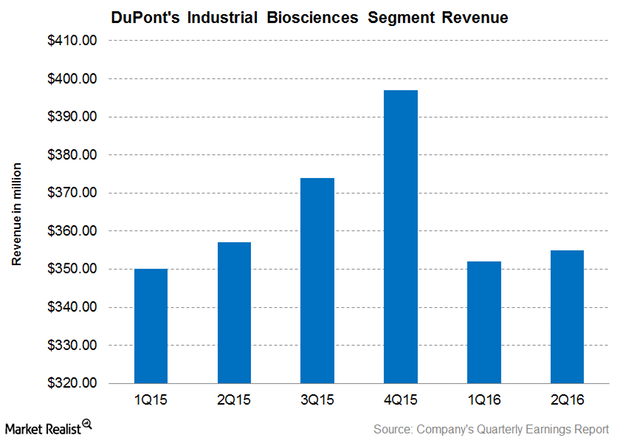

Why Did DuPont’s Industrial Biosciences Segment Revenue Fall in 2Q16?

For 2Q16, DuPont’s Industrial Biosciences segment reported revenues of $355 million, representing 5% of the company’s total revenue.

How Monsanto’s Business Fits into Bayer’s Portfolio

What’s in it for Bayer when it comes to acquiring Monsanto (MON)? The answer lies in Bayer’s business segments and geographic reach.

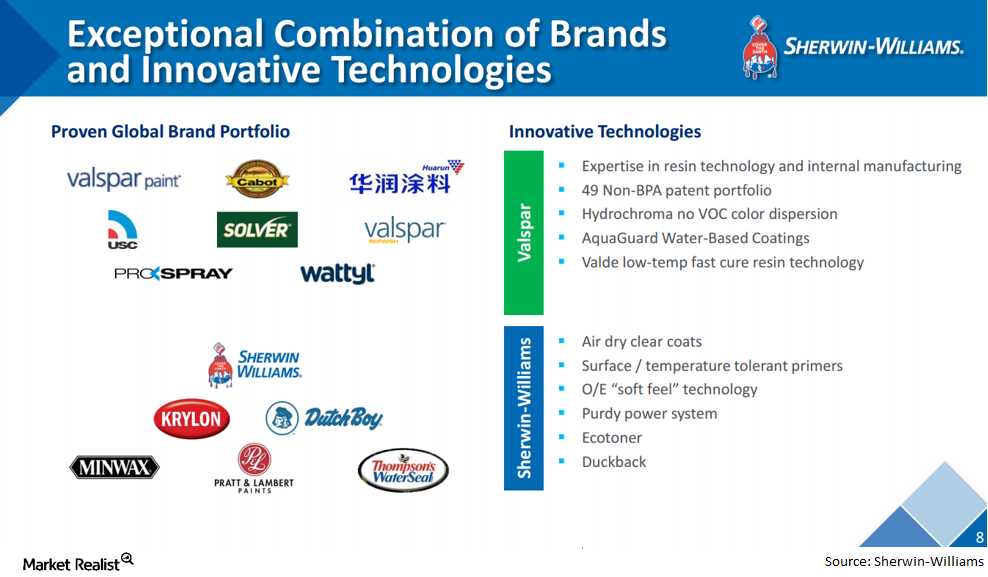

What’s the Rationale for the Valspar and Sherwin-Williams Merger?

Sherwin-Williams is buying coatings manufacturer Valspar in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction.

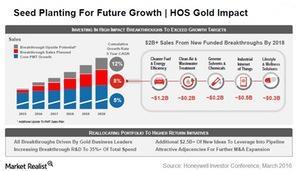

Honeywell PMT: Winning by Innovating

Environmental regulations in emerging markets such as China and India present a high-growth area for Honeywell and other companies with significant scale advantages to access.

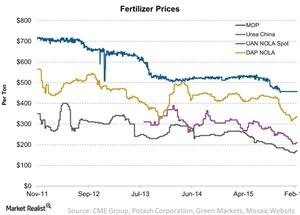

An Update on NPK Fertilizer Price Trends

Fertilizer prices have fallen significantly over the years. But more recently, prices are showing a trend reversal for urea, UAN, and phosphate fertilizer.

The Importance of Specialty Chemicals in the Oil Industry

Specialty oilfield chemicals are used in the oil and gas industry to improve well performance by making exploration and production more efficient.

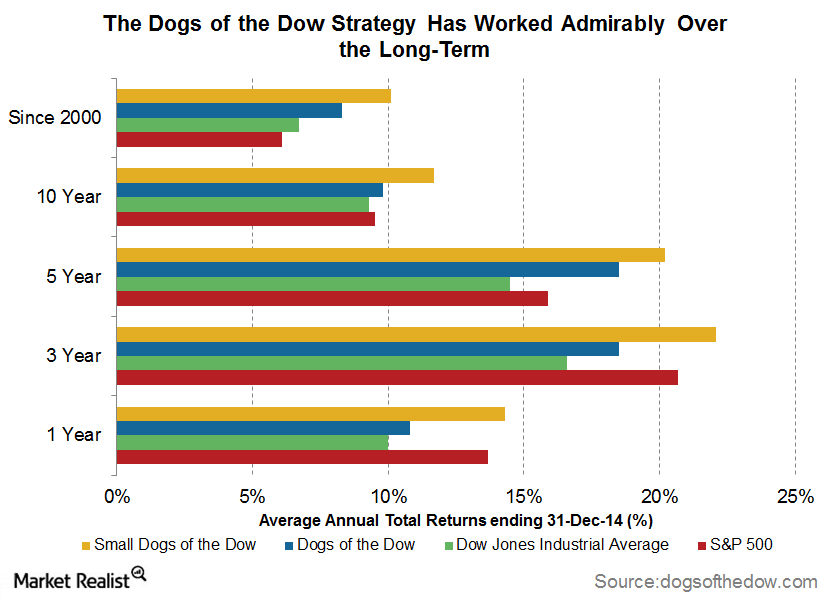

Dogs of the Dow: A Classic Investment Strategy

The Dogs of the Dow strategy involves ranking the 30 stocks comprising the Dow Jones Industrial Average index on the basis of their dividend yields and selecting the top ten.

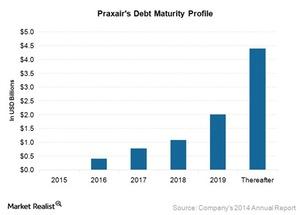

Does Praxair Have a Sustainable Debt Maturity Profile?

Praxair’s total debt has increased significantly, rising from $6.6 billion in 2011 to $9.3 billion in 2014.

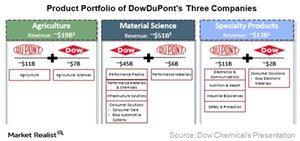

DowDuPont Will Spin Off into 3 Independent Public Companies

After the merger, DowDuPont will spin off into three independent and public companies—agriculture, material science, and specialty products.

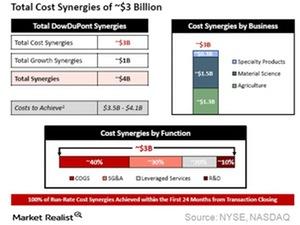

Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.

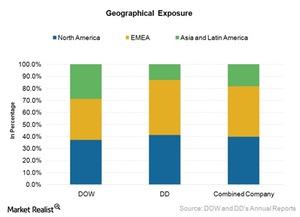

Will the Merger Have Geographical Synergy for the New Company?

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence.

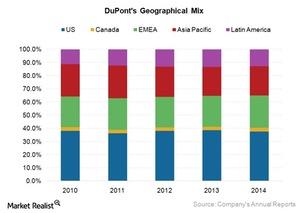

How Is DuPont’s Geographical Sales Exposure and Global Presence?

DuPont is a global company with operations in more than 90 countries. In 2014, the company’s North America region contributed 41% to its total revenue.

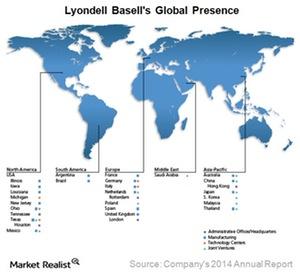

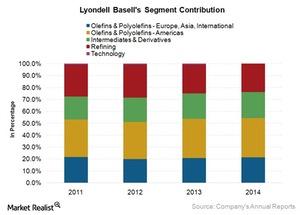

How Does LyondellBasell’s Geographical Exposure Compare to Peers?

LyondellBasell (LYB) has a presence throughout the world. However, the company generates around 50% of its revenue from the United States.

LyondellBasell: A Leading Manufacturer of Olefins and Polyolefins

LyondellBasell is one of the world’s leading producers of olefins and polyolefins. After Dow Chemical, LYB is the second largest company by revenue and EBITDA in the US.

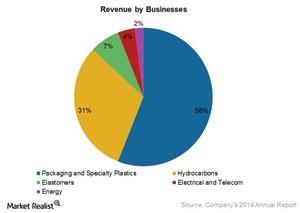

Understanding Dow’s Largest Segment, Performance Plastics

Dow’s Performance Plastics segment contributed 39% and 46% to Dow’s total revenue and EBITDA, respectively, in 2014.